|

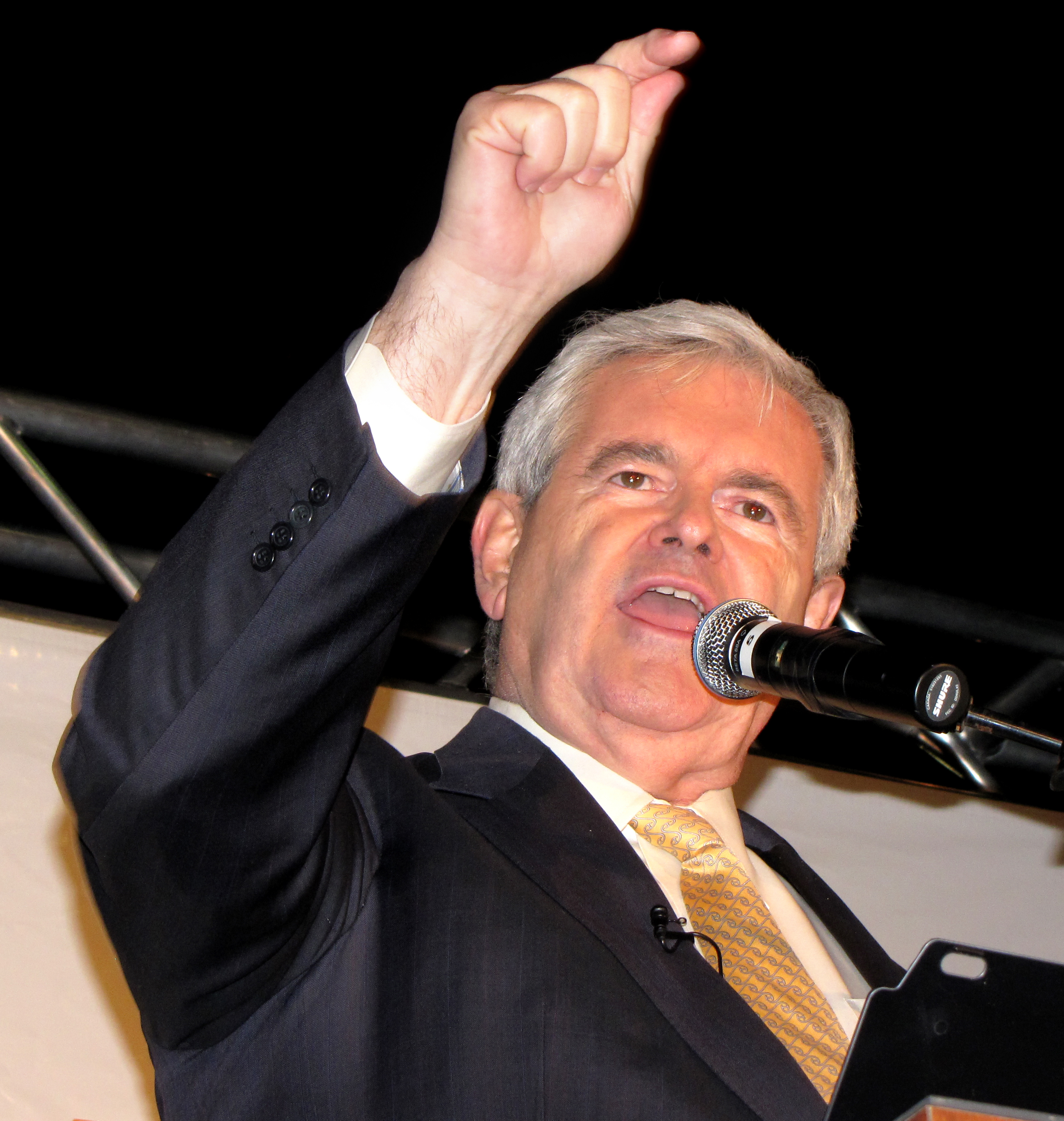

American Solutions For Winning The Future

American Solutions for Winning the Future (often referred to as American Solutions) was a 527 organization created by former Speaker of the United States House of Representatives Newt Gingrich. The group first received national attention for its 2008 effort, "Drill Here. Drill Now. Pay Less", focused on the issue of offshore drilling. The organization closed in July 2011. American Solutions was established by Gingrich in 2007.Kendra NarrFormer Gingrich 527 closes ''Politico'' (August 26, 2011). Gingrich served as chairman of the group. The group was a "fundraising juggernaut" that raised $52 million from major donors, such as Sheldon Adelson and the coal company Peabody Energy. The group promoted deregulation and increased offshore oil drilling and other fossil-fuel extraction and opposed the Employee Free Choice Act;Kathryn McGarr & Kenneth P. VogelNewt's big cash haul: $8 million ''Politico'' (July 31, 2009). ''Politico'' reported in 2009 that, "The operation, which includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

527 Organization

A 527 organization or 527 group is a type of U.S. tax-exempt organization organized under Section 527 of the U.S. Internal Revenue Code (). A 527 group is created primarily to influence the selection, nomination, election, appointment or defeat of candidates to federal, state or local public office. Technically, almost all political committees, including state, local, and federal candidate committees, traditional political action committees (PACs), "Political action committee#Super PACs, Super PACs", and political parties are "527s". However, in common practice the term is usually applied only to such organizations that are not regulated under state or federal campaign finance laws because they do not Issue advocacy ads, "expressly advocate" for the election or defeat of a candidate or party. There are no upper limits on contributions to 527s and no restrictions on who may contribute. There are no spending limits imposed on these organizations. The organizations must register w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

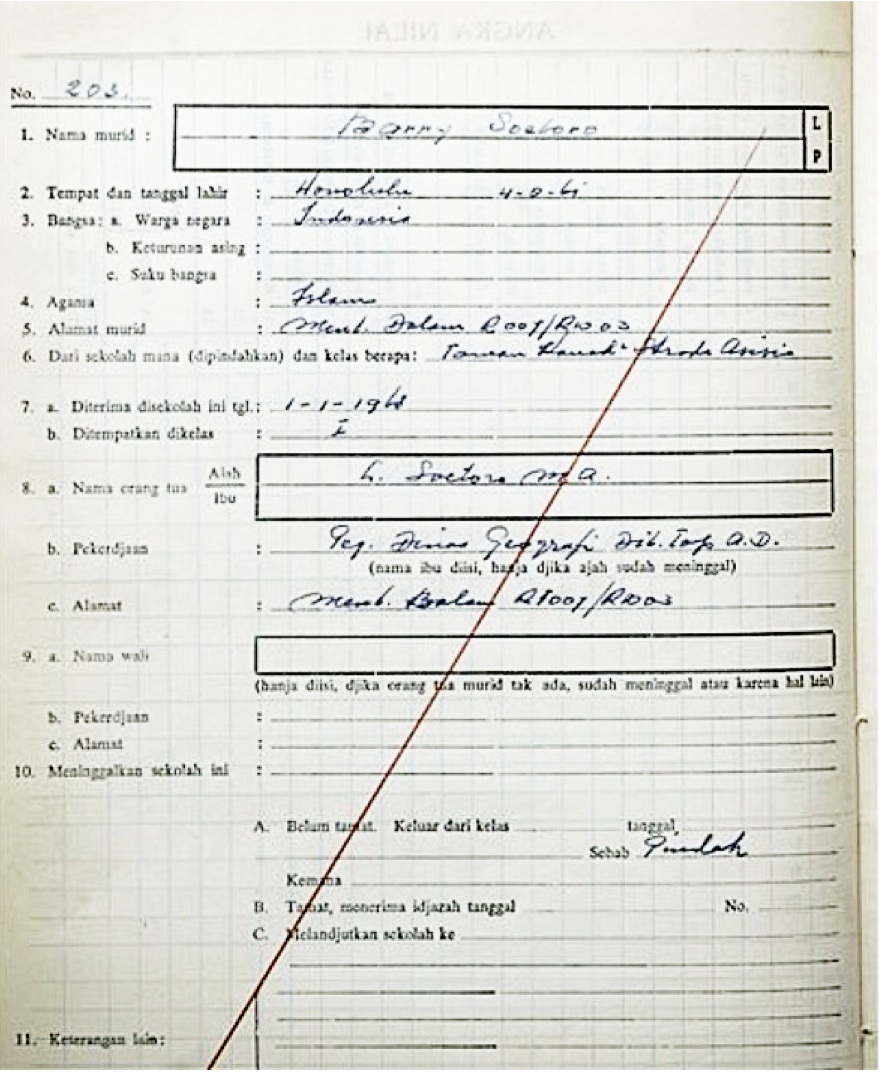

Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. Obama previously served as a U.S. senator representing Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004. Born in Honolulu, Hawaii, Obama graduated from Columbia University in 1983 with a Bachelor of Arts degree in political science and later worked as a community organizer in Chicago. In 1988, Obama enrolled in Harvard Law School, where he was the first black president of the ''Harvard Law Review''. He became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. In 1996, Obama was elected to represent the 13th district in the Illinois Senate, a position he held until 2004, when he successfully ran for the U.S. Senate. In the 2008 pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

A patient is any recipient of health care services that are performed by healthcare professionals. The patient is most often ill or injured and in need of treatment by a physician, nurse, optometrist, dentist, veterinarian, or other health care provider. Etymology The word patient originally meant 'one who suffers'. This English noun comes from the Latin word , the present participle of the deponent verb, , meaning , and akin to the Greek verb ( ) and its cognate noun (). This language has been construed as meaning that the role of patients is to passively accept and tolerate the suffering and treatments prescribed by the healthcare providers, without engaging in shared decision-making about their care. Outpatients and inpatients An outpatient (or out-patient) is a patient who attends an outpatient clinic with no plan to stay beyond the duration of the visit. Even if the patient will not be formally admitted with a note as an outpatient, their attendance is stil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. In South Africa, capital gains tax applies to the disposal of assets by individuals, companies, and trusts, with inclusion rates differing by entity type and with special provisions for primary residences and offshore assets. Not all countries impose a capital gains tax, and most have different rates of taxation for individuals compared to corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, the Cayman Islands, the Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, a so-called investment savings account (ISK – ''investeringssparkonto'') wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax In The United States

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have " inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax In The Republic Of Ireland

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of the Irish labour force (paid 50% of Irish salary tax), and created 57% of Irish OECD non-farm value-add. As of 2017, 25 of the top 50 Irish firms were U.S.–controlled businesses, representing 70% of the revenue of the top 50 Irish firms. By 2018, Ireland had received the most U.S. in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven system. Ireland's "headline" corporation tax rate is 12.5%, however, foreign multinationals pay an aggregate of 2.2–4.5% on global profits "shifted" to Ireland, via Ireland's global network of bilateral tax treaties. These lower effective tax rates are achieved by a complex set of Irish base erosion and profit shifting ("BEPS") tools which handle the largest BEPS flows in the world (e.g. the Double Ir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Tax In The United States

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the state to act as a single entity (a legal entity recognized by private and public law as "born out of statute"; a legal person in a legal context) and recognized as such in law for certain purposes. Early incorporated entities were established by charter (i.e., by an ''ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue stock, or whether they are formed to make a profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this article) or '' sole'' (a legal entity consisting of a single incorporated office occupied by a sing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Fle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Milwaukee County Executive Scott Walker Runs For Governor Of Wisconsin In October 2010

Milwaukee is the most populous city in the U.S. state of Wisconsin. Located on the western shore of Lake Michigan, it is the 31st-most populous city in the United States and the fifth-most populous city in the Midwest with a population of 577,222 at the 2020 census. It is the county seat of Milwaukee County. The Milwaukee metropolitan area is the 40th-most populous metropolitan area in the U.S. with 1.57 million residents. Founded in the early 19th century and incorporated in 1846, Milwaukee grew rapidly due to its location as a port city. Its history was heavily influenced by German immigrants and it continues to be a center for German-American culture, specifically known for its brewing industry. The city developed as an industrial powerhouse during the 19th and early 20th centuries. Milwaukee is an ethnically and culturally diverse city, however it continues to be one of the most racially segregated cities as a result of early-20th-century redlining. Milwaukee is ra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Katon Dawson

Katon Edwards Dawson (born February 29, 1956) is an American politician from the state of South Carolina, former chairman of the South Carolina Republican Party and was a 2009 candidate for chairman of the Republican National Committee. Early life Dawson was born in Columbia, South Carolina in then-heavily Democratic South Carolina, his parents helped organize the state's first GOP precincts. Dawson says his political interest came from attending a Barry Goldwater speech in 1964, and first volunteered for Richard Nixon's 1968 presidential campaign. Dawson graduated from the University of South Carolina. Political career Dawson was elected Richland County GOP vice chairman in 1994 and state party chair 2002. In 2006, despite nationwide losses by the Republican party, the South Carolina GOP carried eight of nine statewide constitutional offices. In August 2007 Dawson drew national attention for his decision to move the 2008 South Carolina Republican presidential primary from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South Carolina Republican Party

The South Carolina Republican Party (SCGOP) is the state affiliate of the national Republican Party in South Carolina. It is one of two major political parties in the state, along with the South Carolina Democratic Party, and is the dominant party. Incumbent governor Henry McMaster, as well as senators Tim Scott and Lindsey Graham, are members of the Republican party. Graham has served since January 3, 2003, having been elected in 2002 and re-elected in 2008, 2014, and 2020; Tim Scott was appointed in 2013 by then-governor Nikki Haley, who is also a Republican. Since 2003, every governor of South Carolina has been a Republican. Additionally, Republicans hold a supermajority in both the South Carolina Senate and South Carolina House of Representatives. In 2020, District 1, which was represented by Democrat Joe Cunningham, was won by Republican Nancy Mace; the party now represents six out of seven of the state's congressional districts. History In 1868, legislation prohibitio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |