liquidity trap on:

[Wikipedia]

[Google]

[Amazon]

A liquidity trap is a situation, described in

"It's baack: Japan's Slump and the Return of the Liquidity Trap,"

Brookings Papers on Economic Activity

Mr Keynes and the Classics: A Suggested Interpretation

, ''

Paul Krugman Does Not Understand the Liquidity Trap

, ''Naked Capitalism''website, 23 July 2014

Stabilizing an Unstable Economy

', 1st edition: Yale University Press, 1986; reprint: McGraw Hill, 2008, that "after a debt

In the wake of the Keynesian Revolution in the 1930s and 1940s, various

In the wake of the Keynesian Revolution in the 1930s and 1940s, various

Why negative interest rates sometimes succeed

by Gemma Tetlow, ''

During the

During the

The on-going crisis has nothing to do with a supposed liquidity trap

, 28 June 2012 The rise in the monetary base did not affect interest rates or commodity prices. Taking the precedent of the

TED rate

for the period 2007/16 the critics of the mainstream definition claim Pilkington, Philip (2013)

What is a Liquidity Trap?

, ''Fixing the economists'' website, 4 July 2013 that, after that period, there is no more of any kind of a liquidity trap since government and private-sector bonds are "very much in demand". This goes against Keynes' point as Keynes stated that "almost everyone prefers cash to holding a debt." However, modern finance has the concept of

IS-LM: An Explanation

, ''Journal of Post Keynesian Economics'', Volume 3, 1980, Issue 2 {{Authority control Keynesian economics

Keynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomics, macroeconomic theories and Economic model, models of how aggregate demand (total spending in the economy) strongl ...

, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-i ...

rather than holding a debt (financial instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

) which yields so low a rate of interest." Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money

''The General Theory of Employment, Interest and Money'' is a book by English economist John Maynard Keynes published in February 1936. It caused a profound shift in economic thought, giving macroeconomics a central place in economic theory and ...

'', United Kingdom: Palgrave Macmillan, 2007 edition,

A liquidity trap is caused when people hold cash because they expect an adverse event such as deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases i ...

, insufficient aggregate demand

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the ...

, or war

War is an armed conflict between the armed forces of states, or between governmental forces and armed groups that are organized under a certain command structure and have the capacity to sustain military operations, or between such organi ...

. Among the characteristics of a liquidity trap are interest rates that are close to zero lower bound and changes in the money supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i ...

that fail to translate into changes in inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap,"

Brookings Papers on Economic Activity

Origin and definition of the term

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

, in his 1936 ''General Theory'', wrote the following: There is the possibility...that, after the rate of interest has fallen to a certain level, liquidity-preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest. But whilst this limiting case might become practically important in future, I know of no example of it hitherto.This concept of

monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

's potential impotence was further worked out in the works of British economist John Hicks

Sir John Richard Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics ...

, Hicks, John R. (1937)Mr Keynes and the Classics: A Suggested Interpretation

, ''

Econometrica

''Econometrica'' is a peer-reviewed academic journal of economics, publishing articles in many areas of economics, especially econometrics. It is published by Wiley-Blackwell on behalf of the Econometric Society. The current editor-in-chief is ...

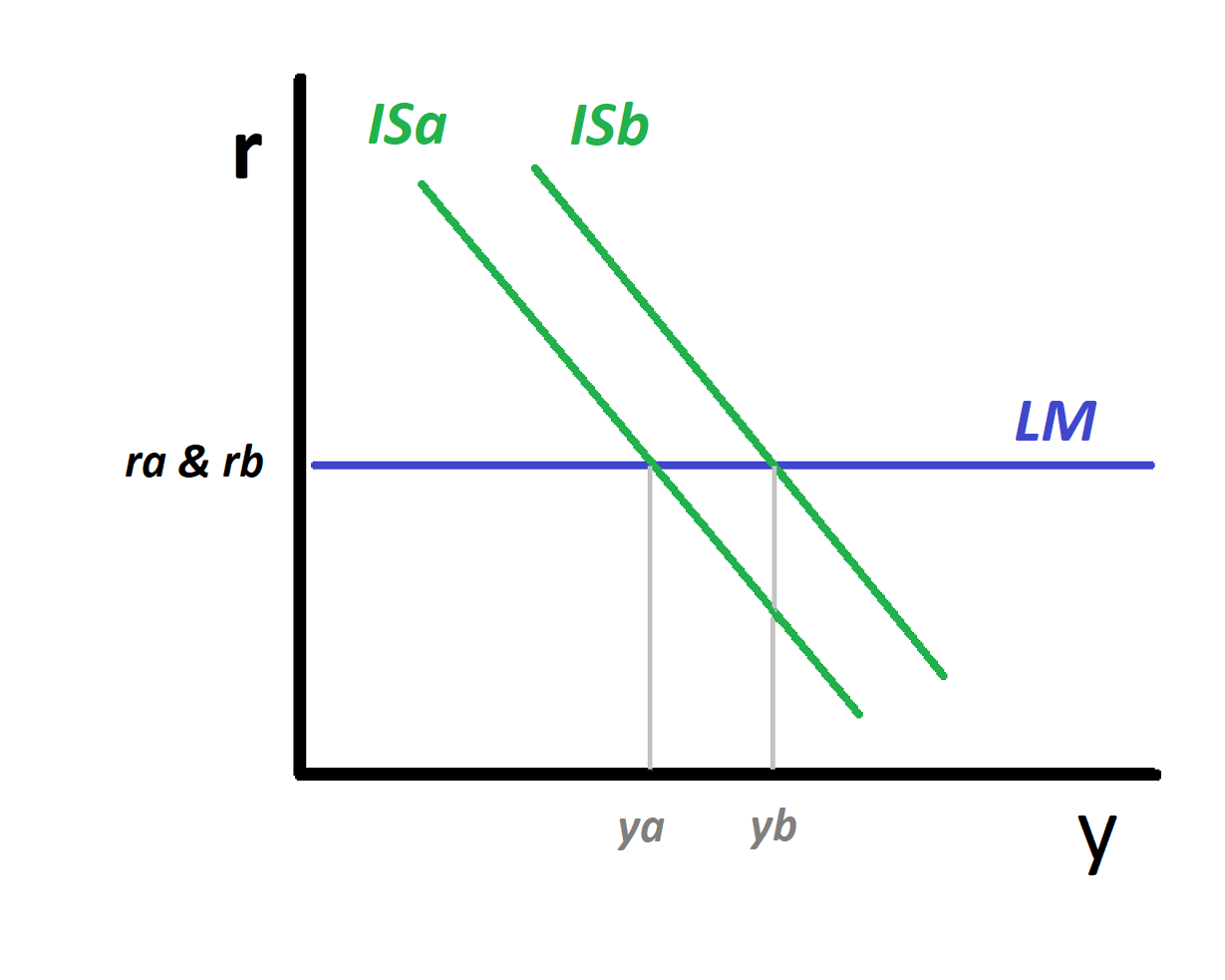

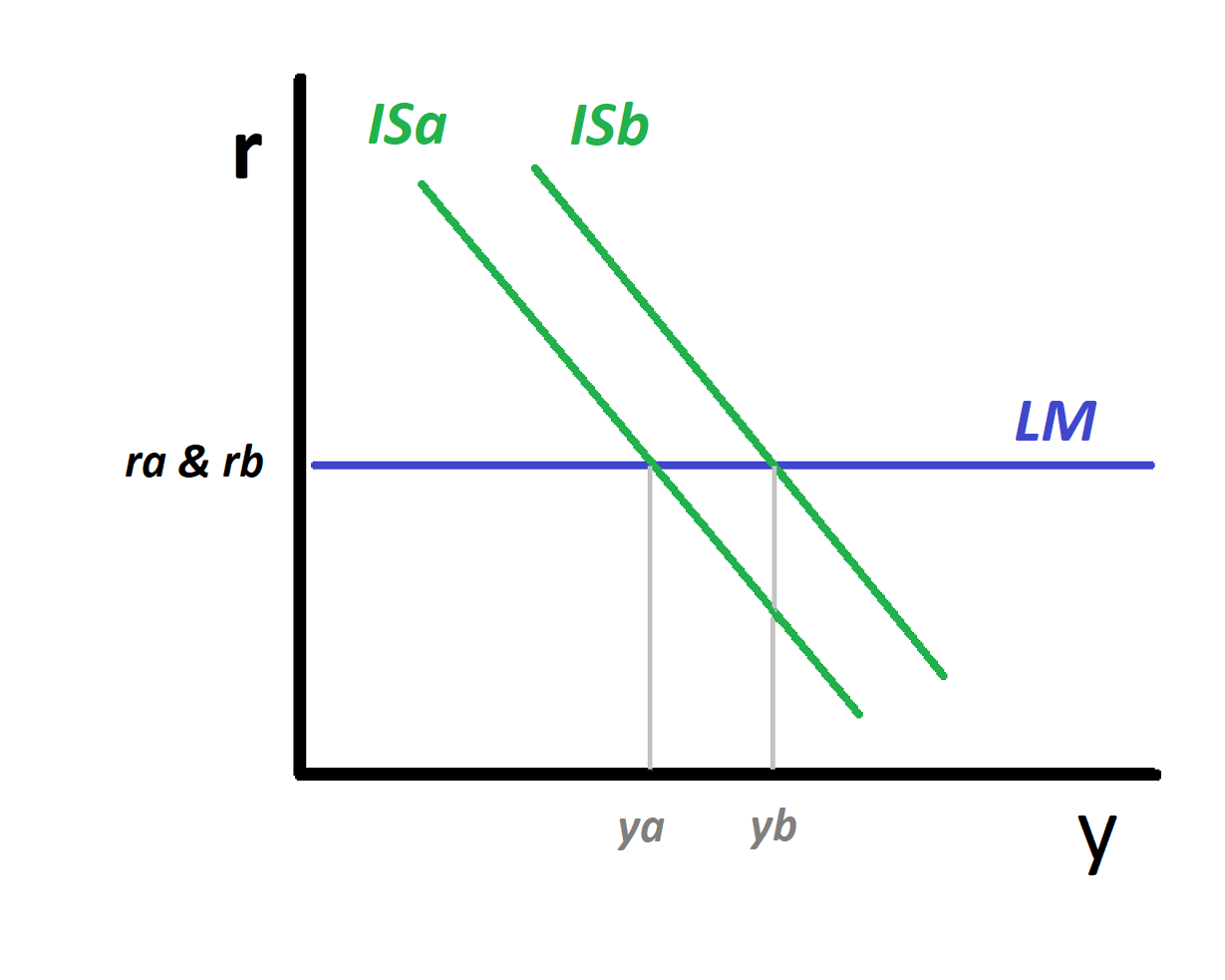

'', Vol. 5, No. 2, April 1937, pp. 147-159 who published the IS–LM model representing Keynes's system.The model depicts and tracks the intersection of the "investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

–saving

Saving is income not spent, or deferred Consumption (economics), consumption. In economics, a broader definition is any income not used for immediate consumption. Saving also involves reducing expenditures, such as recurring Cost, costs.

Methods ...

" (IS) curve with the " liquidity preference–money supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i ...

" (LM) curve. At the intersection, according to the mainstream, Neo-Keynesian analysis, simultaneous equilibrium occurs in both interest and financial-assets markets Nobel laureate

The Nobel Prizes (, ) are awarded annually by the Royal Swedish Academy of Sciences, the Swedish Academy, the Karolinska Institutet, and the Norwegian Nobel Committee to individuals and organizations who make outstanding contributions in th ...

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

, in his work on monetary policy, follows the formulations of Hicks:Hicks, subsequently and a few years before his passing, repudiated the IS/LM model, describing it as an "impoverished" representation of Keynesian economics. See Hicks (1981) A liquidity trap may be defined as a situation in which conventional monetary policies have become impotent, because nominal interest rates are at or near zero: injectingIn a liquidity trap, people are indifferent between bonds and cash because the rates of interest bothmonetary base In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This includ ...into the economy has no effect, because onetarybase and bonds are viewed by theprivate sector The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government. Employment The private sector employs most of the workfo ...as perfect substitutes.

financial instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership, interest in an entity or a contractual right to receive or deliver in the form ...

provide to their holder is practically equal: The interest on cash is zero and the interest on bonds is near-zero. Hence, the central bank cannot affect the interest rate any more (through augmenting the monetary base

In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This includ ...

) and has lost control over it.

In Keynes' description of a liquidity trap, people simply do not want to hold bonds and prefer other, more-liquid forms of money instead. Because of this preference, after converting bonds into cash,Whereby "cash" includes both currency and bank accounts, aka M1 this causes an incidental but significant decrease to the bonds' prices and a subsequent increase to their yields. However, people prefer cash no matter how high these yields are or how high the central bank sets the bond's rates (yields). Pilkington, Philip (2014)Paul Krugman Does Not Understand the Liquidity Trap

, ''Naked Capitalism''website, 23 July 2014

Post-Keynesian economist

Post-Keynesian economics is a school of economic thought with its origins in '' The General Theory'' of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney ...

Hyman Minsky

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist and economy professor at Washington University in St. Louis. A distinguished scholar at the Levy Economics Institute of Bard College, his research was inten ...

posited Minsky, Hyman (1986 008 008, OO8, O08, or 0O8 may refer to:

* "008", a fictional 00 Agent

In Ian Fleming's James Bond novels and the derived films, the 00 Section of MI6 is considered the secret service's elite. A 00 (pronounced "Double O") is a field agent who ho ...

Stabilizing an Unstable Economy

', 1st edition: Yale University Press, 1986; reprint: McGraw Hill, 2008, that "after a debt

deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases i ...

that induces a deep depression, an increase in the money supply

In macroeconomics, money supply (or money stock) refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation (i ...

with a fixed head count of other inancialassets may not lead to a rise in the price of other assets." This naturally causes interest rates on assets that are not considered "almost perfectly liquid" to rise. In which case, as Minsky had stated elsewhere, Minsky, Hyman (1975 008 008, OO8, O08, or 0O8 may refer to:

* "008", a fictional 00 Agent

In Ian Fleming's James Bond novels and the derived films, the 00 Section of MI6 is considered the secret service's elite. A 00 (pronounced "Double O") is a field agent who ho ...

''John Maynard Keynes'', McGraw-Hill Professional, New York, 2008, The view that the liquidity-preference function is a demand-for-money relation permits the introduction of the idea that in appropriate circumstances the demand for money may be infinitelyelastic Elastic is a word often used to describe or identify certain types of elastomer, Elastic (notion), elastic used in garments or stretch fabric, stretchable fabrics. Elastic may also refer to: Alternative name * Rubber band, ring-shaped band of rub ...with respect to variations in the interest rate… The liquidity trap presumably dominates in the immediate aftermath of arecession In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...orfinancial crisis A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banki ....

Historical debate

neoclassical economists

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a goo ...

sought to minimize the effect of liquidity-trap conditions. Don Patinkin and Lloyd Metzler invoked the existence of the so-called " Pigou effect", in which the stock of real money balances is ostensibly an argument of the aggregate demand

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the ...

function for goods, so that the money stock would directly affect the "investment saving" curve in IS/LM analysis. Monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

would thus be able to stimulate the economy even when there is a liquidity trap.

Monetarist

Monetarism is a school of thought in monetary economics that emphasizes the role of policy-makers in controlling the amount of money in circulation. It gained prominence in the 1970s, but was mostly abandoned as a direct guidance to monetary ...

s, most notably Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

, Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Sch ...

, Karl Brunner, Allan Meltzer and others, strongly condemned any notion of a "trap" that did not feature an environment of a zero, or near-zero, interest rate across the whole spectrum of interest rates, i.e. both short- and long-term debt of the government and the private sector. In their view, any interest rate different from zero along the yield curve is a sufficient condition to eliminate the possibility of the presence of a liquidity trap.See " Monetarism and the liquidity trap

In recent times, when the Japanese economy fell

A fell (from Old Norse ''fell'', ''fjall'', "mountain"Falk and Torp (2006:161).) is a high and barren landscape feature, such as a mountain or Moorland, moor-covered hill. The term is most often employed in Fennoscandia, Iceland, the Isle of M ...

into a period of prolonged stagnation, despite near-zero interest rates, the concept of a liquidity trap returned to prominence. Keynes's formulation of a liquidity trap refers to the existence of a horizontal demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

-curve for money at some positive level of interest rates; yet, the liquidity trap invoked in the 1990s referred merely to the presence of zero or near-zero interest-rates policies (ZIRP), the assertion being that interest rates could not fall below zero.The assumption being that no one would lend 100 dollars unless they were to get at least 100 dollars back, although we have seen in the 21st century the introduction, without any problem in demand, of negative interest-rates. See e.g.Why negative interest rates sometimes succeed

by Gemma Tetlow, ''

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and also published digitally that focuses on business and economic Current affairs (news format), current affairs. Based in London, the paper is owned by a Jap ...

'', 5 September 2016 Some economists, such as Nicholas Crafts

Nicholas Francis Robert Crafts Order of the British Empire, CBE (9 March 1949 – 6 October 2023) was a British economist who was known for his contributions to economic history, in particular on the Industrial Revolution.

He was Professor of ...

, have suggested a policy of inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

-targeting (by a central bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

that is independent of the government) at times of prolonged, very low, nominal interest-rates, in order to avoid a liquidity trap or escape from it.

Some Austrian School

The Austrian school is a Heterodox economics, heterodox Schools of economic thought, school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result primarily from the motivat ...

economists, such as those of the Ludwig von Mises Institute

The Ludwig von Mises Institute for Austrian Economics, or Mises Institute, is a nonprofit think tank headquartered in Auburn, Alabama, that is a center for Austrian economics, right-wing libertarian thought and the paleolibertarian and anarcho ...

, reject Keynes' theory of liquidity preference altogether. They argue that lack of domestic investment during periods of low interest-rates is the result of previous malinvestment

In Austrian business cycle theory, malinvestments are badly allocated business investments resulting from artificially low interest rates for borrowing and an unsustainable increase in money supply. Central banks are often blamed for causing malin ...

and time preference

In behavioral economics, time preference (or time discounting,. delay discounting, temporal discounting, long-term orientation) is the current relative valuation placed on receiving a good at an earlier date compared with receiving it at a late ...

s rather than liquidity preference. Chicago school economists remain critical of the notion of liquidity traps.

Keynesian economists, like Brad DeLong and Simon Wren-Lewis, maintain that the economy continues to operate within the IS-LM model, albeit an "updated" one, and the rules have "simply changed."

2008 financial crisis

During the

During the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, as short-term interest rates for the various central banks in the United States and Europe moved close to zero, economists such as Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

argued that much of the developed world, including the United States, Europe, and Japan, was in a liquidity trap. He noted that tripling of the monetary base

In economics, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This includ ...

in the US between 2008 and 2011 failed to produce any significant effect on domestic price indices or dollar-denominated commodity prices, a notion supported by others, such as Scott Sumner.

U.S. Federal Reserve economists assert that the liquidity trap can explain low inflation in periods of vastly increased central bank money supply. Based on experience $3.5 trillion of quantitative easing

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary polic ...

from 2009–2013, the hypothesis is that investors hoard and do not spend the increased money because the opportunity cost

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, ...

of holding cash (namely the interest forgone) is zero when the nominal interest rate is zero. This hoarding effect is purported to have reduced consequential inflation to half of what would be expected directly from the increase in the money supply, based on statistics from the expansive years. They further assert that the liquidity trap is possible only when the economy is in deep recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

.

COVID-19 recession

Modest inflation during theCOVID-19

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by the coronavirus SARS-CoV-2. In January 2020, the disease spread worldwide, resulting in the COVID-19 pandemic.

The symptoms of COVID‑19 can vary but often include fever ...

crisis in 2020, despite unprecedented monetary stimulus and expansion, was similarly ascribed to hoarding of cash.

Post-Keynesians respond that the confusion by "mainstream economists" between conditions of a liquidity trap, as defined by Keynes and in the Post-Keynesian framework, and conditions of near-zero or zero interest rates, is intentional and ideologically motivated in ostensibly attempting to support monetary over fiscal policies. They argue that, quantitative easing

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary polic ...

programs in the United States, and elsewhere, caused the prices of financial assets to rise across the board and interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s to fall; yet, a liquidity trap cannot exist, according to the Keynesian definition, unless the prices on imperfectly safe financial assets are falling and their interest rates are rising. Mitchell, William (2012)The on-going crisis has nothing to do with a supposed liquidity trap

, 28 June 2012 The rise in the monetary base did not affect interest rates or commodity prices. Taking the precedent of the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, critics of the mainstream definition of a liquidity trap point out that the central bank of the United States never, effectively, lost control of the interest rate. Whereas the United States did experience a liquidity trap in the period 2009/10, i.e. in "the immediate aftermath" of the crisis,During approximately 2009/10, the interest rates on risky financial assets failed to respond to Fed intervention, as demonstrated by the TED spread history. SeTED rate

for the period 2007/16 the critics of the mainstream definition claim Pilkington, Philip (2013)

What is a Liquidity Trap?

, ''Fixing the economists'' website, 4 July 2013 that, after that period, there is no more of any kind of a liquidity trap since government and private-sector bonds are "very much in demand". This goes against Keynes' point as Keynes stated that "almost everyone prefers cash to holding a debt." However, modern finance has the concept of

cash and cash equivalents

Cash and cash equivalents (CCE) are the most liquid current assets found on a business's balance sheet. Cash equivalents are short-term commitments "with temporarily idle cash and easily convertible into a known cash amount". An investment normal ...

; Treasuries may in some cases be treated as cash equivalents and not "debt" for liquidity purposes.

See also

*Inflation targeting

In macroeconomics, inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that moneta ...

*Inverted yield curve

In finance, an inverted yield curve is a yield curve in which short-term debt instruments (typically bonds) have a greater yield than longer term bonds. An inverted yield curve is an unusual phenomenon; bonds with shorter maturities generally ...

* Helicopter money

*Productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proce ...

*Return on investment

Return on investment (ROI) or return on costs (ROC) is the ratio between net income (over a period) and investment (costs resulting from an investment of some resources at a point in time). A high ROI means the investment's gains compare favorab ...

*Speculative bubble

Speculative may refer to:

In arts and entertainment

*Speculative art (disambiguation)

*Speculative fiction, which includes elements created out of human imagination, such as the science fiction and fantasy genres

** Speculative Fiction Group, a Pe ...

*Subprime mortgage crisis

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010, contributing to the 2008 financial crisis. It led to a severe economic recession, with millions becoming unemployed and many busines ...

*Too big to fail

"Too big to fail" (TBTF) is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected with an economy that their failure would be disastrous to the greater e ...

* Zero interest rate policy

Notes

References

Further reading

* * * Hicks, John R. (1981)IS-LM: An Explanation

, ''Journal of Post Keynesian Economics'', Volume 3, 1980, Issue 2 {{Authority control Keynesian economics