Tehran Stock Exchange on:

[Wikipedia]

[Google]

[Amazon]

The Tehran Stock Exchange (TSE) ( fa, بورس اوراق بهادار تهران,

The concept of stock industrialization dates to 1936, when

The concept of stock industrialization dates to 1936, when

Stock Exchange Act

. Initially limited in size and scope, the Tehran Stock Exchange (the "TSE") began operations in 1967, trading only in corporate and government bonds. Iran's rapid economic expansion in the 1970s, coupled with a popular desire to participate in the country's economic growth through the financial markets, led to a demand for equity. The Government became actively engaged in the process, by granting shares to employees of large state-owned and family-owned enterprises. Market activity increased substantially, as both companies and *

*

International Options Market Association

The Securities and Exchange Organization (SEO)

is responsible for administration and supervisory duties, governed by the Board of Directors. The SEO's Board of Directors are elected by the Securities and Exchange Council. SEO also actively promotes innovation in Islamic products and has formed a specific "

public holidays

Trading takes place through the Automated Trade Execution System from 9am to 12 noon, which is integrated with a clearing, settlement

depository and registry system

Settlement is T+3. The TSE is solely an order-driven market and all transactions are executed in the manner and under the principles of open auction.

Retrieved April 30, 2011 TSE Services Company (TSESC), who is in charge of the site, supplies computer services. TSESC is a member o

Association of National Numbering Agencies (ANNA)

. Retrieved July 31, 2010.

Since 1998 importers and exporters have also been permitted to trade foreign-exchange certificates on the TSE, creating a floating value for the

Since 1998 importers and exporters have also been permitted to trade foreign-exchange certificates on the TSE, creating a floating value for the

88 brokerages active in the TSE

are licensed to trade the futures contracts. The leverage for futures contracts is set at 1-to-10. TSE will only deal in the derivatives through electronic trading. As of 2013, '' Mofid'', '' Keshavarzi'', ''Agah'' and '' Nahayat Negar'' were the top 4 performers among TSE's brokerage firms. These firms executing 41% of the total value in on-line trading.

Starting March 2011

investors are able to trade in the Iranian stock market through the

. Turquoise Partners. Retrieved November 3, 2011 In 2013, 83 brokerage firms (out of TSE's 93 firms) offered on-line transactions, accounting for 18% of the total trading value. In 2014, Iran's TSE was in talks to share its trading data with

. Retrieved July 31, 2010. * Participation bonds: 0.1% of transaction value payable by both the buyer and seller with a maximum of 100 million IRR.

88 brokerages active in the TSE

are licensed to trade the futures contracts. The leverage for futures contracts is set at 1-to-10. TSE will only deal in the derivatives through electronic trading. In the TSE's derivatives market, over 13,200 single stock futures contracts were traded in 2011 with a value of over 510 billion Rials.

According to the

According to the

Retrieved April 30, 2011 2012: Companies showing the most profit, are mostly in pharmaceutical, petrochemical and steel businesses. The sharp decline of the Rial in 2012 has made exports more competitive. Other favoured companies are state-owned industrial companies that rely on a mostly domestic

. Turquoise Partners. Retrieved February 25, 2015.

Financial Tribune, December 14, 2016. Retrieved December 14, 2016. As of 2014, about 300 foreign investors (including 25

permitted brokerage firms

and investment banks are investing in the TSE according to the investment funds regulation.

• TSE Dividend & Price "

• TSE All-Share FF adjusted (TEFIX)

• TSE TEFIX-30 - Blue chip index

• TSE Cash Dividend Index (TEDIX)

• TSE-50 - (Top 50 most active companies)

• Each industry (sector) Index

• Industrial Index

• Financial Index

• Each Company Index (based on Price & Volume) In 1990, the All-Shares Price

weighted market value of all share prices appearing on the TSE Board

and is measured every two minutes. In addition to the TEPIX, daily price indices of shares of each company, each sector, and the "Top Fifty" most active companies (TSE-50) are computed.

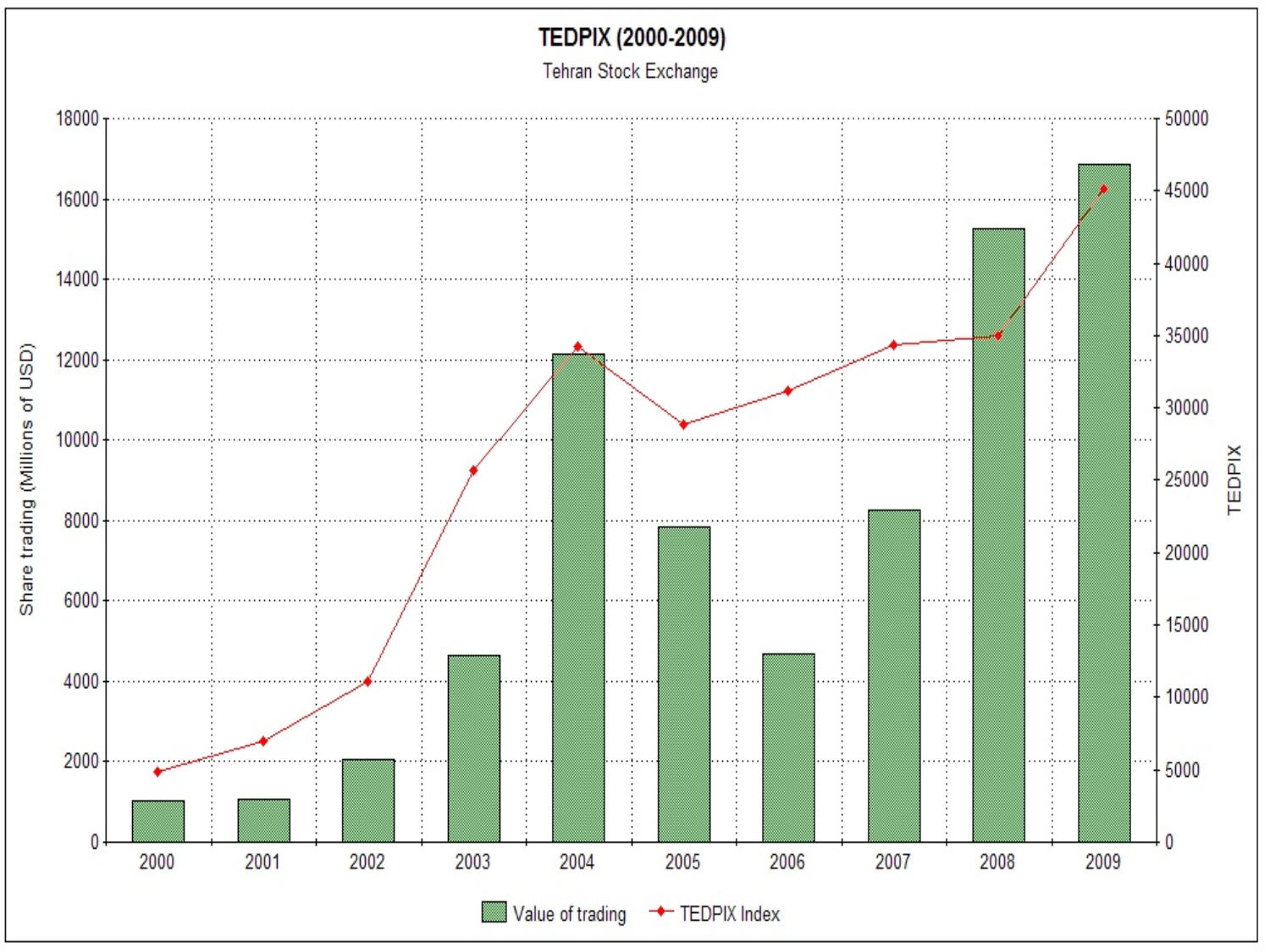

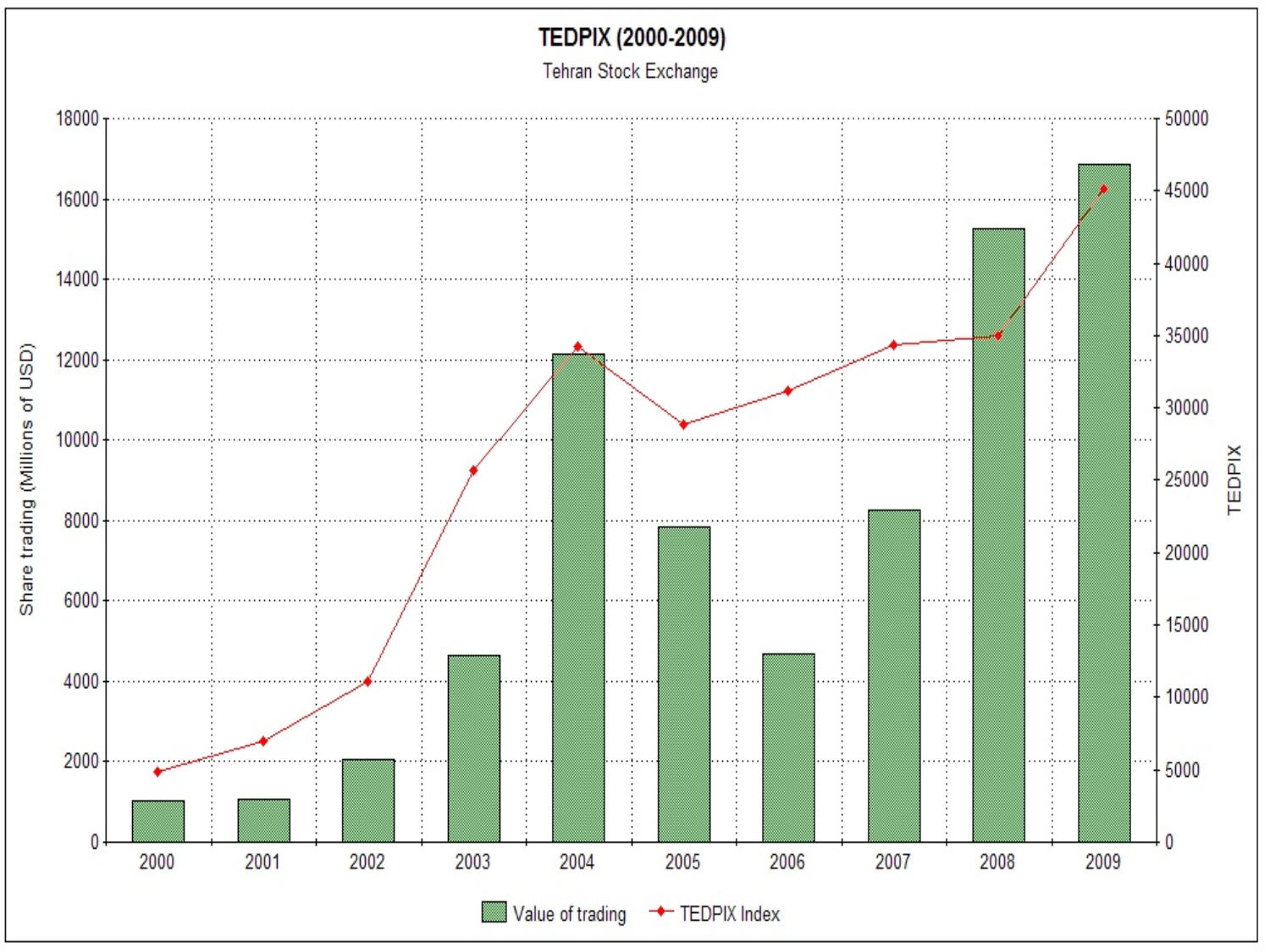

2000–2004: The performance of the TSE has had no

2000–2004: The performance of the TSE has had no

Retrieved December 29, 2010.

Retrieved April 9, 2011. According to the

Wall Street Journal , 30 October 2012. Retrieved November 4, 2012. 2013: Following

International Business Times, April 11, 2014. Retrieved April 16, 2014. 2014: As of September 2014, the TSE trades at price-to-earnings multiple of 6 times, with a 17 percent dividend yield. By comparison, the MSCI Frontier Markets index trades at price-to-earnings multiple of 12.4 times, with a 3.7 percent dividend yield.Iran shares cast a spell

. ''Tehran Times'', September 17, 2014. Retrieved September 25, 2014. 2015: The Iranian state is the biggest player in the economy, and the annual budget strongly influences the outlook of local industries and the stock market. The 2015 budget is not expected to bring much growth for many of the domestic industries. 2016: As of June 2016, TSE had an average P/E of 7 against 13.8 for MSCI Emerging Markets. TEDPIX annualized 10-year performance in US$ was 10.1% (against 3.9% for MSCI Emerging Markets for the same period.) 2018: in June 2018, the TEPIX index reached an all-time-high of 102,000. It is expected that listed export-oriented companies (~50% of TSE capitalization) will be advantaged following the steep devaluation of the

Iran is the last, large untapped emerging market in the world. According to many experts, the economy of Iran has many investment opportunities, particularly on its stock exchange. The

Iran is the last, large untapped emerging market in the world. According to many experts, the economy of Iran has many investment opportunities, particularly on its stock exchange. The

So far, the Tedpix index has been driven by domestic investors, including wealthy Iranians, public sector pension funds and the investment arms of state-owned banks. For the index to prosper in the long run, more foreign investors need to make significant share purchases. As at 2009, foreign portfolio investment accounts for only about 2 percent of the stock market in Iran. Foreign investors find it difficult to invest directly or indirectly, since banks cannot transfer funds, and there are no custodian banks because of sanctions. On 10 November 2018 Gottfried Leibbrandt, chief executive of SWIFT said in

So far, the Tedpix index has been driven by domestic investors, including wealthy Iranians, public sector pension funds and the investment arms of state-owned banks. For the index to prosper in the long run, more foreign investors need to make significant share purchases. As at 2009, foreign portfolio investment accounts for only about 2 percent of the stock market in Iran. Foreign investors find it difficult to invest directly or indirectly, since banks cannot transfer funds, and there are no custodian banks because of sanctions. On 10 November 2018 Gottfried Leibbrandt, chief executive of SWIFT said in

The new by-law on foreign portfolio investment

was approved by the government in June 2005, but ratified by the Council of Ministers in April, 2010. Under this new bylaw, foreign investors can participate in the TSE for the first time. Initially, however, some limitations had been imposed on foreign investors: * Foreign investors may own a maximum of 10 percent of each listed company. * Foreign investors may not withdraw their main capital and capital gain for the first three years of their investment. Repatriation is possible, after one year under the current regulations. With the new law, Iran has increased the ceiling on foreign participation to 20% and foreign investors can now invest in the capital market, trade shares (including OTC) and: # for small-scale (foreign) investors, take out their money at any time; # for large-scale investors which possess 10 percent of the agency's value or 10 percent of the management position, can take their capital out of the country after two years upon receiving permission from the government. # this new law does not explicitly protect against control and manipulation through foreign pool of money (e.g. through funds located offshore or foreign agents based in Iran.)

get a license

which the exchange says will take seven days on it

website

Iran Investment Monthly

. In 2014, Mehrafarin Brokerage Company became the first

Iran Nuclear Deal Sends Tehran Stocks Higher

''Wall Street Journal'', April 5, 2015. Retrieved April 8, 2015.

