United States Housing Bubble on:

[Wikipedia]

[Google]

[Amazon]

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the

Although an

Although an

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the col ...

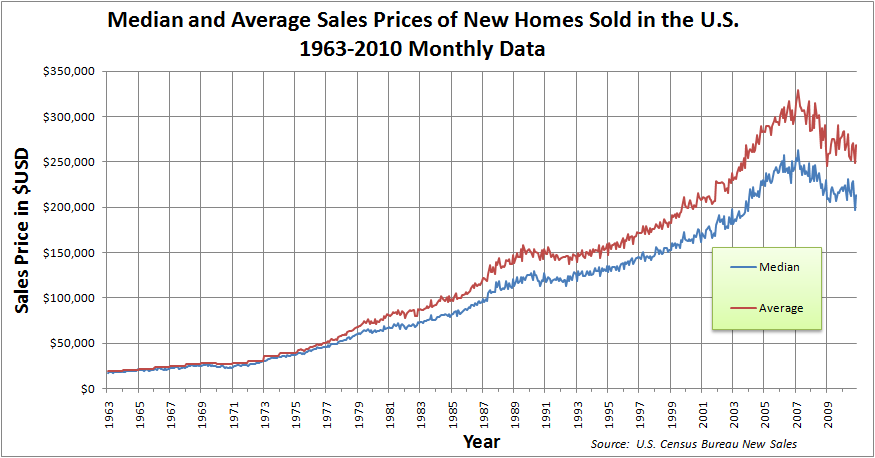

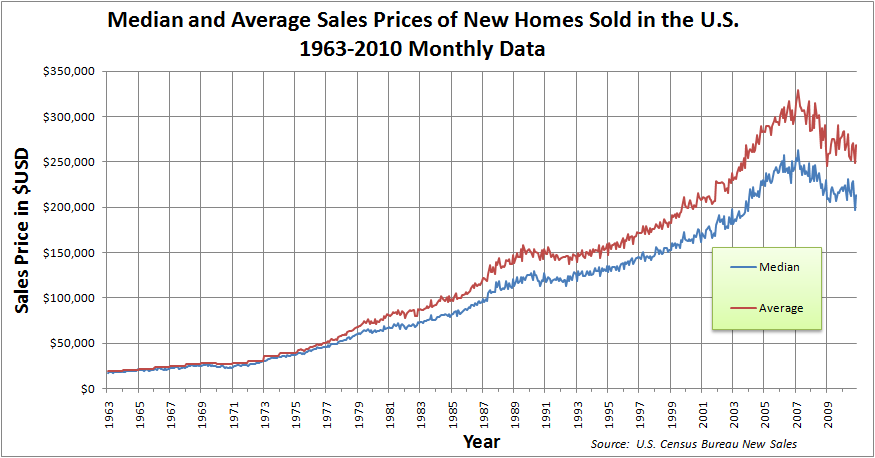

. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States.

Increased foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mort ...

rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subp ...

, Alt-A An Alt-A mortgage, short for Alternative A-paper, is a type of U.S. mortgage that, for various reasons, is considered riskier than A-paper, or "prime", and less risky than " subprime," the riskiest category. For these reasons, as well as in some ca ...

, collateralized debt obligation (CDO), mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any ...

, credit, hedge fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as ...

, and foreign bank markets. In October 2007, Henry Paulson

Henry Merritt Paulson Jr. (born March 28, 1946) is an American banker and financier who served as the 74th United States Secretary of the Treasury from 2006 to 2009. Prior to his role in the Department of the Treasury, Paulson was the Chairman a ...

, the U.S. Secretary of the Treasury, called the bursting housing bubble "the most significant risk to our economy".

Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but mortgage markets, home builders, real estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more genera ...

, home supply retail outlets, Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for ...

hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Duri ...

to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.

In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble. This was shared between the public sector and the private sector. Because of the large market share of Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) (both of which are government-sponsored enterprise

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy, to make those segments of t ...

s) as well as the Federal Housing Administration, they received a substantial share of government support, even though their mortgages were more conservatively underwritten and actually performed better than those of the private sector.

Background

Land prices contributed much more to the price increases than did structures. This can be seen in the building cost index in Fig. 1. An estimate of land value for a house can be derived by subtracting the replacement value of the structure, adjusted for depreciation, from the home price. Using this methodology, Davis and Palumbo calculated land values for 46 U.S. metro areas, which can be found at the website for the Lincoln Institute for Land Policy. Housing bubbles may occur in local or global real estate markets. In their late stages, they are typically characterized by rapid increases in the valuations ofreal property

In English common law, real property, real estate, immovable property or, solely in the US and Canada, realty, is land which is the property of some person and all structures (also called improvements or fixtures) integrated with or aff ...

until unsustainable levels are reached relative to incomes, price-to-rent ratios, and other economic indicators of affordability. This may be followed by decreases in home prices that result in many owners finding themselves in a position of negative equity—a mortgage debt higher than the value of the property. The underlying causes of the housing bubble are complex. Factors include tax policy (exemption of housing from capital gains), historically low interest rates, lax lending standards, failure of regulators to intervene, and speculative fever

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be c ...

. This bubble may be related to the stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, ...

or dot-com bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet.

Between 1995 and its peak in March 2000, the Nasdaq Comp ...

of the 1990s. Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005:

This bubble roughly coincides with the real-estate bubbles of the United Kingdom, Hong Kong, Spain, Poland, Hungary and South Korea.

While bubbles may be identifiable in progress, bubbles can be definitively measured only in hindsight after a market correction,A prediction of a correction in the housing market, possibly after the " fall" of 2005, is implied by ''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Eco ...

'' magazine's cover story for the article "After the fall", which illustrates a brick falling, with the label "House Prices". which began in 2005–2006 for the U.S. housing market.

Former U.S. Federal Reserve Board

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the m ...

Chairman Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

said "We had a bubble

Bubble, Bubbles or The Bubble may refer to:

Common uses

* Bubble (physics), a globule of one substance in another, usually gas in a liquid

** Soap bubble

* Economic bubble, a situation where asset prices are much higher than underlying fund ...

in housing", and also said in the wake of the subprime mortgage and credit crisis in 2007, "I really didn't get it until very late in 2005 and 2006." In 2001, Alan Greenspan dropped interest rates to a low 1% in order to jump the economy after the ".com" bubble. It was then bankers and other Wall Street firms started borrowing money due to its inexpensiveness.

The mortgage and credit crisis was caused by the inability of a large number of home owners to pay their mortgages as their low introductory-rate mortgages reverted to regular interest rates. Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.Richard Syron

Richard F. Syron is a former chairman and chief executive officer of the Federal Home Loan Mortgage Corporation, commonly known as Freddie Mac. He previously served as chairman and CEO of Thermo Electron Corp., and as CEO of the American Stock Exch ...

concluded, "We had a bubble", and concurred with Yale

Yale University is a private research university in New Haven, Connecticut. Established in 1701 as the Collegiate School, it is the third-oldest institution of higher education in the United States and among the most prestigious in the wor ...

economist Robert Shiller's warning that home prices appear overvalued and that the correction could last years, with trillions of dollars of home value being lost. Greenspan warned of "large double digit declines" in home values "larger than most people expect".

Problems for home owners with good credit surfaced in mid-2007, causing the United States' largest mortgage lender, Countrywide Financial, to warn that a recovery in the housing sector was not expected to occur at least until 2009 because home prices were falling "almost like never before, with the exception of the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

". The impact of booming home valuations on the U.S. economy

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GD ...

since the 2001–2002 recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

was an important factor in the recovery, because a large component of consumer spending was fueled by the related refinancing boom, which allowed people to both reduce their monthly mortgage payments with lower interest rates and withdraw equity from their homes as their value increased.

Timeline

Identification

Although an

Although an economic bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be c ...

is difficult to identify except in hindsight, numerous economic and cultural factors led several economists (especially in late 2004 and early 2005) to argue that a housing bubble existed in the U.S. Dean Baker identified the bubble in August 2002, thereafter repeatedly warning of its nature and depth, and the political reasons it was being ignored. Prior to that, Robert Prechter wrote about it extensively as did Professor Shiller in his original publication of '' Irrational Exuberance'' in the year 2000.

The burst of the housing bubble was predicted by a handful of political and economic analysts, such as Jeffery Robert Hunn in a March 3, 2003, editorial. Hunn wrote:

Many contested any suggestion that there could be a housing bubble, particularly at its peak from 2004 to 2006, with some rejecting the "house bubble" label in 2008. Claims that there was no warning of the crisis were further repudiated in an August 2008 article in ''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'', which reported that in mid-2004 Richard F. Syron

Richard F. Syron is a former chairman and chief executive officer of the Federal Home Loan Mortgage Corporation, commonly known as Freddie Mac. He previously served as chairman and CEO of Thermo Electron Corp., and as CEO of the American Stock Exc ...

, the CEO of Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.chief risk officer, warning him that Freddie Mac was financing risk-laden loans that threatened Freddie Mac's financial stability. In his memo, Mr. Andrukonis wrote that these loans "would likely pose an enormous financial and

reputational risk

Reputational damage is the loss to financial capital, social capital and/or market share resulting from damage to a firm's reputation. This is often measured in lost revenue, increased operating, capital or regulatory costs, or destruction of sh ...

to the company and the country". The article revealed that more than two-dozen high-ranking executives said that Mr. Syron had simply decided to ignore the warnings.

Other cautions came as early as 2001, when the late Federal Reserve governor Edward Gramlich warned of the risks posed by subprime mortgages. In September 2003, at a hearing of the House Financial Services Committee, Congressman Ron Paul

Ronald Ernest Paul (born August 20, 1935) is an American author, activist, physician and retired politician who served as the U.S. representative for Texas's 22nd congressional district from 1976 to 1977 and again from 1979 to 1985, as we ...

identified the housing bubble and foretold the difficulties it would cause: "Like all artificially-created bubbles, the boom in housing prices cannot last forever. When housing prices fall, homeowners will experience difficulty as their equity is wiped out. Furthermore, the holders of the mortgage debt will also have a loss." Reuters

Reuters ( ) is a news agency owned by Thomson Reuters Corporation. It employs around 2,500 journalists and 600 photojournalists in about 200 locations worldwide. Reuters is one of the largest news agencies in the world.

The agency was est ...

reported in October 2007 that a Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment ba ...

analyst too had warned in 2006 that companies could suffer from their subprime investments.

The ''Economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this ...

'' magazine stated, "The worldwide rise in house prices is the biggest bubble in history", so any explanation needs to consider its global causes as well as those specific to the United States. The then Federal Reserve Board Chairman Alan Greenspan said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) ... it's hard not to see that there are a lot of local bubbles"; Greenspan admitted in 2007 that ''froth'' "was a euphemism for a bubble". In early 2006, President Bush said of the U.S. housing boom: "If houses get too expensive, people will stop buying them ... Economies should cycle".

Throughout the bubble period there was little if any mention of the fact that housing in many areas was (and still is) selling for well above replacement cost.

On the basis of 2006 market data that were indicating a marked decline, including lower sales, rising inventories, falling median

In statistics and probability theory, the median is the value separating the higher half from the lower half of a data sample, a population, or a probability distribution. For a data set, it may be thought of as "the middle" value. The basic f ...

prices and increased foreclosure rates, some economists have concluded that the correction in the U.S. housing market began in 2006. A May 2006 ''Fortune

Fortune may refer to:

General

* Fortuna or Fortune, the Roman goddess of luck

* Luck

* Wealth

* Fortune, a prediction made in fortune-telling

* Fortune, in a fortune cookie

Arts and entertainment Film and television

* ''The Fortune'' (1931 film) ...

'' magazine report on the US housing bubble states: "The great housing bubble has finally started to deflate ... In many once-sizzling markets around the country, accounts of dropping list prices have replaced tales of waiting lists for unbuilt condos and bidding wars over humdrum three-bedroom colonials."

This article classified several U.S. real-estate regions as "Dead Zones", "Danger Zones", and "Safe Havens".

The chief economist of Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.Joint Center for Housing Studies (JCHS) denied the existence of a national housing bubble and expressed doubt that any significant decline in home prices was possible, citing consistently rising prices since the

Home price appreciation has been non-uniform to such an extent that some economists, including former Fed

Home price appreciation has been non-uniform to such an extent that some economists, including former Fed

* One of the most direct effects was on the construction of new houses. In 2005, 1,283,000 new single-family houses were sold, compared with an average of 609,000 per year during 1990–1995. The largest home builders, such as

* One of the most direct effects was on the construction of new houses. In 2005, 1,283,000 new single-family houses were sold, compared with an average of 609,000 per year during 1990–1995. The largest home builders, such as

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

, an anticipated increased demand from the Baby Boom

A baby boom is a period marked by a significant increase of birth rate. This demographic phenomenon is usually ascribed within certain geographical bounds of defined national and cultural populations. People born during these periods are ofte ...

generation, and healthy levels of employment. However, some have suggested that the funding received by JCHS from the real estate industry may have affected their judgment. David Lereah, former chief economist of the National Association of Realtors

The National Association of Realtors (NAR) is an American trade association for those who work in the real estate industry. It has over 1.4 million members, making it one of the biggest trade associations in the USA including NAR's institutes, so ...

(NAR), distributed "Anti-Bubble Reports" in August 2005 to "respond to the irresponsible bubble accusations made by your local media and local academics".

Among other statements, the reports stated that people "should otbe concerned that home prices are rising faster than family income", that "there is virtually no risk of a national housing price bubble based on the fundamental demand for housing and predictable economic factors", and that "a general slowing in the rate of price growth can be expected, but in many areas inventory shortages will persist and home prices are likely to continue to rise above historic norms". Following reports of rapid sales declines and price depreciation in August 2006, Lereah admitted that he expected "home prices to come down 5% nationally, more in some markets, less in others. And a few cities in Florida and California, where home prices soared to nose-bleed heights, could have 'hard landings'."

National home sales and prices both fell dramatically in March 2007 — the steepest plunge since the 1989 Savings and Loan crisis. According to NAR data, sales were down 13% to 482,000 from the peak of 554,000 in March 2006, and the national median price fell nearly 6% to $217,000 from a peak of $230,200 in July 2006.

John A. Kilpatrick from Greenfield Advisors was cited by Bloomberg News

Bloomberg News (originally Bloomberg Business News) is an international news agency headquartered in New York City and a division of Bloomberg L.P. Content produced by Bloomberg News is disseminated through Bloomberg Terminals, Bloomberg T ...

on June 14, 2007, on the linkage between increased foreclosures and localized housing price declines: "Living in an area with multiple foreclosures can result in a 10 percent to 20 percent decrease in property values". He went on to say, "In some cases that can wipe out the equity of homeowners or leave them owing more on their mortgage than the house is worth. The innocent houses that just happen to be sitting next to those properties are going to take a hit."

The US Senate

The United States Senate is the upper chamber of the United States Congress, with the House of Representatives being the lower chamber. Together they compose the national bicameral legislature of the United States.

The composition and po ...

Banking Committee held hearings on the housing bubble and related loan practices in 2006, titled "The Housing Bubble and its Implications for the Economy" and "Calculated Risk: Assessing Non-Traditional Mortgage Products". Following the collapse

Collapse or its variants may refer to:

Concepts

* Collapse (structural)

* Collapse (topology), a mathematical concept

* Collapsing manifold

* Collapse, the action of collapsing or telescoping objects

* Collapsing user interface elements

** ...

of the subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subp ...

mortgage industry in March 2007, Senator Chris Dodd

Christopher John Dodd (born May 27, 1944) is an American lobbyist, lawyer, and Democratic Party (United States), Democratic Party politician who served as a United States senator from Connecticut from 1981 to 2011. Dodd is the List of United Sta ...

, Chairman of the Banking Committee held hearings and asked executives from the top five subprime mortgage companies to testify and explain their lending practices. Dodd said that "predatory lending" had endangered home ownership for millions of people. In addition, Democratic senators such as Senator Charles Schumer

Charles Ellis Schumer ( ; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021. A member of the Democratic Party (United States), Democratic Party, Schumer is in his fourth Senate term, hav ...

of New York were already proposing a federal government bailout of subprime borrowers in order to save homeowners from losing their residences.

Causes

Extent

Chairman

The chairperson, also chairman, chairwoman or chair, is the presiding officer of an organized group such as a board, committee, or deliberative assembly. The person holding the office, who is typically elected or appointed by members of the group ...

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

, have argued that United States was not experiencing a nationwide housing bubble ''per se'', but a number of local bubbles. However, in 2007 Greenspan admitted that there was in fact a bubble in the U.S. housing market, and that "all the froth bubbles add up to an aggregate bubble".

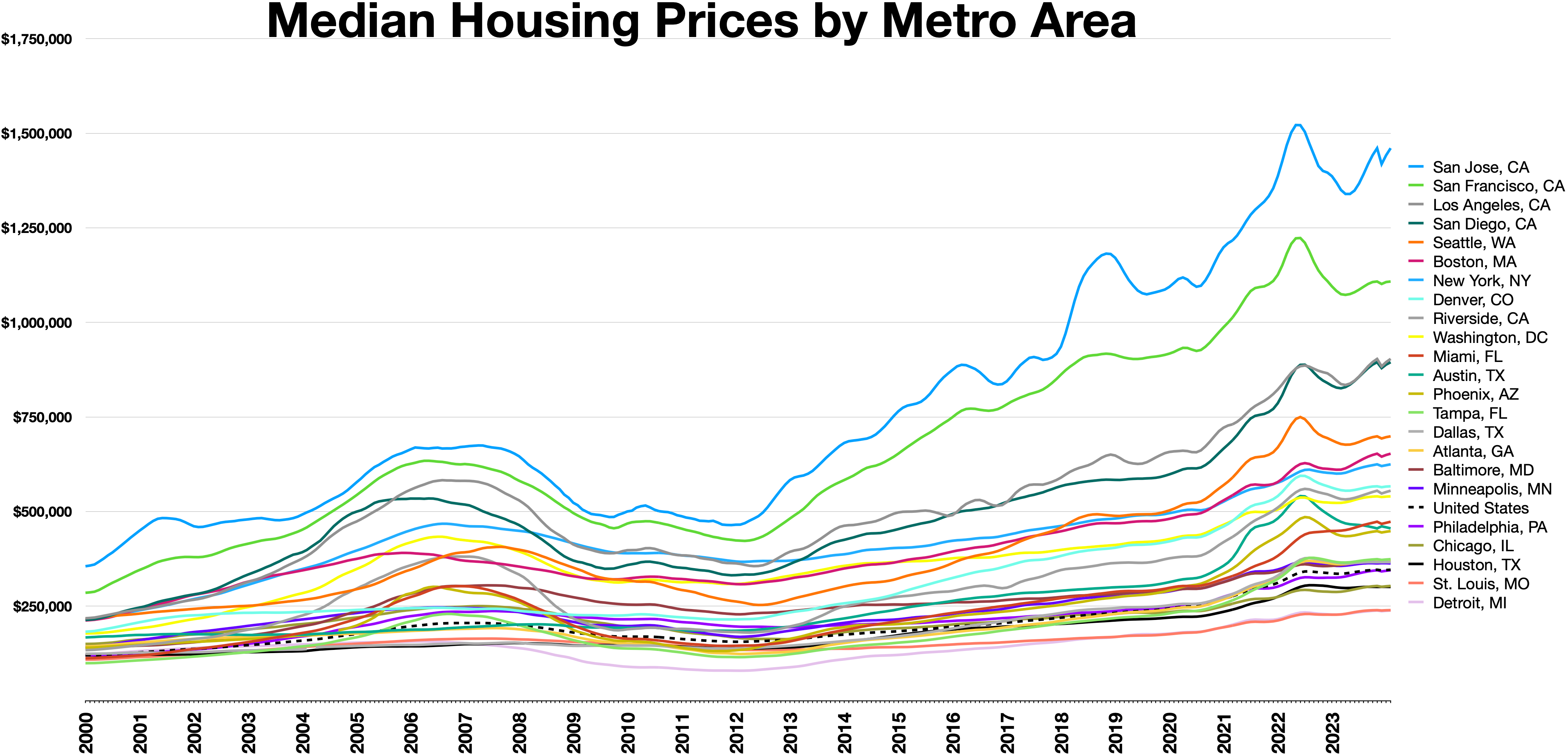

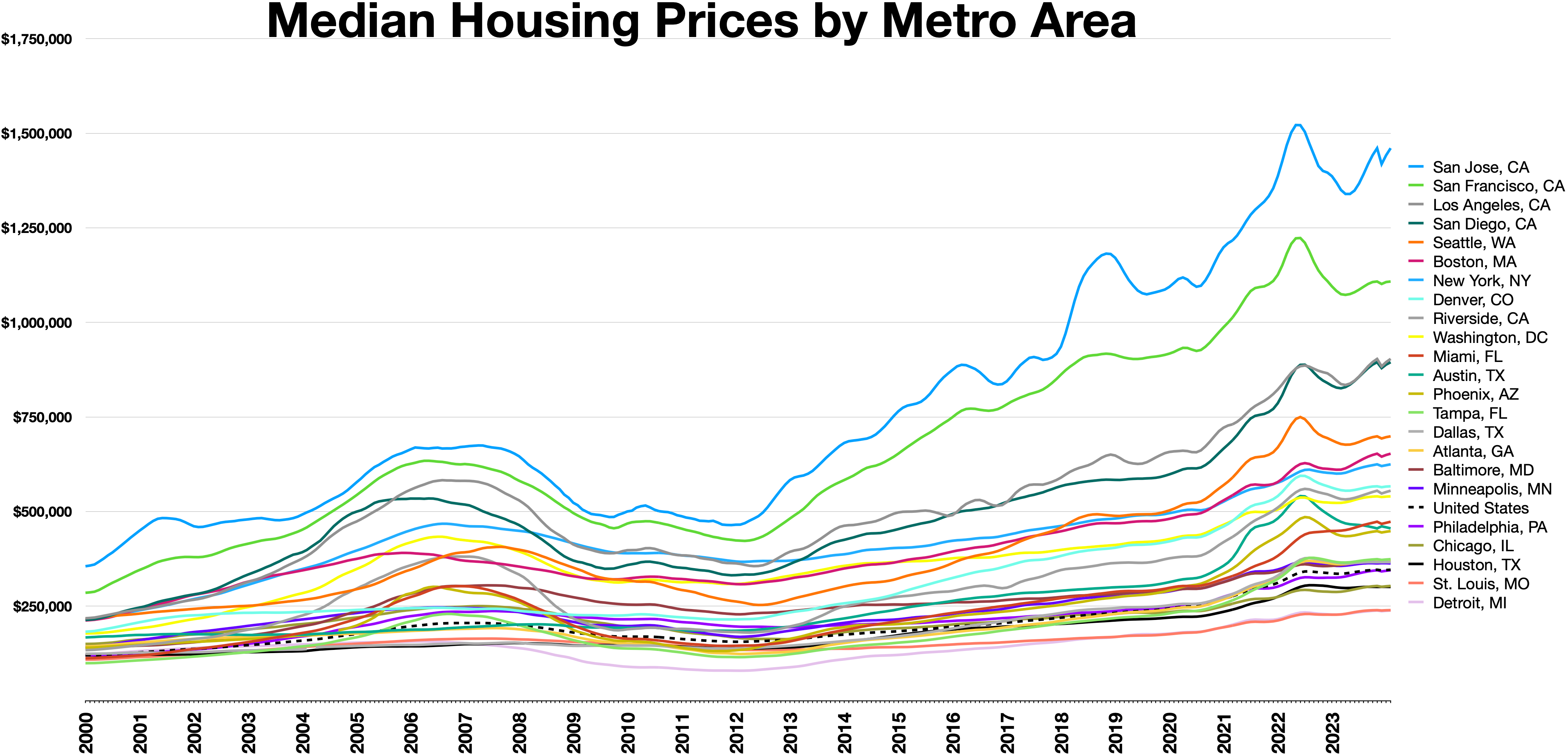

Despite greatly relaxed lending standards and low interest rates, many regions of the country saw very little price appreciation during the "bubble period". Out of 20 largest metropolitan areas tracked by the S&P/Case-Shiller house price index, six (Dallas, Cleveland, Detroit, Denver, Atlanta, and Charlotte) saw less than 10% price growth in inflation-adjusted terms in 2001–2006. During the same period, seven metropolitan areas (Tampa, Miami, San Diego, Los Angeles, Las Vegas, Phoenix, and Washington, D.C.) appreciated by more than 80%.

However, housing bubbles did not manifest themselves in each of these areas at the same time. San Diego and Los Angeles had maintained consistently high appreciation rates since late 1990s, whereas the Las Vegas and Phoenix bubbles did not develop until 2003 and 2004 respectively. It was in the East Coast, the more populated part of the country where the economic real estate turmoil was the worst.

Somewhat paradoxically, as the housing bubble deflates some metropolitan areas (such as Denver and Atlanta) have been experiencing high foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mort ...

rates, even though they did not see much house appreciation in the first place and therefore did not appear to be contributing to the national bubble. This was also true of some cities in the Rust Belt

The Rust Belt is a region of the United States that experienced industrial decline starting in the 1950s. The U.S. manufacturing sector as a percentage of the U.S. GDP peaked in 1953 and has been in decline since, impacting certain regions an ...

such as Detroit

Detroit ( , ; , ) is the largest city in the U.S. state of Michigan. It is also the largest U.S. city on the United States–Canada border, and the seat of government of Wayne County. The City of Detroit had a population of 639,111 at t ...

and Cleveland

Cleveland ( ), officially the City of Cleveland, is a city in the United States, U.S. U.S. state, state of Ohio and the county seat of Cuyahoga County, Ohio, Cuyahoga County. Located in the northeastern part of the state, it is situated along ...

, where weak local economies had produced little house price appreciation early in the decade but still saw declining values and increased foreclosures in 2007. As of January 2009 California, Michigan, Ohio and Florida were the states with the highest foreclosure rates.

By July 2008, year-to-date prices had declined in 24 of 25 U.S. metropolitan areas, with California and the southwest experiencing the greatest price falls. According to the reports, only Milwaukee had seen an increase in house prices after July 2007.

Side effects

Prior to the real estate market correction of 2006–2007, the unprecedented increase in house prices starting in 1997 produced numerous wide-ranging effects in the economy of the United States. * One of the most direct effects was on the construction of new houses. In 2005, 1,283,000 new single-family houses were sold, compared with an average of 609,000 per year during 1990–1995. The largest home builders, such as

* One of the most direct effects was on the construction of new houses. In 2005, 1,283,000 new single-family houses were sold, compared with an average of 609,000 per year during 1990–1995. The largest home builders, such as D. R. Horton

D.R. Horton, Inc. is a home construction company incorporated in Delaware and headquartered in Arlington, Texas. Since 2002, the company has been the largest homebuilder by volume in the United States. The company ranked number 194 on the 2019 Fo ...

, PulteGroup

PulteGroup, Inc. is an American residential home construction company based in Atlanta, Georgia, United States. The company is the 3rd largest home construction company in the United States based on the number of homes closed. In total, the comp ...

, and Lennar, improved operations significantly. D. R. Horton's stock went from $3 in early 1997 to all-time high of $42.82 on July 20, 2005. Pulte Corp's revenues grew from $2.33 billion in 1996 to $14.69 billion in 2005.

* Mortgage equity withdrawal In economics, mortgage equity withdrawal (MEW) is the decision of consumers to borrow money against the real value of their houses. The real value is the current value of the property less any accumulated liabilities (mortgages, loans, etc.) Some a ...

s – primarily home equity loans and cash out refinancings – grew considerably since the early 1990s. According to US Federal Reserve estimates, in 2005 homeowners extracted $750 billion of equity from their homes (up from $106 billion in 1996), spending two thirds of it on personal consumption, home improvements, and credit card debt.

* It is widely believed that the increased degree of economic activity produced by the expanding housing bubble in 2001–2003 was partly responsible for averting a full-scale recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

in the U.S. economy following the dot-com bust and offshoring

Offshoring is the relocation of a business process from one country to another—typically an operational process, such as manufacturing, or supporting processes, such as accounting. Usually this refers to a company business, although state gove ...

to China. Analysts believed that with the downturn in the two sectors, the economy from the early 2000s to 2007 evaded what would have been stagnant growth with a booming housing market creating jobs, economic demand along with a consumer boom that came from home value withdraws until the housing market began a correction.

* Rapidly growing house prices and increasing price gradients forced many residents to flee the expensive centers of many metropolitan areas, resulting in the explosive growth of exurbs

An exurb (or alternately: exurban area) is an area outside the typically denser inner suburban area, at the edge of a metropolitan area, which has some economic and commuting connection to the metro area, low housing density, and growth. It sh ...

in some regions. The population of Riverside County, California

Riverside County is a county located in the southern portion of the U.S. state of California. As of the 2020 census, the population was 2,418,185, making it the fourth-most populous county in California and the 10th-most populous in the Uni ...

almost doubled from 1,170,413 in 1990 to 2,026,803 in 2006, due to its relative proximity to San Diego

San Diego ( , ; ) is a city on the Pacific Ocean coast of Southern California located immediately adjacent to the Mexico–United States border. With a 2020 population of 1,386,932, it is the eighth most populous city in the United States ...

and Los Angeles

Los Angeles ( ; es, Los Ángeles, link=no , ), often referred to by its initials L.A., is the largest city in the state of California and the second most populous city in the United States after New York City, as well as one of the world ...

. On the East Coast, Loudoun County, Virginia

Loudoun County () is in the northern part of the Commonwealth of Virginia in the United States. In 2020, the census returned a population of 420,959, making it Virginia's third-most populous county. Loudoun County's seat is Leesburg. Loudoun ...

, near Washington, D.C., saw its population triple between 1990 and 2006.

*Extreme regional differences in land prices. The differences in housing prices are mainly due to differences in land values, which reached 85% of the total value of houses in the highest priced markets at the peak. The Wisconsin Business School publishes an on line database with building cost and land values for 46 U.S. metro areas. One of the fastest-growing regions in the United States for the last several decades was the Atlanta, Georgia metro area, where land values are a small fraction of those in the high-priced markets. High land values contribute to high living costs in general and are part of the reason for the decline of the old industrial centers while new automobile plants, for example, were built throughout the South, which grew in population faster than the other regions.

*People who either experienced foreclosures or live near foreclosures have a higher probability of falling ill or at the very least dealing with increased anxiety. Overall, it is reported that homeowners who are unable to afford living in their desired locations experience higher instances of poor health. Besides health issues, the unstable housing market has also been shown to increase instances of violence. They subsequently begin to fear that their own homes may be taken from them. Increases in anxiety have at the very least been commonly noted. There is a fear that foreclosures bring about these reactions in people who anticipate the same thing happening to them. An uptick on violent occurrences has also been shown to follow neighborhoods where such uncertainty exists.

These trends were reversed during the real estate market correction of 2006–2007. As of August 2007, D.R. Horton's and Pulte Corp's shares had fallen to 1/3 of their respective peak levels as new residential home sales fell. Some of the cities and regions that had experienced the fastest growth during 2000–2005 began to experience high foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mort ...

rates. It was suggested that the weakness of the housing industry and the loss of the consumption that had been driven by the withdrawal of mortgage equity could lead to a recession, but as of mid-2007 the existence of this recession had not yet been ascertained. In March 2008, Thomson Financial

Thomson Financial was an arm of the Thomson Corporation, an information provider. When the Thomson Corporation merged with Reuters to form Thomson Reuters in April 2008, Thomson Financial was merged with the business of Reuters to form the Market ...

reported that the "Chicago Federal Reserve Bank

The Federal Reserve Bank of Chicago (informally the Chicago Fed) is one of twelve regional Reserve Banks that, along with the Federal Reserve Board of Governors, make up the United States' central bank.

The Chicago Reserve Bank serves the Seven ...

's National Activity Index for February sent a signal that a recession adprobably begun".

The share prices of Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the N ...

and Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia. in 2005 and 2006 many economists and business writers predicted market corrections ranging from a few percentage points to 50% or more from peak values in some markets, and although this cooling had not yet affected all areas of the U.S., some warned that it still could, and that the correction would be "nasty" and "severe". Chief economist Mark Zandi of the economic research firm Moody's Economy.com predicted a "crash" of double-digit depreciation in some U.S. cities by 2007–2009. In a paper he presented to a Federal Reserve Board economic symposium in August 2007, Yale University economist Robert Shiller warned, "The examples we have of past cycles indicate that major declines in real home prices—even 50 percent declines in some places—are entirely possible going forward from today or from the not-too-distant future."

To better understand how the mortgage crisis played out, a 2012 report from the

In March 2007, the United States'

In March 2007, the United States'

The Business Cycle: A Georgist-Austrian Synthesis

" ''American Journal of Economics and Sociology'' 56(4):521–41, October. *

The baby boom, the baby bust, and the housing market

, ''Regional Science and Urban Economics'', Vol.19, No.2, May 1989, pp. 235–258. * *

Joint Center for Housing Studies, Harvard University, 2007

"From Bubble to Depression?"

Steven Gjerstad and Vernon L. Smith, ''

"Mired in Disequilibrium"

Vernon L. Smith, ''

Center for Economic and Policy Research

– CEPR regularly releases reports on the U.S. Housing Bubble. {{Real estate 2000s in the United States 2000s economic history Economic history of the United States Financial economics Interest rates

University of Michigan

, mottoeng = "Arts, Knowledge, Truth"

, former_names = Catholepistemiad, or University of Michigania (1817–1821)

, budget = $10.3 billion (2021)

, endowment = $17 billion (2021)As o ...

analyzed data from the Panel Study of Income Dynamics (PSID), which surveyed roughly 9,000 representative households in 2009 and 2011. The data seems to indicate that, while conditions are still difficult, in some ways the crisis is easing: Over the period studied, the percentage of families behind on mortgage payments fell from 2.2 to 1.9; homeowners who thought it was "very likely or somewhat likely" that they would fall behind on payments fell from 6% to 4.6% of families. On the other hand, family's financial liquidity has decreased: "As of 2009, 18.5% of families had no liquid assets, and by 2011 this had grown to 23.4% of families."

By mid-2016, the national housing price index was "about 1 percent shy of that 2006 bubble peak" in nominal terms but 20% below in inflation adjusted terms.

Subprime mortgage industry collapse

In March 2007, the United States'

In March 2007, the United States' subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subp ...

mortgage industry collapsed due to higher-than-expected home foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.

Formally, a mort ...

rates (no verifying source), with more than 25 subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale. The stock of the country's largest subprime lender, New Century Financial

New Century Financial Corporation was a real estate investment trust that originated mortgage loans in the United States through its operating subsidiaries, New Century Mortgage Corporation and Home123 Corporation.

It was founded in 1995. In 2 ...

, plunged 84% amid Justice Department

A justice ministry, ministry of justice, or department of justice is a ministry or other government agency in charge of the administration of justice. The ministry or department is often headed by a minister of justice (minister for justice in a ...

investigations, before ultimately filing for Chapter 11 bankruptcy on April 2, 2007, with liabilities exceeding $100 million.

The manager of the world's largest bond fund, PIMCO

PIMCO (Pacific Investment Management Company, LLC) is an American investment management firm focusing on active fixed income management worldwide. PIMCO manages investments in many asset classes such as fixed income, equities, commodities, a ...

, warned in June 2007 that the subprime mortgage crisis was not an isolated event and would eventually take a toll on the economy and ultimately have an impact in the form of impaired home prices. Bill Gross, a "most reputable financial guru", sarcastically and ominously criticized the credit ratings of the mortgage-based CDOs now facing collapse:

AAA? You were wooed, Mr. Moody's and Mr. Poor's, by the makeup, those six-inch hooker heels, and a "Business Week has featured predictions by financial analysts that the subprime mortgage market meltdown would result in earnings reductions for largetramp stamp Tattoos on the lower back became popular in the first decade of the 21st century, and gained a reputation for their erotic appeal. The tattoos were sometimes accentuated by low-rise jeans or crop tops. Their popularity was in part due to the inf ...." Many of these good-looking girls are not high-class assets worth 100 cents on the dollar ... e point is that there are hundreds of billions of dollars of this toxic waste ... This problem ltimatelyresides in America's heartland, with millions and millions of overpriced homes.

Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for ...

investment banks trading in mortgage-backed securities, especially Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

, Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, ...

, Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, Ho ...

, Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment ba ...

, and Morgan Stanley

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in more than 41 countries and more than 75,000 employees, the fir ...

. The solvency of two troubled hedge fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as ...

s managed by Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

was imperiled in June 2007 after Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment ba ...

sold off assets seized from the funds and three other banks closed out their positions with them. The Bear Stearns funds once had over $20 billion of assets, but lost billions of dollars on securities backed by subprime mortgages.

H&R Block reported that it had made a quarterly loss of $677 million on discontinued operations, which included the subprime lender Option One, as well as writedowns, loss provisions for mortgage loans and the lower prices achievable for mortgages in the secondary market. The unit's net asset value had fallen 21% to $1.1 billion as of April 30, 2007. The head of the mortgage industry consulting firm Wakefield Co. warned, "This is going to be a meltdown of unparalleled proportions. Billions will be lost." Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

pledged up to U.S. $3.2 billion in loans on June 22, 2007, to bail out one of its hedge funds that was collapsing because of bad bets on subprime mortgages.

Peter Schiff

Peter David Schiff (; born March 23, 1963) is an American stock broker, financial commentator, and radio personality. He is CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer based in Westport, Connecticut. He is also ...

, president of Euro Pacific Capital, argued that if the bonds in the Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The com ...

funds were auctioned on the open market, much weaker values would be plainly revealed. Schiff added, "This would force other hedge funds to similarly mark down the value of their holdings. Is it any wonder that Wall street is pulling out the stops to avoid such a catastrophe? ... Their true weakness will finally reveal the abyss into which the housing market is about to plummet." The ''New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' report connects the hedge fund crisis with lax lending standards: "The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes."

On August 9, 2007, BNP Paribas

BNP Paribas is a French international banking group, founded in 2000 from the merger between Banque Nationale de Paris (BNP, "National Bank of Paris") and Paribas, formerly known as the Banque de Paris et des Pays-Bas. The full name of the grou ...

announced that it could not fairly value the underlying assets in three funds because of its exposure to U.S. subprime

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subp ...

mortgage lending markets. Faced with potentially massive (though unquantifiable) exposure, the European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centra ...

(ECB) immediately stepped in to ease market worries by opening lines of €96.8 billion (U.S. $130 billion) of low-interest credit. One day after the financial panic about a credit crunch had swept through Europe, the U.S. Federal Reserve Bank conducted an "open market operation

In macroeconomics, an open market operation (OMO) is an activity by a central bank to give (or take) liquidity in its currency to (or from) a bank or a group of banks. The central bank can either buy or sell government bonds (or other financial ...

" to inject U.S. $38 billion in temporary reserves into the system to help overcome the ill effects of a spreading credit crunch, on top of a similar move the previous day. In order to further ease the credit crunch in the U.S. credit market, at 8:15 a.m. on August 17, 2007, the chairman of the Federal Reserve Bank Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Duri ...

decided to lower the discount window rate, which is the lending rate between banks and the Federal Reserve Bank, by 50 basis points to 5.75% from 6.25%. The Federal Reserve Bank stated that the recent turmoil in the U.S. financial markets had raised the risk of an economic downturn.

In the wake of the mortgage industry meltdown, Senator Chris Dodd

Christopher John Dodd (born May 27, 1944) is an American lobbyist, lawyer, and Democratic Party (United States), Democratic Party politician who served as a United States senator from Connecticut from 1981 to 2011. Dodd is the List of United Sta ...

, chairman of the Banking Committee, held hearings in March 2007 in which he asked executives from the top five subprime mortgage companies to testify and explain their lending practices. Dodd said that "predatory lending practices" were endangering home ownership for millions of people. In addition, Democratic senators such as Senator Charles Schumer

Charles Ellis Schumer ( ; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021. A member of the Democratic Party (United States), Democratic Party, Schumer is in his fourth Senate term, hav ...

of New York were already proposing a federal government bailout of subprime borrowers like the bailout made in the savings and loan crisis, in order to save homeowners from losing their residences. Opponents of such a proposal asserted that a government bailout of subprime borrowers was not in the best interests of the U.S. economy because it would simply set a bad precedent, create a moral hazard, and worsen the speculation problem in the housing market.

Lou Ranieri

Lewis S. Ranieri (; born 1947) is a former bond trader, founding partner and current chairman of Ranieri Partners,http://www.ranieripartners.com/ranieri-senior-executive-team-1/lewis-s-ranieri a real estate firm. He is considered the "father" ...

of Salomon Brothers

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street durin ...

, creator of the mortgage-backed securities market in the 1970s, warned of the future impact of mortgage defaults: "This is the leading edge of the storm ... If you think this is bad, imagine what it's going to be like in the middle of the crisis." In his opinion, more than $100 billion of home loans were likely to default when the problems seen in the subprime industry also emerge in the prime mortgage markets.

Former Federal Reserve Chairman Alan Greenspan had praised the rise of the subprime mortgage industry and the tools which it uses to assess credit-worthiness in an April 2005 speech. Because of these remarks, as well as his encouragement of the use of adjustable-rate mortgages, Greenspan has been criticized for his role in the rise of the housing bubble and the subsequent problems in the mortgage industry that triggered the economic crisis of 2008

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

. On October 15, 2008, Anthony Faiola, Ellen Nakashima and Jill Drew wrote a lengthy article in ''The Washington Post

''The Washington Post'' (also known as the ''Post'' and, informally, ''WaPo'') is an American daily newspaper published in Washington, D.C. It is the most widely circulated newspaper within the Washington metropolitan area and has a large n ...

'' titled, "What Went Wrong". In their investigation, the authors claim that Greenspan vehemently opposed any regulation of financial instruments known as derivatives. They further claim that Greenspan actively sought to undermine the office of the Commodity Futures Trading Commission

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options.

The Commodity Exchange Act ...

, specifically under the leadership of Brooksley E. Born

Brooksley Elizabeth BornCalifornia Births, 1905 - 1995Brooksley Elizabeth Born/ref> (born August 27, 1940) is an American attorney and former public official who, from August 26, 1996, to June 1, 1999, was chair of the Commodity Futures Trading ...

, when the Commission sought to initiate the regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security, that triggered the economic crisis of 2008. Concerning the subprime mortgage mess, Greenspan later admitted that "I really didn't get it until very late in 2005 and 2006."

On September 13, 2007, the British bank Northern Rock applied to the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government o ...

for emergency funds because of liquidity problems related to the subprime crisis. This precipitated a bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

at Northern Rock branches across the UK by concerned customers who took out "an estimated £2bn withdrawn in just three days".

See also

* 2000s commodities boom * 2010 United States foreclosure crisis *Financial crisis of 2007–08

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of f ...

*Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

*Mortgage Electronic Registration Systems

Mortgage Electronic Registration Systems, Inc. (MERS) is an American privately held corporation. MERS is a separate and distinct corporation that serves as a nominee on mortgages after the turn of the century and is owned by holding company MERSC ...

* Synthetic CDO

*Real estate trend

A real estate trend is any consistent pattern or change in the general direction of the real estate industry which, over the course of time, causes a statistically noticeable change. This phenomenon can be a result of the economy, a change in mortg ...

Notes

Further reading

Books and book chapters

*June Fletcher

June Fletcher is an American business and financial writer for '' The Naples Daily News''. Her beat focuses on business, finance and real estate.

She formerly was a business and real estate reporter for ''The Wall Street Journal''.

Early life and ...

(2005), ''House Poor: Pumped Up Prices, Rising Rates, and Mortgages on Steroid – How to Survive the Coming Housing Crisis'', New York: Collins. .

* Fred E. Foldvary (2007), ''The Depression of 2008'', Berkeley: The Gutenberg Press. .

* Koller, Cynthia A. (2012). "White Collar Crime in Housing: Mortgage Fraud in the United States." El Paso, TX: LFB Scholarly

The London Fire Brigade (LFB) is the fire and rescue service for London, the capital of the United Kingdom. It was formed by the Metropolitan Fire Brigade Act 1865, under the leadership of superintendent Eyre Massey Shaw. It has 5,992staff, i ...

. .

* Patterson, Laura A., & Koller, Cynthia A. Koller (2011). "Diffusion of Fraud Through Subprime Lending: The Perfect Storm." In Mathieu Deflem (ed.) Economic Crisis and Crime (Sociology of Crime Law and Deviance, Volume 16), Emerald Group Publishing Limited, pp. 25–45.

* John R. Talbott (2006). ''Sell Now!: The End of the Housing Bubble'', New York: St. Martin's Griffin. .

* John R. Talbott (2003). ''The Coming Crash in the Housing Market'', New York: McGraw-Hill. .

* Elizabeth Warren

Elizabeth Ann Warren ( née Herring; born June 22, 1949) is an American politician and former law professor who is the senior United States senator from Massachusetts, serving since 2013. A member of the Democratic Party and regarded as ...

and Amelia Warren Tyagi (2003). '' The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke'', New York: Basic Books

Basic Books is a book publisher founded in 1950 and located in New York, now an imprint of Hachette Book Group. It publishes books in the fields of psychology, philosophy, economics, science, politics, sociology, current affairs, and history.

H ...

. .

Articles

* * * * * * * * * * * * Fred E. Foldvary (1997),The Business Cycle: A Georgist-Austrian Synthesis

" ''American Journal of Economics and Sociology'' 56(4):521–41, October. *

N. Gregory Mankiw

Nicholas Gregory Mankiw (; born February 3, 1958) is an American macroeconomist who is currently the Robert M. Beren Professor of Economics at Harvard University. Mankiw is best known in academia for his work on New Keynesian economics.

Mankiw ...

and David N. Weil (1989).The baby boom, the baby bust, and the housing market

, ''Regional Science and Urban Economics'', Vol.19, No.2, May 1989, pp. 235–258. * *

Joint Center for Housing Studies, Harvard University, 2007

"From Bubble to Depression?"

Steven Gjerstad and Vernon L. Smith, ''

Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

'', April 6, 2009, includes charts

"Mired in Disequilibrium"

Vernon L. Smith, ''

Newsweek

''Newsweek'' is an American weekly online news magazine co-owned 50 percent each by Dev Pragad, its president and CEO, and Johnathan Davis (businessman), Johnathan Davis, who has no operational role at ''Newsweek''. Founded as a weekly print m ...

'', January 24, 2011

External links

Center for Economic and Policy Research

– CEPR regularly releases reports on the U.S. Housing Bubble. {{Real estate 2000s in the United States 2000s economic history Economic history of the United States Financial economics Interest rates