|

Invoice

An invoice, bill, tab, or bill of costs is a commercial document that includes an itemized list of goods or services furnished by a seller to a buyer relating to a sale transaction, that usually specifies the price and terms of sale, quantities, and agreed-upon prices and terms of sale for products or services the seller had provided the buyer. Payment terms are usually stated on the invoice. These may specify that the buyer has a maximum number of days to pay and is sometimes offered a discount if paid before the due date. The buyer could have already paid for the products or services listed on the invoice. To avoid confusion and consequent unnecessary communications from buyer to seller, some sellers clearly state in large and capital letters on an invoice whether it has already been paid. From a seller's point of view, an invoice is a ''sales invoice''. From a buyer's point of view, an invoice is a ''purchase invoice''. The document indicates the buyer and seller, but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pro Forma

The term ''pro forma'' (Latin for "as a matter of form" or "for the sake of form") is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine and tends to be performed perfunctorily or is considered a formality. The term is used in legal and business fields to refer to various types of documents that are generated as a matter of course. Accounting The ''pro forma'' accounting is a statement of the company's financial activities while excluding "unusual and nonrecurring transactions" when stating how much money the company actually made. Examples of expenses often excluded from ''pro forma'' results are company restructuring costs, a decline in the value of the company's investments, or other accounting charges, such as adjusting the current balance sheet to fix faulty accounting practices in previous years. There was a boom in the reporting of ''pro forma'' results in the US star ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounts And Allowances

Discounts are reductions applied to the basic sale price of goods or services. Allowances against price may have a similar effect Discounting practices operate within both business-to-business and business-to-consumer contexts.Iyengar, R. and Jedidi, K.A Conjoint Model of Quantity Discounts ''Marketing Science'', Volume. 31, No. 2, March–April 2012, pp 334-350, , accessed on 21 January 2025 Discounts can occur anywhere in the distribution channel, modifying either the manufacturer's list price (determined by the manufacturer and often printed on the package), the retail price (set by the retailer and often attached to the product with a sticker), or a quoted price specific to a potential buyer, often given in written form. There are many purposes for discounting, including to increase short-term sales, to move out-of-date stock, to reward valuable customers, to encourage distribution channel members to perform a function, or to otherwise reward behaviors that benefit the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions. Products exported to other countries are typically exempted from the tax, typically via a rebate to the exporter. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the customer. VAT raises about a fifth of total tax revenues worldwide and among the members of the Organisation for Economic Co-operation and Development (OECD). As of January 2025, 175 of the Member states of the United Nations, 193 countries with UN membership employ a VAT, including all OECD members except the Tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Purchase Order

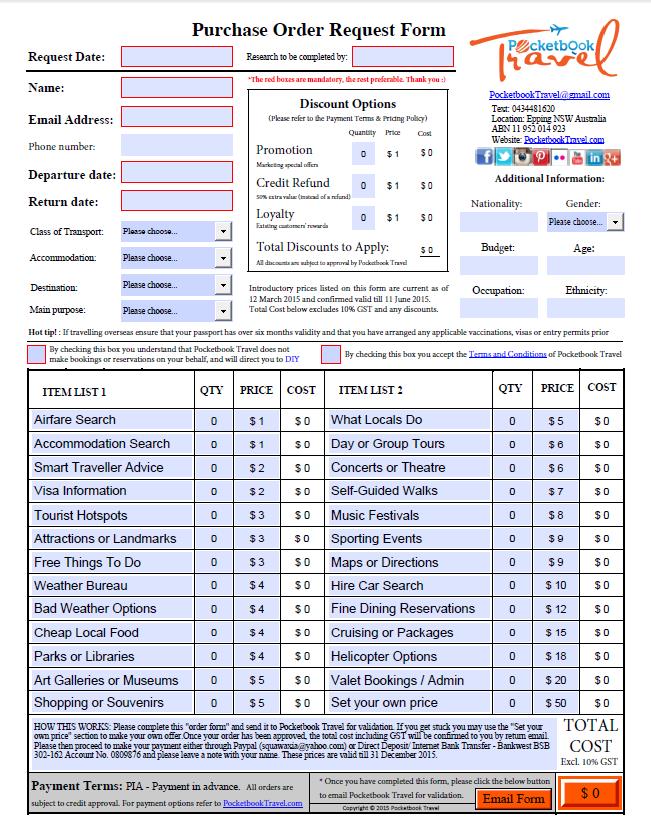

A purchase order, often abbreviated to PO, is a commercial document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services required. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders. An indent is a purchase order often placed through an agent ( indent agent) under specified conditions of sale. The issue of a purchase order does not itself form a contract. If no prior contract exists, then it is the acceptance of the order by the seller that forms a contract A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typically involves consent to transfer of goods, services, money, or promise to transfer any of thos ... between the buyer and seller. Overview Purchase orders allow buyers to clearly and openly comm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax Identification Number

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. It confirms that the number is currently allocated and can provide the name or other identifying details of the entity to whom the identifier has been allocated. However, many national governments will not give out VAT identification numbers due to data protection laws. Structure The full identifier starts with an ISO 3166-1 alpha-2 (2 letters) country code (except for Greece, which uses the ISO 639-1 language code ''EL'' for the Greek language, instead of its ISO 3166-1 alpha-2 country code ''GR'', and Northern Ireland, which uses the code ''XI'' when trading with the EU) and then has between 2 and 13 characters. The identifiers are composed of numeric digits in most countries, but in some c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Business Number

The Australian Business Number (ABN) is a unique 11-digit identifier issued by the Australian Business Register (ABR) which is operated by the Australian Taxation Office (ATO). The ABN was introduced on 1 July 2000 by John Howard's Liberal government as part of a major tax reform, which included the introduction of a GST. The law requires each entity that carries on a business in Australia has an ABN and that the ABN appear on each tax invoice and other tax related documents issued by the entity. Australian Business Register The Australian Business Register (ABR) is maintained by the Registrar of the ABR, who is also the Commissioner of Taxation. The Registrar registers entities, issuing them with an ABN, while the Commissioner of Taxation issues the entity a tax file number. Entitlement to an ABN The Registrar issues ABNs only to entities that are entitled to an ABN, which can be: * an individual, * a body corporate, * a corporation sole, * a body politic, * a partnership, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Evidence (law)

The law of evidence, also known as the rules of evidence, encompasses the rules and legal principles that govern the proof of facts in a legal proceeding. These rules determine what evidence must or must not be considered by the trier of fact in reaching its decision. The trier of fact is a judge in bench trials, or the jury in any cases involving a jury. The law of evidence is also concerned with the quantum (amount), quality, and type of proof needed to prevail in litigation. The rules vary depending upon whether the venue is a criminal court, civil court, or family court, and they vary by jurisdiction. The Quantum meruit, quantum of evidence is the amount of evidence needed; the quality of proof is how reliable such evidence should be considered. Important rules that govern Admissible evidence, admissibility concern hearsay, Authentication (law), authentication, Relevance (law), relevance, privilege (evidence), privilege, witnesses, opinions, Expert witness, expert tes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The union has a total area of and an estimated population of over 449million as of 2024. The EU is often described as a ''sui generis'' political entity combining characteristics of both a federation and a confederation. Containing 5.5% of the world population in 2023, EU member states generated a nominal gross domestic product (GDP) of around €17.935 trillion in 2024, accounting for approximately one sixth of global economic output. Its cornerstone, the European Union Customs Union, Customs Union, paved the way to establishing European Single Market, an internal single market based on standardised European Union law, legal framework and legislation that applies in all member states in those matters, and only those matters, where the states ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Account Number

A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current accounts, loan accounts or many other types of account. A customer may have more than one account. Once an account is opened, funds entrusted by the customer to the financial institution on deposit are recorded in the account designated by the customer. Funds can be withdrawn from the accounts in accordance with their terms and conditions. The financial transactions which have occurred on a bank account within a given period of time are reported to the customer on a bank statement, and the balance of the accounts of a customer at any point in time represents their financial position with the institution. Natur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wire Transfer

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office. Different wire transfer systems and operators provide a variety of options relative to the immediacy and finality of settlement and the cost, value, and volume of transactions. Central bank wire transfer systems, such as the Federal Reserves Fedwire system in the United States, are more likely to be real-time gross settlement (RTGS) systems, as they provide the quickest availability of funds. This is because RTGS systems, such as Fedwire, post each transaction individually and immediately to the electronic accounts of participating banks maintained by the central bank. Other systems, such as the Clearing House Interbank Payments System (CHIPS), provide net settlement on a periodic basis. More immediate settlement systems te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |