Scheduled banks on:

[Wikipedia]

[Google]

[Amazon]

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934

Reserve Bank of India Act, 1934 is the legislative act under which the Reserve Bank of India was formed. This act along with the Companies Act, which was amended in 1936, were meant to provide a framework for the supervision of banking firms in ...

. Reserve Bank of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible f ...

(RBI) in turn includes only those banks in this Schedule which satisfy the criteria laid down vide section 42(6)(a) of the said Act.

Banks not under this Schedule are called Non-Scheduled Banks

Facilities

Every Scheduled bank enjoys two types of principal facilities: it becomes eligible for debts/loans at thebank rate

Bank rate, also known as discount rate in American English, is the rate of interest which a central bank charges on its loans and advances to a commercial bank. The bank rate is known by a number of different terms depending on the country, and ...

from the RBI; and, it automatically acquires the membership of clearing house

Clearing house or Clearinghouse may refer to:

Banking and finance

* Clearing house (finance)

* Automated clearing house

* ACH Network, an electronic network for financial transactions in the U.S.

* Bankers' clearing house

* Cheque clearing

* Cl ...

.

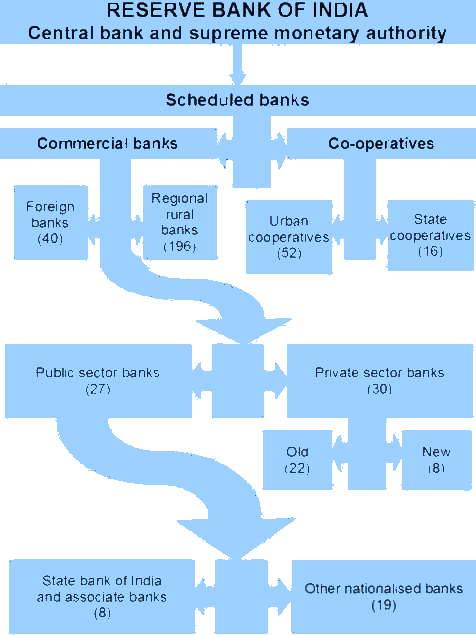

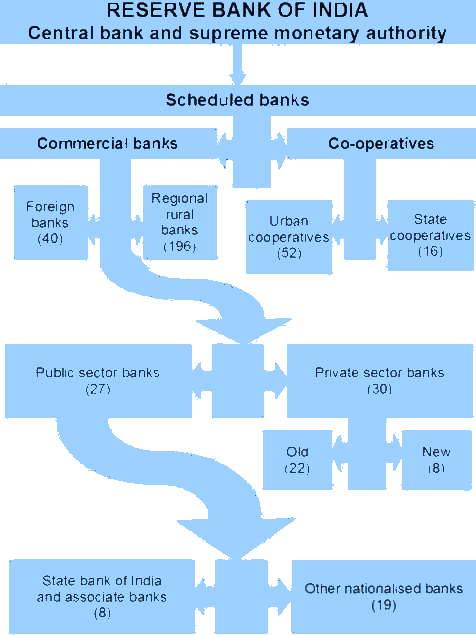

Types of banks

There are two main categories of commercial banks in India namely - * ScheduledCommercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with co ...

s

* Scheduled Co-operative banks

Scheduled commercial Banks are further divided into 5 types as below -

# Nationalised Banks

# Development Banks

# Regional urban

Banks

# Foreign Banks

# Private sector Banks

#Payment bank

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the p ...

(currently five banks NSDL Payments Bank, Airtel Payments Bank, Fino Payments Bank, India Post Payments Bank, Paytm Payments Bank

Paytm Payments Bank (PPBL) is an Indian payments bank, founded in 2015 and headquartered in Noida. In the same year, it received the license to run a payments bank from the Reserve Bank of India and was launched in November 2017. In 2021, the ban ...

have been granted Scheduled bank status).

Scheduled Co-operative banks are further divided into 2 types namely -

# Scheduled State Co-operative banks

# Scheduled Urban Co-operative banks

See also

*Banking in India

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791. ...

* List of banks in India

This is the list of banks which are listed as Scheduled Banks (India) under second schedule of RBI Act, 1934.

Commercial banks Public Sector Banks (PSBs)

There are 12 public sector banks as of 15 November 2021

Private-sector banks

A ...

References

Further reading

* {{cite web, title=Reserve Bank of India Act, 1934: The Second Schedule, url=http://rbidocs.rbi.org.in/rdocs/Publications/PDFs/RBIAM_230609.pdf, pages=91–100, publisher=Reserve Bank of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible f ...

Banking in India