private finance initiative on:

[Wikipedia]

[Google]

[Amazon]

The private finance initiative (PFI) was a

To better promote PFI, the Labour government appointed Malcolm Bates to chair the efforts to review the policy with a number of Arthur Andersen staffers. They recommended the creation of a Treasury Task Force (TTF) to train public servants into PFI practice and to coordinate the implementation of PFI. In 1998, the TTF was renamed to "Partnership UK" (PUK) and sold 51% of its share to the private sector. PUK was then chaired by Sir Derek Higgs, director of Prudential Insurance and chairman of British Land plc. These changes meant that the government transferred the responsibility of managing PFI to a corporation closely related with the owners, financiers, consultants, and subcontractors that stood to benefit from this policy. This created a strong appearance of conflict of interest.

Trade unions such as

To better promote PFI, the Labour government appointed Malcolm Bates to chair the efforts to review the policy with a number of Arthur Andersen staffers. They recommended the creation of a Treasury Task Force (TTF) to train public servants into PFI practice and to coordinate the implementation of PFI. In 1998, the TTF was renamed to "Partnership UK" (PUK) and sold 51% of its share to the private sector. PUK was then chaired by Sir Derek Higgs, director of Prudential Insurance and chairman of British Land plc. These changes meant that the government transferred the responsibility of managing PFI to a corporation closely related with the owners, financiers, consultants, and subcontractors that stood to benefit from this policy. This created a strong appearance of conflict of interest.

Trade unions such as

Despite being so critical of PFI while in opposition and promising reform, once in power George Osborne progressed 61 PFI schemes worth a total of £6.9bn in his first year as Chancellor. According to Mark Hellowell from the

Despite being so critical of PFI while in opposition and promising reform, once in power George Osborne progressed 61 PFI schemes worth a total of £6.9bn in his first year as Chancellor. According to Mark Hellowell from the

''A new approach to public private partnerships''

accessed 26 April 2024 Under this "new approach", the government would become a minority equity co-investor in future projects, partly to better align the private and public sector interests in new projects. A consultation exercise was subsequently undertaken by the government regarding the terms on which the public sector stake would be managed, aiming for a generally consistent approach across projects but with scope for details to be finalised prior to operation to reflect any project-specific issues. The government's response to the consultation and the "Standard PF2 Equity Documents" were published in October 2013. Under the Priority School Building Programme which was launched in 2014 by the Education and Skills Funding Agency, the rebuilding and/or refurbishment of 46 schools in England was funded and procured using the PF2 model.

The high cost of hospitals built under PFI is forcing service cuts at neighbouring hospitals built with public money. Overspending at the PFI-funded Worcestershire Royal Hospital has put a question mark over services at neighbouring hospitals. A strategic health authority paper in 2007 noted debts at two hospitals in south-east London: Princess Royal University Hospital and Queen Elizabeth Hospital. The paper attributed the debts in part to their high fixed PFI costs and suggested that the same would soon apply to Lewisham Hospital.

In 2012, seven NHS trusts were unable to meet the repayments for their private finance schemes and were given £1.5 billion in emergency funding, to help them avoid cutting patient services.

* Barking, Havering and Redbridge University Hospitals NHS Trust

* Dartford and Gravesham NHS Trust

* Maidstone and Tunbridge Wells NHS Trust

* North Cumbria University Hospitals NHS Trust

* Peterborough and Stamford Hospitals NHS Foundation Trust

* St Helens and Knowsley Teaching Hospitals NHS Trust

* South London Healthcare NHS Trust

Peter Dixon, Chairman of University College London Hospitals NHS Foundation Trust, with the largest PFI-built hospital in England, has gone on the record to say:

The trust complained in July 2019 that inflexible

The high cost of hospitals built under PFI is forcing service cuts at neighbouring hospitals built with public money. Overspending at the PFI-funded Worcestershire Royal Hospital has put a question mark over services at neighbouring hospitals. A strategic health authority paper in 2007 noted debts at two hospitals in south-east London: Princess Royal University Hospital and Queen Elizabeth Hospital. The paper attributed the debts in part to their high fixed PFI costs and suggested that the same would soon apply to Lewisham Hospital.

In 2012, seven NHS trusts were unable to meet the repayments for their private finance schemes and were given £1.5 billion in emergency funding, to help them avoid cutting patient services.

* Barking, Havering and Redbridge University Hospitals NHS Trust

* Dartford and Gravesham NHS Trust

* Maidstone and Tunbridge Wells NHS Trust

* North Cumbria University Hospitals NHS Trust

* Peterborough and Stamford Hospitals NHS Foundation Trust

* St Helens and Knowsley Teaching Hospitals NHS Trust

* South London Healthcare NHS Trust

Peter Dixon, Chairman of University College London Hospitals NHS Foundation Trust, with the largest PFI-built hospital in England, has gone on the record to say:

The trust complained in July 2019 that inflexible

Officials at the

Officials at the

While it is a catchy term, it is unclear what "value-for-money" means in practice and technical detail. A Scottish auditor once called it "technocratic mumbo-jumbo". A number of PFI projects have cost considerably more than originally anticipated. The duplication of design costs when each bidder in the latter stages of project procurement is preparing its own design was the subject of some criticism: the

While it is a catchy term, it is unclear what "value-for-money" means in practice and technical detail. A Scottish auditor once called it "technocratic mumbo-jumbo". A number of PFI projects have cost considerably more than originally anticipated. The duplication of design costs when each bidder in the latter stages of project procurement is preparing its own design was the subject of some criticism: the

The Private Finance Initiative (PFI)

Research Paper 01/117 * Northern Ireland Audit Office report (2004) into PFI in the health secto

* * Jane Broadbent, 2004

''Private Finance Initiative in the National Health Service: The Nature, Emergence and the Role of Management Accounting in Decision Making and Post-decision Project Evaluation''

Chartered Institute of Management Accountants * {{DEFAULTSORT:Private Finance Initiative Economy of the United Kingdom Government of the United Kingdom Waste legislation in the United Kingdom Monopoly (economics) Public–private partnership Economics of regulation Securities (finance)

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

government procurement

Government procurement or public procurement is the purchase of goods, works (construction) or services by the state, such as by a government agency or a state-owned enterprise. In 2019, public procurement accounted for approximately 12% of GDP ...

policy aimed at creating "public–private partnership

A public–private partnership (PPP, 3P, or P3) is a long-term arrangement between a government and private sectors, private sector institutions.Hodge, G. A and Greve, C. (2007), Public–Private Partnerships: An International Performance Revie ...

s" (PPPs) where private firms are contracted to complete and manage public projects. Initially launched in 1992 by Prime Minister

A prime minister or chief of cabinet is the head of the cabinet and the leader of the ministers in the executive branch of government, often in a parliamentary or semi-presidential system. A prime minister is not the head of state, but r ...

John Major

Sir John Major (born 29 March 1943) is a British retired politician who served as Prime Minister of the United Kingdom and Leader of the Conservative Party (UK), Leader of the Conservative Party from 1990 to 1997. Following his defeat to Ton ...

, and expanded considerably by the Blair government, PFI is part of the wider programme of privatisation and macroeconomic

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/ GDP ...

public policy, and presented as a means for increasing accountability and efficiency for public spending.

PFI is controversial in the UK. In 2003, the National Audit Office felt that it provided good value for money overall; according to critics, PFI has been used simply to place a great amount of debt "off-balance-sheet

In accounting, "off-balance-sheet" (OBS), or incognito leverage, usually describes an asset, debt, or financing activity not on the company's balance sheet. Total return swaps are an example of an off-balance-sheet item.

Some companies may have ...

". In 2011, the parliamentary Treasury Select Committee recommended:

In October 2018, the Chancellor Philip Hammond announced that the UK government would no longer use PFI for new infrastructure projects; however, PFI projects would continue to operate for some time to come.

Overview

The private finance initiative (PFI) is aprocurement

Procurement is the process of locating and agreeing to terms and purchasing goods, services, or other works from an external source, often with the use of a tendering or competitive bidding process. The term may also refer to a contractual ...

method which uses private sector

The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The private sector employs most of the workfo ...

investment in order to deliver public sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, pu ...

infrastructure and/or services according to a specification defined by the public sector. It is a sub-set of a broader procurement approach termed public-private partnership (PPP), with the main defining characteristic being the use of project finance (using private sector debt and equity, underwritten by the public) in order to deliver the public services. Beyond developing the infrastructure and providing finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Admin ...

, private sector companies operate the public facilities, sometimes using former public sector staff who have had their employment contracts transferred to the private sector through the TUPE process which applies to all staff in a company whose ownership changes.

Mechanics

Contracts

A public sector authority signs acontract

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typically involves consent to transfer of goods, services, money, or promise to transfer any of thos ...

with a private sector consortium

A consortium () is an association of two or more individuals, companies, organizations, or governments (or any combination of these entities) with the objective of participating in a common activity or pooling their resources for achieving a ...

, technically known as a special-purpose vehicle (SPV). This consortium is typically formed for the specific purpose of providing the PFI. It is owned by a number of private sector investors, usually including a construction company and a service provider, and often a bank as well. The consortium's funding will be used to build the facility and to undertake maintenance and capital replacement during the life-cycle of the contract. Once the contract is operational, the SPV may be used as a conduit for contract amendment discussions between the customer and the facility operator. SPVs often charge fees for this go-between 'service'.

PFI contracts are typically for 25–30 years (depending on the type of project); although contracts less than 20 years or more than 40 years exist, they are considerably less common. During the period of the contract the consortium will provide certain services, which were previously provided by the public sector. The consortium is paid for the work over the course of the contract on a "no service no fee" performance basis.

The public authority will design an "output specification" which is a document setting out what the consortium is expected to achieve. If the consortium fails to meet any of the agreed standards it should lose an element of its payment until standards improve. If standards do not improve after an agreed period, the public sector authority is usually entitled to terminate the contract, compensate the consortium where appropriate, and take ownership of the project.

Termination procedures are highly complex, as most projects are not able to secure private financing without assurances that the debt financing of the project will be repaid in the case of termination. In most termination cases the public sector is required to repay the debt and take ownership of the project. In practice, termination is considered a last resort only.

Whether public interest is at all protected by a particular PFI contract is highly dependent on how well or badly the contract was written and the determination (or not) and capacity of the contracting authority to enforce it. Many steps have been taken over the years to standardise the form of PFI contracts to ensure public interests are better protected.

Structure of providers

The typical PFI provider is organized into three parts or legal entities: aholding company

A holding company is a company whose primary business is holding a controlling interest in the Security (finance), securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own Share ...

(called "Topco") which is the same as the SPV mentioned above, a capital equipment or infrastructure provision company (called "Capco"), and a services or operating company (called "Opco"). The main contract is between the public sector authority and the Topco. Requirements then 'flow down' from the Topco to the Capco and Opco via secondary contracts. Further requirements then flow down to subcontractor

A subcontractor is a person or business which undertakes to perform part or all of the obligations of another's contract, and a subcontract is a contract which assigns part of an existing contract to a subcontractor.

A general contractor, prime ...

s, again with contracts to match. Often the main subcontractors are companies with the same shareholders

A shareholder (in the United States often referred to as stockholder) of corporate stock refers to an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the ...

as the Topco.

Method of funding

Prior to the2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, large PFI projects were funded through the sale of bonds and/or senior debt

In finance, senior debt is debt that takes priority over other unsecured or otherwise more "junior" debt owed by an issuer. Senior debt is frequently issued in the form of senior notes or referred to as senior loans. Senior debt has greater senior ...

. Since the crisis, funding by senior debt

In finance, senior debt is debt that takes priority over other unsecured or otherwise more "junior" debt owed by an issuer. Senior debt is frequently issued in the form of senior notes or referred to as senior loans. Senior debt has greater senior ...

has become more common. Smaller PFI projects – the majority by number – have typically always been funded directly by banks in the form of senior debt. Senior debt is generally slightly more expensive than bonds, which the banks would argue is due to their more accurate understanding of the credit-worthiness of PFI deals – they may consider that monoline providers underestimate the risk, especially during the construction stage, and hence can offer a better price than the banks are willing to.

Refinancing of PFI deals is common. Once construction is complete, the risk profile of a project can be lower, so cheaper debt can be obtained. This refinancing might in the future be done via bonds – the construction stage is financed using bank debt, and then bonds for the much longer period of operation.

The banks who fund PFI projects are repaid by the consortium from the money received from the government during the lifespan of the contract. From the point of view of the private sector, PFI borrowing is considered low risk because public sector authorities are very unlikely to default. Indeed, under IMF rules, national governments are not permitted to go bankrupt (although this is sometimes ignored, as when Argentina 'restructured' its foreign debt). Repayment depends entirely on the ability of the consortium to deliver the services in accordance with the output specified in the contract.

Under guidance issued prior to the reform proposals initiated in December 2011, public sector partners were permitted to contribute up to 30% of the construction costs as a capital contribution, generally handed over at the end of the construction period and subject to appropriate risk transfer and performance regimes being in place. The government indicated in its reform consultation that allowance for higher levels of capital contribution was being considered, noting the some international practice also offered examples of higher levels of capital contribution.

Insurance

PFI contracts generally allocate risks to the private sector contractor, who takes out appropriateinsurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

to cover these risks and includes anticipated insurance costs in its PFI charges. However, it has been recognised that levels of insurance premium are variable following cyclical economic changes, and difficult to predict over the lifetime of a PFI project. PFI terms were amended in 2002 and standardised in 2006 to allow for insurance cost sharing mechanisms, whereby the client and contractor could share the risk of market fluctuation in insurance premium costs.

History

Development

PFI was implemented in the UK by theConservative

Conservatism is a cultural, social, and political philosophy and ideology that seeks to promote and preserve traditional institutions, customs, and values. The central tenets of conservatism may vary in relation to the culture and civiliza ...

Government led by John Major in 1992. It was introduced against the backdrop of the Maastricht Treaty

The Treaty on European Union, commonly known as the Maastricht Treaty, is the foundation treaty of the European Union (EU). Concluded in 1992 between the then-twelve Member state of the European Union, member states of the European Communities, ...

which provided for European Economic and Monetary Union (EMU). To participate in EMU, EU member states were required to keep public debt below a certain threshold, and PFI was a mechanism to take debt off the government balance sheet and so meet the Maastricht convergence criteria. PFI immediately proved controversial, and was attacked by Labour critics such as the Shadow Chief Secretary to the Treasury Harriet Harman, who said that PFI was really a back-door form of privatisation (House of Commons, 7 December 1993), and the future Chancellor of the Exchequer

The chancellor of the exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and the head of HM Treasury, His Majesty's Treasury. As one of the four Great Offices of State, t ...

, Alistair Darling

Alistair Maclean Darling, Baron Darling of Roulanish, (28 November 1953 – 30 November 2023) was a British politician who served as Chancellor of the Exchequer under prime minister Gordon Brown from 2007 to 2010. A member of the Labour Party ...

, warned that "apparent savings now could be countered by the formidable commitment on revenue expenditure in years to come".

Initially, the private sector was unenthusiastic about PFI, and the public sector was opposed to its implementation. In 1993, the Chancellor of the Exchequer described its progress as "disappointingly slow". To help promote and implement the policy, he created the Private Finance Office within the Treasury, with a Private Finance Panel headed by Alastair Morton. These institutions were staffed with people linked with the City of London

The City of London, also known as ''the City'', is a Ceremonial counties of England, ceremonial county and Districts of England, local government district with City status in the United Kingdom, city status in England. It is the Old town, his ...

, and accountancy

Accounting, also known as accountancy, is the process of recording and processing information about economic entities, such as businesses and corporations. Accounting measures the results of an organization's economic activities and conveys ...

and consultancy

A consultant (from "to deliberate") is a professional (also known as ''expert'', ''specialist'', see variations of meaning below) who provides advice or services in an area of specialization (generally to medium or large-size corporations). Con ...

firms who had a vested interest in the success of PFI. The largest of the early PFI projects was Pathway, announced by Peter Lilley in 1995, which was to automate the handling of benefit payments at post offices.

Two months after Tony Blair

Sir Anthony Charles Lynton Blair (born 6 May 1953) is a British politician who served as Prime Minister of the United Kingdom from 1997 to 2007 and Leader of the Labour Party (UK), Leader of the Labour Party from 1994 to 2007. He was Leader ...

's Labour Party took office, the Health Secretary, Alan Milburn, announced that "when there is a limited amount of public-sector capital available, as there is, it's PFI or bust". PFI expanded considerably in 1996 and then expanded much further under Labour with the NHS (Private Finance) Act 1997, resulting in criticism from many trade union

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages ...

s, elements of the Labour Party, the Scottish National Party

The Scottish National Party (SNP; ) is a Scottish nationalist and social democratic party. The party holds 61 of the 129 seats in the Scottish Parliament, and holds 9 out of the 57 Scottish seats in the House of Commons of the United Kingdom, ...

(SNP), and the Green Party, as well as commentators such as George Monbiot. Proponents of the PFI include the World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

, the IMF and the Confederation of British Industry

The Confederation of British Industry (CBI) is a British business interest group, which says it represents 190,000 businesses. The CBI has been described by the ''Financial Times'' as "Britain's biggest business lobby group". Incorporated by roy ...

.

Both Conservative and Labour governments sought to justify PFI on the practical

grounds that the private sector is better at delivering services than the public sector. This position has been supported by the UK National Audit Office with regard to certain projects. However, critics claim that many uses of PFI are ideological rather than practical; Dr. Allyson Pollock recalls a meeting with the then Chancellor of the Exchequer

The chancellor of the exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and the head of HM Treasury, His Majesty's Treasury. As one of the four Great Offices of State, t ...

Gordon Brown

James Gordon Brown (born 20 February 1951) is a British politician who served as Prime Minister of the United Kingdom and Leader of the Labour Party (UK), Leader of the Labour Party from 2007 to 2010. Previously, he was Chancellor of the Ex ...

who could not provide a rationale for PFI other than to "declare repeatedly that the public sector is bad at management, and that only the private sector is efficient and can manage services well."

To better promote PFI, the Labour government appointed Malcolm Bates to chair the efforts to review the policy with a number of Arthur Andersen staffers. They recommended the creation of a Treasury Task Force (TTF) to train public servants into PFI practice and to coordinate the implementation of PFI. In 1998, the TTF was renamed to "Partnership UK" (PUK) and sold 51% of its share to the private sector. PUK was then chaired by Sir Derek Higgs, director of Prudential Insurance and chairman of British Land plc. These changes meant that the government transferred the responsibility of managing PFI to a corporation closely related with the owners, financiers, consultants, and subcontractors that stood to benefit from this policy. This created a strong appearance of conflict of interest.

Trade unions such as

To better promote PFI, the Labour government appointed Malcolm Bates to chair the efforts to review the policy with a number of Arthur Andersen staffers. They recommended the creation of a Treasury Task Force (TTF) to train public servants into PFI practice and to coordinate the implementation of PFI. In 1998, the TTF was renamed to "Partnership UK" (PUK) and sold 51% of its share to the private sector. PUK was then chaired by Sir Derek Higgs, director of Prudential Insurance and chairman of British Land plc. These changes meant that the government transferred the responsibility of managing PFI to a corporation closely related with the owners, financiers, consultants, and subcontractors that stood to benefit from this policy. This created a strong appearance of conflict of interest.

Trade unions such as Unison

Unison (stylised as UNISON) is a Great Britain, British trade union. Along with Unite the Union, Unite, Unison is one of the two largest trade unions in the United Kingdom, with over 1.2 million members who work predominantly in public servic ...

and the GMB, which are Labour supporters, strongly opposed these developments. At the 2002 Labour Party Conference

The Labour Party Conference is the annual conference of the British Labour Party (UK), Labour Party. It is formally the supreme decision-making body of the party and is traditionally held in the final week of September, during the party conferen ...

, the delegates adopted a resolution condemning PFI and calling for an independent review of the policy, which was ignored by the party leadership.

Implementation

In education, the first PFI school opened in 2000. KPMG LLP, ''Investment in school buildings and PFI - do they play a role in educational outcomes?'', 2008 version In 2005/2006 the Labour Government introduced Building Schools for the Future, a scheme introduced for improving the infrastructure of Britain's schools. Of the £2.2 billion funding that the Labour government committed to BSF, £1.2 billion (55.5%) was to be covered by PFI credits. Some local authorities were persuaded to accept Academies in order to secure BSF funding in their area. In 2003 the Labour Government used public-private partnership (PPP) schemes for the privatisation ofLondon Underground

The London Underground (also known simply as the Underground or as the Tube) is a rapid transit system serving Greater London and some parts of the adjacent home counties of Buckinghamshire, Essex and Hertfordshire in England.

The Undergro ...

's infrastructure and rolling stock. The two private companies created under the PPP, Metronet and Tube Lines were later taken into public ownership.

By October 2007 the total capital value of PFI contracts signed throughout the UK was £68bn, committing the British taxpayer to future spending of £215bn over the life of the contracts. The 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

presented PFI with difficulties because many sources of private capital had dried up. Nevertheless, PFI remained the UK government's preferred method for public sector procurement under Labour. In January 2009 the Labour Secretary of State for Health, Alan Johnson, reaffirmed this commitment with regard to the health sector, stating that "PFIs have always been the NHS’s 'plan A' for building new hospitals … There was never a 'plan B'".

However, because of banks' unwillingness to lend money for PFI projects, the UK government now had to fund the so-called 'private' finance initiative itself. In March 2009 it was announced that the Treasury would lend £2bn of public money to private firms building schools and other projects under PFI. Labour's Chief Secretary to the Treasury

The Chief Secretary to the Treasury is a senior ministerial office in the government of the United Kingdom and is the second most senior ministerial office in HM Treasury, after the Chancellor of the Exchequer. The office holder is always a full ...

, Yvette Cooper

Yvette Cooper (born 20 March 1969) is a British politician who has served as Home Secretary since July 2024. A member of the Labour Party (UK), Labour Party, Cooper has been Member of Parliament (United Kingdom), member of parliament (MP) for Po ...

, claimed the loans should ensure that projects worth £13bn – including waste treatment projects, environmental schemes and schools – would not be delayed or cancelled. She also promised that the loans would be temporary and would be repaid at a commercial rate. But, at the time, Vince Cable

Sir John Vincent Cable (born 9 May 1943) is a British politician who was Leader of the Liberal Democrats from 2017 to 2019. He was Member of Parliament (United Kingdom), Member of Parliament (MP) for Twickenham (UK Parliament constituency), Twic ...

of the Liberal Democrats, subsequently Secretary of State for Business in the coalition

A coalition is formed when two or more people or groups temporarily work together to achieve a common goal. The term is most frequently used to denote a formation of power in political, military, or economic spaces.

Formation

According to ''A G ...

, argued in favour of traditional public financing structures instead of propping up PFI with public money:

In opposition at the time, even the Conservative Party considered that, with the taxpayer now funding it directly, PFI had become "ridiculous". Philip Hammond, subsequently Secretary of State for Transport

The secretary of state for transport, also referred to as the transport secretary, is a Secretary of State (United Kingdom), secretary of state in the Government of the United Kingdom, with overall responsibility for the policies of the Departm ...

in the coalition, said:

In an interview in November 2009, Conservative George Osborne, subsequently Chancellor of the Exchequer

The chancellor of the exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and the head of HM Treasury, His Majesty's Treasury. As one of the four Great Offices of State, t ...

in the coalition, sought to distance his party from the excesses of PFI by blaming Labour for its misuse. At the time, Osborne proposed a modified PFI which would preserve the arrangement of private sector investment for public infrastructure projects in return for part-privatisation, but would ensure proper risk transfer to the private sector along with transparent accounting:

Despite being so critical of PFI while in opposition and promising reform, once in power George Osborne progressed 61 PFI schemes worth a total of £6.9bn in his first year as Chancellor. According to Mark Hellowell from the

Despite being so critical of PFI while in opposition and promising reform, once in power George Osborne progressed 61 PFI schemes worth a total of £6.9bn in his first year as Chancellor. According to Mark Hellowell from the University of Edinburgh

The University of Edinburgh (, ; abbreviated as ''Edin.'' in Post-nominal letters, post-nominals) is a Public university, public research university based in Edinburgh, Scotland. Founded by the City of Edinburgh Council, town council under th ...

:

The high cost of PFI deals is a major issue, with advocates for renegotiating PFI deals in the face of reduced public sector budgets, or even for refusing to pay PFI charges on the grounds that they are a form of odious debt. Critics such as Peter Dixon argue that PFI is fundamentally the wrong model for infrastructure investment, saying that public sector funding is the way forward.

In November 2010 the UK government released spending figures showing that the current total payment obligation for PFI contracts in the UK was £267 billion. Research has also shown that in 2009 the Treasury failed to negotiate decent PFI deals with publicly owned banks, resulting in £1bn of unnecessary costs. This failure is particularly grave given the coalition's own admission in their national infrastructure plan that a 1% reduction in the cost of capital for infrastructure investment could save the taxpayer £5bn a year.

The Department for Environment, Food and Rural Affairs

The Department for Environment, Food and Rural Affairs (Defra) is a Departments of the Government of the United Kingdom, ministerial department of the government of the United Kingdom. It is responsible for environmental quality, environmenta ...

(DEFRA) withdrew funding support from seven waste management PFI projects as a result of the 2010 Spending Review, directing the cuts to those projects where least progress had been made with contract procurement and obtaining planning permission.

In February 2011 the Treasury announced a project to examine the £835m Queen's Hospital PFI deal. Once savings and efficiencies are identified, the hope - as yet unproven - is that the PFI consortium can be persuaded to modify its contract. The same process could potentially be applied across a range of PFI projects.

PF2

In December, 2012 the Treasury published aWhite Paper

A white paper is a report or guide that informs readers concisely about a complex issue and presents the issuing body's philosophy on the matter. It is meant to help readers understand an issue, solve a problem, or make a decision. Since the 199 ...

outlining the results of a review of the PFI and proposals for change. These aimed to:

* centralise procurement by and for government departments, increase Treasury involvement in the procurement process, and move the management of all public sector investment in PFI schemes into a central unit in the Treasury;

* draw funding providers into projects at an earlier stage to reduce windfall gains when they were sold on;

* exclude "soft services" from PFI schemes where the specification was likely to change at short notice (such as catering and cleaning);

* reduce the role of bank debt in financing;

* improve transparency and accountability by both public and private sector participants;

* increase the proportion of risk carried by the public sector.HM Treasury (2012)''A new approach to public private partnerships''

accessed 26 April 2024 Under this "new approach", the government would become a minority equity co-investor in future projects, partly to better align the private and public sector interests in new projects. A consultation exercise was subsequently undertaken by the government regarding the terms on which the public sector stake would be managed, aiming for a generally consistent approach across projects but with scope for details to be finalised prior to operation to reflect any project-specific issues. The government's response to the consultation and the "Standard PF2 Equity Documents" were published in October 2013. Under the Priority School Building Programme which was launched in 2014 by the Education and Skills Funding Agency, the rebuilding and/or refurbishment of 46 schools in England was funded and procured using the PF2 model.

Scotland

A specialist unit was set up within the Scottish Office in 2005 to handle PFI projects. In November 2014,Nicola Sturgeon

Nicola Ferguson Sturgeon (born 19 July 1970) is a Scottish politician who served as First Minister of Scotland and Leader of the Scottish National Party (SNP) from 2014 to 2023. She has served as a member of the Scottish Parliament (MSP) sin ...

announced a £409m public-private funding package which would be funded through a non-profit distributing model which would cap private sector returns, returning any surplus to the public sector. On Monday 11 April 2016, 17 PFI-funded schools in Edinburgh failed to open after the Easter break because of structural problems identified in two of them the previous Friday; the schools had been erected in the 1990s by Miller Construction.

Ending of PFI for new infrastructure projects

A January 2018 report by the National Audit Office found that the UK had incurred many billions of pounds in extra costs for no clear benefit through PFIs. In October 2018, the Chancellor, Philip Hammond, announced that the UK Government will no longer use PF2, the current model of Private Finance Initiative, for new infrastructure projects, due to value-for-money considerations and the difficulties caused by the collapse of PFI construction company Carillion. A Centre of Excellence was established within theDepartment of Health and Social Care

The Department of Health and Social Care (DHSC) is a ministerial department of the Government of the United Kingdom. It is responsible for government policy on health and adult social care matters in England, along with a few elements of the s ...

to improve management of existing PFI contracts in the NHS.

Examples of projects

There have been over 50 English hospitals procured under a PFI contract with capital cost exceeding £50 million: There have been some six Scottish hospitals procured under a PFI contract with capital cost exceeding £50 million: The following is a selection of major projects in other sectors procured under a PFI contract: ''The Guardian'' published a full list of PFI contracts by department in July 2012, and HM Treasury published a full list of PFI contracts by department in March 2015.Impact

Analysis

A study byHM Treasury

His Majesty's Treasury (HM Treasury or HMT), and informally referred to as the Treasury, is the Government of the United Kingdom’s economic and finance ministry. The Treasury is responsible for public spending, financial services policy, Tax ...

in July 2003 was supportive, showing that the only deals in its sample which were over budget were those where the public sector changed its mind after deciding what it wanted and from whom it wanted it.

A later report by the National Audit Office in 2009 found that 69 per cent of PFI construction projects between 2003 and 2008 were delivered on time and 65 per cent were delivered at the contracted price.

However, a report by the National Audit Office in 2011 was much more critical, finding that the use of PFI "has the effect of increasing the cost of finance for public investments relative to what would be available to the government if it borrowed on its own account" and "the price of finance is significantly higher with a PFI."

An article in ''The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

'' reports that:

On the other hand, Monbiot argues that the specifications of many public infrastructure projects have been distorted to increase their profitability for PFI contractors.

PFI projects allowed the Ministry of Defence to gain many useful resources "''on a shoestring''"; PFI deals were signed for barracks, headquarters buildings, training for pilots and sailors, and an aerial refuelling service, amongst other things.

Individuals have speculated that some PFI projects have been shoddily specified and executed. For example, in 2005 a confidential government report condemned the PFI-funded Newsam Centre at Seacroft Hospital for jeopardising the lives of 300 patients and staff. The Newsam Centre is for people with lifelong learning difficulties and the mentally ill. The report said that there were shortcomings "in each of the five key areas of documentation, design, construction, operation and management" at the hospital, which cost £47m. Between 2001 and 2005 there were four patient suicides, including one which was left undiscovered for four days in an out-of-order bathroom. The coroner said that Leeds Mental Health Teaching NHS Trust, which is responsible for the facility, had failed to keep patients under proper observation. The government report said that the design and construction of the building did not meet the requirements for a facility for mental patients. The building has curving corridors which make patient observation and quick evacuation difficult. The report said that the building also constituted a fire hazard, as it was constructed without proper fire protection materials in the wall and floor joints. In addition, mattresses and chairs used below-standard fire-retardant materials. Patients were allowed to smoke in rooms where they could not be easily observed. The fire-safety manual was described as "very poor", and the fire-safety procedure consisted of a post-it note marked "to be provided by the Trust". The report concluded that "every section of the fire safety code" had been breached.

On the other hand, the building of two new PFI Police Stations on behalf of Kent Police serving the Medway area and the North Kent area (Gravesend and Dartford) is credited as a successful PFI project. Supporters say that the new buildings take into account the modern needs of the police better than the 60s/70s building, and that another advantage is that the old buildings can be sold for income or redeveloped into the police estate.

Education

KPMG investigations in 2008 and 2009 found that school renewals had beneficial impacts on educational outcomes and that the rate of improvement was higher in PFI schools than where construction or renewal was conventionally funded.National Health Service (NHS)

In 2017 there were 127 PFI schemes in the English NHS. The contracts vary greatly in size. Most include the cost of running services such as facilities management, hospital portering and patient food, and these amount to around 40% of the cost. Total repayments will cost around £2.1 billion in 2017 and will reach a peak in 2029. This is around 2% of the NHS budget. A 2009 study by University College London, studying data at hospitals built since 1995, supports the argument that private-sector providers are more accountable to provide quality services: It showed that hospitals operating under PFI have better patient environment ratings than conventionally funded hospitals of similar age. The PFI hospitals also have higher cleanliness scores than non-PFI hospitals of similar age, according to data collected by the NHS. Jonathan Fielden, chair of the British Medical Association's consultants' committee has said that PFI debts are "distorting clinical priorities" and affecting the treatment given to patients. Fielden cited the example of University Hospital Coventry where the NHS Trust was forced to borrow money to make the first £54m payment owed to the PFI contractor. He said that the trust was in the ignominious position of struggling for money before the hospital's doors even opened. The trust could not afford to run all the services that it had commissioned and was having to mothball services and close wards.Treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry; in a business context, corporate treasury.

*A place or location where treasure, such as currency or precious items are kept. These can be ...

rules were preventing it from buying out its 40-year PFI contract, which could deliver savings of £30 million a year. The contract equity holders are receiving around £20 million in annual dividends which is "double the figure envisaged at the start of the project and sprojected to rise to £60m by the end of the deal".

An anonymous NHS finance director pointed out in November 2015, that PFI payments are often linked to the Retail Price Index

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and servi ...

which has risen more rapidly than the NHS tariff. He estimated that payments were about 3 percent higher than those incurred using traditional public dividend capital.

Northumbria Healthcare NHS Foundation Trust

Northumbria Healthcare NHS Foundation Trust is an NHS foundation trust which provides hospital and community health services in North Tyneside and hospital, community health and adult social care services in Northumberland.

History

The trust ...

was the first to buy out a PFI contract, borrowing £114.2 million from Northumbria County Council in a deal which reduced its costs by £3.5 million per year.

A report by the Centre for Health and the Public Interest in 2017 calculated that PFI companies had made pre-tax profits from the NHS of £831m in the previous six years. They calculate that PFI payments in the NHS will rise from £2.2 billion in 2019–20 to a peak of £2.7 billion in 2029–30.

Private sector

Semperian, Innisfree Ltd and the HICL Infrastructure Company are the main players in NHS contracts.Employment

When spending is tight, hospitals may prefer to retain medical staff and services by spending less on building maintenance. But under PFI, hospitals are forced to prioritise the contractual payments for their buildings over jobs and, according to figures published by the Department of Health, these committed payments can account for up to 20% of operating budget. Nigel Edwards, head of policy for theNHS Confederation

The NHS Confederation, formerly the National Association of Health Authorities and Trusts, is a membership body for organisations that commission and provide National Health Service services founded in 1990. The predecessor organisation was calle ...

, noted that:

Dr Jonathan Fielden, chair of the British Medical Association's consultants' committee has said that as a result of the high costs of a PFI scheme in Coventry "they are potentially reducing jobs". In fact by 2005 the hospital trust in Coventry was anticipating a deficit of £13m due to PFI and "drastic measures" were required to plug the gap including shutting one ward, removing eight beds from another, shortening the opening hours of the Surgical Assessment Unit, and the "rationalisation of certain posts" – which meant cutting 116 jobs.

Under PFI, many staff have their employment contracts automatically transferred to the private sector, using a process known as TUPE. In many cases this results in worse terms of employment and pension rights. Heather Wakefield, UNISON

Unison (stylised as UNISON) is a Great Britain, British trade union. Along with Unite the Union, Unite, Unison is one of the two largest trade unions in the United Kingdom, with over 1.2 million members who work predominantly in public servic ...

's national secretary for local government, has said:

Debt

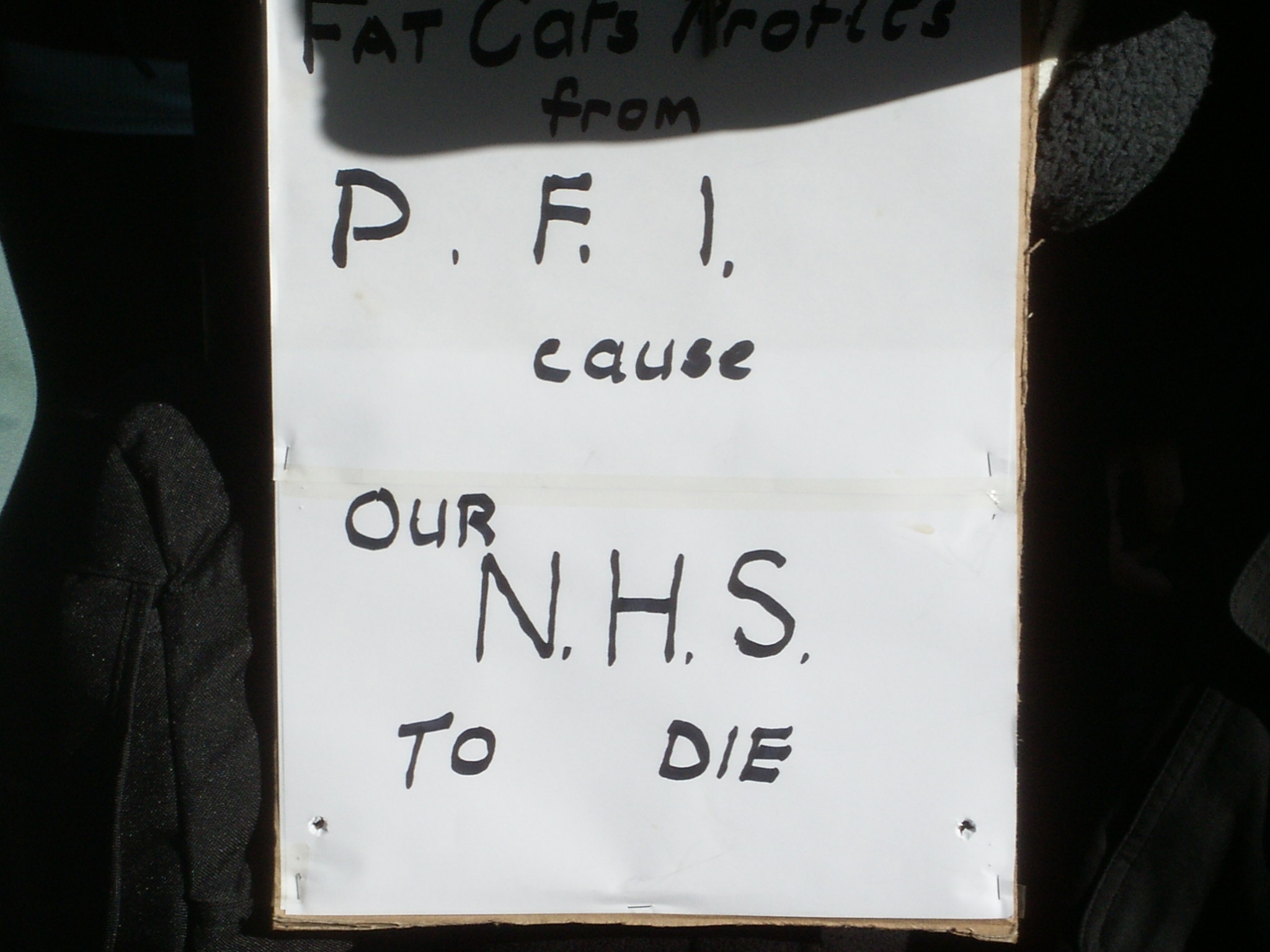

The debt created by PFI has a significant impact on the finances of public bodies. As of October 2007 the total capital value of PFI contracts signed throughout the UK was £68bn. However, central and local government are committed to paying a further £267bn over the lifetime of these contracts. To give regional examples, the £5.2bn of PFI investment in Scotland up to 2007 has created a public sector liability of £22.3bn and the investment of just £618m via PFI in Wales up to 2007 has created a public sector liability of £3.3bn. However, these debts are small compared to other public-sector liabilities. Annual payments to the private owners of the PFI schemes are due to peak at £10bn in 2017. In some cases Trusts are having to 'rationalise' spending by closing wards and laying off staff, but they are not allowed to default on their PFI payments. As ''The Guardian'' explained "In September 1997 the government declared that these payments would be legally guaranteed: beds, doctors, nurses and managers could be sacrificed, but not the annual donation to the Fat Cats Protection League". Mark Porter, of the British Medical Association said: "Locking the NHS into long-term contracts with the private sector has made entire local health economies more vulnerable to changing conditions. Now the financial crisis has changed conditions beyond recognition, so trusts tied into PFI deals have even less freedom to make business decisions that protect services, making cuts and closures more likely." John Appleby, chief economist at the King's Fund health think-tank, said: Officials at the

Officials at the Treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry; in a business context, corporate treasury.

*A place or location where treasure, such as currency or precious items are kept. These can be ...

have also admitted that they may have to attempt to renegotiate certain PFI contracts in order to reduce payments, although it is far from certain that the private investors would accept this.

PFI contracts are generally off-balance-sheet

In accounting, "off-balance-sheet" (OBS), or incognito leverage, usually describes an asset, debt, or financing activity not on the company's balance sheet. Total return swaps are an example of an off-balance-sheet item.

Some companies may have ...

, meaning that they do not show up as part of the national debt. This fiscal technicality has been characterized as a benefit and a flaw of PFI.

In the UK, the technical reason why PFI debts are off-balance-sheet is that the government authority taking out the PFI theoretically transfers one or more of the following risks to the private sector: risk associated with demand for the facility (e.g. under-utilisation); risk associated with construction of the facility (e.g. overspend and delay); or risk associated with the 'availability' of the facility. The PFI contract bundles the payment to the private sector as a single ('unitary') charge for both the initial capital spend and the ongoing maintenance and operation costs. Because of supposed risk transfer, the entire contract is deemed to be revenue rather than capital spending. As a result, no capital spend appears on the government's balance sheet (the revenue expenditure would not have been on the government balance sheet in any event). Public accounting standards are being changed to bring these numbers back onto the balance sheet. For example, in 2007 Neil Bentley, the CBI's Director of Public Services, told a conference that the CBI was keen for the government to press ahead with accounting rule changes that would put large numbers of PFI projects onto the government's books. He was concerned that accusations of "accounting tricks" were delaying PFI projects.

Risk

Supporters of PFI claim that risk is successfully transferred from public to private sectors as a result of PFI, and that the private sector is better atrisk management

Risk management is the identification, evaluation, and prioritization of risks, followed by the minimization, monitoring, and control of the impact or probability of those risks occurring. Risks can come from various sources (i.e, Threat (sec ...

. As an example of successful risk transfer they cite the case of the National Physical Laboratory. This deal ultimately caused the collapse of the building contractor Laser (a joint venture

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to acce ...

between Serco and John Laing) when the cost of the complex scientific laboratory, which was ultimately built, was very much larger than estimated.

On the other hand, Allyson Pollock argues that in many PFI projects risks are not in fact transferred to the private sector and, based on the research findings of Pollock and others, George Monbiot argues that the calculation of risk in PFI projects is highly subjective, and is skewed to favour the private sector:

Following an incident in the Royal Infirmary of Edinburgh where surgeons were forced to continue a heart operation in the dark following a power cut caused by PFI operating company Consort, Dave Watson from Unison criticised the way the PFI contract operates:

In February 2019 the Healthcare Safety Investigation Branch produced a report into mistakes involving piped air being mistakenly supplied to patients rather than piped oxygen and said that cost pressures could make it difficult for trusts to respond to safety alerts because of the financial costs of replacing equipment. Private finance initiative contracts increased those costs and exacerbated the problem.

Value for money

A National Audit Office study in 2003 endorsed the view that PFI projects represent good value for taxpayers' money, but some commentators have criticised PFI for allowing excessive profits for private companies at the expense of the taxpayer. An investigation by Professor Jean Shaoul of Manchester Business School into the profitability of PFI deals based on accounts filed atCompanies House

Companies House is the executive agency of the British Government that maintains the Company register, register of companies, employs the company registrars and is responsible for Incorporation (business), incorporating all forms of Company, co ...

revealed that the rate of return for the companies on twelve large PFI Hospitals was 58%. Excessive profits can be made when PFI projects are refinanced. An article in the Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and also published digitally that focuses on business and economic Current affairs (news format), current affairs. Based in London, the paper is owned by a Jap ...

recalls the

While it is a catchy term, it is unclear what "value-for-money" means in practice and technical detail. A Scottish auditor once called it "technocratic mumbo-jumbo". A number of PFI projects have cost considerably more than originally anticipated. The duplication of design costs when each bidder in the latter stages of project procurement is preparing its own design was the subject of some criticism: the

While it is a catchy term, it is unclear what "value-for-money" means in practice and technical detail. A Scottish auditor once called it "technocratic mumbo-jumbo". A number of PFI projects have cost considerably more than originally anticipated. The duplication of design costs when each bidder in the latter stages of project procurement is preparing its own design was the subject of some criticism: the Royal Institute of British Architects

The Royal Institute of British Architects (RIBA) is a professional body for architects primarily in the United Kingdom, but also internationally, founded for the advancement of architecture under its royal charter granted in 1837, three suppl ...

(RIBA) put forward a model known as "Smart PFI" in 2005, under which a traditionally appointed design team would prepare "example plans" which would be finalised and costed by PFI bidders.

More recent reports indicate that PFI represents poor value for money. A treasury select committee stated that 'PFI was no more efficient than other forms of borrowing and it was "illusory" that it shielded the taxpayer from risk'.

One key criticism of PFI, when it comes to value for money, is the lack of transparency surrounding individual projects. This means that independent attempts, such as that by the Association for Consultancy and Engineering, to assess PFI data across government departments have been able to find significant variations in the costs to the taxpayer.

Tax

Some PFI deals have also been associated withtax avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxe ...

, including a deal to sell properties belonging to the UK government's own tax authority. The House of Commons Public Accounts Committee criticised HM Revenue and Customs

His Majesty's Revenue and Customs (commonly HM Revenue and Customs, or HMRC, and formerly Her Majesty's Revenue and Customs) is a department of the UK government responsible for the collection of taxes, the payment of some forms of stat ...

over the PFI STEPS deal to sell about 600 properties to a company called Mapeley, based in the tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

of Bermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest.

Bermuda is an ...

. The committee said it was "a very serious blow indeed" for the government's own tax-collecting services to have entered into the contract with Mapeley, whom they described as "tax avoiders". Conservative MP Edward Leigh said there were "significant weaknesses" in the way the contract was negotiated. The government agencies had failed to clarify Mapeley's tax plans until a late stage in the negotiations. Leigh said: "It is incredible that the Inland Revenue, of all departments, did not, during contract negotiations, find out more about Mapeley's structure".

Bureaucracy

The National Audit Office has accused the government's PFI dogma of ruining a £10bn Ministry of Defence project. The Future Strategic Tanker Aircraft project to develop a fleet of multi-role RAF tanker and passenger aircraft was delayed for over 5 years while, in the meantime, old and unreliable planes continue to be used for air-to-air refuelling, and for transporting troops to and from Afghanistan. Edward Leigh, thenConservative

Conservatism is a cultural, social, and political philosophy and ideology that seeks to promote and preserve traditional institutions, customs, and values. The central tenets of conservatism may vary in relation to the culture and civiliza ...

chair of the Public Accounts Committee which oversees the work of the NAO, said: "By introducing a private finance element to the deal, the MoD managed to turn what should have been a relatively straightforward procurement into a bureaucratic nightmare". The NAO criticised the MoD for failing to carry out a "sound evaluation of alternative procurement routes" because there had been the "assumption" in the ministry that the aircraft must be provided through a PFI deal in order to keep the numbers off the balance sheet, due to "affordability pressures and the prevailing policy to use PFI wherever possible".

Complexity

Critics claim that the complexity of many PFI projects is a barrier to accountability. For example, a report by the Trade UnionUNISON

Unison (stylised as UNISON) is a Great Britain, British trade union. Along with Unite the Union, Unite, Unison is one of the two largest trade unions in the United Kingdom, with over 1.2 million members who work predominantly in public servic ...

entitled "What is Wrong with PFI in Schools?" says:

Malcolm Trobe, the President of the Association of School and College Leaders has said that the idea that contracting out the school building process via PFI would free up head teachers to concentrate on education has turned out to be a myth. In many cases it has in fact increased the workload on already stretched staff.

Waste

ABBC Radio 4

BBC Radio 4 is a British national radio station owned and operated by the BBC. The station replaced the BBC Home Service on 30 September 1967 and broadcasts a wide variety of spoken-word programmes from the BBC's headquarters at Broadcasti ...

investigation into PFI noted the case of Balmoral High School in Northern Ireland which cost £17m to build in 2002. In 2007 the decision was made to close the school because of lack of pupils. But the PFI contract is due to run for another 20 years, so the taxpayer will be paying millions of pounds for an unused facility.

With regard to hospitals, Prof. Nick Bosanquet of Imperial College London

Imperial College London, also known as Imperial, is a Public university, public research university in London, England. Its history began with Prince Albert of Saxe-Coburg and Gotha, Prince Albert, husband of Queen Victoria, who envisioned a Al ...

has argued that the government commissioned some PFI hospitals without a proper understanding of their costs, resulting in a number of hospitals which are too expensive to be used. He said:

In 2012, it was reported that dozens of NHS Trust

An NHS trust is an organisational unit within the National Health Services of England and Wales, generally serving either a geographical area or a specialised function (such as an ambulance service). In any particular location there may be several ...

s labouring under PFI-related debts were at risk of closure.

According to Stella Creasy, a self-acknowledged PFI "nerd", the fundamental problem was the rate of interest charged because of a lack of competition between providers. "Barts was a £1bn project. They’ll pay back £7bn. That is not good value for money". She wants to see a windfall tax on the PFI companies.

Relationship with government

Treasury

In July 1997 a PFI taskforce was established within theTreasury

A treasury is either

*A government department related to finance and taxation, a finance ministry; in a business context, corporate treasury.

*A place or location where treasure, such as currency or precious items are kept. These can be ...

to provide central co-ordination for the roll-out of PFI. Known as the Treasury Taskforce (TTF), its main responsibilities are to standardise the procurement process and train staff throughout government in the ways of PFI, especially in the private finance units of other government departments. The TTF initially consisted of a policy arm staffed by five civil servants, and a projects section employing eight private sector executives led by Adrian Montague, formally co-head of Global Project Finance at investment bank

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

Dresdner Kleinwort Benson. In 1999 the policy arm was moved to the Office of Government Commerce (OGC), but it was subsequently moved back to the Treasury. The projects section was part-privatised and became Partnerships UK (PUK). The Treasury retained a 49% ' golden share', while the majority stake in PUK was owned by private sector investors. PUK was then staffed almost entirely by private sector procurement specialists such as corporate lawyers, investment bankers

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by unde ...

, consultants and so forth. It took the lead role in evangelising PFI and its variants within government, and was in control of the policy's day-to-day implementation.

In March 2009, in the face of funding difficulties caused by the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, the Treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry; in a business context, corporate treasury.

*A place or location where treasure, such as currency or precious items are kept. These can be ...

established an Infrastructure Finance Unit with a mandate to ensure the continuation of PFI projects. In April 2009, the unit stumped up £120m of public money to ensure that a new waste disposal project in Manchester would go ahead. Andy Rose, the unit head, said: "This is what we were set up to do, to get involved where private sector capital is not available." In May 2009 the unit proposed to provide £30m to bail out a second PFI project, a £700m waste treatment plant in Wakefield. In response, Tony Travers, Director of the Greater London Group at the London School of Economics

The London School of Economics and Political Science (LSE), established in 1895, is a public research university in London, England, and a member institution of the University of London. The school specialises in the social sciences. Founded ...

described the use of public money to finance PFI as "Alice in Wonderland economics".

The House of Commons Public Accounts Committee has criticised the Treasury for failing to negotiate better PFI funding deals with banks in 2009. The committee revealed that British taxpayers are liable for an extra £1bn because the Treasury failed to find alternative ways to fund infrastructure projects during the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. The committee "suggests that the government should have temporarily abandoned PFI to directly fund some projects, instead of allowing the banks – many of which were being bailed out with billions of pounds of public money at the time – to increase their charges . . . by up to 33%".

Scrutiny

The House of Commons Liaison Committee has said that claims of commercialconfidentiality

Confidentiality involves a set of rules or a promise sometimes executed through confidentiality agreements that limits the access to or places restrictions on the distribution of certain types of information.

Legal confidentiality

By law, la ...

are making it difficult for MPs to scrutinise the growing number of PFI contracts in the UK. The National Audit Office (NAO) is responsible for scrutinising public spending throughout the UK on behalf of the British Parliament and is independent of Government. It provides reports on the value for money of many PFI transactions and makes recommendations. The Public Accounts Committee also provides reports on these issues at a UK-wide level. The devolved governments of Scotland, Wales and Northern Ireland have their own equivalents of the NAO such as the Wales Audit Office and the Northern Ireland Audit Office which review PFI projects in their respective localities. In recent years the Finance Committees of the Scottish Parliament

The Scottish Parliament ( ; ) is the Devolution in the United Kingdom, devolved, unicameral legislature of Scotland. It is located in the Holyrood, Edinburgh, Holyrood area of Edinburgh, and is frequently referred to by the metonym 'Holyrood'. ...

and the National Assembly for Wales

The Senedd ( ; ), officially known as the Welsh Parliament in English and () in Welsh, is the devolved, unicameral legislature of Wales. A democratically elected body, Its role is to scrutinise the Welsh Government and legislate on devolve ...

have held enquiries into whether PFI represents good value for money.

Local government

PFI is used in both central and local government. In the case of local government projects, the capital element of the funding which enables thelocal authority

Local government is a generic term for the lowest tiers of governance or public administration within a particular sovereign state.

Local governments typically constitute a subdivision of a higher-level political or administrative unit, such a ...

to pay the private sector for these projects is given by central government in the form of what are known as PFI "credits". The local authority then selects a private company to perform the work, and transfers detailed control of the project, and in theory the risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environ ...

, to the company.

In 2000, South Gloucestershire Council used PFI for household waste and recycling services, selecting private company Suez

Suez (, , , ) is a Port#Seaport, seaport city with a population of about 800,000 in north-eastern Egypt, located on the north coast of the Gulf of Suez on the Red Sea, near the southern terminus of the Suez Canal. It is the capital and largest c ...

to deliver these services for 25 years.

Appraisal process

Jeremy Colman, former deputy general of the National Audit Office and Auditor General for Wales is quoted in theFinancial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and also published digitally that focuses on business and economic Current affairs (news format), current affairs. Based in London, the paper is owned by a Jap ...

saying that many PFI appraisals suffer from "spurious precision" and others are based on "pseudo-scientific mumbo-jumbo". Some, he says, are simply "utter rubbish". He noted government pressures on contracting authorities to weight their appraisals in favour of taking their projects down the PFI route: "If the answer comes out wrong you don't get your project. So the answer doesn't come out wrong very often."

In a paper published in the British Medical Journal

''The BMJ'' is a fortnightly peer-reviewed medical journal, published by BMJ Publishing Group Ltd, which in turn is wholly-owned by the British Medical Association (BMA). ''The BMJ'' has editorial freedom from the BMA. It is one of the world ...

, a team consisting of two public health

Public health is "the science and art of preventing disease, prolonging life and promoting health through the organized efforts and informed choices of society, organizations, public and private, communities and individuals". Analyzing the de ...

specialists and an economist concluded that many PFI appraisals do not correctly calculate the true risks involved. They argued that the appraisal system is highly subjective in its evaluation of risk transferral to the private sector. An example was an NHS project where the risk that clinical cost savings might not be achieved was theoretically transferred to the private sector. In the appraisal this risk was valued at £5m but in practice the private contractor had no responsibility for ensuring clinical cost-savings and faced no penalty if there were none. Therefore, the supposed risk transfer was in fact spurious.

References

External links

*House of Commons Library (2001)The Private Finance Initiative (PFI)

Research Paper 01/117 * Northern Ireland Audit Office report (2004) into PFI in the health secto

* * Jane Broadbent, 2004

''Private Finance Initiative in the National Health Service: The Nature, Emergence and the Role of Management Accounting in Decision Making and Post-decision Project Evaluation''

Chartered Institute of Management Accountants * {{DEFAULTSORT:Private Finance Initiative Economy of the United Kingdom Government of the United Kingdom Waste legislation in the United Kingdom Monopoly (economics) Public–private partnership Economics of regulation Securities (finance)