Market structure on:

[Wikipedia]

[Google]

[Amazon]

Market structure, in

Market structure, in

“Market Structure: Introduction.” The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly, and pure monopoly.

The main criteria by which one can distinguish between different market structures are: the number and size of firms and

The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly, and pure monopoly.

The main criteria by which one can distinguish between different market structures are: the number and size of firms and

Microeconomics

by Elmer G. Wiens: Online Interactive Models of Oligopoly, Differentiated Oligopoly, and Monopolistic Competition {{Authority control

Market structure, in

Market structure, in economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics anal ...

, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Market structure makes it easier to understand the characteristics of diverse markets.

The main body of the market is composed of suppliers and demanders. Both parties are equal and indispensable. The market structure determines the price formation method of the market. Suppliers and Demanders (sellers and buyers) will aim to find a price that both parties can accept creating a equilibrium quantity.

Market definition is an important issue for regulators facing changes in market structure, which needs to be determined. The relationship between buyers and sellers as the main body of the market includes three situations: the relationship between sellers (enterprises and enterprises), the relationship between buyers (enterprises or consumers) and the relationship between buyers and sellers. The relationship between the buyer and seller of the market and the buyer and seller entering the market. These relationships are the market competition and monopoly relationships reflected in economics.

History

Market structure has been a topic of discussion for many economists likeAdam Smith

Adam Smith (baptized 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics"——� ...

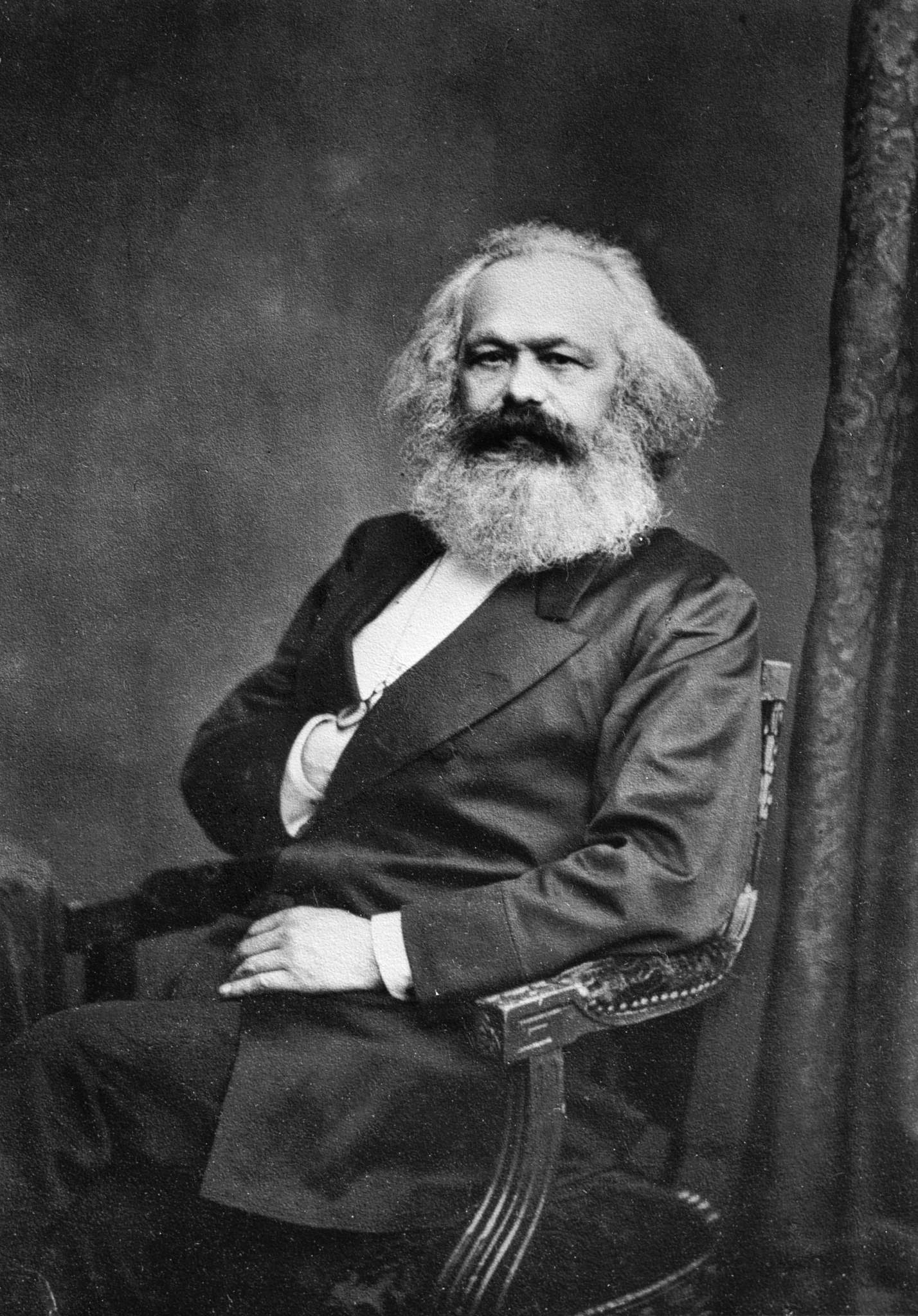

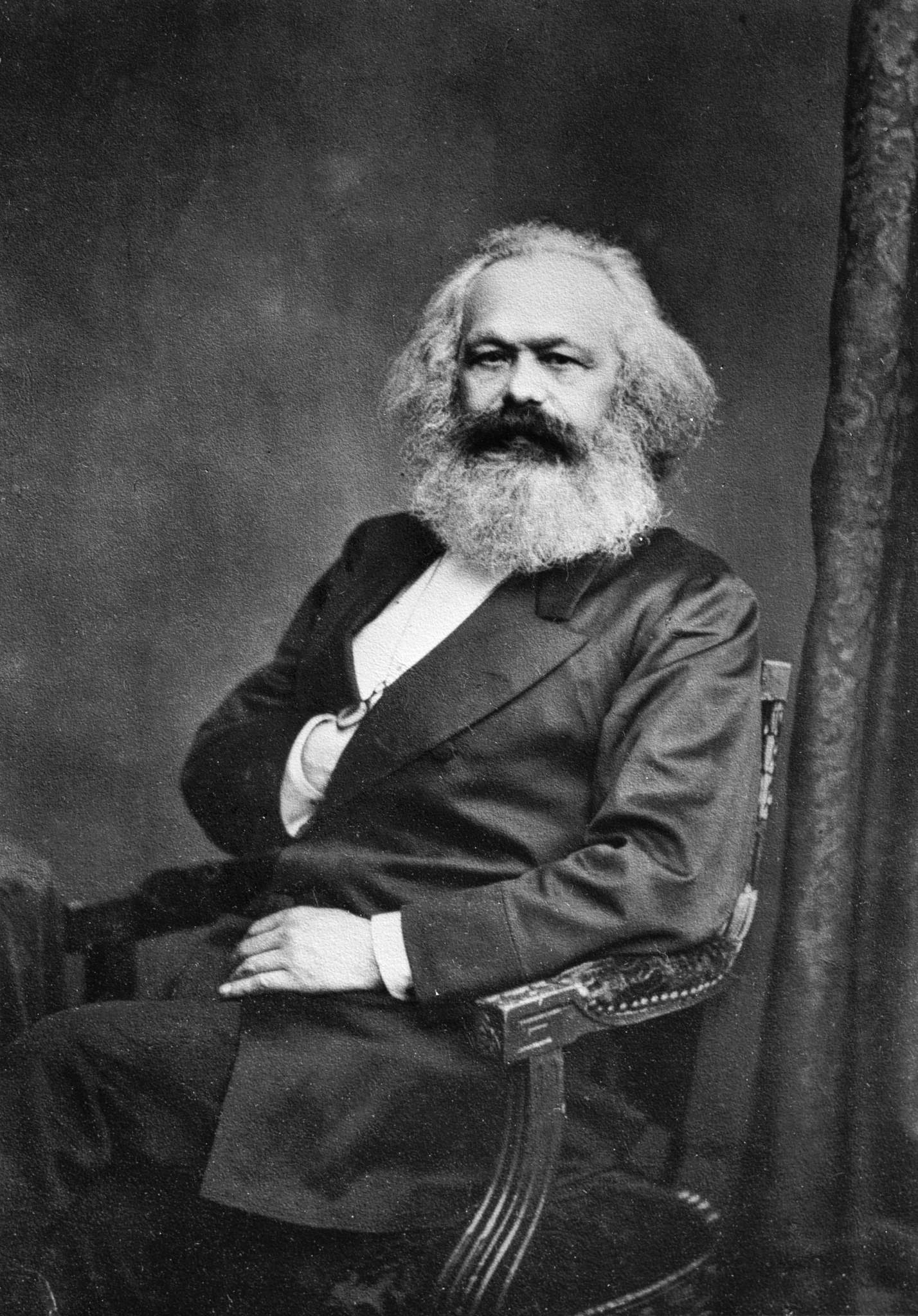

and Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 ...

who have strong conflicting viewpoints on how the market operates in presence of political influence. Adam Smith in his writing on economics stressed the importance of laissez-faire

''Laissez-faire'' ( ; from french: laissez faire , ) is an economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies) deriving from special interest groups ...

principles outlining the operation of the market in the absence of dominant political mechanisms of control, while Karl Marx discussed the working of the market in the presence of a controlled economy sometimes referred to as a command economy in the literature. Both types of market structure have been in historical evidence throughout the twentieth century and twenty-first century.

Market structure has been apparent throughout history due to its natural influence it has on markets, this can be based on the different contributing factors that market up each type of market structure.

Types

Based on the factors that decide the structure of the market, the main forms of market structure are as follows: *Perfect competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models whe ...

, refers to a type of market where there are many buyers and seller that feature free barriers to entry

In theories of competition in economics, a barrier to entry, or an economic barrier to entry, is a fixed cost that must be incurred by a new entrant, regardless of production or sales activities, into a market that incumbents do not have or ha ...

, dealing with homogeneous products with no differentiation, where the price is fixed by the market. Individual firms are price taker as the price is set by the industry as a whole. Example: Agricultural products which have many buyers and sellers, selling homogeneous goods where the price is determined by the demand and supply of the market and not individual firms.

** Imperfect Competition refers to markets where standards for perfect competition are not fulfilled (such as no barriers for entry and exit, homogeneous products and many buyers and sellers). All other types of competition come under imperfect competition.

* Monopolistic competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another (e.g. by branding or quality) and hence are not perfec ...

, a type of imperfect competition where there are many sellers, selling products that are closely related but differentiated from one another (e.g. quality of products may differentiate) and hence they are not perfect substitutes. This market structure exists when there are multiple sellers who attempt to seem different from one another. Examples: toothpaste, soft drinks, clothing as they all are homogeneous products with many buyers and sellers, no to low entry barriers but are different from each other due to quality, taste, branding. Firms have partial control over the price as they are not price takers (due to differentiated products) or Price Maker (as there are many buyers and sellers).

*Oligopoly

An oligopoly (from Greek ὀλίγος, ''oligos'' "few" and πωλεῖν, ''polein'' "to sell") is a market structure in which a market or industry is dominated by a small number of large sellers or producers. Oligopolies often result f ...

, refers to market structure where only small number of firms operate together control the majority of the market share. Firms are neither price takers or makers. Firms tend to avoid price war by following price rigidity. They closely monitor the prices of their competitors and change prices accordingly. Oligopoly firms focus on quality and efficiency of their products to compete with other firms. Example: Network providers ( Entry barriers, Small number of sellers, many buyers, products can be homogeneous or differentiated). Three types of oligopoly.

**Duopoly

A duopoly (from Greek δύο, ''duo'' "two" and πωλεῖν, ''polein'' "to sell") is a type of oligopoly where two firms have dominant or exclusive control over a market. It is the most commonly studied form of oligopoly due to its simplicit ...

, a ase of an oligopoly where two firms operate and have power over the market. Example: Aircraft manufactures: Boeing

The Boeing Company () is an American multinational corporation that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, telecommunications equipment, and missiles worldwide. The company also provides leasing and ...

and Airbus

Airbus SE (; ; ; ) is a European multinational aerospace corporation. Airbus designs, manufactures and sells civil and military aerospace products worldwide and manufactures aircraft throughout the world. The company has three divisions: '' ...

. A duopoly in theory could have the same effect as a monopoly on pricing within a market if they were to collude on prices and or output of goods.

** Oligopsony, a market where many sellers can be present but meet only a few buyers. Example: Cocoa producers

** Cournot quantity competition, one of the first models of oligopoly markets was developed by Augustin Cournot

Antoine Augustin Cournot (; 28 August 180131 March 1877) was a French philosopher and mathematician who also contributed to the development of economics.

Biography

Antoine Augustin Cournot was born at Gray, Haute-Saône. In 1821 he entered o ...

in 1835. In Cournot’s model, there are two firms and each firm selects a quantity to produce, and the resulting total output determines the market price.

** Bertrand Price Competition, Joseph Bertrand was the first to analyze this model in 1883. In Bertrand’s model, there are two firms and each firm selects a price to maximize its own profits, given the price that it believes the other firm will select.

*Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situati ...

, where there is only one seller of a product or service which has no substitute. The firm is the price maker as they have control over the industry. There are high barriers to entry, which an incumbent would conduct entry-deterring strategies if keeping out entrants reaping additional profits for the company. Frank Fisher, a noticed antitrust economist has described monopoly power as “the ability to act in an unconstrained way,” such as increasing price or reducing quality. Example: Standard Oil

Standard Oil Company, Inc., was an American oil production, transportation, refining, and marketing company that operated from 1870 to 1911. At its height, Standard Oil was the largest petroleum company in the world, and its success made its co- ...

(1870–1911)

**Natural monopoly

A natural monopoly is a monopoly in an industry in which high infrastructural costs and other barriers to entry relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming adv ...

, a monopoly in which economies of scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables ...

cause efficiency to increase continuously with the size of the firm. A firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialized firms.

**Or natural obstacles, such as the sole ownership of natural resources, De beers

De Beers Group is an international corporation that specializes in diamond mining, diamond exploitation, diamond retail, diamond trading and industrial diamond manufacturing sectors. The company is active in open-pit, large-scale alluvial and ...

was a monopoly in the diamond industry for years.

**Monopsony

In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. The microeconomic theory of monopsony assumes a single entity ...

, when there is only a single buyer in a market. Discussion of monopsony power in the labor literature largely focused on the pure monopsony model in which a single firm comprised the entirety of demand for labor in a market (e.g., company town).

Features of market structures

The imperfectly competitive structure is quite identical to the realistic market conditions where some monopolistic competitors, monopolists, oligopolists, and duopolists exist and dominate the market conditions. The elements of Market Structure include the number and size of sellers, entry and exit barriers, nature of product, price, selling costs. Market structure can alter based on the new external factors, such as technology, consumer preferences and new entrants. Therefore, elements of Market Structure always stay the same but the importance of a single element may change making it more influential on the current structure. Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the seller's financial need to cover its costs. In other words, competition can align the seller's interests with the buyer's interests and can cause the seller to reveal his true costs and other private information. In the absence of perfect competition, three basic approaches can be adopted to deal with problems related to the control ofmarket power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market powe ...

and an asymmetry between the government and the operator with respect to objectives and information: (a) subjecting the operator to competitive pressures, (b) gathering information on the operator and the market, and (c) applying incentive regulation.Body of Knowledge on Infrastructure Regulation“Market Structure: Introduction.”

The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly, and pure monopoly.

The main criteria by which one can distinguish between different market structures are: the number and size of firms and

The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly, and pure monopoly.

The main criteria by which one can distinguish between different market structures are: the number and size of firms and consumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...

s in the market, the type of goods

In economics, goods are items that satisfy human wants

and provide utility, for example, to a consumer making a purchase of a satisfying product. A common distinction is made between goods which are transferable, and services, which are not ...

and services being traded, and the degree to which information

Information is an abstract concept that refers to that which has the power to inform. At the most fundamental level information pertains to the interpretation of that which may be sensed. Any natural process that is not completely random, ...

can flow freely. In today's time, Karl Marx's theory about political influence on market makes sense as firms and industry are affected strongly by the regulation, taxes, tariffs, patents imposed by the government. These affect the barriers to entry and exit for the firms in the market.

Perfect competition:

1. There are many buyers and sellers in the market, and there is no fixed buying and selling relationship between them.

2. The products or services traded in the market are all the same without any difference.

3. There are no barriers to entry and exit from the market.

4. There are no trade secrets.

5. Capital resources and labour are easily transferable.

Monopolistic Competition:

There are a large number of enterprises, there are no restrictions on entering and exiting the market, and they sell different products of the same kind, and enterprises have a certain ability to control prices. Monopolies have complete market control as the barriers to entry are high and the threat of new entrants is low; therefore they can price set to their preference.

Oligopoly:

The number of enterprises is small, entry and exit from the market are restricted, product attributes are different, and the demand curve is downward sloping and relatively inelastic. Oligopolies are usually found in industries in which initial capital requirements are high and existing companies have strong foothold in market share.

Monopoly:

The number of enterprises is only one, access is restricted or completely blocked, and the products produced and sold are unique and cannot be replaced by other products. The company has strong control and influence over the price of the entire market.

Importance of Market Structure

Market structure is important for a firms use as it motivations, decision making, opportunities. This will incur changes to current market standings affecting: market outcomes, price, availability and variety. Market structure provides indication on potential opportunities and threats which can influence business to adapt there processes and operations in order to meet market structure requirements in order to stay competitive. For example being able to understand market structure will help to identify any product substitutability a foundation element of market structure analysis to then determine the best course of action.Measure of market structure

* N-firm concentration ratio, N-firm concentration ratio is a common measure of market structure. This gives the combined market share of the N largest firms in the market. For example, if the 5-firm concentration ratio in the United States smart phone industry is about .8, which indicates that the combined market share of the five largest smart phone sellers in the United states is about 80 percent. * Herfindahl index, The Herfindahl index defined as the sum of the squared market shares of all the firms in the market. Increases in the Herfindahl index generally indicate a decrease in competition and an increase of market power, vice versal. Generally, the Herfindahl index conveys more information than the N-firm concentration ratio. Besides market structure, many factors contribute to conduct and market performance. Market pressures are similarly evolving therefore when decision making based on market performance it is essential to assess all the circumstances affecting competition rather than rely solely on measures of market structure. Using a single measurement of market share can be misleading or inconclusive as only indicators are taken into account. Different aspects that have been taken into account to measures the innovative advantage within particular market structures are: the size distribution of firms, the existence of certain barriers to entry, and the stage of industry in the product lifecycle. Creating another measure to determine the current market structure that can be used as evidence or to evaluate current market performance thus it can be used to forecast and determine future trends.

See also

*Industrial organization

In economics, industrial organization is a field that builds on the theory of the firm by examining the structure of (and, therefore, the boundaries between) firms and markets. Industrial organization adds real-world complications to the perf ...

* Microeconomics

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics fo ...

* Economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics anal ...

* Structure-conduct-performance paradigm

*Business economics

Business economics is a field in applied economics which uses economic theory and quantitative methods to analyze business enterprises and the factors contributing to the diversity of organizational structures and the relationships of firms with ...

* Stackelberg competition

*Competition (economics)

In economics, competition is a scenario where different economic firmsThis article follows the general economic convention of referring to all actors as firms; examples in include individuals and brands or divisions within the same (legal) firm ...

* Porter's five forces analysis

References

External links

*Microeconomics

by Elmer G. Wiens: Online Interactive Models of Oligopoly, Differentiated Oligopoly, and Monopolistic Competition {{Authority control