high-powered money on:

[Wikipedia]

[Google]

[Amazon]

In

In

Open market operations are

Open market operations are

Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)

{{Authority control Monetary economics Operations of central banks

In

In economics

Economics () is the social science that studies the production, distribution, and consumption of goods and services.

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes ...

, the monetary base (also base money, money base, high-powered money, reserve money, outside money, central bank money or, in the UK, narrow money) in a country is the total amount of money created by the central bank. This includes:

* the total currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

circulating in the public,

* plus the currency that is physically held in the vaults of commercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with co ...

s,

* plus the commercial banks' reserves held in the central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

.

The monetary base should not be confused with the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circul ...

, which consists of the total currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

circulating in the public plus certain types of non-bank deposits with commercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with co ...

s.

Management

Open market operations are

Open market operations are monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

tools which directly expand or contract the monetary base.

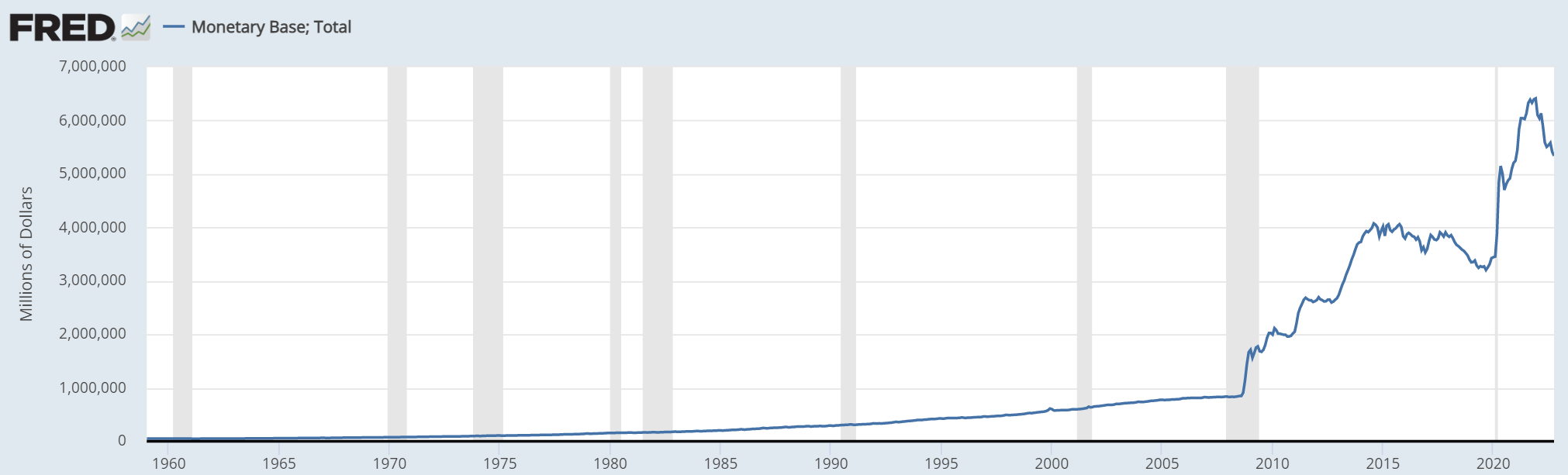

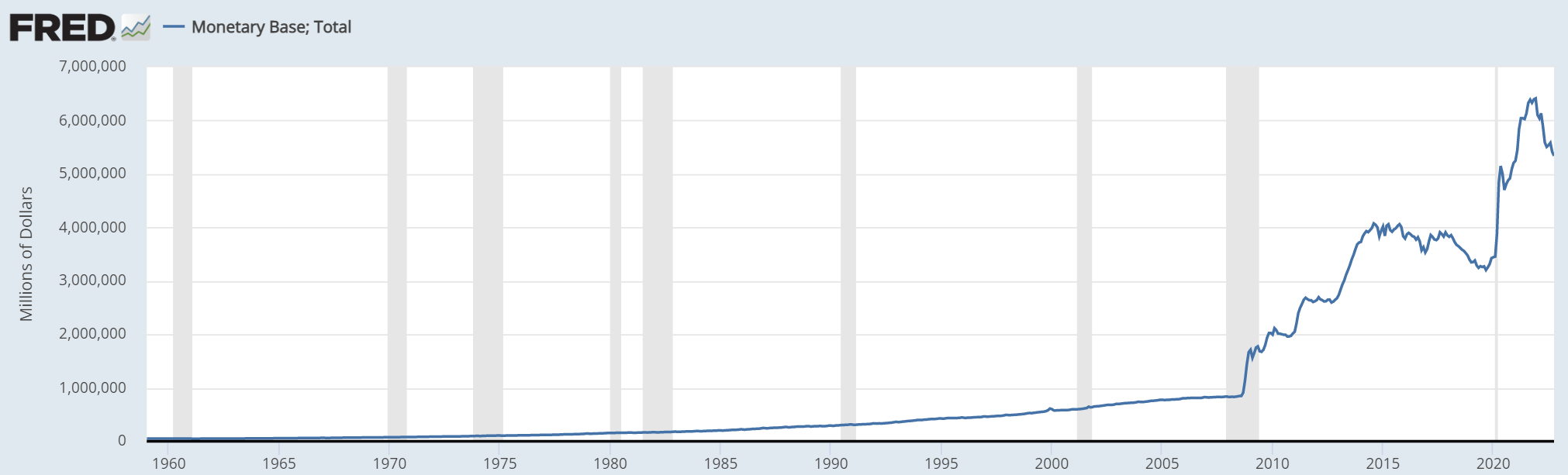

The monetary base is manipulated during the conduct of monetary policy by a finance ministry or the central bank. These institutions change the monetary base through open market operations: the buying and selling of government bonds. For example, if they buy government bonds from commercial banks, they pay for them by adding new amounts to the banks’ reserve deposits at the central bank, the latter being a component of the monetary base.

Typically, a central bank can also influence banking activities by manipulating interest rates and setting reserve requirements (how much money banks must keep on hand instead of loaning out to borrowers). Interest rates, especially on federal funds

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear ...

(ultra-short-term loans between banks), are themselves influenced by open market operations.

The monetary base has traditionally been considered high-powered because its increase will typically result in a much larger increase in the supply of demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

s through banks' loan-making, a ratio called the money multiplier. However, for those that do not agree with the theory of the money multiplier, the monetary base can be thought of as high powered because of the fiscal multiplier instead.

Monetary policy

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

is generally presumed to be the policy preserve of Reserve Banks, who target an interest rate. Control of the amount of Base Money in the economy is then lost, as failure by the Reserve Bank to meet the reserve requirements of the banking system will result in banks who are short of reserves bidding up the interest rate. Interest rates are manipulated by the Reserve bank to maintain an inflation rate which is considered neither too high or too low. This is usually determined using a Taylor Rule.

The quantity of reserves in the banking system is supported by the open market operations performed by the Reserve Banks, involving the purchase and sale of various financial instruments, commonly Government debt (bonds), usually using "repos". Banks only require enough reserves to facilitate interbank settlement processes.

In some countries, Reserve Banks now pay interest on reserves. This adds another lever to the interest rate control mechanisms available to the Reserve Bank.

Following the 2008 financial crisis, Quantitative Easing raised the amount of reserves in the banking system, as the Reserve Banks purchased bad debt from the banks, paying for it with Reserves. This has left the banking system with an oversupply of reserves. This increase in reserves has had no effect on the level of interest rates. Note that reserves are never lent out by banks.

Accounting

Following IFRS standards, base money is registered as a liability of the central banks' balance sheet, implying base money is by nature a debt from the central bank. However, given the special nature of central bank money – which cannot be redeemed in anything other than base money – numerous scholars such as Michael Kumhof have argued it should rather be recorded as a form of equity.See also

* Money creation * Monetary reform * Fractional reserve banking * Credit theory of money * Broad moneyReferences

External links

* * *Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)

{{Authority control Monetary economics Operations of central banks