Credit Unions on:

[Wikipedia]

[Google]

[Amazon]

A credit union, a type of

A credit union, a type of

According to the

According to the

"Spolok Gazdovský" (''The Association of Administrators'' or ''The Association of Farmers'') founded in 1845 by Samuel Jurkovič, was the first cooperative in Europe (Credit union). The cooperative provided a cheap loan from funds generated by regular savings for members of the cooperative. Members of cooperative had to commit to a moral life and had to plant two trees in a public place every year. Despite the short duration of its existence, until 1851, it thus formed the basis of the cooperative movement in Slovakia. Slovak national thinker

"Spolok Gazdovský" (''The Association of Administrators'' or ''The Association of Farmers'') founded in 1845 by Samuel Jurkovič, was the first cooperative in Europe (Credit union). The cooperative provided a cheap loan from funds generated by regular savings for members of the cooperative. Members of cooperative had to commit to a moral life and had to plant two trees in a public place every year. Despite the short duration of its existence, until 1851, it thus formed the basis of the cooperative movement in Slovakia. Slovak national thinker

Credit Union National Association

national trade association for credit unions

World Council of Credit Unions

global trade association for credit unions

Association of Asian Confederations of Credit Unions

regional federation representing 21 national federations in Asia with 35 million retail members

National Credit Union Service Organization

directory of all credit unions in the U.S.

National Credit Union Foundation

charitable arm of credit union industry {{Authority control Cooperative banking Social economy Community building Financial services

A credit union, a type of

A credit union, a type of financial institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial inst ...

similar to a commercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with ...

, is a member-owned nonprofit

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in co ...

financial cooperative

A cooperative (also known as co-operative, co-op, or coop) is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically-contro ...

. Credit unions generally provide services to members similar to retail banks, including deposit account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained belo ...

s, provision of credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies).

Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016.

Leading up to the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of ...

, commercial banks engaged in approximately five times more subprime lending

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subpri ...

relative to credit unions and were two and a half times more likely to fail during the crisis. American credit unions more than doubled lending to small businesses between 2008 and 2016, from $30 billion to $60 billion, while lending to small businesses overall during the same period declined by around $100 billion. In the US, public trust in credit unions stands at 60%, compared to 30% for big banks. Furthermore, small businesses are 80% less likely to be dissatisfied with a credit union than with a big bank.

"Natural-person credit unions" (also called "retail credit unions" or "consumer credit unions") serve individuals, as distinguished from "corporate credit union

A corporate credit union, also known as a central credit union, provides services to natural person (consumer) credit unions. In the credit union industry, they are sometimes referred to as "the credit union’s credit union". In the United States ...

s", which serve other credit unions.

Differences from other financial institutions

Credit unions differ frombank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

s and other financial institutions in that those who have accounts in the credit union are its members and owners, and they elect their board of directors in a one-person-one-vote system regardless of their amount invested. Credit unions see themselves as different from mainstream banks, with a mission to be community-oriented and to "serve people, not profit".

Credit unions offer many of the same financial services as banks but often use different terminology. Typical services include share accounts (savings account

A savings account is a bank account at a retail bank. Common features include a limited number of withdrawals, a lack of cheque and linked debit card facilities, limited transfer options and the inability to be overdrawn. Traditionally, transa ...

s), share draft accounts ( cheque accounts), credit card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the ...

s, share term certificates (certificates of deposit

A certificate of deposit (CD) is a time deposit, a financial product commonly sold by banks, thrift institutions, and credit unions in the United States. CDs differ from savings accounts in that the CD has a specific, fixed term (often one, t ...

), and online banking

Online banking, also known as internet banking, web banking or home banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial ins ...

. Normally, only a member of a credit union may deposit or borrow

Borrow or borrowing can mean: to receive (something) from somebody temporarily, expecting to return it.

*In finance, monetary debt

*In language, the use of loanwords

* In arithmetic, when a digit becomes less than zero and the deficiency is taken f ...

money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money ar ...

. Surveys of customers at banks and credit unions have consistently shown significantly higher customer satisfaction rates with the quality of service at credit unions. Credit unions have historically claimed to provide superior member service and to be committed to helping members improve their financial situation. In the context of financial inclusion

Financial inclusion is defined as the availability and equality of opportunities to access financial services. It refers to a process by which individuals and businesses can access appropriate, affordable, and timely financial products and service ...

, credit unions claim to provide a broader range of loan and savings products at a much cheaper cost to their members than do most microfinance

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings ...

institutions.

Credit unions differ from modern microfinance. Particularly, members' control over financial resources is the distinguishing feature between the cooperative model and modern microfinance. The current dominant model of microfinance, whether it is provided by not-for-profit or for-profit institutions, places the control over financial resources and their allocation in the hands of a small number of microfinance providers that benefit from the highly profitable sector.

Not-for-profit status

In the credit union context, "not-for-profit

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in co ...

" must be distinguished from a charity. Credit unions are "not-for-profit" because their purpose is to serve their members rather than to maximize profits, so unlike charities, credit unions do not rely on donations and are financial institutions that must make what is, in economic terms, a small profit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory inter ...

(i.e., in non-profit accounting terms, a "surplus") to remain in existence. According to the World Council of Credit Unions

The World Council of Credit Unions (WOCCU) is an international trade association and development agency for credit unions headquartered in Madison, Wisconsin. WOCCU aims to improve lives through credit unions and other financial cooperatives thr ...

(WOCCU), a credit union's revenue

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Commercial revenue may also be referred to as sales or as turnover. Some companies receive rev ...

s (from loans and investments) must exceed its operating expenses and dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-i ...

s (interest paid on deposits) in order to maintain capital and solvency.

In the United States, credit unions incorporated and operating under a state credit union law are tax-exempt under Section 501(c)(14)(A). Federal credit unions organized and operated in accordance with the Federal Credit Union Act

The Federal Credit Union Act is an Act of Congress enacted in 1934. The purpose of the law was to make credit available and promote thrift through a national system of nonprofit, cooperative credit unions. This Act established the federal credit ...

are tax-exempt under Section 501(c)(1).

Global presence

World Council of Credit Unions

The World Council of Credit Unions (WOCCU) is an international trade association and development agency for credit unions headquartered in Madison, Wisconsin. WOCCU aims to improve lives through credit unions and other financial cooperatives thr ...

(WOCCU), at the end of 2018 there were 85,400 credit unions in 118 countries. Collectively they served 274.2 million members and oversaw US$2.19 trillion in assets. WOCCU does not include data from cooperative banks, so, for example, some countries generally seen as the pioneers of credit unionism, such as Germany, France, the Netherlands and Italy, are not always included in their data. The European Association of Co-operative Banks reported 38 million members in those four countries at the end of 2010.

The countries with the most credit union activity are highly diverse. According to WOCCU, the countries with the greatest number of credit union members were the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country Continental United States, primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., ...

(101 million), India (20 million), Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by to ...

(10 million), Brazil (6.0 million), South Korea (5.7 million), Philippines (5.4 million), Kenya and Mexico (5.1 million each), Ecuador (4.8 million), Australia (4.5 million), Thailand (4.1 million), Colombia (3.6 million), and Ireland

Ireland ( ; ga, Éire ; Ulster-Scots: ) is an island in the North Atlantic Ocean, in north-western Europe. It is separated from Great Britain to its east by the North Channel, the Irish Sea, and St George's Channel. Ireland is the s ...

(3.3 million).

The countries with the highest percentage of credit union members in the economically active population were Barbados (82%), Ireland (75%), Grenada (72%), Trinidad & Tobago (68%), Belize and St. Lucia (67% each), St. Kitts & Nevis (58%), Jamaica (53% each), Antigua and Barbuda (49%), the United States (48%), Ecuador (47%), and Canada (43%). Several African and Latin American countries also had high credit union membership rates, as did Australia and South Korea. The average percentage for all countries considered in the report was 8.2%. Credit unions were launched in Poland in 1992; there were 2,000 credit union branches there with 2.2 million members. From 1996 to 2016, credit unions in Costa Rica almost tripled their share of the financial market (they grew from 3.7% of the market share to 9.9%), and grew faster than private-sector banks or state-owned banks in Costa Rica, after financial reforms in that country.

