|

2019 Texas Property Tax Reform

In May 2019 significant property tax reform bills passed the Texas Legislature, promising property tax relief and higher funding for schools. Senate Bill 2 tackles property tax issues, and House Bill 3 directly deals with school finance reform. House Bill 3 raised the amount per student each district is allotted from $5,140 to $6,030, and also reduces school property tax rates by about four percent per $100 in property value. House Bill 1 is the overall budget for Texas Texas (, ; Spanish language, Spanish: ''Texas'', ''Tejas'') is a state in the South Central United States, South Central region of the United States. At 268,596 square miles (695,662 km2), and with more than 29.1 million residents in 2 .... The tax reduction was achieved by allocating $6.6 billion from the rainy-day fund, leaving an estimated $8.4 billion in two years.{{Cite web, url=https://hro.house.texas.gov/pdf/focus/2019CSHB_1.pdf, title=Focus on State Finance. 86th Legislature,Texas House of Rep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Reform

Tax reform is the process of changing the way taxes are collected or managed by the government and is usually undertaken to improve tax administration or to provide economic or social benefits. Tax reform can include reducing the level of taxation of all people by the government, making the tax system more progressive or less progressive, or simplifying the tax system and making the system more understandable or more accountable. Numerous organizations have been set up to reform tax systems worldwide, often with the intent to reform income taxes or value added taxes into something considered more economically liberal. Other reforms propose tax systems that attempt to deal with externalities. Such reforms are sometimes proposed to be revenue-neutral, for example in revenue neutrality of the FairTax, meaning they ought not result in more tax or less being collected. Georgism claims that various forms of land tax can both deal with externalities and improve productivity. Austr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Texas Legislature

The Texas Legislature is the state legislature of the US state of Texas. It is a bicameral body composed of a 31-member Senate and a 150-member House of Representatives. The state legislature meets at the Capitol in Austin. It is a powerful arm of the Texas government not only because of its power of the purse to control and direct the activities of state government and the strong constitutional connections between it and the Lieutenant Governor of Texas, but also due to Texas's plural executive. The Legislature is the constitutional successor of the Congress of the Republic of Texas since Texas's 1845 entrance into the Union. The Legislature held its first regular session from February 16 to May 13, 1846. Structure and operations The Texas Legislature meets in regular session on the second Tuesday in January of each odd-numbered year. The Texas Constitution limits the regular session to 140 calendar days. The lieutenant governor, elected statewide separately from th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Texas Senate

The Texas Senate ( es, Senado de Texas) is the upper house of the Texas State Legislature. There are 31 members of the Senate, representing single-member districts across the U.S. state of Texas, with populations of approximately 806,000 per constituency, based on the 2010 U.S. Census. There are no term limits, and each term is four years long. Elections are held in even-numbered years on the first Tuesday after the first Monday in November. In elections in years ending in 2, all seats are up for election. Half of the senators will serve a two-year term, based on a drawing; the other half will fill regular four-year terms. In the case of the latter, they or their successors will be up for two-year terms in the next year that ends in 0. As such, in other elections, about half of the Texas Senate is on the ballot. The Senate meets at the Texas State Capitol in Austin. The Republicans currently control the chamber, which is made up of 18 Republicans and 13 Democrats. Leadership T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Texas House Of Representatives

The Texas House of Representatives is the lower house of the bicameral Texas Legislature. It consists of 150 members who are elected from single-member districts for two-year terms. As of the 2010 United States census, each member represents about 167,637 people. There are no term limits. The House meets at the State Capitol in Austin. Leadership The Speaker of the House is the presiding officer and highest-ranking member of the House. The Speaker's duties include maintaining order within the House, recognizing members during debate, ruling on procedural matters, appointing members to the various committees and sending bills for committee review. The Speaker pro tempore is primarily a ceremonial position, but does, by long-standing tradition, preside over the House during its consideration of local and consent bills. Unlike other state legislatures, the House rules do not formally recognize majority or minority leaders. The unofficial leaders are the Republican Caucus Chairm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

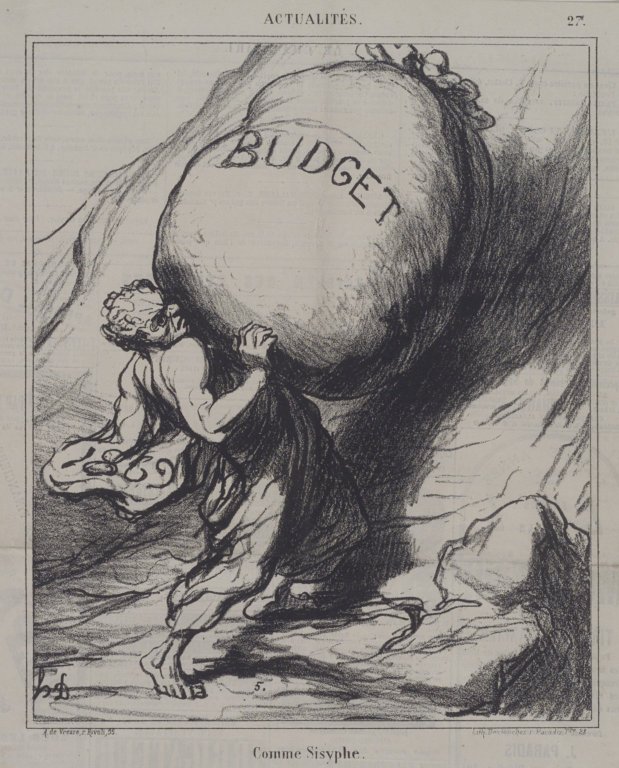

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Texas

Texas (, ; Spanish language, Spanish: ''Texas'', ''Tejas'') is a state in the South Central United States, South Central region of the United States. At 268,596 square miles (695,662 km2), and with more than 29.1 million residents in 2020, it is the second-largest U.S. state by both List of U.S. states and territories by area, area (after Alaska) and List of U.S. states and territories by population, population (after California). Texas shares borders with the states of Louisiana to the east, Arkansas to the northeast, Oklahoma to the north, New Mexico to the west, and the Mexico, Mexican States of Mexico, states of Chihuahua (state), Chihuahua, Coahuila, Nuevo León, and Tamaulipas to the south and southwest; and has a coastline with the Gulf of Mexico to the southeast. Houston is the List of cities in Texas by population, most populous city in Texas and the List of United States cities by population, fourth-largest in the U.S., while San Antonio is the second most pop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Texas Law

The law of Texas is derived from the ''Constitution of Texas'' and consists of several levels, including constitutional, statutory, and regulatory law, as well as case law and local laws and regulations. Sources The Constitution of Texas is the foremost source of state law. Legislation is enacted by the Texas Legislature, published in the '' General and Special Laws'', and codified in the ''Texas Statutes''. State agencies publish regulations (sometimes called administrative law) in the ''Texas Register'', which are in turn codified in the ''Texas Administrative Code''. The Texas legal system is based on common law, which is interpreted by case law through the decisions of the Supreme Court, the Court of Criminal Appeals, and the Courts of Appeals, which are published in the ''Texas Cases'' and '' South Western Reporter''. Counties and municipal governments may also promulgate local ordinances. Constitution The Constitution of Texas is the foundation of the government of Texa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Taxes

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |