|

Americans For Tax Reform

Americans for Tax Reform (ATR) is a politically conservative U.S. advocacy group whose stated goal is "a system in which taxes are simpler, flatter, more visible, and lower than they are today." According to ATR, "The government's power to control one's life derives from its power to tax. We believe that power should be minimized." The organization is known for its "Taxpayer Protection Pledge", which asks candidates for federal and state office to commit themselves in writing to oppose all tax increases. The founder and president of ATR is Grover Norquist, a conservative tax activist. Structure Americans for Tax Reform is a 501(c)(4) organization with 14 employees, finances of $3,912,958, and a membership of 60,000 (as of 2004). It was founded by Grover Norquist in 1985. The associated educational wing is the Americans for Tax Reform Foundation, which is classified as a 501(c)(3) research and educational organization. The purpose of both entities is to educate and/or lobby agai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

501(c)(4)

A 501(c) organization is a nonprofit organization in the Law of the United States#Federal law, federal law of the United States according to Internal Revenue Code (26 U.S.C. § 501(c)). Such organizations are exempt from some Taxation in the United States, federal Income tax in the United States, income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and Labor union, unions. For example, a nonprofit organization may be tax-exempt under section 501(c)(3) organization, 501(c)(3) if its primary activities are charitable, religious, educational, scientific, literary, testing for public safety, fostering amateur sports competition, or preventing cruelty to Child abuse, children or Animal cruelty, animals. Types According to the IRS Publication 557, in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ben Chandler

Albert Benjamin Chandler III (born September 12, 1959) is an American lawyer and politician who served as the United States House of Representatives, United States representative for from 2004 to 2013. A United States Democratic Party, Democrat, Chandler was first elected to Congress in a 2004 Kentucky's 6th congressional district special election, 2004 special election. He served until January 2013, having been defeated for re-election by Andy Barr in the 2012 United States House of Representatives elections in Kentucky#District 6, 2012 elections. Early life, education and career Chandler was born in Versailles, Kentucky on September 12, 1959, the son of Lucie "Toss" (née Dunlap) and A. B. Ben Chandler Jr. His paternal grandfather, Happy Chandler, A. B. Happy Chandler., served as Governor of Kentucky, Commissioner of Baseball, and as a United States Senate, U.S. Senator. Chandler graduated with distinction from the University of Kentucky with a Bachelor of Arts, BA in History ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United States)

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency ( California Franchise Tax Board, for example) containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority. Federal returns Under the Internal Revenue Code returns can be classified as either ''tax returns'' or ''information returns'', although the term "tax return" is sometimes used to describe both kinds of returns in a broad sense. Tax returns, in the more narrow sense, are reports of tax liabilities and payments, often including financial information used to compute the tax. A very common federal tax form is IRS Form 1040. A tax return provides information so that the taxation authority can check on the taxpayer's calculations, or can determine the amount of tax owed if the taxpayer is not required to calculate that amount. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury Inspector General For Tax Administration

The Treasury Inspector General for Tax Administration (TIGTA) is an office in the United States Federal government. It was established in January 1999 in accordance with the Internal Revenue Service Restructuring and Reform Act of 1998 (RRA 98) to provide independent oversight of Internal Revenue Service (IRS) activities. As mandated by RRA 98, TIGTA assumed most of the responsibilities of the IRS' former Inspection Service. TIGTA provides independent oversight of Department of the Treasury matters involving IRS activities, the IRS Oversight Board, and the IRS Office of Chief Counsel. TIGTA's audits, investigations, and inspections are designed to promote the fair administration of the Federal tax system. Although TIGTA is organizationally placed within the Department of the Treasury, and reports to the Secretary of the Treasury and to Congress, TIGTA functions independently of the Department and all other Treasury offices and bureaus. TIGTA's Office of Investigations protec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Property

Private property is a legal designation for the ownership of property by non-governmental Capacity (law), legal entities. Private property is distinguishable from public property, which is owned by a state entity, and from Collective ownership, collective or cooperative property, which is owned by one or more non-governmental entities. Private property is foundational to capitalism, an economic system based on the private ownership of the means of production and their operation for Profit (economics), profit. As a legal concept, private property is defined and enforced by a country's political system. History The first evidence of private property may date back to the Babylonians in 1800 BC, as evidenced by the archeological discovery of Plimpton 322, a clay tablet used for calculating property boundaries; however, written discussions of private property were not seen until the Persian Empire, and emerged in the Western tradition at least as far back as Plato. Before the 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Property Rights Index

Americans for Tax Reform (ATR) is a politically conservative U.S. advocacy group whose stated goal is "a system in which taxes are simpler, flatter, more visible, and lower than they are today." According to ATR, "The government's power to control one's life derives from its power to tax. We believe that power should be minimized." The organization is known for its "Taxpayer Protection Pledge", which asks candidates for federal and state office to commit themselves in writing to oppose all tax increases. The founder and president of ATR is Grover Norquist, a conservative tax activist. Structure Americans for Tax Reform is a 501(c)(4) organization with 14 employees, finances of $3,912,958, and a membership of 60,000 (as of 2004). It was founded by Grover Norquist in 1985. The associated educational wing is the Americans for Tax Reform Foundation, which is classified as a 501(c)(3) research and educational organization. The purpose of both entities is to educate and/or lobby agai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom times so that there is no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

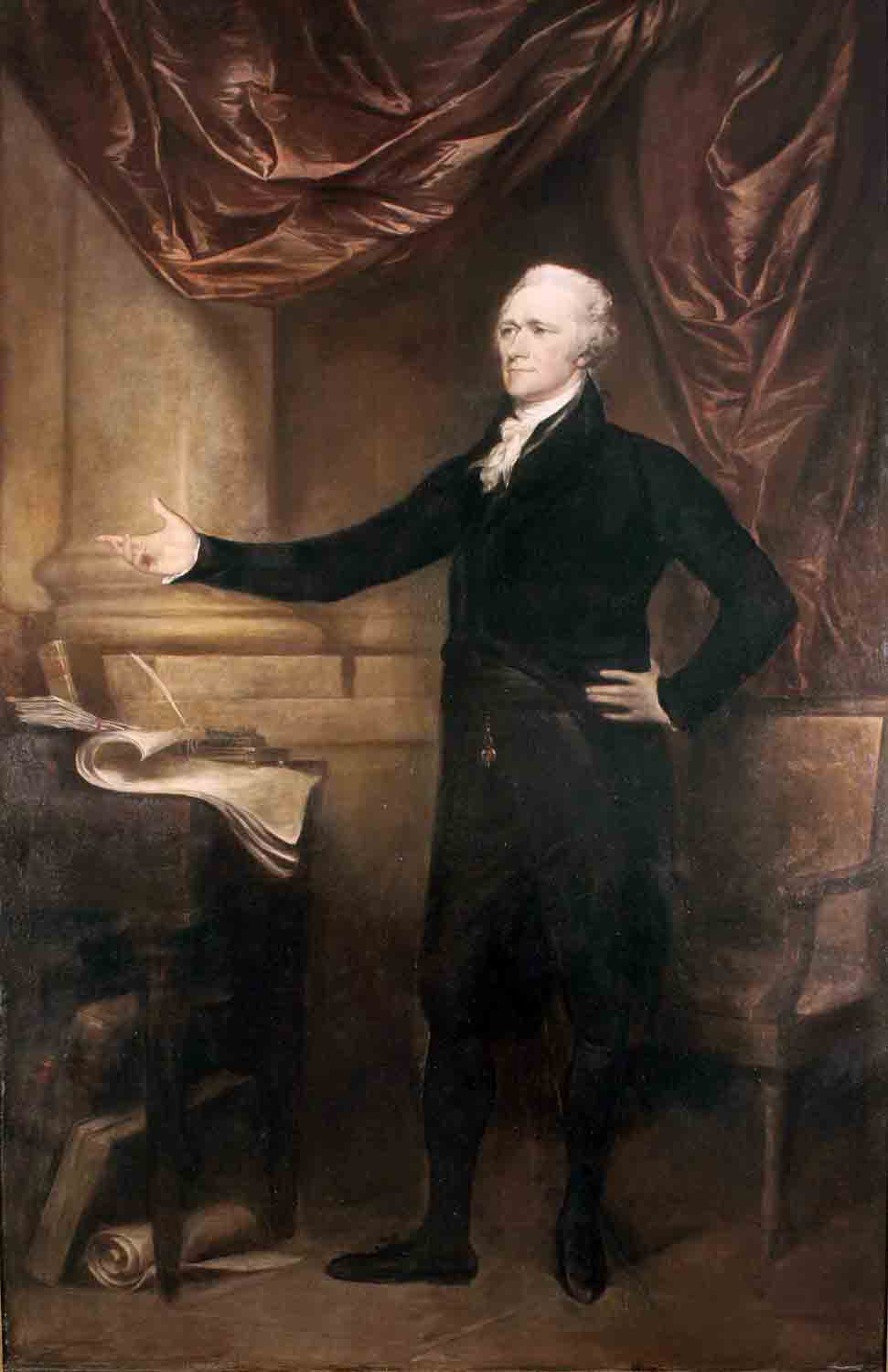

United States Ten-dollar Bill

The United States ten-dollar bill (US$10) is a denomination of U.S. currency. The obverse of the bill features the portrait of Alexander Hamilton, who served as the first U.S. Secretary of the Treasury, two renditions of the torch of the Statue of Liberty (''Liberty Enlightening the World''), and the words "We the People" from the original engrossed preamble of the United States Constitution. The reverse features the U.S. Treasury Building. All $10 bills issued today are Federal Reserve Notes. As of December 2018, the average life of a $10 bill in circulation is 5.3 years before it is replaced due to wear. Ten-dollar bills are delivered by Federal Reserve Banks bound with yellow straps. The source of Hamilton's portrait on the $10 bill is John Trumbull's 1805 painting that belongs to the portrait collection of New York City Hall. The $10 bill is unique in that it is the only denomination in circulation in which the portrait faces to the left. It also features one of two n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Honors Named For Ronald Reagan

Ronald Reagan (1911–2004) was an American politician who served as the 40th president of the United States. Many places both within and outside the United States have been named after Reagan. The ''Ronald Reagan Legacy Project'' is an organization founded by Americans for Tax Reform, president Grover Norquist seeks to name at least one notable public landmark in each U.S. state and all 3067 counties after Reagan. The ''Ronald Reagan Legacy Projects most prominent achievement would be persuading the U.S. Congress to pass a law renaming Washington National Airport as Ronald Reagan Washington National Airport in 1998. Ronald Reagan Boulevard in Warwick, New York built and dedicated in 1981 by real estate developer Frank J. Fazio was the first road to be named after Reagan. The first highway to be named after Reagan was Ronald Reagan Cross County Highway in Cincinnati. Alabama * Ronald Reagan Memorial Highway (portion of Interstate 65 from Birmingham to Decatur) * Ronald Rea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Hill (newspaper)

''The Hill'', formed in 1994, is an American newspaper and digital media company based in Washington, D.C. Focusing on politics, policy, business and international relations, ''The Hill''s coverage includes the U.S. Congress, the presidency and executive branch, and election campaigns. Its stated output is "nonpartisan reporting on the inner workings of Government and the nexus of politics and business". The company's primary outlet is ''TheHill.com''. ''The Hill'' is additionally distributed in print for free around Washington, D.C., and distributed to all congressional offices. It has been owned by Nexstar Media Group since 2021. In 2020, ''The Hill'' was ranked second for online politics readership across all news sites, behind only CNN, remaining ahead of ''Politico'', Fox News, NBCNews.com, and MSNBC. ''The Hill'' had around 32 million monthly viewers in 2023. History Founding and early years The company was formed as a newspaper in 1994 by Democratic power broker ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |