Utility Maximization Problem on:

[Wikipedia]

[Google]

[Amazon]

Utility maximization was first developed by utilitarian philosophers

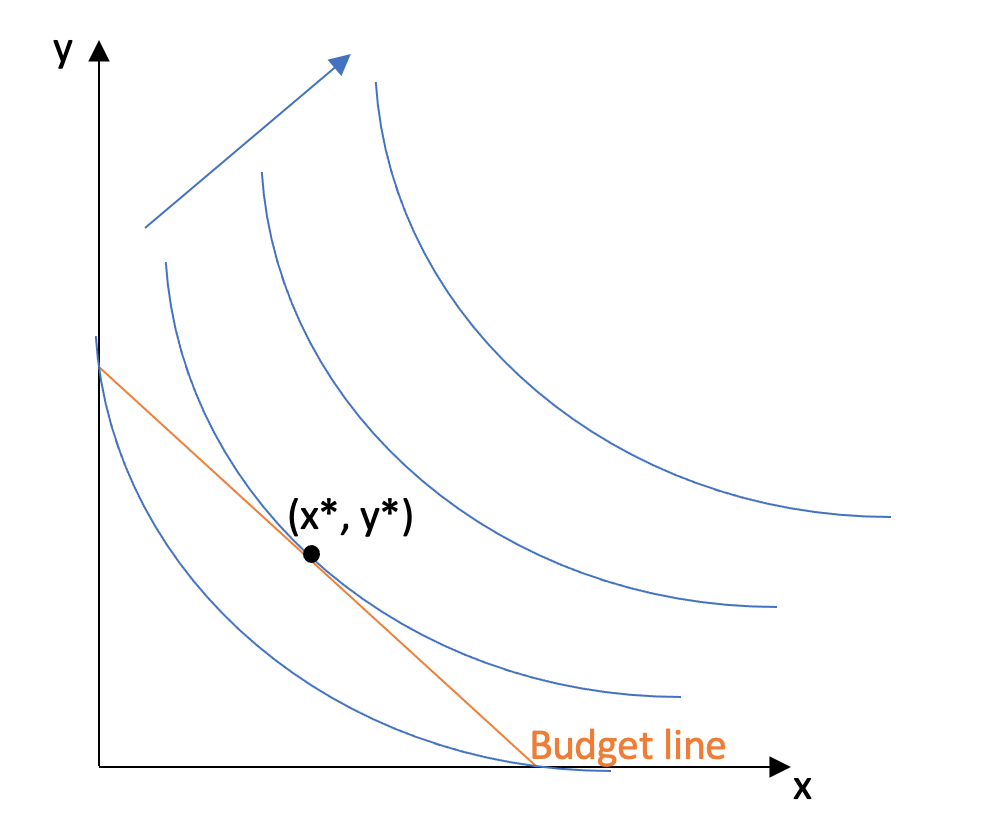

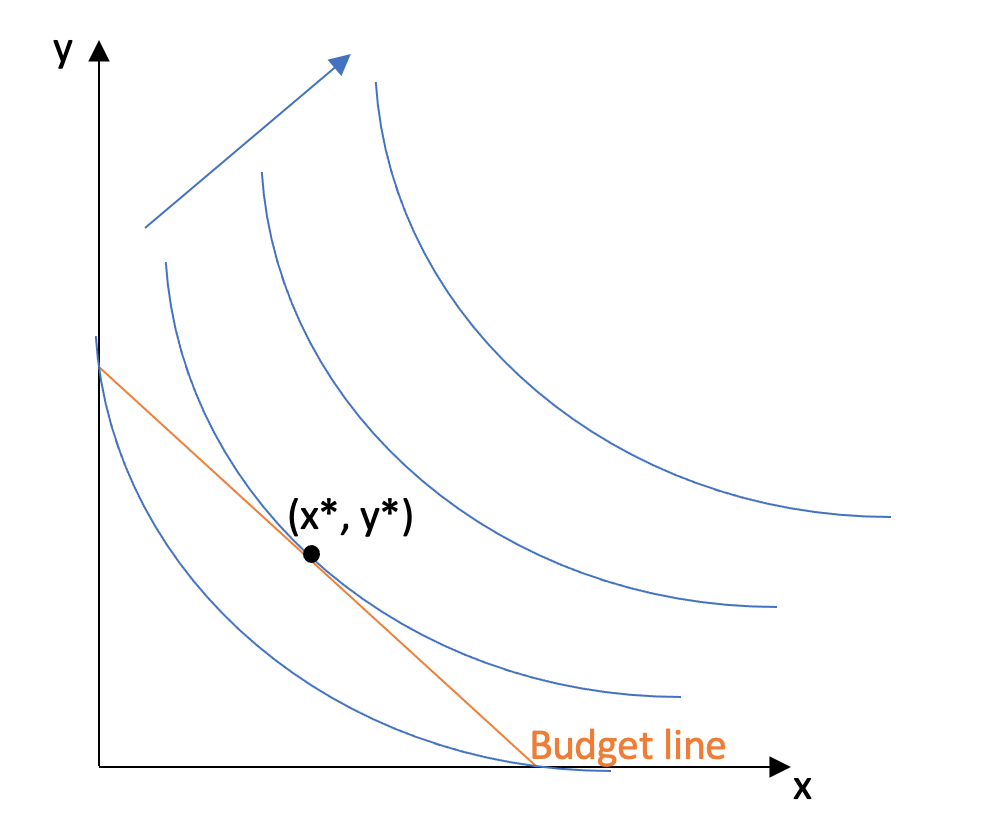

Negativity must be checked for as the utility maximization problem can give an answer where the optimal demand of a good is negative, which in reality is not possible as this is outside the domain. If the demand for one good is negative, the optimal consumption bundle will be where 0 of this good is consumed and all income is spent on the other good (a corner solution). See figure 1 for an example when the demand for good x is negative.

Negativity must be checked for as the utility maximization problem can give an answer where the optimal demand of a good is negative, which in reality is not possible as this is outside the domain. If the demand for one good is negative, the optimal consumption bundle will be where 0 of this good is consumed and all income is spent on the other good (a corner solution). See figure 1 for an example when the demand for good x is negative.

and that the consumer's income is ; then the set of all affordable packages, the

and that the consumer's income is ; then the set of all affordable packages, the

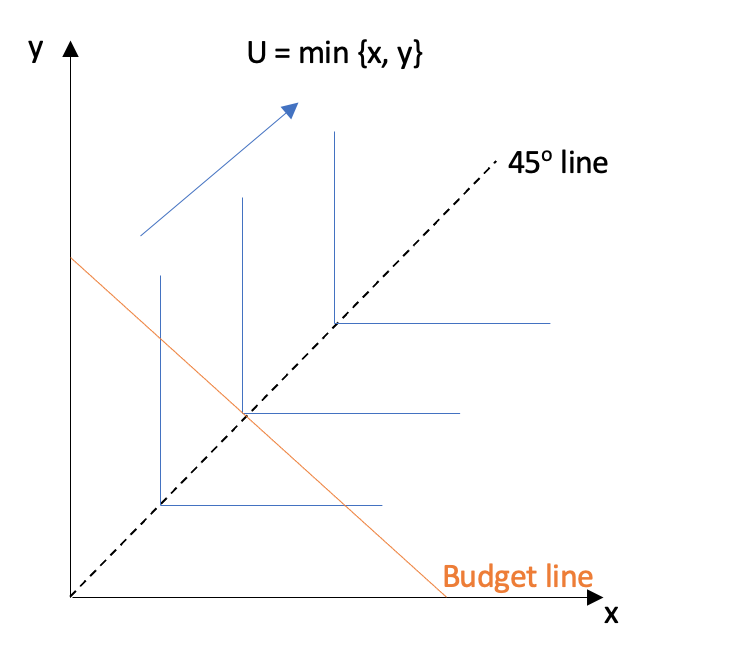

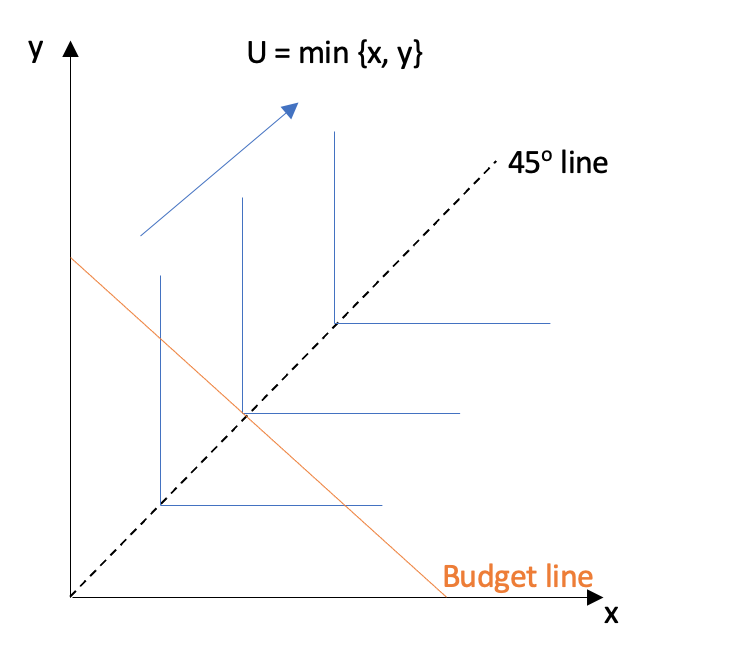

For a minimum function with goods that are perfect compliments, the same steps cannot be taken to find the utility maximising bundle as it is a non differentiable function. Therefore, intuition must be used. The consumer will maximise their utility at the kink point in the highest indifference curve that intersects the budget line where x = y. This is intuition, as the consumer is rational there is no point the consumer consuming more of one good and not the other good as their utility is taken at the minimum of the two ( they have no gain in utility from this and would be wasting their income). See figure 3.

For a minimum function with goods that are perfect compliments, the same steps cannot be taken to find the utility maximising bundle as it is a non differentiable function. Therefore, intuition must be used. The consumer will maximise their utility at the kink point in the highest indifference curve that intersects the budget line where x = y. This is intuition, as the consumer is rational there is no point the consumer consuming more of one good and not the other good as their utility is taken at the minimum of the two ( they have no gain in utility from this and would be wasting their income). See figure 3.

If the consumers income is increased their budget line is shifted outwards ands they now have more income to spend on either good x, good y, or both depending on their preferences for each good. if both goods x and y were

If the consumers income is increased their budget line is shifted outwards ands they now have more income to spend on either good x, good y, or both depending on their preferences for each good. if both goods x and y were

Anatomy of Cobb-Douglas Type Utility Functions in 3DRules for maximising utility by lumen learningAn example of utility maximisationUtility maximisation definition by Economics helpApplication of a utility function by InvestopediaDefinition of substitute goods by Investopedia

{{DEFAULTSORT:Utility Maximization Problem Optimal decisions Utility Mathematical optimization Business and economics portal

Jeremy Bentham

Jeremy Bentham (; 15 February 1748 Old_Style_and_New_Style_dates">O.S._4_February_1747.html" ;"title="Old_Style_and_New_Style_dates.html" ;"title="nowiki/>Old Style and New Style dates">O.S. 4 February 1747">Old_Style_and_New_Style_dates.htm ...

and John Stuart Mill. In microeconomics, the utility maximization problem is the problem consumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...

s face: "How should I spend my money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are as ...

in order to maximize my utility

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosoph ...

?" It is a type of optimal decision problem. It consists of choosing how much of each available good or service to consume, taking into account a constraint on total spending (income), the prices of the goods and their preferences.

Utility maximization is an important concept in consumer theory as it shows how consumers decide to allocate their income. Because consumers are rational

Rationality is the quality of being guided by or based on reasons. In this regard, a person acts rationally if they have a good reason for what they do or a belief is rational if it is based on strong evidence. This quality can apply to an abi ...

, they seek to extract the most benefit for themselves. However, due to bounded rationality and other biases, consumers sometimes pick bundles that do not necessarily maximize their utility. The utility maximization bundle of the consumer is also not set and can change over time depending on their individual preferences of goods, price changes and increases or decreases in income.

Basic setup

For utility maximization there are four basic steps process to derive consumer demand and find the utility maximizing bundle of the consumer given prices, income, and preferences. 1) Check if Walras's law is satisfied 2) 'Bang for buck' 3) the budget constraint 4) Check for negativity1) Walras's Law

Walras's law states that if a consumers preferences are complete, monotone and transitive then the optimal demand will lie on thebudget line

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. Consumer theory uses the concepts of a budget constraint and a preference ...

.

Preferences of the consumer

For a utility representation to exist the preferences of the consumer must be complete and transitive (necessary conditions).= Complete

= Completeness of preferences indicates that all bundles in the consumption set can be compared by the consumer. For example, if the consumer has 3 bundles A,B and C then; A B, A C, B A, B C, C B, C A, A A, B B, C C. Therefore, the consumer has complete preferences as they can compare every bundle.= Transitive

= Transitivity states that individuals preferences are consistent across the bundles. therefore, if the consumer weakly prefers A over B (A B) and B C this means that A C (A is weakly preferred to C)= Monotone

= For a preference relation to be monotone increasing the quantity of both goods should make the consumer strictly better off (increase their utility), and increasing the quantity of one good holding the other quantity constant should not make the consumer worse off (same utility). The preference is monotone if any only if; 1) 2) 3) where > 02) 'Bang for buck'

Bang for buck is a main concept in utility maximization and consists of the consumer wanting to get the best value for their money. If Walras's law has been satisfied, the optimal solution of the consumer lies at the point where the budget line and optimal indifference curve intersect, this is called the tangency condition. To find this point, differentiate the utility function with respect to x and y to find the marginal utilities, then divide by the respective prices of the goods. This can be solved to find the optimal amount of good x or good y.3) Budget constraint

The basic set up of the budget constraint of the consumer is: Due to Walras's law being satisfied: The tangency condition is then substituted into this to solve for the optimal amount of the other good.4) Check for negativity

Negativity must be checked for as the utility maximization problem can give an answer where the optimal demand of a good is negative, which in reality is not possible as this is outside the domain. If the demand for one good is negative, the optimal consumption bundle will be where 0 of this good is consumed and all income is spent on the other good (a corner solution). See figure 1 for an example when the demand for good x is negative.

Negativity must be checked for as the utility maximization problem can give an answer where the optimal demand of a good is negative, which in reality is not possible as this is outside the domain. If the demand for one good is negative, the optimal consumption bundle will be where 0 of this good is consumed and all income is spent on the other good (a corner solution). See figure 1 for an example when the demand for good x is negative.

A technical representation

Suppose the consumer'sconsumption set

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their pref ...

, or the enumeration of all possible consumption bundles that could be selected if there were a budget constraint.

The consumption set = (a set of positive real numbers, the consumer cannot preference negative amount of commodities).

Suppose also that the price vector (''p'') of the n commodities is positive,

and that the consumer's income is ; then the set of all affordable packages, the

and that the consumer's income is ; then the set of all affordable packages, the budget set

In economics, a budget set, or the opportunity set facing a consumer, is the set of all possible consumption bundles that the consumer can afford taking as given the prices of commodities available to the consumer and the consumer's income. Let the ...

is,

The consumer would like to buy the best affordable package of commodities.

It is assumed that the consumer has an ordinal utility function, called ''u''. It is a real-valued function with domain being the set of all commodity bundles, or

:

Then the consumer's optimal choice is the utility maximizing bundle of all bundles in the budget set if then the consumers optimal demand function is:

Finding is the utility maximization problem.

If ''u'' is continuous and no commodities are free of charge, then exists, but it is not necessarily unique. If the preferences of the consumer are complete, transitive and strictly convex then the demand of the consumer contains a unique maximiser for all values of the price and wealth parameters. If this is satisfied then is called the Marshallian demand function. Otherwise, is set-valued and it is called the Marshallian demand correspondence

In microeconomics, a consumer's Marshallian demand function (named after Alfred Marshall) is the quantity they demand of a particular good as a function of its price, their income, and the prices of other goods, a more technical exposition of the s ...

