|

Entrepreneur

Entrepreneurship is the creation or extraction of economic value. With this definition, entrepreneurship is viewed as change, generally entailing risk beyond what is normally encountered in starting a business, which may include other values than simply economic ones. An entrepreneur is an individual who creates and/or invests in one or more businesses, bearing most of the risks and enjoying most of the rewards.The process of setting up a business is known as entrepreneurship. The entrepreneur is commonly seen as an innovator, a source of new ideas, goods, services, and business/or procedures. More narrow definitions have described entrepreneurship as the process of designing, launching and running a new business, which is often similar to a small business, or as the "capacity and willingness to develop, organize and manage a business venture along with any of its risks to make a profit." The people who create these businesses are often referred to as entrepreneurs. While def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Entrepreneur

Entrepreneurship is the creation or extraction of economic value. With this definition, entrepreneurship is viewed as change, generally entailing risk beyond what is normally encountered in starting a business, which may include other values than simply economic ones. An entrepreneur is an individual who creates and/or invests in one or more businesses, bearing most of the risks and enjoying most of the rewards.The process of setting up a business is known as entrepreneurship. The entrepreneur is commonly seen as an innovator, a source of new ideas, goods, services, and business/or procedures. More narrow definitions have described entrepreneurship as the process of designing, launching and running a new business, which is often similar to a small business, or as the "capacity and willingness to develop, organize and manage a business venture along with any of its risks to make a profit." The people who create these businesses are often referred to as entrepreneurs. While def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Start-up Company

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

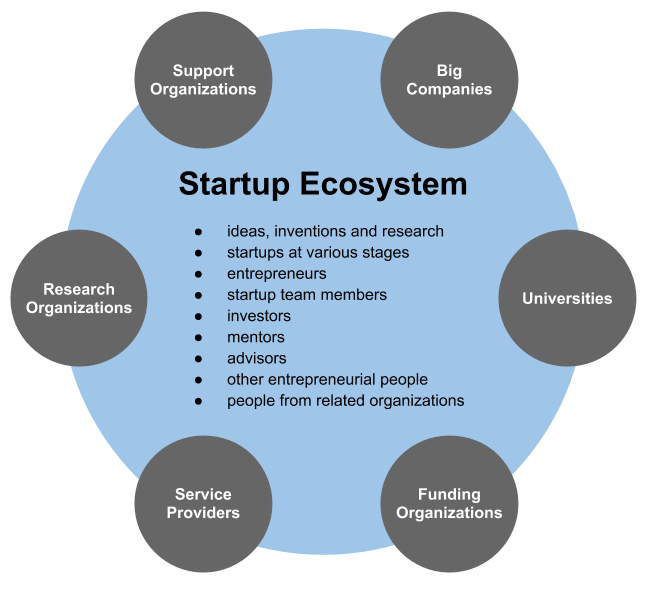

Entrepreneurship Ecosystem

An entrepreneurial ecosystems or entrepreneurship ecosystems are peculiar systems of interdependent actors and relations directly or indirectly supporting the creation and growth of new ventures. The ecosystem metaphor "Ecosystem" refers to the elements – individuals, organizations or institutions – outside the individual entrepreneur that are conducive to, or inhibitive of, the choice of a person to become an entrepreneur, or the probabilities of his or her success following launch. Organizations and individuals representing these elements are referred to as entrepreneurship stakeholders. Stakeholders are any entity that has an interest, actually or potentially, in there being more entrepreneurship in the region. Entrepreneurship stakeholders may include government, schools, universities, private sector, family businesses, investors, banks, entrepreneurs, social leaders, research centers, military, labor representatives, students, lawyers, cooperatives, communes, multinati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joseph Schumpeter

Joseph Alois Schumpeter (; February 8, 1883 – January 8, 1950) was an Austrian-born political economist. He served briefly as Finance Minister of German-Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship. Schumpeter was one of the most influential economists of the early 20th century, and popularized the term "creative destruction", which was coined by Werner Sombart. Early life and education Schumpeter was born in Triesch, Habsburg Moravia (now Třešť in the Czech Republic, then part of Austria-Hungary) in 1883 to German-speaking Catholic parents. Both of his grandmothers were Czech. Schumpeter did not acknowledge his Czech ancestry; he considered himself an ethnic German. His father owned a factory, but he died when Joseph was only four years old. In 1893, Joseph and his mother moved to Vienna. Schumpeter was a loyal suppo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

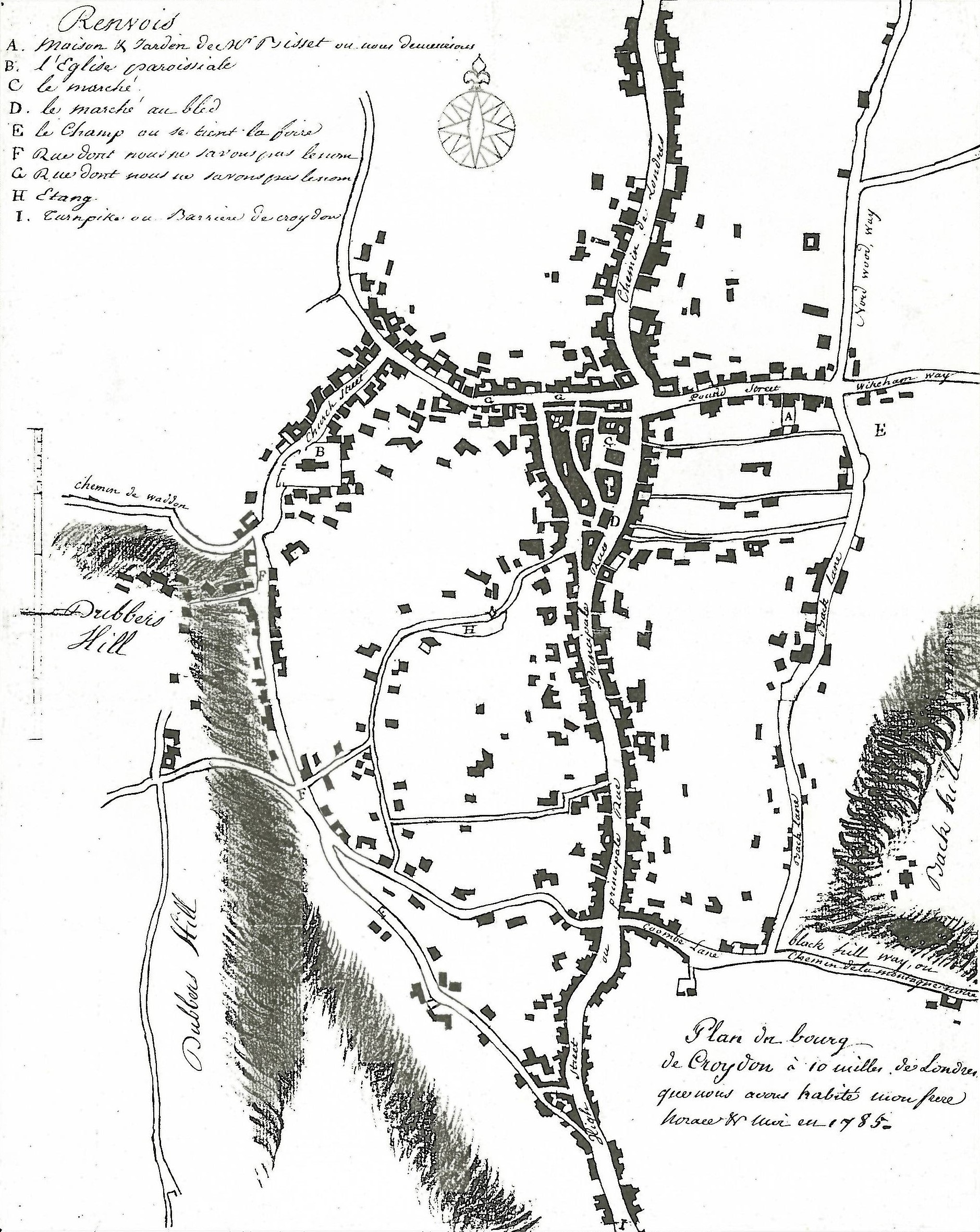

Jean-Baptiste Say

Jean-Baptiste Say (; 5 January 1767 – 15 November 1832) was a liberal French economist and businessman who argued in favor of competition, free trade and lifting restraints on business. He is best known for Say's law—also known as the law of markets—which he popularized. Scholars disagree on the surprisingly subtle question of whether it was Say who first stated what is now called Say's law. Moreover, he was one of the first economists to study entrepreneurship and conceptualized entrepreneurs as organizers and leaders of the economy. Early life Say was born in Lyon. His father Jean-Etienne Say was born to a Protestant family which had moved from Nîmes to Geneva for some time in consequence of the revocation of the Edict of Nantes. Say was intended to follow a commercial career and in 1785 was sent with his brother Horace to complete his education in England. He lodged for a time in Croydon and afterwards (following a return visit to France) in Fulham. During the latte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small Business

Small businesses are types of corporations, partnerships, or sole proprietorships which have fewer employees and/or less annual revenue than a regular-sized business or corporation. Businesses are defined as "small" in terms of being able to apply for government support and qualify for preferential tax policy varies depending on the country and industry. Small businesses range from fifteen employees under the Australian '' Fair Work Act 2009'', fifty employees according to the definition used by the European Union, and fewer than five hundred employees to qualify for many U.S. Small Business Administration programs. While small businesses can also be classified according to other methods, such as annual revenues, shipments, sales, assets, or by annual gross or net revenue or net profits, the number of employees is one of the most widely used measures. Small businesses in many countries include service or retail operations such as convenience stores, small grocery stores, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angel Investing

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or ownership equity. Angel investors usually give support to start-ups at the initial moments (where risks of the start-ups failing are relatively high) and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital, as well as to provide advice to their portfolio companies. Over the last 50 years, the number of angel investors has greatly increased. Etymology and origin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Incubator

Business incubator is an organization that helps startup companies and individual entrepreneurs to develop their businesses by providing a fullscale range of services starting with management training and office space and ending with venture capital financing. The National Business Incubation Association (NBIA) defines business incubators as a catalyst tool for either regional or national economic development. NBIA categorizes its members' incubators by the following five incubator types: academic institutions; non-profit development corporations; for-profit property development ventures; venture capital firms, and a combination of the above. Business incubators differ from research and technology parks in their dedication to startup and early-stage companies. Research and technology parks, on the other hand, tend to be large-scale projects that house everything from corporate, government, or university labs to very small companies. Most research and technology parks do n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

