|

Debtor

A debtor or debitor is a legal entity (legal person) that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this debt arrangement is a bank, the debtor is more often referred to as a borrower. If X borrowed money from their bank, X is the debtor and the bank is the creditor. If X puts money in the bank, X is the creditor and the bank is the debtor. It is not a crime to fail to pay a debt. Except in certain bankruptcy situations, debtors can choose to pay debts in any priority they choose. But if one fails to pay a debt, they have broken a contract or agreement between them and a creditor. Generally, most oral and written agreements for the repayment of consumer debt - debts for personal, family or household purposes secured primarily by a person's residence - are enforceable. For the most part, debts that are business-related must be made in writ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debtors' Prison

A debtors' prison is a prison for people who are unable to pay debt. Until the mid-19th century, debtors' prisons (usually similar in form to locked workhouses) were a common way to deal with unpaid debt in Western Europe.Cory, Lucinda"A Historical Perspective on Bankruptcy" , ''On the Docket'', Volume 2, Issue 2, U.S. Bankruptcy Court, District of Rhode Island, April/May/June 2000, retrieved December 20, 2007. Destitute people who were unable to pay a court-ordered judgment would be incarcerated in these prisons until they had worked off their debt via labour or secured outside funds to pay the balance. The product of their labour went towards both the costs of their incarceration and their accrued debt. Increasing access and lenience throughout the history of bankruptcy law have made prison terms for unaggravated indigence obsolete over most of the world. Since the late 20th century, the term ''debtors' prison'' has also sometimes been applied by critics to criminal justice sy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debtor's Prison

A debtors' prison is a prison for people who are unable to pay debt. Until the mid-19th century, debtors' prisons (usually similar in form to locked workhouses) were a common way to deal with unpaid debt in Western Europe.Cory, Lucinda"A Historical Perspective on Bankruptcy" , ''On the Docket'', Volume 2, Issue 2, U.S. Bankruptcy Court, District of Rhode Island, April/May/June 2000, retrieved December 20, 2007. Destitute people who were unable to pay a court-ordered judgment would be incarcerated in these prisons until they had worked off their debt via labour or secured outside funds to pay the balance. The product of their labour went towards both the costs of their incarceration and their accrued debt. Increasing access and lenience throughout the history of bankruptcy law have made prison terms for unaggravated indigence obsolete over most of the world. Since the late 20th century, the term ''debtors' prison'' has also sometimes been applied by critics to criminal justice sy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Creditor's Rights

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property or service to the second party under the assumption (usually enforced by contract) that the second party will return an equivalent property and service. The second party is frequently called a debtor or borrower. The first party is called the creditor, which is the lender of property, service, or money. Creditors can be broadly divided into two categories: secured and unsecured. *A secured creditor has a security or charge over some or all of the debtor's assets, to provide reassurance (thus to ''secure'' him) of ultimate repayment of the debt owed to him. This could be by way of, for example, a mortgage, where the property represents the security. *An unsecured creditor does not have a charge over the debtor's assets. The term creditor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property or service to the second party under the assumption (usually enforced by contract) that the second party will return an equivalent property and service. The second party is frequently called a debtor or borrower. The first party is called the creditor, which is the lender of property, service, or money. Creditors can be broadly divided into two categories: secured and unsecured. *A secured creditor has a security or charge over some or all of the debtor's assets, to provide reassurance (thus to ''secure'' him) of ultimate repayment of the debt owed to him. This could be by way of, for example, a mortgage, where the property represents the security. *An unsecured creditor does not have a charge over the debtor's assets. The term credito ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Debt

Credit card debt results when a client of a credit card company purchases an item or service through the card system. Debt grows through the accrual of interest and penalties when the consumer fails to repay the company for the money they have spent. The results of not paying this debt on time are that the company will charge a late payment penalty and report the late payment to credit rating agencies. Being late on a payment is sometimes referred to as being in " default". The late payment penalty itself increases the amount of the consumer's total debt. Additionally, a customer may see their interest rate drastically increased as a result of missing multiple payments. The penalty APR rate varies from card to card and is usually disclosed in literature at the time of a credit card application and also as paper inserts in the envelope that contains a credit card directly shipped to a customer's residence. Research shows that people with credit card debt are more likely to for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

