In the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country Continental United States, primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., ...

, the

compensation of company

executives is distinguished by the forms it takes and its dramatic rise over the past three decades. Within the last 30 years, executive compensation or pay has risen dramatically beyond what can be explained by changes in firm size, performance, and industry classification.

This has received a wide range of criticism leveled against it.

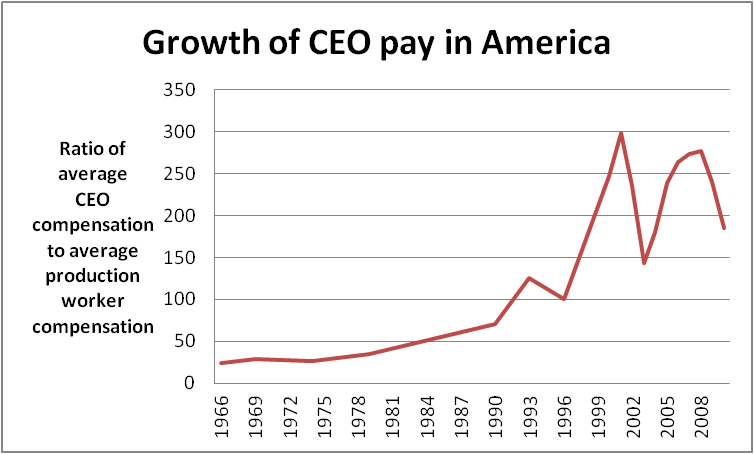

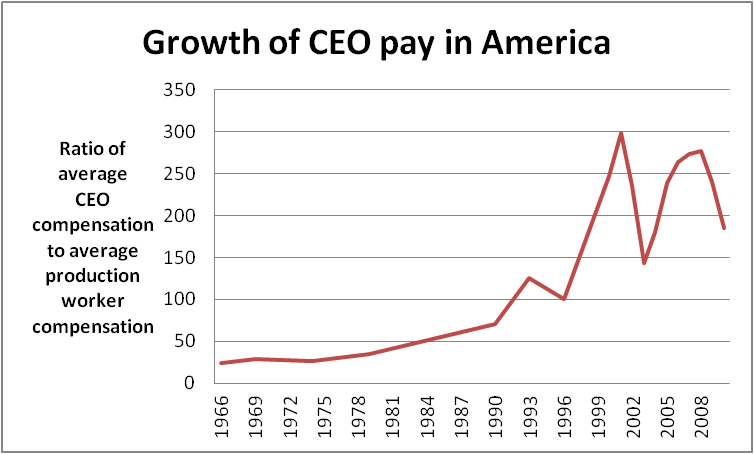

The top CEO's compensation increased by 940.3% from 1978 to 2018 in the US. In 2018, the average CEO's compensation from the top 350 US firms was $17.2 million. The typical worker's annual compensation grew just 11.9% within the same period. It is the highest in the world in both absolute terms and relative to

the median salary in the US.

It has been criticized not only as excessive but also for "rewarding failure"

[Berkshire Hathaway Inc. 2005 Annual Report](_blank)

p.16—including massive drops in stock price, and much of the

national growth in income inequality.

Observers differ as to how much of the rise and nature of this compensation is a natural result of competition for scarce business talent benefiting stockholder value, and how much is the work of manipulation and

self-dealing

Self-dealing is the conduct of a trustee, attorney, corporate officer, or other fiduciary that consists of taking advantage of their position in a transaction and acting in their own interests rather than in the interests of the beneficiaries of ...

by management unrelated to supply, demand, or reward for performance.

[Lucian Bebchuk and Jesse Fried, ''Pay Without Performance'' (2004)] Federal laws and

Securities and Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market ...

(SEC) regulations have been developed on compensation for top senior executives in the last few decades,

[Executive Compensation]

US Securities and Exchange Commission including a $1 million limit on the tax deductibility of compensation not "performance-based", and a requirement to include the dollar value of compensation in a standardized form in annual public filings of the corporation.

[SEC Delays Guidance on Key Executive Compensation Requirements under Dodd-Frank]

, ''Benefits Brief'', Groom Law Group (September 13, 2011).

While an executive may be any corporate "

officer

An officer is a person who has a position of authority in a hierarchical organization. The term derives from Old French ''oficier'' "officer, official" (early 14c., Modern French ''officier''), from Medieval Latin ''officiarius'' "an officer," f ...

"—including the president, vice president, or other upper-level managers—in any company, the source of most comment and controversy is the pay of

chief executive officer

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especiall ...

s (CEOs) (and to a lesser extent the other top-five highest-paid executives

[quote: "Although the CEO is likely to have the most power and influence, in many cases other top executives also have some influence onboard decision making. When executives other than the CEO serve on the board for example ...." (from: Bebchuck and Fried, ''Pay without Performance'', 2004, p.64)][) of large publicly traded firms.

Most of the private sector economy in the United States is made up of such firms where management and ownership are separate, and there are no controlling ]shareholder

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal o ...

s. This separation of those who run a company from those who directly benefit from its earnings, create what economists call a "principal–agent problem

The principal–agent problem refers to the conflict in interests and priorities that arises when one person or entity (the "agent") takes actions on behalf of another person or entity (the " principal"). The problem worsens when there is a gre ...

", where upper-management (the "agent") has different interests, and considerably more information to pursue those interests, than shareholders (the "principals").[Bebchuk, Lucian, ''Pay Without Performance'' by ]Lucian Bebchuk Lucian Arye Bebchuk (born 1955) is a professor at Harvard Law School focusing on economics and finance.

Bebchuck has a B.A. in mathematics and economics from the University of Haifa (1977), an LL.B. from the University of Tel Aviv (1979), an LL.M ...

and Jesse Fried, Harvard University Press

Harvard University Press (HUP) is a publishing house established on January 13, 1913, as a division of Harvard University, and focused on academic publishing. It is a member of the Association of American University Presses. After the retir ...

2004, pp.15–17 This "problem" may interfere with the ideal of management pay set by "arm's length" negotiation between the executive attempting to get the best possible deal for him/her self, and the board of directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit orga ...

seeking a deal that best serves the shareholders,[Bebchuk and Fried, ''Pay Without Performance'', (2004), p.2]

preface and introduction

rewarding executive performance without costing too much. The compensation is typically a mixture of salary, bonuses, equity compensation (stock options, etc.), benefits, and perquisites. It has often had surprising amounts of deferred compensation and pension payments, and unique features such as executive loans (now banned), and post-retirement benefits, and guaranteed consulting fees.

The compensation awarded to executives of publicly-traded companies differs from that awarded to executives of privately held companies

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is ...

. "The most basic differences between the two types of businesses include the lack of publicly traded stock as a compensation vehicle and the absence of public shareholders as stakeholders in private firms." The compensation of senior executives at publicly traded companies is also subject to certain regulatory requirements, such as public disclosures to the U.S. Securities and Exchange Commission.

Levels of compensation

Since the 1990s, CEO compensation in the U.S. has outpaced corporate profits, economic growth and the average compensation of all workers. Between 1980 and 2004, Mutual Fund founder John Bogle

John Clifton "Jack" Bogle (May 8, 1929 – January 16, 2019) was an American investor, business magnate, and philanthropist. He was the founder and chief executive of The Vanguard Group, and is credited with creating the index fund. An avid inve ...

estimates total CEO compensation grew 8.5 per cent/year compared to corporate profit growth of 2.9 per cent/year and per capita income growth of 3.1 per cent.[Pay Madness At Enron]

Dan Ackman, 03.22.2002 By 2006 CEOs made 400 times more than average workers—a gap 20 times bigger than it was in 1965.[

The share of corporate income devoted to compensating the five highest-paid executives of (each) public firms more than doubled from 4.8 per cent in 1993–1995 to 10.3 per cent in 2001–2003.][Based on the ExecuComp database of 1500 companies. ]

The pay for the five top-earning executives at each of the largest 1500 American companies for the ten years from 1994 to 2004 is estimated at $500 billion in 2005 dollars.

A study by the executive compensation analysis firm Equilar Inc. for ''The New York Times'' found that the median pay package for the top 200 chief executives at public companies with at least $1 billion in revenue in 2012 was $15.1 million—an increase of 16 per cent from 2011.

Highest-paid CEOs

In 2012, the highest-paid CEO in the US was

In 2012, the highest-paid CEO in the US was Larry Ellison

Lawrence Joseph Ellison (born August 17, 1944) is an American business magnate and investor who is the co-founder, executive chairman, chief technology officer (CTO) and former chief executive officer (CEO) of the American computer technology ...

of Oracle

An oracle is a person or agency considered to provide wise and insightful counsel or prophetic predictions, most notably including precognition of the future, inspired by deities. As such, it is a form of divination.

Description

The word ...

, with $96.2 million.

That year the top 200 executives earned a total of $3 billion in compensation.[ The median cash compensation was $5.3 million, the median stock and option grants were $9 million.][

In 2018, the highest-paid CEO in the US was ]Elon Musk

Elon Reeve Musk ( ; born June 28, 1971) is a business magnate and investor. He is the founder, CEO and chief engineer of SpaceX; angel investor, CEO and product architect of Tesla, Inc.; owner and CEO of Twitter, Inc.; founder of The B ...

of Tesla, Inc

Tesla, Inc. ( or ) is an American multinational automotive and clean energy company headquartered in Austin, Texas. Tesla designs and manufactures electric vehicles (electric cars and trucks), battery energy storage from home to grid ...

. Musk earned a total of $2.3 billion in compensation.

In 2020, ''The Wall Street Journal'' reported that the median pay for executives at 300 of the biggest U.S. companies reached $13.7 million, up from $12.8 million in 2019. The highest paid CEO out of companies on the S&P 500 in 2020 was Paycom

Paycom Software, Inc., known simply as Paycom, is an American online payroll and human resource technology provider based in Oklahoma City, Oklahoma with offices throughout the United States. It is attributed with being one of the first fully on ...

CEO Chad Richison

Chad Richison is an American entrepreneur who has served as President and Chief Executive Officer of Paycom since its founding. A native Oklahoman, Richison began his career in sales with ADP, a global payroll provider, before moving to Colorado ...

. For companies not on the S&P 500 list, Palantir Technologies

Palantir Technologies is a public American software company that specializes in big data analytics. Headquartered in Denver, Colorado, it was founded by Peter Thiel, Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp in 2003. The compa ...

CEO Alexander Carp and DoorDash

DoorDash, Inc. is an American company that operates an online food ordering and food delivery platform. The company is based in San Francisco, California. It went public in December 2020 on NYSE and trades under the symbol DASH.

With a 56 ...

CEO Tony Xu

Tony Xu (born Xu Xun, 1983/1984) is a Chinese-American billionaire businessman, and the co-founder and chief executive officer (CEO) of DoorDash. Born in Nanjing, China, Xu immigrated to the United States with his parents at the age of five. He ea ...

earned the most in 2020, with pay packages of $1.1 billion and $1 billion respectively.

Types of compensation

The occupation of "executive" (a person having administrative or managerial authority in an organization) includes company presidents, chief executive officers (CEOs), chief financial officers (CFOs), vice presidents, occasionally directors, and other upper-level managers.[ Like other employees in modern US corporations, executives receive a variety of types of cash and non-cash payments or benefits provided in exchange for services—salary, bonuses, fringe benefits, severance payments, deferred payments, retirement benefits.

But components of executive pay are more numerous and more complex than lower-level employees.][ Executives generally negotiate a customized employment contract with documentation spelling out the compensation,][Executive Compensation]

By Susan M. Heathfield, About.com Guide and taking into account government regulations and tax law.

Some types of their pay (gratuitous payments, post-retirement consulting contracts), are unique to their occupation. Other types are not, but generally make up a higher (e.g. stock options) or lower (e.g. salary) proportion of their pay than that of their underlings.

One source sums up the components of executive pay as

* Base salary

* Incentive pay, with a short-term focus, usually in the form of a bonus

* Incentive pay, with a long-term focus, usually in some combination of stock awards, option awards, non-equity incentive plan compensation

* Enhanced benefits package that usually includes a Supplemental Executive Retirement Plan (SERP)

* Extra benefits and perquisites, such as cars and club memberships

* Deferred compensation earnings

Payscale.com, 28 February 2011Forbes

''Forbes'' () is an American business magazine owned by Integrated Whale Media Investments and the Forbes family. Published eight times a year, it features articles on finance, industry, investing, and marketing topics. ''Forbes'' also r ...

'' magazine estimates that about half of Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune (magazine), Fortune'' magazine that ranks 500 of the largest United States Joint-stock company#Closely held corporations and publicly traded corporations, corporations by ...

CEO compensation for 2003 was in cash pay and bonuses, and the other half in vested restricted stock and gains from exercised stock options. In the previous year (2002), it found salary and bonuses averaged $2 million.

Salary

Annual base salary in large publicly owned companies is commonly $1 million. Salary paid in excess of $1 million is not tax-deductible for a firm, though that has not stopped some companies from going over the limit. In the other direction, "some of the largest and most successful corporation" in the US—Google

Google LLC () is an American Multinational corporation, multinational technology company focusing on Search Engine, search engine technology, online advertising, cloud computing, software, computer software, quantum computing, e-commerce, ar ...

, Capital One Financial, Apple Computer

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, United States. Apple is the largest technology company by revenue (totaling in 2021) and, as of June 2022, is the world's biggest company ...

, Pixar

Pixar Animation Studios (commonly known as Pixar () and stylized as P I X A R) is an American computer animation studio known for its critically and commercially successful computer animated feature films. It is based in Emeryville, Californ ...

—paid a CEO annual salary a token $1—i.e. their pay was all in bonuses, options and or other forms. As a general rule, the larger the firm, the smaller the fraction of total compensation for senior executives is made up of salary—one million dollars or otherwise—and higher the fraction is made up of variable or "at-risk" pay[Kevin Hallock, "Dual Agency: Corporate Boards with Reciprocally Interlocking Relationships," in ''Executive Compensation and Shareholder Value: Theory and Evidence,'' ed. Jennifer Carpenter and David Yermack (Boston: Kluwer Academic Publishers, 1999) p.58]).

Bonuses

In 2010, 85.1 percent of CEO

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especially ...

s at S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of ...

companies received an annual bonus payout. The median bonus was $2.15 million.

Bonuses may be used to reward performance or as a kind of deferred compensation to discourage executives from quitting.[Executive Compensation]

By Michael S. Sirkin, Lawrence K. Cagney, 1996 They are often part of both short and long term compensation, and more often part of a plan or formula than simply discretionary.[

]

Bonus formulas

Short-term incentives usually are formula-driven, the formula involving some performance criteria.[

Use of some bonus formulas has been criticized for lacking effective incentives,][ and for abandoning the formula targets for easier criteria when the executives find them too difficult. According to one anonymous insider, "When you've got a formula, you've got to have goals—and it's the people who are the recipients of the money who are setting these. It's in their interests to keep the goals low so that they will succeed in meeting them."][Carol J. Loomis, "This Stuff Is Wrong", ''Fortune'', June 25, 2002, 73–84] If the word bonus suggests payment for particularly good performance, it is not reserved for performance above-average performance in American firms. In 2011, for example, almost all (97 per cent) of American companies paid their executives bonuses.[

Bonus criteria might be incremental revenue growth turnover for a sales director or incremental profitability and revenue growth for a CEO.][ They might also be things like meeting a budget or earning more profits than the preceding year, rather than exceeding the performance of companies in its peer group.

In the 1990s, some corporations ( IBM, GE, and ]Verizon

Verizon Communications Inc., commonly known as Verizon, is an American multinational telecommunications conglomerate and a corporate component of the Dow Jones Industrial Average. The company is headquartered at 1095 Avenue of the Americas ...

Communications) were known to include pension fund earnings as the basis of bonuses when the actual corporate earnings are negative, and discontinuing the practice when the bull market ended and these earnings turned to losses. In one notable case of executive bonus justification, Verizon Communications not only used $1.8 billion of pension income to turn a corporate loss into a $289 million profit but created the $1.8 billion income from a $3.1 billion loss by projecting (optimistic) future returns of 9.25 per cent on pension assets.

Examples of resetting targets when executive performance falls short have been criticized at Coca-Cola

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. Originally marketed as a temperance bar, temperance drink and intended as a patent medicine, it was invented in the late 19th century by John Stith Pembe ...

and AT&T Wireless Services

AT&T Wireless Services, formerly part of AT&T Corp., was a wireless telephone carrier founded in 1987 in the United States, based in Redmond, Washington, and later traded on the New York Stock Exchange under the stock symbol "AWE", as a sep ...

. For example, when executives failed to meet the annual earnings growth rate target of 15 per cent at Coca-Cola in 2002, the target was dropped to 11 per cent. In the sluggish economy following the 2007 recession the practice has become "more frequent".[Heads or Tails, Some CEOs Win the Pay Game](_blank)

By Zachary R. Mider and Jeff Green, businessweek.com, 4 October 2012

Golden hellos

"Golden hellos," or hiring bonuses for executives from rival companies, are intended to compensate a new hire for the loss of value of stock options provided by his/her current employer that is forfeited when they joining a new firm. To entice the potential hire the new employer had to compensate them for their loss by paying a massive signing bonus[

Starting around the mid-1990s in the US, the hellos are said to have become "larger and more common".]Conseco

CNO Financial Group, Inc. (formerly Conseco, Inc. (from Consolidated National Security Corporation)) is a financial services holding company based in Carmel, Indiana. Its insurance subsidiaries provide life insurance, annuity and supplemental he ...

paid Gary Wendt when he joined as CEO[''Pay Without Performance - the Unfulfilled Promise of Executive Compensation'' by Lucian Bebchuk and Jesse Fried, Harvard University Press 2004, p.130] in June 2000. Kmart

Kmart Corporation ( , doing business as Kmart and stylized as kmart) is an American retail company that owns a chain of big box department stores. The company is headquartered in Hoffman Estates, Illinois, United States.

The company was inc ...

promised $10 million to Thomas Conaway as CEO.[ ]Global Crossing

Global Crossing was a telecommunications company that provided computer networking services and operated a tier 1 carrier. It maintained a large backbone network and offered peering, virtual private networks, leased lines, audio and video co ...

gave Robert Annunziata got a $10 million signing bonus in 1999, none of which was he required to return though he held his post as CEO for only 13 months.[Gilded Greetings]

Elizabeth MacDonald, forbes.com, 15 May 2007,

J.C. Penney paid Ron Johnson a signing bonus of $52.7 million in shares when it hired him, but Penny's shares declined 50% during his tenure and he was fired 17 months later in April 2013.

Equity-based pay

Linking executive pay with the value of company shares has been thought of as a way of linking the executive's interests with those of the owners. When the shareholders prosper, so does the executive.

Individual equity compensation may include: restricted stock

Restricted stock, also known as restricted securities, is stock of a company that is not fully transferable (from the stock-issuing company to the person receiving the stock award) until certain conditions (restrictions) have been met. Upon satisfa ...

and restricted stock units (rights to own the employer's stock, tracked as bookkeeping entries,[ lacking voting rights and paid in stock or cash), ]stock appreciation right

Stock appreciation rights (SAR) is a method for companies to give their management or employees a bonus if the company performs well financially. Such a method is called a 'plan'. SARs resemble employee stock options in that the holder/employee ...

s, phantom stock—but the most common form of equity pay has been stock options and shares of stock. In 2008, nearly two-thirds of total CEO compensation was delivered in the form of stock or options.

Stock options

Stock options are the right to buy a specific number of shares of the company's stock during a specified time at a specified price (called the "strike price"). They became more popular for use in executive pay in the US after a law was passed in 1992 encouraging "performance-based" pay, and are now used for both short and long-term compensation.

Perhaps the largest dollar value of stock options granted to an employee was $1.6 billion worth amassed as of 2004 by UnitedHealth Group

UnitedHealth Group Incorporated is an American multinational managed healthcare and insurance company based in Minnetonka, Minnesota. It offers health care products and insurance services. UnitedHealth Group is the world's seventh largest ...

CEO William W. McGuire

William McGuire, M.D. (born 1948) is an American healthcare executive best known for his tenure as chairman and chief executive officer of UnitedHealth Group from 1991 until his resignation in 2006, while under investigation for securities fraud, ...

.[United CEO says he'll take no more stock options](_blank)

David Phelps, Star Tribune, 18 April 2006 (McGuire later returned a large fraction of the options as part of a legal settlement.)

While the use of options may reassure stockholders and the public that management's pay is linked to increasing shareholder value—as well as earn an IRS

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax ...

tax deduction as incentive pay—critics charge options and other ways of tying managers' pay to stock prices are fraught with peril. In the late 1990s, investor Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net ...

lamented that "there is no question in my mind that mediocre CEOs are getting incredibly overpaid. And the way it's being done is through stock options."

Since executives control much of the information available to outside investors they have the ability to fabricate the appearance of success—"aggressive accounting, fictitious transactions that inflate sales, whatever it takes"—to increase their compensation. In the words of ''Fortune

Fortune may refer to:

General

* Fortuna or Fortune, the Roman goddess of luck

* Luck

* Wealth

* Fortune, a prediction made in fortune-telling

* Fortune, in a fortune cookie

Arts and entertainment Film and television

* ''The Fortune'' (1931 film) ...

'' magazine, earning per share can "be manipulated in a thousand unholy ways"[ to inflate stock prices in the short term—a practice made famous by ]Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional compani ...

.

Use of options has not guaranteed superior management performance. A 2000 study of S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of ...

companies found that those that used stock options heavily to pay employees underperformed in share price those that didn't, while another later study found corporations tended to grant more options to executives than was cost-effective.

In addition to short term earnings boosts, techniques to avoid losing out on option payout when management performance has been poor include:[Hacker, Jacob S. ''Winner-Take-All Politics'', (Simon & Schuster, 2010) p.246]

*Setting a low strike price. (An estimated 95 per cent of corporations in America pay executives with "at-the-money

In finance, moneyness is the relative position of the current price (or future price) of an underlying asset (e.g., a stock) with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly ...

" options—i.e. options whose strike price is the same as the price of the stock on the date the option was granted so that any move upward in stock price gives the options value. Many financial economists believe it "highly unlikely" that this same option design would be "efficient in all cases", but at-the-money options give executives the biggest payout of any option price that is still eligible for tax deduction as "incentive pay".)

*Repricing the options to a lower strike price by backdating the option to a date when stock prices were lower (Repricing of stock options has been found to be associated with the option-granting firm's poor stock price performance rather than industry-wide shocks[),

*Timing the granting of options to events that will raise or lower stock prices,

*Not adjusting for ]windfall gain

A windfall gain is an unusually high or abundant income, that is sudden and/or unexpected.

Types

Examples of windfall gains include, but are not limited to:

*Gains from demutualization - this example can lead to especially large windfall gains. ...

s for the firm unrelated to management's own efforts (falling interest rates, market and sector-wide share price movements, etc.) or for how the company performed relative to "peer companies".[Rethinking CEO Stock Options]

By Sydney Finkelstein, businessweek.com, 17 April 2009

Following the housing bubble collapse, critics have also complained that stock options have "turned out to be incredible engines of risk-taking" since they offer "little downside if you bet wrong, but huge upside if you roll your number".[ An example being options given in compensation to buy shares of stock in the CEO's company for $100 when the price is currently $80. Given a choice between a high-risk plan that has an equal chance of driving the company's share price up to $120 or down to $30, or a safe path likely to cause a more modest rise in share price to $100, the CEO has much more incentive to take the risky route since their options are just as worthless with a modest increase (to $100/share or less) than as with a catastrophic fall in price.

Executives' access to insider information affecting stock prices can be used in the timing of both the granting of options and sale of equities after the options are exercised. Studies of the timing of option grants to executives have found "a systematic connection" between when the option was granted and corporate disclosures to the public.][[17. David Aboody and Ron Kasznik, "CEO Stock Option Awards and the Timing of Corporate Voluntary Disclosures," ''Journal Accounting and Economics'' 29 (2000): 73–100][Steven Balsam, Huajing Chen, and Srinivasan Sankaraguruswamy, "Earnings Management Prior to Stock Option Grants," working paper, Temple University Department of Accounting, 2003] That is, they found options are more likely to be granted after companies release bad news or just before they "release good news"[Bebchuk and Fried, ''Pay Without Performance'' (2004), pp.163–164] when company insiders are likely to know the options will be most profitable because the stock price is relatively low. Repricing of stock options also frequently occurs after the release of bad news or just prior to the release of good news.

Executives have also benefited from particularly auspicious timing of selling of equities, according to a number of studies,[Bebchuk and Fried, ''Pay Without Performance'' (2004), p.179] which found members of corporate upper management to have made "considerable abnormal profits" (i.e. higher than market returns). (Since executives have access to insider information on the best time to sell, this may seem in violation of SEC regulations on insider trading. It is not, however, if the insider knowledge used to time a sale is made up of many pieces and not just a single piece of "material" inside data. But even if there is material knowledge, the SEC enforcement is limited to those cases easily won by its relatively small budget.

Restricted stock

Grants to employees of restricted stock

Restricted stock, also known as restricted securities, is stock of a company that is not fully transferable (from the stock-issuing company to the person receiving the stock award) until certain conditions (restrictions) have been met. Upon satisfa ...

and restricted stock units became a popular form of equity pay after 2004 when accounting rules were changed to require employers to count stock options as an expense.[Ins And Outs Of Restricted Stock]

By Eric L. Reiner, ''Financial Advisor Magazine'', April 2006 These have been criticized—for reasons that also apply to restricted stock units and phantom stock—as being the equivalent to an option with a strike price of $0 "a freebie" rewarding the executive even when their performance has driven the stock price down.

Restricted stock is the stock that cannot be sold by the owner until certain conditions are met (usually a certain length of time passing (vesting period) or a certain goal achieved, such as reaching financial targets

by F. John Reh, About.com Guide[

]

Severance/buyout/retirement compensation

CEOs, and sometimes other executives in large public firms, commonly receive large "separation packages" (aka "walk-away" packages) when leaving a firm, whether from being fired, retired, not rehired, or replaced by new management after acquisition. The packages include features such as retirement plans and deferred compensation, as well as post-retirement perks and guaranteed consulting fees.

From 2000 to 2011, the top 21 "walk-away" packages given to CEOs were worth more than $100 million each and came to a total of almost $4 billion.[Twenty-One U.S. CEOs with Golden Parachutes of More Than $100 Million]

, , GMI, January 2012 , By Paul Hodgson, Senior Research Associate, and Greg Ruel, Research Associate

This compensation differs from what lower-level employees receive when leaving their employer in that it is either not offered to non-executives (in the case of the perks and consulting fees) or is not offered beyond the level where there are tax benefits (retirement plans, deferred compensation).

Prior to a 2006 SEC overhaul of proxy disclosures of executive compensation,[ the packages were unique to executives because unlike salary, bonuses, and stock options, they had the advantage of not being required to be disclosed to the public in annual filings, indicating the dollar value of compensation of the CEO and the four other most highly paid executives. easily accessible to the prying eyes of investment analysts and the business media. The SEC required only the compensation of current employees be reported to shareholders, not the perks and cash provided to anyone no longer working for the firm.

In this way, they constitute "stealth compensation". SEC regulations since 2006 have brought more transparency.

]

Pensions and deferred compensation

Because the 401(k) plans—widely provided to corporate employees—are limited in the amount that is tax-deductible to the employer and employee ($17,000 in annual contributions as of 2012, a small sum to top executives), executives are commonly provided with Supplemental Executive Retirement Plans (aka SERPs) (which are defined benefit pension plans) and Deferred Compensation (aka non-Qualifying Deferred Compensation or NQDF). As of 2002, some 70 per cent of firms surveyed provided non-qualifying SERPs to their executives, and 90 per cent offer deferred compensation programs. These plans differ from 401(k) plans and old pension plans offered to lower-level employees in that the employing company (almost always) pays the taxes on them, and in the case of deferred compensation, the company often provides executives with returns substantially above the stock and bond markets.

This compensation can be considerable. One of the few big firms that did disclose its executive pension liability—GE—reported $1.13 billion for the year 2000.

An example of how much deferred compensation for a CEO at a major firm can amount to is the $1 billion the CEO of Coca-Cola

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. Originally marketed as a temperance bar, temperance drink and intended as a patent medicine, it was invented in the late 19th century by John Stith Pembe ...

earned in compensation and investment gains over a 17-year period. In addition, almost all of the tax due on the $1 billion was paid by Coca-Cola company rather than the CEO.

An example of how pensions have been used as "stealthy" compensation mentioned above was a change in the formula for determining the pension that one retiring CEO (Terrence Murray of FleetBoston Financial) made shortly before his departure. While his original contract based his pension on his average annual salary and bonus over the five years before retirement, that was changed to his average taxable compensation over the three years he received the most compensation. This change of a few words more than doubled the pension payout from $2.7 million to an estimated $5.8 million, but these numbers did not appear on the SEC-required executive compensation tables or in the annual report footnotes. The numbers were revealed only because a newspaper covering the story hired an actuary to calculate the new basis. A banking analyst from Prudential Securities noted that while the CEO was in charge, FleetBoston's shares "underperformed the average bank for a decade," and groused: 'What happened to getting a gold watch?'"

Severance pay

The severance benefit for a "typical" executive is in the range of 6 to 12 months of pay and "occasionally" includes "other benefits like health insurance continuation or vesting of incentives".

