Market depth on:

[Wikipedia]

[Google]

[Amazon]

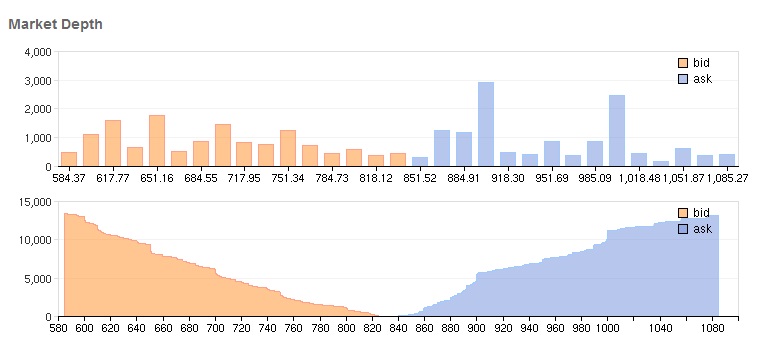

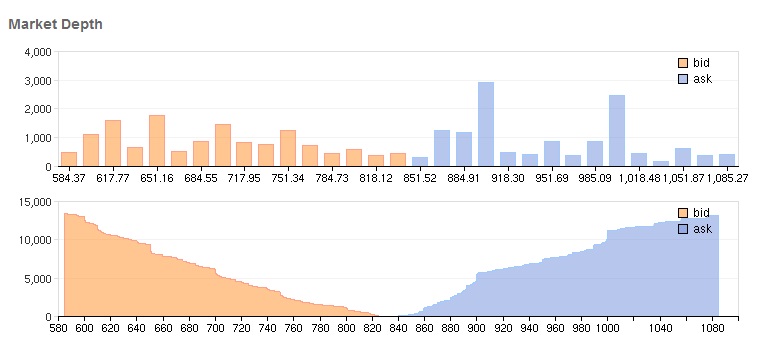

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the

Investopedia *Price movement restrictions. Most major financial markets do not allow completely free exchange of the products they trade, but instead restrict price movement in well-intentioned ways. These include session price change limits on major commodity markets and

World Bank GFDR Report

{{Stock market Financial markets

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the

In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity. Mathematically, it is the size of an order needed to move the market

Market is a term used to describe concepts such as:

*Market (economics), system in which parties engage in transactions according to supply and demand

*Market economy

*Marketplace, a physical marketplace or public market

Geography

*Märket, an ...

price by a given amount. If the market is ''deep'', a large order is needed to change the price.

Factors influencing market depth

* Tick size. This refers to the minimum price increment at which trades may be made on the market. The major stock markets in theUnited States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

went through a process of decimalisation in April 2001. This switched the minimum increment from a sixteenth to a one hundredth of a dollar. This decision improved market depth.Market DepthInvestopedia *Price movement restrictions. Most major financial markets do not allow completely free exchange of the products they trade, but instead restrict price movement in well-intentioned ways. These include session price change limits on major commodity markets and

program trading

Program trading is a type of trading in securities, usually consisting of baskets of fifteen stocks or more that are executed by a computer program simultaneously based on predetermined conditions. Program trading is often used by hedge funds an ...

curbs on the NYSE

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

, which disallow certain large basket trades after the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity inde ...

has moved up or down 200 points in a session.

*Trading restrictions. These include futures contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset ...

and options position limits as well as the widely used uptick rule for US stocks. These prevent market participants from adding to depth when they might otherwise choose to do so.

*Allowable leverage. Major markets and governing bodies typically set minimum margin requirements for trading various products. While this may act to stabilize the marketplace, it decreases the market depth simply because participants otherwise willing to take on very high leverage

Leverage or leveraged may refer to:

*Leverage (mechanics), mechanical advantage achieved by using a lever

* ''Leverage'' (album), a 2012 album by Lyriel

*Leverage (dance), a type of dance connection

*Leverage (finance), using given resources to ...

cannot do so without providing more capital.

*Market transparency. While the latest bid or ask price is usually available for most participants, additional information about the size of these offers and pending bids or offers that are not the best are sometimes hidden for reasons of technical complexity or simplicity. This decrease in available information can affect the willingness of participants to add to market depth.

In some cases, the term refers to financial data feeds available from exchanges or brokers

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be con ...

. An example would be NASDAQ Level II quote data.

References

External links

World Bank GFDR Report

{{Stock market Financial markets