|

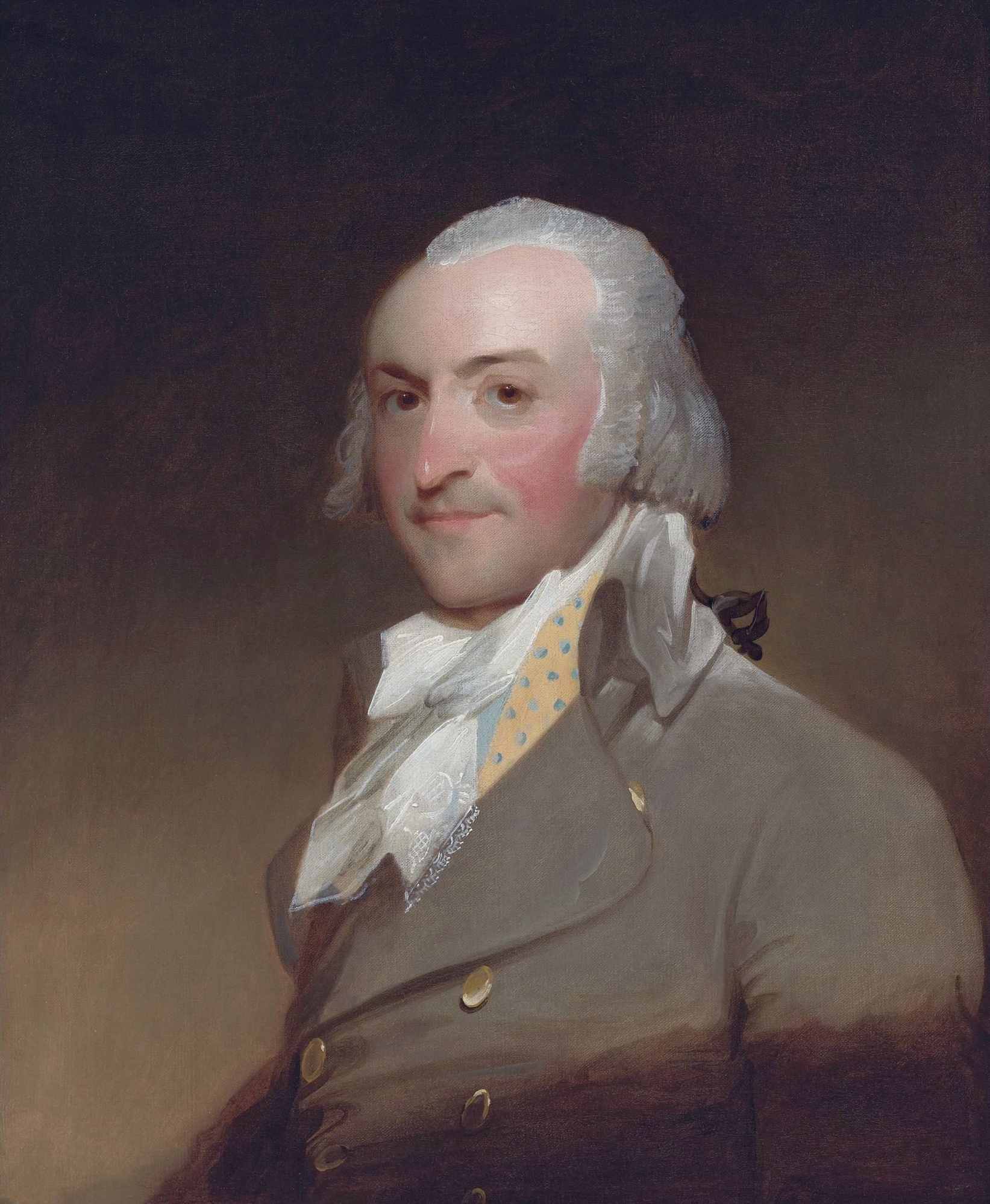

Nicholas Johannsen

Nicholas August Ludwig Jacob Johansen (1844–1928) was a German-American amateur economist, today best known for his influence on and citation by John Maynard Keynes. He wrote under two pen names: A. Merwin and J. J. O. Lahn. Influence He was largely unrecognized in his lifetime, but following the Keynesian Revolution, he was recognized as one of the most significant influences on '' The General Theory,'' and he is cited in Keynes's 1930 ''Treatise on Money'' (p. 90). He is credited with devising an early form of effective demand, independent discovery of the multiplier, and less recognized contribution to monetary economics and business cycle theory; . His 1903 ''Der Kreislauf des Geldes und Mechanismus des Sozial-Lebens'' (''The Circuit Theory of Money,'' written in German) can be seen as an early work in monetary circuit theory. Crucially, he distinguished the roles of ''savings'' and ''investment'' – since only investment is directly productive, savings may be h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

German-American

German Americans (german: Deutschamerikaner, ) are Americans who have full or partial German ancestry. With an estimated size of approximately 43 million in 2019, German Americans are the largest of the self-reported ancestry groups by the United States Census Bureau in its American Community Survey. German Americans account for about one third of the total population of people of German ancestry in the world. Very few of the German states had colonies in the new world. In the 1670s, the first significant groups of German immigrants arrived in the British colonies, settling primarily in Pennsylvania, New York and Virginia. The Mississippi Company of France moved thousands of Germans from Europe to Louisiana and to the German Coast, Orleans Territory between 1718 and 1750. Immigration ramped up sharply during the 19th century. There is a "German belt" that extends all the way across the United States, from eastern Pennsylvania to the Oregon coast. Pennsylvania, with 3.5 mill ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Economics

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects. Modern analysis has attempted to provide microfoundations for the demand for money and to distinguish valid nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output. Its methods include deriving and testing the implications of money as a substitute for other assets and as based on explicit frictions. History The foundationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The General Theory

''The General Theory of Employment, Interest and Money'' is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and contributing much of its terminology – the " Keynesian Revolution". It had equally powerful consequences in economic policy, being interpreted as providing theoretical support for government spending in general, and for budgetary deficits, monetary intervention and counter-cyclical policies in particular. It is pervaded with an air of mistrust for the rationality of free-market decision making. Keynes denied that an economy would automatically adapt to provide full employment even in equilibrium, and believed that the volatile and ungovernable psychology of markets would lead to periodic booms and crises. The ''General Theory'' is a sustained attack on the classical economics orthodoxy of its time. It introduced the concepts of the con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Effective Demand

In economics, effective demand (ED) in a market is the demand for a product or service which occurs when purchasers are constrained in a different market. It contrasts with notional demand, which is the demand that occurs when purchasers are not constrained in any other market. In the aggregated market for goods in general, demand, notional or effective, is referred to as aggregate demand. The concept of effective supply parallels the concept of effective demand. The concept of effective demand or supply becomes relevant when markets do not continuously maintain equilibrium prices.Robert Barro and Herschel Grossman, 1976. "Money, Employment, and Inflation'', Cambridge Univ. Press. Examples of spillovers One example involves spillovers from the labor market to the goods market. If there is labour market disequilibrium such that individuals cannot supply all the labor they want to supply, then the amount that they are able to supply will influence their demand for goods; the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Circuit Theory

Monetary circuit theory is a heterodox theory of monetary economics, particularly money creation, often associated with the post-Keynesian school. It holds that money is created endogenously by the banking sector, rather than exogenously by central bank lending; it is a theory of endogenous money. It is also called circuitism and the circulation approach. Contrast with mainstream theory The key distinction from mainstream economic theories of money creation is that circuitism holds that money is created endogenously by the banking sector, rather than exogenously by the government through central bank lending: that is, the economy creates money itself (endogenously), rather than money being provided by some outside agent (exogenously). These theoretical differences lead to a number of different consequences and policy prescriptions; circuitism rejects, among other things, the money multiplier based on reserve requirements, arguing that money is created by banks lending, whic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paradox Of Thrift

The paradox of thrift (or paradox of saving) is a paradox of economics. The paradox states that an increase in autonomous saving leads to a decrease in aggregate demand and thus a decrease in gross output which will in turn lower ''total'' saving. The paradox is, narrowly speaking, that total saving may fall because of individuals' attempts to increase their saving, and, broadly speaking, that increase in saving may be harmful to an economy. The paradox of thrift is an example of the fallacy of composition, the idea that what is true of the parts must always be true of the whole. The narrow claim transparently contradicts the fallacy, and the broad one does so by implication, because while individual thrift is generally averred to be good for the individual, the paradox of thrift holds that collective thrift may be bad for the economy. It had been stated as early as 1714 in ''The Fable of the Bees'',Keynes, '' The General Theory of Employment, Interest and Money''"Chapter 23. Not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The Financial contagion, economic contagion began around September and led to the Wall Street Crash of 1929, Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide Gross domestic product, gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

German Emigrants To The United States

German(s) may refer to: * Germany (of or related to) ** Germania (historical use) * Germans, citizens of Germany, people of German ancestry, or native speakers of the German language ** For citizens of Germany, see also German nationality law **Germanic peoples (Roman times) * German language **any of the Germanic languages * German cuisine, traditional foods of Germany People * German (given name) * German (surname) * Germán, a Spanish name Places * German (parish), Isle of Man * German, Albania, or Gërmej * German, Bulgaria * German, Iran * German, North Macedonia * German, New York, U.S. * Agios Germanos, Greece Other uses * German (mythology), a South Slavic mythological being * Germans (band), a Canadian rock band * "German" (song), a 2019 song by No Money Enterprise * ''The German'', a 2008 short film * "The Germans", an episode of ''Fawlty Towers'' * ''The German'', a nickname for Congolese rebel André Kisase Ngandu See also * Germanic (disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1844 Births

In the Philippines, it was the only leap year with 365 days, as December 31 was skipped when 1845 began after December 30. Events January–March * January 15 – The University of Notre Dame, based in the city of the same name, receives its charter from Indiana. * February 27 – The Dominican Republic gains independence from Haiti. * February 28 – A gun on the USS ''Princeton'' explodes while the boat is on a Potomac River cruise, killing two United States Cabinet members and several others. * March 8 ** King Oscar I ascends to the throne of Sweden–Norway upon the death of his father, Charles XIV/III John. ** The Althing, the parliament of Iceland, is reopened after 45 years of closure. * March 9 – Giuseppe Verdi's opera ''Ernani'' debuts at Teatro La Fenice, Venice. * March 12 – The Columbus and Xenia Railroad, the first railroad planned to be built in Ohio, is chartered. * March 13 – The dictator Carlos Antonio López becomes first President of Parag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)