Severance packages for the top-five executives at a large firm, however, can go well beyond this. They differ from many lower-level packages not only in their size, but in their broad guarantee to be paid even in the face of poor performance. They are paid as long as the executives are not removed 'for cause'—"usually defined rather narrowly as felony, fraud, malfeasance, gross negligence, moral turpitude, and in some cases, willful refusal to follow the direction of the board".[Bebchuk and Fried, ''Pay Without Performance'' (2004), p.133]

Some examples of severance pay to dismissed CEOs criticized as excessive include:

*Mattel's CEO who received a $50 million severance package after two years of employment despite overseeing a stock price fall of 50 per cent

*$49.3 million payouts to Conseco's CEO, who left the company in "a precarious financial situation"[Dean Foust and Louis Lavelle,]

CEO Pay: Nothing Succeeds like Failure

" ''BusinessWeek'', September 11, 2000, 46

*$9.5 million bonus for Procter & Gamble's CEO, even though he lasted only 17 months and also oversaw a 50 per cent drop in share price, (a loss of $70 billion in shareholder value)[

In 2013, ]Bloomberg Bloomberg may refer to:

People

* Daniel J. Bloomberg (1905–1984), audio engineer

* Georgina Bloomberg (born 1983), professional equestrian

* Michael Bloomberg (born 1942), American businessman and founder of Bloomberg L.P.; politician and m ...

calculated severance packages for CEOs at the largest corporations and found three— John Hammergren of McKesson

McKesson Corporation is an American company distributing pharmaceuticals and providing health information technology, medical supplies, and care management tools. The company delivers a third of all pharmaceuticals used in North America and emplo ...

, Leslie Moonves

Leslie Roy Moonves (; born October 6, 1949) is an American media executive who was the chairman and CEO of CBS Corporation from 2003 until his resignation in September 2018 following numerous allegations of sexual harassment, sexual assault and ...

of CBS Corporation

The second incarnation of CBS Corporation (the first being a short-lived rename of the Westinghouse Electric Corporation) was an American multinational media conglomerate with interests primarily in commercial broadcasting, publishing, an ...

, and David Zaslav

David Zaslav (born January 15, 1960) is an American media executive who currently serves as the Chief Executive Officer and President of Warner Bros. Discovery. Zaslav spearheaded the transaction between AT&T and Discovery to combine with Warne ...

or Discovery Communications

Discovery, Inc. was an American multinational mass media factual television conglomerate based in New York City. Established in 1985, the company operated a group of factual and lifestyle television brands, such as the namesake Discovery Chan ...

—that exceeded $224.7 million.[

Critics complain that not only is this failure to punish poor performance a disincentive to increase stockholder value, but that the usual explanation offered for these payouts—to provide risk-averse execs with insurance against termination—doesn't make sense. The typical CEO is not anticipating many years of income stream since the usual executive contract is only three years. Furthermore, only 2 percent of firms in the S&P 500 reduce any part of the severance package once the executive finds another employer. And if employers are worried about coaxing risk-averse potential employees, why are executives the only ones provided with this treatment? "Given executives' accumulated wealth and generous retirement benefits they commonly receive after leaving the firm, they are likely to be, if anything, less risk-averse and better able to insure themselves than most other employees.

]

Gratuitous payments

Another practice essentially unknown among non-executive employees is the granting of payments or benefits to executives above and beyond what is in their contract when they quit, are fired, or agree to have their companies bought out.[Bebchuk and Fried, ''Pay Without Performance'' (2004), p.87] These are known as "gratuitous" payments.

They may "include forgiveness of loans, accelerated vesting of options and restricted stock, increases in pension benefits (for example by 'crediting' CEOs with additional years of service), awards of lump-sum cash payments, and promises" of the previously mentioned consulting contracts.

Perks

As part of their retirement, top executives have often been given in-kind benefits or "perks" (perquisites). These have included use of corporate jets (sometimes for family and guests as well), chauffeured cars, personal assistants, financial planning, home security systems, club memberships, sports tickets, office space, secretarial help, and cell phone service. Unremarked upon when they are used on the job, perks are more controversial in retirement.

Perks lack the flexibility of cash for the beneficiary. For example, if the retired executive thinks $10,000 worth of a perk such as private jet travel is the best way to spend $10,000, then $10,000 in cash and $10,000 in perk have the same value; however, if there are any possible circumstance in which they would prefer spending some or all of the money on something else, then cash is better.

Also, rather than being a fixed asset whose use costs a corporation less than its worth, perks often cost more than they might first appear.

Consider retiree use of corporate jets, now a common perk. Although the marginal cost of allowing a retired executive to use the company jet may appear limited, it can run quite high. Consider the use of a company plane for a flight from New York to California and then back several days later. Because the New York-based aircraft and flight crew will return to the East Coast after dropping the retired exec off, the actual charge to the company is two round trips: a total of eight takeoffs and landings and approximately 20 hours of flying time, most likely costing—from fuel, maintenance, landing fees, extra pilot and crew fees and incidentals, and depreciation (an aircraft's operating life is reduced for every hour it flies and more importantly, for every takeoff and landing)—at least $50,000.

Like other "separation pay", perks do have the advantage of not having to be reported to shareholders or the SEC in dollar value.

Consulting contracts

As of 2002, about one-quarter of CEOs negotiated a post-retirement ''consulting'' relationship with their old firm despite the fact that few CEOs have been known to seek advice from their predecessors. At least one observer—Frank Glassner, CEO of Compensation Design Group—explains the practice as "disguised severance", rather than money in exchange for useful service to the company.[CEOs cash in after tenure]

by Gary Strauss, 04/25/2002, USA Today

For the CEO of a large firm, such a contract might be worth $1 million a year or more. For example,

*In 2005, AOL Time Warner was paying retired CEO Gerald M. Levin $1 million a year to serve as an adviser for up to five days a month.[

*In 2000, retiring Carter-Wallace CEO Henry Hoyt was promised annual payments of $831,000 for similar monthly obligations.][Lublin, "Executive Pay under the Radar"; and Gary Strauss, "CEOs Cash-In after Tenure," ''USA Today'', April 25, 2002, money section, 1B]

*Verizon co-CEO Charles Lee negotiated a $6 million consulting contract for the first two years of his retirement.[quoted i]

STEALTH COMPENSATION VIA RETIREMENT BENEFITS

Lucian Arye Bebchuk and Jesse M. Fried[

*Delta Airlines CEO Donald Allen's 1997 retirement package provides him with a seven-year, $3.5 million consulting deal under which, according to Delta's public filings, he was 'required to perform his consulting service at such times, and in such places, and for such periods as will result in the least inconvenience to him.'

"Most former CEOs are doing very little for what they're getting paid" since demands for their consultation from the new management are "minuscule", according to executive compensation expert Alan Johnson.

]

Funding compensation

Cash compensation, such as salary, is funded from corporate income. Most equity compensation, such as stock options, does not impose a direct cost on the corporation dispensing it. It does, however, cost company stockholders by increasing the number of shares outstanding and thus, diluting

In chemistry, concentration is the abundance of a constituent divided by the total volume of a mixture. Several types of mathematical description can be distinguished: '' mass concentration'', '' molar concentration'', ''number concentration'', ...

the value of their shares. To minimize this effect, corporations often buy back shares of stock (which does cost the firm cash income).

Life insurance funding

To work around the restrictions and the political outrage concerning executive pay practices, some corporations—banks in particular—have turned to funding bonuses, deferred pay, and pensions owed to executives by using life insurance policies.

Explanations

The growth and complicated nature of executive compensation in America has come to the attention of economists, business researchers, and business journalists. Former SEC Chairman, William H. Donaldson

William Henry Donaldson (born June 2, 1931) was the 27th Chairman of the U.S. Securities and Exchange Commission (SEC), serving from February 2003 to June 2005. He served as Under Secretary of State for International Security Affairs in the Nix ...

, called executive compensation "and how it is determined ... One of the great, as-yet-unsolved problems in the country today."

Performance

One factor that does ''not'' explain CEO pay growth is CEO productivity growth if the productivity is measured by earnings performance. Measuring average pay of CEOs from 1980 to 2004, Vanguard mutual fund founder John Bogle found it grew almost three times as fast as the corporations the CEOs ran—8.5 per cent/year compared to 2.9 per cent/year.[ Whether CEO pay has followed the stock market more closely is disputed. One calculation by one executive compensation consultant (Michael Dennis Graham) found "an extremely high correlation" between CEO pay and stock market prices between 1973 and 2003, while a more recent study by the liberal ]Economic Policy Institute

The Economic Policy Institute (EPI) is a 501(c)(3) non-profit American, left-leaning think tank based in Washington, D.C., that carries out economic research and analyzes the economic impact of policies and proposals. Affiliated with the labor mov ...

found nominal CEO compensation growth (725 per cent) "substantially greater than stock market growth" from 1978 to 2011.

Political and social factors

According to ''Fortune'' magazine, the unleashing of pay for professional athletes with free agency

In professional sports, a free agent is a player who is eligible to sign with other clubs or franchises; i.e., not under contract to any specific team. The term is also used in reference to a player who is under contract at present but who is ...

in the late 1970s ignited the jealousy of CEOs. As business "became glamorized in the 1980s, CEOs realized that being famous was more fun than being invisible". Appearing "near the top of published CEO pay rankings" became a "badge of honor" rather than an embarrassment for many CEOs.[

Economist ]Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

argues that the upsurge in executive pay starting in the 1980s was brought on, in part, by stronger incentives for the recipients:

*A sharp decline in the top marginal income tax rate—from 70 per cent in the early 1970s to 35 per cent today—allows executives to keep much more of their pay and thus incentivizes the top executive "to take advantage of his position".[Krugman, Paul, ''The Conscience of a Liberal'', 2007, p.145]

... and a retreat of countervailing forces:

*News organizations that might once have condemned lavishly paid executives applauded their business genius instead;

*politicians who might once have led populist denunciations of corporate pay now need high-income donors (such as executives) for campaign contributions;

*unions that might once have walked out to protest giant executive bonuses have been devastated by corporate anti-union campaigns and have lost most of their political influence.

Ratcheting and consultants

Compensation consultants have been called an important factor by John Bogle and others. Investor Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net ...

has disparaged the proverbial "ever-accommodating firm of Ratchet, Ratchet and Bingo" for raising the pay of the "mediocre-or-worse CEO".[ John Bogle believes, "much of the responsibility for our flawed system of CEO compensation, ... can be attributed to the rise of the compensation consultant."][Reflections on CEO Compensation]

By John C. Bogle, Academy of Management, May 2008

According to Kim Clark, Dean of Harvard Business School, the use of consultants has created a " Lake Wobegon effect" in CEO pay, where CEOs all consider themselves above average in performance and "want to be at the 75th percentile of the distribution of compensation." Thus average pay is pushed steadily upward as below-average and average CEOs seek above-average pay. Studies confirming this "ratcheting-up effect" include a 1997 study of compensation committee reports from 100 firms. A 2012 study by Charles Elson and Craig Ferrere which found a practice of "peer benchmarking" by boards, where their CEO's pay was pegged to the 50th, 75th, or 90th percentile—never lower—of CEO compensation at peer-group firms.

Conflict of interest

Why consultants would care about executives' opinions that they (the executives) should be paid more, is explained in part by their not being hired in the first place if they didn't, and by executives' ability to offer the consultants more lucrative fees for other consulting work with the firm, such as designing or managing the firm's employee-benefits system. In the words of journalist Clive Crook

Clive Crook (born 1955 in Yorkshire, England) is a former columnist for the ''Financial Times'' and the ''National Journal''; a former senior editor at ''The Atlantic Monthly'', and now writes a column and editorials for Bloomberg News. For twent ...

, the consultants "are giving advice on how much to pay the CEO at the same time that he or she is deciding how much other business to send their way. At the moment 006

Alec Trevelyan (006) is a fictional character and the main antagonist in the 1995 James Bond film '' GoldenEye'', the first film to feature actor Pierce Brosnan as Bond. Trevelyan is portrayed by actor Sean Bean. The likeness of Bean as Ale ...

companies do not have to disclose these relationships."

''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' examined one case in 2006 where the compensation for one company's CEO jumped 48 per cent (to $19.4 million), despite an earnings decline of 5.5 per cent and a stock drop of 26 per cent. Shareholders had been told the compensation was devised with the help of an "outside consultant" the company (Verizon

Verizon Communications Inc., commonly known as Verizon, is an American multinational telecommunications conglomerate and a corporate component of the Dow Jones Industrial Average. The company is headquartered at 1095 Avenue of the Americas ...

) declined to name. Sources told the ''Times'' that the consultant was Hewitt Associates Hewitt may refer to:

Places

;United Kingdom

* Hewitt (hill), Hills in England, Wales and Ireland over two thousand feet with a relative height of at least 30 metres

;United States

* Hewitt, Minnesota, a city

* Hewitt, Texas, a city

* Hewitt, ...

, "a provider of employee benefits management and consulting services", and recipient of more than $500 million in revenue "from Verizon and its predecessor companies since 1997."

A 2006 congressional investigation found median CEO salary 67 percent higher in Fortune 250 companies where the hired compensation consultants had the largest conflicts of interest than in companies without such conflicted consultants. Since then the SEC has issued rules "designed to promote the independence of compensation committee members, consultants and advisers" and prevent conflict of interest in consulting.

Psychological factors

Business columnist James Surowiecki

James Michael Surowiecki ( ; born April 30, 1967) is an American journalist. He was a staff writer at ''The New Yorker'', where he wrote a regular column on business and finance called "The Financial Page".

Background

Surowiecki was born in Meri ...

has noted that " transparent pricing", which usually leads to lower costs, has not had the intended effect not only in executive pay but also in prices of medical procedures performed by hospitals—both situations "where the stakes are very high". He suggests the reasons are psychological—"Do you want the guy doing your neurosurgery, or running your company, to be offering discounts? Better, in the event that something goes wrong, to be able to tell yourself that you spent all you could. And overspending is always easier when you're spending someone else's money."

Management power

Corporate governance

Management's desire to be paid more and to influence pay consultants and others who could raise their pay does not explain why they had the power to make it happen. Company owners—shareholders—and the directors elected by them could prevent this. Why was negotiation of the CEO pay package "like having labor negotiations where one side doesn't care ... there's no one representing shareholders"—as one anonymous CEO of a Fortune 500 company told ''Fortune'' magazine in 2001.

Companies with dispersed ownership and no controlling shareholder have become "the dominant form of ownership" among publicly traded firms in the United States.lies partly in the changing pattern of shareholding. Large shareholders in a company have both the means and the motive to remind managers whom they are working for and to insist that costs (including managers' pay) be contained and assets not squandered on reckless new ventures or vanity projects. Shareholders with small diversified holdings are unable to exercise such influence; they can only vote with their feet, choosing either to hold or to sell their shares, according to whether they think that managers are doing a good job overall. Shareholdings have become more dispersed in recent decades, and the balance of power has thereby shifted from owners to managers.[Executive Privilege]

Clive Crook, theatlantic.com, January 2006

Crook points out that institutional investors

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-link ...

(pension funds, mutual funds, etc.) haven't filled the void left by the departure of the large shareholder "owner capitalist". Bogle worries that money managers have become much less interested in the long term performance of firms they own stock in, with the average turnover of a share of stock "exceeding 250 per cent (changed hands two and a half times)" in 2009, compared to 78 per cent in 2000 and "21 per cent barely 30 years ago." And one growing segment of institutional investing— passively managed index fund

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can a specified basket of underlying investments.Reasonable Investor(s), Boston University Law Review, avai ...

s—by definition pays no attention to company performance, let alone executive pay and incentives.[ (Another source (]Bloomberg Businessweek

''Bloomberg Businessweek'', previously known as ''BusinessWeek'', is an American weekly business magazine published fifty times a year. Since 2009, the magazine is owned by New York City-based Bloomberg L.P. The magazine debuted in New York City ...

) argues that institutional shareholders have become more active following the loss of trillions of dollars in equity as a result of the severe market downturn of 2008-09.[More CEOs Are Learning Who's the Boss]

By Alex Nussbaum, Drew Armstrong, and Jeff Green, businessweek.com, November 21, 2012)

This appeared to many to be a case of a "principal–agent problem

The principal–agent problem refers to the conflict in interests and priorities that arises when one person or entity (the "agent") takes actions on behalf of another person or entity (the " principal"). The problem worsens when there is a gre ...

" and "asymmetrical information"—i.e. a problem for the owners/shareholders (the "principals") who have much less information and different interests than those they ostensibly hire to run the company (the "agent").NASDAQ

The Nasdaq Stock Market () (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second ...

and NYSE

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

stock exchange regulations require that the majority of directors of boards, and all of the directors of the board committees in charge of working out the details of executive pay packages (compensation committees) and nominating new directors (nomination committees), be "independent". Independent directors have "'no material relationship' with the listed company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the company."[Just What is an Independent Director Anyway? ]

Governance Center Blog, The Conference Board

But factors financial, social and psychological that continue to work against board oversight of management have been collected by professors of law Lucian Bebchuk Lucian Arye Bebchuk (born 1955) is a professor at Harvard Law School focusing on economics and finance.

Bebchuck has a B.A. in mathematics and economics from the University of Haifa (1977), an LL.B. from the University of Tel Aviv (1979), an LL.M ...

, Jesse M. Fried, and David I. Walker.

Management may have influence over directors' appointments and the ability to reward directors when they're cooperative—something CEOs have done "in myriad ways" in the past. Regulations limit director compensation but not that of immediate family members of the directors who are non-executive employees of the firm.[

Even with compensation limits, the position of director in large companies is an enviable one with strong incentives not to rock the boat and be pushed out. Pay for Fortune 500 directors averaged $234,000 for 2011, and trade group survey found directors spend an average of a little over four hours a week in work concerning the board. The job also gives valuable business and social connections and sometimes perks (such as free company product).

Election and re-election to the board in large companies are assured by being included on the proxy slate, which is controlled by the nomination committee. Dissident slates of candidate have very seldom appeared on shareholder ballots.

Business dealings between the company and a firm associated with the director must not exceed $1 million annually, but the limit does not apply to dealings after the director leaves the board, nor to charitable contributions to non-profit organizations associated with the director.][Bebchuk and Fried, ''Pay Without Performance'' (2004), (pp.27–29)] The corporate world contributes billions of dollars a year to charity. It "has been common practice" for companies to direct some of this to the "nonprofit organizations that employ or are headed by a director".

Also weakening any will directors might have to clash with CEOs over their compensation is the director's lack of sufficient time (directors averaging four hours a week mentioned above) and information(something executives do have), and the lack of any appreciable disincentive for the favoring executives at the expense of shareholders (ownership by directors of 0.005 per cent or less of the companies on whose boards the directors sit, is common).

Members of the compensation committee may be independent but are often other well-paid executives.[Bebchuk and Fried, ''Pay Without Performance'' (2004), p.33] In 2002, 41 per cent of the directors on compensation committees were active executives, 20 per cent were active CEOs, another 26 per cent of the members of compensation committees were retirees, "most of them retired executives".[ Interlocking directorates—where the CEO of one firm sits on the board of another, and the CEO of ''that'' firm sits on the board of the first CEO—is a practice found in about one out of every twelve publicly traded firms.][Bebchuk and Fried, ''Pay Without Performance'' (2004), p.31]

The social and psychological forces of "friendship, collegiality, loyalty, team spirit, and natural deference to the firm's leader" play a role. Being a director has been compared to being in a club. Rather than thinking of themselves as overseers/supervisors of the CEO, directors are part of the corporate team whose leader is the CEO. When "some directors cannot in good faith continue to support a CEO who has the support of the rest of the board", they are not recognized or even tolerated as gadflies, but "expected to step down".

Connection of power and pay

Authors Bebchuk and Fried postulate that the "agency" problem or "agency cost An agency cost is an economic concept that refers to the costs associated with the relationship between a " principal" (an organization, person or group of persons), and an "agent". The agent is given powers to make decisions on behalf of the princi ...

", of executives power over directors, has reached the point of giving executives the power to control their own pay and incentives. What "places constraints on executive compensation" is not the marketplace for executive talent and hard-headed calculation of compensation costs and benefits by directors and the experts they may use, (or shareholder resolutions, proxies contests, lawsuits, or "the disciplining force of markets"). The controlling factor is what the authors call "outrage"—"the criticism of outsiders whose views matter most to xecutives— institutional investors, business media, and the social and professional groups to which directors and managers belong" and the executives' fear that going too far will "create a backlash from usually quiescent shareholders, workers, politicians, or the general public".General Electric

General Electric Company (GE) is an American multinational conglomerate founded in 1892, and incorporated in New York state and headquartered in Boston. The company operated in sectors including healthcare, aviation, power, renewable ene ...

CEO Jack Welch's relinquishing of millions of dollars of perks after their being publicly revealed by his ex-wife, the willingness of Sears

Sears, Roebuck and Co. ( ), commonly known as Sears, is an American chain of department stores founded in 1892 by Richard Warren Sears and Alvah Curtis Roebuck and reincorporated in 1906 by Richard Sears and Julius Rosenwald, with what began a ...

to make management changes after "previously ignored shareholder activist Robert Monk" identified Sears' directors by name in an advertisement in ''The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

'', and the success of the publicly displayed "focus list" of poorly performing firms created by" the large institutional investor (CalPERS

The California Public Employees' Retirement System (CalPERS) is an agency in the California executive branch that "manages pension and health benefits for more than 1.5 million California public employees, retirees, and their families".CalPERSFa ...

). Further evidence of the power of outrage is found in what the authors call "camouflage" of compensation—the hiding of its value by techniques such as using types of compensation that do not require disclosure, or burying required disclosure in pages and pages of opaque text.

Attempting to confirm the connection between executive power and high pay, Bebchuk and Fried found higher CEO pay or lower incentives to perform in employment contracts were associated with factors that

*strengthened management's position (no large outside shareholder, fewer institutional shareholders, protection from hostile takeover) or weaken the board's position (larger boards, interlocking boards, boards with more directors appointed by the CEO, directors who serve on other boards, etc.).

Larger boards—where it is harder to get a majority to challenge the CEO, and where each director is less responsible—are correlated with CEO pay that is higher[John E. Core, Robert W. Holthausen and David F. Larcker "Corporate Governance, Chief Executive Compensation and Firm Performance." ''Journal of Financial Economics'' 51 (1999) 372] and less sensitive to performance. Boards with directors who serve on three or more other boards—giving them less time and energy to devote to the problems of anyone company—have CEOs with higher pay, all other things being equal.[ CEOs who also serve as chairman of the board are more likely to have higher pay and be less likely to be fired for poor performance. The more outside directors are appointed by a CEO, the higher that CEO's pay and the more likely they are to be given a "golden parachutes".][John E. Core, Robert W. Holthausen and David F. Larcker "Corporate Governance, Chief Executive Compensation and Firm Performance." ''Journal of Financial Economics'' 51(1999) 372–373][

The appointment of compensation committee chairs of the board after the CEO takes office—when the CEO has influence—is correlated with higher CEO compensation.][Brian Main, Charles O'Reilly, and James Wade, "The CEO, the Board of Directors, and Executive Compensation: Economic and Psychological Perspectives," ''Industrial and Corporate Change'' 11 (1995): 302–303]

On the other hand, CEO pay tends to be lower and more sensitive to firm performance when the members of the compensation committee of the board of directors hold a large amount of stock.

(Unfortunately for shareholders this has not been the norm

and not likely to become so.)

The length of the CEO's term—the longer the term the more opportunity to appoint board members—has been found correlated with pay that is less sensitive to firm performance.

Interlocking directorate

Interlocking directorate refers to the practice of members of a corporate board of directors serving on the boards of multiple corporations. A person that sits on multiple boards is known as a ''multiple director''.Scott, 1997p. 7/ref> Two fir ...

s are associated with higher CEO compensation.[Kevin Hallock, "Reciprocally Interlocking Boards of Directors and Executive Compensation" ''Journal of Financial and Quantitative Analysis'' 32 (1997): 332] Protection against "hostile" buyout of a company—which replaces management—is associated with more pay, a reduction in shares held by executives, less value for shareholders,[Paul B. Gompers, Joy L. Ishii, and Andrew Metrick, "Corporate Governance and Equity Prices" ''Quarterly Journal of Economics'' 118 (2003): 107–155] lower profit margins and sales growth.[

Having a shareholder with a stake larger than the CEO's ownership interest is associated with CEO pay that is more performance sensitive

and lower by an average of 5 per cent.][Richard M. Cyert, Sok-Hyon Kang, and Praveen Kumar, "Corporate Governance, Takeovers, and Top-Management Compensation: Theory and Evidence", ''Management Science'' 48 (2002): 453–469]

The ownership of stock by institutional investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked ...

s is associated with lower and more performance-sensitive executive compensation stock,

particularly if the institutional shareholders have no business relationships with the firm (such as managing the pension fund) that management might use as leverage against "unfriendly" shareholder acts by the institution.

Studies of "repricing" executive stock options—criticized as a "way of rewarding management when stock prices fall"—have found it more common among firms with insider-dominated boards[Donald Chance, Raman Kumar, and Rebecca Todd, "The Re-pricing' of Executive Stock Options,' ''Journal of Financial Economics'' 57 (2000): 148] or

a nonindependent board member on the compensation committee.,[Brenner, Sundarma, and Yermack, "Altering the Terms of Executive stock Options," ''Journal of Financial Economics'', 121] and less common with the presence of institutional investors

Shareholder limitations

If directors fail to work in the interest of shareholders, shareholders have the power to sue to stop an executive pay package. However, to overturn the package they must prove that the compensation package is "so irrational that no reasonable person could approve it and ... therefore constitutes 'waste'", a burden of proof is so daunting that a successful case has been compared to the Loch Ness monster

The Loch Ness Monster ( gd, Uilebheist Loch Nis), affectionately known as Nessie, is a creature in Scottish folklore that is said to inhabit Loch Ness in the Scottish Highlands. It is often described as large, long-necked, and with one or ...

— "so rare as to be possibly nonexistent".

Shareholders can vote against the package in the proxy, but not only is this rare—"only 1 per cent of option plans put to a vote in the past have failed to obtain shareholder approval"—it is not binding on the board of directors. Companies generally warn stockholders such votes will be disregarded, or if obeyed will mean the package is simply replaced with other forms of compensation (appreciation rights or cash grants replacing options, for example). Shareholder resolutions are also advisory not compulsory, for corporate boards, which commonly decline to implement resolutions with majority shareholder support.

Market ineffectiveness

Bebchuk et al. argue that agency problems have not been overcome by market forces—the markets for managerial labor, corporate control, capital, and products—that some argue will align the interests of managers with those of shareholders, because the forces are simply "neither sufficiently finely tuned nor sufficiently powerful". The market costs to the executive of a compensation package with managerial "slack" and excess pay—the danger of outsider hostile takeover or a proxy contest that would terminate the executive's job, the fall in value of equity compensation owned by the executive—will seldom if ever be worth more to the executive than the value of their compensation.

This is

*in part because "golden goodbyes" (i.e. the severance/buyout/retirement compensation mentioned above) protect the executive from the pain of being fired,

*in part because hostile takeover defences such as "staggered boards" (which stagger elections and terms of office for directors of corporate boards so that a hostile acquirer cannot gain control for at least a year) have protected management from hostile takeovers in recent years, and

*in part because the value of the shares and options owned by the average CEO (about 1 per cent of the stock market capitalization of their firm's equity) is too low to significantly impact executive behavior. The average CEO owns so little company equity, that even if their compensation package was so wasteful and excessive it reduced the company's value by $100 million, this would cost the (average) CEO only $1 million in lost value of shares and options, a fraction of the $9 million in annual income the top 500 executives in the US averaged in 2009.

Contradiction

According to business journalist James Surowiecki as of 2015, companies to be transparent about executive compensation, boards have many more independent directors, and CEOs "typically have less influence over how boards run", but the "effect on the general level of CEO salaries has been approximately zero."

Market forces

Defenders of executive pay in America say that lucrative compensation can easily be explained by the necessity to attract the best talent; the fact that the demands and scope of a CEO are far greater than in earlier eras; and that the return American executives provide to shareholders earns their compensation.[ And that whatever the alleged problems involved, cures proposed are worse than the disease, involving both burdensome government restriction that will provoke a loss of executive talent;][Red Tape Rising: Obama-Era Regulation at the Three-Year Mark]

By James Gattuso and Diane Katz, heritage.org, March 13, 2012 and encouragement of stockholder votes on executive compensation that will allow anti-free enterprise "interest groups to use shareholder meetings to advance their own agendas".

While admitting there is "little correlation between CEO pay and stock performance—as detractors delight in pointing out," business consultant and commentator Dominic Basulto believes "there is strong evidence that, far from being paid too much, many CEOs are paid too little." Elites in the financial industry (where the average compensation for the top 25 managers in 2004 was $251 million—more than 20 times as much as the average CEO), not to mention the entertainment and sports industry, are often paid even more.["Why Do We Underpay Our Best CEOs?" by Dominic Basulto ''The American'', December 5, 2006 (American Enterprise Institute))]

Robert P. Murphy, author and adjunct scholar of the libertarian

Libertarianism (from french: libertaire, "libertarian"; from la, libertas, "freedom") is a political philosophy that upholds liberty as a core value. Libertarians seek to maximize autonomy and political freedom, and minimize the state's en ...

Ludwig von Mises Institute

Ludwig von Mises Institute for Austrian Economics, or Mises Institute, is a libertarian nonprofit think tank headquartered in Auburn, Alabama, United States. It is named after the Austrian School economist Ludwig von Mises (1881–1973).

It ...

, challenges those who belittle large corporate compensation arguing that it is "no more surprising or outrageous" in a free market that "some types of labor command thousands of times more market value" than the fact that some goods "(such as a house) have price hundreds of thousands of times higher than the prices of other goods (such as a pack of gum)." "Scoffers" like Warren Buffett, who complain of big executive pay packages (salary, bonuses, perks) even when a company has done poorly, fail to appreciate that this "doesn't seem outrageous when the numbers are lower. For example, when GM stock plunged 25 per cent," did the complainers "expect the assembly-line workers to give back a quarter of their wages for that year?" The quality of corporate leadership will suffer (Murphy believes) "if 'outrageous' compensation packages" are forbidden, just as "the frequency and quality of brain surgery would plummet" if the pay of brain surgeons were to be cut.[

]

History

Beginnings

The development of professional corporate management (executives) in the U.S. began after the Civil War

A civil war or intrastate war is a war between organized groups within the same state (or country).

The aim of one side may be to take control of the country or a region, to achieve independence for a region, or to change government polici ...

, along with the development of stock markets, industry