Implicit Price Deflator for Personal Consumption Expenditures on:

[Wikipedia]

[Google]

[Amazon]

The PCE price index (PePP), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures (IPD for PCE) by the Bureau of Economic Analysis (BEA) and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the

The PCE price index (PePP), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures (IPD for PCE) by the Bureau of Economic Analysis (BEA) and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the

The differences between the two indexes can be grouped into four categories: formula effect, weight effect, scope effect, and "other effects".

The differences between the two indexes can be grouped into four categories: formula effect, weight effect, scope effect, and "other effects".

*The formula effect accounts for the different formulas used to calculate the two indexes. The PCE price index is based on the Fisher-Ideal formula, while the CPI is based on a modified Laspeyres formula.

*The weight effect accounts for the relative importance of the underlying commodities reflected in the construction of the two indexes.

*The scope effect accounts for conceptual differences between the two indexes. PCE measures spending by and on behalf of the personal sector, which includes both households and nonprofit institutions serving households; the CPI measures out-of-pocket spending by households. The "net" scope effect adjusts for CPI items out-of-scope of the PCE price index less items in the PCE price index that are out-of-scope of the CPI.

*"Other effects" include seasonal adjustment differences, price differences, and residual differences.

- See more at: https://www.bea.gov/help/faq/555

The above chart is illustrative but may not reflect current values. The comparisons in the table above will vary over time as the relative weights of the components of the indexes change. The CPI base price and weightings are adjusted every two years.

The above table illustrates two commonly discussed important differences between the PCE deflator and CPI-U. The first is the relative importance of housing, which is due in part to the difference in scope mentioned above. CPI contains a large component of owner-equivalent rent, which by definition is an imputed value and not a real direct expenditure. The second major difference in weight is healthcare. This again stems from the definition of the index and the surveys used. CPI measures only the out-of-pocket healthcare costs of households where PCE includes healthcare purchased on behalf of households by third parties, including employer-provided health insurance. In the United States, employer health insurance is a large component and accounts for much of the difference in weights.

Another notable difference is that prices and weightings of the CPI are based on household surveys, while those of the PCE are based on business surveys. One reason for the difference in formulas is that not all the data needed for the Fisher-Ideal formula is available monthly even though it is considered superior. CPI is a practical alternative used to give a quicker read on prices in the previous month. PCE is typically revised three times in each of the months following the end of a quarter, and then the entire NIPA tables are re-based annually and every five years. Despite all these conceptual and methodological differences, the two indexes track fairly closely when averaged over several years.{{cite web, last1=Moyer, first1=Brian C., last2 =Stewart , first2 = Kenneth J., title= A Reconciliation between the Consumer Price Index and the Personal Consumption Expenditures Price Index, url=https://www.bea.gov/papers/pdf/cpi_pce.pdf, website =www.bea.gov , publisher=Bureau of Economic Analysis , accessdate=7 September 2014

*The formula effect accounts for the different formulas used to calculate the two indexes. The PCE price index is based on the Fisher-Ideal formula, while the CPI is based on a modified Laspeyres formula.

*The weight effect accounts for the relative importance of the underlying commodities reflected in the construction of the two indexes.

*The scope effect accounts for conceptual differences between the two indexes. PCE measures spending by and on behalf of the personal sector, which includes both households and nonprofit institutions serving households; the CPI measures out-of-pocket spending by households. The "net" scope effect adjusts for CPI items out-of-scope of the PCE price index less items in the PCE price index that are out-of-scope of the CPI.

*"Other effects" include seasonal adjustment differences, price differences, and residual differences.

- See more at: https://www.bea.gov/help/faq/555

The above chart is illustrative but may not reflect current values. The comparisons in the table above will vary over time as the relative weights of the components of the indexes change. The CPI base price and weightings are adjusted every two years.

The above table illustrates two commonly discussed important differences between the PCE deflator and CPI-U. The first is the relative importance of housing, which is due in part to the difference in scope mentioned above. CPI contains a large component of owner-equivalent rent, which by definition is an imputed value and not a real direct expenditure. The second major difference in weight is healthcare. This again stems from the definition of the index and the surveys used. CPI measures only the out-of-pocket healthcare costs of households where PCE includes healthcare purchased on behalf of households by third parties, including employer-provided health insurance. In the United States, employer health insurance is a large component and accounts for much of the difference in weights.

Another notable difference is that prices and weightings of the CPI are based on household surveys, while those of the PCE are based on business surveys. One reason for the difference in formulas is that not all the data needed for the Fisher-Ideal formula is available monthly even though it is considered superior. CPI is a practical alternative used to give a quicker read on prices in the previous month. PCE is typically revised three times in each of the months following the end of a quarter, and then the entire NIPA tables are re-based annually and every five years. Despite all these conceptual and methodological differences, the two indexes track fairly closely when averaged over several years.{{cite web, last1=Moyer, first1=Brian C., last2 =Stewart , first2 = Kenneth J., title= A Reconciliation between the Consumer Price Index and the Personal Consumption Expenditures Price Index, url=https://www.bea.gov/papers/pdf/cpi_pce.pdf, website =www.bea.gov , publisher=Bureau of Economic Analysis , accessdate=7 September 2014

Briefing.com: Personal Income and Spending

(the core CPI as a comparison)

(click on "Personal Income and Outlays", then skip to Tables 9 and 11 near the bottom.)

St. Louis Federal Reserve FRED2 PCE data index

Personal Consumption Expenditures - PCEImplicit Price Deflator for Personal Consumption Expenditures - Referendum 47's Measure of Inflation

Implicit Price Deflator Information

* ttps://web.archive.org/web/20041117102605/http://www.thestreet.com/markets/marketfeatures/889679.html TheStreet.com: Meet the Fed's Elusive New Inflation Target Price indices

The PCE price index (PePP), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures (IPD for PCE) by the Bureau of Economic Analysis (BEA) and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the

The PCE price index (PePP), also referred to as the PCE deflator, PCE price deflator, or the Implicit Price Deflator for Personal Consumption Expenditures (IPD for PCE) by the Bureau of Economic Analysis (BEA) and as the Chain-type Price Index for Personal Consumption Expenditures (CTPIPCE) by the Federal Open Market Committee

The Federal Open Market Committee (FOMC), a committee within the Federal Reserve System (the Fed), is charged under United States law with overseeing the nation's open market operations (e.g., the Fed's buying and selling of United States Treas ...

(FOMC), is a United States-wide indicator of the average increase in prices for all domestic personal consumption. It is benchmarked to a base of 2012 = 100. Using a variety of data including U.S. Consumer Price Index and Producer Price Index prices, it is derived from the largest component of the GDP in the BEA's National Income and Product Accounts

The national income and product accounts (NIPA) are part of the national accounts of the United States. They are produced by the Bureau of Economic Analysis of the Department of Commerce. They are one of the main sources of data on general econ ...

, personal consumption expenditures.

The personal consumption expenditure (PCE) measure is the component statistic for consumption in gross domestic product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is oft ...

(GDP) collected by the United States Bureau of Economic Analysis (BEA). It consists of the actual and imputed expenditures of household

A household consists of two or more persons who live in the same dwelling. It may be of a single family or another type of person group. The household is the basic unit of analysis in many social, microeconomic and government models, and is i ...

s and includes data pertaining to durable and non-durable goods

In economics, goods are items that satisfy human wants

and provide utility, for example, to a consumer making a purchase of a satisfying product. A common distinction is made between goods which are transferable, and services, which are not t ...

and services

Service may refer to:

Activities

* Administrative service, a required part of the workload of university faculty

* Civil service, the body of employees of a government

* Community service, volunteer service for the benefit of a community or a p ...

. It is essentially a measure of goods and services targeted towards individuals and consumed by individuals. The less volatile measure of the PCE price index is the core PCE (CPCE) price index, which excludes the more volatile and seasonal food

Seasonal food refers to the times of year when the harvest or the flavour of a given type of food is at its peak. This is usually the time when the item is harvested, with some exceptions; an example being sweet potatoes which are best eaten qu ...

and energy

In physics, energy (from Ancient Greek: ἐνέργεια, ''enérgeia'', “activity”) is the quantitative property that is transferred to a body or to a physical system, recognizable in the performance of work and in the form of hea ...

prices.

In comparison to the headline United States Consumer Price Index

The United States Consumer Price Index (CPI) is a set of consumer price indices calculated by the U.S. Bureau of Labor Statistics (BLS). To be precise, the BLS routinely computes many different CPIs that are used for different purposes. E ...

(CPI), which uses one set of expenditure weights for several years, this index uses a Fisher Price Index, which uses expenditure data from the current period and the preceding period. Also, the PCEPI uses a chained index which compares one quarter's price to the previous quarter's instead of choosing a fixed base. This price index method assumes that the consumer has made allowances for changes in relative price

A relative price is the price of a commodity such as a good or service in terms of another; i.e., the ratio of two prices. A relative price may be expressed in terms of a ratio between the prices of any two goods or the ratio between the price o ...

s. That is to say, they have substituted from goods whose prices are rising to goods whose prices are stable or falling.

PCE has been tracked since January 1959. Through July 2018, inflation measured by PCE has averaged 3.3%, while it has averaged 3.8% using CPI. This may be due to the failure of CPI to take into account the substitution effect

In economics and particularly in consumer choice theory, the substitution effect is one component of the effect of a change in the price of a good upon the amount of that good demanded by a consumer, the other being the income effect.

When a ...

. Alternatively, an unpublished report on this difference by the Bureau of Labor Statistics suggests that most of it is from different ways of calculating hospital expenses and airfares.

Federal Reserve

In its "Monetary Policy Report to the Congress

The Monetary Policy Report to the Congress is a semi-annual report prepared by the Board of Governors of the Federal Reserve and presented to the Congress of the United States. The Chairman of the Board of Governors is called on to offer oral t ...

" (" Humphrey–Hawkins Report") from February 17, 2000 the FOMC said it was changing its primary measure of inflation from the consumer price index to the "chain-type price index for personal consumption expenditures".

Comparison to CPI

The differences between the two indexes can be grouped into four categories: formula effect, weight effect, scope effect, and "other effects".

The differences between the two indexes can be grouped into four categories: formula effect, weight effect, scope effect, and "other effects".

*The formula effect accounts for the different formulas used to calculate the two indexes. The PCE price index is based on the Fisher-Ideal formula, while the CPI is based on a modified Laspeyres formula.

*The weight effect accounts for the relative importance of the underlying commodities reflected in the construction of the two indexes.

*The scope effect accounts for conceptual differences between the two indexes. PCE measures spending by and on behalf of the personal sector, which includes both households and nonprofit institutions serving households; the CPI measures out-of-pocket spending by households. The "net" scope effect adjusts for CPI items out-of-scope of the PCE price index less items in the PCE price index that are out-of-scope of the CPI.

*"Other effects" include seasonal adjustment differences, price differences, and residual differences.

- See more at: https://www.bea.gov/help/faq/555

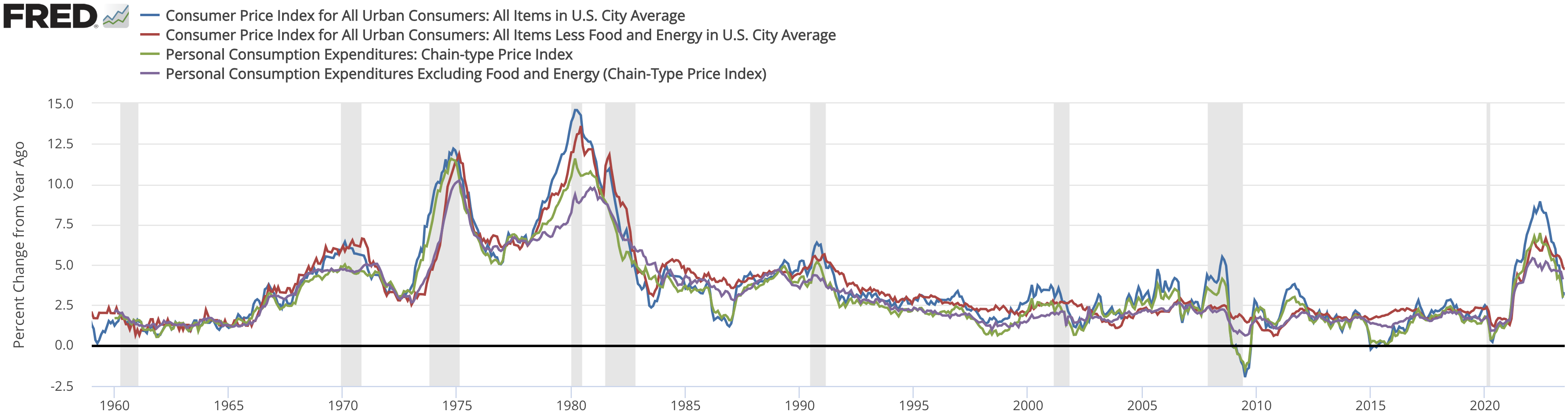

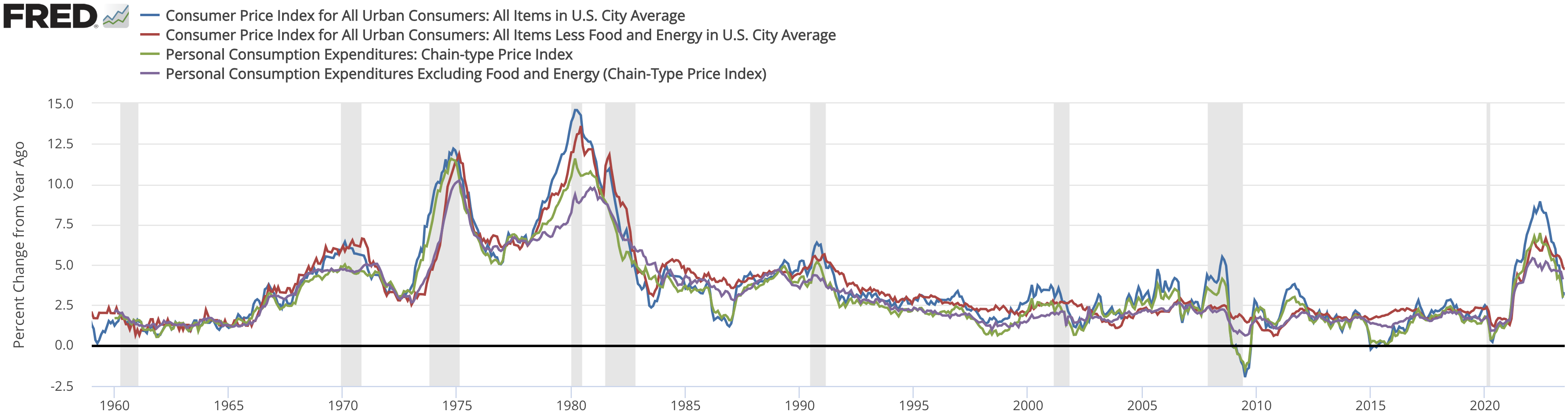

The above chart is illustrative but may not reflect current values. The comparisons in the table above will vary over time as the relative weights of the components of the indexes change. The CPI base price and weightings are adjusted every two years.

The above table illustrates two commonly discussed important differences between the PCE deflator and CPI-U. The first is the relative importance of housing, which is due in part to the difference in scope mentioned above. CPI contains a large component of owner-equivalent rent, which by definition is an imputed value and not a real direct expenditure. The second major difference in weight is healthcare. This again stems from the definition of the index and the surveys used. CPI measures only the out-of-pocket healthcare costs of households where PCE includes healthcare purchased on behalf of households by third parties, including employer-provided health insurance. In the United States, employer health insurance is a large component and accounts for much of the difference in weights.

Another notable difference is that prices and weightings of the CPI are based on household surveys, while those of the PCE are based on business surveys. One reason for the difference in formulas is that not all the data needed for the Fisher-Ideal formula is available monthly even though it is considered superior. CPI is a practical alternative used to give a quicker read on prices in the previous month. PCE is typically revised three times in each of the months following the end of a quarter, and then the entire NIPA tables are re-based annually and every five years. Despite all these conceptual and methodological differences, the two indexes track fairly closely when averaged over several years.{{cite web, last1=Moyer, first1=Brian C., last2 =Stewart , first2 = Kenneth J., title= A Reconciliation between the Consumer Price Index and the Personal Consumption Expenditures Price Index, url=https://www.bea.gov/papers/pdf/cpi_pce.pdf, website =www.bea.gov , publisher=Bureau of Economic Analysis , accessdate=7 September 2014

*The formula effect accounts for the different formulas used to calculate the two indexes. The PCE price index is based on the Fisher-Ideal formula, while the CPI is based on a modified Laspeyres formula.

*The weight effect accounts for the relative importance of the underlying commodities reflected in the construction of the two indexes.

*The scope effect accounts for conceptual differences between the two indexes. PCE measures spending by and on behalf of the personal sector, which includes both households and nonprofit institutions serving households; the CPI measures out-of-pocket spending by households. The "net" scope effect adjusts for CPI items out-of-scope of the PCE price index less items in the PCE price index that are out-of-scope of the CPI.

*"Other effects" include seasonal adjustment differences, price differences, and residual differences.

- See more at: https://www.bea.gov/help/faq/555

The above chart is illustrative but may not reflect current values. The comparisons in the table above will vary over time as the relative weights of the components of the indexes change. The CPI base price and weightings are adjusted every two years.

The above table illustrates two commonly discussed important differences between the PCE deflator and CPI-U. The first is the relative importance of housing, which is due in part to the difference in scope mentioned above. CPI contains a large component of owner-equivalent rent, which by definition is an imputed value and not a real direct expenditure. The second major difference in weight is healthcare. This again stems from the definition of the index and the surveys used. CPI measures only the out-of-pocket healthcare costs of households where PCE includes healthcare purchased on behalf of households by third parties, including employer-provided health insurance. In the United States, employer health insurance is a large component and accounts for much of the difference in weights.

Another notable difference is that prices and weightings of the CPI are based on household surveys, while those of the PCE are based on business surveys. One reason for the difference in formulas is that not all the data needed for the Fisher-Ideal formula is available monthly even though it is considered superior. CPI is a practical alternative used to give a quicker read on prices in the previous month. PCE is typically revised three times in each of the months following the end of a quarter, and then the entire NIPA tables are re-based annually and every five years. Despite all these conceptual and methodological differences, the two indexes track fairly closely when averaged over several years.{{cite web, last1=Moyer, first1=Brian C., last2 =Stewart , first2 = Kenneth J., title= A Reconciliation between the Consumer Price Index and the Personal Consumption Expenditures Price Index, url=https://www.bea.gov/papers/pdf/cpi_pce.pdf, website =www.bea.gov , publisher=Bureau of Economic Analysis , accessdate=7 September 2014

See also

* Price index * Gross domestic product deflator (IPD for GDP) *Household final consumption expenditure

Household final consumption expenditure (POES) is a transaction of the national account's use of income account representing consumer spending. It consists of the expenditure incurred bresident households on individual consumption goods and servi ...

(HFCE)

*Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

References

External links

Data

Briefing.com: Personal Income and Spending

(the core CPI as a comparison)

(click on "Personal Income and Outlays", then skip to Tables 9 and 11 near the bottom.)

St. Louis Federal Reserve FRED2 PCE data index

Articles

Personal Consumption Expenditures - PCE

Implicit Price Deflator Information

* ttps://web.archive.org/web/20041117102605/http://www.thestreet.com/markets/marketfeatures/889679.html TheStreet.com: Meet the Fed's Elusive New Inflation Target Price indices