personal budget on:

[Wikipedia]

[Google]

[Amazon]

A personal budget (for the budget of one person) or household budget (for the budget of one or more person living in the same

For this method, people need to use

For this method, people need to use

dwelling

In law, a dwelling (also known as a residence or an abode) is a self-contained unit of accommodation used by one or more households as a home - such as a house, apartment, mobile home, houseboat, vehicle, or other "substantial" structure. The ...

) is a plan for the coordination of the resources

Resource refers to all the materials available in our environment which are technologically accessible, economically feasible and culturally sustainable and help us to satisfy our needs and wants. Resources can broadly be classified upon their av ...

(income) and expenses of an individual or a household

A household consists of two or more persons who live in the same dwelling. It may be of a single family or another type of person group. The household is the basic unit of analysis in many social, microeconomic and government models, and is i ...

.

Purposes of creating a personal budget

Personal budgets are usually created to help an individual or a household of people to control their spending and achieve their financial goals. Having a budget can help people feel more in control of their finances and make it easier for them to not overspend and to save money. People who budget their money are less likely to obtain large debts, and are more likely to be able to lead comfortable retired lifes and to be prepared for emergencies.Methods of personal budgeting

In the most basic form of creating a personal budget the person needs to calculate theirnet income

In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest ...

, track their spending

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many o ...

over a set period of time, set goals based on the information previously gathered, make a plan to achieve these goals, and adjust their spending based on the plan. There exist many methods of budgeting to help people do this.

50/30/20 budget

The 50/30/20 budget is a simple plan that sorts personal expenses into three categories: "needs" ( basic necessities), "wants", andsavings

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an I ...

. 50% of one's net income then goes towards needs, 30% towards wants, and 20% towards savings.

Pay yourself first method (80/20 budget)

In the pay yourself first budget people first save at least 20% of their net income, and then freely spend the remaining 80%. They can also choose a 70/30, 60/40, or 50/50 budget for more savings. The most important part of this method is to put one's savings apart before spending on anything else.Sub-savings accounts method

This method is a variation of the pay yourself first budget, in which people create multiplesavings accounts

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transac ...

, each for one specific goal (such as a vacation or a new car), and each with an amount of money that should be reached by a specific date. They then divide the amount of money needed by the timeline to calculate how much they should save each month.

Envelope method (cash-only budgeting)

cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In bookkeeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-im ...

instead of debit

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value ''to'' that account, and a credit e ...

or credit cards

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the ...

. They need to allocate their net income into categories (e.g. groceries), withdraw the cash allocated for each category, and put them into envelopes. Any time they want to buy something in one of the categories, they only take the designated envelope so that they cannot overspend.

Zero-based budgeting

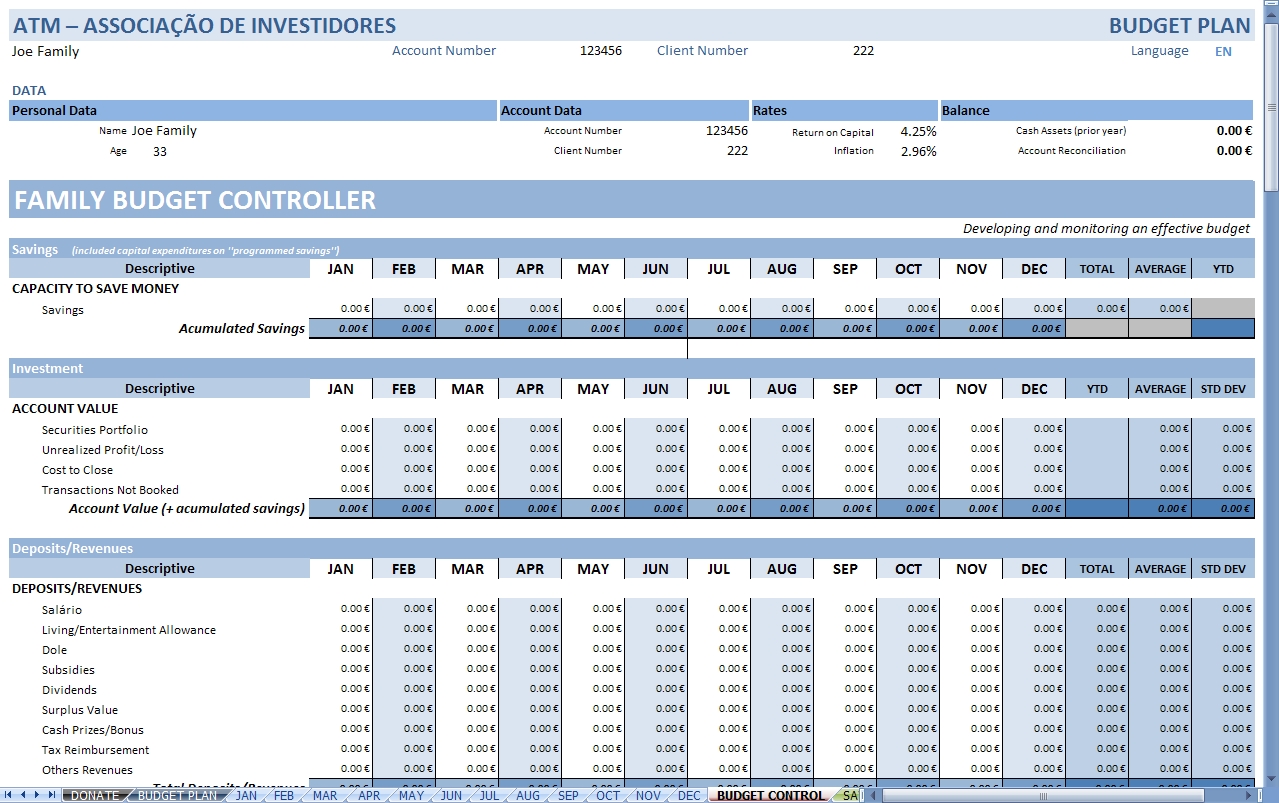

In zero-based budgeting, all of one's net income must be allocated ahead of spending.Personal finance softwares and apps

Several personal financesoftwares

Software is a set of computer programs and associated documentation and data. This is in contrast to hardware, from which the system is built and which actually performs the work.

At the lowest programming level, executable code consists ...

and mobile apps

A mobile application or app is a computer program or software application designed to run on a mobile device such as a phone, tablet, or watch. Mobile applications often stand in contrast to desktop applications which are designed to run on des ...

have been developed to help people with managing their money. Some of them can be used for budgeting and expense tracking, others mainly for one's investment porftolio. There are both free and paid options.

References

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environme ...