Nicholas Kaldor on:

[Wikipedia]

[Google]

[Amazon]

Nicholas Kaldor, Baron Kaldor (12 May 1908 – 30 September 1986), born Káldor Miklós, was a

After the publication of

After the publication of

Alternative Theories of Distribution

', 1956, RES * ''A Model of Economic Growth'', 1957, EJ * ''Monetary Policy, Economic Stability, and Growth'', 1958. * ''Economic Growth and the Problem of Inflation'', 1959, Economica. * ''A Rejoinder to Mr. Atsumi and Professor Tobin'', 1960, RES * ''Keynes's Theory of the Own-Rates of Interest'', 1960, in Kaldor, 1960. * ''Essays on Value and Distribution'', 1960. * ''Essays on Economic Stability and Growth'', 1960. * ''Capital Accumulation and Economic Growth'', 1961, in Lutz, editor, Theory of Capital * ''A New Model of Economic Growth'', with James A. Mirrlees, 1962, RES * ''The Case for a Commodity Reserve Currency'', with A.G. Hart and J. Tinbergen, 1964, UNCTAD * ''Essays on Economic Policy'', 1964, two volumes. * ''Causes of the Slow Rate of Economic Growth in the UK'', 1966. * ''The Case for Regional Policies'', 1970, Scottish JE. * ''The New Monetarism'', 1970, Lloyds Bank Review * ''Conflicts in National Economic Objectives'', 1971, EJ * ''The Irrelevance of Equilibrium Economics'', 1972, EJ * ''What is Wrong with Economic Theory'', 1975, QJE * ''Inflation and Recession in the World Economy'', 1976, EJ * ''Equilibrium Theory and Growth Theory'', 1977, in Boskin, editor, Economics and Human Welfare. * ''Capitalism and Industrial Development'', 1977, Cambridge JE * ''Further Essays on Economic Theory'', 1978. * ''The Role of Increasing Returns, Technical Progress and Cumulative Causation''..., 1981, Economie Appliquee * ''Fallacies on Monetarism'', 1981, Kredit und Kapital. * ''The Scourge of Monetarism'', 1982. *

The economic consequences of Mrs. Thatcher

', 1983. * ''The Role of Commodity Prices in Economic Recovery'', 1983, Lloyds Bank Review * ''Keynesian Economics After Fifty Years'', 1983, in Trevithick and Worswick, editors, Keynes and the Modern World * ''Economics Without Equilibrium'', 1985. * ''Causes of Growth and Stagnation in the World Economy'', 1996 (posthumous, based on 1984 Mattioli Lectures)

The Scourge of Monetarism

' (1982)

Kaldor Business Cycle Model

by Elmer G. Wiens {{DEFAULTSORT:Kaldor, Nicholas 1908 births 1986 deaths Writers from Budapest Hungarian Jews Post-Keynesian economists Life peers Life peers created by Elizabeth II Alumni of the London School of Economics Academics of the London School of Economics 20th-century British economists Naturalised citizens of the United Kingdom Hungarian emigrants to England Fellows of the Econometric Society Members of the Fabian Society

Cambridge

Cambridge ( ) is a College town, university city and the county town in Cambridgeshire, England. It is located on the River Cam approximately north of London. As of the 2021 United Kingdom census, the population of Cambridge was 145,700. Cam ...

economist in the post-war period. He developed the "compensation" criteria called Kaldor–Hicks efficiency

A Kaldor–Hicks improvement, named for Nicholas Kaldor and John Hicks, is an economic re-allocation of resources among people that captures some of the intuitive appeal of a Pareto improvement, but has less stringent criteria and is hence appl ...

for welfare

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifical ...

comparisons (1939), derived the cobweb model

The cobweb model or cobweb theory is an economic model that explains why prices might be subject to periodic fluctuations in certain types of markets. It describes cyclical supply and demand in a market where the amount produced must be chosen bef ...

, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal

Karl Gunnar Myrdal ( ; ; 6 December 1898 – 17 May 1987) was a Swedish economist and sociologist. In 1974, he received the Nobel Memorial Prize in Economic Sciences along with Friedrich Hayek for "their pioneering work in the theory of money a ...

to develop the key concept Circular Cumulative Causation

Circular cumulative causation is a theory developed by Swedish economist Gunnar Myrdal who applied it systematically for the first time in 1944 (Myrdal, G. (1944), ''An American Dilemma: The Negro Problem and Modern Democracy'', New York: Harper). ...

, a multicausal approach where the core variables and their linkages are delineated. Both Myrdal and Kaldor examine circular relationships, where the interdependencies between factors are relatively strong, and where variables interlink in the determination of major processes.

Gunnar Myrdal got the concept from Knut Wicksell and developed it alongside Nicholas Kaldor when they worked together at the United Nations Economic Commission for Europe. Myrdal concentrated on the social provisioning aspect of development, while Kaldor concentrated on demand-supply relationships to the manufacturing sector. Kaldor also coined the term "convenience yield

A convenience yield is an implied return on holding inventories. It is an adjustment to the cost of carry in the non-arbitrage pricing formula for forward prices in markets with trading constraints.

Let F_ be the forward price of an asset with in ...

" related to commodity markets and the so-called theory of storage

The Theory of Storage describes features observed in commodity markets:

When available supplies of the commodity in question are high, and the working inventories of commercial consumers of that commodity are accordingly held to a minimum,

* Futur ...

, which was initially developed by Holbrook Working

Holbrook Working (February 5, 1895 – October 5, 1985) was an American professor of economics and statistics at Stanford University's Food Research Institute known for his contributions on hedging, on the theory of futures prices, on an early t ...

.

Biography

Káldor Miklós was born inBudapest

Budapest (, ; ) is the capital and most populous city of Hungary. It is the ninth-largest city in the European Union by population within city limits and the second-largest city on the Danube river; the city has an estimated population ...

, son of Gyula Káldor, lawyer and legal adviser to the German legation in Budapest, and Jamba, an accomplished linguist and "a well-educated, cultured woman". He was educated in Budapest, as well as in Berlin, and at the London School of Economics

The London School of Economics and Political Science (LSE) is a public university, public research university located in London, England and a constituent college of the federal University of London. Founded in 1895 by Fabian Society members Sidn ...

, where he graduated with a first-class BSc (Econ.) degree in 1930. He subsequently became an assistant lecturer and, by 1938, lecturer and reader in economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

at the LSE. Between 1943 and 1945, Kaldor worked for the National Institute of Economic and Social Research

The National Institute of Economic and Social Research (NIESR), established in 1938, is Britain's oldest independent economic research institute. The institute is a London-based independent UK registered charity that carries out academic researc ...

and in 1947 he resigned from the LSE to become Director of Research and Planning at the Economic Commission for Europe

The United Nations Economic Commission for Europe (ECE or UNECE) is one of the five regional commissions under the jurisdiction of the United Nations Economic and Social Council. It was established in order to promote economic cooperation and i ...

. He was elected to a Fellowship at King's College, Cambridge

King's College is a constituent college of the University of Cambridge. Formally The King's College of Our Lady and Saint Nicholas in Cambridge, the college lies beside the River Cam and faces out onto King's Parade in the centre of the cit ...

and offered a lectureship in the Economics Faculty of the University in 1949. He became a Reader in Economics in 1952, and Professor in 1966.

From 1964, Kaldor was an advisor to the Labour government of the UK and also advised several other countries, producing some of the earliest memoranda regarding the creation of value added tax. Inter alia, Kaldor was considered, with his fellow- Hungarian Thomas Balogh, one of the intellectual authors of the 1964–70 Harold Wilson's government's short-lived Selective Employment Tax (SET) designed to tax employment in service sectors while subsidising employment in manufacturing. In 1966, he became professor of economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

at the University of Cambridge

The University of Cambridge is a public collegiate research university in Cambridge, England. Founded in 1209 and granted a royal charter by Henry III in 1231, Cambridge is the world's third oldest surviving university and one of its most pr ...

. On 9 July 1974, Kaldor was made a life peer as Baron Kaldor, of Newnham in the City of Cambridge

Cambridge ( ) is a College town, university city and the county town in Cambridgeshire, England. It is located on the River Cam approximately north of London. As of the 2021 United Kingdom census, the population of Cambridge was 145,700. Cam ...

.

Kaldor was invited by then Prime Minister of India—Jawaharlal Nehru

Pandit Jawaharlal Nehru (; ; ; 14 November 1889 – 27 May 1964) was an Indian anti-colonial nationalist, secular humanist, social democrat—

*

*

*

* and author who was a central figure in India during the middle of the 20t ...

—to design an expenditure tax system for India in the 1950s. He also went to India's Centre for Development Studies (CDS) in 1985 to inaugurate and deliver the first Joan Robinson Memorial Lecture. Owing to these links, the Kaldor family donated his entire personal collection to the CDS Library. There are 362 books in the collection and they cover a wide range of titles on economic theory, classical political economy, business cycles and history of economic thought.

Business cycle theory

After the publication of

After the publication of John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

' General Theory many attempts were made to build a business cycle model. The models that were built by American Neo-Keynesians such as Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he " ...

proved unstable. They could not describe why an economy should cycle through recession and growth in a stable fashion. The British Neo-Keynesian John Hicks

Sir John Richards Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economi ...

tried to improve the theory by imposing rigid ceilings and floors on the model. But most people thought that this was a poor way of explaining the cycle as it relied on artificial, exogenous constraints. Kaldor, however, had actually invented a fully coherent and highly realistic account of the business cycle in 1940. He used non-linear dynamics to construct this theory. Kaldor's theory was similar to Samuelson's and Hicks' as it used a multiplier-accelerator model to understand the cycle. It differed from these theories, however, as Kaldor introduced the capital stock as an important determinant of the trade cycle. This was in keeping with Keynes' sketch of the business cycle in his General Theory.

Following Keynes, Kaldor argued that investment depended positively on income and negatively on the accumulated capital stock. The idea that investment depends positively on the growth of income is simply the idea of the accelerator model that holds that in periods of high income growth and hence demand growth, investment should rise in the anticipation of high income and demand growth in the future. The intuition lying behind the negative relationship to the accumulation of the capital stock is due to the fact that if firms have a very large amount of productive capacity accumulated already they will not be as inclined to invest in more. Kaldor was in effect integrating Roy Harrod

Sir Henry Roy Forbes Harrod (13 February 1900 – 8 March 1978) was an English economist. He is best known for writing '' The Life of John Maynard Keynes'' (1951) and for the development of the Harrod–Domar model, which he and Evsey Domar dev ...

's ideas about unbalanced growth into his theory.

In the standard accelerator model that stood behind Samuelson's and Hicks' business cycle theories investment was determined as such:

This states that investment is determined by exogenous investment and lagged income multiplied by the accelerator coefficient. Kaldor's model modified this to include a negative coefficient for the capital stock:

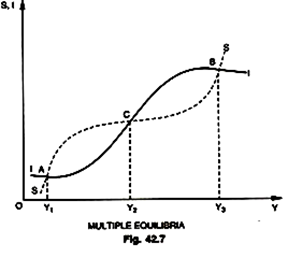

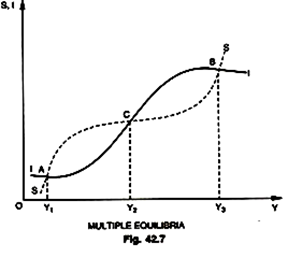

Kaldor then assumed that the investment and savings functions are non-linear. He argued that at the peaks and troughs of the cycle the marginal propensity to save shifts in opposite ways. The intuition behind this is that during recessions people will cut their savings to maintain their standard of living while at high levels of income people will save a larger proportion of their income. He also argued that at the peaks and troughs of the cycle the marginal propensity to invest shifts. The intuition behind this is that at the trough of the cycle there will be a large amount of excess capacity and so businessmen will not want to invest more, while at the peak of the cycle rising costs will discourage investment. This creates non-linear dynamics in the economy that then drive the business cycle.

When Kaldor combines these components we get a clear six-stage model of the business cycle. In the first stage the economy is in equilibrium position. Investment is taking place and the capital stock is growing. In the second stage the growth in the capital stock leads to a downward shift in the investment curve as businessmen decide their factories become overfull. In the third stage (which overlaps with the second stage) the high growth in income causes higher saving which pushes the savings curve upwards. At this point the two curves become tangential and the equilibrium becomes unstable which generates a recession. In the fourth stage the same dynamics kick in but this time moving in the opposite direction. By the sixth stage the equilibrium is again unstable and a boom is produced.

Kaldor also noted the importance of income distribution in his theory of the business cycle. He assumed that savings out of profits were higher than savings out of wages; that is, he argued that poorer people (workers) tend to save less than richer people (capitalists). Or:

Kaldor believed that the business cycle had an inherent mechanism built into it that redistributed income across the cycle and that these mitigated "explosive" results. As we have seen, in a cyclical upswing where planned investment begins to outstrip planned savings prices will tend to rise. Kaldor assumed that those who set prices have more power than those who set wages and so prices will tend to rise faster than wages. This means that profits must also rise faster than wages. Kaldor argued that due to the different savings propensities of capitalists and workers this will lead to higher savings. This will then dampen the cycle somewhat. In a recession or depression Kaldor argued that prices should fall faster than wages for the same reasons that Keynes laid out in his General Theory. This meant that income would be redistributed to workers as real wages rose. This would lead savings to fall in a recession or depression and so would dampen the cycle.

Kaldor's model assumes wage and price flexibility. If wage and price flexibility are not forthcoming the economy may have a tendency to either perpetual and rising inflation or persistent stagnation. Kaldor also makes strong assumptions about how wages and prices respond in both inflations and depressions. If these assumptions do not hold Kaldor's model would lead us to conclude that the cycle might give way to either perpetual and rising inflation or stagnation.

Kaldor's non-linear business cycle theory overcomes the difficulty that many economists had with Roy Harrod

Sir Henry Roy Forbes Harrod (13 February 1900 – 8 March 1978) was an English economist. He is best known for writing '' The Life of John Maynard Keynes'' (1951) and for the development of the Harrod–Domar model, which he and Evsey Domar dev ...

's growth theory. Many of the American Neo-Keynesian economists thought that Harrod's work implied that capitalism would tend toward extremes of zero and infinite growth and that there were no dynamics that might keep it in check. Robert Solow

Robert Merton Solow, GCIH (; born August 23, 1924) is an American economist whose work on the theory of economic growth culminated in the exogenous growth model named after him. He is currently Emeritus Institute Professor of Economics at the ...

, who eventually created the Solow Growth Model in response to these perceived problems, summarised this view as such:

In fact, Kaldor's 1940 paper had already shown this to be completely untrue. Solow was working with an erroneous and underdeveloped theory of the business cycle that he had taken over from Samuelson. By the time Solow was working on his growth theory, the Cambridge UK economists had already satisfactorily laid out a self-limiting theory of the business cycle that they thought was a reasonable description of the real world. This is one of the reasons that the Cambridge economists were so hostile in their reaction to Solow's growth model and went on to attack it in the Cambridge Capital Controversy

The Cambridge capital controversy, sometimes called "the capital controversy"Brems (1975) pp. 369-384 or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that starte ...

of the 1960s. The ignorance on the part of the American economists' knowledge of Kaldor's model also explains why the Cambridge Post-Keynesian

Post-Keynesian economics is a school of economic thought with its origins in '' The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney ...

economists found the ISLM model favoured by the American Neo-Keynesians to be crude and lacking.

Personal life

Kaldor was married to Clarissa Goldsmith, a prominent figure in Cambridge city life and a history graduate from Somerville College, Oxford. They had four daughters: Penny Milsom, a formerLondon Borough of Islington

The London Borough of Islington ( ) is a London borough in Inner London. Whilst the majority of the district is located in north London, the borough also includes a significant area to the south which forms part of central London. Islington has ...

Labour councillor, Katharine Hoskyns, who has stood as a Labour candidate for Westminster City Council

Westminster City Council is the local authority for the City of Westminster in Greater London, England. The city is divided into 20 wards, each electing three councillors. The council is currently composed of 31 Labour Party members and 23 Cons ...

, Frances Stewart, Professor of Economic Development at the University of Oxford

, mottoeng = The Lord is my light

, established =

, endowment = £6.1 billion (including colleges) (2019)

, budget = £2.145 billion (2019–20)

, chancellor ...

, and Mary Kaldor, Professor of Human Security at the London School of Economics

The London School of Economics and Political Science (LSE) is a public university, public research university located in London, England and a constituent college of the federal University of London. Founded in 1895 by Fabian Society members Sidn ...

.

He died in Papworth Everard

Papworth Everard is a village in Cambridgeshire, England. It lies ten miles west of Cambridge and six miles south of Huntingdon. Running through its centre is Ermine Street, the old North Road (now the A1198) and the Roman highway that for ...

, Cambridgeshire

Cambridgeshire (abbreviated Cambs.) is a county in the East of England, bordering Lincolnshire to the north, Norfolk to the north-east, Suffolk to the east, Essex and Hertfordshire to the south, and Bedfordshire and Northamptonshire to the ...

.

Works

* ''The Case Against Technical Progress'', 1932, Economica * ''The Determinateness of Static Equilibrium'', 1934, RES * ''The Equilibrium of the Firm'', 1934, EJ * ''Market Imperfection and Excess Capacity'', 1935, Economica * ''Pigou on Money Wages in Relation to Unemployment'', 1937, EJ * 1939, Welfare propositions of economics and interpersonal comparisons of utility. Economic Journal 49:549–52. * ''Speculation and Economic Stability'', 1939, RES * ''Capital Intensity and the Trade Cycle'', 1939, Economica * ''A Model of the Trade Cycle'', 1940, EJ * ''Professor Hayek and the Concertina Effect'', 1942, Economica * ''The Relation of Economic Growth and Cyclical Fluctuations'', 1954 EJ * ''An Expenditure Tax'', 1955. *Alternative Theories of Distribution

', 1956, RES * ''A Model of Economic Growth'', 1957, EJ * ''Monetary Policy, Economic Stability, and Growth'', 1958. * ''Economic Growth and the Problem of Inflation'', 1959, Economica. * ''A Rejoinder to Mr. Atsumi and Professor Tobin'', 1960, RES * ''Keynes's Theory of the Own-Rates of Interest'', 1960, in Kaldor, 1960. * ''Essays on Value and Distribution'', 1960. * ''Essays on Economic Stability and Growth'', 1960. * ''Capital Accumulation and Economic Growth'', 1961, in Lutz, editor, Theory of Capital * ''A New Model of Economic Growth'', with James A. Mirrlees, 1962, RES * ''The Case for a Commodity Reserve Currency'', with A.G. Hart and J. Tinbergen, 1964, UNCTAD * ''Essays on Economic Policy'', 1964, two volumes. * ''Causes of the Slow Rate of Economic Growth in the UK'', 1966. * ''The Case for Regional Policies'', 1970, Scottish JE. * ''The New Monetarism'', 1970, Lloyds Bank Review * ''Conflicts in National Economic Objectives'', 1971, EJ * ''The Irrelevance of Equilibrium Economics'', 1972, EJ * ''What is Wrong with Economic Theory'', 1975, QJE * ''Inflation and Recession in the World Economy'', 1976, EJ * ''Equilibrium Theory and Growth Theory'', 1977, in Boskin, editor, Economics and Human Welfare. * ''Capitalism and Industrial Development'', 1977, Cambridge JE * ''Further Essays on Economic Theory'', 1978. * ''The Role of Increasing Returns, Technical Progress and Cumulative Causation''..., 1981, Economie Appliquee * ''Fallacies on Monetarism'', 1981, Kredit und Kapital. * ''The Scourge of Monetarism'', 1982. *

The economic consequences of Mrs. Thatcher

', 1983. * ''The Role of Commodity Prices in Economic Recovery'', 1983, Lloyds Bank Review * ''Keynesian Economics After Fifty Years'', 1983, in Trevithick and Worswick, editors, Keynes and the Modern World * ''Economics Without Equilibrium'', 1985. * ''Causes of Growth and Stagnation in the World Economy'', 1996 (posthumous, based on 1984 Mattioli Lectures)

See also

*Kaldor's facts

Kaldor's facts are six statements about economic growth, proposed by Nicholas Kaldor in his article of 1961. He described these as "a stylized view of the facts", which coined the term ''stylized fact.''

Stylized facts of economic growth

Nicholas ...

* Kaldor's growth laws

* Technical progress function

References

Further reading

* * Memorandum on the value added tax, Labour NEC archives, 1963External links

* *The Scourge of Monetarism

' (1982)

Kaldor Business Cycle Model

by Elmer G. Wiens {{DEFAULTSORT:Kaldor, Nicholas 1908 births 1986 deaths Writers from Budapest Hungarian Jews Post-Keynesian economists Life peers Life peers created by Elizabeth II Alumni of the London School of Economics Academics of the London School of Economics 20th-century British economists Naturalised citizens of the United Kingdom Hungarian emigrants to England Fellows of the Econometric Society Members of the Fabian Society