tax wedge on:

[Wikipedia]

[Google]

[Amazon]

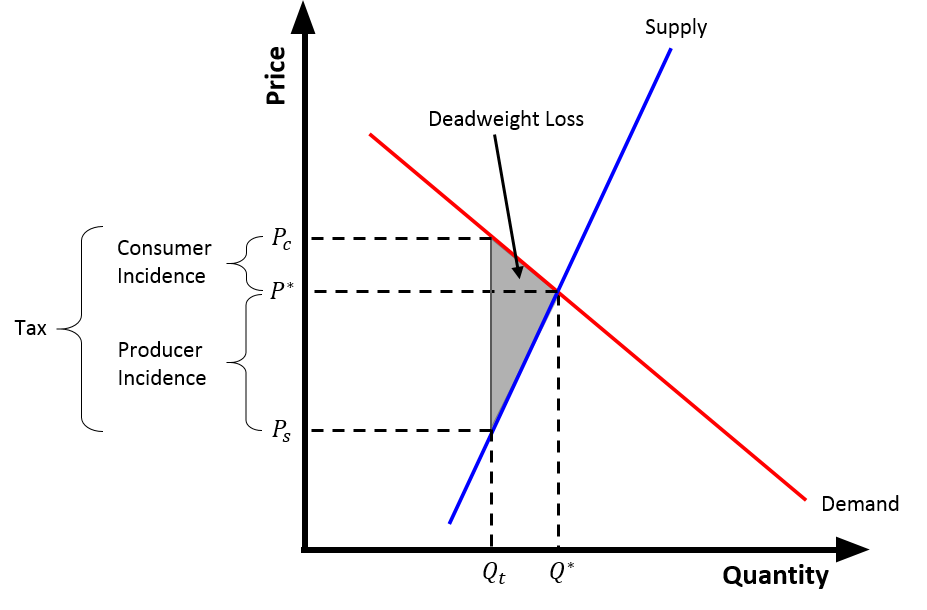

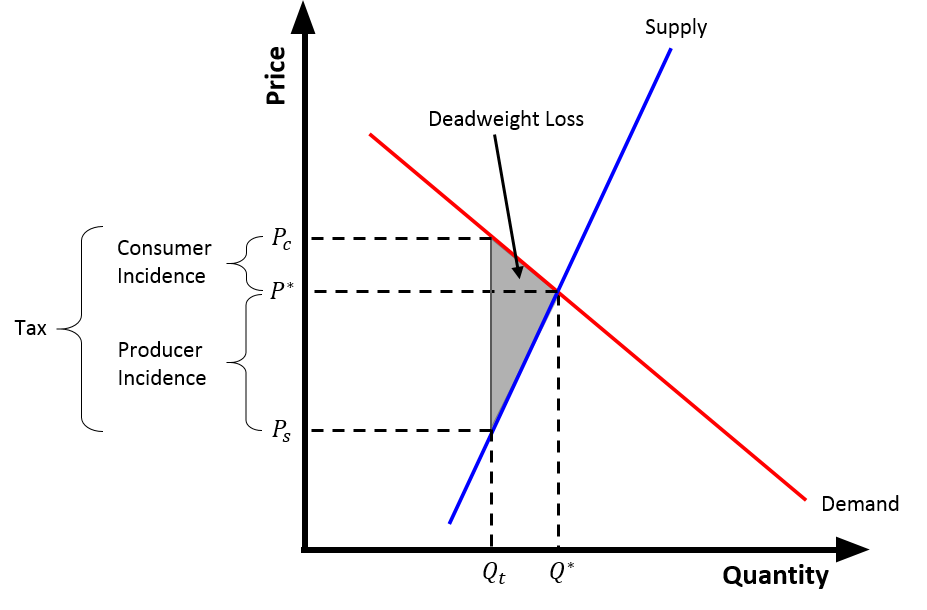

The tax wedge is the deviation from the equilibrium

The tax wedge is the deviation from the equilibrium

The tax wedge is the deviation from the equilibrium

The tax wedge is the deviation from the equilibrium price

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the ...

and quantity

Quantity or amount is a property that can exist as a multitude or magnitude, which illustrate discontinuity and continuity. Quantities can be compared in terms of "more", "less", or "equal", or by assigning a numerical value multiple of a unit ...

