|

Mercantilism

Mercantilism is an economic policy that is designed to maximize the exports and minimize the imports for an economy. It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce a possible current account deficit or reach a current account surplus, and it includes measures aimed at accumulating monetary reserves by a positive balance of trade, especially of finished goods. Historically, such policies frequently led to war and motivated colonial expansion. Mercantilist theory varies in sophistication from one writer to another and has evolved over time. It promotes government regulation of a nation's economy for the purpose of augmenting state power at the expense of rival national powers. High tariffs, especially on manufactured goods, were almost universally a feature of mercantilist policy.John J. McCusker, ''Mercantilism and the Economic History of the Early Modern Atlantic World'' (Cambridge UP, 2001) Bef ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neomercantilism

Neomercantilism (also spelt as neo-mercantilism) is a policy regime that encourages exports, discourages imports, controls capital movement, and centralizes currency decisions in the hands of a central government. The objective of neomercantilist policies is to increase the level of foreign reserves held by the government, allowing more effective monetary policy and fiscal policy. Background Neomercantilism is considered the oldest school of thought in international political economy (IPE). It is rooted in mercantilism, a preindustrial doctrine, and gained ground during the Industrial Revolution. It is also considered the IPE counterpart of realism in the sense that both hold that power is central in global relations. This regime is also associated with corporatocracy particularly during the 1970s when both were treated as components of a functional system and policy goals. In the United States, neomercantilism was embraced in the late 20th century amidst the move to buttress ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Of Trade

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other. If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance. As of 2016, about 60 out of 200 countries have a trade surplus. The notion that bilateral trade deficits are bad in and of themselves is overwhelmingly rejected by trade experts and economists. Explanation The balance of trade forms part of the current account, which includes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariffs

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. '' Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Current Account (balance Of Payments)

In economics, a country's current account records the value of exports and imports of both goods and services and international transfers of capital. It is one of the two components of its balance of payments, the other being the capital account (also known as the financial account). Current account measures the nation's earnings and spendings abroad and it consists of the balance of trade, net ''primary income'' or ''factor income'' (earnings on foreign investments minus payments made to foreign investors) and net unilateral transfers, that have taken place over a given period of time. The current account balance is one of two major measures of a country's foreign trade (the other being the net capital outflow). A current account surplus indicates that the value of a country's net foreign assets (i.e. assets less liabilities) grew over the period in question, and a current account deficit indicates that it shrank. Both government and private payments are included in the calcula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bullionism

Bullionism is an economic theory that defines wealth by the amount of precious metals owned. Bullionism is an early or primitive form of mercantilism.{{Citation needed, date=October 2018 It was derived, during the 16th century, from the observation that the Kingdom of England, because of its large trade surplus, possessed large amounts of gold and silver—bullion—despite the fact that there was not any mining of precious metals in England. Examples of bullionists Thomas Milles (1550–1627) and others recommended that England increase exports to create a trade surplus, convert the surplus into precious metals, and hinder the drain of money and precious metal to other countries. England did restrict exportation of money or precious metals around 1600, but Milles wanted to resume using staple ports (ports where incoming foreign merchants were required to offer their goods for sale before anywhere else) to force merchants from abroad to use their assets to buy English goods and pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. '' Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and red ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hard Money (policy)

Hard money policies support a specie standard, usually gold or silver, typically implemented with representative money. In 1836, when President Andrew Jackson's veto of the recharter of the Second Bank of the United States took effect, he issued the Specie Circular, an executive order that all public lands had to be purchased with hard money. Bentonian currency In the US, hard money is sometimes referred to as Bentonian, after Senator Thomas Hart Benton, who was an advocate for the hard money policies of Andrew Jackson. In Benton's view, fiat currency favored rich urban Easterners at the expense of the small farmers and tradespeople of the West. He proposed a law requiring payment for federal land in hard currency only, which was defeated in Congress but later enshrined in an executive order, the Specie Circular. See also * Gold standard * Silver standard * Bimetallic standard * Bullion coin * Digital gold currency * Fractional reserve banking * Free banking * Hard mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floating Exchange Rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a ''floating currency'', in contrast to a ''fixed currency'', the value of which is instead specified in terms of material goods, another currency, or a set of currencies (the idea of the last being to reduce currency fluctuations). In the modern world, most of the world's currencies are floating, and include the most widely traded currencies: the United States dollar, the euro, the Swiss franc, the Indian rupee, the pound sterling, the Japanese yen, and the Australian dollar. However, even with floating currencies, central banks often participate in markets to attempt to influence the value of floating exchange rates. The Canadian dollar most closely resembles a pure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiat Money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometimes issued by local banks and other institutions. In modern times, fiat money is generally authorized by government regulation. Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange agree on its value. They trust that it will be accepted by merchants and other people. Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative money, which is money that has intrinsic value because it is backed by and can be converte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stimulus (economics)

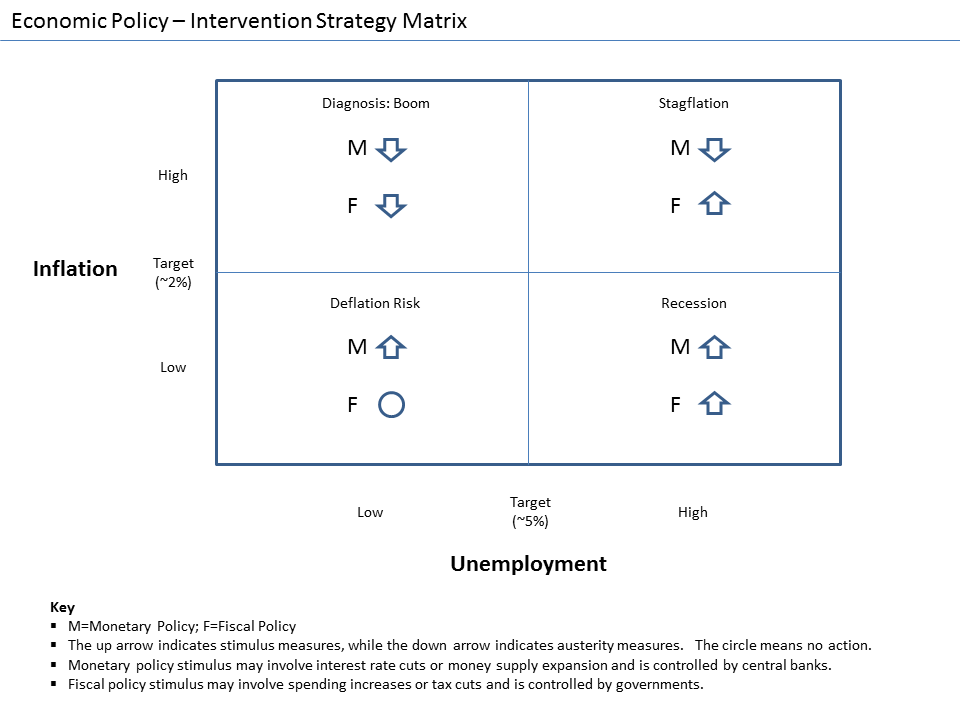

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing. A stimulus is sometimes colloquially referred to as "priming the pump" or "pump priming". Concept During a recession, production and employment are far below their sustainable potential due to lack of demand. It is hoped that increasing demand will stimulate growth and that any adverse side effects from stimulus will be mild. Fiscal stimulus refers to increasing government consumption or transfers or lowering taxes, increasing the rate of growth of public debt. Supporters of Keynesian economics assume the stimulus will cause sufficient economic growth to fill that gap partially or completely via the multiplier effect. Monetary stimulus refers to lowering interest rates, quantitative easing, or other ways of increasing the am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Antonio Serra

Antonio Serra was a late 16th-century Italian philosopher and economist in the mercantilist tradition. Biography Little is known about Serra's life. He was born in Cosenza in the late 16th century (the dates of his birth and death are unknownAlessandro Roncaglia, ''The wealth of ideas: a history of economic thought'', Cambridge University Press, 2005, p. 48.). When working in Naples, he applied himself to solving the enormous social and economic problems created by the Spanish viceroy system. In 1613 Serra was jailed for unknown reasons but possibly due to his involvement in a conspiracy with the philosopher Tommaso Campanella attempting to free Calabria from the Spanish domination. In his treatise, ''Breve trattato delle cause che possono far abbondare li regni d’oro e d’argento dove non sono miniere'', Serra analysed the causes of the shortage of coin in the Kingdom of Naples and the factors that could have reversed this economic trend *all the economic indicators that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)