.

Utility maximisation of perfect compliments

U = min For a minimum function with goods that are perfect compliments, the same steps cannot be taken to find the utility maximising bundle as it is a non differentiable function. Therefore, intuition must be used. The consumer will maximise their utility at the kink point in the highest indifference curve that intersects the budget line where x = y. This is intuition, as the consumer is rational there is no point the consumer consuming more of one good and not the other good as their utility is taken at the minimum of the two ( they have no gain in utility from this and would be wasting their income). See figure 3.

For a minimum function with goods that are perfect compliments, the same steps cannot be taken to find the utility maximising bundle as it is a non differentiable function. Therefore, intuition must be used. The consumer will maximise their utility at the kink point in the highest indifference curve that intersects the budget line where x = y. This is intuition, as the consumer is rational there is no point the consumer consuming more of one good and not the other good as their utility is taken at the minimum of the two ( they have no gain in utility from this and would be wasting their income). See figure 3.

Utility maximisation of perfect substitutes

U = x + y For a utility function with perfect substitutes, the utility maximising bundle can be found by differentiation or simply by inspection. Suppose a consumer finds listening toAustralian

Australian(s) may refer to:

Australia

* Australia, a country

* Australians, citizens of the Commonwealth of Australia

** European Australians

** Anglo-Celtic Australians, Australians descended principally from British colonists

** Aboriginal A ...

rock bands AC/DC and Tame Impala

Tame Impala is the psychedelic music project of Australian multi-instrumentalist Kevin Parker. In the recording studio, Parker writes, records, performs, and produces all of the project's music. As a touring act, Tame Impala consists of Parke ...

perfect substitutes. This means that they are happy to spend all afternoon listening to only AC/DC, or only Tame Impala, or three-quarters AC/DC and one-quarter Tame Impala, or any combination of the two bands in any amount. Therefore, the consumer's optimal choice is determined entirely by the relative prices of listening to the two artists. If attending a Tame Impala concert is cheaper than attending the AC/DC concert, the consumer chooses to attend the Tame Impala concert, and vice versa. If the two concert prices are the same, the consumer is completely indifferent and may flip a coin to decide. To see this mathematically, differentiate the utility function to find that the MRS is constant - this is the technical meaning of perfect substitutes. As a result of this, the solution to the consumer's constrained maximization problem will not (generally) be an interior solution, and as such one must check the utility level in the boundary cases (spend entire budget on good x, spend entire budget on good y) to see which is the solution. The special case is when the (constant) MRS equals the price ratio (for example, both goods have the same price, and same coefficients in the utility function). In this case, any combination of the two goods is a solution to the consumer problem.

Reaction to changes in prices

For a given level of real wealth, only relative prices matter to consumers, not absolute prices. If consumers reacted to changes in nominal prices and nominal wealth even if relative prices and real wealth remained unchanged, this would be an effect calledmoney illusion

In economics, money illusion, or price illusion, is a cognitive bias where money is thought of in nominal, rather than real terms. In other words, the face value (nominal value) of money is mistaken for its purchasing power (real value) at a previ ...

. The mathematical first order conditions for a maximum of the consumer problem guarantee that the demand for each good is homogeneous of degree zero jointly in nominal prices and nominal wealth, so there is no money illusion.

When the prices of goods change, the optimal consumption of these goods will depend on the substitution and income effects. The substitution effect

In economics and particularly in consumer choice theory, the substitution effect is one component of the effect of a change in the price of a good upon the amount of that good demanded by a consumer, the other being the income effect.

When a ...

says that if the demand for both goods is homogeneous, when the price of one good decreases (holding the price of the other good constant) the consumer will consume more of this good and less of the other as it becomes relatively cheeper. The same goes if the price of one good increases, consumers will buy less of that good and more of the other.

The income effect occurs when the change in prices of goods cause a change in income. If the price of one good rises, then income is decreased (more costly than before to consume the same bundle), the same goes if the price of a good falls, income is increased (cheeper to consume the same bundle, they can therefore consume more of their desired combination of goods).

Reaction to changes in income

If the consumers income is increased their budget line is shifted outwards ands they now have more income to spend on either good x, good y, or both depending on their preferences for each good. if both goods x and y were

If the consumers income is increased their budget line is shifted outwards ands they now have more income to spend on either good x, good y, or both depending on their preferences for each good. if both goods x and y were normal good

In economics, a normal good is a type of a good which experiences an increase in demand due to an increase in income, unlike inferior goods, for which the opposite is observed. When there is an increase in a person's income, for example due to a w ...

s then consumption of both goods would increase and the optimal bundle would move from A to C (see figure 5). If either x or y were inferior good

In economics, an inferior good is a good whose demand decreases when consumer income rises (or demand increases when consumer income decreases), unlike normal goods, for which the opposite is observed. Normal goods are those goods for which the ...

s, then demand for these would decrease as income rises (the optimal bundle would be at point B or C).

Bounded rationality

for further information see: Bounded rationality In practice, a consumer may not always pick an optimal bundle. For example, it may require too much thought or too much time. Bounded rationality is a theory that explains this behaviour. Examples of alternatives to utility maximisation due to bounded rationality are;satisficing

Satisficing is a decision-making strategy or cognitive heuristic that entails searching through the available alternatives until an acceptability threshold is met. The term ''satisficing'', a portmanteau of ''satisfy'' and ''suffice'', was introduc ...

, elimination by aspects and the mental accounting heuristic.

* The satisficing

Satisficing is a decision-making strategy or cognitive heuristic that entails searching through the available alternatives until an acceptability threshold is met. The term ''satisficing'', a portmanteau of ''satisfy'' and ''suffice'', was introduc ...

heuristic is when a consumer defines an aspiration level and looks until they find an option that satisfies this, they will deem this option good enough and stop looking.

* Elimination by aspects is defining a level for each aspect of a product they want and eliminating all other options that don't meet this requirement e.g. price under $100, colour etc. until there is only one product left which is assumed to be the product the consumer will choose.

* The mental accounting

Mental accounting (or psychological accounting) attempts to describe the process whereby people code, categorize and evaluate economic outcomes. The concept was first named by Richard Thaler. Mental accounting deals with the budgeting and categor ...

heuristic: In this strategy it is seen that people often assign subjective values to their money depending on their preferences for different things. A person will develop mental accounts for different expenses, allocate their budget within these, then try to maximise their utility within each account.

Related concepts

The relationship between theutility function

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosoph ...

and Marshallian demand

In microeconomics, a consumer's Marshallian demand function (named after Alfred Marshall) is the quantity they demand of a particular good as a function of its price, their income, and the prices of other goods, a more technical exposition of the s ...

in the utility maximisation problem mirrors the relationship between the expenditure function In microeconomics, the expenditure function gives the minimum amount of money an individual needs to spend to achieve some level of utility, given a utility function and the prices of the available goods.

Formally, if there is a utility function u ...

and Hicksian demand in the expenditure minimisation problem. In expenditure minimisation the utility level is given and well as the prices of goods, the role of the consumer is to find a minimum level of expenditure required to reach this utility level.

The utilitarian social choice rule is a rule that says that society should choose the alternative that maximizes the ''sum'' of utilities. While utility-maximization is done by individuals, utility-sum maximization is done by society.

See also

* Choice modelling * Expenditure minimisation problem *Optimal decision

An optimal decision is a decision that leads to at least as good a known or expected outcome as all other available decision options. It is an important concept in decision theory. In order to compare the different decision outcomes, one commonly ...

*Substitution effect

In economics and particularly in consumer choice theory, the substitution effect is one component of the effect of a change in the price of a good upon the amount of that good demanded by a consumer, the other being the income effect.

When a ...

*Utility function

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosoph ...

*Law of demand

In microeconomics, the law of demand is a fundamental principle which states that there is an inverse relationship between price and quantity demanded. In other words, "conditional on all else being equal, as the price of a good increases (↑), ...

* Marginal utility

References

External links

Anatomy of Cobb-Douglas Type Utility Functions in 3D

{{DEFAULTSORT:Utility Maximization Problem Optimal decisions Utility Mathematical optimization Business and economics portal