Securities Exchange on:

[Wikipedia]

[Google]

[Amazon]

A stock exchange, securities exchange, or bourse is an exchange where

A stock exchange, securities exchange, or bourse is an exchange where

In England,

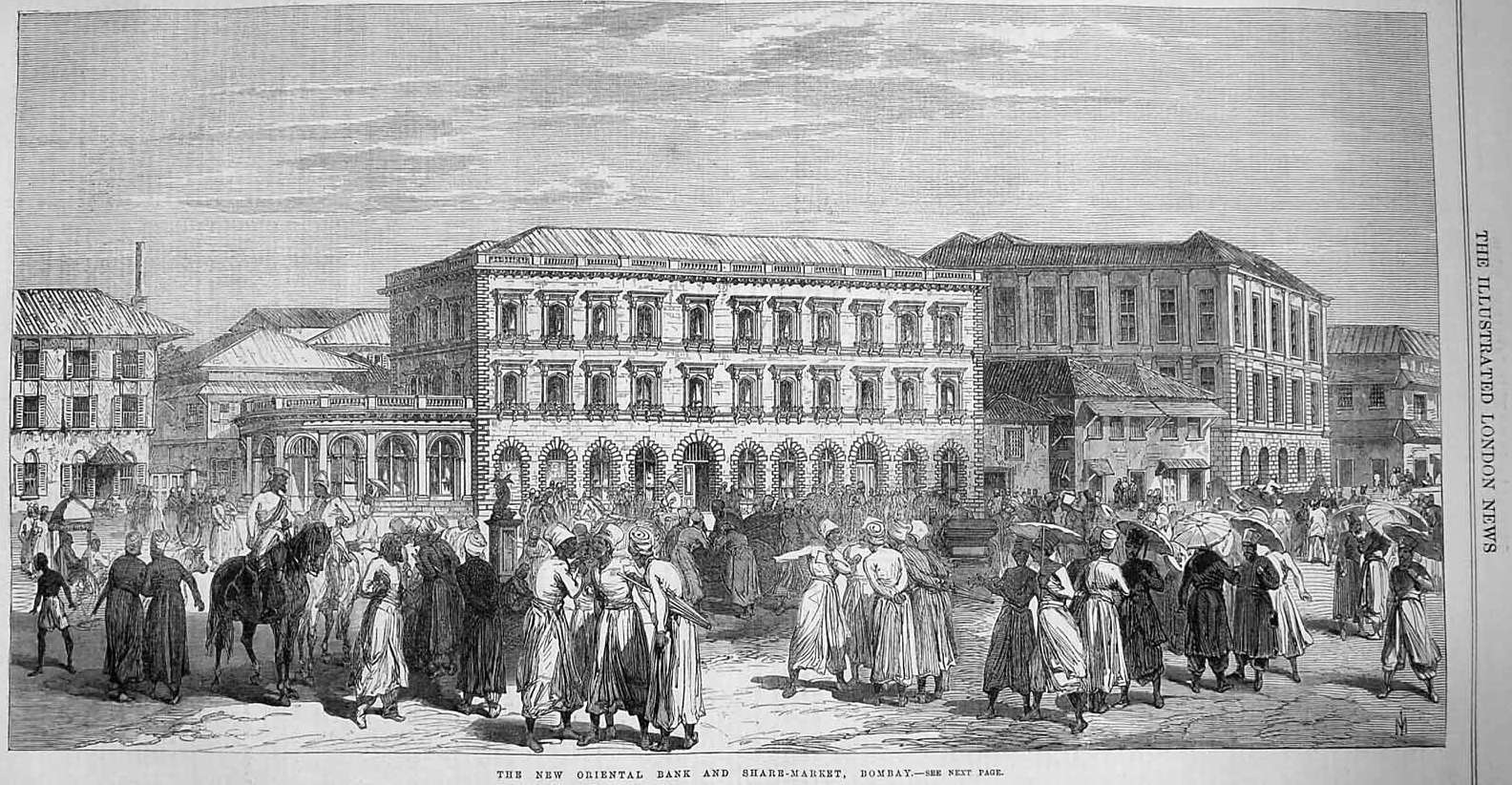

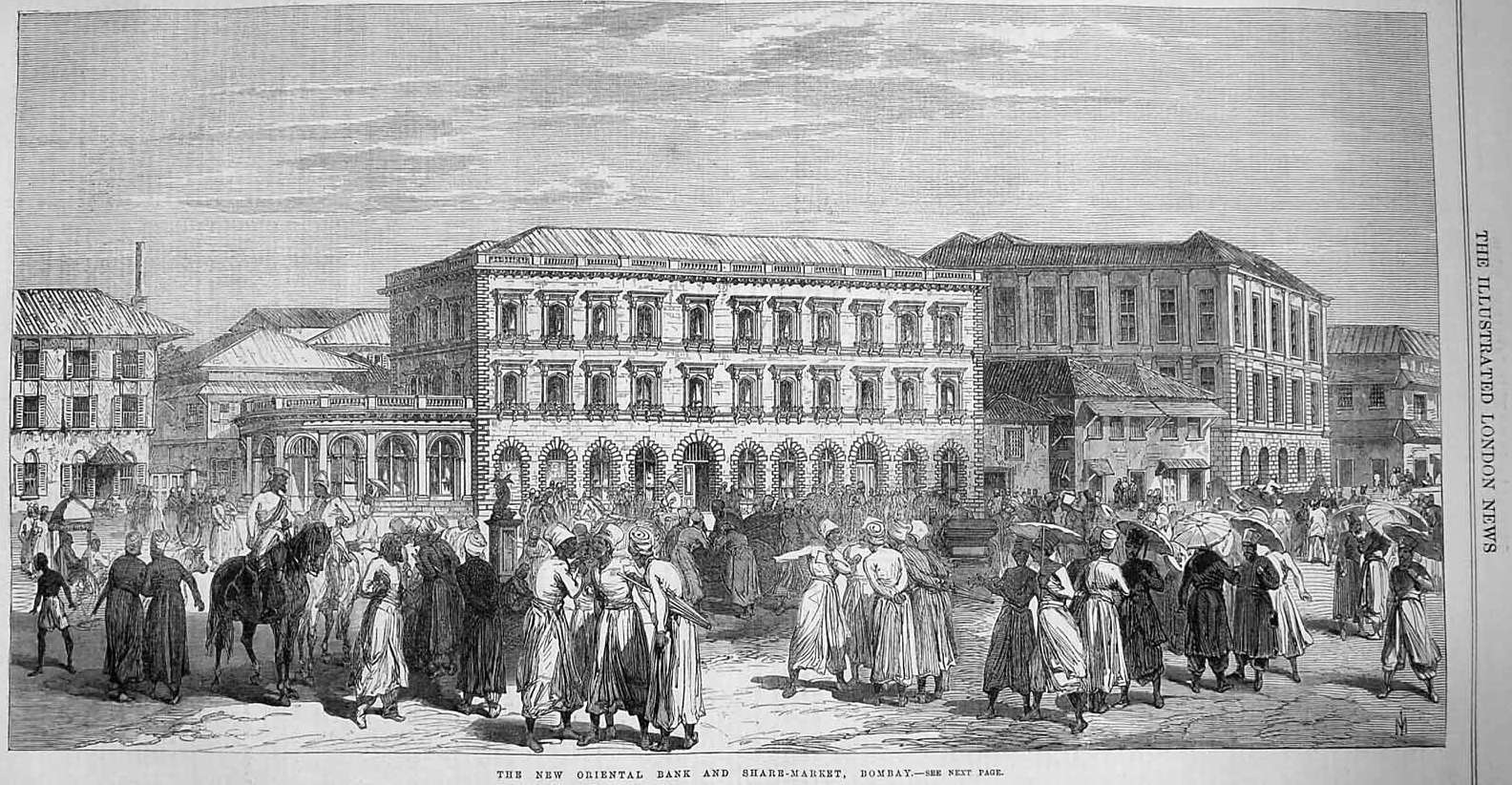

In England,  Bombay Stock Exchange was started by Premchand Roychand in 1875. While BSE Limited is now synonymous with Dalal Street, it was not always so. In the 1850s, five stock brokers gathered together under a Banyan tree in front of Mumbai Town Hall, where Horniman Circle is now situated. A decade later, the brokers moved their location to another leafy setting, this time under banyan trees at the junction of Meadows Street and what was then called Esplanade Road, now Mahatma Gandhi Road. With a rapid increase in the number of brokers, they had to shift places repeatedly. At last, in 1874, the brokers found a permanent location, the one that they could call their own. The brokers group became an official organization known as "The Native Share & Stock Brokers Association" in 1875.

The Bombay Stock Exchange continued to operate out of a building near the

Bombay Stock Exchange was started by Premchand Roychand in 1875. While BSE Limited is now synonymous with Dalal Street, it was not always so. In the 1850s, five stock brokers gathered together under a Banyan tree in front of Mumbai Town Hall, where Horniman Circle is now situated. A decade later, the brokers moved their location to another leafy setting, this time under banyan trees at the junction of Meadows Street and what was then called Esplanade Road, now Mahatma Gandhi Road. With a rapid increase in the number of brokers, they had to shift places repeatedly. At last, in 1874, the brokers found a permanent location, the one that they could call their own. The brokers group became an official organization known as "The Native Share & Stock Brokers Association" in 1875.

The Bombay Stock Exchange continued to operate out of a building near the

Stock exchanges have multiple roles in the economy. This may include the following:

Stock exchanges have multiple roles in the economy. This may include the following:

A stock exchange, securities exchange, or bourse is an exchange where

A stock exchange, securities exchange, or bourse is an exchange where stockbroker

A stockbroker is a regulated broker, broker-dealer, or registered investment adviser (in the United States) who may provide financial advisory and investment management services and execute transactions such as the purchase or sale of stock ...

s and traders can buy and sell securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

, such as shares

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of ...

of stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a compan ...

, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-i ...

s. Securities traded on a stock exchange include stock issued by listed companies, unit trust

A unit trust is a form of collective investment constituted under a trust deed.

A unit trust pools investors' money into a single fund, which is managed by a fund manager. Unit trusts offer access to a wide range of investments, and depending on ...

s, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry

Open outcry is a method of communication between professionals on a stock exchange or futures exchange, typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orde ...

at a central location such as the floor of the exchange or by using an electronic trading platform

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products ...

.

To be able to trade a security on a certain stock exchange, the security must be listed

Listed may refer to:

* Listed, Bornholm, a fishing village on the Danish island of Bornholm

* Listed (MMM program), a television show on MuchMoreMusic

* Endangered species in biology

* Listed building, in architecture, designation of a historicall ...

there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as modern markets use electronic communication network

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system that widely disseminates orders e ...

s, which give them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to broker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be con ...

s who are members of the exchange. In recent years, various other trading venues such as electronic communication networks, alternative trading system

Alternative trading system (ATS) is a US and Canadian regulatory term for a non-exchange trading venue that matches buyers and sellers to find counterparties for transactions. Alternative trading systems are typically regulated as broker-dealers ...

s and "dark pool

In finance, a dark pool (also black pool) is a private forum (alternative trading system or ATS) for trading securities, derivatives, and other financial instruments.Initial public offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investme ...

s of stocks and bonds to investors is done in the primary market :''"Primary market" may also refer to a market in art valuation.''

The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proc ...

and subsequent trading is done in the secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the ...

. A stock exchange is often the most important component of a stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, ...

. Supply and demand in stock markets are driven by various factors that, as in all free market

In economics, a free market is an economic system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of government or any ot ...

s, affect the price of stocks (see stock valuation

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit fr ...

).

There is usually no obligation for stock to be issued through the stock exchange itself, nor must stock be subsequently traded on an exchange. Such trading may be ''off exchange'' or over-the-counter

Over-the-counter (OTC) drugs are medicines sold directly to a consumer without a requirement for a prescription from a healthcare professional, as opposed to prescription drugs, which may be supplied only to consumers possessing a valid prescr ...

. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market. Stock exchanges also serve an economic function in providing liquidity to shareholders

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal ...

in providing an efficient means of disposing of shares.

History

The beginnings of the stock exchange were in Italy in the late Middle Ages. In the 1300s, Venetian lenders would carry slates with information on the various issues for sale and meet with clients, much like a broker does today. The Real Merchants of Venice introduced the principle of exchanging debts between moneylenders; a lender looking to unload a high-risk, high-interest loan might exchange it for a different loan with another lender. These lenders also bought government debt issues. As the natural evolution of their business continued, the lenders began to sell debt issues to the first individual investors.2 The Venetians were the leaders in the field and the first to start trading securities from other governments.3 There is little consensus among scholars as to when corporatestock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a compan ...

was first traded. Some view the key event as the Dutch East India Company

The United East India Company ( nl, Verenigde Oostindische Compagnie, the VOC) was a chartered company established on the 20th March 1602 by the States General of the Netherlands amalgamating existing companies into the first joint-stock ...

's founding in 1602, while others point to much earlier developments (Bruges, Antwerp in 1531 and in Lyon in 1548). The first book in history of securities exchange, the Confusion of Confusions, was written by the Dutch-Jewish trader Joseph de la Vega

José or Joseph Penso de la Vega, best known as Josseph de la Vega (ca. 1650 — Amsterdam, 13 November, 1692), was a Sephardi Jewish merchant in diamonds, financial expert, moral philosopher and poet, residing in Amsterdam. He became famous for ...

and the Amsterdam Stock Exchange

Euronext Amsterdam is a stock exchange based in Amsterdam, the Netherlands. Formerly known as the Amsterdam Stock Exchange, it merged on 22 September 2000 with the Brussels Stock Exchange and the Paris Stock Exchange to form Euronext. The r ...

is often considered the oldest “modern” securities market in the world. On the other hand, economist Ulrike Malmendier of the University of California at Berkeley

The University of California, Berkeley (UC Berkeley, Berkeley, Cal, or California) is a public university, public land-grant university, land-grant research university in Berkeley, California. Established in 1868 as the University of Californi ...

argues that a share market existed as far back as ancient Rome

In modern historiography, ancient Rome refers to Roman people, Roman civilisation from the founding of the city of Rome in the 8th century BC to the collapse of the Western Roman Empire in the 5th century AD. It encompasses the Roman Kingdom ...

, that derives from Etruscan "Argentari". In the Roman Republic

The Roman Republic ( la, Res publica Romana ) was a form of government of Rome and the era of the classical Roman civilization when it was run through public representation of the Roman people. Beginning with the overthrow of the Roman Ki ...

, which existed for centuries before the Empire

An empire is a "political unit" made up of several territories and peoples, "usually created by conquest, and divided between a dominant center and subordinate peripheries". The center of the empire (sometimes referred to as the metropole) ex ...

was founded, there were ''societates publicanorum'', organizations of contractors or leaseholders who performed temple-building and other services for the government. One such service was the feeding of geese on the Capitoline Hill as a reward to the birds after their honking warned of a Gallic invasion in 390 B.C. Participants in such organizations had ''partes'' or shares, a concept mentioned various times by the statesman and orator Cicero

Marcus Tullius Cicero ( ; ; 3 January 106 BC – 7 December 43 BC) was a Roman statesman, lawyer, scholar, philosopher, and academic skeptic, who tried to uphold optimate principles during the political crises that led to the esta ...

. In one speech, Cicero mentions "shares that had a very high price at the time". Such evidence, in Malmendier's view, suggests the instruments were tradable, with fluctuating values based on an organization's success. The ''societas'' declined into obscurity in the time of the emperors, as most of their services were taken over by direct agents of the state.

Tradable bonds as a commonly used type of security were a more recent innovation, spearheaded by the Italian city-states of the late medieval

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the post-classical period of global history. It began with the fall of the Western Roman Empire a ...

and early Renaissance

The Renaissance ( , ) , from , with the same meanings. is a period in European history marking the transition from the Middle Ages to modernity and covering the 15th and 16th centuries, characterized by an effort to revive and surpass ide ...

periods.Stringham, Edward Peter; Curott, Nicholas A.: ''On the Origins of Stock Markets'' art IV: ''Institutions and Organizations''; Chapter 14 pp. 324-344, in ''The Oxford Handbook of Austrian Economics'', edited by Peter J. Boettke and Christopher J. Coyne. (Oxford University Press, 2015, ). Edward P. Stringham & Nicholas A. Curott: "Business ventures with multiple shareholders became popular with ''commenda'' contracts in medieval Italy (Greif

Greif (German for Griffin) may refer to:

* Greif (surname)

* Greif, Inc., a Fortune 1000 company

* Operation Greif, a German infiltration operation using English-speaking troops during the Battle of the Bulge

* Heinkel He 177 Greif, a German he ...

, 2006, p. 286), and Malmendier (2009) provides evidence that shareholder companies date back to ancient Rome. Yet the title of the world's first stock market deservedly goes to that of seventeenth-century Amsterdam, where an active secondary market in company shares emerged. The two major companies were the Dutch East India Company

The United East India Company ( nl, Verenigde Oostindische Compagnie, the VOC) was a chartered company established on the 20th March 1602 by the States General of the Netherlands amalgamating existing companies into the first joint-stock ...

and the Dutch West India Company

The Dutch West India Company ( nl, Geoctrooieerde Westindische Compagnie, ''WIC'' or ''GWC''; ; en, Chartered West India Company) was a chartered company of Dutch merchants as well as foreign investors. Among its founders was Willem Usselincx ...

, founded in 1602 and 1621. Other companies existed, but they were not as large and constituted a small portion of the stock market (Israel 989

Year 989 ( CMLXXXIX) was a common year starting on Tuesday (link will display the full calendar) of the Julian calendar.

Events

By place

Byzantine Empire

* Emperor Basil II uses his contingent of 6,000 Varangians to help him defeat ...

1991, 109–112; Dehing and 't Hart 1997, 54; dela Vega 688

__NOTOC__

Year 688 ( DCLXXXVIII) was a leap year starting on Wednesday (link will display the full calendar) of the Julian calendar. The denomination 688 for this year has been used since the early medieval period, when the Anno Domini calendar ...

1996, 173)."

Joseph de la Vega

José or Joseph Penso de la Vega, best known as Josseph de la Vega (ca. 1650 — Amsterdam, 13 November, 1692), was a Sephardi Jewish merchant in diamonds, financial expert, moral philosopher and poet, residing in Amsterdam. He became famous for ...

, also known as Joseph Penso de la Vega and by other variations of his name, was an Amsterdam trader from a Spanish Jewish family and a prolific writer as well as a successful businessman in 17th-century Amsterdam. His 1688 book ''Confusion of Confusions'' explained the workings of the city's stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, ...

. It was the earliest book about stock trading In finance, a trade is an exchange of a security (stocks, bonds, commodities, currencies, derivatives or any valuable financial instrument) for "cash", typically a short-dated promise to pay in the currency of the country where the ' exchange' is ...

and inner workings of a stock market, taking the form of a dialogue between a merchant, a shareholder

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal o ...

and a philosopher, the book described a market that was sophisticated but also prone to excesses, and de la Vega offered advice to his readers on such topics as the unpredictability of market shifts and the importance of patience in investment.

In England,

In England, King William III

William III (William Henry; ; 4 November 16508 March 1702), also widely known as William of Orange, was the sovereign Prince of Orange from birth, Stadtholder of Holland, Zeeland, Utrecht, Guelders, and Overijssel in the Dutch Republic from the ...

sought to modernize the kingdom's finances to pay for its wars, and thus the first government bonds were issued in 1693 and the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government o ...

was set up the following year. Soon thereafter, English joint-stock companies began going public.

London's first stockbrokers, however, were barred from the old commercial center known as the Royal Exchange, reportedly because of their rude manners. Instead, the new trade was conducted from coffee houses along Exchange Alley. By 1698, a broker named John Castaing, operating out of Jonathan's Coffee House, was posting regular lists of stock and commodity prices. Those lists mark the beginning of the London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St Pau ...

.

One of history's greatest financial bubble

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fin ...

s occurred around 1720. At the center of it were the South Sea Company

The South Sea Company (officially The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, and for the encouragement of the Fishery) was a British joint-stock company founded in Ja ...

, set up in 1711 to conduct English trade with South America, and the Mississippi Company

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and t ...

, focused on commerce with France's Louisiana colony and touted by transplanted Scottish financier John Law

John Law may refer to:

Arts and entertainment

* John Law (artist) (born 1958), American artist

* John Law (comics), comic-book character created by Will Eisner

* John Law (film director), Hong Kong film director

* John Law (musician) (born 1961) ...

, who was acting in effect as France's central banker. Investors snapped up shares in both, and whatever else was available. In 1720, at the height of the mania, there was even an offering of "a company for carrying out an undertaking of great advantage, but nobody to know what it is".

By the end of that same year, share prices had started collapsing, as it became clear that expectations of imminent wealth from the Americas were overblown. In London, Parliament passed the Bubble Act

The Bubble Act 1720 (also Royal Exchange and London Assurance Corporation Act 1719) was an Act of the Parliament of Great Britain passed on 11 June 1720 that incorporated the Royal Exchange and London Assurance Corporation, but more significant ...

, which stated that only royally chartered companies could issue public shares. In Paris, Law was stripped of office and fled the country. Stock trading was more limited and subdued in subsequent decades. Yet the market survived, and by the 1790s shares were being traded in the young United States. On May 17, 1792, the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

opened under a ''Platanus occidentalis

''Platanus occidentalis'', also known as American sycamore, American planetree, western plane, occidental plane, buttonwood, and water beech, is a species of ''Platanus'' native to the eastern and central United States, the mountains of northeas ...

'' (buttonwood tree) in New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

, as 24 stockbrokers signed the Buttonwood Agreement

The Buttonwood Agreement is the founding document of what is now New York Stock Exchange and is one of the most important financial documents in U.S. history. The agreement organized securities trading in New York City and was signed on May 17, ...

, agreeing to trade five securities under that buttonwood tree.

Bombay Stock Exchange was started by Premchand Roychand in 1875. While BSE Limited is now synonymous with Dalal Street, it was not always so. In the 1850s, five stock brokers gathered together under a Banyan tree in front of Mumbai Town Hall, where Horniman Circle is now situated. A decade later, the brokers moved their location to another leafy setting, this time under banyan trees at the junction of Meadows Street and what was then called Esplanade Road, now Mahatma Gandhi Road. With a rapid increase in the number of brokers, they had to shift places repeatedly. At last, in 1874, the brokers found a permanent location, the one that they could call their own. The brokers group became an official organization known as "The Native Share & Stock Brokers Association" in 1875.

The Bombay Stock Exchange continued to operate out of a building near the

Bombay Stock Exchange was started by Premchand Roychand in 1875. While BSE Limited is now synonymous with Dalal Street, it was not always so. In the 1850s, five stock brokers gathered together under a Banyan tree in front of Mumbai Town Hall, where Horniman Circle is now situated. A decade later, the brokers moved their location to another leafy setting, this time under banyan trees at the junction of Meadows Street and what was then called Esplanade Road, now Mahatma Gandhi Road. With a rapid increase in the number of brokers, they had to shift places repeatedly. At last, in 1874, the brokers found a permanent location, the one that they could call their own. The brokers group became an official organization known as "The Native Share & Stock Brokers Association" in 1875.

The Bombay Stock Exchange continued to operate out of a building near the Town Hall

In local government, a city hall, town hall, civic centre (in the UK or Australia), guildhall, or a municipal building (in the Philippines), is the chief administrative building of a city, town, or other municipality. It usually houses ...

until 1928. The present site near Horniman Circle

The Horniman Circle Gardens is a large park in South Mumbai, India, which encompasses an area of 2½ acres (10,100 m²). It is situated in the Fort district of Mumbai, and is surrounded by office complexes housing the country's premier banks. D ...

was acquired by the exchange in 1928, and a building was constructed and occupied in 1930. The street on which the site is located came to be called ''Dalal Street'' in Hindi (meaning "Broker Street") due to the location of the exchange.

On 31 August 1957, the BSE became the first stock exchange to be recognized by the Indian Government

The Government of India (ISO: ; often abbreviated as GoI), known as the Union Government or Central Government but often simply as the Centre, is the national government of the Republic of India, a federal democracy located in South Asia, ...

under the Securities Contracts Regulation Act. Construction of the present building, the Phiroze Jeejeebhoy Towers at Dalal Street, Fort area, began in the late 1970s and was completed and occupied by the BSE in 1980. Initially named the ''BSE Towers'', the name of the building was changed soon after occupation, in memory of Sir Phiroze Jamshedji Jeejeebhoy

Sir Phiroze Jamshedji Jeejeebhoy (1915–1980) was the Chairman of the Bombay Stock Exchange (BSE) from 1966, until his death in 1980. The Bombay Stock Exchange is the largest of its kind in India, and one of the busiest in the world.

Jeejee ...

, chairman of the BSE since 1966, following his death.

In 1986, the BSE developed the S&P BSE SENSEX

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 ...

index, giving the BSE a means to measure the overall performance of the exchange. In 2000, the BSE used this index to open its derivatives market, trading S&P BSE SENSEX futures contracts. The development of S&P BSE SENSEX options along with equity derivatives followed in 2001 and 2002, expanding the BSE's trading platform.

Historically an open outcry floor trading exchange, the Bombay Stock Exchange switched to an electronic trading system developed by Cmc ltd. in 1995. It took the exchange only 50 days to make this transition. This automated, screen-based trading

In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products ...

platform called BSE On-Line Trading (BOLT) had a capacity of 8 million orders per day. Now BSE has raised capital by issuing shares and as on 3 May 2017 the BSE share which is traded in NSE only closed with ₹999.

Roles

Stock exchanges have multiple roles in the economy. This may include the following:

Stock exchanges have multiple roles in the economy. This may include the following:

Raising capital for businesses

Besides the borrowing capacity provided to an individual or firm by thebanking system

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Becaus ...

, in the form of credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

or a loan, a stock exchange provides companies

A company, abbreviated as co., is a legal entity representing an association of people, whether natural, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared go ...

with the facility to raise capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used fo ...

for expansion through selling shares

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of ...

to the investing public.

Capital intensive companies, particularly high tech

High technology (high tech), also known as advanced technology (advanced tech) or exotechnology, is technology that is at the cutting edge: the highest form of technology available. It can be defined as either the most complex or the newest te ...

companies, typically need to raise high volumes of capital in their early stages. For this reason, the public market provided by the stock exchanges has been one of the most important funding sources for many capital intensive startups. In the 1990s and early 2000s, hi-tech listed companies experienced a boom and bust in the world's major stock exchanges. Since then, it has been much more demanding for the high-tech entrepreneur to take his/her company public, unless either the company is already generating sales and earnings, or the company has demonstrated credibility and potential from successful outcomes: clinical trials, market research, patent registrations, etc. This is quite different from the situation of the 1990s to early-2000s period, when a number of companies (particularly Internet boom and biotechnology companies) went public in the most prominent stock exchanges around the world in the total absence of sales, earnings, or any type of well-documented promising outcome. Though it's not as common, it still happens that highly speculative and financially unpredictable hi-tech startups are listed for the first time in a major stock exchange. Additionally, there are smaller, specialized entry markets for these kind of companies with stock index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

Two of the pr ...

es tracking their performance (examples include the Alternext

Euronext Growth is a multilateral trading facility (MTF) operated by Euronext. This equity trading market that was opened May 17, 2005 to address an opportunity posed by small to medium-sized firms that were anticipated to desire easier access t ...

, CAC Small

The CAC Small (formerly the CAC Small 90) is a stock market index used by the Paris Bourse. It is a small-cap index which represents all main-market French equities not included in the CAC 40, the CAC Next 20 or the CAC Mid 60. Together, these 4 i ...

, SDAX

The SDAX (German abbreviation for ''Small-Cap-deutsche Aktienindex'') is a stock market index composed of 70 small and medium-sized companies in Germany. These so-called ' small caps' rank directly below the MDAX (mid-cap) shares in terms of or ...

, TecDAX).

Alternatives to stock exchanges for raising capital

= Research and Development limited partnerships

= Companies have also raised significant amounts of capital through R&Dlimited partnership

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited ...

s. Tax law changes that were enacted in 1987 in the United States changed the tax deductibility of investments in R&D limited partnerships. In order for a partnership to be of interest to investors today, the cash on cash return must be high enough to entice investors.

=Venture capital

= A general source of capital for startup companies has beenventure capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which h ...

. This source remains largely available today, but the maximum statistical amount that the venture company firms in aggregate will invest in any one company is not limitless (it was approximately $15 million in 2001 for a biotechnology company).

=Corporate partners

= Another alternative source of cash for a private company is a corporate partner, usually an established multinational company, which provides capital for the smaller company in return for marketing rights, patent rights, or equity. Corporate partnerships have been used successfully in a large number of cases.Mobilizing savings for investment

When people draw their savings and invest in shares (through aninitial public offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investme ...

or the seasoned equity offering A seasoned equity offering or secondary equity offering (SEO) or capital increase is a new equity issued by an already publicly traded company. Seasoned offerings may involve shares sold by existing shareholders (non-dilutive), new shares (dilutiv ...

of an already listed company), it usually leads to rational

Rationality is the quality of being guided by or based on reasons. In this regard, a person acts rationally if they have a good reason for what they do or a belief is rational if it is based on strong evidence. This quality can apply to an abi ...

allocation of resources because funds, which could have been consumed, or kept in idle deposits with banks, are mobilized and redirected to help companies' management boards finance their organizations. This may promote business activity with benefits for several economic sectors such as agriculture, commerce and industry, resulting in stronger economic growth and higher productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proces ...

levels of firms.

Facilitating acquisitions

Companies view acquisitions as an opportunity to expandproduct line

Product may refer to:

Business

* Product (business), an item that serves as a solution to a specific consumer problem.

* Product (project management), a deliverable or set of deliverables that contribute to a business solution

Mathematics

* Produ ...

s, increase distribution channels, hedge against volatility, increase their market share

Market share is the percentage of the total revenue or sales in a market that a company's business makes up. For example, if there are 50,000 units sold per year in a given industry, a company whose sales were 5,000 of those units would have a ...

, or acquire other necessary business asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that c ...

s. A takeover bid

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to t ...

or mergers and acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspec ...

through the stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, ...

is one of the simplest and most common ways for a company to grow by acquisition or fusion.

Profit sharing

Both casual and professionalstock investor

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an invest ...

s, as large as institutional investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked ...

s or as small as an ordinary middle-class family, through dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-i ...

s and stock price increases that may result in capital gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares.

A ...

s, share in the wealth of profitable businesses. Unprofitable and troubled businesses may result in capital losses for shareholders.

Corporate governance

By having a wide and varied scope of owners, companies generally tend to improve management standards andefficiency

Efficiency is the often measurable ability to avoid wasting materials, energy, efforts, money, and time in doing something or in producing a desired result. In a more general sense, it is the ability to do things well, successfully, and without ...

to satisfy the demands of these shareholders and the more stringent rules for public corporations imposed by public stock exchanges and the government. This improvement can be attributed in some cases to the price mechanism exerted through shares of stock, wherein the price of the stock falls when management is considered poor (making the firm vulnerable to a takeover by new management) or rises when management is doing well (making the firm less vulnerable to a takeover). In addition, publicly listed shares are subject to greater transparency so that investors can make informed decisions about a purchase. Consequently, it is alleged that public companies (companies that are owned by shareholders who are members of the general public and trade shares on public exchanges) tend to have better management records than privately held companies

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is ...

(those companies where shares are not publicly traded, often owned by the company founders, their families and heirs, or otherwise by a small group of investors).

Despite this claim, some well-documented cases are known where it is alleged that there has been considerable slippage in corporate governance

Corporate governance is defined, described or delineated in diverse ways, depending on the writer's purpose. Writers focused on a disciplinary interest or context (such as accounting, finance, law, or management) often adopt narrow definitions ...

on the part of some public companies, particularly in the cases of accounting scandal

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "langua ...

s. The policies that led to the dot-com bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet.

Between 1995 and its peak in March 2000, the Nasdaq Comp ...

in the late 1990s and the subprime mortgage crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the col ...

in 2007–08 are also examples of corporate mismanagement. The mismanagement of companies such as Pets.com (2000), Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional compani ...

(2001), One.Tel (2001), Sunbeam Products

Sunbeam Products is an American brand that has produced electric home appliances since 1910. Its products have included the Mixmaster mixer, the Sunbeam CG waffle iron, Coffeemaster (1938–1964) and the fully automatic T20 toaster.

The compa ...

(2001), Webvan

Webvan was a dot-com company and grocery business that filed for bankruptcy in 2001 after 3 years of operation. It was headquartered in Foster City, California, United States. It delivered products to customers' homes within a 30-minute window o ...

(2001), Adelphia Communications Corporation

Adelphia Communications Corporation was an American cable television company with headquarters in Coudersport, Pennsylvania. It was founded in 1952 by brothers Gus and John Rigas after the pair purchased a cable television franchise for US$300. C ...

(2002), MCI WorldCom

MCI, Inc. (subsequently Worldcom and MCI WorldCom) was a telecommunications company. For a time, it was the second largest long-distance telephone company in the United States, after AT&T. Worldcom grew largely by acquiring other telecommunic ...

(2002), Parmalat

Parmalat S.p.A. is a dairy and food corporation which is a subsidiary of French multinational company Lactalis. It was founded by Calisto Tanzi in 1961.

Having become the leading global company in the production of long-life milk using ultra- ...

(2003), American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/amer ...

(2008), Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

(2008), Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, ...

(2008), General Motors

The General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. It is the largest automaker in the United States and ...

(2009) and Satyam Computer Services

Mahindra Satyam (formerly Satyam Computer Services Limited) was an Indian information technology (IT) services company based in Hyderabad, India, offering software development, system maintenance, packaged software integration and engineerin ...

(2009) all received plenty of media attention.

Many banks and companies worldwide utilize securities identification numbers (ISIN

Isin (, modern Arabic: Ishan al-Bahriyat) is an archaeological site in Al-Qādisiyyah Governorate, Iraq. Excavations have shown that it was an important city-state in the past.

History of archaeological research

Ishan al-Bahriyat was visited ...

) to identify, uniquely, their stocks, bonds and other securities. Adding an ISIN code helps to distinctly identify securities and the ISIN system is used worldwide by funds, companies, and governments.

However, when poor financial, ethical or managerial records become public, stock investor

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an invest ...

s tend to lose money as the stock and the company tend to lose value. In the stock exchanges, shareholders of underperforming firms are often penalized by significant share price decline, and they tend as well to dismiss incompetent management teams.

Creating investment opportunities for small investors

As opposed to other businesses that require huge capital outlay, investing in shares is open to both the large and small stock investors as minimum investment amounts are minimal. Therefore, the stock exchange provides the opportunity for small investors to own shares of the same companies as large investors.Government capital-raising for development projects

Governments at various levels may decide to borrow money to finance infrastructure projects such as sewage and water treatment works or housing estates by selling another category ofsecurities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

known as bonds. These bonds can be raised through the stock exchange whereby members of the public buy them, thus loaning money to the government. The issuance of such bonds can obviate, in the short term, direct taxation of citizens to finance development—though by securing such bonds with the full faith and credit of the government instead of with collateral, the government must eventually tax citizens or otherwise raise additional funds to make any regular coupon payments and refund the principal when the bonds mature.

Barometer of the economy

At the stock exchange, share prices rise and decreases depending, largely, on economic forces. Share prices tend to rise or remain stable when companies and the economy in general show signs of stability and growth. Arecession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

, depression, or financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

could eventually lead to a stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often foll ...

. Therefore, the movement of share prices and in general of the stock index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

Two of the pr ...

es can be an indicator of the general trend in the economy.

Listing requirements

Each stock exchange imposes its ownlisting requirements

In corporate finance, a listing refers to the company's shares being on the list (or board) of stock that are officially traded on a stock exchange. Some stock exchanges allow shares of a foreign company to be listed and may allow dual listing, su ...

upon companies that want to be listed on that exchange. Such conditions may include minimum number of shares outstanding, minimum market capitalization, and minimum annual income.

Examples of listing requirements

The listing requirements imposed by some stock exchanges include: * New York Stock Exchange: theNew York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

(NYSE) requires a company to have issued at least 1.1 million shares of stock worth $40 million and must have earned more than $10 million over the last three years.

* NASDAQ Stock Exchange: NASDAQ

The Nasdaq Stock Market () (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second ...

requires a company to have issued at least 1.25 million shares of stock worth at least $70 million and must have earned more than $11 million over the last three years.

* London Stock Exchange: the main market of the London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St Pau ...

requires a minimum market capitalization (£700,000), three years of audited financial statements, minimum public float (25%) and sufficient working capital

Working capital (WC) is a financial metric which represents operating liquidity available to a business, organisation, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is consi ...

for at least 12 months from the date of listing.

* Bombay Stock Exchange: Bombay Stock Exchange

BSE Limited, also known as the Bombay Stock Exchange (BSE), is an Indian stock exchange. It is located on Dalal Street in Mumbai. Established in 1875 by cotton merchant Premchand Roychand, a Jain businessman, it is the oldest stock exchange i ...

(BSE) requires a minimum market capitalization of and minimum public float equivalent to .

Ownership

Stock exchanges originated asmutual organization

A mutual organization, or mutual society is an organization (which is often, but not always, a company or business) based on the principle of mutuality and governed by private law. Unlike a true cooperative, members usually do not contribute ...

s, owned by its member stockbrokers. However, the major stock exchanges have ''demutualized'', where the members sell their shares in an initial public offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investme ...

. In this way the mutual organization becomes a corporation, with shares that are listed on a stock exchange. Examples are Australian Securities Exchange

Australian Securities Exchange Ltd or ASX, is an Australian public company that operates Australia's primary securities exchange, the Australian Securities Exchange (sometimes referred to outside of Australia as, or confused within Australia as ...

(1998), Euronext

Euronext N.V. (short for European New Exchange Technology) is a pan-European bourse that offers various trading and post-trade services.

Traded assets include regulated equities, exchange-traded funds (ETF), warrants and certificates, bonds, ...

(merged with New York Stock Exchange), NASDAQ

The Nasdaq Stock Market () (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second ...

(2002), Bursa Malaysia

Bursa Malaysia is the stock exchange of Malaysia. It is one of the largest bourses in ASEAN. It is based in Kuala Lumpur and was previously known as the Kuala Lumpur Stock Exchange (KLSE). It provides a full integration of transactions, offe ...

(2004), the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

(2005), Bolsas y Mercados Españoles

Bolsas y Mercados Españoles (; BME) is the Spanish company that deals with the organizational aspects of the Spanish stock exchanges and financial markets, which includes the stock exchanges in Madrid, Barcelona, Bilbao and Valencia. In additio ...

, and the São Paulo Stock Exchange

B3 S.A. - Brasil, Bolsa, Balcão (in English, ''B3 - Brazil Stock Exchange and Over-the-Counter Market''), formerly BM&FBOVESPA, is a stock exchange located in São Paulo, Brazil, and the second oldest of the country.

Its current form can be tra ...

(2007).

The Shenzhen Stock Exchange

The Shenzhen Stock Exchange (SZSE; ) is a stock exchange based in the city of Shenzhen, in the People's Republic of China. It is one of three stock exchanges operating independently in Mainland China, the others being the Beijing Stock Exch ...

and Shanghai Stock Exchange

The Shanghai Stock Exchange (SSE) is a stock exchange based in the city of Shanghai, China. It is one of the three stock exchanges operating independently in mainland China, the others being the Beijing Stock Exchange and the Shenzhen Stock Excha ...

can be characterized as quasi-state institutions insofar as they were created by government bodies in China and their leading personnel are directly appointed by the China Securities Regulatory Commission

The China Securities Regulatory Commission (CSRC) is a government ministry of the State Council of the People's Republic of China (PRC). It is the main regulator of the securities industry in China.

History

China's first Securities Law was ...

.

Another example is Tashkent Stock Exchange

Tashkent Stock Exchange is the major securities trading platform and the only corporate securities exchange in Uzbekistan. It was founded by government in 1994 as an open joint stock company, located in the capital of Uzbekistan - Tashkent.

Over ...

established in 1994, three years after the collapse of the Soviet Union, mainly state-owned but has a form of a public corporation (joint-stock company

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareholders a ...

). Korea Exchange

Korea Exchange (KRX) is the sole securities exchange operator in South Korea. It is headquartered in Busan, and has an office for cash markets and market oversight in Seoul.

History

The Korea Exchange was created through the integration of K ...

(KRX) owns 25% less one share of the Tashkent Stock Exchange.

In 2018, there were 15 licensed stock exchanges in the United States, of which 13 actively traded securities. All of these exchanges were owned by three publicly traded multinational companies, Intercontinental Exchange

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russ ...

, Nasdaq, Inc.

Nasdaq, Inc. is an American multinational financial services corporation that owns and operates three stock exchanges in the United States: the namesake Nasdaq stock exchange, the Philadelphia Stock Exchange, and the Boston Stock Exchange, a ...

, and Cboe Global Markets

Cboe Global Markets is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets.

History

Founded in 1973 by the Chicago Board of Trade and member owned for several decades, on March 11, ...

, except one, IEX

Investors Exchange (IEX) is a stock exchange in the United States. It was founded in 2012 in order to mitigate the effects of high-frequency trading. IEX was launched as a national securities exchange in September 2016. On October 24, 2017, it ...

. In 2019, a group of financial corporations announced plans to open a members owned exchange, MEMX, an ownership structure similar to the mutual organizations of earlier exchanges.

Other types of exchanges

In the 19th century, exchanges were opened to tradeforward contract

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on at the time of conclusion of the contract, making it a type of derivat ...

s on commodities

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them.

The price of a co ...

. Exchange traded forward contracts are called futures contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset ...

s. These ''commodity market

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investin ...

s'' later started offering future contracts on other products, such as interest rates and shares, as well as options

Option or Options may refer to:

Computing

*Option key, a key on Apple computer keyboards

*Option type, a polymorphic data type in programming languages

*Command-line option, an optional parameter to a command

*OPTIONS, an HTTP request method

...

contracts. They are now generally known as futures exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity o ...

s.

See also

*Auction

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition e ...

* Capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers ...

* Commodities exchange

A commodities exchange is an exchange, or market, where various commodities are traded. Most commodity markets around the world trade in agricultural products and other raw materials (like wheat, barley, sugar, maize, cotton, cocoa, coffee, m ...

* Corporate governance

Corporate governance is defined, described or delineated in diverse ways, depending on the writer's purpose. Writers focused on a disciplinary interest or context (such as accounting, finance, law, or management) often adopt narrow definitions ...

* Federation of Euro-Asian Stock Exchanges

The Federation of Euro-Asian Stock Exchanges (FEAS) is a non-profit international organization comprising the main stock exchanges in Eastern Europe, the Middle East, and Central Asia. The purpose of the Federation is to contribute to the cooperat ...

* Financial regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the stability and integrity of the financial system. This may be handle ...

* Histoire des bourses de valeurs (French)

* International Organization of Securities Commissions

The International Organization of Securities Commissions (IOSCO) is an association of organizations that regulate the world's securities and futures markets. Members are typically primary securities and/or futures regulators in a national jurisdi ...

* Securities market participants (United States)

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe ...

* Stag profit

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment ...

* Stock exchanges for developing countries

* Stock market data systems Stock market data systems communicate market data—information about securities and stock trades—from stock exchanges to stockbrokers and stock traders.

History

The earliest stock exchanges were in France in the 12th century and in Bru ...

* World Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

Lists:

* List of stock exchanges

This is a list of major stock exchanges. Those futures exchanges that also offer trading in securities besides trading in futures contracts are listed both here and in the list of futures exchanges.

There are sixteen stock exchanges in the wor ...

* List of European stock exchanges

* List of stock exchanges in the Americas

This is a list of active stock exchanges in the Americas. Stock exchanges in Latin America (where Spanish and Portuguese prevail) use the term ''Bolsa de Valores'', meaning "bag" or "purse" of "values". (compare Börse in German or bourse in ...

* List of African stock exchanges

There are 29 exchanges in Africa, representing 38 nations' capital markets.

21 of the 29 stock exchanges in Africa are members of the African Securities Exchanges Association (ASEA). ASEA members are indicated below by an asterisk (*).

The Eg ...

* List of stock exchanges in Western Asia

This is a list of Asian stock exchanges.

In the Asian region, there are multiple stock exchanges. As per data from World Federation of Exchanges, below are top 10 selected in 2020:

* Shanghai Stock Exchange, China

* Tokyo Stock Exchange, Japan

...

* List of South Asian stock exchanges

This is a list of Asian stock exchanges.

In the Asian region, there are multiple stock exchanges. As per data from World Federation of Exchanges, below are top 10 selected in 2020:

* Shanghai Stock Exchange, China

* Tokyo Stock Exchange, Japan

...

* List of East Asian stock exchanges

This is a list of Asian stock exchanges.

In the Asian region, there are multiple stock exchanges. As per data from World Federation of Exchanges, below are top 10 selected in 2020:

* Shanghai Stock Exchange, China

* Tokyo Stock Exchange, Japan

...

* List of Southeast Asian stock exchanges

* List of stock exchanges in Oceania

This is a list of active stock exchanges in Oceania.

Stock Exchanges in Oceania

See also

* List of stock exchanges

References

{{Reflist

*

Oceania

Oceania (, , ) is a geographical region that includes Australasia, Melanesia, Mic ...

* List of countries without a stock exchange

This is a list of sovereign states without a stock exchange:

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

The following de facto states do not maintain stock exchanges:

*

*

*

*

*

*

*

*

*

*

A number of Caribbean countries are served b ...

* List of stock market indices

Commonly used stock market indices include:

Global

Large companies not ordered by any nation or type of business:

* MSCI World (i.e. MSCI ACWI Index)

* S&P Global 100

* S&P Global 1200

* The Global Dow – Global version of the Dow Jones In ...

* List of financial regulatory authorities by country

The following is an incomplete list of financial regulatory authorities by country.

List

A-B

* Afghanistan - Da Afghanistan Bank (DAB)

* Albania - Albanian Financial Supervisory Authority (FSA)

* Algeria - Commission d'Organisation et de ...

* List of Swiss financial market legislation The Federal Act on Banks and Savings Banks is a Swiss federal law and act-of-parliament that operates as the supreme law governing banking in Switzerland. Although the federal law has only been amended seven times, it has been revised multiple t ...

References

External links

* {{Authority control Exchange