|

Bear Raid

A bear raid is a type of stock market strategy, where a trader (or group of traders) attempts to force down the price of a stock to cover a short position. The name is derived from the common use of ''bear'' or ''bearish'' in the language of market sentiment to reflect the idea that investors expect downward price movement. A bear raid can be done by spreading negative rumors about the target firm, which puts downward pressure on the share price. This is typically considered a form of securities fraud. Alternatively, traders could take on large short positions themselves, manipulating the price with the large volume of selling, making the strategy self-perpetuating. History The practice of bear raid has its roots in the 17th-century Dutch Republic. In 1609, Isaac Le Maire, a sizeable shareholder of the Dutch East India Company (VOC), organized a bear raid on the stock of the company. See also * Uptick rule * Market manipulation In economics and finance, market manip ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 202 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dutch East India Company

The United East India Company ( nl, Verenigde Oostindische Compagnie, the VOC) was a chartered company established on the 20th March 1602 by the States General of the Netherlands amalgamating existing companies into the first joint-stock company in the world, granting it a 21-year monopoly to carry out trade activities in Asia. Shares in the company could be bought by any resident of the United Provinces and then subsequently bought and sold in open-air secondary markets (one of which became the Amsterdam Stock Exchange). It is sometimes considered to have been the first multinational corporation. It was a powerful company, possessing quasi-governmental powers, including the ability to wage war, imprison and execute convicts, negotiate treaties, strike its own coins, and establish colonies. They are also known for their international slave trade. Statistically, the VOC eclipsed all of its rivals in the Asia trade. Between 1602 and 1796 the VOC sent almost a million E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 202 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Manipulation

In economics and finance, market manipulation is a type of market abuse where there is a deliberate attempt to interfere with the free and fair operation of the market; the most blatant of cases involve creating false or misleading appearances with respect to the price of, or market for, a product, security or commodity. Market manipulation is prohibited in most countries, in particular, it is prohibited in the United States under Section 9(a)(2) of the Securities Exchange Act of 1934, in the European Union under Article 12 of the ''Market Abuse Regulation'', in Australia under Section 1041A of the Corporations Act 2001, and in Israel under Section 54(a) of the securities act of 1968. In the US, market manipulation is also prohibited for wholesale electricity markets under Section 222 of the Federal Power Act and wholesale natural gas markets under Section 4A of the Natural Gas Act. The US Securities Exchange Act defines market manipulation as "transactions which create an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uptick Rule

The uptick rule is a trading restriction that states that short selling a stock is allowed only on an uptick. For the rule to be satisfied, the short must be either at a price above the last traded price of the security, or at the last traded price when the most recent movement between traded prices was upward (i.e. the security has traded below the last-traded price more recently than above that price). The U.S. Securities and Exchange Commission (SEC) defined the rule, and summarized it:"''Rule 10a-1(a)(1)'' provided that, subject to certain exceptions, a listed security may be sold short (A) at a price above the price at which the immediately preceding sale was effected (plus tick), or (B) at the last sale price if it is higher than the last different price (zero-plus tick). Short sales were not permitted on minus ticks or zero-minus ticks, subject to narrow exceptions." The rule went into effect in 1938 and was removed when ''Rule 201 Regulation SHO'' became effective in 2007 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tulip Mania

Tulip mania ( nl, tulpenmanie) was a period during the Dutch Golden Age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. The major acceleration started in 1634 and then dramatically collapsed in February 1637. It is generally considered to have been the first recorded speculative bubble or asset bubble in history. In many ways, the tulip mania was more of a then-unknown socio-economic phenomenon than a significant economic crisis. It had no critical influence on the prosperity of the Dutch Republic, which was one of the world's leading economic and financial powers in the 17th century, with the highest per capita income in the world from about 1600 to about 1720. The term "tulip mania" is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values. Forward markets appeared in the Dutch Republic during the 17th century. Among the most notable centre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Boom-bust Cycle

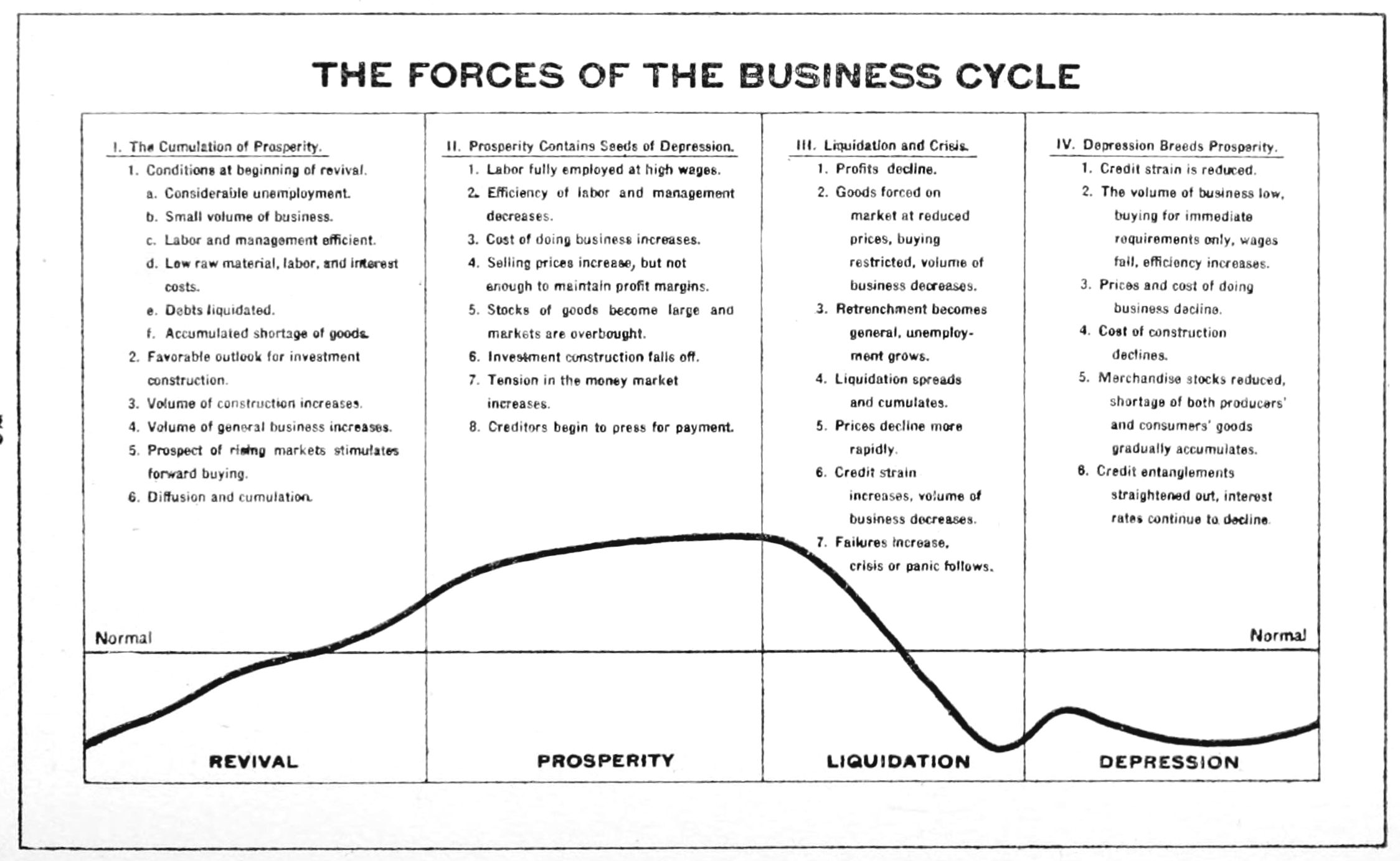

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of busines ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Banking

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodities, particularly cloth merchants. Historically, merchant banks' purpose was to facilitate and/or finance production and trade of commodities, hence the name "merchant". Few banks today restrict their activities to such a narrow scope. In modern usage in the United States, the term additionally has taken on a more narrow meaning, and refers to a financial institution providing capital to companies in the form of share ownership instead of loans. A merchant bank also provides advice on corporate matters to the firms in which they invest. History Merchant banks were the first modern banks. They emerged in the Middle Ages from the Italian grain and cloth merchants community and started to develop in the 11th century during the large Eu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option Trading

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that are bullish on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Review Of Books

The ''London Review of Books'' (''LRB'') is a British literary magazine published twice monthly that features articles and essays on fiction and non-fiction subjects, which are usually structured as book reviews. History The ''London Review of Books'' was founded in 1979, when publication of ''The Times Literary Supplement'' was suspended during the year-long lock-out at ''The Times''. Its founding editors were Karl Miller, then professor of English at University College London; Mary-Kay Wilmers, formerly an editor at ''The Times Literary Supplement''; and Susannah Clapp, a former editor at Jonathan Cape. For its first six months, it appeared as an insert in ''The New York Review of Books''. It became an independent publication in May 1980. Its political stance has been described by Alan Bennett, a prominent contributor, as "consistently radical". Unlike ''The Times Literary Supplement'' (TLS), the majority of the articles the ''LRB'' publishes (usually fifteen per issue) ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

%2C_Hoorn.jpg)