A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with

banking panics, and many

recessions coincided with these panics. Other situations that are often called financial crises include

stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often f ...

es and the

bursting of other financial

bubbles,

currency crises, and

sovereign defaults. Financial crises directly result in a loss of

paper wealth

Paper wealth means wealth as measured by monetary value, as reflected in price of assets – how much money one's assets could be sold for. Paper wealth is contrasted with real wealth, which refers to one's actual physical assets.

For example, if ...

but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century).

Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time.

Types

Banking crisis

When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Since banks lend out most of the cash they receive in deposits (see

fractional-reserve banking), it is difficult for them to quickly pay back all deposits if these are suddenly demanded, so a run renders the bank insolvent, causing customers to lose their deposits, to the extent that they are not covered by deposit insurance. An event in which bank runs are widespread is called a ''systemic banking crisis'' or ''banking panic''.

Examples of bank runs include the

run on the Bank of the United States in 1931 and the run on

Northern Rock in 2007. Banking crises generally occur after periods of risky lending and resulting loan defaults.

Currency crisis

A currency crisis, also called a devaluation crisis,

is normally considered as part of a financial crisis. Kaminsky et al. (1998), for instance, define currency crises as occurring when a weighted average of monthly percentage depreciations in the exchange rate and monthly percentage declines in exchange reserves exceeds its mean by more than three standard deviations. Frankel and Rose (1996) define a currency crisis as a nominal depreciation of a currency of at least 25% but it is also defined as at least a 10% increase in the rate of depreciation. In general, a currency crisis can be defined as a situation when the participants in an exchange market come to recognize that a

pegged exchange rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another m ...

is about to fail, causing

speculation

In finance, speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.)

Many ...

against the peg that hastens the failure and forces a

devaluation.

Speculative bubbles and crashes

A speculative bubble exists in the event of large, sustained overpricing of some class of assets. One factor that frequently contributes to a bubble is the presence of buyers who purchase an asset based solely on the expectation that they can later resell it at a higher price, rather than calculating the income it will generate in the future. If there is a bubble, there is also a risk of a ''crash'' in asset prices: market participants will go on buying only as long as they expect others to buy, and when many decide to sell the price will fall. However, it is difficult to predict whether an asset's price actually equals its fundamental value, so it is hard to detect bubbles reliably. Some economists insist that bubbles never or almost never occur.

Well-known examples of bubbles (or purported bubbles) and crashes in stock prices and other asset prices include the 17th century Dutch

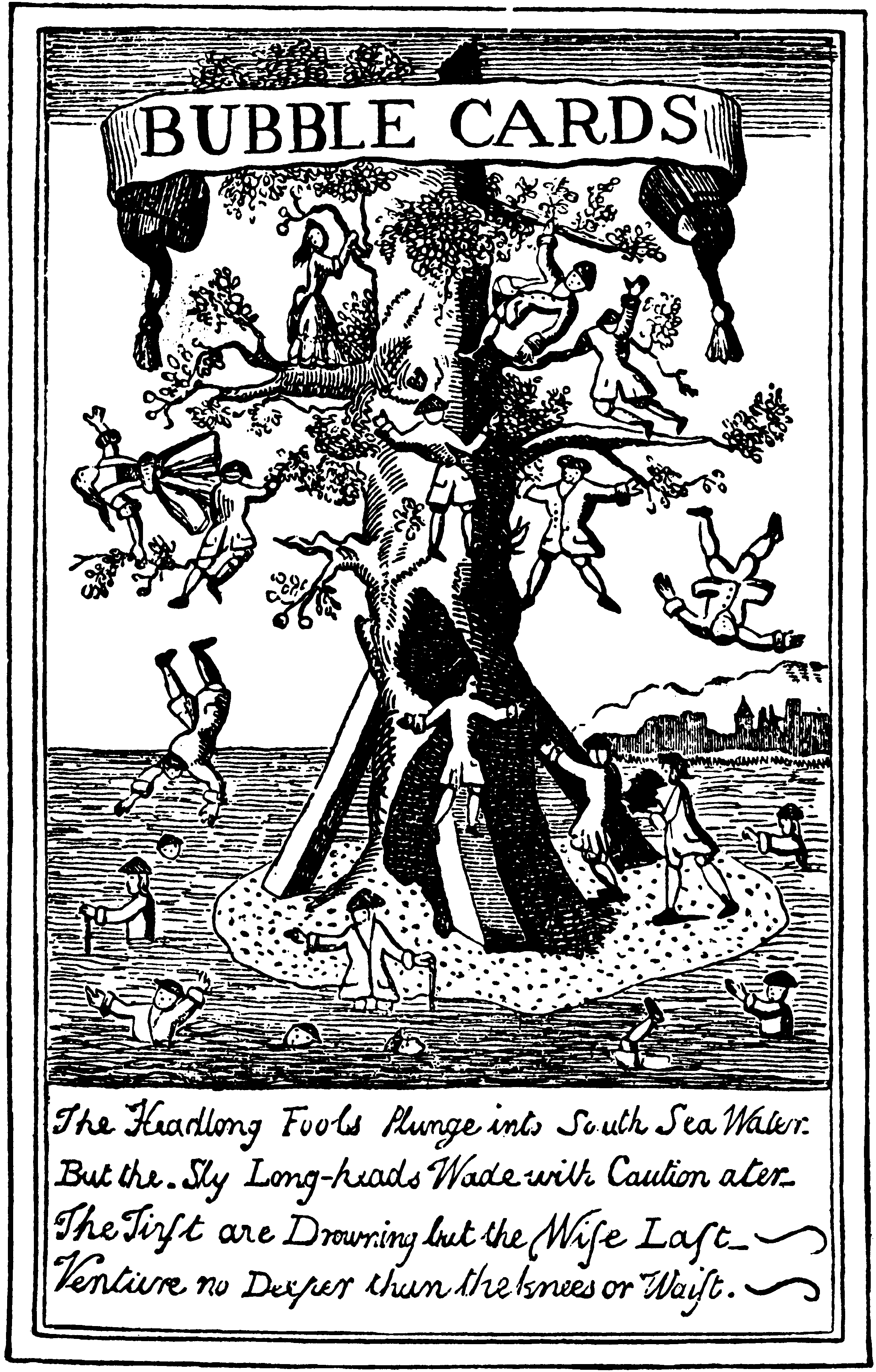

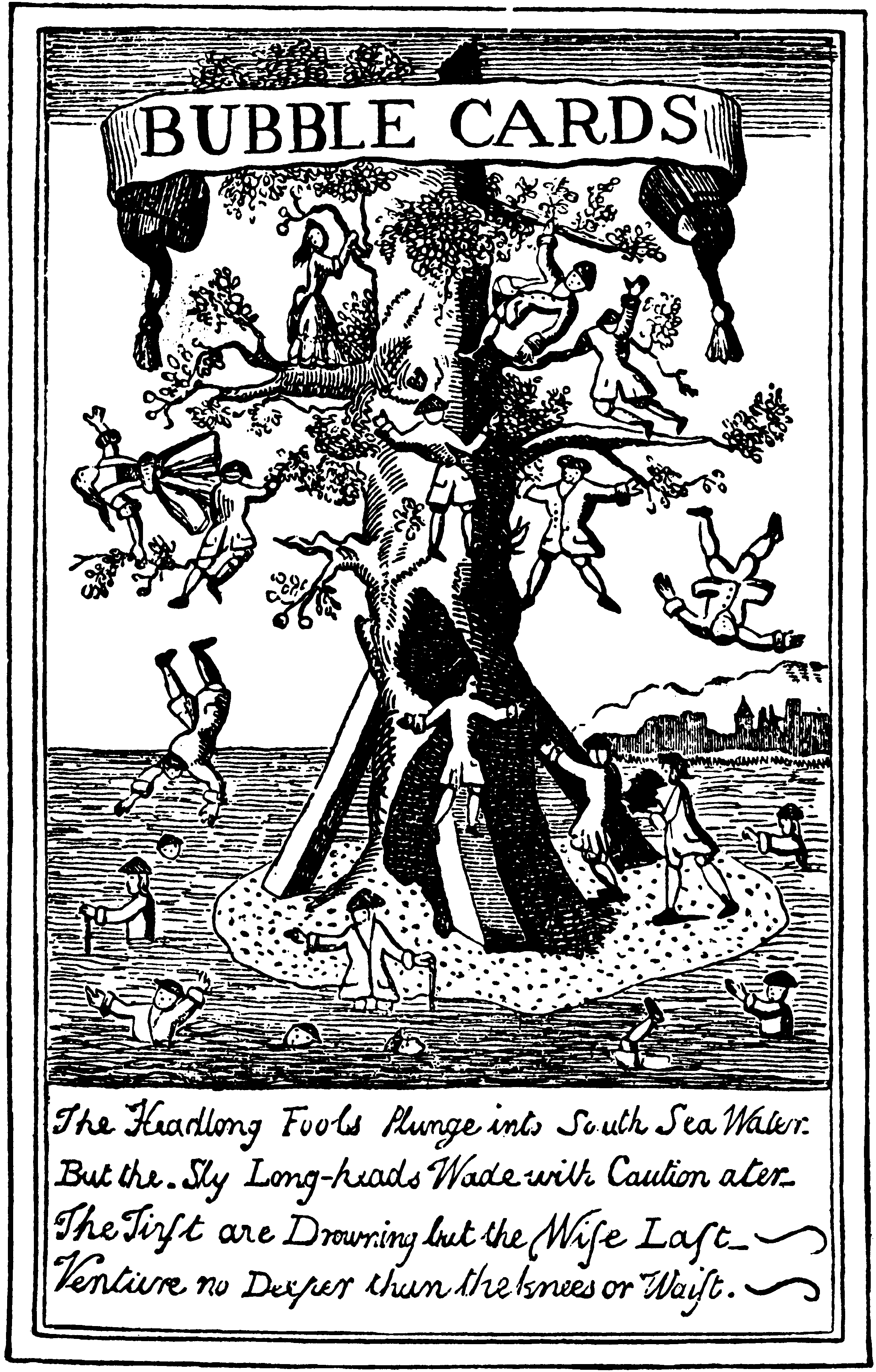

tulip mania, the 18th century

South Sea Bubble, the

Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange coll ...

, the

Japanese property bubble of the 1980s, the crash of the

United States housing bubble during 2006-2008.

The 2000s sparked a real estate bubble where housing prices were increasing significantly as an asset good.

International financial crisis

When a country that maintains a

fixed exchange rate is suddenly forced to

devalue its currency due to accruing an unsustainable current account deficit, this is called a ''currency crisis'' or ''balance of payments crisis''. When a country fails to pay back its

sovereign debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

, this is called a ''sovereign default''. While devaluation and default could both be voluntary decisions of the government, they are often perceived to be the involuntary results of a change in investor sentiment that leads to a

sudden stop

''Sudden Stop'' is the second studio album by Canadian blues musician Colin James released in 1990 on Virgin Records. The album was recorded in Vancouver and Memphis, Tennessee.

The album features guest appearances by Bonnie Raitt, The Memphis ...

in capital inflows or a sudden increase in

capital flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increa ...

.

Several currencies that formed part of the

European Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as ...

suffered crises in 1992–93 and were forced to devalue or withdraw from the mechanism. Another round of currency crises took place in

Asia in 1997–98. Many

Latin American countries defaulted on their debt in the early 1980s. The

1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the ruble and defaulting on its debt. The crisis had s ...

resulted in a devaluation of the ruble and default on Russian government bonds.

Wider economic crisis

Negative GDP growth lasting two or more quarters is called a ''recession''. An especially prolonged or severe recession may be called a ''depression'', while a long period of slow but not necessarily negative growth is sometimes called

economic stagnation

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, "slow" means significantly slower than potential growth as e ...

.

Some economists argue that many recessions have been caused in large part by financial crises. One important example is the

Great Depression, which was preceded in many countries by bank runs and stock market crashes. The

subprime mortgage crisis and the bursting of other real estate bubbles around the world also led to recession in the U.S. and a number of other countries in late 2008 and 2009.

Some economists argue that financial crises are caused by recessions instead of the other way around, and that even where a financial crisis is the initial shock that sets off a recession, other factors may be more important in prolonging the recession. In particular,

Milton Friedman and

Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwar ...

argued that the initial economic decline associated with the

crash of 1929 and the bank panics of the 1930s would not have turned into a prolonged depression if it had not been reinforced by monetary policy mistakes on the part of the Federal Reserve, a position supported by

Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Duri ...

.

Causes and consequences

Strategic complementarities in financial markets

It is often observed that successful investment requires each investor in a financial market to guess what other investors will do.

George Soros has called this need to guess the intentions of others '

reflexivity'. Similarly,

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

compared financial markets to a

beauty contest game in which each participant tries to predict which model ''other'' participants will consider most beautiful.

Furthermore, in many cases, investors have incentives to

coordinate

In geometry, a coordinate system is a system that uses one or more numbers, or coordinates, to uniquely determine the position of the points or other geometric elements on a manifold such as Euclidean space. The order of the coordinates is sign ...

their choices. For example, someone who thinks other investors want to heavily buy

Japanese yen may expect the yen to rise in value, and therefore has an incentive to buy yen, too. Likewise, a depositor in

IndyMac Bank

IndyMac, a contraction of Independent National Mortgage Corporation, was an American bank based in California that failed in 2008 and was seized by the United States Federal Deposit Insurance Corporation (FDIC).

Before its failure, IndyMac Ban ...

who expects other depositors to withdraw their funds may expect the bank to fail, and therefore has an incentive to withdraw, too. Economists call an incentive to mimic the strategies of others ''strategic complementarity''.

It has been argued that if people or firms have a sufficiently strong incentive to do the same thing they expect others to do, then ''self-fulfilling prophecies'' may occur. For example, if investors expect the value of the yen to rise, this may cause its value to rise; if depositors expect a bank to fail this may cause it to fail.

Therefore, financial crises are sometimes viewed as a

vicious circle in which investors shun some institution or asset because they expect others to do so.

Leverage

''Leverage'', which means borrowing to finance investments, is frequently cited as a contributor to financial crises. When a financial institution (or an individual) only invests its own money, it can, in the very worst case, lose its own money. But when it borrows in order to invest more, it can potentially earn more from its investment, but it can also lose more than all it has. Therefore, leverage magnifies the potential returns from investment, but also creates a risk of

bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debto ...

. Since bankruptcy means that a firm fails to honor all its promised payments to other firms, it may spread financial troubles from one firm to another (see

'Contagion' below).

The average degree of leverage in the economy often rises prior to a financial crisis. For example, borrowing to finance investment in the

stock market ("

margin buying") became increasingly common prior to the

Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange coll ...

.

Asset-liability mismatch

Another factor believed to contribute to financial crises is ''asset-liability mismatch'', a situation in which the risks associated with an institution's debts and assets are not appropriately aligned. For example, commercial banks offer deposit accounts that can be withdrawn at any time and they use the proceeds to make long-term loans to businesses and homeowners. The mismatch between the banks' short-term liabilities (its deposits) and its long-term assets (its loans) is seen as one of the reasons

bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

s occur (when depositors panic and decide to withdraw their funds more quickly than the bank can get back the proceeds of its loans).

Likewise,

Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

failed in 2007–08 because it was unable to renew the

short-term debt

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

As short-term securities became a commodity, the money market became a compon ...

it used to finance long-term investments in mortgage securities.

In an international context, many emerging market governments are unable to sell bonds denominated in their own currencies, and therefore sell bonds denominated in US dollars instead. This generates a mismatch between the currency denomination of their liabilities (their bonds) and their assets (their local tax revenues), so that they run a risk of

sovereign default due to fluctuations in exchange rates.

Uncertainty and herd behavior

Many analyses of financial crises emphasize the role of investment mistakes caused by lack of knowledge or the imperfections of human reasoning.

Behavioural finance

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals or institutions, such as how those decisions vary from those implied by classical economic theory.

...

studies errors in economic and quantitative reasoning. Psychologist Torbjorn K A Eliazon has also analyzed failures of economic reasoning in his concept of 'œcopathy'.

Historians, notably

Charles P. Kindleberger

Charles Poor Kindleberger (October 12, 1910 – July 7, 2003) was an American economic historian and author of over 30 books. His 1978 book ''Manias, Panics, and Crashes'', about speculative stock market bubbles, was reprinted in 2000 after the d ...

, have pointed out that crises often follow soon after major financial or technical innovations that present investors with new types of financial opportunities, which he called "displacements" of investors' expectations. Early examples include the

South Sea Bubble and

Mississippi Bubble

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and th ...

of 1720, which occurred when the notion of investment in shares of company

stock was itself new and unfamiliar, and the

Crash of 1929, which followed the introduction of new electrical and transportation technologies. More recently, many financial crises followed changes in the investment environment brought about by financial

deregulation, and the crash of the

dot com bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet.

Between 1995 and its peak in March 2000, the Nasdaq Com ...

in 2001 arguably began with "irrational exuberance" about Internet technology.

Unfamiliarity with recent technical and

financial innovation

Financial innovation is the act of creating new financial instruments as well as new financial technologies, institutions, and markets. Recent financial innovations include hedge funds, private equity, weather derivatives, retail-structured pr ...

s may help explain how investors sometimes grossly overestimate asset values. Also, if the first investors in a new class of assets (for example, stock in "dot com" companies) profit from rising asset values as other investors learn about the innovation (in our example, as others learn about the potential of the Internet), then still more others may follow their example, driving the price even higher as they rush to buy in hopes of similar profits. If such "herd behaviour" causes prices to spiral up far above the true value of the assets, a crash may become inevitable. If for any reason the price briefly falls, so that investors realize that further gains are not assured, then the spiral may go into reverse, with price decreases causing a rush of sales, reinforcing the decrease in prices.

Regulatory failures

Governments have attempted to eliminate or mitigate financial crises by regulating the financial sector. One major goal of regulation is

transparency: making institutions' financial situations publicly known by requiring regular reporting under standardized accounting procedures. Another goal of regulation is making sure institutions have sufficient assets to meet their contractual obligations, through

reserve requirements,

capital requirement

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital ad ...

s, and other limits on

leverage.

Some financial crises have been blamed on insufficient regulation, and have led to changes in regulation in order to avoid a repeat. For example, the former Managing Director of the

International Monetary Fund,

Dominique Strauss-Kahn, has blamed the

financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

on 'regulatory failure to guard against excessive risk-taking in the financial system, especially in the US'. Likewise, the New York Times singled out the deregulation of

credit default swap

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against som ...

s as a cause of the crisis.

However, excessive regulation has also been cited as a possible cause of financial crises. In particular, the

Basel II Accord

Basel II is the second of the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision. It is now extended and partially superseded by Basel III.

The Basel II Accord was publi ...

has been criticized for requiring banks to increase their capital when risks rise, which might cause them to decrease lending precisely when capital is scarce, potentially aggravating a financial crisis.

International regulatory convergence has been interpreted in terms of regulatory herding, deepening market herding (discussed above) and so increasing systemic risk.

From this perspective, maintaining diverse regulatory regimes would be a safeguard.

Fraud has played a role in the collapse of some financial institutions, when companies have attracted depositors with misleading claims about their investment strategies, or have

embezzled the resulting income. Examples include

Charles Ponzi

Charles Ponzi (, ; born Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi; March 3, 1882 – January 15, 1949) was an Italian swindler and con artist who operated in the U.S. and Canada. His aliases included ''Charles Ponci'', ''Carlo'', and ''Cha ...

's scam in early 20th century Boston, the collapse of the

MMM investment fund in Russia in 1994, the scams that led to the

Albanian Lottery Uprising of 1997, and the collapse of

Madoff Investment Securities in 2008.

Many

rogue traders that have caused large losses at financial institutions have been accused of acting fraudulently in order to hide their trades. Fraud in mortgage financing has also been cited as one possible cause of the 2008

subprime mortgage crisis; government officials stated on 23 September 2008 that the

FBI

The Federal Bureau of Investigation (FBI) is the domestic intelligence and security service of the United States and its principal federal law enforcement agency. Operating under the jurisdiction of the United States Department of Justice, t ...

was looking into possible fraud by mortgage financing companies

Fannie Mae and

Freddie Mac,

Lehman Brothers, and insurer

American International Group

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/amer ...

. Likewise it has been argued that many financial companies failed in the recent crisis

because their managers failed to carry out their fiduciary duties.

Contagion

'' Contagion'' refers to the idea that financial crises may spread from one institution to another, as when a bank run spreads from a few banks to many others, or from one country to another, as when currency crises, sovereign defaults, or stock market crashes spread across countries. When the failure of one particular financial institution threatens the stability of many other institutions, this is called ''systemic risk''.

Recessionary effects

Some financial crises have little effect outside of the financial sector, like the Wall Street crash of 1987, but other crises are believed to have played a role in decreasing growth in the rest of the economy. There are many theories why a financial crisis could have a recessionary effect on the rest of the economy. These theoretical ideas include the 'financial accelerator The financial accelerator in macroeconomics is the process by which adverse shocks to the economy may be amplified by worsening financial market conditions. More broadly, adverse conditions in the real economy and in financial markets propagate the ...

', 'flight to quality

A flight-to-quality, or flight-to-safety, is a financial market phenomenon occurring when investors sell what they perceive to be higher- risk investments and purchase safer investments, such as gold and other precious metals. This is considered a ...

' and ' flight to liquidity', and the Kiyotaki-Moore model. Some 'third generation' models of currency crises explore how currency crises and banking crises together can cause recessions.

Theories

Austrian theories

Austrian School

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motivations and actions of individuals. Austrian school ...

economists Ludwig von Mises and Friedrich Hayek discussed the business cycle starting with Mises' ''Theory of Money and Credit'', published in 1912.

Marxist theories

Recurrent major depressions in the world economy at the pace of 20 and 50 years have been the subject of studies since Jean Charles Léonard de Sismondi

Jean Charles Léonard de Sismondi (also known as Jean Charles Leonard Simonde de Sismondi) (; 9 May 1773 – 25 June 1842), whose real name was Simonde, was a Swiss historian and political economist, who is best known for his works on French and ...

(1773–1842) provided the first theory of crisis in a critique of classical political economy's assumption of equilibrium between supply and demand. Developing an economic crisis theory

Crisis theory, concerning the causes and consequences of the tendency for the rate of profit to fall in a capitalist system, is associated with Marxian critique of political economy, and was further popularised through Marxist economics.

Histo ...

became the central recurring concept throughout Karl Marx's mature work. Marx's law of the tendency for the rate of profit to fall borrowed many features of the presentation of John Stuart Mill's discussion ''Of the Tendency of Profits to a Minimum'' (Principles of Political Economy Book IV Chapter IV). The theory is a corollary of the ''Tendency towards the Centralization of Profits''.

In a capitalist system, successfully-operating businesses return less money to their workers (in the form of wages) than the value of the goods produced by those workers (i.e. the amount of money the products are sold for). This profit first goes towards covering the initial investment in the business. In the long-run, however, when one considers the combined economic activity of all successfully-operating business, it is clear that less money (in the form of wages) is being returned to the mass of the population (the workers) than is available to them to buy all of these goods being produced. Furthermore, the expansion of businesses in the process of competing for markets leads to an abundance of goods and a general fall in their prices, further exacerbating ''the tendency for the rate of profit to fall''.

The viability of this theory depends upon two main factors: firstly, the degree to which profit is taxed by government and returned to the mass of people in the form of welfare, family benefits and health and education spending; and secondly, the proportion of the population who are workers rather than investors/business owners. Given the extraordinary capital expenditure required to enter modern economic sectors like airline transport, the military industry, or chemical production, these sectors are extremely difficult for new businesses to enter and are being concentrated in fewer and fewer hands.

Empirical and econometric research continues especially in the world systems theory

World-systems theory (also known as world-systems analysis or the world-systems perspective)Immanuel Wallerstein, (2004), "World-systems Analysis." In ''World System History'', ed. George Modelski, in ''Encyclopedia of Life Support Systems'' (E ...

and in the debate about Nikolai Kondratiev and the so-called 50-years Kondratiev waves. Major figures of world systems theory, like Andre Gunder Frank

Andre Gunder Frank (February 24, 1929 – April 25, 2005) was a German- American sociologist and economic historian who promoted dependency theory after 1970 and world-systems theory after 1984. He employed some Marxian concepts on politic ...

and Immanuel Wallerstein

Immanuel Maurice Wallerstein (; September 28, 1930 – August 31, 2019) was an American sociologist and economic historian. He is perhaps best known for his development of the general approach in sociology which led to the emergence of his wo ...

, consistently warned about the crash that the world economy is now facing. World systems scholars and Kondratiev cycle researchers always implied that Washington Consensus

The Washington Consensus is a set of ten economic policy prescriptions considered to constitute the "standard" reform package promoted for crisis-wracked developing countries by Washington, D.C.-based institutions such as the International Monet ...

oriented economists never understood the dangers and perils, which leading industrial nations will be facing and are now facing at the end of the long economic cycle which began after the oil crisis of 1973.

Minsky's theory

Hyman Minsky has proposed a post-Keynesian explanation that is most applicable to a closed economy. He theorized that financial fragility Financial fragility is the vulnerability of a financial system to a financial crisis. Franklin Allen and Douglas Gale define financial fragility as the degree to which "...small shocks have disproportionately large effects." Roger Lagunoff and Stace ...

is a typical feature of any capitalist

Capitalism is an economic system based on the private ownership of the means of production and their operation for profit. Central characteristics of capitalism include capital accumulation, competitive markets, price system, private p ...

economy. High fragility leads to a higher risk of a financial crisis. To facilitate his analysis, Minsky defines three approaches to financing firms may choose, according to their tolerance of risk. They are hedge finance, speculative finance, and Ponzi finance. Ponzi finance leads to the most fragility.

* for hedge finance, income flows are expected to meet financial obligations in every period, including both the principal and the interest on loans.

* for speculative finance, a firm must roll over debt because income flows are expected to only cover interest costs. None of the principal is paid off.

* for Ponzi finance, expected income flows will not even cover interest cost, so the firm must borrow more or sell off assets simply to service its debt. The hope is that either the market value of assets or income will rise enough to pay off interest and principal.

Financial fragility levels move together with the business cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examin ...

. After a recession, firms have lost much financing and choose only hedge, the safest. As the economy grows and expected profits rise, firms tend to believe that they can allow themselves to take on speculative financing. In this case, they know that profits will not cover all the interest all the time. Firms, however, believe that profits will rise and the loans will eventually be repaid without much trouble. More loans lead to more investment, and the economy grows further. Then lenders also start believing that they will get back all the money they lend. Therefore, they are ready to lend to firms without full guarantees of success.

Lenders know that such firms will have problems repaying. Still, they believe these firms will refinance from elsewhere as their expected profits rise. This is Ponzi financing. In this way, the economy has taken on much risky credit. Now it is only a question of time before some big firm actually defaults. Lenders understand the actual risks in the economy and stop giving credit so easily. Refinancing becomes impossible for many, and more firms default. If no new money comes into the economy to allow the refinancing process, a real economic crisis begins. During the recession, firms start to hedge again, and the cycle is closed.

Coordination games

Mathematical approaches to modeling financial crises have emphasized that there is often positive feedback between market participants' decisions (see strategic complementarity

In economics and game theory, the decisions of two or more players are called strategic complements if they mutually reinforce one another, and they are called strategic substitutes if they mutually offset one another. These terms were originally ...

). Positive feedback implies that there may be dramatic changes in asset values in response to small changes in economic fundamentals. For example, some models of currency crises (including that of Paul Krugman) imply that a fixed exchange rate may be stable for a long period of time, but will collapse suddenly in an avalanche of currency sales in response to a sufficient deterioration of government finances or underlying economic conditions.

According to some theories, positive feedback implies that the economy can have more than one equilibrium. There may be an equilibrium in which market participants invest heavily in asset markets because they expect assets to be valuable. This is the type of argument underlying Diamond and Dybvig's model of bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

s, in which savers withdraw their assets from the bank because they expect others to withdraw too.

Herding models and learning models

A variety of models have been developed in which asset values may spiral excessively up or down as investors learn from each other. In these models, asset purchases by a few agents encourage others to buy too, not because the true value of the asset increases when many buy (which is called "strategic complementarity"), but because investors come to believe the true asset value is high when they observe others buying.

In "herding" models, it is assumed that investors are fully rational, but only have partial information about the economy. In these models, when a few investors buy some type of asset, this reveals that they have some positive information about that asset, which increases the rational incentive of others to buy the asset too. Even though this is a fully rational decision, it may sometimes lead to mistakenly high asset values (implying, eventually, a crash) since the first investors may, by chance, have been mistaken. Herding models, based on Complexity Science

A complex system is a system composed of many components which may interact with each other. Examples of complex systems are Earth's global climate, organisms, the human brain, infrastructure such as power grid, transportation or communication sy ...

, indicate that it is the internal structure of the market, not external influences, which is primarily responsible for crashes.

In "adaptive learning" or "adaptive expectations" models, investors are assumed to be imperfectly rational, basing their reasoning only on recent experience. In such models, if the price of a given asset rises for some period of time, investors may begin to believe that its price always rises, which increases their tendency to buy and thus drives the price up further. Likewise, observing a few price decreases may give rise to a downward price spiral, so in models of this type large fluctuations in asset prices may occur. Agent-based models of financial markets often assume investors act on the basis of adaptive learning or adaptive expectations.

Global financial crisis

As the most recent and most damaging financial crisis event, the Global financial crisis, deserves special attention, as its causes, effects, response, and lessons are most applicable to the current financial system

A financial system is a system that allows the exchange of funds between financial market participants such as lenders, investors, and borrowers. Financial systems operate at national and global levels. Financial institutions consist of complex, c ...

.

History

A noted survey of financial crises is ''This Time is Different: Eight Centuries of Financial Folly'' , by economists

A noted survey of financial crises is ''This Time is Different: Eight Centuries of Financial Folly'' , by economists Carmen Reinhart

Carmen M. Reinhart (née Castellanos, born October 7, 1955) is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior F ...

and Kenneth Rogoff, who are regarded as among the foremost historians of financial crises. In this survey, they trace the history of financial crisis back to sovereign defaults – default on ''public'' debt, – which were the form of crisis prior to the 18th century and continue, then and now causing private bank failures; crises since the 18th century feature both public debt default and private debt default. Reinhart and Rogoff also class debasement of currency and hyperinflation as being forms of financial crisis, broadly speaking, because they lead to unilateral reduction (repudiation) of debt.

Prior to 19th century

Reinhart and Rogoff trace inflation (to reduce debt) to Dionysius I rule in

Reinhart and Rogoff trace inflation (to reduce debt) to Dionysius I rule in Syracuse

Syracuse may refer to:

Places Italy

*Syracuse, Sicily, or spelled as ''Siracusa''

*Province of Syracuse

United States

*Syracuse, New York

**East Syracuse, New York

**North Syracuse, New York

* Syracuse, Indiana

* Syracuse, Kansas

* Syracuse, Mi ...

and begin their "eight centuries" in 1258; debasement of currency also occurred under the Roman Empire

The Roman Empire ( la, Imperium Romanum ; grc-gre, Βασιλεία τῶν Ῥωμαίων, Basileía tôn Rhōmaíōn) was the post-Roman Republic, Republican period of ancient Rome. As a polity, it included large territorial holdings aro ...

and Byzantine Empire

The Byzantine Empire, also referred to as the Eastern Roman Empire or Byzantium, was the continuation of the Roman Empire primarily in its eastern provinces during Late Antiquity and the Middle Ages, when its capital city was Constantinopl ...

. A financial crisis in 33 A.D. caused by a contraction of money supply had been recorded by several Roman historians.

Among the earliest crises Reinhart and Rogoff study is the 1340 default of England, due to setbacks in its war with France (the Hundred Years' War

The Hundred Years' War (; 1337–1453) was a series of armed conflicts between the kingdoms of England and France during the Late Middle Ages. It originated from disputed claims to the French throne between the English House of Planta ...

; see details). Further early sovereign defaults include seven defaults by the Spanish Empire, four under Philip II Philip II may refer to:

* Philip II of Macedon (382–336 BC)

* Philip II (emperor) (238–249), Roman emperor

* Philip II, Prince of Taranto (1329–1374)

* Philip II, Duke of Burgundy (1342–1404)

* Philip II, Duke of Savoy (1438-1497)

* Philip ...

, three under his successors.

Other global and national financial mania since the 17th century include:

* 1637: Bursting of tulip mania in the Netherlands – while tulip mania is popularly reported as an example of a financial crisis, and was a speculative bubble, modern scholarship holds that its broader economic impact was limited to negligible, and that it did not precipitate a financial crisis.

* 1720: Bursting of South Sea Bubble (Great Britain) and Mississippi Bubble

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and th ...

(France) – earliest of modern financial crises; in both cases the company assumed the national debt of the country (80–85% in Great Britain, 100% in France), and thereupon the bubble burst. The resulting crisis of confidence probably had a deep impact on the financial and political development of France.

* Crisis of 1763 - started in Amsterdam, begun by the collapse of Johann Ernst Gotzkowsky

Johann Ernst Gotzkowsky (21 November 1710 – 9 August 1775) was a Prussian merchant with a successful trade in trinkets, silk, taft, porcelain, grain and bills of exchange. Moreover, he acted as a diplomat and important art dealer. His paint ...

and Leendert Pieter de Neufville

Leendert Pieter de Neufville (Amsterdam, March 8, 1729Rotterdam, July 28, 1811) was a Dutch merchant and banker trading in silk, linen, and grain. His business grew quickly during the Seven Years' War. De Neufville secretly supplied the Prussian ...

's bank, spread to Germany and Scandinavia.

* Crisis of 1772

The British credit crisis of 1772-1773 also known as the crisis of 1772, or the panic of 1772, was a peacetime financial crisis which originated in London and then spread to Scotland and the Dutch Republic. – in London and Amsterdam. 20 important banks in London went bankrupt after one banking house defaulted (bankers Neal, James, Fordyce and Down)

* France's Financial and Debt Crisis (1783–1788)- France severe financial crisis due to the immense debt accrued through the French involvement in the Seven Years' War (1756–1763) and the American Revolution (1775-1783).

* Panic of 1792

The Panic of 1792 was a financial credit crisis that occurred during the months of March and April 1792, precipitated by the expansion of credit by the newly formed Bank of the United States as well as by rampant speculation on the part of Will ...

– run on banks in US precipitated by the expansion of credit by the newly formed Bank of the United States

* Panic of 1796–1797

The Panic of 1796–1797 was a series of downturns in credit markets in both Great Britain and the newly established United States in 1796 that led to broader commercial downturns. In the United States, problems first emerged when a land specul ...

– British and US credit crisis caused by land speculation bubble

19th century

* Danish state bankruptcy of 1813

* Financial Crisis of 1818 - in England caused banks to call in loans and curtail new lending, draining specie out of the U.S.

* Panic of 1819: pervasive USA economic recession w/ bank failures; culmination of U.S.'s 1st boom-to-bust economic cycle

* Panic of 1825: pervasive British economic recession in which many British banks failed, & Bank of England nearly failed

* Panic of 1837: pervasive USA economic recession w/ bank failures; a 5-year ''depression'' ensued

* Panic of 1847

The Panic of 1847 was a minor British banking crisis associated with the end of the 1840s railway industry boom and the failure of many non-banks.

Background

As a means of stabilizing the British economy, the ministry of Robert Peel passed the ...

: a collapse of British financial markets associated with the end of the 1840s railway boom. Also see Bank Charter Act of 1844

The Bank Charter Act 1844 (7 & 8 Vict. c. 32), sometimes referred to as the Peel Banking Act of 1844, was an Act of the Parliament of the United Kingdom, passed under the government of Robert Peel, which restricted the powers of British banks ...

* Panic of 1857: pervasive USA economic recession w/ bank failures

* Panic of 1866

The Panic of 1866 was an international financial downturn that accompanied the failure of Overend, Gurney and Company in London, and the ''corso forzoso'' abandonment of the silver standard in Italy.

In Britain, the economic impacts are hel ...

: the Overend Gurney crisis (primarily British)

* Black Friday (1869)

The Black Friday gold panic of September 24, 1869 was caused by a conspiracy between two investors, Jay Gould and his partner James Fisk, and Abel Corbin, a small time speculator who had married Virginia (Jennie) Grant, the younger sister of Pr ...

: aka Gold Panic of 1869

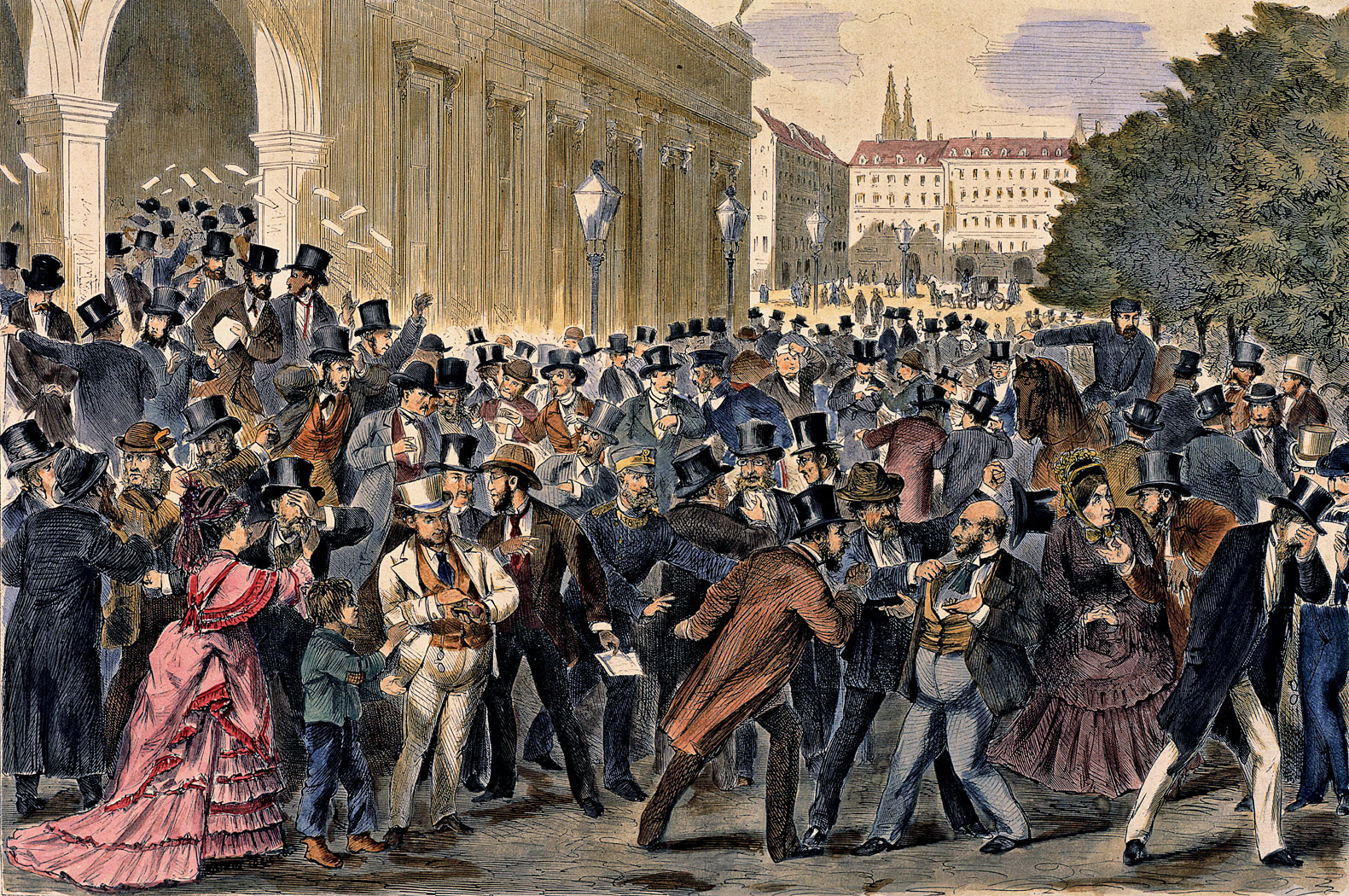

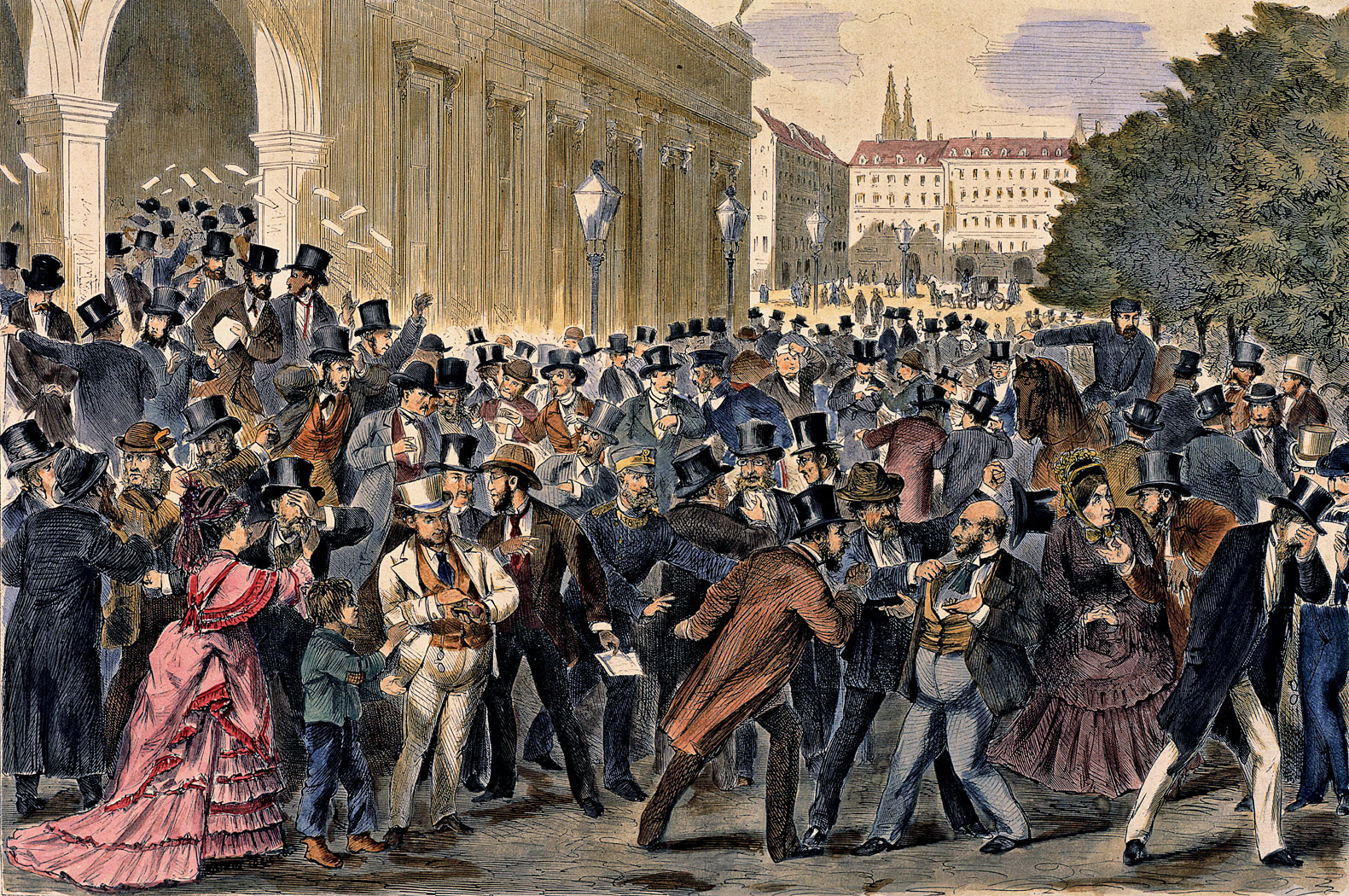

* Panic of 1873: pervasive USA economic recession w/ bank failures, known then as the 5 year ''Great Depression'' & now as the Long Depression

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing st ...

* Panic of 1884

The Panic of 1884 was an economic panic during the Depression of 1882–1885. It was unusual in that it struck at the end rather than the beginning of the recession. The panic created a credit shortage that led to a significant economic decline in ...

: a panic in the United States centred on New York banks

* Panic of 1890: aka Baring Crisis; near-failure of a major London bank led to corresponding South American financial crises

* Panic of 1893

The Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy, and produced political upheaval that led to the political realignment of 1896 and the presi ...

: a panic in the United States marked by the collapse of railroad overbuilding and shaky railroad financing which set off a series of bank failures

* Australian banking crisis of 1893

The 1893 banking crisis in the Australian colonies involved the collapse of a considerable number of commercial banks and building societies, and a general economic depression. It occurred at the same time as the US Panic of 1893 (1893–1897).

...

* Panic of 1896: an acute economic depression

An economic depression is a period of carried long-term economical downturn that is result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country were there is some economic ...

in the United States precipitated by a drop in silver reserves and market concerns on the effects it would have on the gold standard

20th century

* Panic of 1901: limited to crashing of the New York Stock Exchange

* Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from ...

: pervasive USA economic recession w/ bank failures

* Panic of 1910–1911 The Panic of 1910–1911 was a minor economic depression that followed the enforcement of the Sherman Antitrust Act, which regulates the competition among enterprises, trying to avoid monopolies and, generally speaking, a failure of the market itsel ...

*1910: Shanghai rubber stock market crisis

*1914: The Great Financial Crisis (see Aldrich-Vreeland Act)Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange coll ...

, followed by the Great Depression: the largest and most important economic depression in the 20th century

* 1937-1938: an economic downturn that occurred during the Great Depression.

* 1973: 1973 oil crisis – oil prices soared, causing the 1973–1974 stock market crash

The 1973–1974 stock market crash caused a bear market between January 1973 and December 1974. Affecting all the major stock markets in the world, particularly the United Kingdom, it was one of the worst stock market downturns since the Great ...

* Secondary banking crisis of 1973–1975: United Kingdom * 1980s: Latin American debt crisis – beginning in Mexico in 1982 with the

* 1980s: Latin American debt crisis – beginning in Mexico in 1982 with the Mexican Weekend The Mexican Weekend marked the beginning of the Latin American debt crisis. In August 1982, Mexican Secretary of Finance Jesús Silva Herzog Flores flew to Washington, D.C., to declare Mexico's foreign debt unmanageable, and announce that his c ...