Short-term Prediction of Tehran Stock Exchange Price Index (TEPIX): Using Artificial Neural Network (ANN)

Tehran Stock Exchange (TSE)

Tehran Stock Exchange (TSE)

TSE Indexes

TSE Annual Report 2010Sukuk (Islamic Financial Instruments)Tehran Securities Exchange Technology Management Company (TSETMC)

Securities and Exchange Brokers Association

- Self-regulatory organization of TSE

Financial Tribune

- (Iranian English newspaper) Offers daily reports on the TSE

Iran Securities and Exchange Organization (SEO)

– Offers Quarterly Bulletin of Iran Islamic Capital Market

Federation of Euro-Asian Stock Exchanges

– TSE statistics/regulations/operations/international comparisons/calendar and latest news

– Comprehensive 2003-Study

Turquoise Partners

– Monthly report on the Tehran Stock Exchange and Iran's economy

Iran Daily: "Iranian Bourse Prospects for Foreign Investment"Iran CSD Company

– Clearing and settlement of trading, central registry ;Videos

Iran's Stock Exchange and Foreign Investment

- Explains how to invest in Tehran Stock Exchange and OTC market and what is the procedure to receive license for trading in the TSE (2015)

Investing in Iran – Part IPart IIPart IIIPart IVPart VVI

–

romanized

Romanization or romanisation, in linguistics, is the conversion of text from a different writing system to the Roman (Latin) script, or a system for doing so. Methods of romanization include transliteration, for representing written text, and ...

: ''Burs-e Owraq-e Bahadar-e Tehran'') is Iran

Iran, officially the Islamic Republic of Iran, and also called Persia, is a country located in Western Asia. It is bordered by Iraq and Turkey to the west, by Azerbaijan and Armenia to the northwest, by the Caspian Sea and Turkmeni ...

's largest stock exchange, which first opened in 1967. The TSE is based in Tehran

Tehran (; fa, تهران ) is the largest city in Tehran Province and the capital of Iran. With a population of around 9 million in the city and around 16 million in the larger metropolitan area of Greater Tehran, Tehran is the most popul ...

. , 339 companies with a combined market capitalization of US$104.21 billion were listed on TSE. TSE, which is a founding member of the Federation of Euro-Asian Stock Exchanges, has been one of the world's best performing stock exchanges in the years 2002 through 2013. TSE is an emerging

''Emerging'' is the title of the only album by the Phil Keaggy Band, released in 1977 on NewSong Records. The album's release was delayed due to a shift in record pressing plant priorities following the death of Elvis Presley. The album was re ...

or "frontier" market.

Iran's capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers ...

has companies from a wide range of industries, including automotive, telecommunications

Telecommunication is the transmission of information by various types of technologies over wire, radio, optical, or other electromagnetic systems. It has its origin in the desire of humans for communication over a distance greater than that ...

, agriculture

Agriculture or farming is the practice of cultivating plants and livestock. Agriculture was the key development in the rise of sedentary human civilization, whereby farming of domesticated species created food surpluses that enabled people ...

, petrochemical

Petrochemicals (sometimes abbreviated as petchems) are the chemical products obtained from petroleum by refining. Some chemical compounds made from petroleum are also obtained from other fossil fuels, such as coal or natural gas, or renewabl ...

, mining, steel iron, copper, banking and insurance, banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

and others. Many of the companies listed are state-owned firms that have been privatized.

History

The concept of stock industrialization dates to 1936, when

The concept of stock industrialization dates to 1936, when Bank Melli

Bank Melli Iran (BMI; fa, بانک ملی ایران, lit=National Bank of Iran, ''Bânk-e Melli-ye Irân'') is the first national and commercial retail bank of Iran. It is considered as the largest Iranian company in terms of annual income with ...

, together with Belgian experts, issued a report detailing a plan for an operational stock exchange in Iran. However, the plan was not implemented prior to the outbreak of World War II, and did not gain traction until 1967, when the Government revisited the issue and ratified theStock Exchange Act

. Initially limited in size and scope, the Tehran Stock Exchange (the "TSE") began operations in 1967, trading only in corporate and government bonds. Iran's rapid economic expansion in the 1970s, coupled with a popular desire to participate in the country's economic growth through the financial markets, led to a demand for equity. The Government became actively engaged in the process, by granting shares to employees of large state-owned and family-owned enterprises. Market activity increased substantially, as both companies and

high-net-worth individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defi ...

s participated in the new-found wealth associated with the TSE.

Everything came to a standstill after the Islamic Revolution

The Iranian Revolution ( fa, انقلاب ایران, Enqelâb-e Irân, ), also known as the Islamic Revolution ( fa, انقلاب اسلامی, Enqelâb-e Eslâmī), was a series of events that culminated in the overthrow of the Pahlavi dyna ...

leading in a prohibition against interest-based activities and nationalization of major banks and industrial giants. Mobilization of all resources towards the war effort during the 8-year Iran–Iraq War

The Iran–Iraq War was an armed conflict between Iran and Iraq that lasted from September 1980 to August 1988. It began with the Iraqi invasion of Iran and lasted for almost eight years, until the acceptance of United Nations Security Counci ...

did not help matters. Following the end of the war, the 1988 Budget Act re-established activity on the TSE, and within eight years the exchange saw its numbers rise to 249 companies listed. The Government fully embraced economic reforms and a privatization initiative in 1989 with a surge of activity in share activity of many state-owned companies through the defined targets in the first " Five-Year Economic Reform" where the Government

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government i ...

together with the Parliament defined the economic prospects of the country for the coming five years. Attention to promotion of the private sector and new interest in the TSE brought life back to the market. However, lack of regulation and out-of-date legal framework led to crisis in the market leading to certain "meltdowns". Over the 1996 to 2000 period an automated trading system An automated trading system (ATS), a subset of algorithmic trading, uses a computer program to create buy and sell orders and automatically submits the orders to a market center or exchange. The computer program will automatically generate orders ba ...

was introduced, and a number of important regulatory mechanisms were strengthened. The market has experienced its share of highs and lows in the past years including topping the World Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

' list in terms of performance in 2004. As of May 2014, TSE has had three bear market in its history: August 1996 – July 1998 (−32%); December 2004 – July 2006 (−34%); and during the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

(−38%). In 2014, after reaching historic highs, TSE lost a quarter of its total market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

because of the collapse of the Iranian rial

The rial ( fa, ریال ایران, riyâl-è Irân; sign: ﷼; abbreviation: Rl (singular) and Rls (plural) or IR in Latin; ISO code: IRR) is the official currency of Iran.

There is no official symbol for the currency but the Iranian standar ...

and the slump in oil prices

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPE ...

. It was also decided in 2014 that some banks and financial institutions attached to the government inject money into the stock market through a fund called the Market Development Fund which is aimed at market making and decreasing the fluctuations in the stock market.

Other complementary markets have also been established alongside the equities market. In 2003, the Tehran Metal Exchange (now called the Iran Mercantile Exchange

The Iran Mercantile Exchange ( fa, بورس کالای ایران, IME) is a commodities exchange located in Tehran, Iran.

Established on 20 September 2007 from the merger of the Tehran Metal Exchange and the Iran Agricultural Exchange, IME trade ...

after its merger with the ''Agricultural Exchange'' in 2006) was launched. The Oil Bourse An oil bourse is a commodities exchange where energy commodities such as crude oil and natural gas are traded. Examples include the New York Mercantile Exchange and the Intercontinental Exchange.

In 2005, an Iranian oil bourse was announced and ...

and the over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

''Farabourse'' were launched in 2008 followed in 2012 by the Energy/Electricity Bourse and the FOREX bourse.

*

*Exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of t ...

: 1 US $=10,004 IRR (2009)

Industry affiliations

Since 1995, TSE has been a full member of the ''World Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

'' (the former ''Fédération Internationale des Bourses de Valeurs'' or FIBV), and is a founding member of Federation of Euro-Asian Stock Exchanges (FEAS). Since July 2010 the TSE is a member of thInternational Options Market Association

Logo

The symbol of the TSE is a highly stylized representation of an Achaemedian dynasty (550-330 BC) gun-metal relief artifact, which was found in Lorestan province. The artifact features four men, hand in hand, indicating unity and cooperation. They are shown standing inside circles of the globe, which is in turn, according to ancient Iranian myth, supported on the backs of two cows, symbols of intelligence and prosperity.Structure

*The Securities & Exchange Council is the highest authority and is responsible for all related policies, market strategies, and supervision of the market in Iran. The Chairman of the Council will be the Minister of Economics; other members are: Minister of Trades, Governor of theCentral Bank of Iran

The Central Bank of Iran (CBI), also known as ''Bank Markazi'', officially the Central Bank of the Islamic Republic of Iran ( fa, بانک مرکزی جمهوری اسلامی ايران, Bank Markazi-ye Jomhuri-ye Eslāmi-ye Irān; SWIFT Code: ...

, Managing Director of the Chamber of Commerce

A chamber of commerce, or board of trade, is a form of business network. For example, a local organization of businesses whose goal is to further the interests of businesses. Business owners in towns and cities form these local societies to ...

, Attorney General

In most common law jurisdictions, the attorney general or attorney-general (sometimes abbreviated AG or Atty.-Gen) is the main legal advisor to the government. The plural is attorneys general.

In some jurisdictions, attorneys general also have exec ...

, Chairman of the ''Securities and Exchange Organization'', representatives of the active market associations, three financial experts requested by the Economics Minister and approved by the Council of Ministers

A council is a group of people who come together to consult, deliberate, or make decisions. A council may function as a legislature, especially at a town, city or county/ shire level, but most legislative bodies at the state/provincial or ...

, and one representative for each commodity exchange.The Securities and Exchange Organization (SEO)

is responsible for administration and supervisory duties, governed by the Board of Directors. The SEO's Board of Directors are elected by the Securities and Exchange Council. SEO also actively promotes innovation in Islamic products and has formed a specific "

Sharia

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the H ...

committee" to assess the compatibility of new products with Islamic law. SEO is the ''sole'' regulatory entity for the regulation and development of the capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers ...

in Iran.

Operations

Under its new structure, TSE has online trading, an arbitration board,digital signature

A digital signature is a mathematical scheme for verifying the authenticity of digital messages or documents. A valid digital signature, where the prerequisites are satisfied, gives a recipient very high confidence that the message was created b ...

, investor protection, surveillance mechanisms as well as post-trade systems. The TSE is open for trading five days a week from Saturday to Wednesday, excludinpublic holidays

Trading takes place through the Automated Trade Execution System from 9am to 12 noon, which is integrated with a clearing, settlement

depository and registry system

Settlement is T+3. The TSE is solely an order-driven market and all transactions are executed in the manner and under the principles of open auction.

Trading platform

The Tehran Stock Exchange (TSE) has started an ambitious modernization program aimed at increasing market transparency and attracting more domestic and foreign investors. Concrete measures that have been taken in the planning and operations of the stock exchange such as the settlement system, geographical expansion, new exchange laws in order to attract local and foreign capital. The TSE has installed the new trading system which has been purchased from Atos Euronext Market Solutions (AEMS) in 2007. The new system makes it possible to purchase and sell stocks on the same day. The system has also made it possible for 2,000 brokerage stations to work simultaneously, while the number was just about 480 in the past. The rise in electronic dealing, non-stop input and updated data on orders, transactions and indices are among other features of the new system. The new system has made it possible to link the stock market to the international bourses. The bourse can now handle 700 transactions per second and 150,000 transactions per day. The trading system is an order driven system, which matches buying and selling orders of the investors. Investors can place their orders with TSE accredited brokers, who enter these orders into the trading system. Then, the system automatically matches buy and sell orders of a particular security based on the price and quantity requirements. The mechanism for which the price of equities is determined is as follows: *''The best price (price priority)'' *''Time of order priority'' Under the price priority rule, a selling (buying) order with the lowest (highest) price takes precedence. Under the time priority rule, an earlier order takes precedence over others at the same price. Thus, when the lowest sell and the highest buy orders match in price, the transaction is executed at the price. In short, the TSE market is a pure order-driven Market. The trading system also generates and displays details of current and historical trading activity, including prices,volume

Volume is a measure of occupied three-dimensional space. It is often quantified numerically using SI derived units (such as the cubic metre and litre) or by various imperial or US customary units (such as the gallon, quart, cubic inch). ...

s traded and outstanding buy and sell orders. This ensures that investors have the required information to be able to take informed investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

decisions.

The range of price movements is typically restricted to 3% daily either way from last closing (raised to 5% since May 2015). Restriction on Rights

Rights are legal, social, or ethical principles of freedom or entitlement; that is, rights are the fundamental normative rules about what is allowed of people or owed to people according to some legal system, social convention, or ethical theory ...

is 6%. This can be changed in specific situation by the Board of the TSE in case of unusual price movements resulting in an extremely high or low P/E ratio. Short selling is not permitted. There are no minimum trading lots. According to the Iranian Commercial Law, companies are prohibited from share repurchase

Share repurchase, also known as share buyback or stock buyback, is the re-acquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders. When used in coord ...

s.Turquoise Partners: Iran Investment Monthly (February 2011)Retrieved April 30, 2011 TSE Services Company (TSESC), who is in charge of the site, supplies computer services. TSESC is a member o

Association of National Numbering Agencies (ANNA)

. Retrieved July 31, 2010.

Market segmentation

Besides the ''Main'' and ''Secondary Market'', there is a ''Corporate participation certificates Market'' (corporate bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of ...

s). Secondary Market is an exchange facility where the listed securities of small and mid-size companies can be traded efficiently and competitively. Any company, domestic or foreign, can list their products on the exchange for as long as they meet the listing criteria. The value of three markets of Securities and Stock Exchange, Over-the-Counter (OTC) stock exchange and commodity exchange hit $100 billion in December 2010. In 2010, the Kish Stock Exchange was launched to facilitate foreign investment and monetary activities in Kish Island free trade zone.

TSE rate

rial Rial, riyal, or RIAL may refer to:

* Rial (surname), a surname (and list of people with the name)

* Royal Institution for the Advancement of Learning, McGill University

* Rial Racing, a former German Formula One team

Various currencies named ri ...

known as the "TSE rate". In 2002 the "official rate" was abolished, and the TSE rate became the basis for the new unified foreign exchange regime.

OTC market

Since 2009, Iran has been developing anover-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

(OTC) market for bonds and equities (aka Iran Fara Bourse

Iran Fara Bourse Co. (IFB), also known as Farabourse, is an exchange for securities and other financial instruments in Tehran, Iran which operates under the official supervision of Securities and Exchange Organization (SEO).

IFB operates as a sel ...

or ''Farabourse''). Its shareholders include the Tehran Stock Exchange Corporation (20%), several banks, insurance companies and other financial institutions (60%), and private and institutional shareholders (20%). As of July 2011, Farabourse has a total market capitalization of $20 billion and a monthly volume of $2 billion.

Brokers

Trading takes place through licensed privatebroker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be con ...

s registered with the Securities and Exchange Organization of Iran. Thirty-one of th88 brokerages active in the TSE

are licensed to trade the futures contracts. The leverage for futures contracts is set at 1-to-10. TSE will only deal in the derivatives through electronic trading. As of 2013, '' Mofid'', '' Keshavarzi'', ''Agah'' and '' Nahayat Negar'' were the top 4 performers among TSE's brokerage firms. These firms executing 41% of the total value in on-line trading.

Electronic trading and market data

Starting March 2011

investors are able to trade in the Iranian stock market through the

Internet

The Internet (or internet) is the global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a '' network of networks'' that consists of private, p ...

from anywhere in the world, or get all the necessary information before traveling to Iran. There are 87 online service providers which offer round-the-clock information and services about Iran and its stock market. As of September 2011, 40,000 shareholders are registered and conducting transactions online.Iran Investment Monthly - September 2011. Turquoise Partners. Retrieved November 3, 2011 In 2013, 83 brokerage firms (out of TSE's 93 firms) offered on-line transactions, accounting for 18% of the total trading value. In 2014, Iran's TSE was in talks to share its trading data with

Thomson Reuters

Thomson Reuters Corporation ( ) is a Canadian multinational media conglomerate. The company was founded in Toronto, Ontario, Canada, where it is headquartered at the Bay Adelaide Centre.

Thomson Reuters was created by the Thomson Corp ...

(and Bloomberg L.P. in 2015) once the sanctions are lifted.

Trading fees

As of July 2010, trading fees include: *Equities and rights: 0.55% payable by the sellers and 0.5% the buyers.Tehran Stock Exchange: FACT BOOK. Retrieved July 31, 2010. * Participation bonds: 0.1% of transaction value payable by both the buyer and seller with a maximum of 100 million IRR.

New products and services

Presently, TSE trades mainly in securities offered by listed companies. As of 2015, equities and corporate bonds (e.g. Sukuk) are being traded at TSE.Najmeh Bozorgmehr: Tehran stock exchange prepares for flood of foreign investmentFinancial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nik ...

, May 4, 2015. Retrieved October 16, 2015. The plan is to introduce other financial instruments in the near future. The introduction of project-based participation certificates that bear a fixed annual return during the period of the project and promise the final settlement of the profit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory inter ...

at the date of its completion, has diversified the market. As of 2015, TSE does not offer much complicated Islamic finance

Islamic banking, Islamic finance ( ar, مصرفية إسلامية), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic econom ...

instruments such as derivatives (except ETFs and a few put option

In finance, a put or put option is a derivative instrument in financial markets that gives the holder (i.e. the purchaser of the put option) the right to sell an asset (the ''underlying''), at a specified price (the ''strike''), by (or at) a ...

s), nor does it allow short sales

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional " long" position, where the investor will profit if the value of the ...

or margin trading (except for futures) in contrast to the neighboring Dubai Financial Market.

Futures

In 2008, commodity Futures came onto theIran Mercantile Exchange

The Iran Mercantile Exchange ( fa, بورس کالای ایران, IME) is a commodities exchange located in Tehran, Iran.

Established on 20 September 2007 from the merger of the Tehran Metal Exchange and the Iran Agricultural Exchange, IME trade ...

(IME). In July 2010, TSE introduced six single-stock futures contracts based on Parsian Bank and Karafarin Bank, which will expire in two, four and six months. Thirty-one of th88 brokerages active in the TSE

are licensed to trade the futures contracts. The leverage for futures contracts is set at 1-to-10. TSE will only deal in the derivatives through electronic trading. In the TSE's derivatives market, over 13,200 single stock futures contracts were traded in 2011 with a value of over 510 billion Rials.

Outlook

Economic sectors

According to the

According to the Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

in 2015, Iran is "full of well-run companies". Also true, there are companies in Iran which suffer problems such as mismanagement, energy inefficiency, overstaffing, opaque auditing systems, obsolete marketing and distribution networks and high levels of debt.

2007: There were 324 companies listed on the TSE with a total market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

(MC) of US$42,452 million. Close to 60% of the MC relates to listed companies from the following sectors:

* Basic Metals,

* Motor Vehicles and Trailers,

* Chemicals and By-Products,

* Non-Metallic Minerals Products.

A total of 161 companies from these sectors are listed on the TSE, which translates to 49.7% of total companies listed. Largest stocks include:

*Mobarakeh Steel Co.

Mobarakeh Steel Company (MSC, fa, فولاد مبارکه, Foolad Mobarakeh) is an state owned Iranian steel company, located 65 km south west of Esfahan, near the city of Mobarakeh, Esfahan Province, Iran. It is the largest steel maker o ...

with MC of US$3,218 million, which translates to 7.6% of MC,

*National Iranian Copper Industries Company

National Iranian Copper Industries Company abbreviated as NICICO (, ''Shirkat-e Mili-ye Sânai'-ye Mis-e Iran'') is an Iranian publicly traded corporation. This company mines 700,000 tons of copper annually. As of 2020, total sales of the company ...

('' Persian'': Sanaye Mese Iran) at 6.8% of MC,

*SAIPA

SAIPA ( fa, سایپا, ''SAIPA'') is an Iranian automaker headquartered in Tehran. The SAIPAC (an acronym for the French ''Société anonyme iranienne de production des automobiles Citroën'') was established in 1965 as with 75% Iranian ownersh ...

at 5.3% of MC.

2008: other companies in the top spots included:

* Gol Gohar Iron Ore Company ($2.1 billion MC),

* Chadormalu Mining and Industrial Company ($2 billion),

* Kharg Petrochemical Company (over $1 billion),

* Ghadir petrochemical companies (over $1 billion),

*Khouzestan Steel Company

Khouzestan Steel Company (KSC) ( fa, شرکت فولاد خوزستان) is an Iranian steel manufacturing company located in the major city of Ahvaz. It is currently the second-largest producer of raw steel in Iran, following Mobarakeh Steel Comp ...

(over $1 billion),

* Power Plant Projects Management Company (MAPNA) (over $1 billion),

* Retirement Investment Firm (over $1 billion),

*Iran Khodro

Iran Khodro ( fa, ایرانخودرو, ''Irân Xodro''), branded as IKCO, is an Iranian automaker headquartered in Tehran. IKCO was founded in 1962 as Iran National (, ''Irân Nâsionâl''). The public company manufactures vehicles, includin ...

(over $1 billion),

*Metal and Mine Investment Companies (over $1 billion).

This indicates that the capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers ...

in Tehran

Tehran (; fa, تهران ) is the largest city in Tehran Province and the capital of Iran. With a population of around 9 million in the city and around 16 million in the larger metropolitan area of Greater Tehran, Tehran is the most popul ...

is heavily concentrated on four economic sectors with companies that make up nearly half of the total listed companies on the exchange. While 163 companies listed are spread out amongst 26 sectors, with the " Food and Beverages Sector" alone accounts to 32 companies at a market capitalization of US$897.5 million. Studies show that in 2008 about 30 firms, involved in 11 industries, hold close to 75% of shares in Tehran Stock Exchange.

2009: A comparison of the top 100 Iranian companies and the Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune (magazine), Fortune'' magazine that ranks 500 of the largest United States Joint-stock company#Closely held corporations and publicly traded corporations, corporations by ...

in 2009 indicated that the gross profit margins of the top 100 Iranian companies were almost double those of the Fortune 500. For Fortune 500 companies, the average gross profit margin

Gross margin is the difference between revenue and cost of goods sold (COGS), divided by revenue. Gross margin is expressed as a percentage. Generally, it is calculated as the selling price of an item, less the cost of goods sold (e. g. productio ...

was 6.9% and for the Iranian companies, it was 13%. The sector with the highest profit margin among the top 100 Iranian companies in 2009 is mining, with a margin of 58%. The mining companies in the Fortune 500 had a gross profit margin of 11%. After mining, other industries with highest margins are base metals, and telecommunications.

2011: The best performing industries in 2011, in terms of total sales

In bookkeeping, accounting, and financial accounting, net sales are operating revenues earned by a company for selling its products or rendering its services. Also referred to as revenue, they are reported directly on the income statement as ''S ...

, were the banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

and automotive sectors. The worst performers were home appliances and electronics. In terms of gross profit margin

Gross margin is the difference between revenue and cost of goods sold (COGS), divided by revenue. Gross margin is expressed as a percentage. Generally, it is calculated as the selling price of an item, less the cost of goods sold (e. g. productio ...

, mining

Mining is the extraction of valuable minerals or other geological materials from the Earth, usually from an ore body, lode, vein, seam, reef, or placer deposit. The exploitation of these deposits for raw material is based on the econom ...

, telecommunications

Telecommunication is the transmission of information by various types of technologies over wire, radio, optical, or other electromagnetic systems. It has its origin in the desire of humans for communication over a distance greater than that ...

, and oil and gas exploration & production were the best performing industries. Sales totals of the top 100 Iranian companies on the list ranged from $12.8 billion or the top ranking company, Iran Khodro

Iran Khodro ( fa, ایرانخودرو, ''Irân Xodro''), branded as IKCO, is an Iranian automaker headquartered in Tehran. IKCO was founded in 1962 as Iran National (, ''Irân Nâsionâl''). The public company manufactures vehicles, includin ...

, to $318 million for the 100th company.Turquoise Partners: Iran Investment Monthly (March 2011)Retrieved April 30, 2011 2012: Companies showing the most profit, are mostly in pharmaceutical, petrochemical and steel businesses. The sharp decline of the Rial in 2012 has made exports more competitive. Other favoured companies are state-owned industrial companies that rely on a mostly domestic

supply chain

In commerce, a supply chain is a network of facilities that procure raw materials, transform them into intermediate goods and then final products to customers through a distribution system. It refers to the network of organizations, people, activ ...

, turning locally produced raw materials into products targeting Iranian consumers.

2015: Fluctuations in global prices of commodities

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

The price of a co ...

and the official exchange rate of the Iranian currency have a big impact on the profitability of companies which produce global commodities that are either exported or sold on the free market domestically. More than half the weight of the Iranian stock market cap belongs to such companies.Iran Investment Monthly (December 2014). Turquoise Partners. Retrieved February 25, 2015.

Market participants

TheGovernment of Iran

The Government of the Islamic Republic of Iran ( fa, نظام جمهوری اسلامی ایران, Neẓām-e jomhūrī-e eslāmi-e Irān, known simply as ''Neẓām'' ( fa, نظام, lit=the system) among its supporters) is the ruling state ...

directly holds 35 percent of the TSE, while securing another 40 percent through pension funds and investment companies such as the Social Security Investment Company, one of the largest institutional investors on the TSE. Bonyad

Bonyads ( fa, بنیاد "Foundation") are charitable trusts in Iran that play a major role in Iran's non-petroleum economy, controlling an estimated 20% of Iran's GDP, and channeling revenues to groups supporting the Islamic Republic. Exempt f ...

s also play a significant role in TSE trading. In 2016, TSE had 38,000 institutional investors.

In 2005 fewer than 5 percent of Iranians owned stock. The Government is promoting the shareholding

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal o ...

culture in Iran. By March 2010, 3.219 million shareholders had registered in the TSE, with investment firms having 562,375 shareholders, which makes it the "favorite industry" in the stock market. The number of registered shareholders in the TSE increased to 4.5 million in 2011, 7 million in 2014 and 9 million in 2016.9m Trading in Iran’s Securities MarketsFinancial Tribune, December 14, 2016. Retrieved December 14, 2016. As of 2014, about 300 foreign investors (including 25

Iranian citizens abroad

Iranian diaspora refers to Iranian people or those who are of Iranian ancestry living outside Iran.mutual fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICA ...

s managed bpermitted brokerage firms

and investment banks are investing in the TSE according to the investment funds regulation.

Mutual fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICA ...

s are open ended and their operation permission is issued by the ''Iran Securities and Exchange Organization (SEO)''. Since then, 41 funds have been established, four of which are fixed income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the prin ...

funds and the remainder of which are equity funds. As of August 2010, total assets under management within the Iranian fund management industry amount to approximately $230 million with great potential for development. According to The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

in 2015, Western fund managers are already planning financial services companies in Tehran

Tehran (; fa, تهران ) is the largest city in Tehran Province and the capital of Iran. With a population of around 9 million in the city and around 16 million in the larger metropolitan area of Greater Tehran, Tehran is the most popul ...

.

Indices

• TSE All-Share Price Index (TEPIX)• TSE Dividend & Price "

total return

The total return on a portfolio of investments takes into account not only the capital appreciation on the portfolio, but also the income received on the portfolio. The income typically consists of interest, dividends, and securities lending fees. ...

" Index (TEDPIX)• TSE All-Share FF adjusted (TEFIX)

• TSE TEFIX-30 - Blue chip index

• TSE Cash Dividend Index (TEDIX)

• TSE-50 - (Top 50 most active companies)

• Each industry (sector) Index

• Industrial Index

• Financial Index

• Each Company Index (based on Price & Volume) In 1990, the All-Shares Price

Index

Index (or its plural form indices) may refer to:

Arts, entertainment, and media Fictional entities

* Index (''A Certain Magical Index''), a character in the light novel series ''A Certain Magical Index''

* The Index, an item on a Halo megastru ...

(TEPIX) was introduced to the market as the main indicator of share price movements. TEPIX is weighted market value of all share prices appearing on the TSE Board

and is measured every two minutes. In addition to the TEPIX, daily price indices of shares of each company, each sector, and the "Top Fifty" most active companies (TSE-50) are computed.

Performance

2000–2004: The performance of the TSE has had no

2000–2004: The performance of the TSE has had no correlation

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statistic ...

with major exchanges or emerging stock markets over the past few years and not even with the oil price. While the overall indices of the world's five major exchanges – New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

, London

London is the capital and List of urban areas in the United Kingdom, largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary dow ...

, Paris

Paris () is the capital and most populous city of France, with an estimated population of 2,165,423 residents in 2019 in an area of more than 105 km² (41 sq mi), making it the 30th most densely populated city in the world in 2020. Si ...

, Frankfurt

Frankfurt, officially Frankfurt am Main (; Hessian: , " Frank ford on the Main"), is the most populous city in the German state of Hesse. Its 791,000 inhabitants as of 2022 make it the fifth-most populous city in Germany. Located on it ...

and Tokyo

Tokyo (; ja, 東京, , ), officially the Tokyo Metropolis ( ja, 東京都, label=none, ), is the capital and largest city of Japan. Formerly known as Edo, its metropolitan area () is the most populous in the world, with an estimated 37.46 ...

plunged by 40 to 70% between March 2001 and April 2003, the TSE index (Tepix) bucked the trend by going up nearly 80%.The Tehran Stock Exchange: A Maverick Performer?, Middle East Economic Survey, May 23, 2005

2005–2006: In December, 2005, 419 companies with a market capitalization of IRR 32,741.7 million were listed in TSE. The TSE has had an exceptional performance over the past 5 years. In general, the stock market in 2005/06 shed value as it is manifested by the decline of its major stock price indices. The TSE price index (TSPIX) at the end of 2005/06, declined by 21.9%, while the Financial Sector Index, and the Industrial Index, declined by, 38.8%, 19.4% respectively, and the Dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-i ...

Index gained 11.8%, mostly due to a reported US$100 billion capital flight from the country because of the international dispute surrounding the Iranian nuclear programme

The nuclear program of Iran is an ongoing scientific effort by Iran to research nuclear technology that can be used to make nuclear weapons. Iran has several research sites, two uranium mines, a research reactor, and uranium processing facili ...

.

2007: The market bottomed in June 2007 mainly because of the renewed privatization

Privatization (also privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation when ...

drive in the Iranian economy.

2008: The TSE was not directly affected by the international financial turmoil in 2008, but following the global reduction in prices of copper and steel, the bourse index dropped by 12.5 percent, as most of the companies listed on the exchange are producers of such commodities. TSE experienced an 11% growth at the end of 2008 and ranked second in the world in terms of increase in the volume of trade after Luxembourg's Bourse.

2009: The TSE sank about 40% in value between August 2008 and March 2009, influenced by falling oil prices and declining markets in other parts of the world. As of August 1, 2009 it has recovered by more than 10%. During Iranian year 2009/10, the value of capital market was around $20 billion. Some 3 million trade exchanges were made, pushing up the index to 12,500 units from the previous 8,000 units.

2010: In the first month of Iranian 2010 (March 20 – April 21, 2010), the index hit the 14,000 unit mark, up from the previous 12,500, showing 12 percent growth. The value of one month's trading transactions exceeded $1 billion against the previous year's corresponding period of $95 million. Tehran Stock Exchange bourse index from June 2009 to 2010 grew 55 percent and the value of TSE's total market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

went up about 33 percent, to over $71 billion.

On August 2, 2010, the TSE main index (TEPIX) reached a record level of 16,056 points, despite US-sponsored sanctions against Iran. Thus, TEDPIX became the world's second-best performing equity index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

Two of the pr ...

. Factors such as the global spike in oil and metal prices, government support for industries and oil sectors as well as the growth of stock market liquidity flow contributed to the boom. Experts commented that the growth was also partly due to a government decision to sell off 20 percent of its equity in two major automakers. Given the relative low market valuation of TSE stocks in 2010, the upward trend was expected to continue over the long run, rather than being a bubble

Bubble, Bubbles or The Bubble may refer to:

Common uses

* Bubble (physics), a globule of one substance in another, usually gas in a liquid

** Soap bubble

* Economic bubble, a situation where asset prices are much higher than underlying fund ...

. TEPIX reached a new record on September 18, 2010, when it hit 18,658, up from 11,295 at the start of the year. As of December 2010, the TSE index rose about 64 percent since the start of 2010. The Tehran Stock Exchange has been ranked as the best bourse index in Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia ...

, Africa and Middle East in 2010 in terms of performance of the main index.

2011: On February 1, 2011, TEPIX and total market value reached an all-time high of 21,349 and US$100 billion respectively. An alleged $200 million investments by Iranian expats also contributed to this increase.

On April 9, 2011, TSE's main index (TEPIX) hit a new all-time record high at 26,222 over a boost from the stocks of metal and shipping industries.Mehr News Agency: Tehran capital market value hits $84BRetrieved December 29, 2010.

Retrieved April 9, 2011. According to the

World Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

(WFE), TSE had the best performance among WFE member exchanges from May 2010 to May 2011. With a staggering 79% growth rate in its main index, the TSE ranked 1st in WFE's "Broad Stock Index Performance" category followed by the Colombo

Colombo ( ; si, කොළඹ, translit=Koḷam̆ba, ; ta, கொழும்பு, translit=Koḻumpu, ) is the executive and judicial capital and largest city of Sri Lanka by population. According to the Brookings Institution, Colombo me ...

and Lima Stock Exchanges with 75.1% and 48.9% rates respectively.

Overall, Tehran stock exchange posted the second highest gains in global markets in 2011 (TEPIX up 29.6%). Meanwhile, the German's DAX (DAX INDEX) lost 16.5% due and the FTSE 100(UKX INDEX) performed poorly, down 6.7%. Stock markets of emerging economies, like Brazil's Brazil Bovespa Index (IBOV INDEX), shed 18.4%. Equally, MENA

MENA, an acronym in the English language, refers to a grouping of countries situated in and around the Middle East and North Africa. It is also known as WANA, SWANA, or NAWA, which alternatively refers to the Middle East as Western Asia (or ...

stock markets had a poor year in 2011, reflecting both the political turbulence across the region and the battering suffered by most global markets as a result of the eurozone crisis and the increasingly bearish outlook for the global economy.

2012: TSE's overall index hit a new record high in October 2012 surpassing 31,000 points. Export-oriented companies have been favoured because of the imposition of an oil embargo An oil embargo is an economic situation wherein entities engage in an embargo to limit the transport of petroleum to or from an area, in order to exact some desired outcome. One commentator states, " oil embargo is not a common commercial practice; ...

by the international community and the consequent sharp decline in the value of the Iranian rial

The rial ( fa, ریال ایران, riyâl-è Irân; sign: ﷼; abbreviation: Rl (singular) and Rls (plural) or IR in Latin; ISO code: IRR) is the official currency of Iran.

There is no official symbol for the currency but the Iranian standar ...

over 2012.In Iran, Stocks Are a Haven As Economy Hits the Skids.Wall Street Journal , 30 October 2012. Retrieved November 4, 2012. 2013: Following

Iranian rial

The rial ( fa, ریال ایران, riyâl-è Irân; sign: ﷼; abbreviation: Rl (singular) and Rls (plural) or IR in Latin; ISO code: IRR) is the official currency of Iran.

There is no official symbol for the currency but the Iranian standar ...

's strong devaluation between 2012 and 2013 and the presidential elections, many Iranian investors started to move their assets from gold into domestic equities. TEPIX hit 68,461 on October 9 (soaring over 50,000 points). TEPIX reached 71,471 on October 14, 2013. Consequently, TSE's main index grew 130% in 2013.Reuters Plans Tie-Up With Iran's Tehran Stock ExchangeInternational Business Times, April 11, 2014. Retrieved April 16, 2014. 2014: As of September 2014, the TSE trades at price-to-earnings multiple of 6 times, with a 17 percent dividend yield. By comparison, the MSCI Frontier Markets index trades at price-to-earnings multiple of 12.4 times, with a 3.7 percent dividend yield.Iran shares cast a spell

. ''Tehran Times'', September 17, 2014. Retrieved September 25, 2014. 2015: The Iranian state is the biggest player in the economy, and the annual budget strongly influences the outlook of local industries and the stock market. The 2015 budget is not expected to bring much growth for many of the domestic industries. 2016: As of June 2016, TSE had an average P/E of 7 against 13.8 for MSCI Emerging Markets. TEDPIX annualized 10-year performance in US$ was 10.1% (against 3.9% for MSCI Emerging Markets for the same period.) 2018: in June 2018, the TEPIX index reached an all-time-high of 102,000. It is expected that listed export-oriented companies (~50% of TSE capitalization) will be advantaged following the steep devaluation of the

Iranian rial

The rial ( fa, ریال ایران, riyâl-è Irân; sign: ﷼; abbreviation: Rl (singular) and Rls (plural) or IR in Latin; ISO code: IRR) is the official currency of Iran.

There is no official symbol for the currency but the Iranian standar ...

in 2018.

2019: FY 2019 has been a "golden year" according to financial economists. TEDPIX, one of the 2 main indexes, reached an all-time-high of 512,000 points. According to the same experts, several factors contributed to this, namely better regulation, increased knowledge of the stock market and wider access by the general population and the lackluster status of competing sectors such as gold or real estate.

Growth potential

Iran is the last, large untapped emerging market in the world. According to many experts, the economy of Iran has many investment opportunities, particularly on its stock exchange. The

Iran is the last, large untapped emerging market in the world. According to many experts, the economy of Iran has many investment opportunities, particularly on its stock exchange. The Central Bank of Iran

The Central Bank of Iran (CBI), also known as ''Bank Markazi'', officially the Central Bank of the Islamic Republic of Iran ( fa, بانک مرکزی جمهوری اسلامی ايران, Bank Markazi-ye Jomhuri-ye Eslāmi-ye Irān; SWIFT Code: ...

indicate that 70 percent of the Iranians own homes with huge amounts of idle money entering the housing market. However, if the stock market grows stronger, it will undoubtedly attract idle capital. In terms of investment, the domestic rival markets of the bourse are the Iranian real estate market, cars and gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile ...

(with gold being used as a store of value, a hedging tool against hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

and the devaluation of the Rial Rial, riyal, or RIAL may refer to:

* Rial (surname), a surname (and list of people with the name)

* Royal Institution for the Advancement of Learning, McGill University

* Rial Racing, a former German Formula One team

Various currencies named ri ...

). According to Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, Ho ...

, Iran is forecast to reach the highest economic growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate o ...

between 2015 and 2025 and join the world's largest economies (world's 12th economy by 2025). Since 2012, TSE has served as a safe haven against international sanctions

International sanctions are political and economic decisions that are part of diplomatic efforts by countries, multilateral or regional organizations against states or organizations either to protect national security interests, or to protect i ...

and inflation.

Market valuation

In 2007, the market, with a capitalization of $37 billion, was trading at a fraction of the earnings multiples enjoyed by Iran's neighbours, while average earnings continued to grow at about 25 per cent a year. As of 2010, the price-to-earnings rate in Iran's market stands at around six while it is 15 in regional markets. With the removal of obstacles to foreign investment Iran could potentially have a 2,000–3,000 billion US dollar stock exchange market. Due to the price gains the averagedividend yield

The dividend yield or dividend–price ratio of a share is the dividend per share, divided by the price per share. It is also a company's total annual dividend payments divided by its market capitalization, assuming the number of shares is constant ...

has fallen from 16 per cent in 2009 to 13 per cent in 2010. Iran devalued its currency in July 2013. Iran has a large young, educated labor force

The workforce or labour force is a concept referring to the pool of human beings either in employment or in unemployment. It is generally used to describe those working for a single company or industry, but can also apply to a geographic ...

. As of 2014, Iran's wage costs are lower than Vietnam

Vietnam or Viet Nam ( vi, Việt Nam, ), officially the Socialist Republic of Vietnam,., group="n" is a country in Southeast Asia, at the eastern edge of mainland Southeast Asia, with an area of and population of 96 million, making ...

’s (i.e. cheap).

According to Voltan Capital Management LLC in New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

, growth valuations and potential investment upside are similar to frontier markets in their early stage while it has developed characteristics such as well-educated workforce, a large middle-class and a broad industrial base. According to various sources, TSE is 200% undervalued in comparison to frontier market peers because of misperception and sanctions (2015).

Privatization

In recent years, the role of the private sector has been further on the increase. Furthermore, an amendment of the article 44 of theIranian Constitution

The Constitution of the Islamic Republic of Iran ( fa, قانون اساسی جمهوری اسلامی ایران, ''Qanun-e Asasi-ye Jomhuri-ye Eslâmi-ye Iran'') was adopted by referendum on 2 and 3 December 1979, and went into force replac ...

in 2004 has allowed 80% of state assets to be privatized, 40% of which will be conducted through the " Justice Shares" scheme and the rest through the Bourse Organization. The government will keep the title of the remaining 20%.

Under the privatization plan, 47 oil and gas companies (including PetroIran and North Drilling

North Drilling Company ( fa, حفاری شمال, ''Hefari-ye Shimal'') is an Iranian company specialized in drilling oil and gas wells and its services in all regions of Iran and world, to global customers. The company was privatized in June 2009 ...

Company) worth an estimated $90 billion are to be privatized on the Tehran Stock Exchange by 2014.

Foreign investors can bid in Iranian privatization tenders, but need permission from the Economy Ministry on a case-by-case basis. The government has reduced the bureaucratic channels and issues investment permits for foreign nationals in less than seven days.

Iran has announced it will begin to allow foreign firms to purchase Iranian state-run companies, with the possibility of obtaining full ownership.

Iranian expatriates

There are differing estimates of the total capital held by Iranian expatriates. One estimate places the number at $1.3 trillion US dollars. Whatever the actual number, it is clear that these funds are sufficiently large enough to buy significant stakes in all state companies. InDubai

Dubai (, ; ar, wikt:دبي, دبي, translit=Dubayy, , ) is the List of cities in the United Arab Emirates#Major cities, most populous city in the United Arab Emirates (UAE) and the capital of the Emirate of Dubai, the most populated of the 7 ...

alone, Iranian expatriates are estimated to have invested up to $200 billion. Even a 10 percent repatriation

Repatriation is the process of returning a thing or a person to its country of origin or citizenship. The term may refer to non-human entities, such as converting a foreign currency into the currency of one's own country, as well as to the pro ...

of capital would have a significant impact. In 2000, the Iran Press Service reported that Iranian expatriates had invested between $200 and $400 billion in the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country Continental United States, primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., ...

, Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia ...

, and China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's List of countries and dependencies by population, most populous country, with a Population of China, population exceeding 1.4 billion, slig ...

, but almost nothing in Iran. FIPPA provisions apply to all foreign investors, and many Iranian expatriates based in the US continue to make substantial investments in Iran.

Foreign portfolio investment

So far, the Tedpix index has been driven by domestic investors, including wealthy Iranians, public sector pension funds and the investment arms of state-owned banks. For the index to prosper in the long run, more foreign investors need to make significant share purchases. As at 2009, foreign portfolio investment accounts for only about 2 percent of the stock market in Iran. Foreign investors find it difficult to invest directly or indirectly, since banks cannot transfer funds, and there are no custodian banks because of sanctions. On 10 November 2018 Gottfried Leibbrandt, chief executive of SWIFT said in

So far, the Tedpix index has been driven by domestic investors, including wealthy Iranians, public sector pension funds and the investment arms of state-owned banks. For the index to prosper in the long run, more foreign investors need to make significant share purchases. As at 2009, foreign portfolio investment accounts for only about 2 percent of the stock market in Iran. Foreign investors find it difficult to invest directly or indirectly, since banks cannot transfer funds, and there are no custodian banks because of sanctions. On 10 November 2018 Gottfried Leibbrandt, chief executive of SWIFT said in Belgium

Belgium, ; french: Belgique ; german: Belgien officially the Kingdom of Belgium, is a country in Northwestern Europe. The country is bordered by the Netherlands to the north, Germany to the east, Luxembourg to the southeast, France to ...

that some banks in Iran would be disconnected from this financial messaging service.The new by-law on foreign portfolio investment

was approved by the government in June 2005, but ratified by the Council of Ministers in April, 2010. Under this new bylaw, foreign investors can participate in the TSE for the first time. Initially, however, some limitations had been imposed on foreign investors: * Foreign investors may own a maximum of 10 percent of each listed company. * Foreign investors may not withdraw their main capital and capital gain for the first three years of their investment. Repatriation is possible, after one year under the current regulations. With the new law, Iran has increased the ceiling on foreign participation to 20% and foreign investors can now invest in the capital market, trade shares (including OTC) and: # for small-scale (foreign) investors, take out their money at any time; # for large-scale investors which possess 10 percent of the agency's value or 10 percent of the management position, can take their capital out of the country after two years upon receiving permission from the government. # this new law does not explicitly protect against control and manipulation through foreign pool of money (e.g. through funds located offshore or foreign agents based in Iran.)

FOREX

Since April 2010, foreign investors have been able to open foreign-currency accounts at Iranian banks and exchange their currencies to rials and vice versa. Foreigners who want to trade in Iran musget a license

which the exchange says will take seven days on it

website

Non-commercial risks

TheCentral Bank of Iran

The Central Bank of Iran (CBI), also known as ''Bank Markazi'', officially the Central Bank of the Islamic Republic of Iran ( fa, بانک مرکزی جمهوری اسلامی ايران, Bank Markazi-ye Jomhuri-ye Eslāmi-ye Irān; SWIFT Code: ...

is also in charge of providing the investors with the necessary foreign exchange, which is also transferable. Moreover, under the law, foreign investors are protected and insured against possible losses and damages caused by future political turmoil or regional conflicts.

Dual listing

Iran is to target foreign investment in its energy sector by creating an umbrella group of nearly 50 state-run firms and listing its shares on four international stock exchanges.Offshore funds

As of 2014,Turquoise Partners

Turquoise Partners (Persian: گروه مالی فیروزه) is a privately-owned international financial services group based in Iran which was established in 2005. Turquoise provides a wide range of financial services to foreign and domestic ...

in Tehran

Tehran (; fa, تهران ) is the largest city in Tehran Province and the capital of Iran. With a population of around 9 million in the city and around 16 million in the larger metropolitan area of Greater Tehran, Tehran is the most popul ...

(and Confido Capital OY in Helsinki

Helsinki ( or ; ; sv, Helsingfors, ) is the Capital city, capital, primate city, primate, and List of cities and towns in Finland, most populous city of Finland. Located on the shore of the Gulf of Finland, it is the seat of the region of U ...

) are some of the few opportunities for foreign investors to participate on the Tehran Stock Exchange . Turquoise Partners publishes one of the few English

English usually refers to:

* English language

* English people

English may also refer to:

Peoples, culture, and language

* ''English'', an adjective for something of, from, or related to England

** English national ...

newsletters that covers developments of the Tehran Stock Exchange and the Iranian economy calledIran Investment Monthly

. In 2014, Mehrafarin Brokerage Company became the first

broker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be con ...

to open an office in London. ACL Ltd in London

London is the capital and List of urban areas in the United Kingdom, largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary dow ...

says it plans to launch a fund focused on Iran worth over $100 million, if sanctions are lifted. Hundreds of Western hedge fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as ...

managers and investors have visited Iran

Iran, officially the Islamic Republic of Iran, and also called Persia, is a country located in Western Asia. It is bordered by Iraq and Turkey to the west, by Azerbaijan and Armenia to the northwest, by the Caspian Sea and Turkmeni ...

in 2015, in anticipation of the lifting of sanctions. Renaissance Capital and London-based Sturgeon Capital have also shown interest in investing in the TSE.

U.S. sanctions

U.S. persons need a license from the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) in order to invest in the TSE. Analysts expect TSE to be among the biggest early beneficiaries if the sanctions are lifted.Nikhil LohadIran Nuclear Deal Sends Tehran Stocks Higher

''Wall Street Journal'', April 5, 2015. Retrieved April 8, 2015.

Taxes