( and , respectively) as a result of the taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

of a good. Because of the tax, consumer

A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...

s pay more for the good () than they did before the tax, and suppliers

In commerce, a supply chain is a network of facilities that procure raw materials, transform them into intermediate goods and then final products to customers through a distribution system. It refers to the network of organizations, people, activ ...

receive less for the good () than they did before the tax . Put differently, the tax wedge is the difference between the price consumers pay and the value producers receive (net of tax) from a transaction. The tax effectively drives a "wedge" between the price consumers pay and the price producers receive for a product.

Following the Law of Supply and Demand, as the price to consumers increases, and the price received by suppliers decreases, the quantity that each wishes to trade will decrease. After a tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

is introduced, a new equilibrium is reached, where consumers pay more , suppliers receive less , and the quantity exchanged falls . The difference between and will be equivalent to the size of the per-unit tax.

Implications of a tax wedge

Deadweight loss

The filled-in "wedge" created by a tax actually represents the amount ofdeadweight loss

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced ''relative'' to the amoun ...

created by the tax. Deadweight loss is the reduction in social efficiency ( producer and consumer surplus) from preventing trades for which benefits exceed costs. Deadweight loss occurs with a tax because a higher price for consumers, and a lower price received by suppliers, reduces the quantity of the good sold. Thus, the equilibrium quantity of a taxed good is lower than the equilibrium quantity when the same good is not taxed. The deadweight loss created by the tax is equal to , represented by the shaded triangle in the figure.

Tax incidence

There are two types oftax incidence

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

or tax burden created by a tax: the statutory incidence of a tax and the economic incidence of a tax. Typically, a general reference to "tax incidence" refers to the economic incidence of a tax.

The statutory incidence of a tax falls on the party, producers or consumers, that has to physically send a check to the government in the amount of a tax. For example, if a person directly pays his or her income tax to the government (with no employer withholding), the statutory burden would fall on consumers. If a tax is imposed on the producers of gasoline, however, the statutory burden would fall on producers.

The economic incidence of a tax falls on the party that bears the actual cost of the tax. Put another way, economic incidence reflects the actual change in an individual's or firm's resources due to the tax. The statutory incidence of the tax is irrelevant to the economic incidence of the tax. In fact, the economic incidence is completely determined by the elasticity of supply and demand. Typically, both producers and consumers bear some portion of the economic incidence of the tax, but these portions do not have to be equal. The party with the more inelastic (steeper) curve bears more of the tax. For example, consumers of tobacco products typically bear more of the tax on tobacco, because they are addicted to the product and their consumption is not strongly affected by price changes (demand is inelastic). Producers bear more of the tax when supply is inelastic; for example, producers of beachfront hotels would bear more of a tax on hotels and accept lower prices for their product, because a change in price would not have a large effect on the quantity of beachfront hotels. These examples are illustrated graphically (right). The economic incidence on consumers is equal to , and the incidence on producers is equal to .

Full shifting of a tax occurs when one party in a transaction bears all of the tax burden. When demand is perfectly inelastic, the tax burden is fully shifted onto consumers; when supply is perfectly inelastic, the tax burden is fully shifted onto producers. In the long run, however, supply and demand both become more elastic: consumers' preferences for a product can change (cigarette smokers can quit smoking), and suppliers can choose to reduce their investment in, or leave, the market (a hotel chain can decide to sell its beachfront properties). This means that the economic incidence on consumers and producers can change in the long run.

References

{{Reflist Theory of taxation de:Ökonomische Wohlfahrt#Wohlfahrtswirkungen einer Steuer