* 1980s-1990: Savings and loan crisis

* Bank stock crisis (Israel 1983)

* 1987: Black Monday (1987)

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as ''Black Tuesday'' because of the time z ...

– the largest one-day percentage decline in stock market history

* 1988–1992 Norwegian banking crisis

* 1989–1991: United States Savings & Loan crisis

* 1990: Japanese asset price bubble collapsed

* Early 1990s: Scandinavian banking crisis, Swedish banking crisis, Finnish banking crisis of 1990s

* Early 1990s recession

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s. The impacts of the recession contributed in part to the 1992 U.S. presidential election victory of Bill Clinton over inc ...

* 1992–1993: Black Wednesday

Black Wednesday (or the 1992 Sterling crisis) occurred on 16 September 1992 when the UK Government was forced to withdraw sterling from the European Exchange Rate Mechanism (ERM), after a failed attempt to keep its exchange rate above the ...

– speculative attacks on currencies in the European Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as ...

* 1994–1995: Economic crisis in Mexico – speculative attack and default on Mexican debt

* 1997–1998: 1997 Asian Financial Crisis

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1 ...

– devaluations and banking crises across Asia

* 1998: Russian financial crisis

21st century

* 2000–2001: 2001 Turkish economic crisis

The 2001 Turkish economic crisis was a financial crisis which resulted in a stock market crash and collapse in the Turkish Lira as a result of political and economic problems that had been wearing on Turkey for years.

Leading up to the crisis, th ...

* 2000: Early 2000s recession

* 1999–2002: Argentine economic crisis (1999-2002)

Argentines (mistakenly translated Argentineans in the past; in Spanish (masculine) or (feminine)) are people identified with the country of Argentina. This connection may be residential, legal, historical or cultural. For most Argentines, ...

* 2001: Bursting of dot-com bubble

* 2007–2008: Global financial crisis of 2007–2008

* 2008–2011: Icelandic financial crisis

Icelandic refers to anything of, from, or related to Iceland and may refer to:

*Icelandic people

*Icelandic language

*Icelandic alphabet

*Icelandic cuisine

See also

* Icelander (disambiguation)

* Icelandic Airlines, a predecessor of Icelandair

* ...

* 2008–2014: Spanish financial crisis

* 2009-2010: European debt crisis

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, is a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s. Several eurozone me ...

* 2010-2018: Greek government-debt crisis

* 2013-: Ongoing Venezuelan economic crisis

* 2014-2016: Russian financial crisis

* 2018–: Turkish currency and debt crisis

* 2019–: Sri Lankan currency and debt crisis

* 2019-: Lebanese liquidity crisis

The Lebanese liquidity crisis is an ongoing financial crisis affecting Lebanon, that became fully apparent in August 2019, and was further exacerbated by both the COVID-19 pandemic in Lebanon (which began in 2020) and the 2020 Beirut port explosi ...

* 2020: 2020 stock market crash

On 20 February 2020, stock markets across the world suddenly crashed after growing instability due to the COVID-19 pandemic. It ended on 7 April 2020.

Beginning on 13 May 2019, the yield curve on U.S. Treasury securities inverted, and re ...

(especially Black Monday

Black Monday refers to specific Mondays when undesirable or turbulent events have occurred. It has been used to designate massacres, military battles, and stock market crashes.

Historic events

*1209, Dublin – when a group of 500 recently arriv ...

and Black Thursday

Black Thursday is a term used to refer to typically negative, notable events that have occurred on a Thursday. It has been used in the following cases:

*6 February 1851, bushfires in Victoria, Australia.

*18 September 1873, during the Panic of ...

)

* 2022: Russian financial crisis

See also

* Bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy.

A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global syst ...

* Bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

* Credit crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit cr ...

* Financial stability

* Flight-to-liquidity

A flight-to-liquidity is a financial market phenomenon occurring when investors sell what they perceive to be less liquid or higher risk investments, and purchase more liquid investments instead, such as US Treasuries. Usually, flight-to-liquidi ...

* Global debt levels

Global means of or referring to a globe and may also refer to:

Entertainment

* ''Global'' (Paul van Dyk album), 2003

* ''Global'' (Bunji Garlin album), 2007

* ''Global'' (Humanoid album), 1989

* ''Global'' (Todd Rundgren album), 2015

* Bruno ...

* Kondratiev waves

* Lender of last resort

* Liquidity crisis

* Macroprudential policy

Macroprudential regulation is the approach to financial regulation that aims to mitigate risk to the financial system as a whole (or " systemic risk"). In the aftermath of the late-2000s financial crisis, there is a growing consensus among policym ...

* Nikolai Kondratiev

* Real estate bubble

Specific:

* 2000s energy crisis

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147. ...

* 2007–2008 world food price crisis

World food prices increased dramatically in 2007 and the first and second quarter of 2008, creating a global crisis and causing political and economic instability and social unrest in both poor and developed nations. Although the media sp ...

* Great Depression

* Subprime mortgage crisis

* ''America's Great Depression

''America's Great Depression'' is a 1963 treatise on the 1930s Great Depression and its root causes, written by Austrian School economist and author Murray Rothbard. The fifth edition was released in 2000.

Brief summary

Rothbard holds the inte ...

''

* Great Trade Collapse The Great Trade Collapse, a consequence of the 2008 financial crisis, occurred between the third quarter of 2008 and the second quarter of 2009. During this time, world GDP dropped by 1% and world trade dropped by 10%. This drop in global trade was ...

Literature

General perspectives

* Walter Bagehot (1873), '' Lombard Street: A Description of the Money Market''.

* Charles P. Kindleberger

Charles Poor Kindleberger (October 12, 1910 – July 7, 2003) was an American economic historian and author of over 30 books. His 1978 book ''Manias, Panics, and Crashes'', about speculative stock market bubbles, was reprinted in 2000 after the d ...

and Robert Aliber (2005), ''Manias, Panics, and Crashes: A History of Financial Crises'' (Palgrave Macmillan, 2005 ).

* Gernot Kohler and Emilio José Chaves (Editors) "Globalization: Critical Perspectives" Hauppauge, New York

Nova Science Publishers

. With contributions by Samir Amin, Christopher Chase Dunn, Andre Gunder Frank

Andre Gunder Frank (February 24, 1929 – April 25, 2005) was a German- American sociologist and economic historian who promoted dependency theory after 1970 and world-systems theory after 1984. He employed some Marxian concepts on politic ...

, Immanuel Wallerstein

Immanuel Maurice Wallerstein (; September 28, 1930 – August 31, 2019) was an American sociologist and economic historian. He is perhaps best known for his development of the general approach in sociology which led to the emergence of his wo ...

* Hyman P. Minsky

Hyman Philip Minsky (September 23, 1919 – October 24, 1996) was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research at ...

(1986, 2008), ''Stabilizing an Unstable Economy''.

*

*

* Joachim Vogt (2014),

Fear, Folly, and Financial Crises – Some Policy Lessons from History

', UBS Center Public Papers, Issue 2, UBS International Center of Economics in Society, Zurich.

Banking crises

*

* Franklin Allen and Douglas Gale (2007), ''Understanding Financial Crises''.

* Charles W. Calomiris Charles William Calomiris (born November 8, 1957) is an American financial policy expert, author, and professor at Columbia Business School, where he is the Henry Kaufman Professor of Financial Institutions and the Director of Columbia Business Scho ...

and Stephen H. Haber

Stephen H. Haber (born July 12, 1957) is a professor of political science and history known for his work on the political institutions and economic policies that promote innovation and improvements in living standards. Haber is a professor in the ...

(2014), ''Fragile by Design: The Political Origins of Banking Crises and Scarce Credit'', Princeton, NJ: Princeton University Press.

* Jean-Charles Rochet (2008), ''Why Are There So Many Banking Crises? The Politics and Policy of Bank Regulation''.

* R. Glenn Hubbard, ed., (1991) ''Financial Markets and Financial Crises''.

*

* Luc Laeven and Fabian Valencia (2008)

'Systemic banking crises: a new database'

International Monetary Fund Working Paper 08/224.

* Thomas Marois (2012), States, Banks and Crisis: Emerging Finance Capitalism in Mexico and Turkey, Edward Elgar Publishing Limited, Cheltenham, UK.

Bubbles and crashes

* Dutton, Roy (2010),'' Financial Meltdown 2010 (Hardback)''. Infodial.

* Charles Mackay Charles (or Charlie) Mackay, McKay, or MacKay may refer to:

* Charles Mackay (author) (1814–1889), Scottish poet, journalist, author, anthologist, novelist, and songwriter

* Charles McKay (1855–1883), American naturalist and explorer

* Charles ...

(1841), ''Extraordinary Popular Delusions and the Madness of Crowds

''Extraordinary Popular Delusions and the Madness of Crowds'' is an early study of crowd psychology by Scottish journalist Charles Mackay, first published in 1841 under the title ''Memoirs of Extraordinary Popular Delusions''. The book was pub ...

''

* Didier Sornette

Didier Sornette (born June 25, 1957 in Paris) is a French researcher studying subjects including complex systems and risk management. He is Professor on the Chair of Entrepreneurial Risks at the Swiss Federal Institute of Technology Zurich (ETH ...

(2003), ''Why Stock Markets Crash'', Princeton University Press.

* Robert J. Shiller (1999, 2006), ''Irrational Exuberance''.

* Markus Brunnermeier

Markus Konrad Brunnermeier (born March 22, 1969) is an economist, who is the Edwards S. Sanford Professor of Economics at Princeton University, and a nonresident senior fellow at the Peterson Institute for International Economics. He is a facult ...

(2008), 'Bubbles', ''New Palgrave Dictionary of Economics'', 2nd ed.

* Douglas French (2009)

Early Speculative Bubbles and Increases in the Supply of Money

'

* Markus K. Brunnermeier (2001), ''Asset Pricing under Asymmetric Information: Bubbles, Crashes, Technical Analysis, and Herding'', Oxford University Press. .

International financial crises

* Acocella, N. Di Bartolomeo, G. and Hughes Hallett, A. 012 ‘''Central banks and economic policy after the crisis: what have we learned?''’, ch. 5 in: Baker, H.K. and Riddick, L.A. (eds.), ‘''Survey of International Finance''’, Oxford University Press.

* Paul Krugman (1995), ''Currencies and Crises''.

* Craig Burnside, Martin Eichenbaum

Martin Stewart Eichenbaum (born August 23, 1954) is the Charles Moskos professor of economics at Northwestern University, and the co-director of the Center for International Economics and Development. His research focuses on macroeconomics, int ...

, and Sergio Rebelo (2008), 'Currency crisis models', ''New Palgrave Dictionary of Economics'', 2nd ed.

* Maurice Obstfeld (1996), 'Models of currency crises with self-fulfilling features'. ''European Economic Review'' 40.

* Stephen Morris and Hyun Song Shin

Hyun Song Shin () is a South Korean economic theorist and financial economist who focuses on global games. He has been the Economic Adviser and Head of Research of the Bank for International Settlements (BIS) since May 1, 2014.

Previously, he w ...

(1998), 'Unique equilibrium in a model of self-fulfilling currency attacks'. ''American Economic Review'' 88 (3).

* Barry Eichengreen (2004), ''Capital Flows and Crises''.

* Charles Goodhart and P. Delargy (1998), 'Financial crises: plus ça change, plus c'est la même chose'. ''International Finance'' 1 (2), pp. 261–87.

* Jean Tirole (2002), ''Financial Crises, Liquidity, and the International Monetary System''.

* Guillermo Calvo (2005), ''Emerging Capital Markets in Turmoil: Bad Luck or Bad Policy?''

* Barry Eichengreen (2002), ''Financial Crises: And What to Do about Them''.

* Charles Calomiris (1998)

'Blueprints for a new global financial architecture'

The Great Depression and earlier banking crises

* Murray Rothbard (1962), '' The Panic of 1819''

* Murray Rothbard (1963),

America`s Great Depression

'.

* Milton Friedman and Anna Schwartz (1971), ''A Monetary History of the United States''.

* Ben S. Bernanke (2000), ''Essays on the Great Depression''.

* Robert F. Bruner (2007), ''The Panic of 1907. Lessons Learned from the Market's Perfect Storm''.

Recent international financial crises

* Barry Eichengreen and Peter Lindert, eds., (1992), ''The International Debt Crisis in Historical Perspective''.

* Lessons from the Asian financial crisis / edited by Richard Carney. New York, NY : Routledge, 2009. (hardback) (hardback) (ebook) (ebook)

* Robertson, Justin, 1972– US-Asia economic relations : a political economy of crisis and the rise of new business actors / Justin Robertson. Abingdon, Oxon ; New York, NY : Routledge, 2008. (hbk.) (ebook)

2007–2012 financial crisis

* Robert J. Shiller (2008), ''The Subprime Solution: How Today's Global Financial Crisis Happened, and What to Do About It''. .

* JC Coffee, ‘What went wrong? An initial inquiry into the causes of the 2008 financial crisis’ (2009) 9(1) Journal of Corporate Law Studies 1

*

* Markus Brunnermeier (2009), 'Deciphering the liquidity and credit crunch 2007–2008'. ''Journal of Economic Perspectives'' 23 (1), pp. 77–100.

* Paul Krugman (2008), '' The Return of Depression Economics and the Crisis of 2008''. .

"The myths about the economic crisis, the reformist left and economic democracy"

by Takis Fotopoulos

Takis Fotopoulos ( el, Τάκης Φωτόπουλος born 14 October 1940) is a Greek political philosopher, economist and writer who founded the Inclusive Democracy movement, aiming at a synthesis of classical democracy with libertarian socia ...

, The International Journal of Inclusive Democracy

Inclusive Democracy (ID) is a project that aims for direct democracy; economic democracy in a stateless, moneyless and marketless economy; self-management (democracy in the socio-economic realm); and ecological democracy.

The theoretical p ...

, vol 4, no 4, Oct. 2008.

* United States. Congress. House. Committee on the Judiciary. Subcommittee on Commercial and Administrative Law. Working families in financial crisis : medical debt

Medical debt refers to debt incurred by individuals due to health care costs and related expenses.

Medical debt is different from other forms of debt, because it is usually incurred accidentally or faultlessly. People do not plan to fall ill or ...

and bankruptcy : hearing before the Subcommittee on Commercial and Administrative Law of the Committee on the Judiciary, House of Representatives, One Hundred Tenth Congress, first session, 17 July 2007. Washington : U.S. G.P.O. : For sale by the Supt. of Docs., U.S. G.P.O., 2008. 277 p. :

*

*

References

External links

Financial Crises: Lessons from History

BBC #REDIRECT BBC

Here i going to introduce about the best teacher of my life b BALAJI sir. He is the precious gift that I got befor 2yrs . How has helped and thought all the concept and made my success in the 10th board exam. ...

.

{{Authority control

Crisis

Systemic risk

Economic bubbles

Well-known examples of bubbles (or purported bubbles) and crashes in stock prices and other asset prices include the 17th century Dutch tulip mania, the 18th century South Sea Bubble, the

Well-known examples of bubbles (or purported bubbles) and crashes in stock prices and other asset prices include the 17th century Dutch tulip mania, the 18th century South Sea Bubble, the  A noted survey of financial crises is ''This Time is Different: Eight Centuries of Financial Folly'' , by economists

A noted survey of financial crises is ''This Time is Different: Eight Centuries of Financial Folly'' , by economists

Reinhart and Rogoff trace inflation (to reduce debt) to Dionysius I rule in

Reinhart and Rogoff trace inflation (to reduce debt) to Dionysius I rule in  * 1980s: Latin American debt crisis – beginning in Mexico in 1982 with the

* 1980s: Latin American debt crisis – beginning in Mexico in 1982 with the