corporate law on:

[Wikipedia]

[Google]

[Amazon]

Corporate law (also known as company law or enterprise law) is the body of law governing the

Companies returned to the forefront of commerce, although in England to circumvent the Bubble Act 1720 investors had reverted to trading the stock of unincorporated associations, until it was repealed in 1825. However, the process of obtaining Royal charters was insufficient to keep up with demand. In England there was a lively trade in the charters of defunct companies. It was not until the Joint Stock Companies Act 1844 that the first equivalent of modern companies, formed by registration, appeared. Soon after came the Limited Liability Act 1855, which in the event of a company's bankruptcy limited the liability of all shareholders to the amount of capital they had invested.

The beginning of modern company law came when the two pieces of legislation were codified under the Joint Stock Companies Act 1856 at the behest of the then Vice President of the Board of Trade, Mr Robert Lowe. That legislation shortly gave way to the railway boom, and from there the numbers of companies formed soared. In the later nineteenth century depression took hold, and just as company numbers had boomed, many began to implode and fall into insolvency. Much strong academic, legislative and judicial opinion was opposed to the notion that businessmen could escape accountability for their role in the failing businesses. The last significant development in the history of companies was the decision of the House of Lords in '' Salomon v. Salomon & Co.'' where the House of Lords confirmed the separate legal personality of the company, and that the liabilities of the company were separate and distinct from those of its owners.

Companies returned to the forefront of commerce, although in England to circumvent the Bubble Act 1720 investors had reverted to trading the stock of unincorporated associations, until it was repealed in 1825. However, the process of obtaining Royal charters was insufficient to keep up with demand. In England there was a lively trade in the charters of defunct companies. It was not until the Joint Stock Companies Act 1844 that the first equivalent of modern companies, formed by registration, appeared. Soon after came the Limited Liability Act 1855, which in the event of a company's bankruptcy limited the liability of all shareholders to the amount of capital they had invested.

The beginning of modern company law came when the two pieces of legislation were codified under the Joint Stock Companies Act 1856 at the behest of the then Vice President of the Board of Trade, Mr Robert Lowe. That legislation shortly gave way to the railway boom, and from there the numbers of companies formed soared. In the later nineteenth century depression took hold, and just as company numbers had boomed, many began to implode and fall into insolvency. Much strong academic, legislative and judicial opinion was opposed to the notion that businessmen could escape accountability for their role in the failing businesses. The last significant development in the history of companies was the decision of the House of Lords in '' Salomon v. Salomon & Co.'' where the House of Lords confirmed the separate legal personality of the company, and that the liabilities of the company were separate and distinct from those of its owners.

Aktiengesetz (AktG)

and th

The law will set out which rules are mandatory, and which rules can be derogated from. Examples of important rules which cannot be derogated from would usually include how to fire the

A Comparative Bibliography: Regulatory Competition on Corporate Law The Samuel and Ronnie Heyman Center on Corporate Governance Benjamin N. Cardozo School of LawThe Delaware Journal of Corporate LawInternational Financial Law Review

* {{Authority control Legal entities English law Business law Law and economics

rights

Rights are law, legal, social, or ethics, ethical principles of freedom or Entitlement (fair division), entitlement; that is, rights are the fundamental normative rules about what is allowed of people or owed to people according to some legal sy ...

, relations, and conduct of persons

A person (: people or persons, depending on context) is a being who has certain capacities or attributes such as reason, morality, consciousness or self-consciousness, and being a part of a culturally established form of social relations such ...

, companies

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specifi ...

, organization

An organization or organisation (English in the Commonwealth of Nations, Commonwealth English; American and British English spelling differences#-ise, -ize (-isation, -ization), see spelling differences) is an legal entity, entity—such as ...

s and business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for ...

es. The term refers to the legal practice of law relating to corporations, or to the theory of corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

s. Corporate law often describes the law relating to matters which derive directly from the life-cycle of a corporation.John Armour, Henry Hansmann, Reinier Kraakman, Mariana Pargendler "What is Corporate Law?" in ''The Anatomy of Corporate Law: A Comparative and Functional Approach''(Eds Reinier Kraakman, John Armour, Paul Davies, Luca Enriques, Henry Hansmann, Gerard Hertig, Klaus Hopt, Hideki Kanda, Mariana Pargendler, Wolf-Georg Ringe, and Edward Rock, Oxford University Press 2017)1.1 It thus encompasses the formation, funding, governance, and death of a corporation.

While the minute nature of corporate governance as personified by share ownership, capital market, and business culture rules differ, similar legal characteristics and legal problems exist across many jurisdictions. Corporate law regulates how corporations

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

, investors, shareholders, directors, employees, creditors, and other stakeholders such as consumer

A consumer is a person or a group who intends to order, or use purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...

s, the community

A community is a social unit (a group of people) with a shared socially-significant characteristic, such as place, set of norms, culture, religion, values, customs, or identity. Communities may share a sense of place situated in a given g ...

, and the environment interact with one another. Whilst the term company or business law is colloquially used interchangeably with corporate law, the term business law mostly refers to wider concepts of ''commercial law

Commercial law (or business law), which is also known by other names such as mercantile law or trade law depending on jurisdiction; is the body of law that applies to the rights, relations, and conduct of Legal person, persons and organizations ...

,'' that is the law relating to commercial and business related purposes and activities. In some cases, this may include matters relating to corporate governance

Corporate governance refers to the mechanisms, processes, practices, and relations by which corporations are controlled and operated by their boards of directors, managers, shareholders, and stakeholders.