History

"Spolok Gazdovský" (''The Association of Administrators'' or ''The Association of Farmers'') founded in 1845 by Samuel Jurkovič, was the first cooperative in Europe (Credit union). The cooperative provided a cheap loan from funds generated by regular savings for members of the cooperative. Members of cooperative had to commit to a moral life and had to plant two trees in a public place every year. Despite the short duration of its existence, until 1851, it thus formed the basis of the cooperative movement in Slovakia. Slovak national thinker

"Spolok Gazdovský" (''The Association of Administrators'' or ''The Association of Farmers'') founded in 1845 by Samuel Jurkovič, was the first cooperative in Europe (Credit union). The cooperative provided a cheap loan from funds generated by regular savings for members of the cooperative. Members of cooperative had to commit to a moral life and had to plant two trees in a public place every year. Despite the short duration of its existence, until 1851, it thus formed the basis of the cooperative movement in Slovakia. Slovak national thinker Ľudovít Štúr

Ľudovít Velislav Štúr (; hu, Stur Lajos; 28 October 1815 – 12 January 1856), known in his era as Ludevít Štúr, (pen names : B. Dunajský, Bedlivý Ludorob, Boleslav Záhorský, Brat Slovenska, Ein Slave, Ein ungarischer Slave, Karl Wi ...

said about the association: "We would very much like such excellent constitutions to be established throughout our region. They would help to rescue people from evil and misery. A beautiful, great idea, a beautiful excellent constitution!"

Modern credit union history dates from 1852, when Franz Hermann Schulze-Delitzsch

Franz Hermann Schulze-Delitzsch, also Hermann Schulze, (29 August 1808 – 29 April 1883) was a German politician and economist. He was responsible for the organizing of the world's first credit unions. He was also co-founder of the German Progre ...

consolidated the learning from two pilot projects, one in Eilenburg

Eilenburg (; hsb, Jiłow) is a town in Germany. It lies in the district of Nordsachsen in Saxony, approximately 20 km northeast of the city of Leipzig.

Geography

Eilenburg lies at the banks of the river Mulde at the southwestern edge ...

and the other in Delitzsch

Delitzsch (; Slavic: ''delč'' or ''delcz'' for hill) is a town in Saxony in Germany, 20 km north of Leipzig and 30 km east of Halle (Saale). With 24,850 inhabitants at the end of 2015, it is the largest town in the district of Nordsa ...

in the Kingdom of Saxony

The Kingdom of Saxony (german: Königreich Sachsen), lasting from 1806 to 1918, was an independent member of a number of historical confederacies in Napoleonic through post-Napoleonic Germany. The kingdom was formed from the Electorate of Sax ...

into what are generally recognized as the first credit unions in the world. He went on to develop a highly successful urban credit union system. In 1864, Friedrich Wilhelm Raiffeisen

Friedrich Wilhelm Raiffeisen (30 March 1818 – 11 March 1888) was a German mayor and cooperative pioneer. Several credit union systems and cooperative banks have been named after Raiffeisen, who pioneered rural credit unions.

Life

Friedrich Wilhe ...

founded the first rural credit union in Heddesdorf (now part of Neuwied

Neuwied () is a town in the north of the German state of Rhineland-Palatinate, capital of the District of Neuwied. Neuwied lies on the east bank of the Rhine, 12 km northwest of Koblenz, on the railway from Frankfurt am Main to Cologne. Th ...

) in Germany. By the time of Raiffeisen's death in 1888, credit unions had spread to Italy, France, the Netherlands, England, Austria, and other nations.

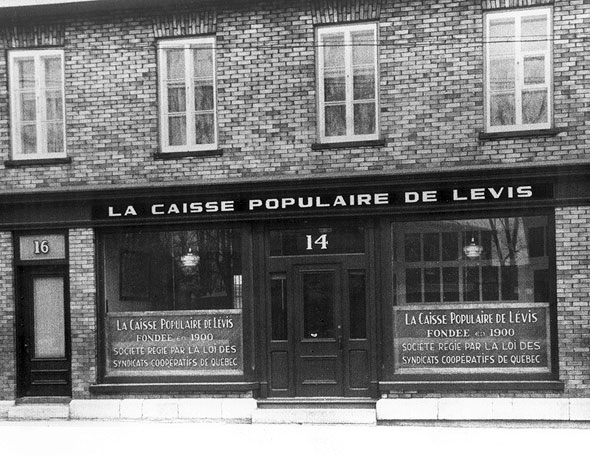

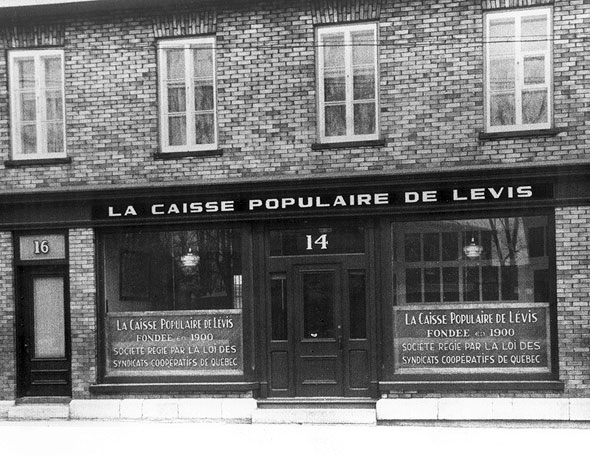

The first credit union in North America, the Caisse Populaire de Lévis in Quebec

Quebec ( ; )According to the Canadian government, ''Québec'' (with the acute accent) is the official name in Canadian French and ''Quebec'' (without the accent) is the province's official name in Canadian English is one of the thirte ...

, Canada, began operations on 23 January 1901 with a 10-cent deposit. Founder Alphonse Desjardins, a reporter in the Canadian parliament, was moved to take up his mission in 1897 when he learned of a Montrealer who had been ordered by the court to pay nearly Can$

The Canadian dollar (symbol: $; code: CAD; french: dollar canadien) is the currency of Canada. It is abbreviated with the dollar sign $, there is no standard disambiguating form, but the abbreviation Can$ is often suggested by notable style ...

5,000 in interest on a loan of $150 from a moneylender. Drawing extensively on European precedents, Desjardins developed a unique parish-based model for Quebec: the ''caisse populaire''.

In the United States, St. Mary's Bank Credit Union of Manchester, New Hampshire

Manchester is a city in Hillsborough County, New Hampshire, United States. It is the most populous city in New Hampshire. At the 2020 census, the city had a population of 115,644.

Manchester is, along with Nashua, one of two seats of New Ha ...

, was the first credit union. Assisted by a personal visit from Desjardins, St. Mary's was founded by French-speaking

French ( or ) is a Romance language of the Indo-European family. It descended from the Vulgar Latin of the Roman Empire, as did all Romance languages. French evolved from Gallo-Romance, the Latin spoken in Gaul, and more specifically in No ...

immigrants to Manchester from Quebec on 24 November 1908. Several Little Canadas throughout New England

New England is a region comprising six states in the Northeastern United States: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont. It is bordered by the state of New York to the west and by the Canadian provinces ...

formed similar credit unions, often out of necessity, as Anglo-American

Anglo-Americans are people who are English-speaking inhabitants of Anglo-America. It typically refers to the nations and ethnic groups in the Americas that speak English as a native language, making up the majority of people in the world who spe ...

banks frequently rejected Franco-American loans. America's Credit Union Museum

America's Credit Union Museum is located in Manchester, New Hampshire, on the site of the first credit union founded in the United States. The museum is housed at the original location for St. Mary's Cooperative Credit Association, renamed in 1 ...

now occupies the location of the home from which St. Mary's Bank Credit Union first operated. In November 1910 the Woman's Educational and Industrial Union set up the Industrial Credit Union, modeled on the Desjardins credit unions it was the first non-faith-based community credit union serving all people in the greater Boston area. The oldest statewide credit union in the United States was established in 1913. The St. Mary's Bank Credit Union serves any resident of the Commonwealth of Massachusetts

Massachusetts ( Massachusett: ''Muhsachuweesut Massachusett_writing_systems.html" ;"title="nowiki/> məhswatʃəwiːsət.html" ;"title="Massachusett writing systems">məhswatʃəwiːsət">Massachusett writing systems">məhswatʃəwiːsət'' E ...

.

After being promoted by the Catholic Church

The Catholic Church, also known as the Roman Catholic Church, is the List of Christian denominations by number of members, largest Christian church, with 1.3 billion baptized Catholics Catholic Church by country, worldwide . It is am ...

in the 1940s to assist the poor in Latin America

Latin America or

* french: Amérique Latine, link=no

* ht, Amerik Latin, link=no

* pt, América Latina, link=no, name=a, sometimes referred to as LatAm is a large cultural region in the Americas where Romance languages — languages derived ...

, credit unions expanded rapidly during the 1950s and 1960s, especially in Bolivia, Costa Rica, the Dominican Republic, Honduras, and Peru. The Regional Confederation of Latin American Credit Unions (COLAC) was formed and with funding by the Inter-American Development Bank

The Inter-American Development Bank (IDB or IADB) is an international financial institution headquartered in Washington, D.C., United States of America, and serving as the largest source of development financing for Latin America and the Carib ...

credit unions in the regions grew rapidly throughout the 1970s and into the early 1980s. By 1988 COLAC credit unions represented 4 million members across 17 countries with a loan portfolio of circa US$0.5 billion. However, from the late 1970s onwards many Latin American credit unions struggled with inflation, stagnating membership, and serious loan recovery problems. In the 1980s donor agencies such as USAID

The United States Agency for International Development (USAID) is an independent agency of the U.S. federal government that is primarily responsible for administering civilian foreign aid and development assistance. With a budget of over $27 bi ...

attempted to rehabilitate Latin American credit unions by providing technical assistance and focusing credit unions' efforts on mobilising deposits from the local population. In 1987, the regional financial crisis caused a run on credit unions. Significant withdrawals and high default rates caused liquidity problems for many credit unions in the region.

Stability and risks

Credit unions and banks in most jurisdictions are legally required to maintain a reserve requirement of assets to liabilities. If a credit union or traditional bank is unable to maintain positive cash flow and/or is forced to declare insolvency, its assets are distributed to creditors (including depositors) in order of seniority according to bankruptcy law. If the total deposits exceed the assets remaining after more senior creditors are paid, all depositors will lose some or all of their initial deposits. However, most jurisdictions have deposit insurance that promises to make depositors whole up to a maximum insurable account level.Corporate

Credit unions as such provide service only to individual consumers. ''Corporate credit unions'' (also known as ''central credit unions'' in Canada) provide service to credit unions, with operational support, funds clearing tasks, and product and service delivery.Leagues and associations

Credit unions often form cooperatives among themselves to provide services to members. Acredit union service organization

Credit union service organizations (CUSOs) are corporate entities in the United States that are owned by federally chartered or federally insured, state chartered credit unions.

Under US federal law and the National Credit Union Administration ...

(CUSO) is generally a for-profit subsidiary of one or more credit unions formed for this purpose. For example, CO-OP Financial Services

CU Cooperative Systems, Inc. doing business as Co-op Solutions (formerly d.b.a. CO-OP Financial Services), is a company that operates an interbank network connecting the ATMs of credit unions in the United States, with locations also in Canada ...

, the largest credit-union-owned interbank network

An interbank network, also known as an ATM consortium or ATM network, is a computer network that enables ATM cards issued by a financial institution that is a member of the network to be used to perform ATM transactions through ATMs that belo ...

in the United States, provides an ATM network and shared branching services to credit unions. Other examples of cooperatives among credit unions include credit counselling services as well as insurance and investment services.

State credit union leagues can partner with outside organizations to promote initiatives for credit unions or customers. For example, the Indiana Credit Union League sponsors an initiative called "Ignite", which is used to encourage innovation in the credit union industry, with the Filene Research Institute.

The National Association of Federally-Insured Credit Unions (NAFCU) is a national trade association for all state and federally-chartered credit unions. Based outside of Washington, D.C., NAFCU's mission is to provide all credit unions with federal advocacy, compliance assistance, and education.

The World Council of Credit Unions

The World Council of Credit Unions (WOCCU) is an international trade association and development agency for credit unions headquartered in Madison, Wisconsin. WOCCU aims to improve lives through credit unions and other financial cooperatives thr ...

(WOCCU) is both a trade association

A trade association, also known as an industry trade group, business association, sector association or industry body, is an organization founded and funded by businesses that operate in a specific industry. An industry trade association partic ...

for credit unions worldwide and a development agency

An aid agency, also known as development charity, is an organization dedicated to distributing aid. Many professional aid organisations exist, both within government, between governments as multilateral donors and as private voluntary organizatio ...

. The WOCCU's mission is to "assist its members and potential members to organize, expand, improve and integrate credit unions and related institutions as effective instruments for the economic and social development of all people".

The Credit Union National Association

The Credit Union National Association, commonly known as CUNA (pronounced "Cue-Nuh"), is a national trade association for both state- and federally chartered credit unions located in the United States. CUNA provides member credit unions with ...

(CUNA) is a national trade association for both state- and federally chartered credit unions located in the United States. The National Credit Union Foundation is the primary charitable arm of the United States' credit union movement and an affiliate of CUNA.

EverythingCU.com is an online community of credit union professionals.

Deposit insurance

In the United States, federal credit unions are chartered and overseen by theNational Credit Union Administration

The National Credit Union Administration (NCUA) is a government-backed insurer of credit unions in the United States, one of two agencies that provide deposit insurance to depositors in U.S. depository institutions, the other being the Feder ...

(NCUA), which also provides deposit insurance similar to the manner in which the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cr ...

(FDIC) provides deposit insurance to banks. State-chartered credit unions are overseen by the state's financial regulatory agency and may, but are not required to, obtain deposit insurance. Because of problems with bank failures in the past, no state provides deposit insurance and as such there are two primary sources for depository insurance – the NCUA and American Share Insurance (ASI), a private insurer based in Ohio.

In Canada, the majority of credit unions and ''caisses populaires'' are provincially incorporated and deposit insurance is provided by a provincial Crown corporation

A state-owned enterprise (SOE) is a government entity which is established or nationalised by the ''national government'' or ''provincial government'' by an executive order or an act of legislation in order to earn profit for the government ...

. For example, in Ontario up to 250,000 of eligible deposits in credit unions are insured by the Financial Services Regulatory Authority of Ontario

The Financial Services Regulatory Authority of Ontario (FSRA; french: Autorité ontarienne de réglementation des services financiers) is a self-funding Crown agency which acts as the financial regulator for the province of Ontario, Canada. Est ...

. Federal credit unions, such as the UNI Financial Cooperation

Caisse populaire acadienne ltée, operating as UNI Financial Cooperation (french: UNI Coopération financière), is a Francophone credit union (french: caisse populaire) based in New Brunswick, Canada whose members are primarily Acadians. UNI's ...

''caisse'' in New Brunswick, are incorporated under federal charters and are members of the Canada Deposit Insurance Corporation

The Canada Deposit Insurance Corporation (CDIC; french: Société d'assurance-dépôts du Canada) is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and ...

.

See also

*Bond of association

The (common) bond of association or common bond is the social connection among the members of credit unions and co-operative banks. Common bonds substitute for collateral in the early stages of financial system development. Like solidarity l ...

* Consumers' cooperative

A consumers' co-operative is an enterprise owned by consumers and managed democratically and that aims at fulfilling the needs and aspirations of its members. Such co-operatives operate within the market system, independently of the state, as a f ...

* Cooperative banking

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

Cooperative banking, as discussed here, includes retail banking car ...

* Capital market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers ...

* Community federal credit union

* Deposit account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained belo ...

* Democratic member control (cooperatives)

The Rochdale Principles are a set of ideals for the operation of cooperatives. They were first set out in 1844 by the Rochdale Pioneers, Rochdale Society of Equitable Pioneers in Rochdale, England and have formed the basis for the principles o ...

* History of credit unions

Credit unions are not-for-profit financial cooperatives. In the early stages of development of a nation's financial system, unserved and underserved populations must rely on risky and expensive informal financial services from sources like money l ...

* Humanomics

Humanomics is a national initiative that was launched by a number of credit unions across Canada on May 1, 2014. The purpose of the Program is to bring a human focus to the concept of economics, by having the participating credit unions support ...

* Labour Bank

* Credit unions in Canada

Canada has significant per-capita membership in credit unions, representing more than a third of the working-age population. Credit union membership is largest in Quebec, where they are known as ''caisses populaires'' (people's banks), and in west ...

* Credit unions in the United Kingdom

Credit unions in the United Kingdom were first established in the 1960s. Credit unions are member-owned financial cooperatives operated for the purpose of promoting thrift, providing credit and other financial services to their members.

Credit u ...

* Credit unions in the United States

Credit unions in the United States served 100 million members, comprising 43.7% of the economically active population, in 2014. U.S. credit unions are not-for-profit, cooperative, tax-exempt organizations. The clients of the credit unions become ...

References

Further reading

* Ian MacPherson. ''Hands Around the Globe: A History of the International Credit Union Movement and the Role and Development of the World Council of Credit Unions, Inc.'' Horsdal & Schubart Publishers Ltd, 1999. * F.W. Raiffeisen. ''The Credit Unions''. Trans. by Konrad Engelmann. The Raiffeisen Printing and Publishing Company, Neuwid on the Rhine, Germany, 1970. * Fountain, Wendell. ''The Credit Union World''. AuthorHouse, Bloomington, Indiana, 2007.External links

Credit Union National Association

national trade association for credit unions

World Council of Credit Unions

global trade association for credit unions

Association of Asian Confederations of Credit Unions

regional federation representing 21 national federations in Asia with 35 million retail members

National Credit Union Service Organization

directory of all credit unions in the U.S.

National Credit Union Foundation

charitable arm of credit union industry {{Authority control Cooperative banking Social economy Community building Financial services