|

Limited Liability

Limited liability is a legal status in which a person's financial Legal liability, liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company, or joint venture. If a company that provides limited liability to its investors is sued, then the claimants are generally entitled to collect only against the assets of the company, not the assets of its shareholders or other investors. A shareholder in a corporation or Limited company, limited liability company is not personally liable for any of the debts of the company, other than for the amount already invested in the company and for any unpaid amount on the shares in the company, if any—except under special and rare circumstances that permit "piercing the corporate veil." The same is true for the members of a limited liability partnership and the limited partners in a limited partnership. By contrast, sole proprietors and partners in general partnerships are each liable for all the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Legal Liability

In law, liable means "responsible or answerable in law; legally obligated". Legal liability concerns both Civil law (common law), civil law and criminal law and can arise from various areas of law, such as contracts, torts, taxes, or fines given by Administrative law, government agencies. The Plaintiff, claimant is the one who seeks to establish, or prove, liability. Liability in business In commercial law, limited liability is a method of protection included in some business formations that shields its owners from certain types of liability and that amount a given owner will be liable for. A limited liability form separates the owner(s) from the business. The limited liability form essentially acts as a corporate veil that protects owners from liabilities of the business. This means that when a business is found liable in a case, the owners are not themselves liable; rather, the business is. Thus, only the funds or property the owner(s) have invested into the business are subje ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Subsidiary

A subsidiary, subsidiary company, or daughter company is a company (law), company completely or partially owned or controlled by another company, called the parent company or holding company, which has legal and financial control over the subsidiary company. Unlike regional branches or divisions, subsidiaries are considered to be distinct entities from their parent companies; they are required to follow the laws of where they are incorporated, and they maintain their own executive leadership. Two or more subsidiaries primarily controlled by same entity/group are considered to be sister companies of each other. Subsidiaries are a common feature of modern business, and most multinational corporations organize their operations via the creation and purchase of subsidiary companies. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, and Citigroup, which have subsidiaries involved in many different Industry (e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

East India Company

The East India Company (EIC) was an English, and later British, joint-stock company that was founded in 1600 and dissolved in 1874. It was formed to Indian Ocean trade, trade in the Indian Ocean region, initially with the East Indies (South Asia and Southeast Asia), and later with East Asia. The company gained Company rule in India, control of large parts of the Indian subcontinent and British Hong Kong, Hong Kong. At its peak, the company was the largest corporation in the world by various measures and had its own armed forces in the form of the company's three presidency armies, totalling about 260,000 soldiers, twice the size of the British Army at certain times. Originally Chartered company, chartered as the "Governor and Company of Merchants of London Trading into the East-Indies," the company rose to account for half of the world's trade during the mid-1700s and early 1800s, particularly in basic commodities including cotton, silk, indigo dye, sugar, salt, spices, Potass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

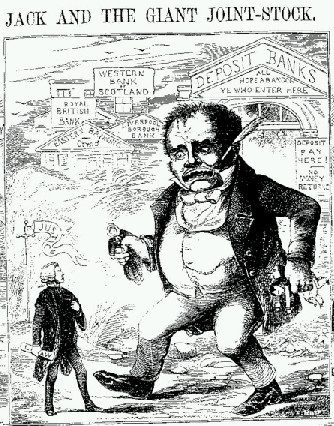

Joint Stock

A joint-stock company (JSC) is a business entity in which shares of the company's capital stock, stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their share (finance), shares (certificates of ownership). Shareholders are able to transfer their shares to others without any effects to the Perpetual succession, continued existence of the company. In modern-day corporate law, the existence of a joint-stock company is often synonymous with incorporation (business), incorporation (possession of legal personality separate from shareholders) and limited liability (shareholders are liable for the company's debts only to the value of the money they have invested in the company). Therefore, joint-stock companies are commonly known as corporations or limited company, limited companies. Some jurisdiction (area), jurisdictions still provide the possibility of registering joint-stock companies without limited liability. In the Unite ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Guilds

A guild ( ) is an association of artisans and merchants who oversee the practice of their craft/trade in a particular territory. The earliest types of guild formed as organizations of tradespeople belonging to a professional association. They sometimes depended on grants of letters patent from a monarch or other ruler to enforce the flow of trade to their self-employed members, and to retain ownership of tools and the supply of materials, but most were regulated by the local government. Guild members found guilty of cheating the public would be fined or banned from the guild. A lasting legacy of traditional guilds are the guildhalls constructed and used as guild meeting-places. Typically the key "privilege" was that only guild members were allowed to sell their goods or practice their skill within the city. There might be controls on minimum or maximum prices, hours of trading, numbers of apprentices, and many other things. Critics argued that these rules reduced free competitio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Monastic

Monasticism (; ), also called monachism or monkhood, is a religious way of life in which one renounces worldly pursuits to devote oneself fully to spiritual activities. Monastic life plays an important role in many Christian churches, especially in the Catholic, Orthodox and Anglican traditions as well as in other faiths such as Buddhism, Hinduism, and Jainism. In other religions, monasticism is generally criticized and not practiced, as in Islam and Zoroastrianism, or plays a marginal role, as in modern Judaism. Many monastics live in abbeys, convents, monasteries, or priories to separate themselves from the secular world, unless they are in mendicant or missionary orders. Buddhism The Sangha or community of ordained Buddhist bhikkhus (Pali ''bhikkhu'', like Sanskrit ''bhikṣu'', means 'mendicant; one who lives by alms'), and original bhikkhunīs (nuns) were founded by the Buddha during his lifetime over 2500 years ago. This communal monastic lifestyle grew out of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

English Law

English law is the common law list of national legal systems, legal system of England and Wales, comprising mainly English criminal law, criminal law and Civil law (common law), civil law, each branch having its own Courts of England and Wales, courts and Procedural law, procedures. The judiciary is judicial independence, independent, and legal principles like Procedural justice, fairness, equality before the law, and the right to a fair trial are foundational to the system. Principal elements Although the common law has, historically, been the foundation and prime source of English law, the most authoritative law is statutory legislation, which comprises Act of Parliament, Acts of Parliament, Statutory Instrument, regulations and by-laws. In the absence of any statutory law, the common law with its principle of ''stare decisis'' forms the residual source of law, based on judicial decisions, custom, and usage. Common law is made by sitting judges who apply both United Kingdom l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Par Value

In finance and accounting, par value means stated value or face value of a financial instrument. Expressions derived from this term include at par (at the par value), over par (over par value) and under par (under par value). Bonds A bond selling at par is priced at 100% of face value. Par can also refer to a bond's original issue value or its value upon redemption at maturity. Stock The par value of stock has no relation to market value and, as a concept, is somewhat archaic. The par value of a share is the value stated in the corporate charter below which shares of that class cannot be sold upon initial offering; the issuing company promises not to issue further shares below par value, so investors can be confident that no one else will receive a more favorable issue price. Thus, par value is the nominal value of a security which is determined by the issuing company to be its minimum price. This was far more important in unregulated equity markets than in the regulated marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Undercapitalization

Under-capitalization refers to any situation where a business cannot acquire the funds they need. An under-capitalized business may be one that cannot afford current operational expenses due to a lack of capital, which can trigger bankruptcy, may be one that is over-exposed to risk, or may be one that is financially sound but does not have the funds required to expand to meet market demand. Causes of under-capitalization Under-capitalization is often a result of improper financial planning. However, a viable business may have difficulty raising sufficient capital during an economic downturn or in a country that imposes artificial constraints on capital investment. There are several different causes of undercapitalization, including: *Financing growth with short-term capital, rather than permanent capital *Failing to secure an adequate bank loan at a critical time *Failing to obtain insurance against predictable business risks *Adverse macroeconomic conditions Accountants can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Cornell Law Review

The ''Cornell Law Review'' is the flagship legal journal of Cornell Law School. Originally published in 1915 as the ''Cornell Law Quarterly'', the journal features scholarship in all fields of law. Notably, past issues of the ''Cornell Law Review'' have included articles by Supreme Court justices Robert H. Jackson, John Marshall Harlan II, William O. Douglas, Felix Frankfurter, Ruth Bader Ginsburg, and Amy Coney Barrett. History Cornell Law School first published a law review in June 1894—the first and only issue of the ''Cornell Law Journal''—and again published a law review (the ''New York Law Review'') from January to July 1895. Following these initial efforts, the ''Cornell Law Review'' began its continuous publication in 1915. Until 1966, the ''Cornell Law Review'' published four issues annually and was known as the ''Cornell Law Quarterly''. Six Student Editors were joined by one Faculty Editor, a Business Manager, and an Assistant Business Manager. In the first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Separate Legal Entity

In the United States, a separate legal entity (SLE) refers to a type of legal entity with detached accountability. Any company is set up as an SLE to legally separate it from the individual or owner, such as a limited liability company or a corporation. If a business is a separate legal entity, it means it has some of the same rights in law as a person. It is, for example, able to enter contracts, sue and be sued, and own property. A sole trader or partnership does not have a separate legal entity. References See also * Types of business entity A business entity is an entity that is formed and administered as per corporate law in order to engage in business activities, charitable work, or other activities allowable. Most often, business entities are formed to sell a product or a serv ... Legal entities {{US-law-stub * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Corporate Law

Corporate law (also known as company law or enterprise law) is the body of law governing the rights, relations, and conduct of persons, companies, organizations and businesses. The term refers to the legal practice of law relating to corporations, or to the theory of corporations. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation.John Armour, Henry Hansmann, Reinier Kraakman, Mariana Pargendler "What is Corporate Law?" in ''The Anatomy of Corporate Law: A Comparative and Functional Approach''(Eds Reinier Kraakman, John Armour, Paul Davies, Luca Enriques, Henry Hansmann, Gerard Hertig, Klaus Hopt, Hideki Kanda, Mariana Pargendler, Wolf-Georg Ringe, and Edward Rock, Oxford University Press 2017)1.1 It thus encompasses the formation, funding, governance, and death of a corporation. While the minute nature of corporate governance as personified by share ownership, capital market, and business culture rules diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |