Traditional investments on:

[Wikipedia]

[Google]

[Amazon]

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds,

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds,

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds,

In finance, the notion of traditional investments refers to putting money into well-known assets (such as bonds, cash

In economics, cash is money in the physical form of currency, such as banknotes and coins.

In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-i ...

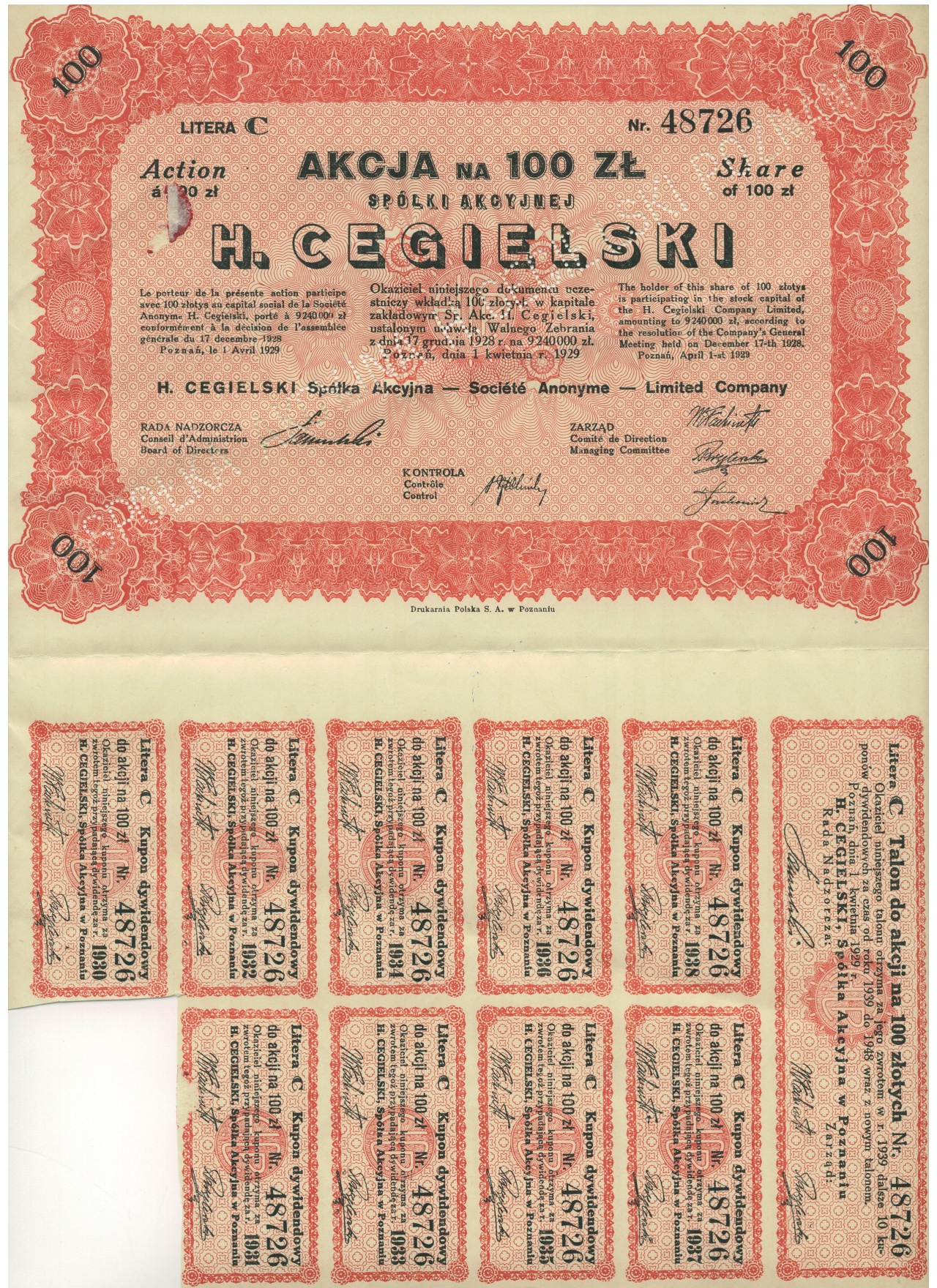

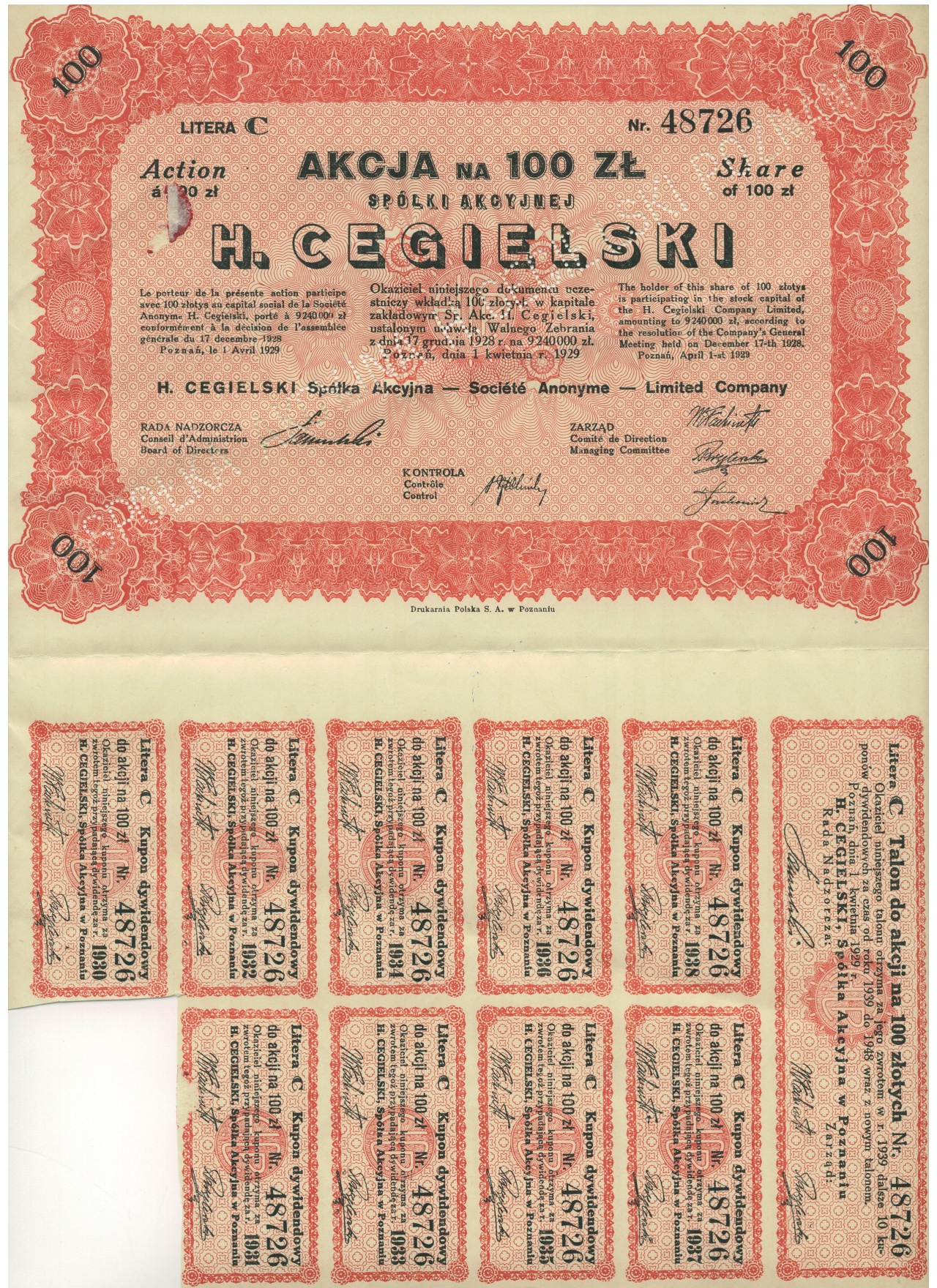

, real estate, and equity shares

In financial markets, a share (sometimes referred to as stock or equity) is a unit of equity ownership in the capital stock of a corporation. It can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Sha ...

) with the expectation of capital appreciation

Capital appreciation is an increase in the price or value of assets. It may refer to appreciation of company stocks or bonds held by an investor, an increase in land valuation, or other upward revaluation of fixed assets.

Capital appreciation ...

, dividends, and interest earnings. Traditional investments are to be contrasted with alternative investments

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding capital stocks, bonds, and cash.

The term is a relatively loose one and includes tangible a ...

.

Bonds

Here the investor purchasesdebt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

issued by companies or governments

A government is the system or group of people governing an organized community, generally a state.

In the case of its broad associative definition, government normally consists of legislature, executive, and judiciary. Government is a m ...

which promises to pay an annual return until the debt is repaid. The value of the investment changes as the level of general interest rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

fluctuates, causing the bond to become more or less valuable.

Cash

In cashinvesting

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broade ...

, money is typically invested in short-term, low-risk investment vehicles like certificates of deposit, money market fund

A money market fund (also called a money market mutual fund) is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a hig ...

s, and high yield bank accounts.

Real estate

In real estate, money is used to purchaseproperty

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, re ...

for the purpose of holding, reselling or leasing for income and there is an element of capital risk.

Residential real estate

Investment in residential real estate is the most common form of real estate investment measured by number of participants because it includes property purchased as a primary residence. In many cases the buyer does not have the full purchase price for a property and must borrow additional money from a bank, finance company or private lender.Commercial real estate

Commercial real estate consists of apartments, office buildings, retail space, hotels, warehouses, and other commercial properties. Investors may purchase commercial property outright, with the help of a loan, or collectively through a real estate fund.Real estate investment trusts

Investment in real estate investment trusts (REITs) is like investing in a pool of real estate that the company manages.Stocks and shares

This involves purchasing a share in the equity of acompany

A company, abbreviated as co., is a Legal personality, legal entity representing an association of legal people, whether Natural person, natural, Juridical person, juridical or a mixture of both, with a specific objective. Company members ...

with the expectation that the share price

A share price is the price of a single share of a number of saleable equity shares of a company.

In layman's terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for.

B ...

will increase. Purchasing a share in the company is the same as owning part of the company. Stock investing can come in the form of buying individual stocks, mutual funds, index funds and exchange traded funds (ETFs).

References

{{Investment-management, state=expanded Investment