Wells Fargo & Company is an American multinational financial services company with a significant global presence.

The company operates in 35 countries and serves over 70 million customers worldwide.

It is a

systemically important financial institution

A systemically important financial institution (SIFI) is a bank, insurance company, or other financial institution whose failure might trigger a financial crisis. They are colloquially referred to as "too big to fail".

As the 2008 financial cri ...

according to the

Financial Stability Board

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established in the 2009 G20 Pittsburgh Summit as a successor to the Financial Stability Forum (FSF) ...

, and is considered one of the "

Big Four Banks

The Big Four (or Big 4) is the colloquial name given to the four main banks in several countries where the banking industry is dominated by just four institutions and where the phrase has thus gained relevance. Some countries include more or fe ...

" in the United States, alongside

JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest ba ...

,

Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

, and

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, t ...

.

The company's primary subsidiary is Wells Fargo Bank, N.A., a

national bank that designates its

Sioux Falls, South Dakota

Sioux Falls ( ) is the List of cities in South Dakota, most populous city in the U.S. state of South Dakota and the List of United States cities by population, 117th-most populous city in the United States. It is the county seat of Minnehaha Coun ...

, site as its main office (and therefore is treated by most U.S. federal courts as a citizen of South Dakota).

Rouse v. Wachovia Mortgage, FSB

', 747 F.3d 707 (9th Cir. 2014) (citing cases on each side of circuit split and joining majority rule that a national bank is only a citizen of the state in which its main office is located). It is the

fourth-largest bank in the United States by total

assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can b ...

and is also one of the largest as ranked by

bank deposit

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

...

s and

market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

. It has 8,050 branches and 13,000

automated teller machines

Automation describes a wide range of technologies that reduce human intervention in processes, mainly by predetermining decision criteria, subprocess relationships, and related actions, as well as embodying those predeterminations in machine ...

and 2,000 stand-alone mortgage branches. It is the second-largest retail mortgage originator in the United States, originating one out of every four home loans, and services $1.8 trillion in home mortgages, one of the largest servicing portfolios in the U.S.

[ It is one of the most valuable bank brands. Wells Fargo is ranked 47th on the ]Fortune 500

The ''Fortune'' 500 is an annual list compiled and published by ''Fortune (magazine), Fortune'' magazine that ranks 500 of the largest United States Joint-stock company#Closely held corporations and publicly traded corporations, corporations by ...

list of the largest companies in the U.S.

In addition to banking, the company provides equipment financing via subsidiaries including Wells Fargo Rail and provides investment management

Investment management (sometimes referred to more generally as financial asset management) is the professional asset management of various Security (finance), securities, including shareholdings, Bond (finance), bonds, and other assets, such as r ...

and stockbroker

A stockbroker is an individual or company that buys and sells stocks and other investments for a financial market participant in return for a commission, markup, or fee. In most countries they are regulated as a broker or broker-dealer and ...

age services. A key part of Wells Fargo's business strategy is cross-selling

Cross-selling is a sales technique involving the selling of an additional product or service to an existing customer. In practice, businesses define cross-selling in many different ways. Elements that might influence the definition might includ ...

, the practice of encouraging existing customers to buy additional banking services.London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

, Dublin

Dublin is the capital and largest city of Republic of Ireland, Ireland. Situated on Dublin Bay at the mouth of the River Liffey, it is in the Provinces of Ireland, province of Leinster, and is bordered on the south by the Dublin Mountains, pa ...

, Paris

Paris () is the Capital city, capital and List of communes in France with over 20,000 inhabitants, largest city of France. With an estimated population of 2,048,472 residents in January 2025 in an area of more than , Paris is the List of ci ...

, Milan

Milan ( , , ; ) is a city in northern Italy, regional capital of Lombardy, the largest city in Italy by urban area and the List of cities in Italy, second-most-populous city proper in Italy after Rome. The city proper has a population of nea ...

, Dubai

Dubai (Help:IPA/English, /duːˈbaɪ/ Help:Pronunciation respelling key, ''doo-BYE''; Modern Standard Arabic, Modern Standard Arabic: ; Emirati Arabic, Emirati Arabic: , Romanization of Arabic, romanized: Help:IPA/English, /diˈbej/) is the Lis ...

, Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

, Tokyo

Tokyo, officially the Tokyo Metropolis, is the capital of Japan, capital and List of cities in Japan, most populous city in Japan. With a population of over 14 million in the city proper in 2023, it is List of largest cities, one of the most ...

, Shanghai

Shanghai, Shanghainese: , Standard Chinese pronunciation: is a direct-administered municipality and the most populous urban area in China. The city is located on the Chinese shoreline on the southern estuary of the Yangtze River, with the ...

, Beijing

Beijing, Chinese postal romanization, previously romanized as Peking, is the capital city of China. With more than 22 million residents, it is the world's List of national capitals by population, most populous national capital city as well as ...

, and Toronto

Toronto ( , locally pronounced or ) is the List of the largest municipalities in Canada by population, most populous city in Canada. It is the capital city of the Provinces and territories of Canada, Canadian province of Ontario. With a p ...

, among others. Back-offices are in India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

and the Philippines

The Philippines, officially the Republic of the Philippines, is an Archipelagic state, archipelagic country in Southeast Asia. Located in the western Pacific Ocean, it consists of List of islands of the Philippines, 7,641 islands, with a tot ...

with more than 20,000 staff. Notably, Wells Fargo is the first major national U.S. bank to undergo a successful unionization drive. As of 2024, 20 branch locations have joined Wells Fargo Workers United-CWA, a division of Communications Workers of America

The Communications Workers of America (CWA) is the largest communications and media labor union in the United States, representing about 700,000 members in both the private and public sectors (also in Canada and Puerto Rico). The union has 27 loc ...

, in less than a year.

Wells Fargo operates under Charter No. 1, the first national bank charter

A charter is the grant of authority or rights, stating that the granter formally recognizes the prerogative of the recipient to exercise the rights specified. It is implicit that the granter retains superiority (or sovereignty), and that the ...

issued in the United States. This charter was issued to First National Bank of Philadelphia on June 20, 1863, by the Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to corporate charter, charter, bank regulation ...

. Wells Fargo, in its present form, is a result of a merger between the original Wells Fargo & Company and Minneapolis

Minneapolis is a city in Hennepin County, Minnesota, United States, and its county seat. With a population of 429,954 as of the 2020 United States census, 2020 census, it is the state's List of cities in Minnesota, most populous city. Locat ...

-based Norwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

in 1998. The merged company took the better-known Wells Fargo name and moved to Wells Fargo's hub in San Francisco. At the same time, Norwest's banking subsidiary merged with Wells Fargo's Sioux Falls-based banking subsidiary. Wells Fargo became a coast-to-coast bank with the 2008 acquisition of Charlotte-based Wachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total asset ...

.

History

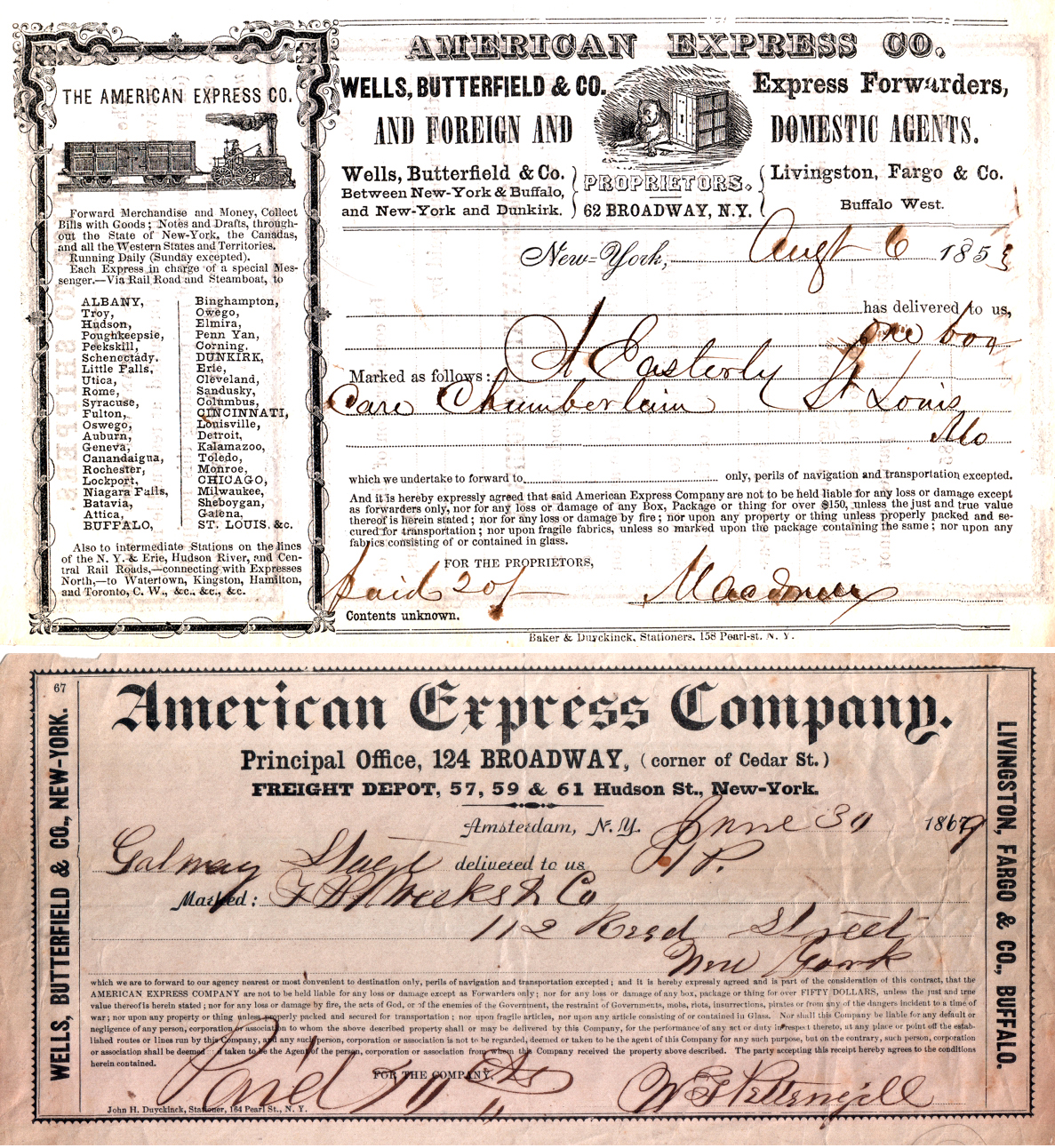

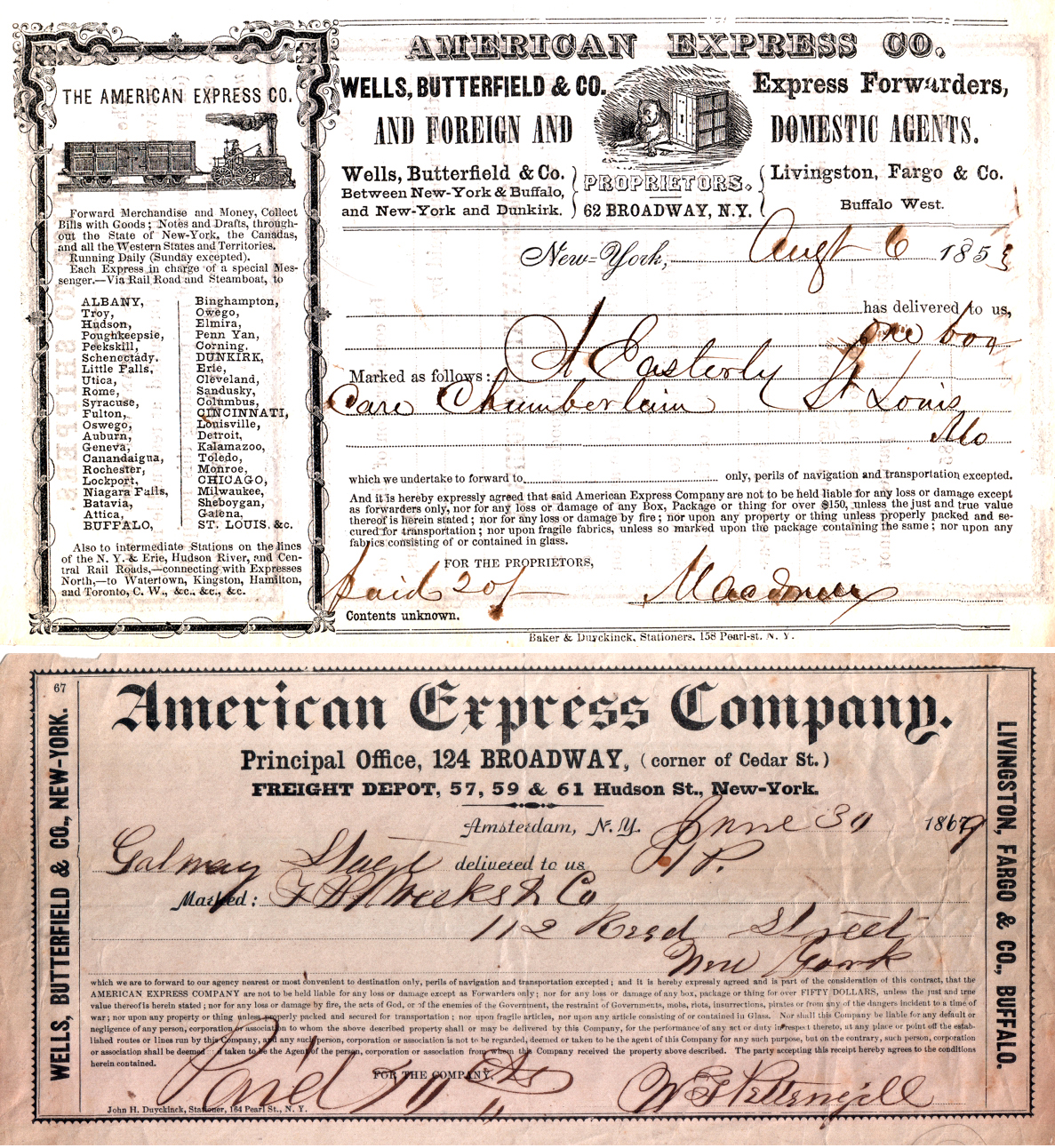

Henry Wells

Henry Wells (December 12, 1805 – December 10, 1878) was an American businessman important in the history of both the American Express Company and Wells Fargo & Company. Wells worked as a freight agent before joining the express business. Hi ...