Definitions

"Corporate governance" may ...

or financial law

Financial law is the law and regulation of the commercial banking, capital markets, insurance, derivatives and investment management sectors. Understanding financial law is crucial to appreciating the creation and formation of banking and finan ...

. When used as a substitute for corporate law, business law means the law relating to the ''business corporation'' (or business enterprises), including such activity as raising capital, company formation, and registration with the government.

Overview

Academics identify four legal characteristics universal to business enterprises. These are: * Separate legal personality of the corporation (access to tort and contract law in a manner similar to a person) *Limited liability

Limited liability is a legal status in which a person's financial Legal liability, liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company, or joint venture. If a company that provides limi ...

of the shareholders (a shareholder's personal liability is limited to the value of their shares in the corporation)

* Transferable shares (if the corporation is a "public company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) co ...

", the shares are publicly listed and traded)

* Delegated management under a board structure; the board of directors

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency.

The powers, duties, and responsibilities of a board of directors are determined by government regulatio ...

delegates day-to-day management of the company to executives. RC Clark, ''Corporate Law'' (Aspen 1986) 2; H Hansmann et al., ''Anatomy of Corporate Law'' (2004) ch 1 set out similar criteria, and in addition state modern companies involve shareholder ownership. However this latter feature is not the case in many European jurisdictions, where employees participate in their companies.

Widely available and user-friendly corporate law enables business participants to possess these four legal characteristics and thus transact as businesses. Thus, corporate law is a response to three endemic opportunism: conflicts between managers and shareholders, between controlling and non-controlling shareholders; and between shareholders and other contractual counterparts (including creditors and employees).

A corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

may accurately be called a company; however, a company should not necessarily be called a corporation, which has distinct characteristics. In the United States, a company may or may not be a separate legal entity, and is often used synonymous with "firm" or "business." According to Black's Law Dictionary, in America a company means "a corporation — or, less commonly, an association, partnership or union — that carries on industrial enterprise." Other types of business associations can include partnership

A partnership is an agreement where parties agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations ...

s (in the UK governed by the Partnership Act 1890), or trusts (such as a pension fund), or companies limited by guarantee (like some community organizations or charities). Corporate law deals with companies that are incorporated or registered under the corporate or company law of a sovereign state

A sovereign state is a State (polity), state that has the highest authority over a territory. It is commonly understood that Sovereignty#Sovereignty and independence, a sovereign state is independent. When referring to a specific polity, the ter ...

or their sub-national states.

The defining feature of a corporation is its legal independence from the shareholders that own it. Under corporate law, corporations of all sizes have separate legal personality, with limited or unlimited liability for its shareholders. Shareholders control the company through a board of directors

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency.

The powers, duties, and responsibilities of a board of directors are determined by government regulatio ...

which, in turn, typically delegates control of the corporation's day-to-day operations to a full-time executive. Shareholders' losses, in the event of liquidation, are limited to their stake in the corporation, and they are not liable for any remaining debts owed to the corporation's creditors. This rule is called limited liability

Limited liability is a legal status in which a person's financial Legal liability, liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company, or joint venture. If a company that provides limi ...

, and it is why the names of corporations end with " Ltd." or some variant such as " Inc." or " plc."

Under almost all legal systems corporations have much the same legal rights and obligations as individuals. In some jurisdictions, this extends to allow corporations to exercise human rights

Human rights are universally recognized Morality, moral principles or Social norm, norms that establish standards of human behavior and are often protected by both Municipal law, national and international laws. These rights are considered ...

against real individuals and the state, and they may be responsible for human rights violations. Just as they are "born" into existence through its members obtaining a certificate of incorporation, they can "die" when they lose money into insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet i ...

. Corporations can even be convicted of criminal offences, such as corporate fraud and corporate manslaughter.

History

Although some forms of companies are thought to have existed duringAncient Rome

In modern historiography, ancient Rome is the Roman people, Roman civilisation from the founding of Rome, founding of the Italian city of Rome in the 8th century BC to the Fall of the Western Roman Empire, collapse of the Western Roman Em ...

and Ancient Greece

Ancient Greece () was a northeastern Mediterranean civilization, existing from the Greek Dark Ages of the 12th–9th centuries BC to the end of classical antiquity (), that comprised a loose collection of culturally and linguistically r ...

, the closest recognizable ancestors of the modern company did not appear until the 16th century. With increasing international trade, Royal charter

A royal charter is a formal grant issued by a monarch under royal prerogative as letters patent. Historically, they have been used to promulgate public laws, the most famous example being the English Magna Carta (great charter) of 1215, but ...

s were granted in Europe (notably in England

England is a Countries of the United Kingdom, country that is part of the United Kingdom. It is located on the island of Great Britain, of which it covers about 62%, and List of islands of England, more than 100 smaller adjacent islands. It ...

and Holland

Holland is a geographical regionG. Geerts & H. Heestermans, 1981, ''Groot Woordenboek der Nederlandse Taal. Deel I'', Van Dale Lexicografie, Utrecht, p 1105 and former provinces of the Netherlands, province on the western coast of the Netherland ...

) to merchant adventurers. The Royal charters usually conferred special privileges on the trading company (including, usually, some form of monopoly

A monopoly (from Greek language, Greek and ) is a market in which one person or company is the only supplier of a particular good or service. A monopoly is characterized by a lack of economic Competition (economics), competition to produce ...

). Originally, traders in these entities traded stock on their own account, but later the members came to operate on joint account and with joint stock, and the new Joint stock company was born.

Early companies were purely economic ventures; it was only a belatedly established benefit of holding joint stock that the company's stock could not be seized for the debts of any individual member. The development of company law in Europe was hampered by two notorious "bubbles" (the South Sea Bubble in England and the Tulip Bulb Bubble in the Dutch Republic

The United Provinces of the Netherlands, commonly referred to in historiography as the Dutch Republic, was a confederation that existed from 1579 until the Batavian Revolution in 1795. It was a predecessor state of the present-day Netherlands ...

) in the 17th century, which set the development of companies in the two leading jurisdictions back by over a century in popular estimation.

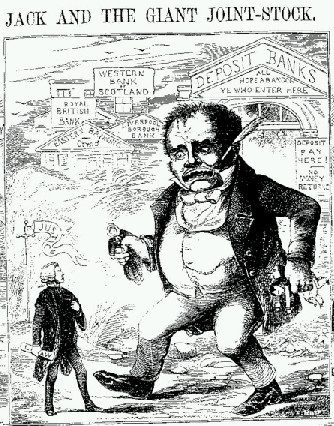

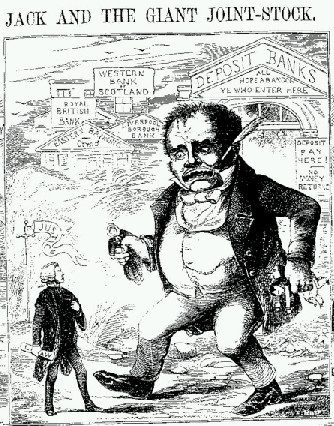

Companies returned to the forefront of commerce, although in England to circumvent the Bubble Act 1720 investors had reverted to trading the stock of unincorporated associations, until it was repealed in 1825. However, the process of obtaining Royal charters was insufficient to keep up with demand. In England there was a lively trade in the charters of defunct companies. It was not until the Joint Stock Companies Act 1844 that the first equivalent of modern companies, formed by registration, appeared. Soon after came the Limited Liability Act 1855, which in the event of a company's bankruptcy limited the liability of all shareholders to the amount of capital they had invested.

The beginning of modern company law came when the two pieces of legislation were codified under the Joint Stock Companies Act 1856 at the behest of the then Vice President of the Board of Trade, Mr Robert Lowe. That legislation shortly gave way to the railway boom, and from there the numbers of companies formed soared. In the later nineteenth century depression took hold, and just as company numbers had boomed, many began to implode and fall into insolvency. Much strong academic, legislative and judicial opinion was opposed to the notion that businessmen could escape accountability for their role in the failing businesses. The last significant development in the history of companies was the decision of the House of Lords in '' Salomon v. Salomon & Co.'' where the House of Lords confirmed the separate legal personality of the company, and that the liabilities of the company were separate and distinct from those of its owners.

Companies returned to the forefront of commerce, although in England to circumvent the Bubble Act 1720 investors had reverted to trading the stock of unincorporated associations, until it was repealed in 1825. However, the process of obtaining Royal charters was insufficient to keep up with demand. In England there was a lively trade in the charters of defunct companies. It was not until the Joint Stock Companies Act 1844 that the first equivalent of modern companies, formed by registration, appeared. Soon after came the Limited Liability Act 1855, which in the event of a company's bankruptcy limited the liability of all shareholders to the amount of capital they had invested.

The beginning of modern company law came when the two pieces of legislation were codified under the Joint Stock Companies Act 1856 at the behest of the then Vice President of the Board of Trade, Mr Robert Lowe. That legislation shortly gave way to the railway boom, and from there the numbers of companies formed soared. In the later nineteenth century depression took hold, and just as company numbers had boomed, many began to implode and fall into insolvency. Much strong academic, legislative and judicial opinion was opposed to the notion that businessmen could escape accountability for their role in the failing businesses. The last significant development in the history of companies was the decision of the House of Lords in '' Salomon v. Salomon & Co.'' where the House of Lords confirmed the separate legal personality of the company, and that the liabilities of the company were separate and distinct from those of its owners.

Corporate structure

The law of business organizations originally derived from thecommon law

Common law (also known as judicial precedent, judge-made law, or case law) is the body of law primarily developed through judicial decisions rather than statutes. Although common law may incorporate certain statutes, it is largely based on prece ...

of England

England is a Countries of the United Kingdom, country that is part of the United Kingdom. It is located on the island of Great Britain, of which it covers about 62%, and List of islands of England, more than 100 smaller adjacent islands. It ...

, and has evolved significantly in the 20th century. In common law countries today, the most commonly addressed forms are:

* Corporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

* Limited company

In a limited company, the Legal liability, liability of members or subscribers of the company is limited to what they have invested or guaranteed to the company. Limited companies may be limited by Share (finance), shares or by guarantee. In a c ...

* Unlimited company

* Limited liability partnership

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit aspects of both partnerships and corporations. In an LLP, each partner is n ...

* Limited partnership

A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnership ...

* Not-for-profit corporation

A nonprofit corporation is any legal entity which has been incorporated under the law of its jurisdiction for purposes other than making profits for its owners or shareholders. Depending on the laws of the jurisdiction, a nonprofit corporation m ...

* Company limited by guarantee

* Partnership

A partnership is an agreement where parties agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations ...

* Sole proprietorship

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by only one person and in which there is no legal distinction between the owner and the business entity. ...

* Privately held company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equi ...

The proprietary limited company is a statutory business form in several countries, including Australia

Australia, officially the Commonwealth of Australia, is a country comprising mainland Australia, the mainland of the Australia (continent), Australian continent, the island of Tasmania and list of islands of Australia, numerous smaller isl ...

. Many countries have forms of business entity unique to that country, although there are equivalents elsewhere. Examples are the limited liability company

A limited liability company (LLC) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of ...

(LLC) and the limited liability limited partnership (LLLP) in the United States. Other types of business organizations, such as cooperative

A cooperative (also known as co-operative, coöperative, co-op, or coop) is "an autonomy, autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned a ...

s, credit unions and publicly owned enterprises, can be established with purposes that parallel, supersede, or even replace the profit maximization mandate of business corporations.

There are various types of company that can be formed in different jurisdictions, but the most common forms of company are:

* ''a company limited by guarantee''. Commonly used where companies are formed for non-commercial purposes, such as clubs or charities. The members guarantee the payment of certain (usually nominal) amounts if the company goes into insolvent liquidation, but otherwise they have no economic rights in relation to the company .

* ''a company limited by guarantee with a share capital''. A hybrid entity, usually used where the company is formed for non-commercial purposes, but the activities of the company are partly funded by investors who expect a return.

* ''a company limited by shares''. The most common form of company used for business ventures.

* ''an unlimited company'' either with or without a share capital. This is a hybrid company, a company similar to its limited company (Ltd.) counterpart but where the members or shareholders do not benefit from limited liability should the company ever go into formal liquidation

Liquidation is the process in accounting by which a Company (law), company is brought to an end. The assets and property of the business are redistributed. When a firm has been liquidated, it is sometimes referred to as :wikt:wind up#Noun, w ...

.

There are, however, many specific categories of corporations and other business organizations which may be formed in various countries and jurisdiction

Jurisdiction (from Latin 'law' and 'speech' or 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, the concept of jurisdiction applies at multiple level ...

s throughout the world.

Corporate legal personality

One of the key legal features of corporations are their separate legal personality, also known as "personhood" or being "artificial persons". However, the separate legal personality was not confirmed underEnglish law

English law is the common law list of national legal systems, legal system of England and Wales, comprising mainly English criminal law, criminal law and Civil law (common law), civil law, each branch having its own Courts of England and Wales, ...

until 1895 by the House of Lords

The House of Lords is the upper house of the Parliament of the United Kingdom. Like the lower house, the House of Commons of the United Kingdom, House of Commons, it meets in the Palace of Westminster in London, England. One of the oldest ext ...

in '' Salomon v. Salomon & Co.'' Separate legal personality often has unintended consequences, particularly in relation to smaller, family companies. In '' B v. B'' 978Fam 181 it was held that a discovery order obtained by a wife against her husband was not effective against the husband's company as it was not named in the order and was separate and distinct from him. And in '' Macaura v. Northern Assurance Co Ltd'' a claim under an insurance policy failed where the insured had transferred timber from his name into the name of a company wholly owned by him, and it was subsequently destroyed in a fire; as the property now belonged to the company and not to him, he no longer had an "insurable interest" in it and his claim failed.

Separate legal personality allows corporate groups flexibility in relation to tax planning, and management of overseas liability. For instance in '' Adams v. Cape Industries plc'' it was held that victims of asbestos poisoning at the hands of an American subsidiary could not sue the English parent in tort. Whilst academic discussion highlights certain specific situations where courts are generally prepared to " pierce the corporate veil", to look directly at, and impose liability directly on the individuals behind the company; the actual practice of piercing the corporate veil is, at English law, non-existent. However, the court will look beyond the corporate form where the corporation is a sham or perpetuating a fraud. The most commonly cited examples are:

* where the company is a mere façade

* where the company is effectively just the agent of its members or controllers

* where a representative of the company has taken some personal responsibility for a statement or action

* where the company is engaged in fraud or other criminal wrongdoing

* where the natural interpretation of a contract or statute is as a reference to the corporate group and not the individual company

* where permitted by statute (for example, many jurisdictions provide for shareholder liability where a company breaches environmental protection laws)

Capacity and powers

Historically, because companies are artificial persons created by operation of law, the law prescribed what the company could and could not do. Usually this was an expression of the commercial purpose which the company was formed for, and came to be referred to as the company's ''objects'', and the extent of the objects are referred to as the company's capacity. If an activity fell outside the company's capacity it was said to be '' ultra vires'' and void. By way of distinction, the organs of the company were expressed to have various ''corporate powers''. If the objects were the things that the company was able to do, then the powers were the means by which it could do them. Usually expressions of powers were limited to methods of raising capital, although from earlier times distinctions between objects and powers have caused lawyers difficulty. Most jurisdictions have now modified the position by statute, and companies generally have capacity to do all the things that a natural person could do, and power to do it in any way that a natural person could do it. However, references to corporate capacity and powers have not quite been consigned to the dustbin of legal history. In many jurisdictions, directors can still be liable to their shareholders if they cause the company to engage in businesses outside its objects, even if the transactions are still valid as between the company and the third party. And many jurisdictions also still permit transactions to be challenged for lack of " corporate benefit", where the relevant transaction has no prospect of being for the commercial benefit of the company or its shareholders. As artificial persons, companies can only act through human agents. The main agent who deals with the company's management and business is theboard of directors

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency.

The powers, duties, and responsibilities of a board of directors are determined by government regulatio ...

, but in many jurisdictions other officers can be appointed too. The board of directors is normally elected by the members, and the other officers are normally appointed by the board. These agents enter into contracts on behalf of the company with third parties.

Although the company's agents owe duties to the company (and, indirectly, to the shareholders) to exercise those powers for a proper purpose, generally speaking third parties' rights are not impugned if it transpires that the officers were acting improperly. Third parties are entitled to rely on the ostensible authority of agents held out by the company to act on its behalf. A line of common law cases reaching back to '' Royal British Bank v Turquand'' established in common law that third parties were entitled to assume that the internal management of the company was being conducted properly, and the rule has now been codified into statute in most countries.

Accordingly, companies will normally be liable for all the act and omissions of their officers and agents. This will include almost all torts

A tort is a civil wrong, other than breach of contract, that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act. Tort law can be contrasted with criminal law, which deals with c ...

, but the law relating to crimes committed by companies is complex, and varies significantly between countries.

Corporate crime

* Corporate Manslaughter and Corporate Homicide Act 2007Corporate governance

Corporate governance is primarily the study of the power relations among a corporation's senior executives, itsboard of directors

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency.

The powers, duties, and responsibilities of a board of directors are determined by government regulatio ...

and those who elect them ( shareholders in the " general meeting" and employees), as well as other stakeholders, such as creditors, consumer

A consumer is a person or a group who intends to order, or use purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...

s, the environment and the community

A community is a social unit (a group of people) with a shared socially-significant characteristic, such as place, set of norms, culture, religion, values, customs, or identity. Communities may share a sense of place situated in a given g ...

at large. One of the main differences between different countries in the internal form of companies is between a two-tier and a one tier board. The United Kingdom, the United States, and most Commonwealth countries have single unified boards of directors. In Germany, companies have two tiers, so that shareholders (and employees) elect a "supervisory board", and then the supervisory board chooses the "management board". There is the option to use two tiers in France, and in the new European Companies ().

Recent literature, especially from the United States, has begun to discuss corporate governance in the terms of management science. While post-war discourse centred on how to achieve effective "corporate democracy" for shareholders or other stakeholders, many scholars have shifted to discussing the law in terms of principal–agent problems. On this view, the basic issue of corporate law is that when a "principal" party delegates his property (usually the shareholder's capital, but also the employee's labour) into the control of an "agent" (i.e. the director of the company) there is the possibility that the agent will act in his own interests, be "opportunistic", rather than fulfill the wishes of the principal. Reducing the risks of this opportunism, or the "agency cost", is said to be central to the goal of corporate law.

Constitution

The rules for corporations derive from two sources. These are the country's statutes: in the US, usually the Delaware General Corporation Law (DGCL); in the UK, the Companies Act 2006 (CA 2006); in Germany, thAktiengesetz (AktG)

and th

The law will set out which rules are mandatory, and which rules can be derogated from. Examples of important rules which cannot be derogated from would usually include how to fire the

board of directors

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency.

The powers, duties, and responsibilities of a board of directors are determined by government regulatio ...

, what duties directors owe to the company or when a company must be dissolved as it approaches bankruptcy. Examples of rules that members of a company would be allowed to change and choose could include, what kind of procedure general meetings should follow, when dividends get paid out, or how many members (beyond a minimum set out in the law) can amend the constitution. Usually, the statute will set out model articles, which the corporation's constitution will be assumed to have if it is silent on a bit of particular procedure.

The United States, and a few other common law countries, split the corporate constitution into two separate documents (the UK got rid of this in 2006). The memorandum of association

The memorandum of association of a company is an important corporate document in certain jurisdictions. It is often simply referred to as the memorandum. In the UK, it has to be filed with the Registrar of Companies during the process of incorp ...

(or articles of incorporation) is the primary document, and will generally regulate the company's activities with the outside world. It states which objects the company is meant to follow (e.g. "this company makes automobiles") and specifies the authorised share capital of the company. The articles of association (or by-laws) is the secondary document, and will generally regulate the company's internal affairs and management, such as procedures for board meetings, dividend entitlements etc. In the event of any inconsistency, the memorandum prevails and in the United States only the memorandum is publicised. In civil law jurisdictions, the company's constitution is normally consolidated into a single document, often called the charter

A charter is the grant of authority or rights, stating that the granter formally recognizes the prerogative of the recipient to exercise the rights specified. It is implicit that the granter retains superiority (or sovereignty), and that the ...

.

It is quite common for members of a company to supplement the corporate constitution with additional arrangements, such as '' shareholders' agreements'', whereby they agree to exercise their membership rights in a certain way. Conceptually a shareholders' agreement fulfills many of the same functions as the corporate constitution, but because it is a contract, it will not normally bind new members of the company unless they accede to it somehow. One benefit of shareholders' agreement is that they will usually be confidential, as most jurisdictions do not require shareholders' agreements to be publicly filed. Another common method of supplementing the corporate constitution is by means of '' voting trusts'', although these are relatively uncommon outside the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

and certain offshore jurisdictions. Some jurisdictions consider the company seal

A company seal (sometimes referred to as the corporate seal or common seal) is an official seal used by a company. Company seals were predominantly used by companies in common law jurisdictions, although in modern times, most countries have done ...

to be a part of the "constitution" (in the loose sense of the word) of the company, but the requirement for a seal has been abrogated by legislation in most countries.

Balance of power

The most important rules for corporate governance are those concerning the balance of power between theboard of directors

A board of directors is a governing body that supervises the activities of a business, a nonprofit organization, or a government agency.

The powers, duties, and responsibilities of a board of directors are determined by government regulatio ...

and the members of the company. Authority is given or "delegated" to the board to manage the company for the success of the investors. Certain specific decision rights are often reserved for shareholders, where their interests could be fundamentally affected. There are necessarily rules on when directors can be removed from office and replaced. To do that, meetings need to be called to vote on the issues. How easily the constitution can be amended and by whom necessarily affects the relations of power.

It is a principle of corporate law that the directors of a company have the right to manage. This is expressed in statute in the DGCL, where §141(a) states,

In Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

, §76 AktG says the same for the management board, while under §111 AktG the supervisory board's role is stated to be to "oversee" (''überwachen''). In the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

, the right to manage is not laid down in law, but is found in Part.2 of the Model Articles. This means it is a default rule, which companies can opt out of (s.20 CA 2006) by reserving powers to members, although companies rarely do. UK law specifically reserves shareholders right and duty to approve "substantial non cash asset transactions" (s.190 CA 2006), which means those over 10% of company value, with a minimum of £5,000 and a maximum of £100,000. Similar rules, though much less stringent, exist in §271 DGCL and through case law in Germany under the so-called '' Holzmüller-Doktrin''.

Probably the most fundamental guarantee that directors will act in the members' interests is that they can easily be sacked. During the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, two Harvard

Harvard University is a private Ivy League research university in Cambridge, Massachusetts, United States. Founded in 1636 and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of higher lear ...

scholars, Adolf Berle and Gardiner Means wrote '' The Modern Corporation and Private Property'', an attack on American law which failed to hold directors to account, and linked the growing power and autonomy of directors to the economic crisis. In the UK, the right of members to remove directors by a simple majority is assured under s.168 CA 2006 Moreover, Art.21 of the Model Articles requires a third of the board to put themselves up for re-election every year (in effect creating maximum three year terms). 10% of shareholders can demand a meeting any time, and 5% can if it has been a year since the last one (s.303 CA 2006). In Germany, where employee participation creates the need for greater boardroom stability, §84(3) AktG states that management board directors can only be removed by the supervisory board for an important reason (''ein wichtiger Grund'') though this can include a vote of no-confidence by the shareholders. Terms last for five years, unless 75% of shareholders vote otherwise. §122 AktG lets 10% of shareholders demand a meeting. In the US, Delaware lets directors enjoy considerable autonomy. §141(k) DGCL states that directors can be removed without any cause, unless the board is "classified", meaning that directors only come up for re-appointment on different years. If the board is classified, then directors cannot be removed unless there is gross misconduct. Director's autonomy from shareholders is seen further in §216 DGCL, which allows for plurality voting and §211(d) which states shareholder meetings can only be called if the constitution allows for it. The problem is that in America, directors usually choose where a company is incorporated and §242(b)(1) DGCL says any constitutional amendment requires a resolution by the directors. By contrast, constitutional amendments can be made at any time by 75% of shareholders in Germany (§179 AktG) and the UK (s.21 CA 2006).

Countries with co-determination employ the practice of workers of an enterprise having the right to vote for representatives on the board of directors in a company.

Director duties

In most jurisdictions, directors owe strict duties of good faith, as well as duties of care and skill, to safeguard the interests of the company and the members. In many developed countries outside the English speaking world, company boards are appointed as representatives of both shareholders and employees to " codetermine" company strategy. Corporate law is often divided intocorporate governance

Corporate governance refers to the mechanisms, processes, practices, and relations by which corporations are controlled and operated by their boards of directors, managers, shareholders, and stakeholders.

Definitions

"Corporate governance" may ...

(which concerns the various power relations within a corporation) and corporate finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analy ...

(which concerns the rules on how capital is used).

Directors also owe strict duties not to permit any conflict of interest

A conflict of interest (COI) is a situation in which a person or organization is involved in multiple wikt:interest#Noun, interests, financial or otherwise, and serving one interest could involve working against another. Typically, this relates t ...

or conflict with their duty to act in the best interests of the company. This rule is so strictly enforced that, even where the conflict of interest or conflict of duty is purely hypothetical, the directors can be forced to disgorge all personal gains arising from it. In '' Aberdeen Ry v. Blaikie'' (1854) 1 Macq HL 461 Lord Cranworth stated in his judgment that, However, in many jurisdictions the members of the company are permitted to ratify transactions which would otherwise fall foul of this principle. It is also largely accepted in most jurisdictions that this principle should be capable of being abrogated in the company's constitution.

The standard of skill and care that a director owes is usually described as acquiring and maintaining sufficient knowledge and understanding of the company's business to enable him to properly discharge his duties. This duty enables the company to seek compensation from its director if it can be proved that a director has not shown reasonable skill or care which in turn has caused the company to incur a loss. In many jurisdictions, where a company continues to trade despite foreseeable bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the deb ...

, the directors can be forced to account for trading losses personally. Directors are also strictly charged to exercise their powers only for a proper purpose. For instance, were a director to issue a large number of new shares, not for the purposes of raising capital but in order to defeat a potential takeover bid, that would be an improper purpose.

Company law theory

Ronald Coase has pointed out, all business organizations represent an attempt to avoid certain costs associated with doing business. Each is meant to facilitate the contribution of specific resources - investment capital, knowledge, relationships, and so forth - towards a venture which will prove profitable to all contributors. Except for the partnership, all business forms are designed to providelimited liability

Limited liability is a legal status in which a person's financial Legal liability, liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company, or joint venture. If a company that provides limi ...

to both members of the organization and external investors. Business organizations originated with agency law, which permits an agent to act on behalf of a principal, in exchange for the principal assuming equal liability for the wrongful acts committed by the agent. For this reason, all partners in a typical general partnership may be held liable for the wrongs committed by one partner. Those forms that provide limited liability are able to do so because the state provides a mechanism by which businesses that follow certain guidelines will be able to escape the full liability imposed under agency law. The state provides these forms because it has an interest in the strength of the companies that provide jobs and services therein, but also has an interest in monitoring and regulating their behaviour.

Litigation

Members of a company generally have rights against each other and against the company, as framed under the company's constitution. However, members cannot generally claim against third parties who cause damage to the company which results in a diminution in the value of their shares or others membership interests because this is treated as " reflective loss" and the law normally regards the company as the proper claimant in such cases. In relation to the exercise of their rights, minority shareholders usually have to accept that, because of the limits of their voting rights, they cannot direct the overall control of the company and must accept the will of the majority (often expressed as ''majority rule''). However, majority rule can be iniquitous, particularly where there is one controlling shareholder. Accordingly, a number of exceptions have developed in law in relation to the general principle of majority rule. * Where the majority shareholder(s) are exercising their votes to perpetrate a fraud on the minority, the courts may permit the minority to sue * members always retain the right to sue if the majority acts to invade their personal rights, e.g. where the company's affairs are not conducted in accordance with the company's constitution (this position has been debated because the extent of a personal right is not set in law). ''Macdougall v Gardiner'' and ''Pender v Lushington'' present irreconcilable differences in this area. * in many jurisdictions it is possible for minority shareholders to take a ''representative'' or '' derivative action'' in the name of the company, where the company is controlled by the alleged wrongdoersCorporate finance

Through the operational life of the corporation, perhaps the most crucial aspect of corporate law relates to raising capital for the business to operate. The law, as it relates to corporate finance, not only provides the framework for which a business raises funds - but also provides a forum for principles and policies which drive the fundraising, to be taken seriously. Two primary methods of financing exists with regard to corporate financing, these are: *Equity financing; and *Debt financing Each has relative advantages and disadvantages, both at law and economically. Additional methods of raising capital necessary to finance its operations is that of retained profits Various combinations of financing structures have the capacity to produce fine-tuned transactions which, using the advantages of each form of financing, support the limitations of the corporate form, its industry, or economic sector.Gullifer and Payne ''Corporate Finance Law: Principles and Policy'' (2nd Edn Hart Publishing, 2015) 38 A mix of both debt and equity is crucial to the sustained health of the company, and its overall market value is independent of its capital structure. One notable difference is that interest payments to debt is tax deductible whilst payment of dividends are not, this will incentivise a company to issue debt financing rather than preferred stock in order to reduce their tax exposure.Shares and share capital

A company limited by shares, whether public or private, must have at least one issued share; however, depending on the corporate structure, the formatting may differ. If a company wishes to raise capital through equity, it will usually be done by issuing shares (sometimes called "stock" (not to be confused with stock-in-trade)) or warrants. In the common law, whilst a shareholder is often colloquially referred to as the owner of the company - it is clear that the shareholder is not an owner of the company but makes the shareholder a member of the company and entitles them to enforce the provisions of the company's constitution against the company and against other members. A share is an item of property, and can be sold or transferred. Shares also normally have a nominal or par value, which is the limit of the shareholder's liability to contribute to the debts of the company on an insolvent liquidation. Shares usually confer a number of rights on the holder. These will normally include: * voting rights * rights to dividends (or payments made by companies to their shareholders) declared by the company * rights to any return of capital either upon redemption of the share, or upon the liquidation of the company * in some countries, shareholders have preemption rights, whereby they have a preferential right to participate in future share issues by the company Companies may issue different types of shares, called "classes" of shares, offering different rights to the shareholders depending on the underlying regulatory rules pertaining to corporate structures, taxation, and capital market rules. A company might issue both ordinary shares and preference shares, with the two types having different voting and/or economic rights. It might provide that preference shareholders shall each receive a cumulative preferred dividend of a certain amount per annum, but the ordinary shareholders shall receive everything else. Corporations will structure capital raising in this way in order to appeal to different lenders in the market by providing different incentives for investment. The total value of issued shares in a company is said to represent its ''equity capital''. Most jurisdictions regulate the minimum amount of capital which a company may have, although some jurisdictions prescribe minimum amounts of capital for companies engaging in certain types of business (e.g.bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

ing, insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

etc.).

Similarly, most jurisdictions regulate the maintenance of equity capital, and prevent companies returning funds to shareholders by way of distribution when this might leave the company financially exposed. Often this extends to prohibiting a company from providing financial assistance for the purchase of its own shares.

Dissolution

Events such as mergers, acquisitions, insolvency, or the commission of a crime affect the corporate form. In addition to the creation of the corporation, and its financing, these events serve as a transition phase into either dissolution, or some other material shift.Mergers and acquisitions

A merger or acquisition can often mean the altering or extinguishing of the corporation.Corporate insolvency

If unable to discharge its debts in a timely manner, a corporation may end up on bankruptcy liquidation. Liquidation is the normal means by which a company's existence is brought to an end. It is also referred to (either alternatively or concurrently) in some jurisdictions as ''winding up'' or ''dissolution''. Liquidations generally come in two forms — either ''compulsory liquidations'' (sometimes called ''creditors' liquidations'') and ''voluntary liquidations'' (sometimes called ''members' liquidations'', although a voluntary liquidation where the company is insolvent will also be controlled by the creditors, and is properly referred to as a ''creditors' voluntary liquidation''). Where a company goes into liquidation, normally a liquidator is appointed to gather in all the company's assets and settle all claims against the company. If there is any surplus after paying off all the creditors of the company, this surplus is then distributed to the members. As its names imply, applications for compulsory liquidation are normally made by creditors of the company when the company is unable to pay its debts. However, in some jurisdictions, regulators have the power to apply for the liquidation of the company on the grounds of public good, i.e., where the company is believed to have engaged in unlawful conduct, or conduct which is otherwise harmful to the public at large. Voluntary liquidations occur when the company's members decide voluntarily to wind up the affairs of the company. This may be because they believe that the company will soon become insolvent, or it may be on economic grounds if they believe that the purpose for which the company was formed is now at an end, or that the company is not providing an adequate return on assets and should be broken up and sold off. Some jurisdictions also permit companies to be wound up on "just and equitable" grounds. Generally, applications for just and equitable winding-up are brought by a member of the company who alleges that the affairs of the company are being conducted in a prejudicial manner, and asking the court to bring an end to the company's existence. For obvious reasons, in most countries, the courts have been reluctant to wind up a company solely on the basis of the disappointment of one member, regardless of how well-founded that member's complaints are. Accordingly, most jurisdictions that permit just and equitable winding up also permit the court to impose other remedies, such as requiring the majority shareholder(s) to buy out the disappointed minority shareholder at a fair value.Insider dealing

Insider trading is the trading of acorporation

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

's stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporatio ...

or other securities (e.g., bonds or stock options) by individuals with potential access to non-public information about the company. In most countries, trading by corporate insiders such as officers, key employees, directors, and large shareholders may be legal if this trading is done in a way that does not take advantage of non-public information. However, the term is frequently used to refer to a practice in which an insider or a related party trades based on material

A material is a matter, substance or mixture of substances that constitutes an Physical object, object. Materials can be pure or impure, living or non-living matter. Materials can be classified on the basis of their physical property, physical ...

non-public information obtained during the performance of the insider's duties at the corporation, or otherwise in breach of a fiduciary

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (legal person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. One party, ...

or other relationship of trust and confidence or where the non-public information was misappropriated from the company. Illegal insider trading is believed to raise the cost of capital for securities issuers, thus decreasing overall economic growth.

In the United States and several other jurisdictions, trading conducted by corporate officers, key employees, directors, or significant shareholders (in the United States, defined as beneficial owners of ten percent or more of the firm's equity securities) must be reported to the regulator or publicly disclosed, usually within a few business days of the trade. Many investors follow the summaries of these insider trades in the hope that mimicking these trades will be profitable. While "legal" insider trading cannot be based on material non-public information, some investors believe corporate insiders nonetheless may have better insights into the health of a corporation (broadly speaking) and that their trades otherwise convey important information (e.g., about the pending retirement of an important officer selling shares, greater commitment to the corporation by officers purchasing shares, etc.)

Trends and developments

Most case law on the matter of corporate governance dates to the 1980s and primarily addresses hostile takeovers, however, current research considers the direction of legal reforms to address issues of shareholder activism,institutional investors

An institutional investor is an entity that pools money to purchase security (finance), securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, s ...

and capital market intermediaries. Corporations and boards are challenged to respond to these developments. Shareholder demographics have been effected by trends in worker retirement, with more institutional intermediaries like mutual funds playing a role in employee retirement. These funds are more motivated to partner with employers to have their fund included in a company's retirement plans than to vote their shares – corporate governance activities only increase costs for the fund, while the benefits would be shared equally with competitor funds.

Shareholder activism prioritizes wealth maximization and has been criticized as a poor basis for determining corporate governance rules. Shareholders do not decide corporate policy, that is done by the board of directors, but shareholders may vote to elect board directors and on mergers and other changes that have been approved by directors. They may also vote to amend corporate bylaws. Broadly speaking there have been three movements in 20th century American law that sought a federal corporate law: the Progressive Movement, some aspects of proposals made in the early stages of the New Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

and again in the 1970s during a debate about the effect of corporate decision making on states. However, these movements did not establish federal incorporation. Although there has been some federal involvement in corporate governance rules as a result, the relative rights of shareholders and corporate officers is still mostly regulated by state laws. There is no federal legislation like there is for corporate political contributions or regulation of monopolies and federal laws have developed along different lines than state laws.

By region

Europe

Germany

United Kingdom

United States

In theUnited States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, most corporations are incorporated, or organized, under the laws of a particular state. The laws of the state of incorporation normally governs a corporation's internal operations, even if the corporation's operations take place outside that state. Corporate law differs from state to state. Because of these differences, some businesses will benefit from having a corporate lawyer

A lawyer is a person who is qualified to offer advice about the law, draft legal documents, or represent individuals in legal matters.

The exact nature of a lawyer's work varies depending on the legal jurisdiction and the legal system, as w ...

determine the most appropriate or advantageous state in which to incorporate.

Business entities may also be regulated by federal laws and in some cases by local laws and ordinances.

Delaware

A majority of publicly traded companies in the U.S. are Delaware corporations. Some companies choose to incorporate in Delaware because the Delaware General Corporation Law offers lower corporate taxes than many other states. Many venture capitalists prefer to invest in Delaware corporations. Also, theDelaware Court of Chancery

The Delaware Court of Chancery is a court of equity in the U.S. state of Delaware. It is one of Delaware's three constitutional courts, along with the Supreme Court and Superior Court. Since 2018, the court consists of seven judges. The cour ...

is widely recognized as a good venue for the litigation of business disputes.

See also

References

External links

*A Comparative Bibliography: Regulatory Competition on Corporate Law

* {{Authority control Legal entities English law Business law Law and economics