Taxation in Australia on:

[Wikipedia]

[Google]

[Amazon]

/ref> Between 1915 and 1942, income taxes were levied at both the state and federal level. The Taxation Administration Act 1953 was assented to on 4 March 1953. In 1972, the government of

Local governments are typically funded largely by taxes on land value (council rates) on residential, industrial and commercial properties. In addition, some State governments levy tax on land values for investors and primary residences of high value. The State governments also levy stamp duties on transfers of land and other similar transactions.

Fire Service Levies are also commonly applied to domestic house insurance and business insurance contracts. These levies are required under State Government law to assist in funding the fire services in each State.

Local governments are typically funded largely by taxes on land value (council rates) on residential, industrial and commercial properties. In addition, some State governments levy tax on land values for investors and primary residences of high value. The State governments also levy stamp duties on transfers of land and other similar transactions.

Fire Service Levies are also commonly applied to domestic house insurance and business insurance contracts. These levies are required under State Government law to assist in funding the fire services in each State.

The Federal Government imposes excise taxes on goods such as

The Federal Government imposes excise taxes on goods such as

Fringe Benefits Tax is the tax applied by the

Fringe Benefits Tax is the tax applied by the

Disturbing Questions About the Estate Tax and the Timing of Deaths

. Tax Foundation. Retrieved on 16 September 2012. following the lead of the Queensland Government led by Joh Bjelke-Petersen.

Private pensions (known as

Tax Return Perth

{{DEFAULTSORT:Taxation in Australia

Income taxes

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Ta ...

are the most significant form of taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

in Australia, and collected by the federal government

A federation (also known as a federal state) is a political entity characterized by a union of partially self-governing provinces, states, or other regions under a central federal government ( federalism). In a federation, the self-gover ...

through the Australian Taxation Office

The Australian Taxation Office (ATO) is an Australian statutory agency and the principal revenue collection body for the Australian Government. The ATO has responsibility for administering the Australian federal taxation system, superannuatio ...

. Australian GST GST may refer to:

Taxes

* General sales tax

* Goods and Services Tax, the name for the value-added tax in several jurisdictions:

** Goods and services tax (Australia)

** Goods and Services Tax (Canada)

** Goods and Services Tax (Hong Kong)

**Go ...

revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission

The Commonwealth Grants Commission is an Australian independent statutory body that advises the Australian Government on financial assistance to the states and territories of Australia under section 96 of the Australian Constitution. The Commis ...

.

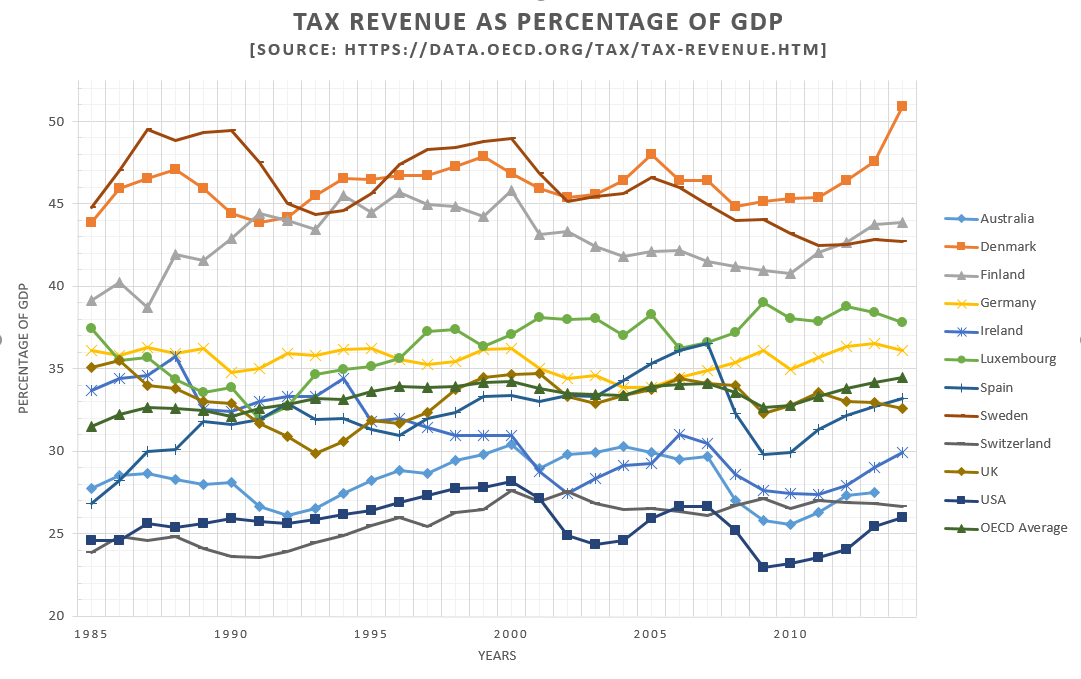

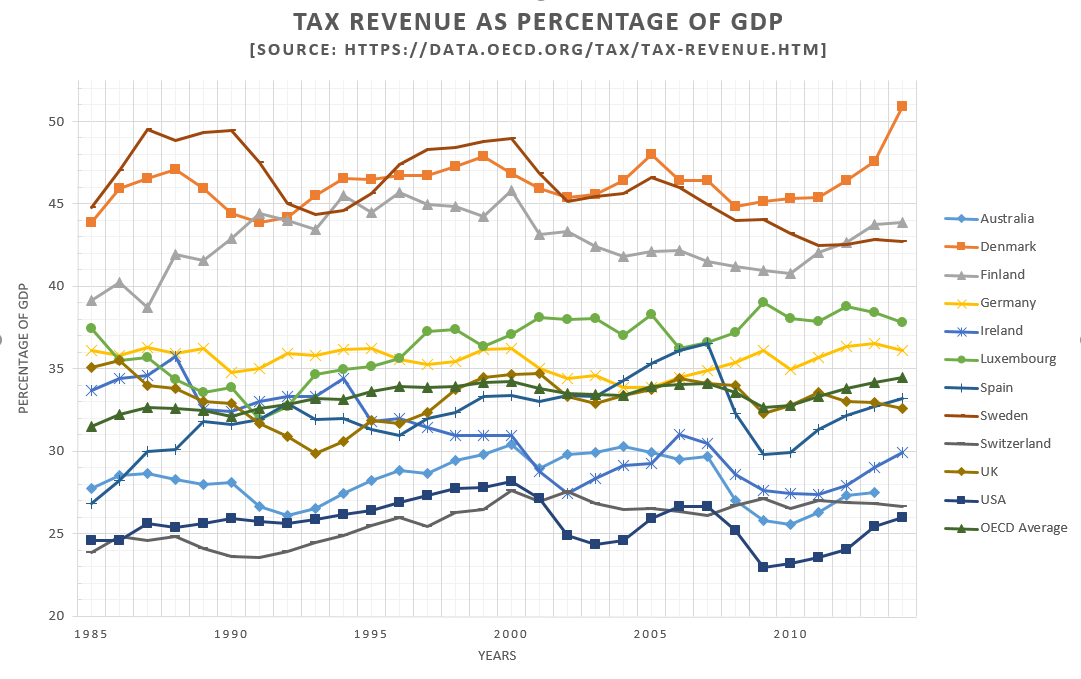

Australia maintains a relatively low tax burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

in comparison with other wealthy, developed nations, at 27.8% of GDP in 2018.

History

When the first Governor, Governor Phillip, arrived inNew South Wales

)

, nickname =

, image_map = New South Wales in Australia.svg

, map_caption = Location of New South Wales in AustraliaCoordinates:

, subdivision_type = Country

, subdivision_name = Australia

, established_title = Before federation

, es ...

in 1788, he had a Royal Instruction that gave him power to impose taxation if the colony needed it. The first taxes in Australia were raised to help pay for the completion of Sydney's first gaol and provide for the orphans of the colony. Import duties were put on spirits, wine and beer and later on luxury goods.

After 1824 the Government of New South Wales raised extra revenue from customs and excise duties. These were the most important sources of revenue for the colony throughout the 19th century. Taxes were raised on spirits, beer, tobacco, cigars and cigarettes. These taxes would vary between each of the Australian colonies, and this state of affairs remained in place after the colonies achieved statehood

A state is a centralized political organization that imposes and enforces rules over a population within a territory. There is no undisputed definition of a state. One widely used definition comes from the German sociologist Max Weber: a "st ...

.

Thomas de la Condamine was appointed as the first Collector of the Internal Revenue on 7 April 1827 with the actual office of the Collector of the Internal Revenue established on 1 May 1827 by Governor Ralph Darling

General Sir Ralph Darling, GCH (1772 – 2 April 1858) was a British Army officer who served as Governor of New South Wales from 1825 to 1831. He is popularly described as a tyrant, accused of torturing prisoners and banning theatrical entertain ...

. When de la Condamine's appointment was not confirmed by the Secretary of State for War and the Colonies

The Secretary of State for War and the Colonies was a British cabinet-level position responsible for the army and the British colonies (other than India).

The Secretary was supported by an Under-Secretary of State for War and the Colonies.

Hi ...

William Huskisson

William Huskisson (11 March 177015 September 1830) was a British statesman, financier, and Member of Parliament for several constituencies, including Liverpool.

He is commonly known as the world's first widely reported railway passenger casu ...

, the duties fell to James Busby who held the position until December 1835 when the position was filled by William McPhereson. The Collector of the Internal Revenue collected all revenue, such as moneys received from the sale or rental of land except that from customs duties and court fees. The Internal Revenue Office was abolished on 4 January 1837 with its business becoming the responsibility of the Colonial Treasurer.

Colonial governments also raised money from fees on wills and stamp duty, which is a tax imposed on certain kinds of documents. In 1880, the Colony of Tasmania imposed a tax on earnings received from the profits of public companies.

Income taxes

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Ta ...

were introduced in the late 19th century in a few of the colonies before Federation. In 1884, a general tax on income was introduced in South Australia, and in 1895 income tax was introduced in New South Wales at the rate of six pence in the pound, or 2.5%. Federal income tax was first introduced in 1915, in order to help fund Australia's war effort in the First World War

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

.A brief history of Australia’s tax system Department of the Treasury/ref> Between 1915 and 1942, income taxes were levied at both the state and federal level. The Taxation Administration Act 1953 was assented to on 4 March 1953. In 1972, the government of

William McMahon

Sir William McMahon (23 February 190831 March 1988) was an Australian politician who served as the 20th Prime Minister of Australia, in office from 1971 to 1972 as leader of the Liberal Party. He was a government minister for over 21 years, ...

appointed the NSW Supreme Court

The Supreme Court of New South Wales is the highest state court of the Australian State of New South Wales. It has unlimited jurisdiction within the state in civil matters, and hears the most serious criminal matters. Whilst the Supreme Cour ...

judge

A judge is a person who presides over court proceedings, either alone or as a part of a panel of judges. A judge hears all the witnesses and any other evidence presented by the barristers or solicitors of the case, assesses the credibility an ...

Kenneth Asprey to conduct a full and wide-ranging review of the tax system. Although controversial when completed for the Whitlam Government in 1975, the Asprey report on taxation has acted "as a guide and inspiration to governments and their advisers for the following 25 years." The main recommendations of the report have all been implemented and are today part of Commonwealth taxation in Australia.

On 20 September 1985, Capital gains tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Not all countries impose a c ...

was introduced. The GST GST may refer to:

Taxes

* General sales tax

* Goods and Services Tax, the name for the value-added tax in several jurisdictions:

** Goods and services tax (Australia)

** Goods and Services Tax (Canada)

** Goods and Services Tax (Hong Kong)

**Go ...

replaced the older wholesale sales tax in 2000. In July 2001, the Financial Institutions Duty was abolished. Between 2002 and 2005, Bank Account Debits Tax

Bank account debits tax (BADT or BAD) was an Australian bank transaction tax levied on customer withdrawals from bank accounts with a cheque facility (both withdrawals made by cheque or by another means, such as EFTPOS).

The tax was introduced ...

was abolished.

On 1 July 2012 the Federal government introduced a Carbon price

Carbon pricing (or pricing), also known as cap and trade (CAT) or emissions trading scheme (ETS), is a method for nations to reduce global warming. The cost is applied to greenhouse gas emissions in order to encourage polluters to reduce the co ...

, requiring large emitters of carbon dioxide to purchase permits, the government also introduced a Minerals Resource Rent Tax, originally called a resources 'super profits' tax in the Henry Tax Report. The revenue from the carbon pricing regime was used to reduce income tax by increasing the tax-free threshold and increase pensions and welfare payments, as well as introducing compensation for some affected industries. The Carbon Tax and associated Resources Rent tax were repealed in 2014.

The Government has brought back a duty on financial institutions in the form of a 'major bank levy' on the five largest banks in Australia.

In 2021, US President Joe Biden worked with a 130 countries to implement a fixed tax rate of 15% to ensure that big businesses don't try to cheat.

Forms of taxes and excises, both Federal and State

Personal income taxes

Income taxes

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Ta ...

on individuals are imposed at the federal level. This is the most significant source of revenue in Australia. State governments have not imposed income taxes since World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

.

Personal income taxes in Australia are imposed on the personal income of each person on a progressive basis, with higher rates applying to higher income levels. Unlike some other countries, personal income tax in Australia is imposed on an individual and not on a family unit.

Individuals are also taxed on their share of any partnership or trust profits to which they are entitled for the financial year

A fiscal year (or financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many ...

.

Capital gains tax

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property.

Not all countries impose a c ...

(CGT) in the context of the Australian taxation system applies to the capital gain made on disposal of any asset, except for specific exemptions. The most significant exemption is the family home. Rollover provisions apply to some disposals, one of the most significant is transfers to beneficiaries on death, so that the CGT is not a quasi death duty.

CGT operates by having net gains treated as taxable income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

in the tax year an asset is sold or otherwise disposed of. If an asset is held for at least 1 year then any gain is first discounted by 50% for individual taxpayers, or by 33% for superannuation funds. Net capital losses in a tax year may be carried forward and offset against future capital gains. However, capital losses cannot be offset against income.

Personal use assets and collectables are treated as separate categories and losses on those are quarantined so they can only be applied against gains in the same category, not other gains. This works to stop taxpayers subsidising hobbies from their investment earnings.

Corporate taxes

A company tax is paid by companies and corporations on its net profit, but the company’s loss is carried forward to the next financial year. Unlike personal income taxes which use a progressive scale, company tax is calculated at a flat rate of 30% (25% for small businesses, which are defined below). Corporate tax is paid on the corporation’s profit at the corporate rate and is generally available for distribution, in addition to any retained earnings it may have carried forward, to shareholders as dividends. A tax credit (called afranking credit

Dividend imputation is a corporate tax system in which some or all of the tax paid by a company may be attributed, or imputed, to the shareholders by way of a tax credit to reduce the income tax payable on a distribution. In comparison to the ...

) is available to resident shareholders who receive the dividends to reflect the tax paid by the corporation (a process known as dividend imputation

Dividend imputation is a corporate tax system in which some or all of the tax paid by a company may be attributed, or imputed, to the shareholders by way of a tax credit to reduce the income tax payable on a distribution. In comparison to the ...

). A withholding tax applies on unfranked dividends paid to non-resident shareholders.

From 2015/16, designated "small business entities" with an aggregated annual turnover threshold of less than $2 million were eligible for a lower tax rate of 28.5%. Since 1 July 2016, small business entities with aggregated annual turnover of less than $10 million have had a reduced company tax rate of 27.5%. From 2017/18, corporate entities eligible for the lower tax rate have been known as "base rate entities". The small business threshold has remained at $10 million since 2017/18; but the base rate entity threshold (the aggregated annual turnover threshold under which entities will be eligible to pay a lower tax rate) has continued to rise until the base rate entities have an annual turnover of $50 million giving a tax rate of 25% to the entities below this threshold.

Trustee liability taxes

Where all or part of the net trust income is distributed to either non-residents or minors, the trustee of that trust is assessed on that share on behalf of the beneficiary. In this case, the beneficiaries must declare that share of net trust income on their individual income tax returns, and also claim a credit for the amount of tax the trustee paid on their behalf. Where the trust accumulates net trust income, the trustee is assessed on that accumulated income at the highest individual marginal rate. In both cases the trustee will be issued a notice of assessment subsequent to lodging the trust tax return.Goods and Services taxes

A goods and services tax (GST) is avalue added tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the en ...

levied by the federal government at 10% on the supply of most goods and services by entities registered for the tax. The GST was introduced in Australia on 1 July 2000 by the then Howard Liberal government. A number of supplies are GST-free (e.g., many basic foodstuffs, medical and educational services, exports), input-taxed (residential accommodation, financial services, etc.), exempt (Government charges) or outside the scope of GST.

The revenue from this tax is distributed to the States.

State governments do not levy any sales taxes though they do impose stamp duties on a range of transactions.

''In summary'', the GST rate of 10% is charged on most goods and services consumed in Australia. A business which is registered for GST would include the GST in the sale prices it charges. However, a business can claim a credit for the GST paid on business expenses and other inputs (called a GST credit). The business would pay to the Tax Office the difference between GST charged on sales and GST credits.

Two types of sales are treated differently:

# Suppliers of GST-free goods and services will not have to pay GST when they make a sale but they will be entitled to GST credits.

# Suppliers of input taxed goods and services do not have to charge GST on sales but they will not be entitled to claim GST credits from their purchases of inputs.

Property taxes

Departure tax

The Passenger Movement Charge (PMC) is a fee levied by the Australian government on all passengers departing on international flights or maritime transport. The PMC replaced thedeparture tax

A departure tax is a fee charged (under various names) by a country when a person is leaving the country.

Background

Some countries charge a departure tax only when a person is leaving by air. In these cases, the departure tax can be ''de fa ...

in 1995 and was initially described as a charge to partially offset the cost to government of the provision of passenger facilitation at airports, principally customs, immigration and quarantine functions. It is classified by the International Air Transport Association

The International Air Transport Association (IATA ) is a trade association of the world's airlines founded in 1945. IATA has been described as a cartel since, in addition to setting technical standards for airlines, IATA also organized tariff ...

as a departure tax, rather than an airport charge, as its revenue does not directly contribute to passenger processing at airports or sea ports. Since 2017, the PMC has been a flat rate of A$60 per passenger over 12 years of age, with a few limited exemptions.

Excise taxes

cigarettes

A cigarette is a narrow cylinder containing a combustible material, typically tobacco, that is rolled into thin paper for smoking. The cigarette is ignited at one end, causing it to smolder; the resulting smoke is orally inhaled via the opp ...

, petrol

Gasoline (; ) or petrol (; ) (see ) is a transparent, petroleum-derived flammable liquid that is used primarily as a fuel in most spark-ignited internal combustion engines (also known as petrol engines). It consists mostly of organic c ...

, and alcohol

Alcohol most commonly refers to:

* Alcohol (chemistry), an organic compound in which a hydroxyl group is bound to a carbon atom

* Alcohol (drug), an intoxicant found in alcoholic drinks

Alcohol may also refer to:

Chemicals

* Ethanol, one of sev ...

. The rates imposed may change in February and August each year in response to changes in the consumer price index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Overview

A CPI is a statisti ...

.

Fuel taxes in Australia

The excise tax on commonly used fuels inAustralia

Australia, officially the Commonwealth of Australia, is a sovereign country comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands. With an area of , Australia is the largest country by ...

as of October 2018 are as follows:

* A$0.416 per litre on Unleaded Petrol fuel (Includes standard, blended ( E10) and premium grades)

* A$0.416 per litre on Diesel fuel

Diesel fuel , also called diesel oil, is any liquid fuel specifically designed for use in a diesel engine, a type of internal combustion engine in which fuel ignition takes place without a spark as a result of compression of the inlet air and ...

(Ultra-low sulphur/Conventional)

* A$0.134 per litre on Liquified petroleum gas

Liquefied petroleum gas (LPG or LP gas) is a fuel gas which contains a flammable mixture of hydrocarbon gases, specifically propane, propylene, butylene, isobutane and n-butane.

LPG is used as a fuel gas in heating appliances, cookin ...

used as fuel (Autogas

Autogas or LPG is liquefied petroleum gas (LPG) used as a fuel in internal combustion engines in vehicles as well as in stationary applications such as generators. It is a mixture of propane and butane.

Autogas is widely used as a "green" ...

or LPG as it is commonly known in Australia)

* A$0.081 per litre on Ethanol

Ethanol (abbr. EtOH; also called ethyl alcohol, grain alcohol, drinking alcohol, or simply alcohol) is an organic compound. It is an alcohol with the chemical formula . Its formula can be also written as or (an ethyl group linked to a ...

fuel (Can be reduced/removed via Grants)

* A$0.041 per litre on Biodiesel

Biodiesel is a form of diesel fuel derived from plants or animals and consisting of long-chain fatty acid esters. It is typically made by chemically reacting lipids such as animal fat ( tallow), soybean oil, or some other vegetable oi ...

(Can be reduced/removed via Grants)

Note: Petrol used for aviation

Aviation includes the activities surrounding mechanical flight and the aircraft industry. ''Aircraft'' includes airplane, fixed-wing and helicopter, rotary-wing types, morphable wings, wing-less lifting bodies, as well as aerostat, lighter- ...

is taxed at $0.03556 per litre

Luxury Car Tax

Luxury Car Tax is payable by businesses which sell or import luxury cars, where the value of the car is above $66,331, or $75,526 for fuel-efficient cars with a fuel consumption of less than 7L per 100 km.Customs duties

Customs duties

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and p ...

are imposed on many imported goods, such as alcohol

Alcohol most commonly refers to:

* Alcohol (chemistry), an organic compound in which a hydroxyl group is bound to a carbon atom

* Alcohol (drug), an intoxicant found in alcoholic drinks

Alcohol may also refer to:

Chemicals

* Ethanol, one of sev ...

, tobacco products

Tobacco is the agricultural product of the leaves of plants in the genus ''Nicotiana'', commonly termed ''tobacco plants''. All species of ''Nicotiana'' contain the addictive drug nicotine—a psychostimulant alkaloid found in all parts of the ...

, perfume

Perfume (, ; french: parfum) is a mixture of fragrant essential oils or aroma compounds (fragrances), fixatives and solvents, usually in liquid form, used to give the human body, animals, food, objects, and living-spaces an agreeable scent ...

, and other items. Some of these goods can be purchased ''duty-free'' at duty-free shop

A duty-free shop (or store) is a retail outlet whose goods are exempt from the payment of certain local or national taxes and duties, on the requirement that the goods sold will be sold to travelers who will take them out of the country, w ...

s.

Payroll taxes

Payroll tax

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the em ...

es in Australia are levied by state governments on employers based on wages paid by them. Payroll tax rates vary between states. Typically, payroll tax applies to wages above the threshold, which also varies. Groups of companies may be taxed as a single entity where their operations are significantly integrated or related. This has significance in the grouping of payroll amounts in determining whether the threshold had been reached.

Current Payroll Tax Rates and Thresholds

Queensland and the Northern Territory payroll tax rates are effective rates on payrolls above $5.5 million and $5.75 million respectively. All other jurisdictions levy marginal rates. Some companies may be eligible for deductions, concessions and exemptions.

Payroll taxes in Australian Capital Territory

From 1 July 2014: * The rate of payroll tax is 6.85%. * The annual threshold is $1,850,000. * The monthly threshold is $154,166.66.Payroll taxes in New South Wales

From 1 July 2013: * The rate of payroll tax is 5.45%. * Medicare payments are up to 12% * Pension Fund contribution is 9.5% * The annual threshold is $750,000. * The monthly threshold is: ** 28 days = $57,534 ** 30 days = $61,644 ** 31 days = $63,699 Employers, or a group of related businesses, whose total Australian wages exceed the current NSW monthly threshold, are required to pay NSW payroll tax. Each monthly payment or 'nil' remittance is due seven days after the end of each month or the next business day if the seventh day is a weekend (i.e. August payment is due by 7 September). The annual reconciliation and payment or 'nil' remittance is due by 21 July. Effective July 2007 – In NSW, payroll tax is levied under the Payroll Tax Act 2007 and administered by the Taxation Administration Act 1996. Prior to 1 July 2007 – In NSW, payroll tax was levied under the Payroll Tax Act 1971 and administered by the Taxation Administration Act 1996.Payroll taxes in Northern Territory

From 1 July 2012: * The rate of payroll tax is 5.50%. * The annual threshold is $1,500,000. * The monthly threshold is $125,000.Payroll taxes in Queensland

Companies or groups of companies that pay $1,100,000 or more a year in Australian wages must pay payroll tax. There are deductions, concessions and exemptions available to those that are eligible. From 1 July 2012: * The rate of payroll tax is 4.75%. * The annual threshold is $1,100,000. * The monthly threshold is $91,666.Payroll taxes in South Australia

A Payroll Tax liability arises inSouth Australia

South Australia (commonly abbreviated as SA) is a States and territories of Australia, state in the southern central part of Australia. It covers some of the most arid parts of the country. With a total land area of , it is the fourth-largest o ...

when an employer (or a Group of employers) has a wages bill in excess of $600,000 for services rendered by employees anywhere in Australia if any of those services are rendered or performed in South Australia.

From 1 July 2012:

* The rate of payroll tax is 4.95%.

* The annual threshold is $600,000.

* The monthly threshold is $50,000.

Payroll taxes in Tasmania

From 1 July 2013: * The rate of payroll tax is 6.1%. * The annual threshold is $1,250,000. * The monthly threshold is: ** 28 days = $95,890 ** 30 days = $102,740 ** 31 days = $106,164Payroll taxes in Victoria

From 1 July 2014: * The rate of payroll tax is 4.85% (2.425% for regional employers) * Medicare payments are up to 12% * Pension Fund contribution is 9.5% * The annual threshold is $550,000. * The monthly threshold is $45,833. From 1 July 2021: * The rate of payroll tax is 4.85% (1.2125% for regional employers) * The annual threshold is $700,000. * The monthly threshold is $58,333.Payroll taxes in Western Australia

Payroll tax is a general purpose tax assessed on the wages paid by an employer in Western Australia. The tax is self-assessed in that the employer calculates the liability and then pays the appropriate amount to the Office of State Revenue, by way of a monthly, quarterly or annual return. From 1 July 2014: * The rate of payroll tax is 5.5%. * The annual threshold is $800,000. * The monthly threshold is $66,667. On 8 December 2004 new legislation was passed making it mandatory for an employer that has, or is a member of a group that has, an expected payroll tax liability equal to or greater than $100,000 per annum, to lodge and pay their payroll tax return via Revenue Online (ROL). This amendment to the Payroll Tax Assessment Act 2002 was effective 1 July 2006.Fringe Benefits Tax

Australian Taxation Office

The Australian Taxation Office (ATO) is an Australian statutory agency and the principal revenue collection body for the Australian Government. The ATO has responsibility for administering the Australian federal taxation system, superannuatio ...

to most, although not all, fringe benefits, which are generally non-cash benefits. Most fringe benefits are also reported on employee payment summaries for inclusion on personal income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

tax return

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer.

Taxation is one ...

s that must be lodged annually.

Inheritance tax

There is noinheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an e ...

in Australia, with all states in Australia abolishing what was known as ''death duties'' in 1979. Tax Foundation. Retrieved on 16 September 2012.

superannuation in Australia

In Australia, superannuation, or just super, is the term for retirement pension benefit funds. Employers make compulsory contributions into these funds on behalf of their employees.

Superannuation is compulsory for all employed people workin ...

) may be taxed at up to three points, depending on the circumstances: at the point of tribution to a fund, on investment income and at the time benefits are received. In some circumstances, no ta

The compulsory nature of Australian Superannuation means that it is sometimes regarded as being similar to social security taxes levied in other nations. This is more frequently the case when comparisons are being made between the tax burden of respective nations.

See also

* Australia Tax *Bottom of the harbour tax avoidance

Bottom of the harbour tax avoidance was a form of tax avoidance used in Australia in the 1970s. Legislation made it a criminal offence in 1980. The practice came to symbolise the worst of variously contrived tax strategies from those times.

...

* Cherry-picking tax avoidance

* Negative gearing (Australia)

* Office of State Revenue (New South Wales)

* Salary packaging

Salary packaging (also known as salary sacrifice or salary exchange) is the inclusion of employee benefits (also called fringe benefits) in an employee remuneration package in exchange for giving up part of monetary salary. Such arrangements are e ...

* Tax file number A tax file number (TFN) is a unique identifier issued by the Australian Taxation Office (ATO) to each taxpaying entity — an individual, company, superannuation fund, partnership, or trust. Not all individuals have a TFN, and a business has both a ...

* Tax return (Australia)

Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year.

Australian individual taxpayers can file their return online with the ATO's myTax s ...

* Tax Institute (Australia)

* Darwin Rebellion

Tax law:

* Constitutional basis of taxation in Australia

* Bank Notes Tax Act 1910

Related:

* Australian federal budget

* Australian economy

References

Tax Return Perth

{{DEFAULTSORT:Taxation in Australia