Affluence in the United States on:

[Wikipedia]

[Google]

[Amazon]

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either

Affluence in the United States has been attributed in many cases to inherited wealth amounting to "a substantial head start": in September 2012, the

Affluence in the United States has been attributed in many cases to inherited wealth amounting to "a substantial head start": in September 2012, the

For example, a household in possession of an $800,000 house, $5,000 in mutual funds, $30,000 in cars, $20,000 worth of stock in their own company, and a $45,000 IRA would have assets totaling $900,000. Assuming that this household would have a $250,000 mortgage, $40,000 in car loans, and $10,000 in credit card debt, its debts would total $300,000. Subtracting the debts from the worth of this household's assets (900,000 − $300,000 = $600,000), this household would have a net worth of $600,000. Net worth can vary with fluctuations in value of the underlying assets.

As one would expect, households with greater income often have the highest net worths, though high income cannot be taken as an always accurate indicator of net worth. Overall the number of wealthier households is on the rise, with

For example, a household in possession of an $800,000 house, $5,000 in mutual funds, $30,000 in cars, $20,000 worth of stock in their own company, and a $45,000 IRA would have assets totaling $900,000. Assuming that this household would have a $250,000 mortgage, $40,000 in car loans, and $10,000 in credit card debt, its debts would total $300,000. Subtracting the debts from the worth of this household's assets (900,000 − $300,000 = $600,000), this household would have a net worth of $600,000. Net worth can vary with fluctuations in value of the underlying assets.

As one would expect, households with greater income often have the highest net worths, though high income cannot be taken as an always accurate indicator of net worth. Overall the number of wealthier households is on the rise, with

Zhu Xiao Di. Feb. 2007. Joint Center for Housing Studies."Wealth Inequality: Data and Models." Marco Cagetti and

"It's the Inequality, Stupid"

''Mother Jones'', March/April 2011 Issue In 2009, the average income of the top 1% was $960,000 with a minimum income of $343,927.

CNN, October 29, 2011"Tax Data Show Richest 1 Percent Took a Hit in 2008, But Income Remained Highly Concentrated at the Top. Recent Gains of Bottom 90 Percent Wiped Out."Center on Budget and Policy Priorities

Retrieved October 2011. Robert Pear

''The New York Times'', October 25, 2011 During the economic expansion between 2002 and 2007, the income of the top 1% grew 10 times faster than the income of the bottom 90%. In this period 66% of total income gains went to the 1%, who in 2007 had a larger share of total income than at any time since 1928. According to PolitiFact and others, the top 400 wealthiest Americans "have more wealth than half of all Americans combined." Inherited wealth may help explain why many Americans who have become rich may have had a "substantial head start". In September 2012, according to the

by G. William Domhoff of the UC-Santa Cruz Sociology Department However, according to the federal reserve, "For most households, pensions and Social Security are the most important sources of income during retirement, and the promised benefit stream constitutes a sizable fraction of household wealth" and "including pensions and Social Security in net worth makes the distribution more even".Pensions, Social Security, and the Distribution of Wealth

by Arthur B. Kennickell and Annika E. Sundén of Board of Governors of the Federal Reserve System When including household wealth from pensions and social security, the richest 1% of the American population in 1992 owned 16% of the country's total wealth, as opposed to 32% when excluding pensions and social security. After the

Recent U.S. Census Bureau publications indicate a strong correlation between race and affluence. In the top

Recent U.S. Census Bureau publications indicate a strong correlation between race and affluence. In the top

As of 2002, there were approximately 146,000 (0.1%) households with incomes exceeding $1,500,000, while the top 0.01% or 11,000 households had incomes exceeding $5,500,000. The 400 highest tax payers in the nation had gross annual household incomes exceeding $87,000,000. Household incomes for this group have risen more dramatically than for any other. As a result, the gap between those who make less than one and half million dollars annually (99.9% of households) and those who make more (0.1%) has been steadily increasing, prompting ''

As of 2002, there were approximately 146,000 (0.1%) households with incomes exceeding $1,500,000, while the top 0.01% or 11,000 households had incomes exceeding $5,500,000. The 400 highest tax payers in the nation had gross annual household incomes exceeding $87,000,000. Household incomes for this group have risen more dramatically than for any other. As a result, the gap between those who make less than one and half million dollars annually (99.9% of households) and those who make more (0.1%) has been steadily increasing, prompting ''

Image:MeanNetWorth2007.png, U.S. mean family net worth by percentile of net worth (1989–2007)

Image:MedianNetWorth2007.png, U.S. median family net worth by percentile of net worth (1989–2007)

The total value of all U.S. household wealth in 2000 was approximately $44 trillion. Prior to the Late-2000s recession which began in December 2007 its value was at $65.9 trillion. After, it plunged to $48.5 trillion during the first quarter of 2009. The total household net worth rose 1.3% by the fourth quarter of 2009 to $54.2 trillion, indicating the American economy is recovering.

Alternate income measures forum

Americans Underestimate U.S. Wealth Inequality

(audio – ''

15 Mind-Blowing Facts About Wealth And Inequality In America

(charts – ''

It's the Inequality, Stupid: 11 Charts that Explain Everything that's Wrong with America

(''

US Census Bureau, personal income forum

(

Introducing the Distributional Financial Accounts of the United States

(Federal Reserve – March 2019) {{United States topics American upper class

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

or wealth

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an I ...

.

In absolute terms affluence is a relatively widespread phenomenon in the United States, with over 30% of households having an income exceeding $100,000 per year and over 30% of households having a net worth exceeding $250,000, as of 2019. However, when looked at in relative terms, wealth is highly concentrated: the bottom 50% of Americans only share 2% of total household wealth while the top 1% hold 35% of that wealth.

In the United States, as of 2019, the median household income is $60,030 per year and the median household net worth is $97,300, while the mean household income is $89,930 per year and the mean household net worth is $692,100.

Income vs. wealth

While income is often seen as a type of wealth in colloquial language use, wealth and income are two substantially different measures of economic prosperity. Wealth is the total value of net possessions of an individual or household, while income is the total inflow of wealth over a given time period. Hence the change in wealth over that time period is equal to the income minus the expenditures in that period. Income is a so-called " flow" variable, while wealth is a so-called " stock" variable.Income as a metric

Affluence in the United States has been attributed in many cases to inherited wealth amounting to "a substantial head start": in September 2012, the

Affluence in the United States has been attributed in many cases to inherited wealth amounting to "a substantial head start": in September 2012, the Institute for Policy Studies

The Institute for Policy Studies (IPS) is an American progressive think tank started in 1963 that is based in Washington, D.C. It was directed by John Cavanagh from 1998 to 2021. In 2021 Tope Folarin was announced as new Executive Director. ...

found that over 60 percent of the Forbes richest 400 Americans had grown up with substantial privilege.

Income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

is commonly used to measure affluence, although this is a relative indicator: a middle class

The middle class refers to a class of people in the middle of a social hierarchy, often defined by occupation, income, education, or social status. The term has historically been associated with modernity, capitalism and political debate. Com ...

person with a personal income of $77,500 annually and a billionaire may both be referred to as affluent, depending on reference groups. An average American with a median income of $32,000 ($39,000 for those employed full-time between the ages of 25 and 64) when used as a reference group would justify the personal income in the tenth percentile of $77,500 being described as affluent, but if this earner were compared to an executive of a Fortune 500 company, then the description would not apply. Accordingly, marketing firms and investment houses classify those with household incomes exceeding $250,000 as mass affluent In marketing and financial services, mass affluent and emerging affluent are the high end of the mass market, or individuals with US$100,000 to US$1,000,000 of liquid financial assets plus an annual household income over US$75,000.

Mass affluent ...

, while the threshold upper class

Upper class in modern societies is the social class composed of people who hold the highest social status, usually are the wealthiest members of class society, and wield the greatest political power. According to this view, the upper class is gen ...

is most commonly defined as the top 1% with household incomes commonly exceeding $525,000 annually.

According to the U.S. Census Bureau

The United States Census Bureau (USCB), officially the Bureau of the Census, is a principal agency of the U.S. Federal Statistical System, responsible for producing data about the American people and economy. The Census Bureau is part of the ...

, 42% of U.S. households have two income earners, thus making households' income levels higher than personal income levels; the percent of married-couple families with children where both parents work is 59.1%.

In 2005, the economic survey revealed the following income distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ec ...

for households and individuals:

* The top 5% of individuals had six figure incomes (exceeding $100,000); the top 10% of individuals had incomes exceeding $75,000;

* The top 5% of households, three quarters of whom had two income earners, had incomes of $166,200 (about 10 times the 2009 US minimum wage, for one income earner, and about 5 times the 2009 US minimum wage for two income earners) or higher, with the top 10% having incomes well in excess of $100,000.

* The top 0.12% of households had incomes exceeding $1,600,000 annually.

Households may also be differentiated among each other, depending on whether or not they have one or multiple income earners (the high female participation in the economy means that many households have two working members). For example, in 2005 the median household income

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways o ...

for a two income earner households was $67,000 while the median income for an individual employed full-time with a graduate degree

Postgraduate or graduate education refers to academic or professional degrees, certificates, diplomas, or other qualifications pursued by post-secondary students who have earned an undergraduate (bachelor's) degree.

The organization and struc ...

was in excess of $60,000, demonstrating that nearly half of individuals with a graduate degree

Postgraduate or graduate education refers to academic or professional degrees, certificates, diplomas, or other qualifications pursued by post-secondary students who have earned an undergraduate (bachelor's) degree.

The organization and struc ...

have earnings comparable with most dual income households.

By another measure – the number of square feet per person in the home – the average home in the United States has more than 700 square feet per person, 50% – 100% more than in other high-income countries (though this indicator may be regarded as an accident of geography, climate and social preference, both within the US and beyond it) but this metric indicates even those in the lowest income percentiles enjoy more living space than the middle classes in most European nations. Similarly ownership levels of 'gadgets' and access to amenities are exceptionally high compared to many other countries.

Overall, the term affluent may be applied to a variety of individuals, households, or other entities, depending on context. Data from the U.S. Census Bureau serves as the main guideline for defining affluence. U.S. government data not only reveal the nation's income distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ec ...

but also the demographic characteristics of those to whom the term "affluent", may be applied.

Wealth

Wealth in the United States is commonly measured in terms of net worth, which is the sum of allasset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can ...

s, including the market value of real estate, like a home, minus all liabilities. The United States is the wealthiest country in the world.

For example, a household in possession of an $800,000 house, $5,000 in mutual funds, $30,000 in cars, $20,000 worth of stock in their own company, and a $45,000 IRA would have assets totaling $900,000. Assuming that this household would have a $250,000 mortgage, $40,000 in car loans, and $10,000 in credit card debt, its debts would total $300,000. Subtracting the debts from the worth of this household's assets (900,000 − $300,000 = $600,000), this household would have a net worth of $600,000. Net worth can vary with fluctuations in value of the underlying assets.

As one would expect, households with greater income often have the highest net worths, though high income cannot be taken as an always accurate indicator of net worth. Overall the number of wealthier households is on the rise, with

For example, a household in possession of an $800,000 house, $5,000 in mutual funds, $30,000 in cars, $20,000 worth of stock in their own company, and a $45,000 IRA would have assets totaling $900,000. Assuming that this household would have a $250,000 mortgage, $40,000 in car loans, and $10,000 in credit card debt, its debts would total $300,000. Subtracting the debts from the worth of this household's assets (900,000 − $300,000 = $600,000), this household would have a net worth of $600,000. Net worth can vary with fluctuations in value of the underlying assets.

As one would expect, households with greater income often have the highest net worths, though high income cannot be taken as an always accurate indicator of net worth. Overall the number of wealthier households is on the rise, with baby boomers

Baby boomers, often shortened to boomers, are the Western demographic cohort following the Silent Generation and preceding Generation X. The generation is often defined as people born from 1946 to 1964, during the mid-20th century baby boom. ...

hitting the highs of their careers. In addition, wealth is unevenly distributed, with the wealthiest 25% of US households owning 87% of the wealth in the United States, which was $54.2 trillion in 2009."Growing Wealth, Inequality, and Housing in the United States."Zhu Xiao Di. Feb. 2007. Joint Center for Housing Studies."Wealth Inequality: Data and Models." Marco Cagetti and

Mariacristina De Nardi

Mariacristina De Nardi is an economist who was born in Treviso, Italy. She is the Thomas Sargent Professor at the University of Minnesota since 2019. In 2013, De Nardi was appointed professor of economics at University College London; since Septe ...

. Aug. 2005. Federal Reserve Bank of Chicago.

U.S. household and non-profit organization net worth rose from $44.2 trillion in Q1 2000 to a pre-recession peak of $67.7 trillion in Q3 2007. It then fell $13.1 trillion to $54.6 trillion in Q1 2009 due to the subprime mortgage crisis. It then recovered, rising consistently to $86.8 trillion by Q4 2015. This is nearly double the 2000 level.

Mechanisms to gain wealth

Assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can ...

are known as the raw materials of wealth, and they consist primarily of stocks and other financial and non-financial property, particularly homeownership.Haskins, Ron: "Wealth and Economic Mobility". Economic Mobility Project, 2007. While tangible assets are unequally distributed, financial assets are much more unequal. In 2004, the top 1% controlled 50.3% of the financial assets while the bottom 90% held only 14.4% of the total US financial assets.

These discrepancies exist because the many wealth building tools established by the Federal Government work better for high earners. These include 401k plans

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodical employee contributions come directly out of their ...

, 403b plans

In the United States, a 403(b) plan is a U.S. tax-advantaged retirement savings plan available for public education organizations, some non-profit employers (only Internal Revenue Code 501(c)(3) organizations), cooperative hospital service organiza ...

, and IRAs

The Infrared Astronomical Satellite (Dutch: ''Infrarood Astronomische Satelliet'') (IRAS) was the first space telescope to perform a survey of the entire night sky at infrared wavelengths. Launched on 25 January 1983, its mission lasted ten mo ...

. Traditional IRAs, 401k and 403b plans are tax shelters created for working individuals. These plans allow for tax sheltered (or pre-tax) contributions of earned income directly to tax sheltered savings accounts. Annual contributions are capped to ensure that high earners cannot enjoy the tax benefit disproportionately. The Roth IRA

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement pla ...

is another tool that can help create wealth in the working and middle classes.

Assets in Roth IRAs grow tax free; interests, dividends, and capital gains are all exempt from income taxes. Contributions to Roth IRAs are limited to those with annual incomes less than the threshold established yearly by the IRS. The benefits of these plans, however, are only available to workers and families whose incomes and expenses allow them excess funds to commit for a long period, typically until the investor reaches age 59½. The effect of these tools are further limited by the contribution limits placed on them.

Including human capital such as skills, the United Nations International Human Dimensions Programme

The International Human Dimensions Programme on Global Environmental Change (IHDP) was a research programme that studied the human and societal aspects of the phenomenon of global change.

IHDP aimed to frame, develop and integrate social science ...

estimated the total wealth of the United States in 2008 to be $118 trillion.

Top percentiles of income

Affluence and economic standing within society are often expressed in terms of percentile ranking. Economic ranking is conducted either in terms of giving lower thresholds for a designated group (e.g. the top 5%, 10%, 15%, etc.) or in terms of the percentage of households/individuals with incomes above a certain threshold (e.g. above $75,000, $100,000, $150,000, etc.). The table below presents 2006 income data in terms of the lower thresholds for the given percentages (e.g. the top 25.6% of households had incomes exceeding $80,000, compared to $47,000 for the top quarter of individuals). Source: U.S. Census Bureau, 2006Household income over time

Household income

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamp ...

changes over time, with income gains being substantially larger for the upper percentiles than for the lower percentiles. All areas of the income strata have seen their incomes rise since the late 1960s, especially during the late 1990s. The overall increase in household income is not the result of an increase in the percentage of households with more than one income earner. In fact, the lowest 50% population have become very poor sharing just 2% of wealth in spite of modern social practice of more than one working person, mostly women in the household. But the myth is highly prevalent and promoted by media. The standard of living of a 1960s single working parent can only be afforded today when both parents work due to disproportionate distribution of wealth today:

Two income-earner households are more common among the top quintile of households than the general population: 2006 U.S. Census Bureau data indicates that over three quarters, 76%, of households in the top quintile, with annual incomes exceeding $91,200, had two or more income earners compared to just 42% among the general population and a small minority in the bottom three quintiles. As a result, much of the rising income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

inequity between the upper and lower percentiles can be explained through the increasing percentage of households with two or more incomes.

Source: U.S. Census Bureau (2004): "Income, Poverty, and Health Insurance Coverage in the United States: 2003", p. 36 et seq. All figures are inflation-adjusted and given in 2003 dollars.

Income distribution over time

According to theCongressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

, between 1979 and 2007 incomes of the top 1% of Americans grew by an average of 275%. During the same time period, the 60% of Americans in the middle of the income scale saw their income rise by 40%. From 1992 to 2007 the top 400 income earners in the U.S. saw their income increase 392% and their average tax rate reduced by 37%.Dave Gilson and Carolyn Perot"It's the Inequality, Stupid"

''Mother Jones'', March/April 2011 Issue In 2009, the average income of the top 1% was $960,000 with a minimum income of $343,927.

CNN, October 29, 2011"Tax Data Show Richest 1 Percent Took a Hit in 2008, But Income Remained Highly Concentrated at the Top. Recent Gains of Bottom 90 Percent Wiped Out."

Retrieved October 2011.

''The New York Times'', October 25, 2011 During the economic expansion between 2002 and 2007, the income of the top 1% grew 10 times faster than the income of the bottom 90%. In this period 66% of total income gains went to the 1%, who in 2007 had a larger share of total income than at any time since 1928. According to PolitiFact and others, the top 400 wealthiest Americans "have more wealth than half of all Americans combined." Inherited wealth may help explain why many Americans who have become rich may have had a "substantial head start". In September 2012, according to the

Institute for Policy Studies

The Institute for Policy Studies (IPS) is an American progressive think tank started in 1963 that is based in Washington, D.C. It was directed by John Cavanagh from 1998 to 2021. In 2021 Tope Folarin was announced as new Executive Director. ...

, "over 60 percent" of the Forbes richest 400 Americans "grew up in substantial privilege".

If a family has a positive net worth then it has more wealth than the combined net worth of over 30.6 million American families. This is because the bottom 25% of American families have a negative combined net worth.

Complications in interpreting income statistics

Interpreting these income statistics is complicated by several factors: membership in the top 1% changes from year to year, the IRS made large changes in the definition of adjusted gross income in 1987, and numbers for particular income ranges may be distorted by outliers (in the top segment) and failure to include transfer payments (in the lower segments). Regarding Income Mobility, the IRS occasionally studies income data from actual households over time, usually over one decade. Their results underestimate income mobility by excluding those under age 25, the most mobile population, from their studies. Many people look only at annual reported income data split into income quintiles. It is erroneous to assume that individual households remain in the same quintile over time, just as it usually is when using aggregate data. A majority of households in the top income quintile in one year, for example, will have moved to a lower quintile within a decade. Three out of four households in the top 0.01% of income will no longer be in that small group ten years later. In summary, half of all of U.S. households move from one income quintile to a different income quintile every decade. And actual households who started a decade in the lowest quintile of income, when tracked over the next ten years, will have proportionally more income growth than actual households who started the decade in the highest quintile of income. Thus, when comparing income/wealth quintile distributions from different time periods, generalizations can only be made with regards to the households in aggregate for each quintile, and can not be made to any individual households over the same time period (i.e. assuming the wealth value has been appropriately adjusted for differences in time, one cannot infer that a decrease in total wealth percentage for one quintile over time means that the households from that quintile have lost wealth as individuals, but only that total wealth percentage has decreased for those in that quintile at the time of measurement). Top 20% income vs. the bottom 20% income households: #The average number of people with jobs in a top income quintile household is two, while a majority of bottom-income-quintile households have no-one employed. #If there are two adult income earners in a household who are married, their incomes are combined on tax forms. This is very common among top-quintile-income households. The lowest-quintile households, however, include a lot more single-person households, or two unmarried working adults living together and sharing expenses, but reporting their incomes to the IRS as if they were two separate households. #75%...80% of actual income for bottom-quintile-households consists of specific transfer payments from social or relief programs (aka "welfare" and other benefits), which payments are not included in IRS data as income. The top income quintile gets a very small percentage of their actual income from transfer payments. #TheIRS

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax ...

warns against comparisons of pre-1987 and post-1987 income data due to significant changes in the definition of adjusted gross income (AGI) that made top-quintile households appear to have large reported income gains, when in fact there was no change to their income at all. In addition to AGI changes, large marginal tax rate reductions during the Reagan Administration caused another large change in tax reporting. A lot of corporate income formerly reported on corporate tax return

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer.

Taxation is one of ...

s was switched to lower-tax-rate individual tax returns (as Subchapter S corporations). This reporting change appeared to boost top-quintile income, when in fact their incomes had not changed. As a result, the top income quintile for households today includes a lot of corporate income previously reported in corporate tax returns, while Subchapter S corporations that lose money, are likely to be included in the bottom-income-quintile households. Income comparisons that compare pre-1987 to post-1987 income, are very common, but they are also biased, according to the IRS, and should be ignored.

Impact of age and experience: people that are older and have more experience, tend to have considerably larger incomes than younger and inexperienced workers. Normalizing for age and experience is rarely an effective statistical compensation, as each elderly citizen began as inexperienced.

