Bermuda Black Hole (tax avoidance) on:

[Wikipedia]

[Google]

[Amazon]

Bermuda black hole refers to base erosion and profit shifting (BEPS)

The Tax Haven That's Saving Google Billions

''Business Week''. Apple's "Bermuda black hole", called Apple Operations Ireland ("AOI"), became part of a 2013 US Senate inquiry by

A seminal 2017 academic study published in

A seminal 2017 academic study published in

tax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdi ...

schemes in which untaxed global profits end up in Bermuda

)

, anthem = "God Save the King"

, song_type = National song

, song = "Hail to Bermuda"

, image_map =

, map_caption =

, image_map2 =

, mapsize2 =

, map_caption2 =

, subdivision_type = Sovereign state

, subdivision_name =

, es ...

, which is considered a tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

. The term was most associated with US technology multinationals such as Apple and Google who used Bermuda as the "terminus" for their Double Irish arrangement

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest ta ...

tax structure.

Definition

"Bermuda black hole" was used in relation to US corporate tax strategies that routed un-taxed profits to Bermuda, where they did not emerge again for fear of being subject to US corporation tax. Instead, the untaxed profits were "lent out" to the corporate parent, or its subsidiaries, thus avoiding the risk of incurring US taxation. The Bermuda black hole led to US corporations amassing over US$1 trillion in offshore locations from 2004 to 2017 (before theTax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

).

A "Bermuda black hole" became the most favoured common final destination for the Double Irish with a Dutch Sandwich

Dutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring EU withholding taxes on untaxed profits as they were being moved to non-EU tax havens (such as the Bermuda bl ...

base erosion and profit shifting (BEPS) corporate tax avoidance strategy as used by US multinational technology firms in Ireland; and particularly Apple and Google.Drucker J. (2010)The Tax Haven That's Saving Google Billions

''Business Week''. Apple's "Bermuda black hole", called Apple Operations Ireland ("AOI"), became part of a 2013 US Senate inquiry by

Carl Levin

Carl Milton Levin (June 28, 1934 – July 29, 2021) was an American attorney and politician who served as a United States senator from Michigan from 1979 to 2015. A member of the Democratic Party, he was the chair of the Senate Armed Services ...

and John McCain

John Sidney McCain III (August 29, 1936 – August 25, 2018) was an American politician and United States Navy officer who served as a United States senator from Arizona from 1987 until his death in 2018. He previously served two te ...

, which led to the 2014–2016 EU Commission inquiry and a US$13 billion fine, the largest corporate tax avoidance fine in history.

The term "black hole" is not unique to Bermuda and has been used to describe other uses of offshore tax havens, such as the "Cayman black hole".

Replacement

A seminal 2017 academic study published in

A seminal 2017 academic study published in Nature magazine

''Nature'' is a British weekly scientific journal founded and based in London, England. As a multidisciplinary publication, ''Nature'' features peer-reviewed research from a variety of academic disciplines, mainly in science and technology. It ...

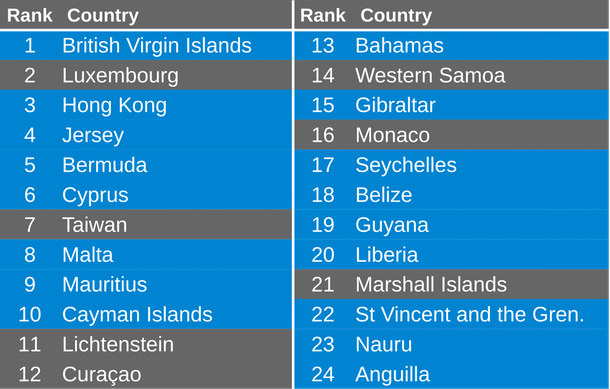

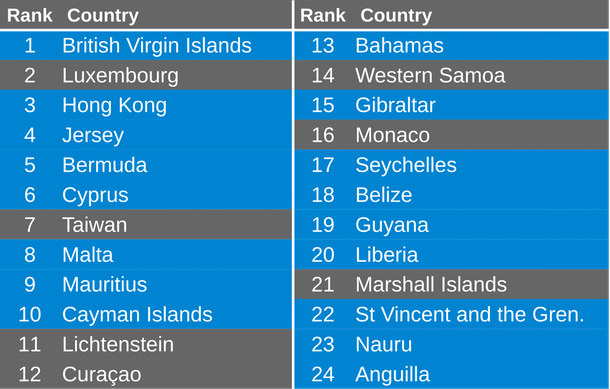

on the classification of tax havens and offshore financial centres used the related term of "Sink offshore financial centre", instead of "black hole", to describe locations like Bermuda as: "jurisdictions in which a disproportional amount of value disappears from the economic system". In the study Bermuda was ranked as the 5th largest of 24 Sink OFCs identified and classified in the study (see graphic).

The 2017 study, which was titled ''Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network'', used quantitative analysis techniques to prove that some global jurisdictions act like corporate taxation "black holes" (e.g. the Sink OFCs), where funds are sent as their legal "terminus". However, the study showed how the Sink OFCs rely heavily on jurisdictions that act as Conduit OFCs in routing untaxed global profits to the "black holes".

2017 TCJA

Tax academics believe that the change in the US corporate tax code from theTax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs A ...

(TCJA) should diminish the ability of US corporations to use offshore structures that shield untaxed profits from US taxation, such as "Bermuda black hole" (or Bermuda Sinks), as global US corporate income is now deemed automatically repatriated to the US under the TCJA. It is therefore likely that the term "Bermuda black hole" will not remain in common use.

See also

*Tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

* Singapore Sling

* Dutch Sandwich

Dutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring EU withholding taxes on untaxed profits as they were being moved to non-EU tax havens (such as the Bermuda bl ...

References

{{Reflist Economy of Bermuda Tax avoidance International taxation Offshore finance