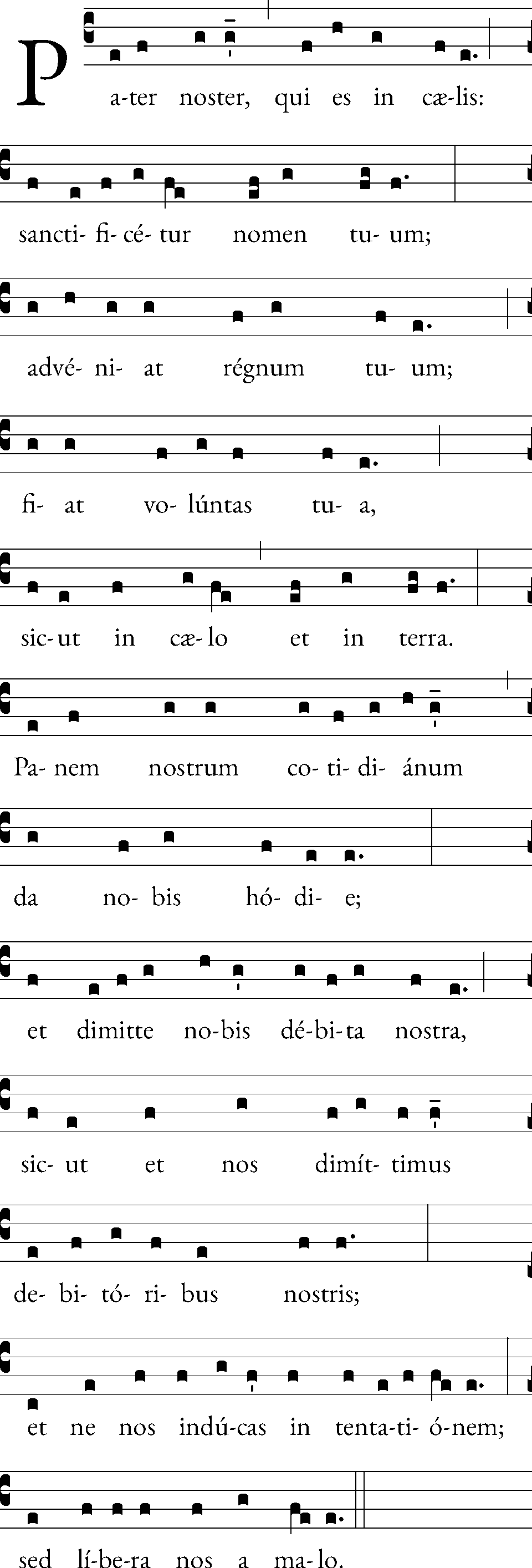

Lord's Prayer

The Lord's Prayer, also called the Our Father or Pater Noster, is a central Christian prayer which Jesus taught as the way to pray. Two versions of this prayer are recorded in the gospels: a longer form within the Sermon on the Mount in the Gospel of Matthew, and a shorter form in the Gospel of Luke when "one of his disciples said to him, 'Lord, teach us to pray, as John taught his disciples. Regarding the presence of the two versions, some have suggested that both were original, the Matthean version spoken by Jesus early in his ministry in Galilee, and the Lucan version one year later, "very likely in Judea". The first three of the seven petitions in Matthew address God; the other four are related to human needs and concerns. Matthew's account alone includes the "Your will be done" and the "Rescue us from the evil one" (or "Deliver us from evil") petitions. Both original Greek texts contain the adjective ''epiousios'', which does not appear in any other classical or Koine Greek ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency is when a person or company has enough assets to pay what is owed, but does not have the appropriate form of payment. For example, a person may own a large house and a valuable car, but not have enough liquid assets to pay a debt when it falls due. Cash-flow insolvency can usually be resolved by negotiation. For example, the bill collector may wait until the car is sold and the debtor agrees to pay a penalty. Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. The person or company might enter bankruptcy, but not necessarily. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. A compa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan Covenant

A loan covenant is a condition in a commercial loan or bond Bond or bonds may refer to: Common meanings * Bond (finance), a type of debt security * Bail bond, a commercial third-party guarantor of surety bonds in the United States * Chemical bond, the attraction of atoms, ions or molecules to form chemical ... issue that requires the borrower to fulfill certain conditions or which forbids the borrower from undertaking certain actions, or which possibly restricts certain activities to circumstances when other conditions are met. Typically, violation of a covenant may result in a default on the loan being declared, penalties being applied, or the loan being ''called''. The legal provision in the loan agreement providing for the loan to be "called" is the "Acceleration Clause": once the buyer defaults, all future payments due under the loan are "accelerated" and deemed to be due and payable immediately. Covenants may also be waived, either temporarily or permanently, usually at th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Promissory Note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of money to the other (the ''payee''), either at a fixed or determinable future time or on demand of the payee, under specific terms and conditions. Overview The terms of a note usually include the principal amount, the interest rate if any, the parties, the date, the terms of repayment (which could include interest) and the maturity date. Sometimes, provisions are included concerning the payee's rights in the event of a default, which may include foreclosure of the maker's assets. In foreclosures and contract breaches, promissory notes under CPLR 5001 allow creditors to recover prejudgement interest from the date interest is due until liability is established. For loans between individuals, writing and signing a promissory note are oft ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)