Utility Ratemaking on:

[Wikipedia]

[Google]

[Amazon]

Utility ratemaking is the formal regulatory process in the United States by which

The price of a utility's products and services will affect its consumption. As with most demand curves, a price increase decreases demand. Through a concept known as ''rate design'' or ''rate structure'', regulators set the prices (known as "rates" in the case of utilities) and thereby affect the consumption. With ''declining block rates'', the per-unit price of utility consumption decreases as the energy consumption increases. Typically a declining block rate is offered only to very large consumers. If conservation is the goal, regulators can promote

The price of a utility's products and services will affect its consumption. As with most demand curves, a price increase decreases demand. Through a concept known as ''rate design'' or ''rate structure'', regulators set the prices (known as "rates" in the case of utilities) and thereby affect the consumption. With ''declining block rates'', the per-unit price of utility consumption decreases as the energy consumption increases. Typically a declining block rate is offered only to very large consumers. If conservation is the goal, regulators can promote

public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

set the prices (more commonly known as "rates") they will charge consumers. Ratemaking, typically carried out through "rate cases" before a public utilities commission, serves as one of the primary instruments of government regulation

Regulation is the management of complex systems according to a set of rules and trends. In systems theory, these types of rules exist in various fields of biology and society, but the term has slightly different meanings according to context. Fo ...

of public utilities.

Overview

Historically, many different classes of business have been classified aspublic utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

, and thus have been legally mandated to go through the ratemaking process in order to determine the allowable service charges for their industry. Although the classification of public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

has changed over time, typically such businesses must constitute a ''de facto'' monopoly

A monopoly (from Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a speci ...

(or "natural monopoly

A natural monopoly is a monopoly in an industry in which high infrastructural costs and other barriers to entry relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming adv ...

") for the services they provide within a particular jurisdiction. Prominent public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

that must utilize ratemaking to set rates include railroads, natural gas

Natural gas (also called fossil gas or simply gas) is a naturally occurring mixture of gaseous hydrocarbons consisting primarily of methane in addition to various smaller amounts of other higher alkanes. Low levels of trace gases like carbo ...

distribution, telecommunication

Telecommunication is the transmission of information by various types of technologies over wire, radio, optical, or other electromagnetic systems. It has its origin in the desire of humans for communication over a distance greater than that fe ...

s, and electricity

Electricity is the set of physical phenomena associated with the presence and motion of matter that has a property of electric charge. Electricity is related to magnetism, both being part of the phenomenon of electromagnetism, as describ ...

generation and distribution.

In the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territori ...

, where many industries classified as public utilities

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

are either private businesses or publicly traded corporations, ratemaking is typically carried out through the authority of a state regulatory body, most often a public utilities commission in an administrative law

Administrative law is the division of law that governs the activities of executive branch agencies of government. Administrative law concerns executive branch rule making (executive branch rules are generally referred to as "regulations"), ad ...

format. At the national level the Federal Energy Regulatory Commission (formerly the Federal Power Commission) also exercises authority over matters of intrastate wholesale sales of electric power.

Ratemaking goals

Ratemaking has aneconomic

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the ...

dimension because it attempts to set prices at efficient (nonmonopolistic, competitive) levels. Ratemaking is political

Politics (from , ) is the set of activities that are associated with making decisions in groups, or other forms of power relations among individuals, such as the distribution of resources or status. The branch of social science that stud ...

because the product is determined to be a social necessity and rates must be fair across different classes of consumers. Additionally, ratemaking can be designated to serve other social purposes. Although it can be said that all regulation is a combination of politics and economics, ratemaking is frequently more technical. Ratemaking has five functions:

# Capital attraction;

# Reasonable energy pricing;

# Incentive to be efficient;

# Demand control or consumer rationing; and

# Income transfer.

These regulatory goals can conflict. When prices are kept below market, efficiency suffers. When prices exceed the market, prices may not be reasonable. Both events have occurred during the history of utility regulation. The above goals attempt to serve the interests of the utility, its shareholders, consumers, and the general public. To be constitutional, a rate cannot be so high as to be confiscatory. Most state statutes further require rates to be just, reasonable, and non-discriminatory.

Capital attraction

Although utilities are regulated industries, they are typically privately owned and must therefore attract private capital. Accordingly, because of constitutional takings law, government regulators must assure private companies that a fair revenue is available in order to continue to attract investors and borrow money. This creates competing aims of capital attraction and fair prices for customers. Utility companies are therefore allowed to charge "reasonable rates," which are generally regarded as rates that allow utilities to encourage people to invest in utility stocks andbond

Bond or bonds may refer to:

Common meanings

* Bond (finance), a type of debt security

* Bail bond, a commercial third-party guarantor of surety bonds in the United States

* Chemical bond, the attraction of atoms, ions or molecules to form chemica ...

s at the same rate of return they would in comparable non-regulated industries.

Reasonable energy pricing

State laws typically restrict utilities from large, sudden rate increases. Utilities should implement new rates over time so that consumers and business can adapt to the changing prices. This is known as the principle of gradualism.Demand control or consumer rationing

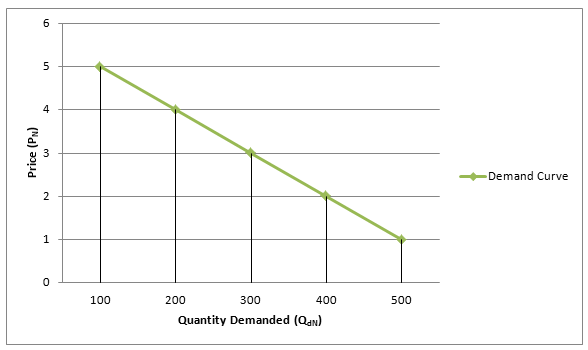

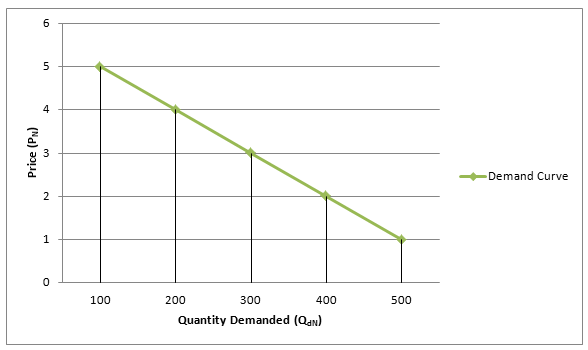

The price of a utility's products and services will affect its consumption. As with most demand curves, a price increase decreases demand. Through a concept known as ''rate design'' or ''rate structure'', regulators set the prices (known as "rates" in the case of utilities) and thereby affect the consumption. With ''declining block rates'', the per-unit price of utility consumption decreases as the energy consumption increases. Typically a declining block rate is offered only to very large consumers. If conservation is the goal, regulators can promote

The price of a utility's products and services will affect its consumption. As with most demand curves, a price increase decreases demand. Through a concept known as ''rate design'' or ''rate structure'', regulators set the prices (known as "rates" in the case of utilities) and thereby affect the consumption. With ''declining block rates'', the per-unit price of utility consumption decreases as the energy consumption increases. Typically a declining block rate is offered only to very large consumers. If conservation is the goal, regulators can promote conservation

Conservation is the preservation or efficient use of resources, or the conservation of various quantities under physical laws.

Conservation may also refer to:

Environment and natural resources

* Nature conservation, the protection and managem ...

by letting prices rise. A third possible rate design is a flat rate which charges the same price for all consumption.

Income transfer

Ratemaking distributes wealth from consumers to utility owners. Ratemaking also involves redistribution of wealth among and within classes of customers. Utility customers are generally grouped in three categories – residential, industrial, and commercial. Each group is sometimes further subdivided.Executive compensation

The compensation received by the executive inutility companies

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and ...

often receives the most scrutiny in the review of operating expenses

An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system . Its counterpart, a capital expenditure (capex), is the cost of developing or provid ...

. Just as regulated utilities and their governing bodies struggle to maintain a balance between keeping consumer costs reasonable and being profitable enough to attract investors, they must also compete with private companies for talented executives and then be able to retain those executives.

Constraints from regulation have been shown to affect the level of compensation received by executives in electric utilities. Executive compensation usually consists of four parts:

# Base salary

# Short term incentive pay (STIP)

# Long-term incentive pay (LTIP); and

# Benefits such as retirement and health care

Regulated companies are less likely to use incentive-based compensation in addition to base salaries. Executives in regulated electric utilities are less likely to be paid for their performance in bonuses or stock options

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified da ...

.

Electric utility ratemaking for executives

Executives in regulated electric utilities also have less managerial control than those in unregulated or private industries. These executives are in charge of large numbers of workers as well as the company’s physical andfinancial assets

A financial asset is a non-physical asset whose value is derived from a contractual claim, such as bank deposits, bonds, and participations in companies' share capital. Financial assets are usually more liquid than other tangible assets, such as ...

. Limiting their control has been shown to reduce investment opportunities. The same constraints are placed on the board of directors for the utility by the monitoring or oversight of the utility commission and they are less likely to approve compensation policies that include incentive-based pay. The compensation for electric utility executives will be the lowest in regulated utilities that have an unfavorable regulatory environment. These companies have more political constraints than those in a favorable regulatory environment and are less likely to have a positive response to requests for rate increases.

Just as increased constraints from regulation drive compensation down for executives in electric utilities, deregulation has been shown to increase compensation. The need to encourage risk-taking behavior in seeking new investment opportunities while keeping costs under control requires deregulated companies to offer performance-based incentives to their executives. It has been found that increased compensation is also more likely to attract executives experienced in working in competitive environments.

The Energy Act of 1992 in the United States removed previous barriers to wholesale competition in the electric utility

An electric utility is a company in the electric power industry (often a public utility) that engages in electricity generation and distribution of electricity for sale generally in a regulated market. The electrical utility industry is a major pr ...

industry. Currently twenty-four states allow for deregulated electric utilities: Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Texas, Virginia, Arizona, Arkansas, California, Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, Michigan, Montana, New Hampshire, New Jersey, New Mexico, New York, and Washington D.C. As electric utility monopolies have been increasingly broken up into deregulated businesses, executive compensation has risen; particularly incentive compensation.

Revenue Requirement formula

The traditional rate formula is intended to produce a utility's revenue requirement: :''R = O + (V − D)r'' The elements of the traditional rate formula are defined as: :R is the utility's total revenue requirement or rate level. This is the total amount of money a regulator allows a utility to collect from customers. :O is the utility's operating expenses, which are passed through to customers at cost with no mark-up. Examples include labor (for everything from field repair and maintenance crews to customer service and accounting personnel); bad debt expense; interest on debt; depreciation on assets; and federal (and sometimes state) taxes on income. A large operating expense is often the cost of the commodity itself (electricity, or natural gas, or water) purchased by a utility for its customers' use. :V is the gross value of the utility's tangible and intangible property. :D is the utility's accrued depreciation. Combined (V − D) constitute the utility's rate base, also known as its capital investment. Examples include wires, pipes, poles, substations, pumping stations, generating stations, computer software, computer hardware, office furniture, office buildings, etc. :r is the rate of return a for-profit utility is allowed to earn on its capital investment or on its rate base. Non-profit utilities, such as those owned by states or municipalities, or those owned by customers in rural areas (common in the United States) do not add an "r" in the Revenue Requirement formula, nor do they incur income tax expenses. The traditional rate formula encourages capital investment because it provides a rate of return on the rate base. The more a utility invests, the more money it earns. This is why for-profit utilities prefer capital investment over operating expenses, called "capital bias".Translation of Revenue Requirements into customer rates

Once a utility's revenue requirement is established in a quasi-judicial proceeding called a rate case, overseen in most countries by monopoly regulators, the focus turns to translating revenue requirements into customer rates. Though an oversimplification, most revenue requirements are translated into a rate per unit of commodity used by a customer. In electric utilities, the unit is typically a kilowatt hour, or "kWh"; for natural gas, the unit is typically ten British Thermal Units, called a dekatherm, or "dkt"; in water utilities, the unit is typically a gallon. The formula for translating revenue requirements into customer rates (for example, cents per kWh) is Rate per unit = R (revenue requirement) / expected commodity sales in units in the upcoming year. The logic behind this is simple. If a utility's revenue requirement is $10 million, and it expects to sell 100 million units, the rate per unit is $0.10 cents/unit. If the utility actually sells 100 million units at $0.10 cents/unit, it will collect its $10 million revenue requirement. However, if a utility sells fewer units than expected, it will collect less than its $10 million revenue requirement, and if a utility sells more units than expected, it will collect more than its $10 million revenue requirement. This is why utilities prefer to sell more units than expected, called "throughput incentive".Operating expenses

A firm's operating expenses, such as wages, salaries, supplies, maintenance, taxes, and research and development, must be recouped if the utility is to stay operational. Operating costs are most often the largest component of the revenue requirement, and the easiest to determine. Occasionally, operating expense items have caught the attention of regulatory agencies and courts, and these items have been examined more closely. Regulators must make two determinations. First, they must determine which items should be allowed as expenses. Second, regulators must determine the value of those expense items. The determination of value has generally been left to the management of the utility under the theory that these are essentially business decisions which will not be second guessed by a regulatory agency or a court. Managerial good faith is presumed. Although both agencies and courts have the legal authority to supervise the utility's management, they will not substitute their judgment unless there is an abuse of managerial discretion. Hence, litigation involving operating expense issues has been light.Performance-based regulation

The above-described formula may be used to calculate a firm's allowed revenues (cost-of-service regulation). However, if the rates are set on the basis of a company's own costs, there is no incentive to reduce these costs. Furthermore, regulated utilities may have the incentive to overinvest. The purpose ofperformance-based regulation

Performance-based regulation (PBR) is an approach to utility regulation designed to strengthen utility performance incentives. Thus defined, the term PBR is synonymous with incentive regulation. The two most common forms of PBR are award-penalty ...

is to reduce the negative impact of information asymmetries and to motivate regulated companies to reduce their costs in order to increase profit. Usually, this is done by setting a cap on prices or revenues. A general formula is:

:''P(t) = (1 + RPI - X) . P(t-1)''

where

:P(t) is the price in time t.

:RPI is the rate of inflation.

:X is the efficiency factor (X-factor).

:P(t-1) is the price in time (t - 1).

Since the price is set with regard to the overall inflation rate (RPI) and required growth of efficiency (X-factor), such kind of regulation is also called RPI-X regulation.

Notes

References

* * {{DEFAULTSORT:Utility ratemaking Economics of regulation Public utilities of the United States