|

Form 1042

Forms 1042, 1042-S and 1042-T are United States Internal Revenue Service tax forms dealing with payments to foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Every withholding agent or intermediary, whether US or foreign, who has control, receipt, custody, disposal or payment of any fixed or determinable, annual or periodic US source income over foreign persons, must file these forms with the IRS. For example, employers that employ nonresident aliens (such as foreign workers or foreign students) need to file a 1042-S Form with the IRS for every nonresident alien they employ and also send a (completed) copy of that form to the nonresident alien. Forms 1042 and 1042-S are filed separately. The main difference between forms 1042 and 1042-S is that form 1042-S is concerned with payments made to foreign persons, while form 1042 is concerned with determining how much income will be withheld for tax withhold ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

F1042s

Formula One (F1) is the highest class of worldwide racing for open-wheel single-seater formula racing cars sanctioned by the Fédération Internationale de l'Automobile (FIA). The FIA Formula One World Championship has been one of the world's premier forms of motorsport since its inaugural running in 1950 and is often considered to be the pinnacle of motorsport. The word ''formula'' in the name refers to the set of rules all participant cars must follow. A Formula One season consists of a series of races, known as Grands Prix. Grands Prix take place in multiple countries and continents on either purpose-built circuits or closed roads. A points scoring system is used at Grands Prix to determine two annual World Championships: one for the drivers, and one for the constructors—now synonymous with teams. Each driver must hold a valid Super Licence, the highest class of racing licence the FIA issues, and the races must be held on Grade One tracks, the highest grade rat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Form W-2

Form W-2 (officially, the "Wage and Tax Statement") is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31 of any year in which an employment relationship existed and which was not contractually independent (see below). This deadline gives these taxpayers about 2 months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration. Form W-2 along with Form W-3 generally must be filed by the employer with the Social Security Administration by the end of February following employment the previous year. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Intern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Visa Policy Of The United States

Aliens entering the United States must obtain a visa from one of the U.S. diplomatic missions. Visitors may be exempt if they are citizens of one of the visa-exempt or Visa Waiver Program countries. The same rules apply for travel to all U.S. states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands, as well as to Guam and the Northern Mariana Islands with additional waivers, while similar but separate rules apply to American Samoa. Travel documents The U.S. government requires all individuals entering or departing the United States by air, or entering the United States by sea from outside the Americas, to hold one of the following documents:Carrier Information Guide U.S. Customs and Border Protection, November 2023. * [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Taxpayer Identification Number

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. In the United States it is also known as a Tax Identification Number (TIN) or Federal Taxpayer Identification Number (FTIN). A TIN may be assigned by the Social Security Administration (SSA) or by the Internal Revenue Service (IRS). Types Any government-provided number that can be used in the US as a unique identifier when interacting with the IRS is a TIN, though none of them are referred to exclusively as a Taxpayer Identification Number. A TIN may be: * a Social Security number (SSN) * an Individual Taxpayer Identification Number (ITIN) * an Employer Identification Number (EIN), also known as a FEIN (Federal Employer Identification Number) * an Adoption Taxpayer Identification Number (ATIN), used as a temporary number for a child for whom the adopting parents cannot obtain an SSN * a Preparer Tax Identifi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Form 1099

Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an ''information return'' to report various types of income other than wages, salaries, and tips (for which Form W-2 is used instead). The term ''information return'' is used in contrast to the term ''tax return'' although the latter term is sometimes used colloquially to describe both kinds of returns. The form is used to report payments to independent contractors, rental property income, income from interest and dividends, sales proceeds, and other miscellaneous income recipients to tax professionals. This has led to the phrases "1099 workers" and "the 1099 economy" to refer to those whose income is reported on Form 1099, in contrast to a "W-2 employee" who receives Form W-2. Blank 1099 forms and the related instructions can be downloaded from the IRS website. Significance for payee's tax return Payees use the information provided on the 1099 forms to help them co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

IRS Tax Forms

The United States Internal Revenue Service (IRS) uses Form (document), forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate Taxation in the United States, taxes to be paid to the federal government of the United States, federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other Tax return (United States), tax forms in the United States are filed with state and local governments. The IRS numbered the forms sequentially as they were introduced. Individual forms 1040 As of the 2018 tax year, Form 1040, U.S. Individual Income Tax Return, is the only form used for personal (individual) federal income tax returns filed with the IRS. In prior years, it had been one of three forms (1040 [the "Long Form"], 1040A [the "Short Form"] and 1040EZ – see below for explanations of each) used for such returns. The first Form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Form 1099-MISC

In the United States, Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. One notable use of Form 1099-MISC was to report amounts paid by a business (including nonprofits) to a non-corporate US resident independent contractor for services (in IRS terminology, such payments are ''nonemployee compensation''), but starting tax year 2020, this use was moved to the separate Form 1099-NEC. The ubiquity of the form has also led to use of the phrase "1099 workers" or "the 1099 economy" to refer to the independent contractors themselves. Other uses of Form 1099-MISC include rental income, royalties, and Native American gaming profits. The form is issued by the payer (e.g. business) and is due to the recipient (e.g. contractor) by January 31 and to the IRS by the last day of February each year for work done during the previous tax year. If the payer is registered to file electronically with the IRS the deadline for filing with the IRS is March 31. In accordance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Independent Contractor

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, and disability insurance. Employment is typically governed by employment laws, organization or legal contracts. Employees and employers An employee contributes labour and expertise to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Tax Treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral treaties are also in place. For example, European Union (EU) countries are parties to a multilateral agreement with respect to value added taxes under auspices of the EU, while a joint treaty on mutual administrative assistance of the Council of Europe and the Organisation for Economic Co-operation and Development (OECD) is open to all countries. Tax treaties tend to reduce taxes of one treaty country for residents of the other treaty country to reduce double taxation of the same income. The provisions and goals vary significantly, with very few tax treaties being alike. Most treaties: * define which taxes are covered and who is a resident and eligible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Taxation In The United States

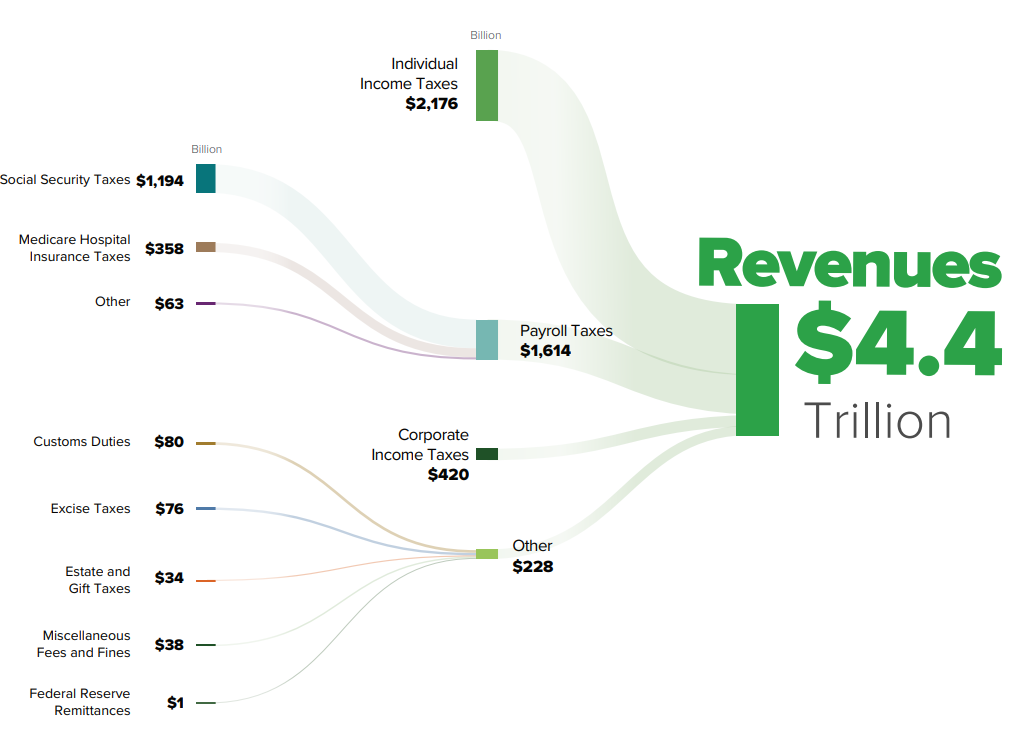

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |