United States note on:

[Wikipedia]

[Google]

[Amazon]

A United States Note, also known as a Legal Tender Note, is a type of

During 1861, the first year of the American Civil War, the expenses incurred by the Union Government much exceeded its limited revenues from taxation, and borrowing was the main vehicle for financing the war. The Act of July 17, 1861 authorized

During 1861, the first year of the American Civil War, the expenses incurred by the Union Government much exceeded its limited revenues from taxation, and borrowing was the main vehicle for financing the war. The Act of July 17, 1861 authorized

/ref> and the Third Legal Tender Act,ch. 73, enacted March 3, 1863, had expanded the limit to , the option to exchange the notes for United States bonds at par had been revoked, and notes of $1 and $2 denominations had been introduced as the appearance of fiat currency had per

In June 1874, Congress established a maximum for Greenback circulation of , and in January 1875, approved the Specie Payment Resumption Act, which authorized a reduction of the circulation of Greenbacks towards a revised limit of , and required the government to redeem them for gold, on demand, after January 1, 1879. As a result, the currency strengthened and by April 1876, the notes were on par with silver coins which then began to re-emerge into circulation.Bowers, Q. David; David Sundman (2006). ''100 GREATEST AMERICAN CURRENCY NOTES'', Atlanta, Georgia: Whitman Publishing. . On May 31, 1878, the contraction in the circulation was halted at —a level which would be maintained for almost 100 years afterwards. While was a significant figure at the time, it is now a very small fraction of the total currency in circulation in the United States. The year 1879 found Sherman, now Secretary of the Treasury, in possession of sufficient specie to redeem notes as requested, but as this brought the value of the greenbacks into parity with gold for the first time since the Specie Suspension of December 1861, the public voluntarily accepted the greenbacks as part of the circulating medium.

While the United States Notes had been used as a form of debt issuance during the Civil War, afterwards they were used as a way of moderately influencing the money supply by the federal government—such as through the actions of Boutwell and Richardson. During the

In June 1874, Congress established a maximum for Greenback circulation of , and in January 1875, approved the Specie Payment Resumption Act, which authorized a reduction of the circulation of Greenbacks towards a revised limit of , and required the government to redeem them for gold, on demand, after January 1, 1879. As a result, the currency strengthened and by April 1876, the notes were on par with silver coins which then began to re-emerge into circulation.Bowers, Q. David; David Sundman (2006). ''100 GREATEST AMERICAN CURRENCY NOTES'', Atlanta, Georgia: Whitman Publishing. . On May 31, 1878, the contraction in the circulation was halted at —a level which would be maintained for almost 100 years afterwards. While was a significant figure at the time, it is now a very small fraction of the total currency in circulation in the United States. The year 1879 found Sherman, now Secretary of the Treasury, in possession of sufficient specie to redeem notes as requested, but as this brought the value of the greenbacks into parity with gold for the first time since the Specie Suspension of December 1861, the public voluntarily accepted the greenbacks as part of the circulating medium.

While the United States Notes had been used as a form of debt issuance during the Civil War, afterwards they were used as a way of moderately influencing the money supply by the federal government—such as through the actions of Boutwell and Richardson. During the

/ref> In September 1994, the Riegle Improvement Act released the Treasury from its long-standing obligation to keep United States Notes in circulation. Just prior to the Riegle act, the treasury considered releasing its large remaining stockpile of unissued United States Notes into general circulation, but with the recently redesigned series 1996 Federal Reserve Note, it was decided confusion would likely arise with the sudden appearance of two very different notes in circulation.Riegle Community Development and Regulatory Improvement Act of 1994, see Sec. 602(f)(4)

/ref> The Treasury announced in 1996 that the remaining stock of United States Notes had been destroyed.

Like all U.S. currency, United States Notes were produced in a large sized format until 1929, at which time the notes' sizes were reduced to the small-size format of the present day. Per the Treasury Department Appropriation Bill of 1929, notes issued before October 1928 were inches and later issues were to be inches, which allowed the Treasury Department to produce 12 notes per inch sheet of paper that previously would yield 8 notes at the old size.

The original large-sized Civil War issues were dated 1862 and 1863, and issued in denominations of , , , , , , , and . The United States Notes were dramatically redesigned for the Series of 1869, the so-called ''Rainbow Notes''. The notes were again redesigned for the Series of 1874, 1875 and 1878. The Series of 1878 included, for the first and last time, notes of and denominations. The final across-the-board redesign of the large-sized notes was the Series of 1880. Individual denominations were redesigned in 1901, 1907, 1917 and 1923.

On small-sized United States Notes, the U.S. Treasury Seal and the

Like all U.S. currency, United States Notes were produced in a large sized format until 1929, at which time the notes' sizes were reduced to the small-size format of the present day. Per the Treasury Department Appropriation Bill of 1929, notes issued before October 1928 were inches and later issues were to be inches, which allowed the Treasury Department to produce 12 notes per inch sheet of paper that previously would yield 8 notes at the old size.

The original large-sized Civil War issues were dated 1862 and 1863, and issued in denominations of , , , , , , , and . The United States Notes were dramatically redesigned for the Series of 1869, the so-called ''Rainbow Notes''. The notes were again redesigned for the Series of 1874, 1875 and 1878. The Series of 1878 included, for the first and last time, notes of and denominations. The final across-the-board redesign of the large-sized notes was the Series of 1880. Individual denominations were redesigned in 1901, 1907, 1917 and 1923.

On small-sized United States Notes, the U.S. Treasury Seal and the

''A History of the Greenbacks: With Special Reference to the Economic Consequences of Their Issue, 1862–65.''

Chicago: University of Chicago Press, 1903. * Irwin Unger, '' The Greenback Era: A Social and Political History of American Finance, 1865–1879.'' (1965) * Henry George

"On Greenbacks, Free Silver, and Free Banking,"

''The Standard'', December 14, 1889.

U.S. Treasury Dept. information about United States Notes

{{Obsolete United States currency and coinage Freiwirtschaft Monetary reform Banknotes of the United States 1862 establishments in the United States 1971 disestablishments in the United States

paper money

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

that was issued from 1862 to 1971 in the U.S. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as "greenbacks", a name inherited from the earlier greenbacks, the Demand Note

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 . Demand Notes were the first issue of paper money by the United State ...

s, that they replaced in 1862. Often termed Legal Tender Notes, they were named United States Notes by the First Legal Tender Act, which authorized them as a form of fiat currency

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was some ...

. During the early 1860s the so-called ''second obligation'' on the reverse of the notes stated:

By the 1930s, this obligation would eventually be shortened to:

They were originally issued directly into circulation by the U.S. Treasury to pay expenses incurred by the Union during the American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States. It was fought between the Union (American Civil War), Union ("the North") and t ...

. During the next century, the legislation governing these notes was modified many times and numerous versions were issued by the Treasury.

United States Notes that were issued in the large-size format, before 1929, differ dramatically in appearance when compared to modern American currency, but those issued in the small-size format, starting 1929, are very similar to contemporary Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 191 ...

s of the same denominations with the distinction of having red U.S. Treasury Seals and serial number

A serial number is a unique identifier assigned incrementally or sequentially to an item, to ''uniquely'' identify it.

Serial numbers need not be strictly numerical. They may contain letters and other typographical symbols, or may consist enti ...

s in place of green ones. Also, while a variety of denominations were issued as United States Notes during the large-size era, only the $1, $2, $5, and $100 denominations were ever issued as small-size notes.

Existing United States Notes remain valid currency in the United States; however, as no United States Notes have been issued since January 1971, they are increasingly rare in circulation and command higher prices than face value as items of numismatic

Numismatics is the study or collection of currency, including coins, tokens, paper money, medals and related objects.

Specialists, known as numismatists, are often characterized as students or collectors of coins, but the discipline also incl ...

interest.

History

Demand Notes

During 1861, the first year of the American Civil War, the expenses incurred by the Union Government much exceeded its limited revenues from taxation, and borrowing was the main vehicle for financing the war. The Act of July 17, 1861 authorized

During 1861, the first year of the American Civil War, the expenses incurred by the Union Government much exceeded its limited revenues from taxation, and borrowing was the main vehicle for financing the war. The Act of July 17, 1861 authorized United States Secretary of the Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal a ...

Salmon P. Chase

Salmon Portland Chase (January 13, 1808May 7, 1873) was an American politician and jurist who served as the sixth chief justice of the United States. He also served as the 23rd governor of Ohio, represented Ohio in the United States Senate, a ...

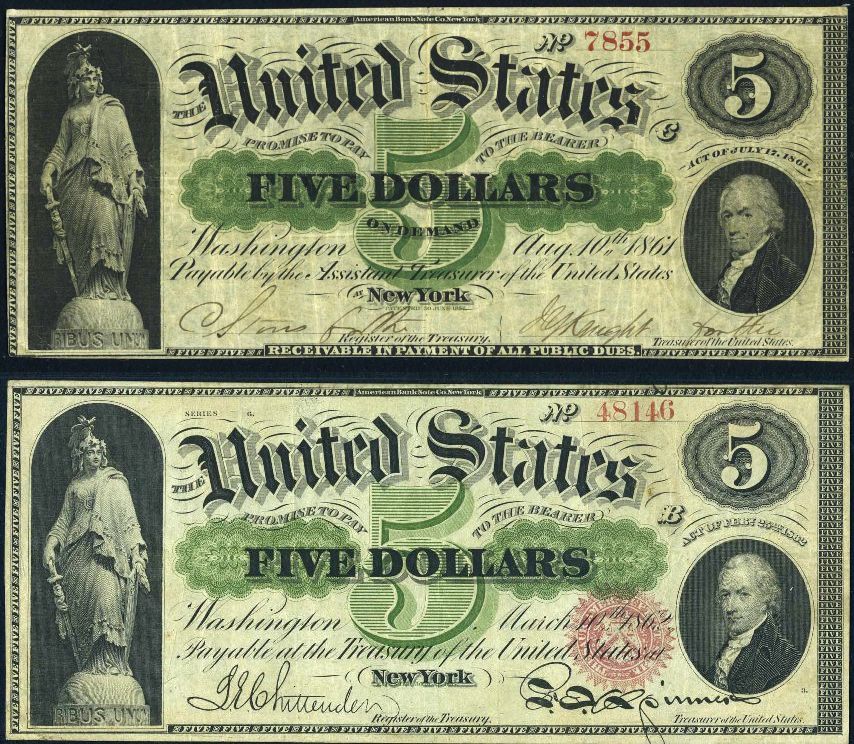

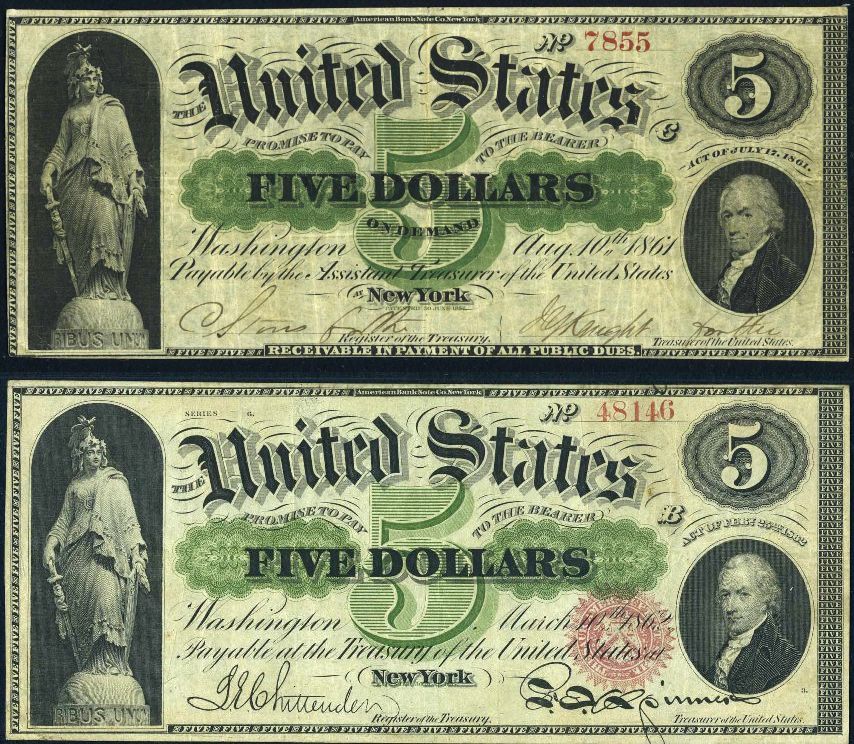

to raise money via the issuance of $50,000,000 in Treasury Notes payable on demand.Mitchell, Wesley Clair, "A History of the Greenbacks With Special Reference To the Economic Consequences of Their Issue 1862–65", University of Chicago, Chicago, 1903. These Demand Notes were paid to creditors directly and used to meet the payroll of soldiers in the field. While issued within the legal framework of Treasury Note Debt, the Demand Notes were intended to circulate as currency and were of the same size as banknotes and closely resembled them in appearance. During December 1861, economic conditions deteriorated and a suspension of specie payment caused the government to cease redeeming the Demand Notes as coins.

The Legal Tender Acts

The beginning of 1862 found the Union's expenses increasing, and the government was having trouble funding the escalating war. U.S. Demand Notes—which were used, among other things, to pay Union soldiers—were unredeemable, and the value of the notes began to deteriorate. Congressman and Buffalo banker Elbridge G. Spaulding prepared a bill, based on the Free Banking Law of New York, that eventually became the National Banking Act of 1863. Recognizing, however, that his proposal would take many months to pass Congress, during early February Spaulding introduced another bill to permit the U.S. Treasury to issue million in notes as legal tender. This caused tremendous controversy in Congress, as hitherto the Constitution had been interpreted as not granting the government the power to issue a paper currency. "The bill before us is a war measure, a measure of ''necessity'', and not of choice," Spaulding argued before the House, adding, "These are extraordinary times, and extraordinary measures must be resorted to in order to save our Government, and preserve our nationality." Spaulding justified the action as a "''necessary means'' of carrying into execution the powers granted in the Constitution 'to raise and ''support'' armies', and 'to provide and ''maintain'' a navy. Despite strong opposition, PresidentAbraham Lincoln

Abraham Lincoln ( ; February 12, 1809 – April 15, 1865) was an American lawyer, politician, and statesman who served as the 16th president of the United States from 1861 until his assassination in 1865. Lincoln led the nation throu ...

signed the First Legal Tender Act,ch. 33, enacted February 25, 1862, into law, authorizing the issuance of United States Notes as a legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

—the paper currency soon to be known as "greenbacks".

Initially, the emission was limited to total face value between the new Legal Tender Notes and the existing Demand Notes. The Act also intended for the new notes to be used to replace the Demand Notes as soon as practical. The Demand Notes had been issued in denominations of $5, $10, and $20, and these were replaced by United States Notes nearly identical in appearance on the obverse. In addition, notes of entirely new design were introduced in denominations of $50, $100, $500 and . The Demand Notes' printed promise of payment "On Demand" was removed and the statement "This Note is a Legal Tender" was added.

Legal tender status guaranteed that creditors would have to accept the notes despite the fact that they were not backed by gold, bank deposits, or government reserves, and had no interest. However, the First Legal Tender Act did not make the notes an ''unlimited legal tender'' as they could not be used by merchants to pay customs duties on imports and could not be used by the government to pay interest on its bonds. The Act did provide that the notes be receivable by the government for short term deposits at 5% interest, and for the purchase of 6% interest 20-year bonds at par. The rationale for these terms was that the Union government would preserve its credit-worthiness by supporting the value of its bonds by paying their interest in gold. Early in the war, customs duties were a large part of government tax revenue and by making these payable in gold, the government would generate the coin necessary to make the interest payments on the bonds. Lastly, by making the bonds available for purchase at par in United States Notes, the value of the latter would be confirmed as well. The limitations of the legal tender status were quite controversial. Thaddeus Stevens

Thaddeus Stevens (April 4, 1792August 11, 1868) was a member of the United States House of Representatives from Pennsylvania, one of the leaders of the Radical Republican faction of the Republican Party during the 1860s. A fierce opponent of sla ...

, the Chairman of the House of Representatives Committee of Ways and Means, which had authored an earlier version of the Legal Tender Act that would have made United States Notes a legal tender for ''all'' debts, denounced the exceptions, calling the new bill "mischievous" because it made United States Notes an intentionally depreciated currency for the masses, while the banks who loaned to the government got "sound money" in gold. This controversy would continue until the removal of the exceptions during 1933.

By the First Legal Tender Act, Congress limited the Treasury's emission of United States Notes to ; however, by 1863, the Second Legal Tender Act,ch. 142, enacted July 11, 1862, a Joint Resolution of Congress,United States Congress. Resolution of January 17, 1863, No. 9. Washington D.C.: 1863/ref> and the Third Legal Tender Act,ch. 73, enacted March 3, 1863, had expanded the limit to , the option to exchange the notes for United States bonds at par had been revoked, and notes of $1 and $2 denominations had been introduced as the appearance of fiat currency had per

Gresham's law

In economics, Gresham's law is a monetary principle stating that "bad money drives out good". For example, if there are two forms of commodity money in circulation, which are accepted by law as having similar face value, the more valuable com ...

driven even silver coinage out of circulation. As a result of this inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

, the greenback began to trade at a substantial discount from gold, which prompted Congress to pass the short-lived Anti-Gold Futures Act of 1864 The Anti-Gold Futures Act of 1864 () was the first instance of United States Federal regulation of derivatives. More formally titled "An Act to Prohibit Certain Sales of Gold and Foreign Exchange," the Act was passed by Congress on June 17, 1864. ...

, which was soon repealed after it seemed to accelerate the decrease of greenback value.

The largest amount of greenbacks outstanding at any one time was calculated as . The Union's reliance on expanding the circulation of greenbacks eventually ended with the emission of Interest Bearing and Compound Interest Treasury Notes, and the passage of the National Banking Act. However, the end of the war found the greenbacks trading for only about half of their nominal value in gold. The Secret Service

A secret service is a government agency, intelligence agency, or the activities of a government agency, concerned with the gathering of intelligence data. The tasks and powers of a secret service can vary greatly from one country to another. Fo ...

was founded on July 5, 1865, to minimize counterfeiting

To counterfeit means to imitate something authentic, with the intent to steal, destroy, or replace the original, for use in illegal transactions, or otherwise to deceive individuals into believing that the fake is of equal or greater value tha ...

, which accounted for up to half of the currency.

Post Civil War

At the end of the Civil War, some economists, such as Henry Charles Carey, argued for building on the precedent of non-interest-based fiat money and making the greenback system permanent. However, Secretary of the Treasury McCulloch argued that the Legal Tender Acts had been war measures, and that the United States should soon reverse them and return to thegold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from th ...

. The House of Representatives voted overwhelmingly to endorse the Secretary's argument."United States Notes", John Joseph Lalor, ''Cyclopaedia of Political Science, Political Economy, and of the Political History of the United States'', Rand McNally & Co, Chicago, 1881. With an eventual return to gold convertibility in mind, the Funding Act of April 12, 1866 was passed, authorizing McCulloch to retire million of the Greenbacks within six months and up to million per month thereafter. This he proceeded to do until only were outstanding during February 1868. By this time, the wartime economic prosperity was ended, the crop harvest was poor, and a financial panic in Great Britain caused a recession and a sharp decrease of prices in the United States.Studenski, Paul; Krooss, Hermand Edward (1952). ''Financial History of the United States'', New York, NY: McGraw-Hill. . The contraction of the money supply was blamed for the deflationary effects, and caused debtors to agitate successfully for a halt to the notes' retirement.

During the early 1870s, Treasury Secretaries George S. Boutwell and William Adams Richardson

William Adams Richardson (November 2, 1821 – October 19, 1896) was an American lawyer who served as the 29th United States secretary of the treasury from 1873 to 1874. During his tenure, the Panic of 1873 swept the nation and caused a depress ...

maintained that, though Congress had mandated as the minimum Greenback circulation, the old Civil War statutes still authorized a maximum of —and thus they had at their discretion a "reserve" of . While the Senate Finance Committee under John Sherman disagreed, being of the opinion that the was a maximum as well as a minimum, no legislation was passed to assert the Committee's opinion. Starting in 1872, Boutwell and Richardson used the "reserve" to counteract seasonal demands for currency, and eventually expanded the circulation of the Greenbacks to in response to the Panic of 1873

The Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 to 1877 or 1879 in France and in Britain. In Britain, the Panic started two decades of stagnation known as the ...

.Timberlake, Richard H.(1993). ''Monetary Policy in the United States: An Intellectual and Institutional History'', Chicago: University of Chicago Press. .

In June 1874, Congress established a maximum for Greenback circulation of , and in January 1875, approved the Specie Payment Resumption Act, which authorized a reduction of the circulation of Greenbacks towards a revised limit of , and required the government to redeem them for gold, on demand, after January 1, 1879. As a result, the currency strengthened and by April 1876, the notes were on par with silver coins which then began to re-emerge into circulation.Bowers, Q. David; David Sundman (2006). ''100 GREATEST AMERICAN CURRENCY NOTES'', Atlanta, Georgia: Whitman Publishing. . On May 31, 1878, the contraction in the circulation was halted at —a level which would be maintained for almost 100 years afterwards. While was a significant figure at the time, it is now a very small fraction of the total currency in circulation in the United States. The year 1879 found Sherman, now Secretary of the Treasury, in possession of sufficient specie to redeem notes as requested, but as this brought the value of the greenbacks into parity with gold for the first time since the Specie Suspension of December 1861, the public voluntarily accepted the greenbacks as part of the circulating medium.

While the United States Notes had been used as a form of debt issuance during the Civil War, afterwards they were used as a way of moderately influencing the money supply by the federal government—such as through the actions of Boutwell and Richardson. During the

In June 1874, Congress established a maximum for Greenback circulation of , and in January 1875, approved the Specie Payment Resumption Act, which authorized a reduction of the circulation of Greenbacks towards a revised limit of , and required the government to redeem them for gold, on demand, after January 1, 1879. As a result, the currency strengthened and by April 1876, the notes were on par with silver coins which then began to re-emerge into circulation.Bowers, Q. David; David Sundman (2006). ''100 GREATEST AMERICAN CURRENCY NOTES'', Atlanta, Georgia: Whitman Publishing. . On May 31, 1878, the contraction in the circulation was halted at —a level which would be maintained for almost 100 years afterwards. While was a significant figure at the time, it is now a very small fraction of the total currency in circulation in the United States. The year 1879 found Sherman, now Secretary of the Treasury, in possession of sufficient specie to redeem notes as requested, but as this brought the value of the greenbacks into parity with gold for the first time since the Specie Suspension of December 1861, the public voluntarily accepted the greenbacks as part of the circulating medium.

While the United States Notes had been used as a form of debt issuance during the Civil War, afterwards they were used as a way of moderately influencing the money supply by the federal government—such as through the actions of Boutwell and Richardson. During the Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% fro ...

, President Theodore Roosevelt

Theodore Roosevelt Jr. ( ; October 27, 1858 – January 6, 1919), often referred to as Teddy or by his initials, T. R., was an American politician, statesman, soldier, conservationist, naturalist, historian, and writer who served as the 26t ...

attempted to increase liquidity in the markets by authorizing the Treasury to issue more Greenbacks, but the Aldrich–Vreeland Act provided for the needed flexibility by the National Bank Note supply instead. Eventually, the perceived need for an elastic currency was addressed with the Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 191 ...

s authorized by the Federal Reserve Act of 1913

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, and attempts to alter the circulating quantity of United States Notes ended.

End of the United States Note

Soon after private ownership of gold was banned in 1933 (a ban that would be lifted in 1974), all of the remaining types of circulating currency, National Bank Notes, silver certificates,Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 191 ...

s, and United States Notes, were redeemable by individuals only for silver

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical ...

. Eventually, even silver redemption stopped in June 1968, during a time in which all U.S. currency (both coins and paper currency) was changed to fiat currency

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was some ...

. For the general public, there was then little to distinguish United States Notes from Federal Reserve Notes. As a result, the public circulation of United States Notes, in the form of and bills was discontinued in August 1966, and replaced with Federal Reserve Notes and, eventually, Federal Reserve Notes as well. United States Notes became rare in hand-to-hand commerce and also beginning in 1966, the Treasury converted the outstanding balance into new United States Notes, the majority of which sat unissued in bank vaults. Series 1966 and Series 1966A United States Notes were printed from 1966 to 1969, with distribution into public circulation officially ending January 21, 1971.U.S. Treasury – FAQ: Legal Tender Status/ref> In September 1994, the Riegle Improvement Act released the Treasury from its long-standing obligation to keep United States Notes in circulation. Just prior to the Riegle act, the treasury considered releasing its large remaining stockpile of unissued United States Notes into general circulation, but with the recently redesigned series 1996 Federal Reserve Note, it was decided confusion would likely arise with the sudden appearance of two very different notes in circulation.Riegle Community Development and Regulatory Improvement Act of 1994, see Sec. 602(f)(4)

/ref> The Treasury announced in 1996 that the remaining stock of United States Notes had been destroyed.

Comparison to Federal Reserve Notes

Both United States Notes andFederal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 191 ...

s have been legal tender since the gold recall of 1933. Both have been used in circulation as money in the same way. However, the issuing authority for them came from different statutes. United States Notes are, depending on their issue, redeemable directly for precious metal – as after the specie resumption of 1879 which authorized federal officials to do so if requested. The difference between a United States Note and a Federal Reserve Note is that a United States Note represented a "bill of credit" and, since it was issued by the government itself and does not involve either lending or borrowing, was inserted by the Treasury directly into circulation free of interest. Federal Reserve notes are not backed either by precious metals or the full faith of the United States government. The twelve Federal Reserve Banks issue them into circulation pursuant to the Federal Reserve Act of 1913. A commercial bank belonging to the Federal Reserve System can obtain Federal Reserve notes from the Federal Reserve Bank in its district whenever it wishes. It must pay for them in full, dollar for dollar, by drawing down its account with its district Federal Reserve Bank.

Characteristics

serial number

A serial number is a unique identifier assigned incrementally or sequentially to an item, to ''uniquely'' identify it.

Serial numbers need not be strictly numerical. They may contain letters and other typographical symbols, or may consist enti ...

s are printed in red (contrasting with Federal Reserve Notes, where they appear in green). By the time the treasury adopted the small-size format in 1928, the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after ...

had existed for fifteen years and there had been a decline in the need for United States Notes; the notes were mainly issued in and denominations in the Series years of 1928, 1953, and 1963. There was a limited issue of notes in the Series of 1928, most of which were released in 1948 in Puerto Rico

Puerto Rico (; abbreviated PR; tnq, Boriken, ''Borinquen''), officially the Commonwealth of Puerto Rico ( es, link=yes, Estado Libre Asociado de Puerto Rico, lit=Free Associated State of Puerto Rico), is a Caribbean island and unincorporated ...

, and an issue of notes in the Series year of 1966, mainly to satisfy the legacy legal requirement of maintaining the mandated quantity in circulation after the and denominations had been discontinued in August 1966. The BEP also printed but did not issue notes in the 1928 Series. An example was displayed at the 1933 Worlds Fair in Chicago.

Section 5119(b)(2) of Title 31, United States Code, was amended by the Riegle Community Development and Regulatory Improvement Act of 1994 (Public Law 103-325) to read as follows: "The Secretary shall not be required to reissue United States currency notes upon redemption." This does not change the legal tender status of United States Notes nor does it require a recall of those notes already in circulation. This provision means that United States Notes are to be canceled and destroyed but not reissued. This will eventually result in a decrease in the amount of these notes outstanding.

Large-size United States Notes (1862–1923)

Series 1928 United States Notes

Series 1953 United States Notes

Series 1963 United States Notes

Series 1966 United States Notes

Public debt of the United States

, the U.S. Treasury calculates that million in United States notes are in circulation and, in accordance with debt ceiling legislation, excludes this amount from the statutory debt limit of the United States. The million excludes million in United States Notes issued prior to July 1, 1929, determined pursuant to Act of June 30, 1961, 31 U.S.C. 5119, to have been destroyed or irretrievably lost.Politics and controversy

The United States Notes were introduced asfiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometim ...

rather than the precious metal medium of exchange that the United States had traditionally used. Their introduction was thus contentious.

The United States Congress

The United States Congress is the legislature of the federal government of the United States. It is Bicameralism, bicameral, composed of a lower body, the United States House of Representatives, House of Representatives, and an upper body, ...

had enacted the ''Legal Tender Acts'' during the U.S. Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states ...

when southern Democrats were absent from the Congress, and thus their Jacksonian hard money views were underrepresented. After the war, the Supreme Court

A supreme court is the highest court within the hierarchy of courts in most legal jurisdictions. Other descriptions for such courts include court of last resort, apex court, and high (or final) court of appeal. Broadly speaking, the decisions of ...

ruled on the ''Legal Tender Cases

The ''Legal Tender Cases'' were two 1871 United States Supreme Court cases that affirmed the constitutionality of paper money. The two cases were '' Knox v. Lee'' and '' Parker v. Davis''.

The U.S. federal government had issued paper money known ...

'' to determine the constitutionality of the use of greenbacks. The 1870 case ''Hepburn v. Griswold

''Hepburn v. Griswold'', 75 U.S. (8 Wall.) 603 (1870), was a United States Supreme Court case in which the Chief Justice of the United States, Salmon P. Chase, speaking for the Court, declared certain parts of the Legal Tender Acts to be uncons ...

'' found unconstitutional the use of greenbacks when applied to debts established prior to the First ''Legal Tender Act'' as the five Democrats on the Court, Nelson, Grier, Clifford, Field, and Chase

Chase or CHASE may refer to:

Businesses

* Chase Bank, a national bank based in New York City, New York

* Chase Aircraft (1943–1954), a defunct American aircraft manufacturing company

* Chase Coaches, a defunct bus operator in England

* Chase C ...

, ruled against the Civil War legislation in a 5–3 decision. Secretary Chase had become Chief Justice of the United States and a Democrat, and spearheaded the decision invalidating his own actions during the war. However, Grier retired from the Court, and President Grant appointed two new Republicans, Strong

Strong may refer to:

Education

* The Strong, an educational institution in Rochester, New York, United States

* Strong Hall (Lawrence, Kansas), an administrative hall of the University of Kansas

* Strong School, New Haven, Connecticut, United S ...

and Bradley, who joined the three sitting Republicans, Swayne, Miller

A miller is a person who operates a mill, a machine to grind a grain (for example corn or wheat) to make flour. Milling is among the oldest of human occupations. "Miller", "Milne" and other variants are common surnames, as are their equivalent ...

, and Davis

Davis may refer to:

Places Antarctica

* Mount Davis (Antarctica)

* Davis Island (Palmer Archipelago)

* Davis Valley, Queen Elizabeth Land

Canada

* Davis, Saskatchewan, an unincorporated community

* Davis Strait, between Nunavut and Gre ...

, to reverse Hepburn, 5–4, in the 1871 cases '' Knox v. Lee'' and '' Parker v. Davis''. In 1884, the Court, controlled 8–1 by Republicans, granted the federal government very broad power to issue Legal Tender paper through the case '' Juilliard v. Greenman'', with only the lone remaining Democrat, Field, dissenting.

The states in the far west stayed loyal to the Union, but also had hard money sympathies. During the specie suspension from 1862 to 1878, western states used the gold dollar as a unit of account whenever possible and accepted greenbacks at a discount wherever they could. The preferred forms of paper money were gold certificate

Gold certificates were issued by the United States Treasury as a form of representative money from 1865 to 1933. While the United States observed a gold standard, the certificates offered a more convenient way to pay in gold than the use of coin ...

s and National Gold Bank Note

National Gold Bank Notes were National Bank Notes issued by nine national gold banks in California in the 1870s and 1880s and redeemable in gold. Printed on a yellow-tinted paper, six denominations circulated: $5, $10, $20, $50, $100, and $500. A $ ...

s, the latter having been created specifically to address the desire for hard money in California

California is a state in the Western United States, located along the Pacific Coast. With nearly 39.2million residents across a total area of approximately , it is the most populous U.S. state and the 3rd largest by area. It is also the m ...

.

During the 1870s and 1880s, the Greenback Party

The Greenback Party (known successively as the Independent Party, the National Independent Party and the Greenback Labor Party) was an American political party with an anti-monopoly ideology which was active between 1874 and 1889. The party ran ...

existed for the primary purpose of advocating an increased circulation of United States Notes as a way of creating inflation according to the quantity theory of money

In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries. The QTM states that the general price level of goods and services is directly ...

. However, as the 1870s unfolded, the market price of silver decreased with respect to gold, and inflationists found a new cause in the Free Silver movement. Opposition to the resumption of specie convertibility of the Greenbacks during 1879 was accordingly muted.

See also

* History of central banking in the United StatesFootnotes

Notes

References

* * *Further reading

* Wesley Clair Mitchell''A History of the Greenbacks: With Special Reference to the Economic Consequences of Their Issue, 1862–65.''

Chicago: University of Chicago Press, 1903. * Irwin Unger, '' The Greenback Era: A Social and Political History of American Finance, 1865–1879.'' (1965) * Henry George

"On Greenbacks, Free Silver, and Free Banking,"

''The Standard'', December 14, 1889.

External links

U.S. Treasury Dept. information about United States Notes

{{Obsolete United States currency and coinage Freiwirtschaft Monetary reform Banknotes of the United States 1862 establishments in the United States 1971 disestablishments in the United States