Median income levels

Wealth distribution

According to an analysis that excludes pensions and social security, the richest 1% of the American population in 2007 owned 34.6% of the country's total wealth, and the next 19% owned 50.5%. Thus, the top 20% of Americans owned 85% of the country's wealth and the bottom 80% of the population owned 15%. Financial inequality was greater than inequality in total wealth, with the top 1% of the population owning 42.7%, the next 19% of Americans owning 50.3%, and the bottom 80% owning 7%.Wealth, Income, and Powerby G. William Domhoff of the UC-Santa Cruz Sociology Department However, according to the federal reserve, "For most households, pensions and Social Security are the most important sources of income during retirement, and the promised benefit stream constitutes a sizable fraction of household wealth" and "including pensions and Social Security in net worth makes the distribution more even".Pensions, Social Security, and the Distribution of Wealth

by Arthur B. Kennickell and Annika E. Sundén of Board of Governors of the Federal Reserve System When including household wealth from pensions and social security, the richest 1% of the American population in 1992 owned 16% of the country's total wealth, as opposed to 32% when excluding pensions and social security. After the

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

which started in 2007, the share of total wealth owned by the top 1% of the population grew from 34.6% to 37.1%, and that owned by the top 20% of Americans grew from 85% to 87.7%. The Great Recession also caused a drop of 36.1% in median household wealth but a drop of only 11.1% for the top 1%.

Changes in wealth

1989–2001

When observing the changes in the wealth among American households, one can note an increase in wealthier individuals and a decrease in the number of poor households, while net worth increased most substantially in semi-wealthy and wealthy households. Overall the percentage of households with a negative net worth (more debt than assets) declined from 9.5% in 1989 to 4.1% in 2001. The percentage of net worths ranging from $500,000 to one million doubled while the percentage of millionaires tripled. From 1995 to 2004, there was tremendous growth among household wealth, as it nearly doubled from $21.9 trillion to $43.6 trillion, but the wealthiest quartile of the economic distribution made up 89% of this growth. During this time frame, wealth became increasingly unequal, and the wealthiest 25% became even wealthier. According to U.S. Census Bureau statistics, this 'upward shift' is most likely the result of a booming housing market which caused homeowners to experience tremendous increases in home equity. Life-cycles have also attributed to the rising wealth among Americans. With more and more baby-boomers reaching the climax of their careers and the middle-aged population making up a larger segment of the population now than ever before, more and more households have achieved comfortable levels of wealth. Zhu Xiao Di (2004) notes, that household wealth usually peaks around families headed by people in their 50s, and as a result, the baby boomer generation reached this age range at the time of the analysis.After 2007

Household net worth fell from 2007 to 2009 by a total of $17.5 trillion or 25.5%. This was the equivalent loss of one year of GDP. By the fourth quarter of 2010, the household net worth had recovered by a growth of 1.3 percent to a total of $56.8 trillion. An additional growth of 15.7 percent is needed just to bring the value to where it was before therecession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

started in December 2007. In 2014 a record breaking net worth of $80.7 trillion was achieved.

Professions

According to the University of Chicago, the top 1% is primarily made up of owner-managers of small to medium-sized businesses of which the most profitable are physician's and dentist's offices, professional and technical services, specialty trade contracting, legal services. The typical business has $7 million in sales and 57 employees. With a 10% profit margin, this will place two business partners in the top 1%. The remainder of the top 1% tends to be the classic professions: medicine, dentistry, law, engineering, finance, and corporate executive management. A correlation has been shown between increases in income and increases in worker satisfaction. Increasing worker satisfaction, however, is not solely a result of the increase in income: workers in more complex and higher level occupations tend to have attained higher levels of education and thus are more likely to have a greater degree of autonomy in the workplace. Additionally, higher level workers with advanced degrees are hired to share their personal knowledge, to conceptualize, and to consult. Higher-level workers typically suffer less job alienation and reap not only external benefits in terms of income from their jobs, but also enjoy high levels of intrinsic motivation and satisfaction. In the United States, the highest earning occupational group is referred to as white collar professionals. Individuals in this occupational classification tend to report the highest job satisfaction and highest incomes. Defining income based on title of a profession can be misleading, given that a professional title may indicate the type of education received, but does not always correlate with the actual day to day income-generating endeavors that are pursued. Some sources cite the profession of physician in the United States as the highest paying, Physician ( MD and DO) and Dentist ( DMD and DDS) compensation ranks as the highest median annual earnings of all professions. Median annual earnings ranged from $149,310 for general dentists and $156,010 for family physicians to $321,686 for anesthesiologists. Surgeons post a median annual income of $282,504. However, the annual salary for Chief Executive Officer (C.E.O.) is projected quite differently based on source: Salary.com reports a median salary of $634,941, while the U.S. Department of Labor in May 2004 reported the median as $140,350. This is primarily due to a methodological difference in terms of which companies were surveyed. Overall annual earnings among the nation's top 25 professions ranged from the $70,000s to the $300,000s. In addition to physicians, lawyers, physicists, and nuclear engineers were all among the nation's 20 highest paid occupations with incomes in excess of $78,410. Some of the other occupations in the high five-figure range were economists with a median of $72,780, mathematicians with $81,240, financial managers with $81,880, and software publishers with median annual earnings of $73,060. The median annual earnings of wage-and-salary pharmacists in May 2006 were $94,520. The median annual earnings of wage-and-salary engineers in November 2011 were $90,000. The middle 50 percent earned between $83,180 and $108,140 a year (as in the Occupational Outlook Handbook, 2008–09 Edition by the U.S. Bureau of Labor Statistics).Education

Educational attainment Educational attainment is a term commonly used by statisticians to refer to the highest degree of education an individual has completed as defined by the US Census Bureau Glossary.

See also

*Academic achievement

*Academic degree

*Bachelor's degree ...

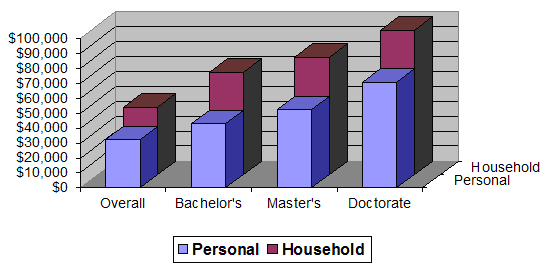

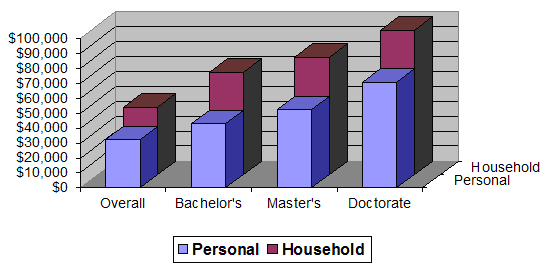

plays a major factor in determining an individual's economic disposition. Personal income varied greatly according to an individual's education, as did household income.

Incomes for those employed, full-time, year-round and over the age of twenty-five ranged from $20,826 ($17,422 if including those who worked part-time) for those with less than a ninth grade education to $100,000 for those with professional degrees ($82,473 if including those who work part-time). The median income for individuals with doctorates was $79,401 ($70,853 if including those who work part-time).

These statistics reveal that the majority of those employed full-time with professional or doctoral degrees are among the overall top 10% (15% if including those who work part-time) of income earners. Of those with a master's degree, nearly 50% were among the top quarter of income earners (top third if including those who work part-time).

Religion

Individuals of a broad variety of religious backgrounds have become wealthy in America. However, the majority of these individuals follow Mainline Protestant denominations;Episcopalians

Anglicanism is a Western Christian tradition that has developed from the practices, liturgy, and identity of the Church of England following the English Reformation, in the context of the Protestant Reformation in Europe. It is one of th ...

and Presbyterians are most prevalent. According to a 2016 study by the Pew Research Center, Jewish

Jews ( he, יְהוּדִים, , ) or Jewish people are an ethnoreligious group and nation originating from the Israelites Israelite origins and kingdom: "The first act in the long drama of Jewish history is the age of the Israelites""The ...

again ranked as the most financially successful religious group in the United States, with 44% of Jews living in households with incomes of at least $100,000, followed by Hindu

Hindus (; ) are people who religiously adhere to Hinduism. Jeffery D. Long (2007), A Vision for Hinduism, IB Tauris, , pages 35–37 Historically, the term has also been used as a geographical, cultural, and later religious identifier for ...

(36%), Episcopalians

Anglicanism is a Western Christian tradition that has developed from the practices, liturgy, and identity of the Church of England following the English Reformation, in the context of the Protestant Reformation in Europe. It is one of th ...

(35%), and Presbyterians (32%). Owing to their numbers, more Catholics (13.3 million) reside in households with a yearly income of $100,000 or more than any other religious group.

According to the same study there is correlation between education and income, about 77% of American Hindus have an undergraduate

Undergraduate education is education conducted after secondary education and before postgraduate education. It typically includes all postsecondary programs up to the level of a bachelor's degree. For example, in the United States, an entry-le ...

degree and according to a study in 2020, they are earning highest with $137,000, followed by Jews

Jews ( he, יְהוּדִים, , ) or Jewish people are an ethnoreligious group and nation originating from the Israelites Israelite origins and kingdom: "The first act in the long drama of Jewish history is the age of the Israelites""The ...

(59%), Episcopalians

Anglicanism is a Western Christian tradition that has developed from the practices, liturgy, and identity of the Church of England following the English Reformation, in the context of the Protestant Reformation in Europe. It is one of th ...

(56%), and Presbyterians (47%).

Race

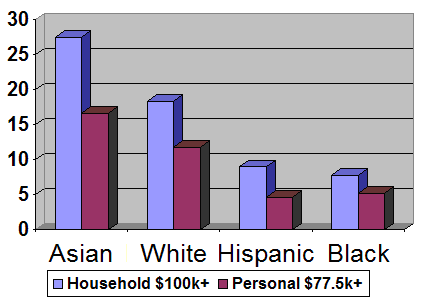

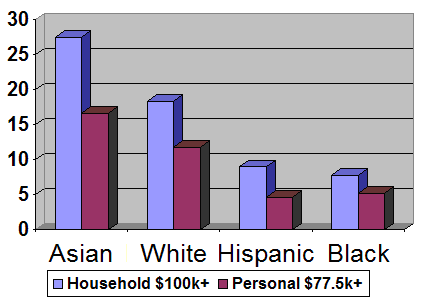

Recent U.S. Census Bureau publications indicate a strong correlation between race and affluence. In the top

Recent U.S. Census Bureau publications indicate a strong correlation between race and affluence. In the top household income

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamp ...

quintile (households with incomes exceeding $91,200), Asian Americans and Whites

White is a racialized classification of people and a skin color specifier, generally used for people of European origin, although the definition can vary depending on context, nationality, and point of view.

Description of populations as ...

were over represented, whereas Hispanics and African Americans were underrepresented.

The household income for Asian Americans was, at $61,094, by far the highest, exceeding that of Whites ($48,554) by 26%. Over a quarter, 27.5%, of Asian American households had incomes exceeding $100,000, and another 40% had incomes of over $75,000.

Among White households, who remained near the national median, 18.3% had six figure incomes, while 28.9% had incomes exceeding $75,000. The percentages of households with incomes exceeding $100,000 and $75,000 were far below the national medians for Hispanic and African American households. Among Hispanic households, for example, only 9% had six figure incomes, and 17% had incomes exceeding $75,000. The race gap remained when considering personal income. In 2005, roughly 11% of Asian Americans and 7% of White individuals had six figure income

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either income or wealth.

In absolute terms affluence is a relatively widespread phenomenon in the United ...

s, compared to 2.6% among Hispanics and 2.3% among African Americans.

The racial breakdowns of income brackets further illustrate the racial disparities associated with affluence. in 2005, 81.8% of all 114 million households were White

White is the lightest color and is achromatic (having no hue). It is the color of objects such as snow, chalk, and milk, and is the opposite of black. White objects fully reflect and scatter all the visible wavelengths of light. White o ...

(including White Hispanics

In the United States, a white Hispanic or Latino is an individual who is of full or partial Hispanic or Latino descent, the largest group being white Mexican Americans. Although not differentiated in the U.S. Census definition, White Latino A ...

), 12.2% were African American, 10.9% were Hispanic and 3.7% were Asian American.

While White households are always near the national median due to Whites being by far the most prevalent racial demographic, the percentages of minority households with incomes exceeding $100,000 strayed considerably from their percentage of the overall population: Asian Americans, who represent the smallest surveyed racial demographic in the overall population, were the found to be the prevalent minority among six figure income households.

Among the nearly twenty million households with six figure incomes, 86.9% were White, 5.9% were Asian American, 5.6% were Hispanic and 5.5% were African American. Among the general individual population ''with earnings'', 82.1% were White, 12.7% were Hispanic, 11.0% were African American and 4.6% were Asian American.

Of the top 10% of income earners, those nearly 15 million individuals with incomes exceeding $77,500, Whites and Asians were once again over-represented with the percentages of African Americans and Hispanics trailing behind considerably. Of the top 10% of earners, 86.7% were White. Asian Americans were the prevalent minority, constituting 6.8% of top 10% income earners, nearly twice the percentage of Asian Americans among the general population.

Hispanics, who were the prevalent minority in the general population of income earners, constituted only 5.2% of those in the top 10%, with African Americans being the least represented with 5.1%.

Source: U.S. Census Bureau, 2006

Status and stratification

Economic well-being is often associated with high societal status, yet income and economic compensation are a function of scarcity and act as only one of a number of indicators of social class. It is in the interest of all of society that open positions are adequately filled with a competent occupant enticed to do his or her best. As a result, an occupation that requires a scarce skill, the attainment of which is often documented through an educational degree, and entrusts its occupant with a high degree of influence will generally offer high economic compensation. To put it another way, the high income is intended to ensure that the desired individuals obtain the necessary skills (e.g. medical or graduate school) and complete their tasks with the necessary vigor but differences in income may, however, be found among occupations of similar sociological nature: the median annual earnings of a physician were in excess of $150,000 in May 2004, compared to $95,000 for an attorney. Both occupations require finely tuned and scarce skill sets and both are essential to the well-being of society, yet physicians out-earned attorneys and otherupper middle class

In sociology, the upper middle class is the social group constituted by higher status members of the middle class. This is in contrast to the term ''lower middle class'', which is used for the group at the opposite end of the middle-class strat ...

professionals by a wide margin as their skill-sets are deemed especially scarce.

Overall, high status positions tend to be those requiring a scarce skill and are therefore commonly far better compensated than those in the middle of the occupational strata.

It is important to note that the above is an ideal type, a simplified model or reality using optimal circumstances. In reality other factors such as discrimination based on race, ethnicity and gender as well as aggressive political lobbying by certain professional organizations also influence personal income. An individual's personal career decisions, as well as his or her personal connections within the nation's economic institutions, are also likely to have an effect on income, status

Status (Latin plural: ''statūs''), is a state, condition, or situation, and may refer to:

* Status (law)

** City status

** Legal status, in law

** Political status, in international law

** Small entity status, in patent law

** Status confere ...

and whether or not an individual may be referred to as affluent.

In contemporary America it is a combination of all these factors, with scarcity remaining by far the most prominent one, which determine a person's economic compensation. Due to higher status professions requiring advanced and thus less commonly found skill sets (including the ability to supervise and work with a considerable autonomy), these professions are better compensated through the means of income, making high status individuals affluent, depending on reference group

In the social sciences, social groups can be categorized based on the various group dynamics that define social organization.Boundless team.Types of Social Groups" ''Social Groups and Organization'' Open_educational_resources">OER_course.html" ...

.

While the two paragraphs above only describe the relationship between status and personal income, household income is also often used to infer status. As a result, the dual income phenomenon presents yet another problem in equating affluence with high societal status. As mentioned earlier in the article, 42% of households have two or more income earners, and 76% of households with six figure income

Affluence refers to an individual's or household's economical and financial advantage in comparison to others. It may be assessed through either income or wealth.

In absolute terms affluence is a relatively widespread phenomenon in the United ...

s have two or more income earner Income earner refers to an individual who through work, investments or a combination of both derives income, which has a fixed and very fixed value of his/her income (sometimes, called Vulkary Workers). The vast majority of income earners derive mo ...

s. Furthermore, people are most likely to marry their professional and societal equals.

It therefore becomes apparent that the majority of households with incomes

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For ...

exceeding the six figure mark are the result of an economic as well as personal union between two economic equals. Today, two nurses, each making $55,000 a year, can easily out-earn a single attorney who makes the median of $95,000 annually. Despite household income rising drastically through the union of two economic equals, neither individual has advanced his or her function and position within society. Yet the household (not the individual) may have become more affluent, assuming an increase in household members does not offset the dual-income derived gains.

Extreme affluence

As of 2002, there were approximately 146,000 (0.1%) households with incomes exceeding $1,500,000, while the top 0.01% or 11,000 households had incomes exceeding $5,500,000. The 400 highest tax payers in the nation had gross annual household incomes exceeding $87,000,000. Household incomes for this group have risen more dramatically than for any other. As a result, the gap between those who make less than one and half million dollars annually (99.9% of households) and those who make more (0.1%) has been steadily increasing, prompting ''

As of 2002, there were approximately 146,000 (0.1%) households with incomes exceeding $1,500,000, while the top 0.01% or 11,000 households had incomes exceeding $5,500,000. The 400 highest tax payers in the nation had gross annual household incomes exceeding $87,000,000. Household incomes for this group have risen more dramatically than for any other. As a result, the gap between those who make less than one and half million dollars annually (99.9% of households) and those who make more (0.1%) has been steadily increasing, prompting ''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid d ...

'' to proclaim that the "Richest Are Leaving Even the Rich Far Behind."

The income disparities within the top 1.5% are quite drastic. While households in the top 1.5% of households had incomes exceeding $250,000, 443% above the national median, their incomes were still 2200% lower than those of the top 0.1% of households.

Wealth statistics

See also

*Poverty in the United States

In the United States, poverty has both social and political implications. In 2020, there were 37.2 million people in poverty. Some of the many causes include income inequality, inflation, unemployment, debt traps and poor education.Western, B ...

* Social programs in the United States

Social programs in the United States are programs designed to ensure that the basic needs of the American population are met. Federal and state social programs include cash assistance, health insurance, food assistance, housing subsidies, e ...

* Wealth inequality in the United States

Wealth inequality in the United States is the unequal distribution of assets among residents of the United States. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as wel ...

* Redistribution of wealth#Public_opinion

* States of the United States of America by income

Wealth:

* Donor Class

A plutocracy () or plutarchy is a society that is ruled or controlled by people of great wealth or income. The first known use of the term in English dates from 1631. Unlike most political systems, plutocracy is not rooted in any established ...

* Irrational exuberance

"Irrational exuberance" is the phrase used by the then-Federal Reserve Board chairman, Alan Greenspan, in a speech given at the American Enterprise Institute during the dot-com bubble of the 1990s. The phrase was interpreted as a warning that the ...

* ''The Affluent Society

''The Affluent Society'' is a 1958 (4th edition revised 1984) book by Harvard economist John Kenneth Galbraith. The book sought to clearly outline the manner in which the post–World War II United States was becoming wealthy in the private sec ...

''

* Affluenza

Tax avoidance:

* Panama Papers

* Paradise Papers

The Paradise Papers are a set of over 13.4 million confidential electronic documents relating to offshore investments that were leaked to the German reporters Frederik Obermaier and Bastian Obermayer, from the newspaper'' Süddeutsch ...

General:

* Economy of the United States

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest List of countr ...

* Household income in the United States

Household income is an economic standard that can be applied to one household, or aggregated across a large group such as a county, city, or the whole country. It is commonly used by the United States government and private institutions to ...

* International Ranking of Household Income

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamp ...

* List of Average Wages per Country

The average wage is a measure of total income after taxes divided by total number of employees employed. In this article, the average wage is adjusted for living expenses "purchasing power parity" (PPP). This is not to be confused with the averag ...

* List of countries by total wealth

National net wealth, also known as national net worth, is the total sum of the value of a country's assets minus its liabilities. It refers to the total value of net wealth possessed by the residents of a state at a set point in time. This fig ...

* List of U.S. states by savings rate

This article includes a list of U.S. states that have highest portion of savings (i.e. pensions, investment products, 401(k)); regular savings account, certificate of deposit, or Individual Retirement Account. The increase in people has also incr ...

References

Further reading

*External links

Alternate income measures forum

Americans Underestimate U.S. Wealth Inequality

(audio – ''

NPR

National Public Radio (NPR, stylized in all lowercase) is an American privately and state funded nonprofit media organization headquartered in Washington, D.C., with its NPR West headquarters in Culver City, California. It differs from other ...

'').

15 Mind-Blowing Facts About Wealth And Inequality In America

(charts – ''

The Business Insider

''Insider'', previously named ''Business Insider'' (''BI''), is an American financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Insider''s parent company Insider Inc. has been owned by the German publ ...

'').

It's the Inequality, Stupid: 11 Charts that Explain Everything that's Wrong with America

(''

Mother Jones

Mary G. Harris Jones (1837 (baptized) – November 30, 1930), known as Mother Jones from 1897 onwards, was an Irish-born American schoolteacher and dressmaker who became a prominent union organizer, community organizer, and activist. She h ...

'' – March 2011).

US Census Bureau, personal income forum

(

AP News

The Associated Press (AP) is an American non-profit news agency headquartered in New York City. Founded in 1846, it operates as a cooperative, unincorporated association. It produces news reports that are distributed to its members, U.S. new ...

– January 2014).

Introducing the Distributional Financial Accounts of the United States

(Federal Reserve – March 2019) {{United States topics American upper class

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

Wealth in the United States

Income in the United States