ISEQ on:

[Wikipedia]

[Google]

[Amazon]

Euronext Dublin (formerly The Irish Stock Exchange, ISE; ga, Stocmhalartán na hÉireann) is Ireland's main stock exchange, and has been in existence since 1793.

The Euronext Dublin lists debt and fund securities and is used as a European gateway exchange for companies seeking to access investors in Europe and beyond. With over 35,000 securities listed on its markets, the exchange is used by over 4,000 issuers from more than 85 countries to raise funds and access international investors.

A study by Indecon (international economic consultants) published in 2014 on the Irish Stock Exchange found that having a local stock market and securities industry directly supports 2,100 jobs in Ireland and is worth €207 million each year to the Irish economy. It also found that having a domestic securities industry centred on the Irish Stock Exchange generates €207 million in estimated direct economic impact (measured in Gross Value Added or GDP) and €230 million in direct tax for the Irish exchequer (including stamp duty on trading in Irish shares).

The exchange is regulated by the Central Bank of Ireland under the Markets in Financial Instruments Regulations (

The Irish Stock Exchange was first recognised by legislation in 1799 when the Irish Parliament passed the Stock Exchange (Dublin) Act. The exchange originally operated from the Royal Exchange and was built so that businessmen could sell goods and commodities and trade

The Irish Stock Exchange was first recognised by legislation in 1799 when the Irish Parliament passed the Stock Exchange (Dublin) Act. The exchange originally operated from the Royal Exchange and was built so that businessmen could sell goods and commodities and trade

Euronext Dublin

official website {{authority control Financial services in the Republic of Ireland 2018 mergers and acquisitions

MiFID

Markets in Financial Instruments Directive 20142014/65/EU commonly known as MiFID 2 (Markets in financial instruments directive 2), is a legal act of the European Union. Together with Regulation (EU) No 600/2014 it provides a legal framework fo ...

) and is a member of the World Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

and the Federation of European Stock Exchanges.

History

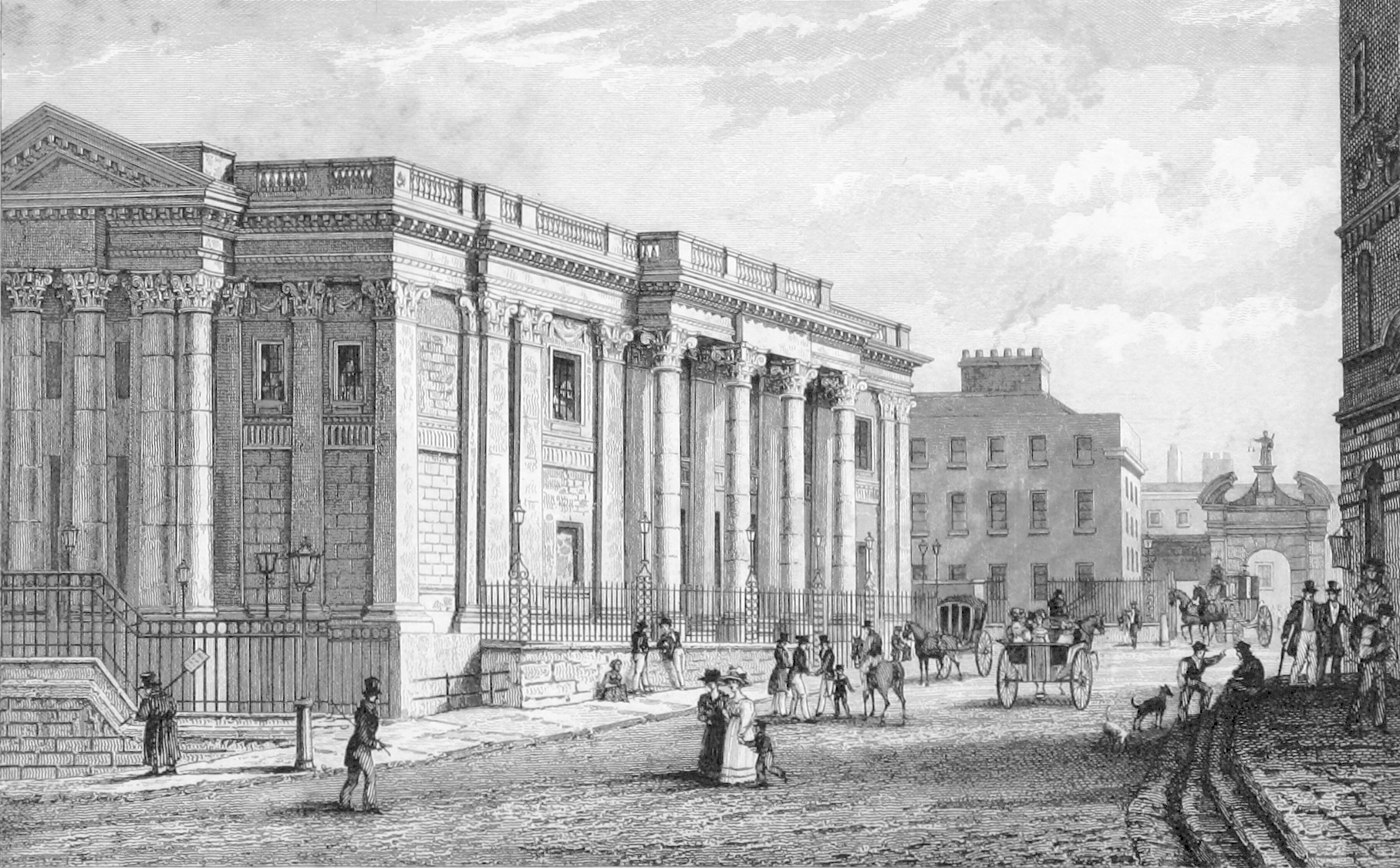

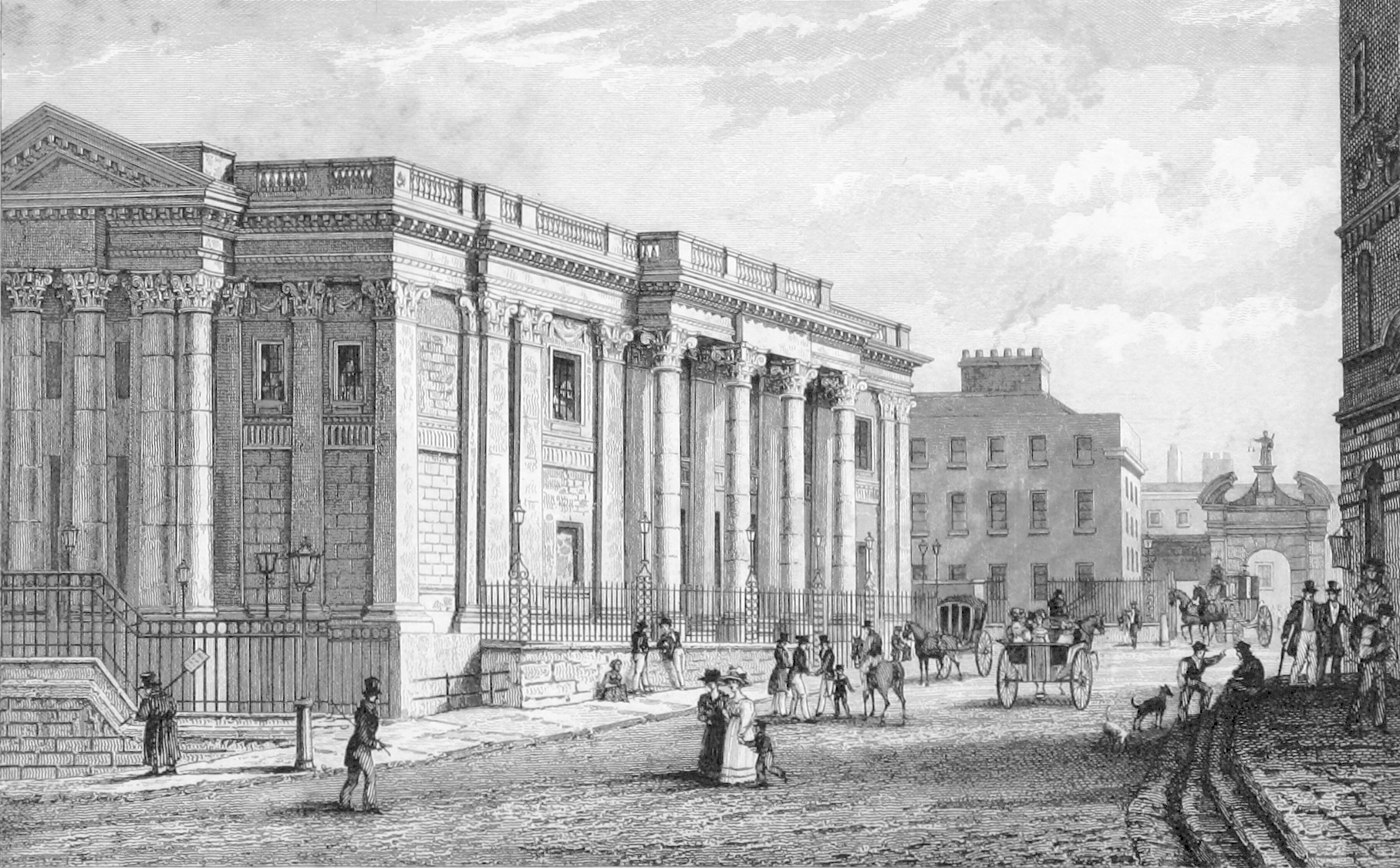

The Irish Stock Exchange was first recognised by legislation in 1799 when the Irish Parliament passed the Stock Exchange (Dublin) Act. The exchange originally operated from the Royal Exchange and was built so that businessmen could sell goods and commodities and trade

The Irish Stock Exchange was first recognised by legislation in 1799 when the Irish Parliament passed the Stock Exchange (Dublin) Act. The exchange originally operated from the Royal Exchange and was built so that businessmen could sell goods and commodities and trade bills of exchange

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a ...

. In different periods of its history, the ISE included a number of regional exchanges, including the Cork and Dublin

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 c ...

exchanges. In 1973, the Irish exchange merged with British and other Irish stock exchanges becoming part of the International Stock Exchange of Great Britain and Ireland (now called the London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St P ...

).

In 1837, Samuel Lewis records the stock exchange offices as having moved from the Royal Exchange to the Commercial Buildings on Dame Street, close to the present day offices of the stock exchange at Anglesea Street in Temple Bar, stating that

"the increase in commercial business since the erection of this building having required additional accommodation in a situation more convenient for mercantile transactions, the Exchange has been gradually deserted and the meetings held there transferred to the Commercial Buildings in College-green".

In 1995, it became independent again and in April 2014 it demutualised changing its corporate structure and becoming a plc which is owned by a number of stockbroking firms.

At the time of its demutualisation, the country's main stockbrokers received shares in the €56m-valued exchange and dividing up €26m in excess cash. Davy Stockbrokers

Davy Group is Ireland's largest stockbroker, wealth manager, asset manager and financial advisor and has offices in Dublin, Belfast, Cork, Galway and London. Davy offers services to private clients, small businesses, corporations and institution ...

took the largest stake, at 37.5 per cent, followed by Goodbody Stockbrokers

Goodbody Stockbrokers is Ireland's longest established stockbroker, stockbroking firm with roots dating back to 1877. As well as being one of the leading institutional brokers, it is one of the largest private client firms in Ireland. It is a m ...

with 26.2 per cent; Investec

Investec is an Anglo-South African international banking and wealth management group. It provides a range of financial products and services to a client base in Europe, Southern Africa, and Asia-Pacific.

Investec is dual-listed on the London S ...

with 18 per cent; the then Royal Bank of Scotland Group

NatWest Group plc is a British banking and insurance holding company, based in Edinburgh, Scotland. The group operates a wide variety of banking brands offering personal and business banking, private banking, investment banking, insurance and ...

6.3 per cent; Cantor Fitzgerald

Cantor Fitzgerald, L.P. is an American financial services firm that was founded in 1945. It specializes in institutional equity, fixed income sales and trading, and serving the middle market with investment banking services, prime brokerage, an ...

6 per cent; and Campbell O’Connor with 6 per cent.

In March 2018, Euronext

Euronext N.V. (short for European New Exchange Technology) is a pan-European bourse that offers various trading and post-trade services.

Traded assets include regulated equities, exchange-traded funds (ETF), warrants and certificates, bonds, ...

completed the purchase of the ISE, and renamed the ISE as Euronext Dublin.

Markets

The Irish Stock Exchange operates 4 markets - the Main Securities Market, the principal market for Irish and overseas companies; the Enterprise Securities Market (ESM), an equity market designed for growth companies; the Global Exchange Market (GEM), a specialist debt market for professional investors and the Atlantic Securities Market (ASM), a market dedicated to companies who wish to dual list in Ireland and the United States.

Equity markets for listed companies

There are currently 50 companies with shares listed on the markets of the Irish Stock Exchange. There are three markets on which for companies to list equities on the ISE: * The Main Securities Market (MSM), suited to larger companies with substantial funding needs * The Enterprise Securities Market (ESM), for high-growth companies raising equity in earlier stages of development * The Atlantic Securities Market (ASM), for multinational companies that want to broaden their investor reach to include dollar and euro pools of capital in a streamlined mannerMoney raised

In 2016, 11 companies trading on the ISE raised €513m in equity funds from international investors. New equity listings in 2016 came from Venn Life Sciences, Draper Esprit, and Dalata Hotel Group, which transferred its listing from the ESM to a primary listing on the MSM in June 2016. In 2015 the largest biotech ever to IPO in Europe took place on the ISE when Malin Corporation, the Irish-based global life sciences company, raised €330m from international investors in an exclusive listing on the ISE. Three other IPOs took place in 2015 raising a further €650m: Applegreen, Permanent TSB and Hostelworld. In 2014 three companies joined the ISE's markets: Dalata Hotel Group, the largest hotel operator in Ireland, Irish Residential Properties REIT plc, the first residentially focused REIT to list in Ireland and Mainstay Medical, an Irish medical device company. These three companies raised a combined total of €700 at IPO. Total fund raising in 2014 of listed companies was €1.7 billion.Trading and membership

The ISE offers domestic and international membership for trading in shares, ETFs,Irish Government

The Government of Ireland ( ga, Rialtas na hÉireann) is the cabinet that exercises executive authority in Ireland.

The Constitution of Ireland vests executive authority in a government which is headed by the , the head of government. The gover ...

bonds and other securities using world-class, easily accessible and cost-effective trading and post-trade infrastructure.

The ISE's electronic trading platform

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products ...

is called ISE Xetra and is provided in partnership with Deutsche Börse

Deutsche Börse AG () or the Deutsche Börse Group, is a German company offering marketplace organizing for the trading of shares and other securities. It is also a transaction services provider. It gives companies and investors access to gl ...

since the ISE closed its trading floor in Anglesea Street (a listed building) Dublin 2 on 6 June 2000. Shares trading on the ISE are settled by Euroclear

Euroclear is a Belgium-based financial services company that specializes in the settlement of securities transactions, as well as the safekeeping and asset servicing of these securities. It was founded in 1968 as part of J.P. Morgan & Co. to settl ...

UK & Ireland via the CREST system and cleared by Eurex Clearing AG.

The ISE is the main centre of liquidity in Irish shares. The company with the highest turnover on the ISE in 2016 was CRH. This was followed Ryanair, Paddy Power Betfair

Flutter Entertainment plc (formerly Paddy Power Betfair plc) is an Irish gambling holding company created by the merger of Paddy Power and Betfair, and the later acquisition of The Stars Group. It is listed on the London Stock Exchange, and is ...

, Bank of Ireland and Kerry Group

Kerry Group plc is a public food company headquartered in Ireland. It is quoted on the Dublin ISEQ and London stock exchanges.

Given the company's origins in the co-operative movement, farmer-suppliers of the company retain a significant in ...

.

Trading volumes on the exchange in 2011 were about a quarter of the 2007 peak. In June 2012, following the collapse of a stockbroker, the Sunday Independent asked "Will there even be a stand-alone Irish equity market in five years' time? The omens are not good." However this has proven not to be the case as in 2016 the number of equity trades had increased by 17.4% to 6.6m, up from 5.6m in 2015, the first time trading has reached over 6m trades and the sixth consecutive year of growth in trade numbers.

Debt markets

The ISE is among the leading centres globally for the listing of debt securities with statistics showing debt listings growing by more than 7% in 2016 to reach over 29,000 securities. The ISE was ranked at #2 among global exchanges according to rankings released by theWorld Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

(WFE) at the end of December 2016.

The ISE offers two markets for the listing of debt securities: the Global Exchange Market (GEM), an exchange-regulated market and multilateral trading facility

A multilateral trading facility (MTF) is a European Union regulatory term for a self-regulated financial trading venue. These are alternatives to the traditional stock exchanges where a market is made in securities, typically using electronic ...

(MTF), for banks, companies and sovereigns listing debt, and the Main Securities Market (MSM). Major global companies listing debt on ISE's markets include Vodafone plc, Whirlpool

A whirlpool is a body of rotating water produced by opposing currents or a current running into an obstacle. Small whirlpools form when a bath or a sink is draining. More powerful ones formed in seas or oceans may be called maelstroms ( ). ''Vo ...

, Canada Pension Plan Investment Board, Kingdom of Saudi Arabia, Barclays, Goldman Sachs, Ryanair, Coca-Cola

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. Originally marketed as a temperance drink and intended as a patent medicine, it was invented in the late 19th century by John Stith Pemberton in Atlant ...

and Ferrari.

Fund markets

The ISE is the #1 centre for listing investment funds and Exchange Traded Funds (ETFs) globally according to statistics released by the World Federation of Exchanges (WFE), with 1,041 new fund classes admitted in 2016. Global investment managers can choose from one of two markets when listings funds: the MSM or GEM. Notable investment managers listing funds on ISE markets include Tideway, BNY Mellon, PIMCO and Fidelity Investments.ISEFundHub

In 2014 the ISE launched ISEFundHub, an information portal for funds listed on the ISE and funds domiciled in Ireland. The portal displays important information such as fund net asset values (NAVs) and key fund documents as well as extensive performance-based analytics. The service is offered by the ISE in partnership with FundConnect, a Danish-based funds infrastructure provider in the European market.Other services

Legal Entity Identifier (LEI) services The ISE is endorsed by the Regulatory Oversight Committee (ROC) and sponsored by the Central Bank of Ireland as a Local Operating Unit (LOU) for the processing of Legal Entity Identifier (LEI) services for Ireland. LEIs are codes designed to create a global reference data system that uniquely identifies every legal entity or structure, in any jurisdiction, that is party to a financial transaction. Businesses may apply for an LEI code through ISEdirect. LEIs were brought in by global regulators as part of the response to the global financial crisis. International Securities Identity Number (ISIN) services An International Securities Identity Number ( ISIN) is a code that uniquely identifies a specific securities issue. The ISE is the National Numbering Agency in Ireland for ISIN codes and is a member of the global industry body the Association of National Numbering Agencies (ANNA). Information services The ISE is the official source of market data on ISE markets and publishes a range of market indices. The published index of shares is known as the Irish Stock Exchange Quotient or ISEQ Overall Index. Other equity indexes of the exchange include the ISEQ ESM Index, theISEQ 20

The ISEQ 20 is a benchmark stock market index composed of companies that trade on Euronext Dublin. The index comprises the 20 companies with the highest trading volume and market capitalisation contained within the ISEQ Overall Index. The index w ...

, the ISEQ General, ISEQ SmallCap, and ISEQ Financial. The ISE also has two other ISEQ 20 based indices, the ISEQ 20 Capped Index and the ISEQ 20 Leveraged Strategy Index.

The ISE also publishes a range of bond indices.

Announcement services

The ISE files and publish regulatory documents and announcements for issuers enabling them to comply with their regulatory obligations.

Criticism

Two reports of an investigation into the "wholly inappropriate sale of perpetual bonds" by Davy Stockbrokers to credit unions failed to involve any of the credit unions affected, leaving them "in the dark and powerless to add any value to the findings of this investigation". The ISE, who have Davy as one of its largest shareholders, then declined to give them access to the reports. The Chairman of one of the Credit Union's who suffered large losses told his members “The failure to publish the reports is to place the complaints process in a shroud of secrecy. Such a failure of openness, transparency and fairness can only serve to undermine confidence in the complaints process, forcing those with grievances into the courts. Such a course of action is not in the interest of any of the stakeholders.” In April 2010, Financial Regulator at the Central Bank of Ireland told the same committee that "senior management of the exchange should step up to the plate" after failing to help charities, credit unions and rich individuals who received letters informing them that many investments made by stockbrokers over the past decade are now worthless. The Central Bank began an unprecedented investigation into the entire stockbroking community in December 2011. The 12-month-long investigation found "major problems" and that there would have to be mergers of firms to ensure the industry survives. This merger process will have to be done in a controlled way – because any instability in the sector could pose a danger to many people's savings, and prevent new businesses from raising money at a time when banks are not lending. In September 2012 it was forced to issue a correction after it reported figures to the market that suggested a surge in trading in government bonds, in one case as much as 85pc of the year's volume of trades were reported to have gone through the system in a single day.See also

* List of stock exchangesReferences

External links

Euronext Dublin

official website {{authority control Financial services in the Republic of Ireland 2018 mergers and acquisitions

Dublin

Dublin (; , or ) is the capital and largest city of Ireland. On a bay at the mouth of the River Liffey, it is in the province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 c ...

Seanad nominating bodies