|

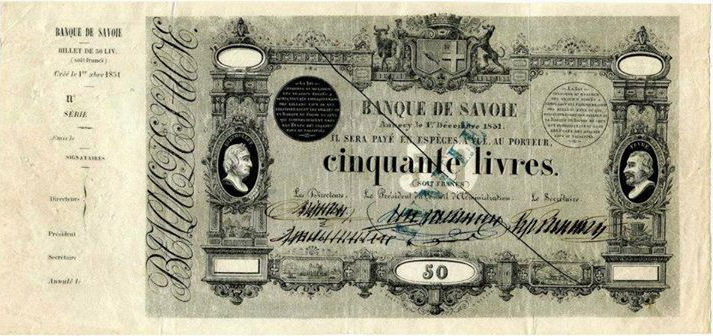

Bank Of Savoy

The Bank of Savoy (french: Banque de Savoie, also referred to under that name in Italian) was a bank of issue of the Kingdom of Sardinia, established in 1851 and based in Annecy and Chambéry. As a consequence of France's annexation of the former Duchy of Savoy under the Treaty of Turin (1860), the Bank of Savoy ceded its money-issuance role to the Bank of France in 1865. Kingdom of Sardinia The Bank of Savoy was established by Sardinian Royal Law of , succeeding the Banque d'Annecy which had been created by royal edict of . It was the kingdom's second bank of issue following the establishment two years earlier of the National Bank in the Sardinian States. Its territorial scope was focused on the former Duchy of Savoy, with principal seat in Annecy and a secondary seat (or branch office) in Chambéry, and it received the privilege to mint coins and issue paper money with legal tender status in Savoy. Its head office building in Annecy was the , a historic building erected in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annecy (74) Hôtel De Sales 043

Annecy ( , ; , also ) is the Prefectures in France, prefecture and List of communes in France with over 20,000 inhabitants, largest city of the Haute-Savoie Departments of France, department in the Auvergne-Rhône-Alpes Regions of France, region of Southeastern France. It lies on the northern tip of Lake Annecy, south of Geneva, Switzerland. Nicknamed the "Pearl of the French Alps" in Raoul Blanchard's monograph describing its location between lake and mountains, the town controls the northern entrance to the lake gorge. Due to a lack of available building land between the lake and the protected Semnoz mountain, its population has remained stable, around 50,000 inhabitants, since 1950. However, the 2017 merger with several ex-communes extended the population of the city to 128,199 inhabitants and that of the Urban unit, urban area to 177,622, placing Annecy seventh in the Auvergne-Rhône-Alpes region. Switching from the County of Geneva, counts of Geneva's dwelling in the 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

French Franc

The franc (, ; sign: F or Fr), also commonly distinguished as the (FF), was a currency of France. Between 1360 and 1641, it was the name of coins worth 1 livre tournois and it remained in common parlance as a term for this amount of money. It was reintroduced (in decimal form) in 1795. After two centuries of inflation, it was redenominated in 1960, with each (NF) being worth 100 old francs. The NF designation was continued for a few years before the currency returned to being simply the franc. Many French residents, though, continued to quote prices of especially expensive items in terms of the old franc (equivalent to the new centime), up to and even after the introduction of the euro (for coins and banknotes) in 2002. The French franc was a commonly held international reserve currency of reference in the 19th and 20th centuries. Between 1998 and 2002, the conversion of francs to euros was carried out at a rate of 6.55957 francs to 1 euro. History The French Franc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Of The Kingdom Of Italy

The National Bank of the Kingdom of Italy (), known from 1850 to around 1870 as the National Bank of the Sardinian States (), was a bank of issue of the Kingdom of Sardinia then the Kingdom of Italy after unification in 1861. Despite its name, it had no monopoly on money issuance, in a financial system that proved prone to instability. It was successively headquartered in Genoa (1850-1853), Turin (1850-1865), Florence (1865-1873), and Rome (1873-1893). Following the controversial failure of Banca Romana, the National Bank was eventually merged with several peers in 1893 to form the Bank of Italy. Background The first decades of the 19th century saw a number of note-issuing banks created on a local basis, reflecting the political fragmentation of Italy and similar to experiences in other parts of Europe such as Germany or Belgium. These banks differed from 20th-century central banks as they maintained commercial banking operations in addition to those ling with their monetary rol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York City

New York, often called New York City or NYC, is the most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the most densely populated major city in the United States, and is more than twice as populous as second-place Los Angeles. New York City lies at the southern tip of New York State, and constitutes the geographical and demographic center of both the Northeast megalopolis and the New York metropolitan area, the largest metropolitan area in the world by urban landmass. With over 20.1 million people in its metropolitan statistical area and 23.5 million in its combined statistical area as of 2020, New York is one of the world's most populous megacities, and over 58 million people live within of the city. New York City is a global cultural, financial, entertainment, and media center with a significant influence on commerce, health care and life sciences, research, technology, educa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Groupe BPCE

Groupe BPCE (for Banque Populaire Caisse d'Epargne) is a major French banking group formed by the 2009 merger of two major retail banking groups, Groupe Caisse d'Épargne and Groupe Banque Populaire. As of 2021, it was France's fourth largest bank, the seventh largest in Europe, and the nineteenth in the world by total assets. It has more than 8,200 branches nationwide under their respective brand names serving nearly 150 million customers. It is Europe's largest bank by revenue, ahead of BNP Paribas and HSBC. It is considered a global systemically important bank (G-SIB) by the Financial Stability Board. Background Caisses d'Épargne, Eulia and Ixis Groupe Caisse d'Épargne ("Savings Bank Group") was born in 1818 with the foundation of the Paris savings bank, . It long grew from the bottom up as an expanding set of local savings banks, until a 1983 legislation created a central financial entity or "national center", the (CENCEP). In 1992, CENCEP was replaced by the (CNCE) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Groupe Banque Populaire

Groupe Banque Populaire ("People's Bank") was a French group of cooperative banks. The central entity was controlled by 15 independent regional banks and also operated under the CASDEN and the Crédit Coopératif subsidiaries. In 2006, Groupe Banque Populaire created Natixis with another French cooperative banking group, Groupe Caisse d'Epargne, to which they brought Banque Populaire's Natexis and Caisse d'Epargne's IXIS Corporate and Investment Bank. In 2009, Banque Populaire and Caisse d'Epargne merged to form Groupe BPCE. Merger In October 2008 the group announced plans, since approved by the French government, to merge with Groupe Caisse d'Epargne. The companies merged in 2009 to form the Groupe BPCEJolly, DavidParent of French Bank Agrees to Guarantee Troubled Assets.''New York Times.'' 26 August 2009. and retain their separate retail banking brands and branch networks. Banque Populaire's chief executive officer Philippe Dupont has been nominated to head the enlarged c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédit Commercial De France

The ''Crédit Commercial de France'' (CCF, "Commercial Credit ompanyof France") is a commercial bank in France, founded in 1894 as the ''Banque Suisse et Française'' and renamed to CCF in 1917. By the end of the 1920s, it had grown to be the sixth largest bank in France. Its brand was eclipsed between 2005 and 2022 under HSBC ownership, but is set to be revived by the bank's new owner Cerberus Capital Management. History Banque Suisse et Française Financiers Ernest Méjà and Benjamin Rossier founded the (BSF, "Swiss and French Bank") at 27, rue Laffite in Paris, on . They had previously worked together for the Swiss , whose Paris branch formed the initial core of the new venture. Méjà remained as joint managing director of the bank with Rossier until his death in 1910. Rossier then continued to run the bank until his retirement in 1936. From its early days, the BSF took an active interest in commerce and industry. A successful working relationship was developed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Société Générale

Société Générale S.A. (), colloquially known in English as SocGen (), is a French-based multinational financial services company founded in 1864, registered in downtown Paris and headquartered nearby in La Défense. Société Générale is France's third largest bank by total assets after BNP Paribas and Crédit Agricole. It is also the sixth largest bank in Europe and the world's eighteenth. It is considered a systemically important bank by the Financial Stability Board. From 1966 to 2003 it was known as one of the ''Trois Vieilles'' ("Old Three") major French commercial banks, along with Banque Nationale de Paris (from 2000 BNP Paribas) and Crédit Lyonnais. History 19th Century The bank was founded by a group of industrialists and financiers during the Second Empire on May 4, 1864. Its full name was ''Société Générale pour favoriser le développement du commerce et de l'industrie en France'' ("General Company to Support the Development of Commerce and Indu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédit Du Nord

is a French retail banking network. It consists of the following banks: * , Toulouse, Aquitaine (oldest existing bank in France, founded in 1760) * , Alsace, Lorraine * , Savoy * , Massif Central * , Lyon * , Limoges * , Marseille * itself in the rest of France * , a stock brokerage firm is mainly owned by Société Générale but run separately from Société Générale's own French retail banking network. specialises on professionals and small business. It serves about 1.5 million customers in more than 700 stores (2006). History started in Lille in 1848. After buying a number of small banks, it was, in turn, acquired by Paribas between 1972 (35% owned) and 1988 (100% owned) but remained run as a separate network. In the following years several regional French banks were brought in the group while retaining their names. In 1984, it was the fifth-ranking French banking group. It rebranded itself, after working with Creative Business (a public relations company), wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédit Lyonnais

The Crédit Lyonnais (, "Lyon Credit ompany) was a major French bank, created in 1863 and absorbed by former rival Crédit Agricole in 2003. Its head office was initially in Lyon but moved to Paris in 1882. In the early years of the 20th century, it was the world's largest bank by total assets. Its former French retail network survives as LCL S.A., a fully owned subsidiary of Crédit Agricole, under the brand LCL adopted in 2005 with reference to "Le Crédit Lyonnais". History 19th Century The creation of Crédit Lyonnais was favored by French legislation of that liberalized the creation of joint-stock companies without prior government authorization. The bank was chartered on by Henri Germain, who was the largest shareholder with 5.4 percent of equity capital and became its first chairman. Prominent promoters of Saint-Simonianism initially participated in the venture, namely François Barthélemy Arlès-Dufour who was instrumental in convincing Germain to initiate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crédit Mobilier

The Crédit Mobilier (full name Société Générale du Crédit Mobilier, "general company for movable ollateral-backedcredit") was a French banking company created by the Pereire brothers, and one of the world’s most significant and influential financial institutions in the mid-19th century. The Crédit Mobilier had a major role in the financing of numerous railroads and other infrastructure projects by mobilizing the savings of middle class French investors as capital for vast lending schemes. Its operations resulted in vast debts for the countries which accepted its infrastructure loans, and the bank was thus indirectly involved in European encroachment on countries whose governments subsequently defaulted on these loans, not least during the worldwide economic depression of the 1870s. It became a powerful and dynamic funding agent for major projects in France, Europe, North Africa and the world at large. As Napoleon III redeveloped Paris, the Crédit Mobilier speculated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |