Prudential Insurance on:

[Wikipedia]

[Google]

[Amazon]

Prudential Financial, Inc. is an American

Fortune Global 500

The ''Fortune'' Global 500, also known as Global 500, is an annual ranking of the top 500 corporations worldwide as measured by revenue. The list is compiled and published annually by ''Fortune'' magazine.

Methodology

Until 1989, it listed onl ...

and Fortune 500 company whose subsidiaries provide insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge ...

, retirement planning

Retirement planning, in a financial context, refers to the allocation of savings or revenue for retirement. The goal of retirement planning is to achieve financial independence.

The process of retirement planning aims to:

*Assess readiness-to-ret ...

, investment management, and other products and services to both retail

Retail is the sale of goods and services to consumers, in contrast to wholesaling, which is sale to business or institutional customers. A retailer purchases goods in large quantities from manufacturers, directly or through a wholesaler, and ...

and institutional customers throughout the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

and in over 40 other countries. In 2019, Prudential was the largest insurance provider in the United States with $815.1 billion in total assets.

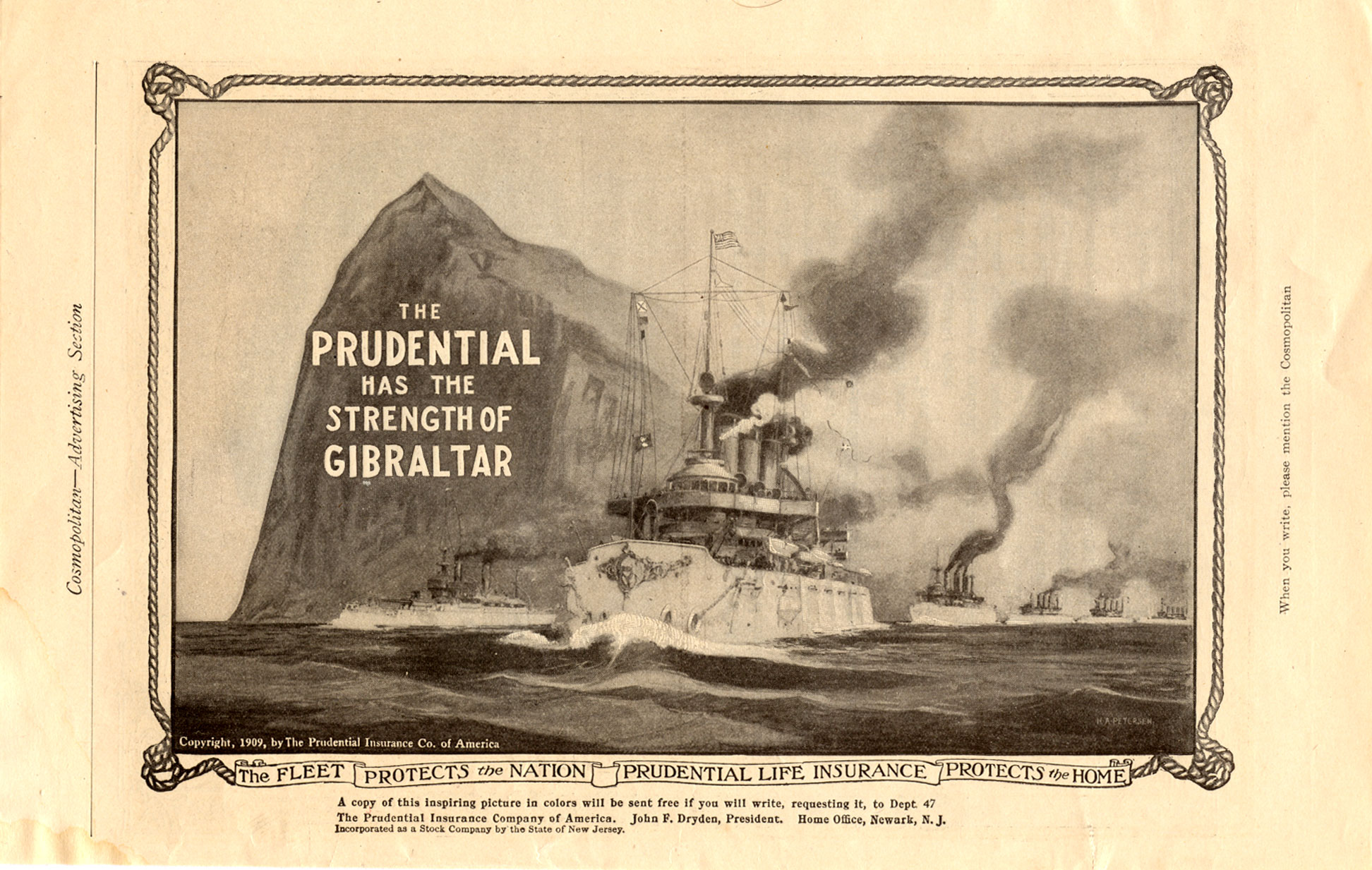

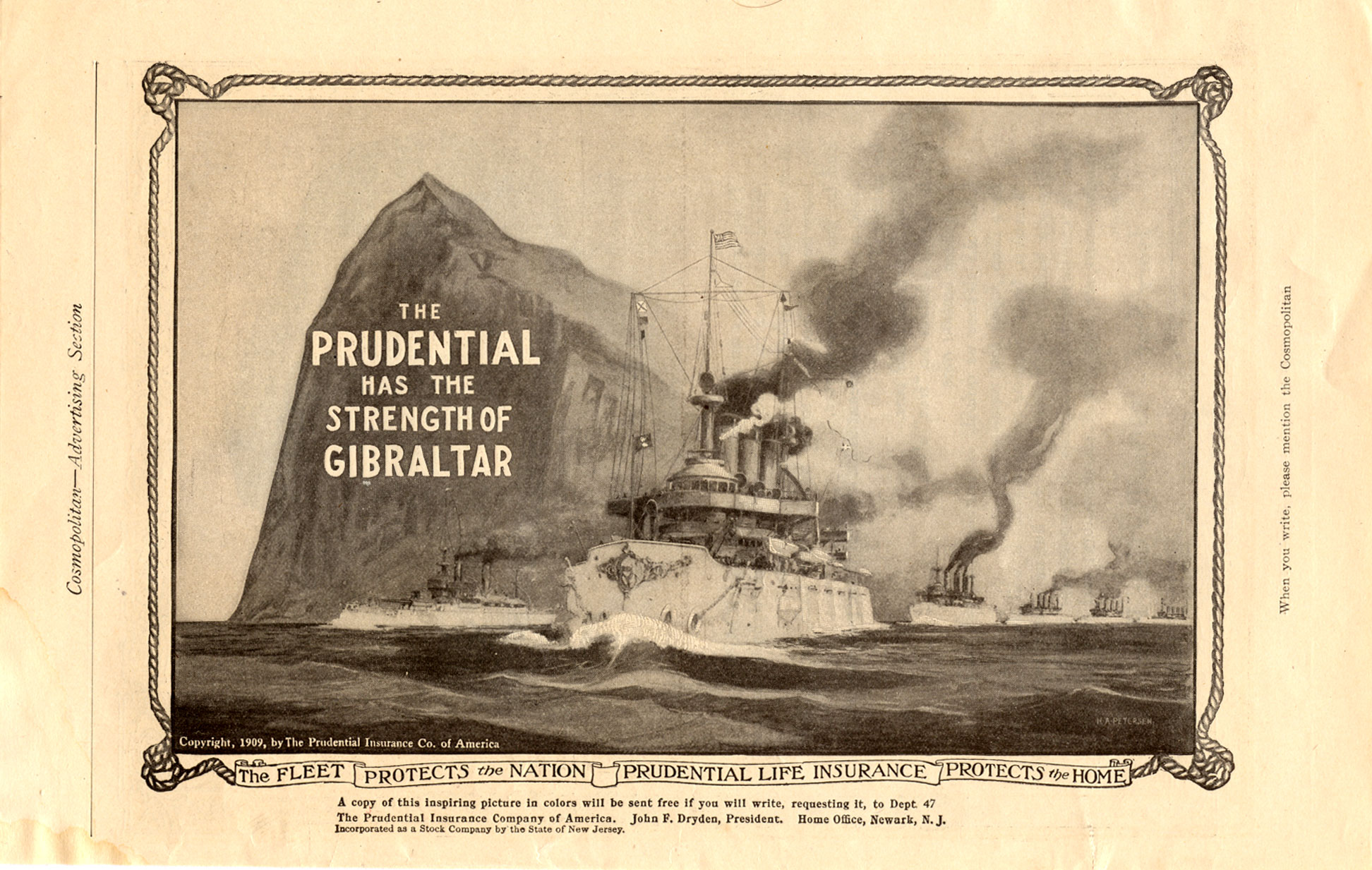

The company uses the Rock of Gibraltar as its logo

A logo (abbreviation of logotype; ) is a graphic mark, emblem, or symbol used to aid and promote public identification and recognition. It may be of an abstract or figurative design or include the text of the name it represents as in a wo ...

.

Logo

The use of Prudential's symbol, the Rock of Gibraltar, began after an advertising agent passed Laurel Hill, a volcanic neck, in Secaucus, New Jersey, on a train in the 1890s. The related slogans "Get a Piece of the Rock" and "Strength of Gibraltar" are also still quite widely associated with Prudential, though current advertising uses neither of these. Through the years, the symbol went through various versions, but in 1989, a simplified pictogram symbol of the Rock of Gibraltar was adopted. It has been used ever since. The logotype was updated with a proprietary font in 1996. The font, Prudential Roman, was designed byDoyald Young

Doyald Young (September 12, 1926 – February 28, 2011) was an American typeface designer and teacher who specialized in the design of logotypes, corporate alphabets, lettering and typefaces.

Work

The typefaces designed by Doyald Young inclu ...

and John March, based on the Century font family.

History

Started inNewark, New Jersey

Newark ( , ) is the most populous city in the U.S. state of New Jersey and the seat of Essex County and the second largest city within the New York metropolitan area.John F. Dryden, who later became a U.S. Senator. In the beginning, the company sold only one product, burial insurance. Dryden was the president of Prudential until 1912. He was succeeded by his son Forrest F. Dryden, who was the president until 1922.

A history of The Prudential Insurance Company of America up to about 1975 is the topic of the book ''Three Cents A Week'', referring to the premium paid by early policyholders.

At the turn of the 20th century, Prudential and other large insurers reaped the bulk of their profits from industrial life insurance, or insurance sold by solicitors house-to-house in poor urban areas. For their insurance, industrial workers paid double what others paid for ordinary life insurance, and due to high lapse rates, as few as 1 in 12 policies reached maturity. Prominent lawyer and future U.S. Supreme Court Justice Louis Brandeis helped pass a 1907 Massachusetts law to protect workers by allowing savings banks to sell life insurance at lower rates.

A history of The Prudential Insurance Company of America up to about 1975 is the topic of the book ''Three Cents A Week'', referring to the premium paid by early policyholders.

At the turn of the 20th century, Prudential and other large insurers reaped the bulk of their profits from industrial life insurance, or insurance sold by solicitors house-to-house in poor urban areas. For their insurance, industrial workers paid double what others paid for ordinary life insurance, and due to high lapse rates, as few as 1 in 12 policies reached maturity. Prominent lawyer and future U.S. Supreme Court Justice Louis Brandeis helped pass a 1907 Massachusetts law to protect workers by allowing savings banks to sell life insurance at lower rates.

Prudential has evolved from a

Prudential has evolved from a

Official website

{{Authority control 1875 establishments in New Jersey Companies based in Newark, New Jersey Companies listed on the New York Stock Exchange Financial services companies based in New Jersey Financial services companies established in 1875 Former mutual insurance companies Life insurance companies of the United States Mutual funds of the United States

A history of The Prudential Insurance Company of America up to about 1975 is the topic of the book ''Three Cents A Week'', referring to the premium paid by early policyholders.

At the turn of the 20th century, Prudential and other large insurers reaped the bulk of their profits from industrial life insurance, or insurance sold by solicitors house-to-house in poor urban areas. For their insurance, industrial workers paid double what others paid for ordinary life insurance, and due to high lapse rates, as few as 1 in 12 policies reached maturity. Prominent lawyer and future U.S. Supreme Court Justice Louis Brandeis helped pass a 1907 Massachusetts law to protect workers by allowing savings banks to sell life insurance at lower rates.

A history of The Prudential Insurance Company of America up to about 1975 is the topic of the book ''Three Cents A Week'', referring to the premium paid by early policyholders.

At the turn of the 20th century, Prudential and other large insurers reaped the bulk of their profits from industrial life insurance, or insurance sold by solicitors house-to-house in poor urban areas. For their insurance, industrial workers paid double what others paid for ordinary life insurance, and due to high lapse rates, as few as 1 in 12 policies reached maturity. Prominent lawyer and future U.S. Supreme Court Justice Louis Brandeis helped pass a 1907 Massachusetts law to protect workers by allowing savings banks to sell life insurance at lower rates.

Prudential has evolved from a

Prudential has evolved from a mutual insurance

A mutual insurance company is an insurance company owned entirely by its policyholders. Any profits earned by a mutual insurance company are either retained within the company or rebated to policyholders in the form of dividend distributions or ...

company (owned by its policyholders) to a joint stock company (as it was prior to 1915). It is now traded on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed ...

under the symbol PRU. The Prudential Stock was issued and started trading on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed ...

on December 13, 2001.

On August 1, 2004, the U.S. Department of Homeland Security

The United States Department of Homeland Security (DHS) is the U.S. federal executive department responsible for public security, roughly comparable to the interior or home ministries of other countries. Its stated missions involve anti-terr ...

announced the discovery of terrorist threats against the Prudential Headquarters in Newark, New Jersey

Newark ( , ) is the most populous city in the U.S. state of New Jersey and the seat of Essex County and the second largest city within the New York metropolitan area.X-ray

An X-ray, or, much less commonly, X-radiation, is a penetrating form of high-energy electromagnetic radiation. Most X-rays have a wavelength ranging from 10 picometers to 10 nanometers, corresponding to frequencies in the range 30&nb ...

machines. In the same year, a joint venture was formed between Prudential and China Everbright Limited.

On November 28, 2007, the Prudential board of directors elected a new CEO, John R. Strangfeld, to replace retiring Arthur F. Ryan.

Acquisitions and divestitures

In 1981, the company acquired Bache & Co., a stock brokerage service that operated as a wholly owned subsidiary until 2003, when Wachovia and Prudential combined their retail brokerage operations intoWachovia Securities

Wachovia Securities was the trade name of Wachovia's retail brokerage and institutional capital markets and investment banking subsidiaries. Following Wachovia's merger with Wells Fargo and Company on December 31, 2008, the retail brokerage beca ...

, with Prudential a minority stake holder. In 1999, Prudential sold its healthcare division, Prudential HealthCare, to Aetna

Aetna Inc. () is an American managed health care company that sells traditional and consumer directed health care insurance and related services, such as medical, pharmaceutical, dental, behavioral health, long-term care, and disability plans, ...

for $1 billion.

On May 1, 2003, Prudential formalized the acquisition of American Skandia, the largest distributor of variable annuities through independent financial professionals in the United States. The CEO of American Skandia, Wade Dokken, partnered with Goldman Sachs and sold the division to Prudential for $1.2 billion. The combination of American Skandia variable annuities and Prudential fixed annuities was part of Prudential's strategy to acquire complementary businesses that help meet retirement goals.

In April 2004, the company acquired the retirement business of CIGNA Corporation. In late 2009, Prudential sold its minority stake in Wachovia Securities Financial Holdings LLC to Wells Fargo & Co. In 2011, Prudential sold Prudential Bache Commodities, LLC to Jefferies.

In February 2011, the company acquired AIG Edison and AIG Star both in Japan from American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/amer ...

, Inc (AIG) for a total of $4.8 billion. This acquisition bolstered Prudential's operations in Asia while giving cash to AIG to pay back the federal government from its bailout in 2008.

In January 2013, the company acquired the individual life insurance business from The Hartford

The Hartford Financial Services Group, Inc., usually known as The Hartford, is a United States-based investment and insurance company. The Hartford is a Fortune 500 company headquartered in its namesake city of Hartford, Connecticut. It was ranke ...

for $615 million in cash. The acquisition includes 700,000 in force life insurance policies with a face amount of approximately $135 billion. This move by Prudential brought over additional life insurance revenue.

In September 2019, the company agreed to acquire online startup Assurance IQ Inc. for $2.35 billion. Assurance has underperformed financial expectations, and industry commentators believe Prudential paid too much for the acquisition.

Controversies

Investor fraud

During the 1980s and 1990s, Prudential Securities Incorporated (PSI), formerly a division of Prudential Financial, was investigated by the Securities and Exchange Commission (SEC) for suspected fraud. During the investigation, it was found that PSI had defrauded investors of close to $8 billion, the largest fraud found by the SEC in US history to that point. The SEC charged that Prudential allowed rogue executives to cheat customers on a large scale and blithely ignored a 1986 SEC order to overhaul its internal enforcement of securities laws. In all, some 400,000 individual investors lost money on the deals. In 1993, Prudential Financial eventually settled with investors for $330 million. Prudential said it would repay customers across the U.S. who lost money on the company's limited partnerships in the 1980s. In addition, the firm was required to pay another $41 million in fines. The settlement also resolved investigations of the firm by the National Association of Securities Dealers and 49 states, including California, where 52,000 investors lost money in Prudential limited partnerships. Further investigation was conducted by the SEC into the executives of the company to determine the extent of the fraud.Class action lawsuit over sales practices

In 1997, Prudential settled aclass action

A class action, also known as a class-action lawsuit, class suit, or representative action, is a type of lawsuit where one of the parties is a group of people who are represented collectively by a member or members of that group. The class actio ...

lawsuit by millions of its customers who had been sold unnecessary life insurance by Prudential agents over a 13-year period ending in 1995. The settlement called for Prudential to repay an estimated $2 billion to customers through direct refunds and enhancements to existing policies. The settlement had been the subject of extensive negotiations involving not only Prudential and its customers, but also insurance regulators in 30 states. Prudential had agreed in early 1997 to pay a fine of $35 million to settle state allegations of deceptive sales practices. Prudential acknowledged that for more than a decade its agents had improperly persuaded customers to cash in old policies and purchase new ones so that the agents could generate additional sales commissions.

US military life insurance lawsuit

In 2010, various media outlets noted allegations that the Prudential Life Insurance Company was manipulating the payout of life insurance benefits due to the families of American soldiers in order to gain extra profits. The company provided life insurance to people in the armed forces under a government contract. Rather than paying the full amount due to the families at once, the company would instead deposit the funds into a Prudential corporate account. These accounts are referred to as 'retained asset accounts' and are essentially an I.O.U. from the company to the payee (in many cases a fallen service members' family). While Prudential was making profits of up to 4.2% in its general account in early 2010, they paid out 0.5% interest in these non-FDIC insured "Alliance" accounts. In some cases, when families requested to be sent a full payout in the form of a check, the family was sent a checkbook, rather than the amount due. It is not clear if the practice was in violation of law or the contract. In August 2010, the company was sued by a number of the bereaved families. The company's response included an open letter to the military community in which it addressed what it characterized as "misinformation" about the nature of the accounts. '' Military Times'' noted that prior lawsuits against insurance companies pertaining to the use of retained asset accounts have been dismissed in federal courts without action.Ratings, awards and The Prudential Foundation

Prudential has received a 100% rating on the Corporate Equality Index released by the Human Rights Campaign every year since 2003, the second year of the report. In addition, the company is in the "Hall of Fame" of ''Working Mothers'' magazine among other companies that have made their "100 Best Companies for Working Mothers" list for 15 or more years. It is still achieving that list, as of 2013. According to Business Week's ''The Best Places to Launch a Career 2008'', Prudential Insurance was ranked #59 out of 119 companies on the list. In 2007, The Prudential Foundation provided over $450,000 in Prudential CARES Volunteer Grants to 444 nonprofit organizations worldwide. The Prudential CARES Volunteer Grants Program recognizes individual and team volunteers based on a minimum of 40 hours of volunteer service per individual. Grants range from $250 to $5,000 for each award winner's charitable organization. Prudential ranked #69 on the 2017Forbes

''Forbes'' () is an American business magazine owned by Integrated Whale Media Investments and the Forbes family. Published eight times a year, it features articles on finance, industry, investing, and marketing topics. ''Forbes'' also r ...

World’s Biggest Public Companies list, calling out their $45.6 billion market value. Prudential ranked No. 52 in the 2018 Fortune 500 list of the largest United States corporations by total revenue. As of 2019, Prudential is the largest insurance provider in the United States with $815.1 billion in total assets.

See also

*List of United States insurance companies

This is a list of insurance companies based in the United States. These are companies with a strong national or regional presence having insurance as their primary business.

In 1752, Benjamin Franklin founded the first American insurance company a ...

* Prudential plc

Prudential plc is a British multinational insurance company headquartered in London, England. It was founded in London in May 1848 to provide loans to professional and working people.

Prudential has dual primary listings on the London Stock E ...

—an unrelated United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the European mainland, continental mainland. It comprises England, Scotlan ...

-based company.

** Jackson National Life, the U.S. subsidiary of Prudential plc since 1986

References

External links

Official website

{{Authority control 1875 establishments in New Jersey Companies based in Newark, New Jersey Companies listed on the New York Stock Exchange Financial services companies based in New Jersey Financial services companies established in 1875 Former mutual insurance companies Life insurance companies of the United States Mutual funds of the United States