and William G. Fargo, who founded American Express

American Express Company or Amex is an American bank holding company and multinational financial services corporation that specializes in payment card industry, payment cards. It is headquartered at 200 Vesey Street, also known as American Expr ...

along with John Butterfield, formed Wells Fargo & Company in 1852 to provide "express" and banking services to California, which was growing rapidly due to the California Gold Rush

The California gold rush (1848–1855) began on January 24, 1848, when gold was found by James W. Marshall at Sutter's Mill in Coloma, California. The news of gold brought approximately 300,000 people to California from the rest of the U ...

. Its earliest and most significant tasks included transporting gold from the Philadelphia Mint

The Philadelphia Mint is a branch of the United States Mint in Philadelphia. It was built in 1792 following the Coinage Act of 1792, in order to establish a national identity and the needs of commerce in the United States, and is the first and ...

and "express" mail delivery that was faster and less expensive than U.S. Mail. American Express was not interested in serving California.

By the end of the California Gold Rush

The California gold rush (1848–1855) began on January 24, 1848, when gold was found by James W. Marshall at Sutter's Mill in Coloma, California. The news of gold brought approximately 300,000 people to California from the rest of the U ...

, Wells Fargo was a dominant express and banking organization in the West, making large shipments of gold and delivering mail and supplies. It was also the primary lender of Butterfield Overland Mail

Butterfield Overland Mail (officially Overland Mail Company)Waterman L. Ormsby, edited by Lyle H. Wright and Josephine M. Bynum, "The Butterfield Overland Mail", The Huntington Library, San Marino, California, 1991. was a stagecoach service in ...

Company, which ran a 2,757-mile route through the Southwest to San Francisco and was nicknamed the "Butterfield Line" after the name of the company's president, John Butterfield. In 1860, Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of ...

failed to pass the annual Post Office appropriation bill

An appropriation bill, also known as supply bill or spending bill, is a proposed law that authorizes the expenditure of government funds. It is a bill that sets money aside for specific spending. In some democracies, approval of the legislature ...

, leaving the Post Office unable to pay Overland Mail Company. This caused Overland to default on its debts to Wells Fargo, allowing Wells Fargo to take control of the mail route. Wells Fargo then operated the western portion of the Pony Express

The Pony Express was an American express mail service that used relays of horse-mounted riders between Missouri and California. It was operated by the Central Overland California and Pikes Peak Express Company.

During its 18 months of opera ...

.

Six years later, the "Grand Consolidation" united Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

In 1872, Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad

A transcontinental railroad or transcontinental railway is contiguous rail transport, railroad trackage that crosses a continent, continental land mass and has terminals at different oceans or continental borders. Such networks may be via the Ra ...

, became president of the company after acquiring a large stake, a position he held until 1892.

In 1905, Wells Fargo separated its banking and express operations, and Wells Fargo's bank merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

During the First World War

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

, the United States government nationalized Wells Fargo's express business into a federal agency known as the US Railway Express Agency (REA). After the war, the REA was privatized and continued service until 1975.

In 1923, Wells Fargo Nevada merged with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.

In 1954, Wells Fargo & Union Trust shortened its name to Wells Fargo Bank. Four years later, it merged with American Trust Company to form the Wells Fargo Bank American Trust Company. It changed its name back to Wells Fargo Bank in 1962.

In 1968, Wells Fargo was converted to a federal banking charter and became Wells Fargo Bank, N.A. In that same year, Wells Fargo merged with Henry Trione's Sonoma Mortgage in a $10.8 million stock transfer, making Trione the largest shareholder in Wells Fargo until Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is ...

and Walter Annenberg

Walter Hubert Annenberg (March 13, 1908 – October 1, 2002) was an American businessman, investor, philanthropist, and diplomat. Annenberg owned and operated Triangle Publications, which included ownership of ''The Philadelphia Inquirer' ...

surpassed him.West Hartford, Connecticut

West Hartford is a town in Hartford County, Connecticut, United States, west of downtown Hartford, Connecticut, Hartford. The town is part of the Capitol Planning Region, Connecticut, Capitol Planning Region. The population was 64,083 at the 20 ...

, was the victim of the White Eagle robbery. The robbery was organized by Los Macheteros (a guerrilla group seeking Puerto Rican independence from the United States) and involved an insider armored truck guard. It was the largest US bank theft to date with $7.1 million stolen.

Throughout the 1980s and '90s, Wells Fargo completed a series of acquisitions. In 1986, it acquired Crocker National Bank

Crocker National Bank was an American bank headquartered in San Francisco, California. It was acquired by and merged into Wells Fargo Bank in 1986.

History

The bank traces its history to the Woolworth National Bank in San Francisco. Charles ...

from Midland Bank

Midland Bank plc was one of the Big Four (banks)#United Kingdom, Big Four banking groups in the United Kingdom for most of the 20th century. It is now part of HSBC. The bank was founded as the Birmingham and Midland Bank in Union Street, Birming ...

. Then, in 1987 it acquired the personal trust business of Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

. In 1988, it acquired Barclays Bank of California from Barclays plc. In 1991, Wells Fargo spent $491 million to acquire 130 branches in California from Great American Bank. In 1996, Wells Fargo acquired First Interstate Bancorp

First Interstate Bancorp was a bank holding company based in the United States. Headquartered in Los Angeles, it was the nation's eighth largest banking company.

Although First Interstate Bancorp was taken over by Wells Fargo in 1996, the name ...

for $11.6 billion. Integration went poorly as many executives left.

Wells Fargo became the first major US financial services firm to offer internet banking, in May 1995.

After its string of acquisitions, in 1998, Wells Fargo Bank was acquired by Norwest Corporation

Norwest Corporation was a banking and financial services company based in Minneapolis, Minnesota, United States. In 1998, it merged with Wells Fargo & Co. and since that time has operated under the Wells Fargo name.

History Early formation

Th ...

of Minneapolis, with the combined company assuming the Wells Fargo name.

It then began on another set of acquisitions, starting in 2000, when Wells Fargo Bank acquired National Bank of Alaska

National Bank of Alaska (originally known as Bank of Alaska) was Alaska's largest financial institution for the latter part of the 20th century. In 2000, it was purchased by Wells Fargo, giving the larger bank a presence in 23 states.

Founding a ...

and First Security Corporation. In late 2001, it acquired H.D. Vest Financial Services for $128 million, but sold it in 2015 for $580 million. The 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

resulted in many bank takeovers. In 2007, Wells Fargo acquired Greater Bay Bancorp, which had $7.4 billion in assets, in a $1.5 billion transaction. It also acquired Placer Sierra Bank and CIT Group's construction unit that same year. In 2008, Wells Fargo acquired United Bancorporation of Wyoming and Century Bancshares of Texas.

On October 3, 2008, after Wachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total asset ...

turned down an inferior offer from Citigroup, Wachovia agreed to be bought by Wells Fargo for about $14.8 billion in stock. The next day, a New York state judge issued a temporary injunction blocking the transaction from going forward while the competing offer from Citigroup was sorted out. Citigroup alleged that it had an exclusivity agreement with Wachovia that barred Wachovia from negotiating with other potential buyers. The injunction was overturned late in the evening on October 5, 2008, by the New York state appeals court. Citigroup and Wells Fargo then entered into negotiations brokered by the FDIC to reach an amicable solution to the impasse. The negotiations failed. Citigroup was unwilling to take on more risk than the $42 billion that would have been the cap under the previous FDIC-backed deal (with the FDIC incurring all losses over $42 billion). Citigroup did not block the merger, but sought damages of $60 billion for breach of an alleged exclusivity agreement with Wachovia.

On October 28, 2008, Wells Fargo received $25 billion of funds via the Emergency Economic Stabilization Act

The Emergency Economic Stabilization Act of 2008, also known as the "bank bailout of 2008" or the "Wall Street bailout", was a United States federal law enacted during the Great Recession, which created federal programs to "bail out" failing fi ...

in the form of a preferred stock purchase by the United States Department of the Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments.

...

. As a result of requirements of the government stress tests, the company raised $8.6 billion in capital in May 2009. On December 23, 2009, Wells Fargo redeemed $25 billion of preferred stock issued to the United States Department of the Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments.

...

. As part of the redemption of the preferred stock, Wells Fargo also paid accrued dividends of $131.9 million, bringing the total dividends paid to $1.441 billion since the preferred stock was issued in October 2008.

In April 2009, Wells Fargo acquired North Coast Surety Insurance Services.

In 2010, hedge fund administrator Citco purchased the trust company operation of Wells Fargo in the Cayman Islands

The Cayman Islands () is a self-governing British Overseas Territories, British Overseas Territory, and the largest by population. The territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located so ...

.

In 2011, the company hired 25 investment bankers from Citadel LLC

Citadel LLC (formerly known as Citadel Investment Group, LLC) is an American multinational hedge fund and financial services company. Founded in 1990 by Kenneth Griffin, it has more than $65 billion in assets under management . The company has ...

.

In April 2012, Wells Fargo acquired Merlin Securities. In December 2012, it was rebranded as Wells Fargo Prime Services. In December of that year, Wells Fargo acquired a 35% stake in The Rock Creek Group LP. The stake was increased to 65% in 2014 but sold back to management in July 2018.

In 2015, Wells Fargo Rail acquired GE Capital Rail Services and merged in with First Union Rail. In late 2015, Wells Fargo acquired three GE units focused on business loans equipment financing.

In March 2017, Wells Fargo announced a plan to offer smartphone-based transactions with mobile wallets including Wells Fargo Wallet, Android Pay and Samsung Pay.

In June 2018, Wells Fargo sold all 52 of its physical bank branch locations in Indiana

Indiana ( ) is a U.S. state, state in the Midwestern United States, Midwestern region of the United States. It borders Lake Michigan to the northwest, Michigan to the north and northeast, Ohio to the east, the Ohio River and Kentucky to the s ...

, Michigan

Michigan ( ) is a peninsular U.S. state, state in the Great Lakes region, Great Lakes region of the Upper Midwest, Upper Midwestern United States. It shares water and land boundaries with Minnesota to the northwest, Wisconsin to the west, ...

, and Ohio

Ohio ( ) is a U.S. state, state in the Midwestern United States, Midwestern region of the United States. It borders Lake Erie to the north, Pennsylvania to the east, West Virginia to the southeast, Kentucky to the southwest, Indiana to the ...

to Flagstar Bank.Wells Fargo account fraud scandal

The Wells Fargo cross-selling scandal was caused by creation of millions of fraudulent savings and checking accounts on behalf of Wells Fargo clients without their consent or knowledge due to aggressive internal sales goals at Wells Fargo. News ...

and former general counsel C. Allen Parker became interim CEO.

In July 2019, Principal Financial Group

Principal Financial Group, Inc. (PFG) is an American global financial investment management and insurance company headquartered in Des Moines, Iowa, United States.

History

PFG was first founded under the name Bankers Life Insurance Company. Ba ...

acquired the company's Institutional Retirement & Trust business.

On September 27, 2019, Charles Scharf

Charles W. Scharf (born April 24, 1965) is an American investment banker and business executive who is the chief executive officer and president of Wells Fargo. He was previously the CEO of Visa Inc. and BNY.

Early life

Scharf completed his Exe ...

was announced as the firm's new CEO.

In 2020, the company sold its student loan portfolio.

In May 2021, the company sold its Canadian Direct Equipment Finance business to Toronto-Dominion Bank

Toronto-Dominion Bank (), doing business as TD Bank Group (), is a Canadian multinational banking and financial services corporation headquartered in Toronto, Ontario. The bank was created on February 1, 1955, through the merger of the Bank of ...

.

In 2021, the company sold its asset management division, Wells Fargo Asset Management (WFAM) to private equity firms GTCR

GTCR LLC is a Chicago, Illinois-based private equity firm focused on leveraged buyout, leveraged recapitalization, growth capital and rollup transactions. The firm principally invests in high-growth industries, including financial services & te ...

and Reverence Capital Partners for $2.1 billion. WFAM had $603 billion in assets under management

In finance, assets under management (AUM), sometimes called fund under management, refers to the total market value of all financial assets that a financial institution—such as a mutual fund, venture capital firm, or depository institutio ...

as of December 31, 2020, of which 33% was invested in money market fund

A money market fund (also called a money market mutual fund) is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a hig ...

s. WFAM was rebranded as Allspring Global Investments.

In December 2024, Wells Fargo announced that it would be selling it decades-long San Francisco headquarters building to downsize its footprint in San Francisco by moving to another building nearby. The move was interpreted by bankers as a sign of the financial industry drifting away from San Francisco and California.

Environmental record

In 2022, Wells Fargo announced a goal of reducing absolute emissions by companies it lends to in the oil and gas sector by 26% by 2030 from 2019 levels. Some critics say these goals conflict with the bank being the largest lender to fossil fuel

A fossil fuel is a flammable carbon compound- or hydrocarbon-containing material formed naturally in the Earth's crust from the buried remains of prehistoric organisms (animals, plants or microplanktons), a process that occurs within geolog ...

companies in the U.S. and one of the largest globally. The company has committed to net zero financed emissions by 2050; however, major environmental groups are skeptical that this goal will be achieved. The company has stated that it will not finance any hydrocarbon exploration

Hydrocarbon exploration (or oil and gas exploration) is the search by petroleum geologists and geophysicists for hydrocarbon deposits, particularly petroleum and natural gas, in the Earth's crust using petroleum geology.

Exploration methods

...

projects in the Arctic

The Arctic (; . ) is the polar regions of Earth, polar region of Earth that surrounds the North Pole, lying within the Arctic Circle. The Arctic region, from the IERS Reference Meridian travelling east, consists of parts of northern Norway ( ...

. The company has also provided financing to renewable energy projects.

In December 2024, Wells Fargo withdrew itself from its membership of Net- Zero Banking Alliance.

Lawsuits, fines, and controversies

Regulatory issues

The company has been the subject of several investigations by regulators. Many of these issues have resulted in reputational damage. On February 2, 2018, the Wells Fargo account fraud scandal

The Wells Fargo cross-selling scandal was caused by creation of millions of fraudulent savings and checking accounts on behalf of Wells Fargo clients without their consent or knowledge due to aggressive internal sales goals at Wells Fargo. News ...

resulted in the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

barring Wells Fargo from growing its nearly $2 trillion asset base any further until the company fixed its internal problems to the satisfaction of the Federal Reserve. In June 2025, the Federal Reserve lifted the punitive asset cap, allowing the bank to pursue growth and provide more financing to corporate clients. Scharf called the decision “a pivotal milestone in our journey to transform Wells Fargo."

In September 2021, Wells Fargo incurred further fines from the United States Justice Department

The United States Department of Justice (DOJ), also known as the Justice Department, is a federal executive department of the U.S. government that oversees the domestic enforcement of federal laws and the administration of justice. It is equi ...

charging fraudulent behavior by the bank against foreign-exchange currency trading customers. ''Bloomberg L.P.

Bloomberg L.P. is an American privately-held financial, software, data, and media company headquartered in Midtown Manhattan, New York City. It was co-founded by Michael Bloomberg in 1981, with Thomas Secunda, Duncan MacMillan, Charles Ze ...

'' reported in March 2022 that Wells Fargo was the only major lender in 2020 to reject more home refinance applications from Black applicants than it approved.

In December 2022, the U.S. levied a $3.7 billion loan-management fine upon Wells Fargo. In March 2023, Wells Fargo blamed a technical glitch for misstating the balances of customers' accounts, in many cases incorrectly deeming the customers as having a negative bank balance.money laundering

Money laundering is the process of illegally concealing the origin of money obtained from illicit activities (often known as dirty money) such as drug trafficking, sex work, terrorism, corruption, and embezzlement, and converting the funds i ...

and funneling cash illegally to Mexico through the creation of fictitious accounts.

1981 MAPS Wells Fargo embezzlement scandal

In 1981, it was discovered that a Wells Fargo assistant operations officer, Lloyd Benjamin "Ben" Lewis, had perpetrated one of the largest embezzlements in history through its Beverly Drive branch. During 1978–1981, Lewis had successfully written phony debit and credit receipts to benefit boxing promoters Harold J. Smith (né

The birth name is the name of the person given upon their birth. The term may be applied to the surname, the given name or to the entire name. Where births are required to be officially registered, the entire name entered onto a births registe ...

Ross Eugene Fields) and Sam "Sammie" Marshall, chairman and president, respectively, of Muhammad Ali Professional Sports, Inc. (MAPS), of which Lewis was also listed as a director; Marshall, too, was a former employee of the same Wells Fargo branch as Lewis. In excess of $300,000 was paid to Lewis, who pled guilty to embezzlement

Embezzlement (from Anglo-Norman, from Old French ''besillier'' ("to torment, etc."), of unknown origin) is a type of financial crime, usually involving theft of money from a business or employer. It often involves a trusted individual taking ...

and conspiracy

A conspiracy, also known as a plot, ploy, or scheme, is a secret plan or agreement between people (called conspirers or conspirators) for an unlawful or harmful purpose, such as murder, treason, or corruption, especially with a political motivat ...

charges in 1981, and testified against his co-conspirators for a reduced five-year sentence. (Boxer Muhammad Ali

Muhammad Ali (; born Cassius Marcellus Clay Jr.; January 17, 1942 – June 3, 2016) was an American professional boxer and social activist. A global cultural icon, widely known by the nickname "The Greatest", he is often regarded as the gr ...

had received a fee for the use of his name, and had no other involvement with the organization.)

Higher costs charged to African-American and Hispanic borrowers

Illinois Attorney General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the bank steered African American

African Americans, also known as Black Americans and formerly also called Afro-Americans, are an Race and ethnicity in the United States, American racial and ethnic group that consists of Americans who have total or partial ancestry from an ...

s and Hispanics

The term Hispanic () are people, cultures, or countries related to Spain, the Spanish language, or broadly. In some contexts, especially within the United States, "Hispanic" is used as an ethnic or meta-ethnic term.

The term commonly appli ...

into high-cost subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subpr ...

loans. A Wells Fargo spokesman responded that "The policies, systems, and controls we have in place – including in Illinois – ensure race is not a factor..." An affidavit filed in the case stated that loan officers had referred to black mortgage-seekers as "mud people," and the subprime loans as "ghetto loans."The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'', "We just went right after them. Wells Fargo mortgage had an emerging-markets unit that specifically targeted black churches because it figured church leaders had a lot of influence and could convince congregants to take out subprime loans." The report presented data from the city of Baltimore

Baltimore is the most populous city in the U.S. state of Maryland. With a population of 585,708 at the 2020 census and estimated at 568,271 in 2024, it is the 30th-most populous U.S. city. The Baltimore metropolitan area is the 20th-large ...

, where more than half the properties subject to foreclosure on a Wells Fargo loan from 2005 to 2008 now stand vacant, and 71 percent of those are in predominantly black neighborhoods.[ Wells Fargo agreed to pay $125 million to subprime borrowers and $50 million in direct down payment assistance in certain areas, for a total of $175 million.

]

Failure to monitor suspected money laundering

In a March 2010 agreement with US federal prosecutors, Wells Fargo acknowledged that between 2004 and 2007 Wachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total asset ...

had failed to monitor and report suspected money laundering by narcotics traffickers, including the cash used to buy four planes that shipped a total of 22 tons of cocaine into Mexico.

Overdraft fees

In August 2010, Wells Fargo was fined by United States district court

The United States district courts are the trial courts of the United States federal judiciary, U.S. federal judiciary. There is one district court for each United States federal judicial district, federal judicial district. Each district cov ...

judge William Alsup for overdraft practices designed to "gouge" consumers and "profiteer" at their expense, and for misleading consumers about how the bank processed transactions and assessed overdraft fees. In May 2013, Wells Fargo paid $203 million to settle class-action litigation accusing the bank of imposing excessive overdraft

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there i ...

fees on checking-account customers.

Settlement and fines regarding mortgage servicing practices

On February 9, 2012, it was announced that the five largest mortgage servicers (Ally Financial

Ally Financial Inc. (known as GMAC until 2010) is an American bank holding company incorporated in Delaware and headquartered at Ally Detroit Center in Detroit, Michigan. The company provides financial services including car finance, online bank ...

, Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

, Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, t ...

, JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest ba ...

, and Wells Fargo) agreed to a settlement with the US Federal Government and 49 states over improper foreclosure practices in the 2010 United States foreclosure crisis, including "robo-signing" (having someone fraudulently sign that they know the contents of a document they do not in fact know) and foreclosing without standing

Standing, also referred to as orthostasis, is a position in which the body is held in an upright (orthostatic) position and supported only by the feet. Although seemingly static, the body rocks slightly back and forth from the ankle in the ...

via MERS

Middle East respiratory syndrome (MERS) is a viral respiratory infection caused by '' Middle East respiratory syndrome–related coronavirus'' (MERS-CoV). Symptoms may range from none, to mild, to severe depending on age and risk level. Typi ...

. The settlement, known as the National Mortgage Settlement (NMS), required the servicers to provide about $26 billion in relief to distressed homeowners and in direct payments to the federal and state governments; Wells Fargo's share was the second largest, at $5.4 billion. This settlement amount makes the NMS the second largest civil settlement in U.S. history, only trailing the Tobacco Master Settlement Agreement. The five banks were also required to comply with 305 new mortgage servicing standards. Oklahoma

Oklahoma ( ; Choctaw language, Choctaw: , ) is a landlocked U.S. state, state in the South Central United States, South Central region of the United States. It borders Texas to the south and west, Kansas to the north, Missouri to the northea ...

held out and agreed to settle with the banks separately.

On April 5, 2012, a federal judge ordered Wells Fargo to pay $3.1 million in punitive damages over a single loan, one of the largest fines for a bank ever for mortgaging service misconduct, after the bank improperly charged Michael Jones, a New Orleans

New Orleans (commonly known as NOLA or The Big Easy among other nicknames) is a Consolidated city-county, consolidated city-parish located along the Mississippi River in the U.S. state of Louisiana. With a population of 383,997 at the 2020 ...

homeowner, with $24,000 in mortgage fees, after the bank misallocated payments to interest instead of principal. Elizabeth Magner, a federal bankruptcy judge in the Eastern District of Louisiana, cited the bank's behavior as "highly reprehensible", stating that Wells Fargo has taken advantage of borrowers who rely on the bank's accurate calculations. The award was affirmed on appeal in 2013.

In May 2013, New York attorney-general Eric Schneiderman announced a lawsuit against Wells Fargo over alleged violations of the national mortgage settlement. Schneidermann claimed Wells Fargo had violated rules over giving fair and timely serving. In 2015, a judge sided with Wells Fargo.

SEC fine due to inadequate risk disclosures

On August 14, 2012, Wells Fargo agreed to pay around $6.5 million to settle U.S. Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market m ...

(SEC) charges that in 2007 it sold risky mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals ( ...

without fully realizing their dangers.

Lawsuit by FHA over loan underwriting

In 2016, Wells Fargo agreed to pay $1.2 billion to settle allegations that the company violated the False Claims Act

False or falsehood may refer to:

* False (logic), the negation of truth in classical logic

* Lie or falsehood, a type of deception in the form of an untruthful statement

* False statement, aka a falsehood, falsity, misstatement or untruth, is a st ...

by underwriting over 100,000 Federal Housing Administration

The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a Independent agencies of the United States government, United States government agency founded by Pr ...

(FHA) backed loans when over half of the applicants did not qualify for the program.

In October 2012, Wells Fargo was sued by United States Attorney

United States attorneys are officials of the U.S. Department of Justice who serve as the chief federal law enforcement officers in each of the 94 U.S. federal judicial districts. Each U.S. attorney serves as the United States' chief federal ...

Preet Bharara

Preetinder Singh Bharara (; born October 13, 1968) is an Indian American lawyer and former federal prosecutor who served as the United States Attorney for the Southern District of New York from 2009 to 2017. As of 2025, he is a partner at the ...

over questionable mortgage deals.

Lawsuit due to premium inflation on forced place insurance

In April 2013, Wells Fargo settled a suit with 24,000 Florida homeowners alongside insurer QBE Insurance

QBE Insurance Group Limited is an Australian multinational general insurance and reinsurance company headquartered in Sydney, Australia. QBE offers commercial, personal and specialty products and risk management products. The company employs aro ...

, in which Wells Fargo was accused of inflating premiums on forced-place insurance.

Violation of New York credit card laws

In February 2015, Wells Fargo agreed to pay $4 million, including a $2 million penalty and $2 million in restitution for illegally taking an interest in the homes of borrowers in exchange for opening credit card accounts for the homeowners.

Tax liability and lobbying

In December 2011, Public Campaign criticized Wells Fargo for spending $11 million on lobbying

Lobbying is a form of advocacy, which lawfully attempts to directly influence legislators or government officials, such as regulatory agency, regulatory agencies or judiciary. Lobbying involves direct, face-to-face contact and is carried out by va ...

during 2008–2010, while increasing executive pay and laying off workers, while having no federal tax liability due to losses from the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. . However, in 2013, the company paid $9.1 billion in income taxes.

Prison industry investment

The company has invested its clients' funds in GEO Group

The GEO Group, Inc. (GEO) is a publicly traded C corporation headquartered in Boca Raton, Florida, that invests in private prisons and mental health facilities in the United States, Australia, South Africa, and the United Kingdom. The company ...

, a multi-national provider of for-profit private prison

A private prison, or for-profit prison, is a place where people are imprisoned by a third party that is contracted by a government agency. Private prison companies typically enter into contractual agreements with governments that commit pris ...

s. By March 2012, its stake had grown to more than 4.4 million shares worth $86.7 million. As of November 2012, Wells Fargo divested 33% of its holdings of GEO's stock, reducing its stake to 4.98% of Geo Group's common stock, below the threshold of which it must disclose further transactions.

Discrimination against African Americans in hiring

In August 2020, the company agreed to pay $7.8 million in back wages for allegedly discriminating against 34,193 African Americans in hiring for tellers, personal bankers, customer sales and service representatives, and administrative support positions. The company agreed to provide jobs to 580 of the affected applicants.

SEC settlement for insider trading case

In May 2015, Gregory T. Bolan Jr., a stock analyst at Wells Fargo agreed to pay $75,000 to the U.S. Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market m ...

to settle allegations that he gave Joseph C. Ruggieri, a stock trader, insider information on probable ratings charges. Ruggieri was not convicted of any crime.

Wells Fargo cross-selling scandal

In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is an independent agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, Payday lo ...

(CFPB) issued $100 million in fines, the largest in the agency's five-year history, along with $50 million in fines from the City and County of Los Angeles, and $35 million in fines from the Office of Comptroller of the Currency. The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package.

