depreciation (economics) on:

[Wikipedia]

[Google]

[Amazon]

In

In

In

Depreciation Accounting Simplified

Valuation (finance) Capital (economics) Depreciation

economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and intera ...

, depreciation is the gradual decrease in the economic value

Value or values may refer to:

Ethics and social

* Value (ethics) wherein said concept may be construed as treating actions themselves as abstract objects, associating value to them

** Values (Western philosophy) expands the notion of value beyo ...

of the capital stock

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. "Share capi ...

of a firm, nation or other entity, either through physical depreciation, obsolescence or changes in the demand for the services of the capital in question. If the capital stock is in one period , gross (total) investment spending on newly produced capital is and depreciation is , the capital stock in the next period, , is . The net

Net or net may refer to:

Mathematics and physics

* Net (mathematics), a filter-like topological generalization of a sequence

* Net, a linear system of divisors of dimension 2

* Net (polyhedron), an arrangement of polygons that can be folded up ...

increment to the capital stock is the difference between gross investment and depreciation, and is called net investment

In economics, net investment is spending which increases the availability of fixed capital goods or means of production and goods inventories. It is the total spending on newly produced physical capital (fixed investment) and on inventories (invent ...

.

Models

In economics, the value of a capital asset may be modeled as thepresent value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has inte ...

of the flow of services the asset will generate in future, appropriately adjusted for uncertainty. Economic depreciation over a given period is the reduction in the remaining value of future goods and services.

Under certain circumstances, such as an unanticipated increase in the price of the services generated by an asset or a reduction in the discount rate, its value may increase rather than decline. Depreciation is then negative.

Depreciation can alternatively be measured as the change in the ''market'' value of capital

Capital may refer to:

Common uses

* Capital city, a municipality of primary status

** List of national capital cities

* Capital letter, an upper-case letter Economics and social sciences

* Capital (economics), the durable produced goods used f ...

over a given period: the market price of the capital at the beginning of the period minus its market price at the end of the period.

Such a method in calculating depreciation differs from other methods, such as straight-line depreciation in that it is included in the calculation of implicit cost In economics, an implicit cost, also called an imputed cost, implied cost, or notional cost, is the opportunity cost equal to what a firm must give up in order to use a factor of production for which it already owns and thus does not pay rent. It is ...

, and thus economic profit

In economics, profit is the difference between the revenue that an economic entity has received from its outputs and the total cost of its inputs. It is equal to total revenue minus total cost, including both explicit and implicit costs.

It i ...

.

Modeling depreciation of a durable as delivering the same services from purchase until failure, with zero scrap value (rather than slowing degrading and retaining residual value

''Residual value'' is one of the constituents of a leasing calculus or operation. It describes the future value of a good in terms of absolute value in monetary terms and it is sometimes abbreviated into a percentage of the initial price when the i ...

), is referred to as the light bulb model of depreciation, or more colorfully as the one-hoss shay model, after a poem by Oliver Wendell Holmes Sr.

Oliver Wendell Holmes Sr. (; August 29, 1809 – October 7, 1894) was an American physician, poet, and polymath based in Boston. Grouped among the fireside poets, he was acclaimed by his peers as one of the best writers of the day. His most fa ...

, about a carriage which worked perfectly for exactly one hundred years, then fell completely apart in an instant.

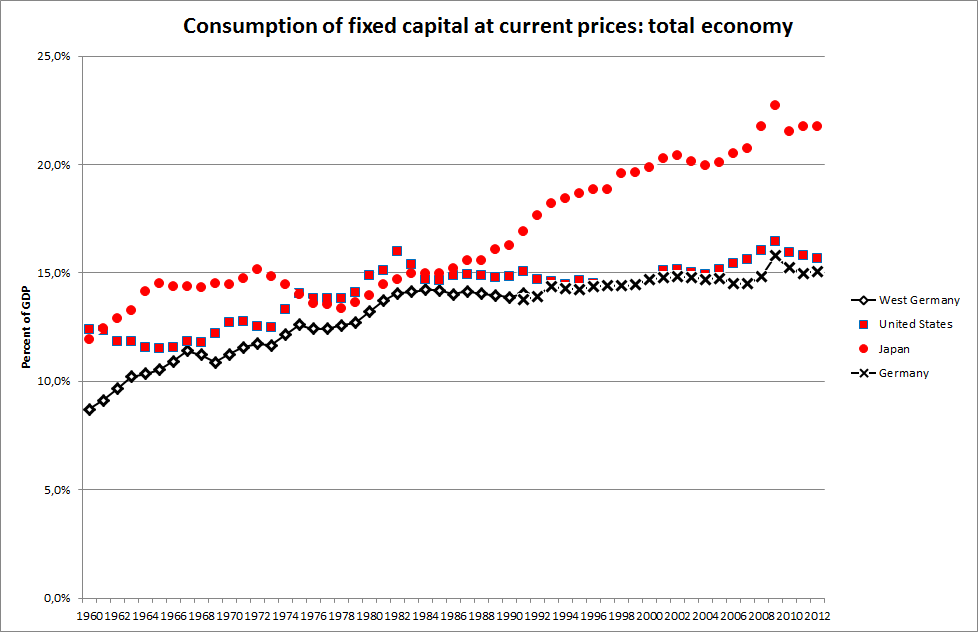

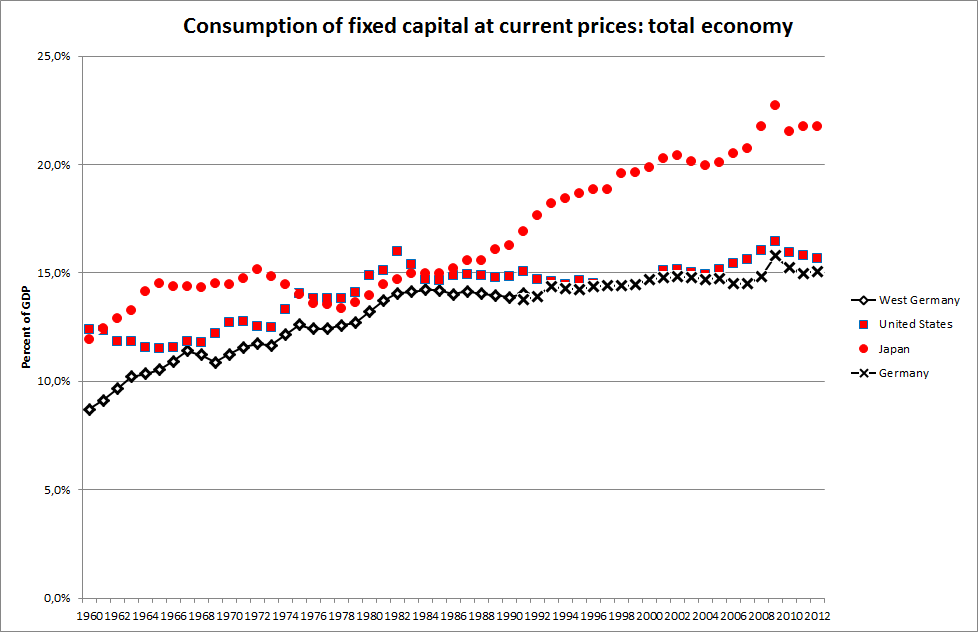

National accounts

In

In national accounts

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry ...

the decline in the aggregate capital stock

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. "Share capi ...

arising from the use of fixed assets in production is referred to as consumption of fixed capital

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process ...

(CFC). Hence, CFC is equal to the difference between aggregate gross fixed capital formation

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ES ...

( gross investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing i ...

) and net fixed capital formation (net investment

In economics, net investment is spending which increases the availability of fixed capital goods or means of production and goods inventories. It is the total spending on newly produced physical capital (fixed investment) and on inventories (invent ...

) or between Gross National Product

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign ...

and Net National Product Net national product (NNP) refers to gross national product (GNP), i.e. the total market value of all final goods and services produced by the factors of production of a country or other polity during a given time period, minus depreciation. Simila ...

. Unlike depreciation in business accounting, CFC in national accounts is, in principle, not a method of allocating the costs of past expenditures on fixed assets over subsequent accounting periods. Rather, fixed assets at a given moment in time are valued according to the remaining benefits to be derived from their use.

References

{{Reflist, 2Depreciation Accounting Simplified

Valuation (finance) Capital (economics) Depreciation