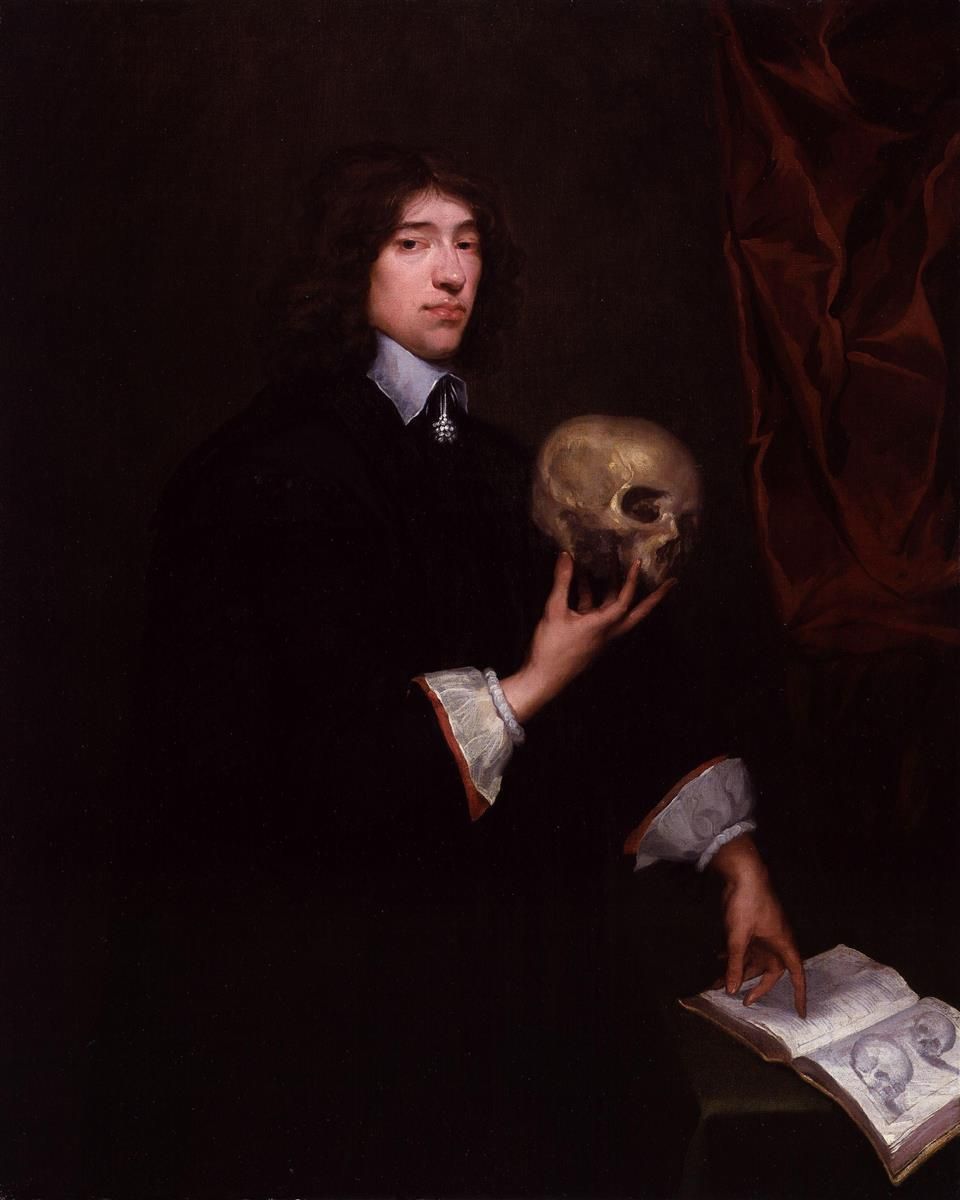

Richard Cantillon

Richard Cantillon (; 1680s – ) was an Irish-French economist and author of '' Essai Sur La Nature Du Commerce En Général'' (''Essay on the Nature of Trade in General''), a book considered by William Stanley Jevons to be the "cradle of political economy". Although little information exists on Cantillon's life, it is known that he became a successful banker and merchant at an early age. His success was largely derived from the political and business connections he made through his family and through an early employer, James Brydges. During the late 1710s and early 1720s, Cantillon speculated in, and later helped fund, John Law's Mississippi Company, from which he acquired great wealth. However, his success came at a cost to his debtors, who pursued him with lawsuits, criminal charges, and even murder plots until his death in 1734. ''Essai'' remains Cantillon's only surviving contribution to economics. It was written around 1730 and circulated widely in manuscript form, bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Israel Kirzner

Israel Meir Kirzner (also Yisroel Mayer Kirzner ; born February 13, 1930) is a British-born American economist closely identified with the Austrian School. Early life and education The son of a well-known rabbi and Talmudist, Kirzner was born in London and reached the United States by way of South Africa. After studying at the University of Cape Town, South Africa in 1947–48, and with the University of London External Programme in 1950–51, Kirzner received his B.A. ''summa cum laude'' from Brooklyn College in 1954, and an MBA in 1955 and Ph.D. in 1957 from New York University, where he studied under Ludwig von Mises. Kirzner is also an ordained Rabbi; see below. Economics Kirzner is emeritus professor of economics at New York University and a leading authority on Ludwig von Mises's thinking and methodology in economics. Kirzner's research on entrepreneurship economics is also widely recognized. His book, ''Competition and Entrepreneurship'' criticizes neoclassical theo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Innovation

Innovation is the practical implementation of ideas that result in the introduction of new goods or services or improvement in offering goods or services. ISO TC 279 in the standard ISO 56000:2020 defines innovation as "a new or changed entity realizing or redistributing value". Others have different definitions; a common element in the definitions is a focus on newness, improvement, and spread of ideas or technologies. Innovation often takes place through the development of more-effective products, processes, services, technologies, art works or business models that innovators make available to markets, governments and society. Innovation is related to, but not the same as, invention: innovation is more apt to involve the practical implementation of an invention (i.e. new / improved ability) to make a meaningful impact in a market or society, and not all innovations require a new invention. Technical innovation often manifests itself via the engineering process when the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |