|

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.Milton Friedman, ''Money Mischief: Episodes in Monetary History'', Houghton Mifflin Harcourt (1994) p. 37. Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of inde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Economics

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years. Neoclassical economics historically dominated macroeconomics and, together with Keynesian economics, formed the neoclassical synthesis which dominated mainstream economics as "neo-Keynesian economics" from the 1950s to the 1970s.Clark, B. (1998). ''Principles of political economy: A comparative approach''. Westport, Connecticut: Praeger. Nadeau, R. L. (2003). ''The Wealth o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Steve Keen

Steve Keen (born 28 March 1953) is an Australian economist and author. He considers himself a post-Keynesian, criticising neoclassical economics as inconsistent, unscientific and empirically unsupported. The major influences on Keen's thinking about economics include John Maynard Keynes, Karl Marx, Hyman Minsky, Piero Sraffa, Augusto Graziani, Joseph Alois Schumpeter, Thorstein Veblen, and François Quesnay. Hyman Minsky's financial instability hypothesis forms the main basis of his major contribution to economics which mainly concentrates on mathematical modelling and simulation of financial instability. He is a notable critic of the Australian property bubble, as he sees it. Keen was formerly an associate professor of economics at University of Western Sydney, until he applied for voluntary redundancy in 2013, due to the closure of the economics program at the university. In autumn 2014, he became a professor and Head of the School of Economics, History and Politics at K ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistician

A statistician is a person who works with theoretical or applied statistics. The profession exists in both the private and public sectors. It is common to combine statistical knowledge with expertise in other subjects, and statisticians may work as employees or as statistical consultants. Nature of the work According to the United States Bureau of Labor Statistics, as of 2014, 26,970 jobs were classified as ''statistician'' in the United States. Of these people, approximately 30 percent worked for governments (federal, state, or local). As of October 2021, the median pay for statisticians in the United States was $92,270. Additionally, there is a substantial number of people who use statistics and data analysis in their work but have job titles other than ''statistician'', such as actuaries, applied mathematicians, economists, data scientists, data analysts (predictive analytics), financial analysts, psychometricians, sociologists, epidemiologists, and quantitative ps ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on these elements. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating "what ought to be"; between economic theory and applied economics; between rational a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bachelor Of Arts

Bachelor of arts (BA or AB; from the Latin ', ', or ') is a bachelor's degree awarded for an undergraduate program in the arts, or, in some cases, other disciplines. A Bachelor of Arts degree course is generally completed in three or four years, depending on the country and institution. * Degree attainment typically takes four years in Afghanistan, Armenia, Azerbaijan, Bangladesh, Brazil, Brunei, China, Egypt, Ghana, Greece, Georgia, Hong Kong, Indonesia, Iran, Iraq, Ireland, Japan, Kazakhstan, Kenya, Kuwait, Latvia, Lebanon, Lithuania, Mexico, Malaysia, Mongolia, Myanmar, Nepal, Netherlands, Nigeria, Pakistan, the Philippines, Qatar, Russia, Saudi Arabia, Scotland, Serbia, South Korea, Spain, Sri Lanka, Taiwan, Thailand, Turkey, Ukraine, the United States and Zambia. * Degree attainment typically takes three years in Albania, Australia, Bosnia and Herzegovina, the Caribbean, Iceland, India, Israel, Italy, New Zealand, Norway, South Africa, Switzerland, the Canadian province o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

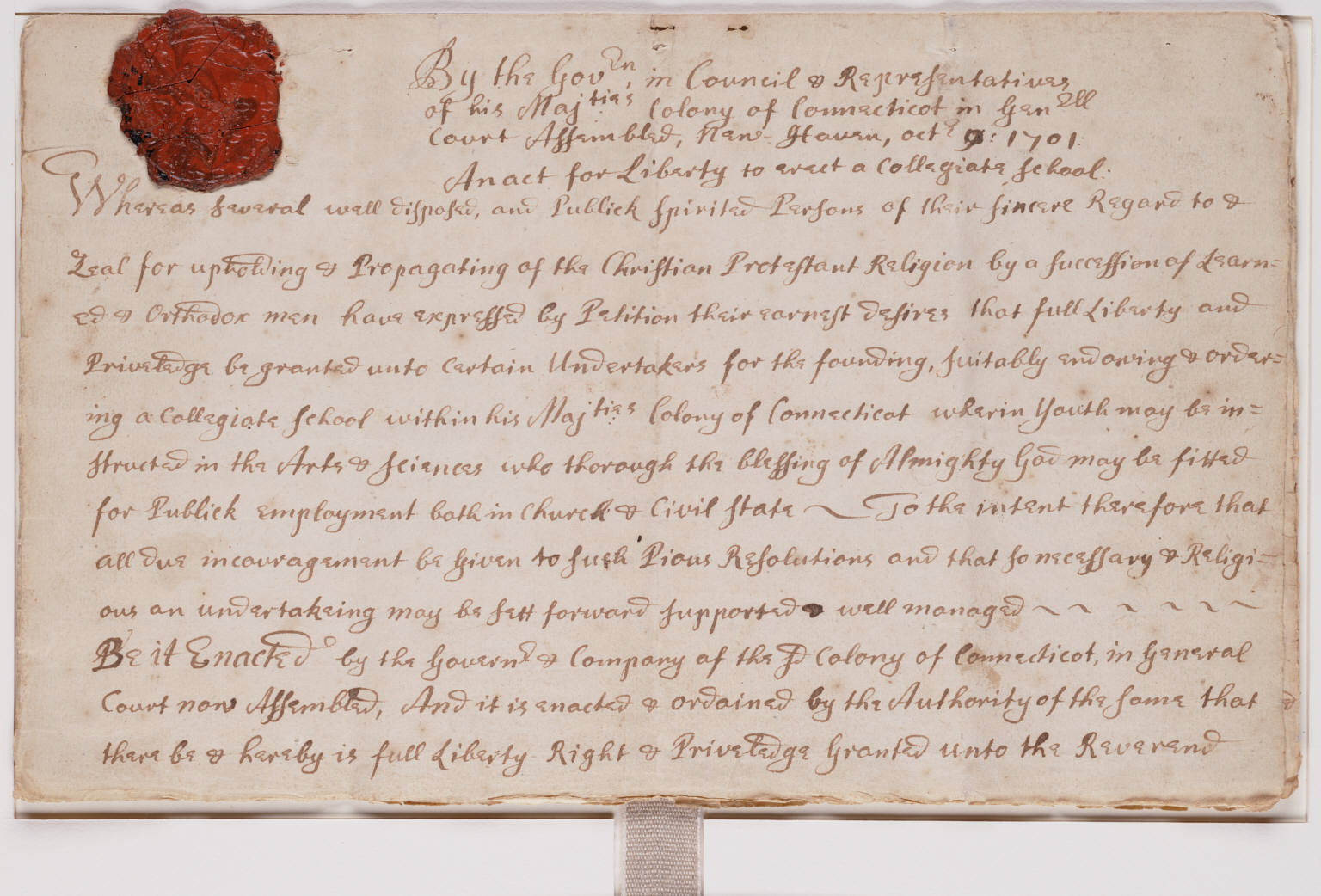

Yale University

Yale University is a Private university, private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the List of Colonial Colleges, third-oldest institution of higher education in the United States and among the most prestigious in the world. It is a member of the Ivy League. Chartered by the Connecticut Colony, the Collegiate School was established in 1701 by clergy to educate Congregationalism in the United States, Congregational ministers before moving to New Haven in 1716. Originally restricted to theology and sacred languages, the curriculum began to incorporate humanities and sciences by the time of the American Revolution. In the 19th century, the college expanded into graduate and professional instruction, awarding the first Doctor of Philosophy, PhD in the United States in 1861 and organizing as a university in 1887. Yale's faculty and student populations grew after 1890 with rapid expansion of the physical campus and sc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent Party Of Connecticut

The Independent Party of Connecticut (IPC) is a minor political party in the State of Connecticut. As of November 3, 2014, Connecticut had 16,189 active voters registered with the Connecticut Secretary of State with the Independent party, making it the third largest party in the state. The party has at least one elected official. In November, 2013, Lawrence DePillo was elected to the Waterbury Board of Aldermen. History In the 1930s, an Independent-Republican party was formed by Professor Albert Levitt of Redding, CT and Irving Fisher, a Yale economist. However, the official title of "Independent Party" was used later on. In 1958, Andrew C. LaCroix of Easton, Connecticut was acting treasurer of the Independent Party of Connecticut. The party backed Ms. Vivian Kellems of Stonington, Connecticut in a 1956 write-in campaign. At that time, Anthony Sparaco of Old Saybrook was president, and Rosemary Favale of Waterbury was vice-president. In 1959, Charles R. Iovino of Milford, Con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fisher Separation Theorem

In economics, the Fisher separation theorem asserts that the primary objective of a corporation will be the maximization of its present value, regardless of the preferences of its shareholders. The theorem therefore separates management's "productive opportunities" from the entrepreneur's "market opportunities". It was proposed by—and is named after—the economist Irving Fisher. The theorem has its "clearest and most famous expositionin the ''Theory of Interest'' (1930); particularly in the "second approximation to the theory of interest"II:VI. {{Ref improve section, date=January 2011 The Fisher separation theorem states that: * the firm's Corporate_finance#The_investment_decision, investment decision is independent of the consumption preferences of the owner; * the investment decision is independent of the financing decision. * the value of a capital project (investment) is independent of the mix of methods – equity, debt, and/or cash – used to finance the project. Fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Illusion

In economics, money illusion, or price illusion, is a cognitive bias where money is thought of in nominal, rather than real terms. In other words, the face value (nominal value) of money is mistaken for its purchasing power (real value) at a previous point in time. Viewing purchasing power as measured by the nominal value is false, as modern fiat currencies have no intrinsic value and their real value depends purely on the price level. The term was coined by Irving Fisher in ''Stabilizing the Dollar''. It was popularized by John Maynard Keynes in the early twentieth century, and Irving Fisher wrote an important book on the subject, ''The Money Illusion'', in 1928. The existence of money illusion is disputed by monetary economists who contend that people act rationally (i.e. think in real prices) with regard to their wealth. Eldar Shafir, Peter A. Diamond, and Amos Tversky (1997) have provided empirical evidence for the existence of the effect and it has been shown to affect beha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phillips Curve

The Phillips curve is an economic model, named after William Phillips hypothesizing a correlation between reduction in unemployment and increased rates of wage rises within an economy. While Phillips himself did not state a linked relationship between employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place. While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run.Chang, R. (1997"Is Low Unemployment Inflationary?" ''Federal Reserve Bank of Atlanta Economic Review'' 1Q97:4-13 In 1967 and 1968, Friedman and Phelps asserted that the Phillips curve was only applicable in the short-run and that, in the long-run, inflationary policies would not decrease unemployment. Friedman then correctly predicted that in the 1973–75 recession, both inflation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Deflation

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults and because the value of their collateral falls, leading to a surge in bank insolvencies, a reduction in lending and by extension, a reduction in spending. The theory was developed by Irving Fisher following the Wall Street Crash of 1929 and the ensuing Great Depression. The debt deflation theory was familiar to John Maynard Keynes prior to Fisher's discussion of it, but he found it lacking in comparison to what would become his theory of liquidity preference. The theory, however, has enjoyed a resurgence of interest since the 1980s, both in mainstream economics and in the heterodox school of post-Keynesian economics, and has subsequently been developed by such post-Keynesian economists as Hyman Minsky and by the neo-classical mainstream ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |