Dividend recapitalization on:

[Wikipedia]

[Google]

[Amazon]

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of

"How the Twinkie Made the Super-Rich Even Richer"

''

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of

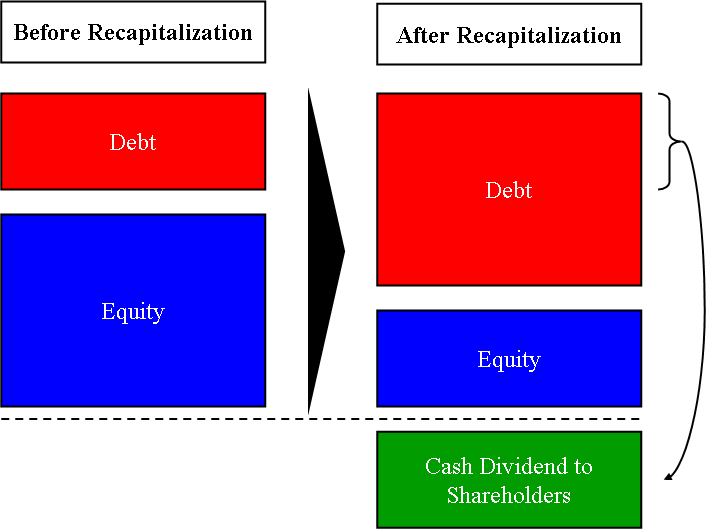

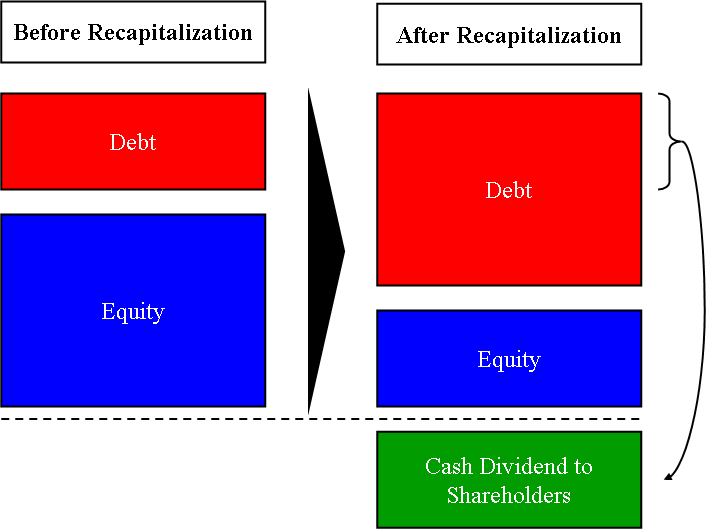

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of leveraged recapitalization

In corporate finance, a leveraged recapitalization is a change of the company's capital structure, usually substitution of debt for equity.

Overview

Such recapitalizations are executed via issuing bonds to raise money and using the proceeds to ...

in which a payment is made to shareholders. As opposed to a typical dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-i ...

which is paid regularly from the company's earnings, a dividend recapitalization occurs when a company raises debt —e.g. by issuing bonds to fund the dividend.

These types of recapitalization can be minor adjustments to the capital structure of the company, or can be large changes involving a change in the power structure as well. As with other leveraged transactions, if a firm cannot make its debt payments, meet its loan covenant

A loan covenant is a condition in a commercial loan or bond

Bond or bonds may refer to:

Common meanings

* Bond (finance), a type of debt security

* Bail bond, a commercial third-party guarantor of surety bonds in the United States

* Chemical bond ...

s or rollover its debt it enters financial distress

Financial distress is a term in corporate finance used to indicate a condition when promises to creditors of a company are broken or honored with difficulty. If financial distress cannot be relieved, it can lead to bankruptcy. Financial distress ...

which often leads to bankruptcy. Therefore, the additional debt burden of a leveraged recapitalization makes a firm more vulnerable to unexpected business problems including recessions

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

and financial crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

.

Typically a dividend recapitalization will be pursued when the equity investors are seeking to realize value from a private company but do not want to sell their interest in the business.

Example

Between 2003 to 2007, 188 companies controlled by private equity firms issued more than $75 billion in debt that was used to pay dividends to the buyout firms. In their relatively brief period of management ofHostess Brands

Hostess Brands is an American-based bakery company formed in 2013. It owns several bakeries in the United States that produce snack cakes under the Hostess and Dolly Madison brand names and its Canadian subsidiary, Voortman Cookies Limited, pr ...

, maker of Twinkie brand snack cakes and other products, Apollo Global Management and C. Dean Metropoulos

Charles Dean Metropoulos ( el, Ντιν Μητρόπουλος; born May 1946 in Tripoli) is a Greek-American billionaire investor and businessman. He was the owner of Pabst Brewing Company, which was founded by Jacob Best in 1844. On the ''Forb ...

and Company added leverage and took a $900 million dividend, "the third largest of 2015" in the private equity industry.Corkery, Michael, and Ben Protess"How the Twinkie Made the Super-Rich Even Richer"

''

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid d ...

'', December 10, 2016. Retrieved 2016-12-11.

See also

*Private equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a t ...

*Leveraged recapitalization

In corporate finance, a leveraged recapitalization is a change of the company's capital structure, usually substitution of debt for equity.

Overview

Such recapitalizations are executed via issuing bonds to raise money and using the proceeds to ...

References

Financial capital Dividends {{private-equity-stub