On October 12, 2016, John Stumpf, the then chairman and CEO, announced that he would be retiring amidst the scandals. President and chief operating officer Timothy J. Sloan succeeded Stumpf, effective immediately. Following the scandal, applications for credit cards and checking accounts at the bank plummeted. In response to the event, the Better Business Bureau

The Better Business Bureau (BBB) is an American private, 501(c)(6) nonprofit organization founded in 1912. BBB's self-described mission is to focus on advancing marketplace trust, consisting of 92 independently incorporated local BBB organizati ...

dropped accreditation of the bank. Several states and cities ended business relations with the company.

An investigation by the Wells Fargo board of directors, the report of which was released in April 2017, primarily blamed Stumpf, who it said had not responded to evidence of wrongdoing in the consumer services division, and Tolstedt, who was said to have knowingly set impossible sales goals and refused to respond when subordinates disagreed with them. Wells Fargo coined the phrase, "Go for Gr-Eight" – or, in other words, aim to sell at least 8 products to every customer. The board chose to use a clawback clause in the retirement contracts of Stumpf and Tolstedt to recover $75 million worth of cash and stock from the former executives.

In February 2020, the company agreed to pay $3 billion to settle claims by the United States Department of Justice

The United States Department of Justice (DOJ), also known as the Justice Department, is a United States federal executive departments, federal executive department of the U.S. government that oversees the domestic enforcement of Law of the Unite ...

and the Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its primary purpose is to enforce laws against market m ...

. The settlement did not prevent individual employees from being targets of future litigation. The Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

put a limit to Wells Fargo's assets, as a result of the scandal. In 2020, Wells Fargo sold $100 million in assets to stay under the limit.

In December 2022, the bank agreed to a settlement with the CFPB of $3.7billion over abuses tied to the fake account scandal as well as mortgages and auto loans. The total was split between $1.7billion for a civil penalty and $2billion for customers. Separately, in May 2023, the bank agreed to pay $1billion to settle a shareholder class-action suit.

Racketeering lawsuit for mortgage appraisal overcharges

In November 2016, Wells Fargo agreed to pay $50 million to settle allegations of overcharging hundreds of thousands of homeowners for appraisals ordered after they defaulted on their mortgage loans. While banks are allowed to charge homeowners for such appraisals, Wells Fargo frequently charged homeowners fees of $95 to $125 on appraisals for which the bank had been charged $50 or less. The plaintiffs had sought triple damages under the U.S. Racketeer Influenced and Corrupt Organizations Act

The Racketeer Influenced and Corrupt Organizations (RICO) Act is a United States federal law that provides for extended criminal penalties and a civil cause of action for acts performed as part of an ongoing criminal organization.

RICO was e ...

on grounds that sending invoices and statements with fraudulently concealed fees constituted mail and wire fraud sufficient to allege racketeering.

Financing of Dakota Access Pipeline

Wells Fargo is a lender on the Dakota Access Pipeline

The Dakota Access Pipeline (DAPL) or Bakken pipeline is a underground pipeline in the United States that has the ability to transport up to 750,000 barrels of light sweet crude oil per day. It begins in the shale oil fields of the Bakken For ...

, a underground oil pipeline transport

A pipeline is a system of Pipe (fluid conveyance), pipes for long-distance transportation of a liquid or gas, typically to a market area for consumption. The latest data from 2014 gives a total of slightly less than of pipeline in 120 countries ...

system in North Dakota

North Dakota ( ) is a U.S. state in the Upper Midwest, named after the indigenous Dakota people, Dakota and Sioux peoples. It is bordered by the Canadian provinces of Saskatchewan and Manitoba to the north and by the U.S. states of Minneso ...

. The pipeline has been controversial regarding its potential impact on the environment.

In February 2017, the city councils of Seattle, Washington

Seattle ( ) is the List of municipalities in Washington, most populous city in the U.S. state of Washington (state), Washington and in the Pacific Northwest region of North America. With a population of 780,995 in 2024, it is the List of Unit ...

and Davis, California

Davis is the most populous city in Yolo County, California, United States. Located in the Sacramento Valley region of Northern California, the city had a population of 66,850 in 2020, not including the on-campus population of the University of ...

voted to move $3 billion of deposits from the bank due to its financing of the Dakota Access Pipeline as well as the Wells Fargo account fraud scandal

The Wells Fargo cross-selling scandal was caused by creation of millions of fraudulent savings and checking accounts on behalf of Wells Fargo clients without their consent or knowledge due to aggressive internal sales goals at Wells Fargo. News ...

.

Failure to comply with document security requirements

In December 2016, the Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

fined Wells Fargo $5.5 million for failing to store electronic documents in a "write once, read many" format, which makes it impossible to alter or destroy records after they are written.

Doing business with the gun industry and NRA

From December 2012 through February 2018, Wells Fargo reportedly helped two of the biggest firearms and ammunition companies obtain $431.1 million in loans.National Rifle Association of America

The National Rifle Association of America (NRA) is a gun rights advocacy group based in the United States. Founded in 1871 to advance rifle marksmanship, the modern NRA has become a prominent Gun politics in the United States, gun rights ...

(NRA) and provided bank accounts and a $28-million line of credit.

Discrimination against female workers

In June 2018, about a dozen female Wells Fargo executives from the wealth management division met in Scottsdale, Arizona

Scottsdale is a city in eastern Maricopa County, Arizona, United States, and is part of the Phoenix metropolitan area. Named Scottsdale in 1894 after its founder Winfield Scott (chaplain), Winfield Scott, a retired Chaplain Corps (United States ...

to discuss the minimal presence of women occupying senior roles within the company. The meeting, dubbed "the meeting of 12", represented the majority of the regional managing directors, of which 12 out of 45 were women. Wells Fargo had previously been investigating reports of gender bias in the division in the months leading up to the meeting.

Overselling auto insurance

On June 10, 2019, Wells Fargo agreed to pay $385 million to settle a lawsuit accusing it of allegedly scamming millions of auto-loan customers into buying insurance they did not need from National General Insurance.

In February 2023, Wells Fargo agreed to pay $300 million in a settlement with shareholders over auto insurance disclosures.

Failure to Supervise Registered Representatives

On August 28, 2020, Wells Fargo agreed to pay a fine of $350,000 as well as $10 million in restitution payments to certain customers after the Financial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

accused the company of failing to reasonably supervise two of its registered representatives that recommended that customers invest a high percentage of their assets in high-risk energy securities in 2014 and 2015.

Steering customers to more expensive retirement accounts

In April 2018, the United States Department of Labor

The United States Department of Labor (DOL) is one of the executive departments of the U.S. federal government. It is responsible for the administration of federal laws governing occupational safety and health, wage and hour standards, unemp ...

launched a probe into whether Wells Fargo was pushing its customers into more expensive retirement plans as well as into retirement funds managed by Wells Fargo itself.

Alteration of documents

In May 2018, the company discovered that its business banking group had improperly altered documents about business clients in 2017 and early 2018.

Executive compensation

With CEO John Stumpf being paid 473 times more than the median employee, Wells Fargo ranked number 33 among the S&P 500 companies for CEO—employee pay inequality. In October 2014, a Wells Fargo employee earning $15 per hour emailed the CEO—copying 200,000 other employees—asking that all employees be given a $10,000 per year raise taken from a portion of annual corporate profits to address wage stagnation

Real wages are wages adjusted for inflation, or equivalently wages in terms of the amount of goods and services that can be bought. This term is used in contrast to nominal wages or unadjusted wages. Because it has been adjusted to account for ...

and income inequality. After being contacted by the media, Wells Fargo responded that all employees receive "market competitive" pay and benefits significantly above U.S. federal minimums.

Pursuant to Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, publicly traded companies are required to disclose (1) the median total annual compensation of all employees other than the CEO and (2) the ratio of the CEO's annual total compensation to that of the median employee.

Aggressive freezing and closing of bank accounts

The Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is an independent agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, Payday lo ...

found that, between 2011 and 2016, Wells Fargo had been freezing entire consumer deposit accounts based on automated fraud detection. This freeze extended to the entire account, not just the suspicious amount, and all access to funds was blocked. As a result, customers were unable to access their funds until the accounts were closed and the funds were returned. In 2022, the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is an independent agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, Payday lo ...

mandated that Wells Fargo provide $160 million in compensation to more than a million individuals, addressing the significant harm caused by its aggressive tactic of freezing and closing bank accounts during the period from 2011 to 2016.

In popular culture

The company was a theme or the subject in several films. In the 1939 John Ford-directed movie "Stagecoach", at the 5:22 mark two men can be seen hoisting a chest plainly marked "Wells Fargo." '' Seven Men from Now'' (a 1956 film), ''Cheyenne

The Cheyenne ( ) are an Indigenous people of the Great Plains. The Cheyenne comprise two Native American tribes, the Só'taeo'o or Só'taétaneo'o (more commonly spelled as Suhtai or Sutaio) and the (also spelled Tsitsistas, The term for th ...

'' (the 1947 film), ''Wells Fargo

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important fi ...

'' (a 1937 film) and '' Unclaimed Goods'' (a 1918 silent) are examples. A long running television series, ''Tales of Wells Fargo

''Tales of Wells Fargo'' is an American Westerns on television, Western television series starring Dale Robertson in 201 episodes that aired from 1957 to 1962 on NBC. Produced by Revue Productions, the series aired in a half-hour format until i ...

'' ran from 1957 to 1962, focusing on a fictitious Wells Fargo special agent.

Wells Fargo stagecoaches are mentioned in the song " The Deadwood Stage (Whip-Crack-Away!)" in the 1953 film ''Calamity Jane

Martha Jane Canary (May 1, 1856 – August 1, 1903), better known as Calamity Jane, was an American American frontier, frontierswoman, Exhibition shooting, sharpshooter, sex worker, and storyteller. In addition to many exploits, she was known f ...

'' performed by Doris Day

Doris Day (born Doris Mary Kappelhoff; April 3, 1922 – May 13, 2019) was an American actress and singer. She began her career as a big band singer in 1937, achieving commercial success in 1945 with two No. 1 recordings, "Sentimental Journey ...

: "With a fancy cargo, care of Wells and Fargo, Illinois - Boy!". Wells Fargo is also shown as the delivery service bringing the instruments for the town band in the 1962 film ''The Music Man

''The Music Man'' is a musical theatre, musical with book, music, and lyrics by Meredith Willson, based on a story by Willson and Franklin Lacey. The plot concerns a confidence trick, con man Harold Hill, who poses as a boys' band organizer and ...

''. A Wells Fargo & Company stagecoach is seen passing through the town of Hill Valley as Marty is walking down the street in the 1990 film, '' Back to the Future Part III''.

The song "The Wells Fargo Wagon" is part of the Broadway musical

Musical is the adjective of music.

Musical may also refer to:

* Musical theatre, a performance art that combines songs, spoken dialogue, acting and dance

* Musical film

Musical film is a film genre in which songs by the Character (arts), charac ...

The Music Man

''The Music Man'' is a musical theatre, musical with book, music, and lyrics by Meredith Willson, based on a story by Willson and Franklin Lacey. The plot concerns a confidence trick, con man Harold Hill, who poses as a boys' band organizer and ...

, referring to Wells, Fargo & Company's stagecoach delivery in the early 20th century, the time in which ''The Music Man'' is set.

Charity

On March 2, 2022, Wells Fargo announced $1 million donation to the American Red Cross

The American National Red Cross is a Nonprofit organization, nonprofit Humanitarianism, humanitarian organization that provides emergency assistance, disaster relief, and disaster preparedness education in the United States. Clara Barton founded ...

that will be used for Ukrainian refugees fleeing from the Russian invasion.

In April 2022, The Wells Fargo foundation announced its pledge of $210 million toward racial equity in homeownership. With $60 million of the donation awarded in Wealth Opportunities Restored through Homeownership (WORTH) grants which will run until 2025. Additionally, $150 million will be committed to lower mortgage rates and reducing the refinancing costs to aid minority homeowners.

In April 2023, TD Jakes Group and Wells Fargo have formalized a 10-year partnership to create inclusive communities for people of all income levels. Wells Fargo has committed approximately $1 billion to fund projects that align with the overall strategy.

The first of the projects focuses on the development of mixed-income housing

The definition of mixed-income housing is broad and encompasses many types of dwellings and neighborhoods. Following Brophy and Smith, the following will discuss “non-organic” examples of mixed-income housing, meaning “a deliberate effort to ...

and retail facilities outside of Atlanta

Atlanta ( ) is the List of capitals in the United States, capital and List of municipalities in Georgia (U.S. state), most populous city in the U.S. state of Georgia (U.S. state), Georgia. It is the county seat, seat of Fulton County, Georg ...

.

In December 2023, Wells Fargo appointed Darlene Goins as president of the Wells Fargo Foundation and Head of Philanthropy and Community Impact. Previously, she had held leadership roles at FICO, a leading data and analytics company, and at Wells Fargo, she was responsible for helping low-income populations as head of philanthropy for financial health. She also led the Banking Inclusion Initiative, a 10-year commitment to help people access low-cost basic accounts and help those without bank account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transaction

A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, ...

s gain easy access to low-cost banking services and financial education.

On Sep 23, 2024,Wells Fargo launched a $1.6 billion delayed-draw term loan to support Tempur Sealy International's acquisition of Mattress Firm Group.

See also

* List of Wells Fargo directors

* List of Wells Fargo presidents

* Wells Fargo Arena

* Wells Fargo Center

* Wells Fargo History Museum

* Big Four banks

The Big Four (or Big 4) is the colloquial name given to the four main banks in several countries where the banking industry is dominated by just four institutions and where the phrase has thus gained relevance. Some countries include more or fe ...

References

External links

*

{{Authority control

1852 establishments in New York (state)

American companies established in 1852

Banks based in California

Banks established in 1852

Companies based in San Francisco

Companies listed on the New York Stock Exchange

Financial District, San Francisco

Mortgage lenders of the United States

Online brokerages

Systemically important financial institutions

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a