United Kingdom national debt on:

[Wikipedia]

[Google]

[Amazon]

The United Kingdom national debt is the total quantity of money borrowed by the Government of the

The United Kingdom national debt is the total quantity of money borrowed by the Government of the

The UK national debt is often confused with the

The UK national debt is often confused with the

Distinct from both the national debt and the PSNCR is the interest that the government must pay to service the existing national debt. In 2023, the annual cost of servicing the public debt amounted to around £108bn, or roughly 3% of GDP.

By international standards, Britain enjoys very low borrowing costs.

Distinct from both the national debt and the PSNCR is the interest that the government must pay to service the existing national debt. In 2023, the annual cost of servicing the public debt amounted to around £108bn, or roughly 3% of GDP.

By international standards, Britain enjoys very low borrowing costs.

The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later imperial conquests. The national debt increased dramatically during and after the

The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later imperial conquests. The national debt increased dramatically during and after the

During the

During the

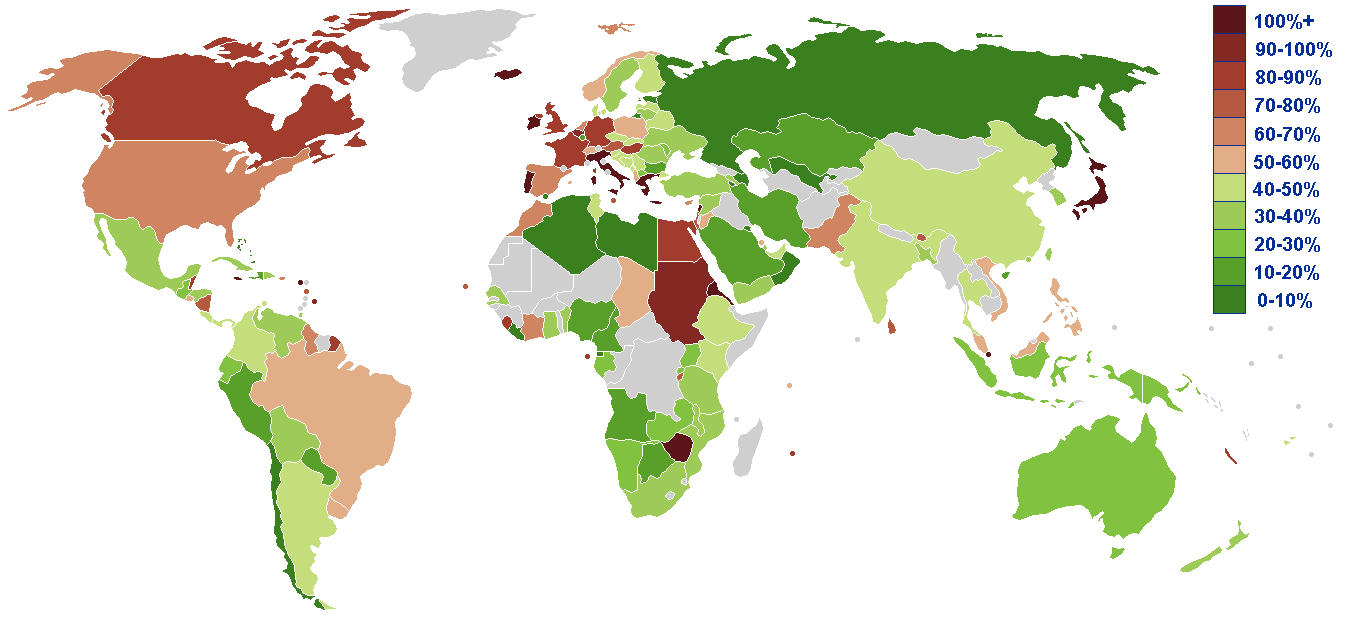

In 2020, Britain's volume of debt was ranked 3rd internationally according to the

In 2020, Britain's volume of debt was ranked 3rd internationally according to the

BBC Budget 2009 Overview

Telegraph.co.uk 2011 Budget coverage

BBC Budget 2008 Overview

HM Treasury Whole of Government Accounts development programme

Better Government Initiative experts say billions wasted on services, Daily Telegraph, 24 November 2007

Better Government Initiative

UK National Debt Clock

PricewaterhouseCoopers budget coverage and analysis

The UK Economy at the Crossroads

research paper from the Center for Economic and Policy Research, March 2018 {{Authority control Government of the United Kingdom Public finance of the United Kingdom Government debt by country

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

at any time through the issue of securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

by the British Treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry; in a business context, corporate treasury.

*A place or location where treasure, such as currency or precious items are kept. These can be ...

and other government agencies.

At the end of March 2023, UK general government gross debt was £2,537.0 billion, or 100.5% gross domestic product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performanc ...

.

Approximately a third of the UK national debt is owned by the British government due to the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one ...

's quantitative easing programme, so approximately a third of the cost of servicing the debt is paid by the government to itself. In 2018, this reduced the annual servicing cost to approximately £30 billion (approx 2% of GDP, approx 5% of UK government tax income).

In 2017, due to the Government's budget deficit ( PSNCR), the national debt increased by £46 billion. The Cameron–Clegg coalition

The Cameron–Clegg coalition was formed by David Cameron and Nick Clegg when Cameron was invited by Queen Elizabeth II to form a new government, following the resignation of Prime Minister Gordon Brown on 11 May 2010, after the general el ...

government in 2010 planned that they would eliminate the deficit by the 2015/16 financial year. However, by 2014 they admitted that the structural deficit would not be eliminated until the financial year 2017/18. This forecast was pushed back to 2018/19 in March 2015, and to 2019/20 in July 2015, before the target of a return to surplus at any particular time was finally abandoned by the then Chancellor of the Exchequer

The chancellor of the exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and the head of HM Treasury, His Majesty's Treasury. As one of the four Great Offices of State, t ...

George Osborne in July 2016.

Definition

The UK national debt is the total quantity of money borrowed by theGovernment of the United Kingdom

His Majesty's Government, abbreviated to HM Government or otherwise UK Government, is the central government, central executive authority of the United Kingdom of Great Britain and Northern Ireland.

at any time through the issue of securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

by the British Treasury and other government agencies.

Debt versus deficit

The UK national debt is often confused with the

The UK national debt is often confused with the government budget deficit

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government government revenues, revenues and government expenditures, spending. For ...

(officially known as the Public Sector Net Cash Requirement (PSNCR)). For example, the then Prime Minister David Cameron

David William Donald Cameron, Baron Cameron of Chipping Norton (born 9 October 1966) is a British politician who served as Prime Minister of the United Kingdom from 2010 to 2016. Until 2015, he led the first coalition government in the UK s ...

was reprimanded in February 2013 by the UK Statistics Authority

The UK Statistics Authority (UKSA, ) is a non-ministerial government department of the Government of the United Kingdom responsible for oversight of the Office for National Statistics, maintaining a national code of practice for official statist ...

for creating confusion between the two, by stating in a political broadcast that his administration was "paying down Britain's debts". In fact, his administration had been attempting to reduce the deficit, not the overall debt; which continued to rise even as the deficit was reduced.

UK budget

The public debt increases or decreases as a result of the annualbudget deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budg ...

or surplus. The British government budget deficit

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government government revenues, revenues and government expenditures, spending. For ...

or surplus is the cash difference between government receipts and spending. The British government debt is rising due to a gap between revenue and expenditure. Total government revenue in the fiscal year 2015/16 was projected to be £673 billion, whereas total expenditure was estimated at £742 billion. Therefore, the total deficit was £69 billion. This represented a rate of borrowing of a little over £1.3 billion per week.

Gilts

The British government finances its debt by issuinggilts

Gilt-edged securities, also referred to as gilts, are bonds issued by the UK Government. The term is of British origin, and referred to the debt securities issued by the Bank of England on behalf of His Majesty's Treasury, whose paper certific ...

, or Government securities. These securities are the simplest form of government bond

A government bond or sovereign bond is a form of Bond (finance), bond issued by a government to support government spending, public spending. It generally includes a commitment to pay periodic interest, called Coupon (finance), coupon payments' ...

and make up the largest share of British government debt. A conventional gilt is a bond issued by the British government that pays the holder a fixed cash payment (or coupon

In marketing, a coupon is a ticket or document that can be redeemed for a financial discount or rebate when purchasing a product.

Customarily, coupons are issued by manufacturers of consumer packaged goods

or by retailers, to be used in ...

) every six months until maturity, at which point the holder receives the final coupon payment and the return of the principal.

Cost of servicing the debt

Distinct from both the national debt and the PSNCR is the interest that the government must pay to service the existing national debt. In 2023, the annual cost of servicing the public debt amounted to around £108bn, or roughly 3% of GDP.

By international standards, Britain enjoys very low borrowing costs.

Distinct from both the national debt and the PSNCR is the interest that the government must pay to service the existing national debt. In 2023, the annual cost of servicing the public debt amounted to around £108bn, or roughly 3% of GDP.

By international standards, Britain enjoys very low borrowing costs.

Credit rating

Like other sovereign debt, the British national debt is rated by various ratings agencies. On 23 February 2013, it was reported that Moody's had downgraded UK debt from Aaa to Aa1, the first time since 1978 that the country has not had an AAA credit rating. This was described as a "humiliating blow" by Shadow Chancellor Ed Balls. George Osborne, the Chancellor, said that it was "a stark reminder of the debt problems facing our country", adding that "we will go on delivering the plan that has cut the deficit by a quarter". France and the United States of America had each lost their AAA credit status in 2012. The agency Fitch also downgraded its credit rating for British government debt from AAA to AA+ in April 2013. Further downgrades were made by Fitch andStandard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is co ...

in June 2016, following the UK's vote in the referendum of that month to leave the European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The u ...

. Standard & Poor's had hitherto maintained the UK's AAA status.

Remedies for indebtedness

All the main political parties in Britain agree that the national debt is too high, but disagree on the best policy to deal with it, with Conservative Party politicians advocating a larger role for cuts to public spending. By contrast, the Labour Party tends to advocate fewer cuts and more emphasis on economic stimulus, higher rates of taxation on wealthier individuals and corporations and new taxes for those. Another body of opinion is that the "consensus" regarding the problematic nature of the national debt is incorrect. The view proposed by economists such as Professor Stephanie Kelton of Stony Brook University in New York is that there is often too much emphasis in political discussions on 'balancing the books'.History

The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later imperial conquests. The national debt increased dramatically during and after the

The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later imperial conquests. The national debt increased dramatically during and after the Napoleonic Wars

{{Infobox military conflict

, conflict = Napoleonic Wars

, partof = the French Revolutionary and Napoleonic Wars

, image = Napoleonic Wars (revision).jpg

, caption = Left to right, top to bottom:Battl ...

, rising to around 200% of GDP. Over the course of the 19th century the national debt gradually fell, only to see large increases again during World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

and World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

. After the war, the national debt once again slowly fell as a proportion of GDP.

Modern era

In 1976, the British Government led byJames Callaghan

Leonard James Callaghan, Baron Callaghan of Cardiff ( ; 27 March 191226 March 2005) was a British statesman and Labour Party (UK), Labour Party politician who served as Prime Minister of the United Kingdom from 1976 to 1979 and Leader of the L ...

faced a Sterling crisis during which the value of the pound tumbled and the government found it difficult to raise sufficient funds to maintain its spending commitments. The Prime Minister was forced to apply to the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

for a £2.3 billion rescue package; the largest-ever call on IMF resources up to that point. In November 1976, the IMF announced its conditions for a loan, including deep cuts in public expenditure, in effect taking control of UK domestic policy. The crisis was seen as a national humiliation, with Callaghan being forced to go "cap in hand" to the IMF.

Recent history

In the late 1990s and early 2000s, the national debt dropped in relative terms, falling to 29% of GDP by 2002. In 1997, the Labour Government ofTony Blair

Sir Anthony Charles Lynton Blair (born 6 May 1953) is a British politician who served as Prime Minister of the United Kingdom from 1997 to 2007 and Leader of the Labour Party (UK), Leader of the Labour Party from 1994 to 2007. He was Leader ...

had inherited a PSNCR of approximately £5 billion per annum, but by sticking to the spending plans of the outgoing Conservative Government, this was gradually turned into a modest budget surplus. During the Spending Review of 2000, Labour began to pursue a looser fiscal policy, and by 2002 annual borrowing had reached £20 billion.

The national debt continued to increase, together with sustained economic growth, increasing to 37% of GDP in 2007. This was due to extra government borrowing, largely caused by increased spending on health, education, and social security benefits. Between 2008 and 2013, when the British economy slowed sharply and fell into recession, the national debt rose dramatically, mainly caused by increased spending on social security benefits, financial bailouts for banks, and a significant drop in receipts from stamp duty, corporate tax, and income tax.

In the 20-year period from 1986/87 to 2006/07 government spending in the United Kingdom averaged around 40% of GDP. As a result of the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

and the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

, government spending increased to a historically high level of 48% of GDP in 2009/10, partly as a result of the cost of a series of bank bailouts. In July 2007, Britain had government debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occu ...

at 35.5% of GDP. This figure rose to 56.8% of GDP by July 2009.

The national debt today

During the

During the COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, national debt reached £2.004 trillion for the first time due to government spending on virus measures, such as the Coronavirus Job Retention Scheme ("furlough scheme").

The national debt stood at £1.786 trillion at the calendar year end 2018, or 85.2% of GDP; as published by the Office for National Statistics

The Office for National Statistics (ONS; ) is the executive office of the UK Statistics Authority, a non-ministerial department which reports directly to the Parliament of the United Kingdom, UK Parliament.

Overview

The ONS is responsible fo ...

. However, the OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

claimed the national debt to be 118.3% of GDP as of 5 January 2021

The annual amount that the government must borrow to plug the gap in its finances used to be known as the public sector borrowing requirement, but is now called the Public Sector Net Cash Requirement (PSNCR). The PSNCR figure for the financial year end 2017 was £46 billion, total British GDP in 2017 was £1.959 trillion.

By historic peacetime standards, the national debt is large and growing. There is concern that official calculations of national debt omit many 'off-book' liabilities which mask the true nature of the debt: for example, Nick Silver of the Institute of Economic Affairs estimated the current British liabilities, including state and public pensions, as well as other commitments by the government, to be near £5 trillion, compared with the Government's estimate of £845 billion (as of 17 November 2010) These liabilities can be compared to total net assets (2010 figures) of £7.3 trillion, which equates to approximately a net worth of £120,000 per head of the population. Based on such a method of calculation, UK national debt would be equivalent to, or potentially exceed, historic highs.

The British government's debt is owned by a wide variety of investors, most notably pension funds. These funds are on deposit, mainly in the form of Treasury bonds at the Bank of England. The pension funds, therefore, have an asset which has to be offset by a liability, or a debt, of the government. As of the end of 2016, 27.6% of the national debt was owed to overseas governments and investors.

International comparisons

CIA World Factbook

''The World Factbook'', also known as the ''CIA World Factbook'', is a reference resource produced by the United States' Central Intelligence Agency (CIA) with almanac-style information about the countries of the world. The official print ve ...

, behind only Greece

Greece, officially the Hellenic Republic, is a country in Southeast Europe. Located on the southern tip of the Balkan peninsula, it shares land borders with Albania to the northwest, North Macedonia and Bulgaria to the north, and Turkey to th ...

and Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea ...

See also

* 2011 United Kingdom budget *Economic history of the United Kingdom

The economic history of the United Kingdom relates the economic development in the British state from the absorption of Wales into the Kingdom of England after Laws in Wales Acts 1535 and 1542, 1535 to the modern United Kingdom of Great Britain ...

* Economy of the United Kingdom

The United Kingdom has a highly developed social market economy. From 2017 to 2025 it has been the sixth-largest national economy in the world measured by nominal gross domestic product (GDP), tenth-largest by purchasing power parity (PPP), ...

* Euro area crisis

* The National Fund

* UK Debt Management Office

* National debt of the United States

The "national debt of the United States" is the total national debt owed by the federal government of the United States, federal government of the United States to United States Treasury security, treasury security holders. The national debt ...

* Whole of Government Accounts

References

Bibliography

* Ferguson, Niall, ''The Ascent of Money: A Financial History of the World'', Penguin Books, London (2008) * ''The Week'', p. 15, 21 September 2013External links

BBC Budget 2009 Overview

Telegraph.co.uk 2011 Budget coverage

BBC Budget 2008 Overview

HM Treasury Whole of Government Accounts development programme

Better Government Initiative experts say billions wasted on services, Daily Telegraph, 24 November 2007

Better Government Initiative

UK National Debt Clock

PricewaterhouseCoopers budget coverage and analysis

The UK Economy at the Crossroads

research paper from the Center for Economic and Policy Research, March 2018 {{Authority control Government of the United Kingdom Public finance of the United Kingdom Government debt by country