The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA),

that amended the

Internal Revenue Code of 1986. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the

standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

and family tax credits, eliminating

personal exemption

Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. In 2017, the personal exe ...

s and making it less beneficial to itemize deductions, limiting

deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the

alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and cancelling the penalty enforcing individual mandate of the

Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Pres ...

(ACA).

The Act is based on tax reform advocated by congressional

Republicans and the

Trump administration

Donald Trump's tenure as the List of presidents of the United States, 45th president of the United States began with Inauguration of Donald Trump, his inauguration on January 20, 2017, and ended on January 20, 2021. Trump, a Republican Party ...

. The nonpartisan

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

(CBO) reported that under the Act individuals and

pass-through entities like partnerships and

S corporations would receive about $1.125 trillion in net benefits (i.e. net tax cuts offset by reduced healthcare subsidies) over 10 years, while

corporations

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and r ...

would receive around $320billion in benefits. The CBO estimated that implementing the Act would add an estimated $2.289

trillion

''Trillion'' is a number with two distinct definitions:

*1,000,000,000,000, i.e. one million million, or (ten to the twelfth power), as defined on the short scale. This is now the meaning in both American and British English.

* 1,000,000,000,00 ...

to the

national debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

over ten years,

or about $1.891trillion after taking into account

macroeconomic feedback effects, in addition to the $9.8trillion increase forecast under the current policy

baseline and existing $20trillion national debt.

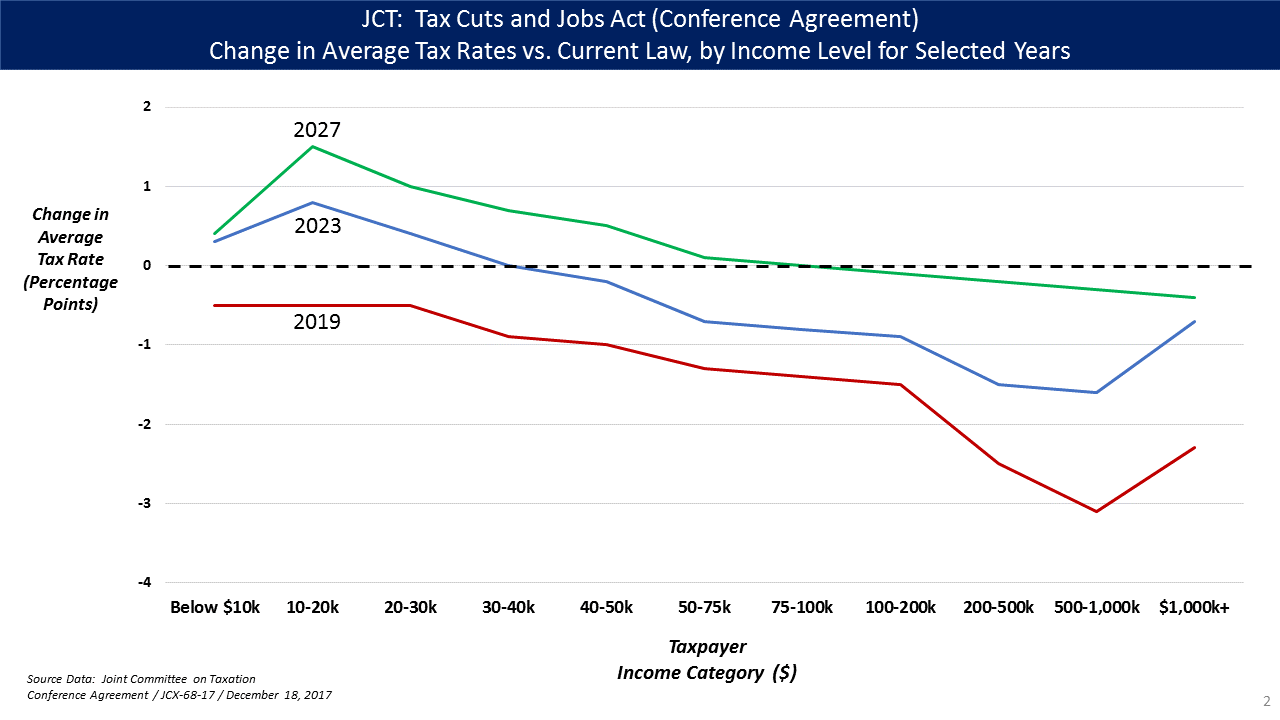

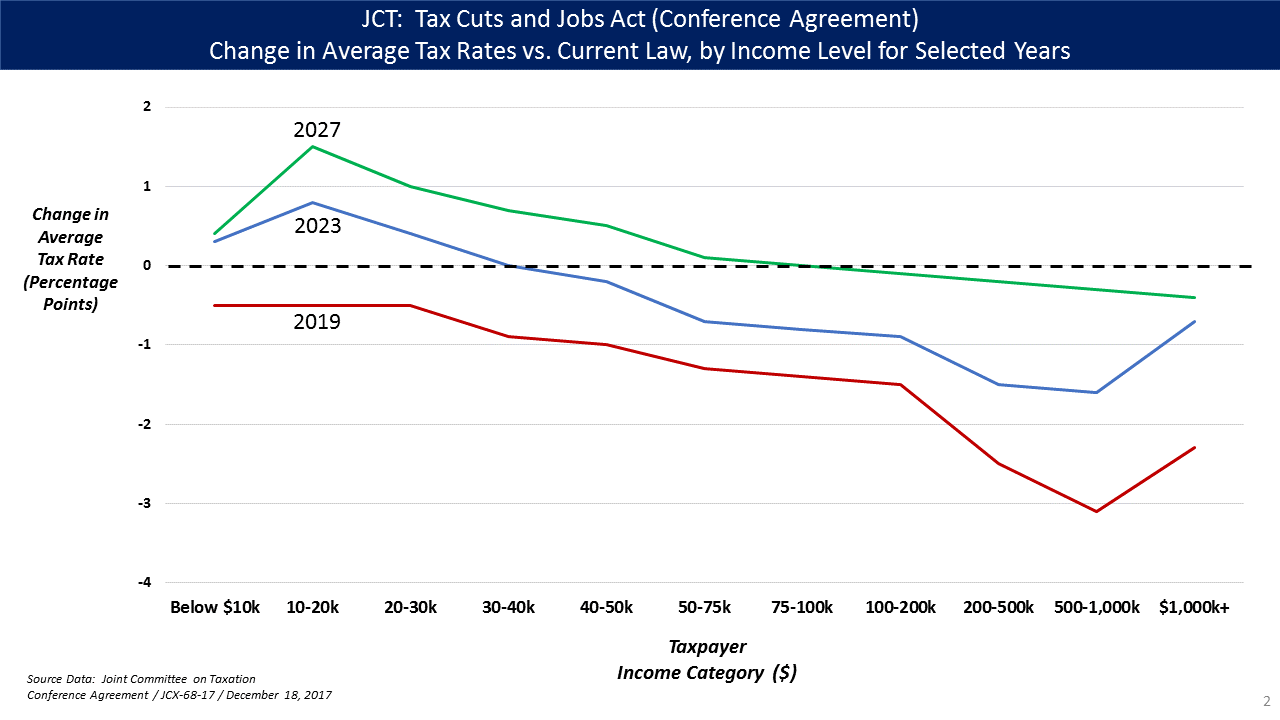

Many tax cut provisions, especially income tax cuts, will expire in 2025, and starting in 2021 will increase over time; by 2027 this would affect an estimated 65% of the population and in that same year the law's provisions are set to be fully enacted, but the corporate tax cuts are permanent. The Senate was able to pass the bill with only 51 votes, without the need to defeat a

filibuster

A filibuster is a political procedure in which one or more members of a legislative body prolong debate on proposed legislation so as to delay or entirely prevent decision. It is sometimes referred to as "talking a bill to death" or "talking out ...

, under the

budget reconciliation process.

The House passed the penultimate version of the bill on December 19, 2017. The Senate passed the final bill, 51–48, on December 20, 2017. On the same day, a re-vote was held in the House for procedural reasons; the bill passed, 224–201. The bill was signed into law by President

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of P ...

on December 22, 2017. Most of the changes introduced by the bill went into effect on January 1, 2018, and did not affect 2017 taxes.

Supporters argued that the law would increase

GDP growth, increase levels of business investment, increase wage and salary income for households, that the tax cuts would pay for themselves, and that the law would simplify tax codes.

Opponents argued that the law would result in adverse impacts, including a higher budget deficit,

higher trade deficit,

greater income inequality,

and lower healthcare coverage and higher healthcare costs,

and a disproportionate impact on certain states and professions. Critics also argued that advocates misrepresented the law.

Some of the reforms enacted by the Republicans have become controversial within key states, particularly the $10,000 cap on state and local tax deductibility, and were challenged in federal court before being upheld.

According to an aggregation of polls from

Real Clear Politics, 34% of Americans were in favor of the new plan, 39% not in favor, and 28% unsure.

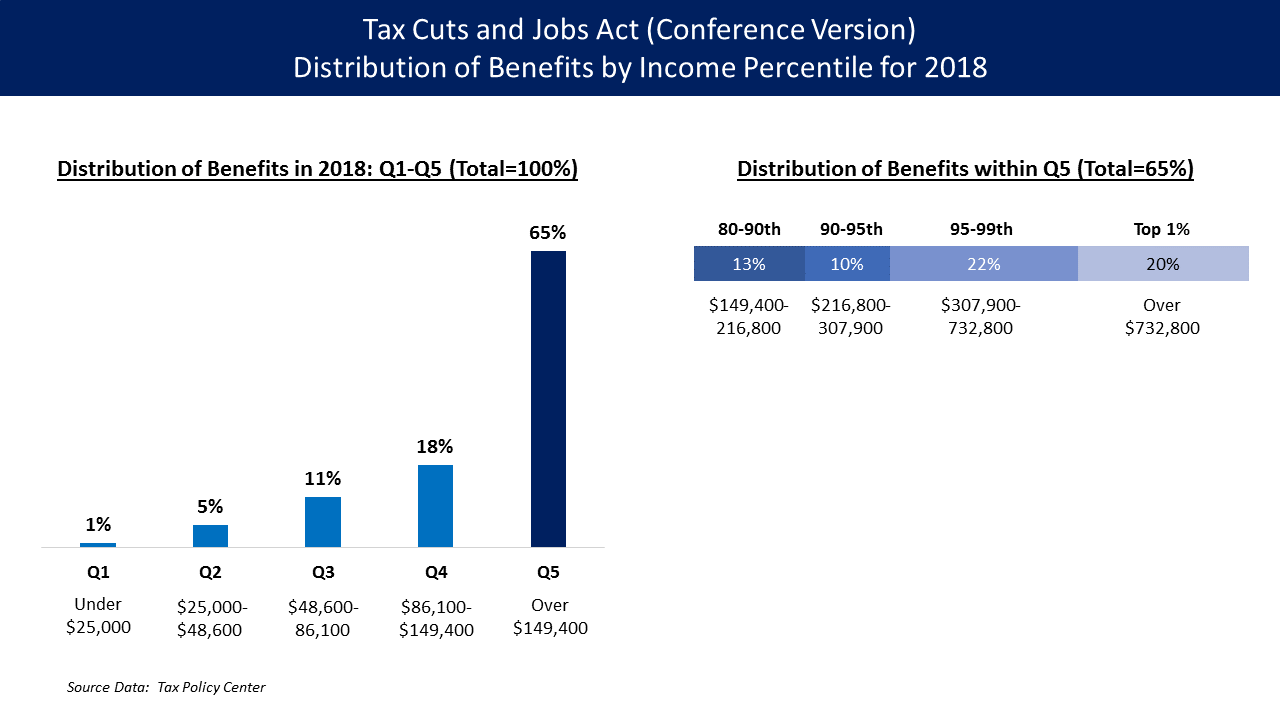

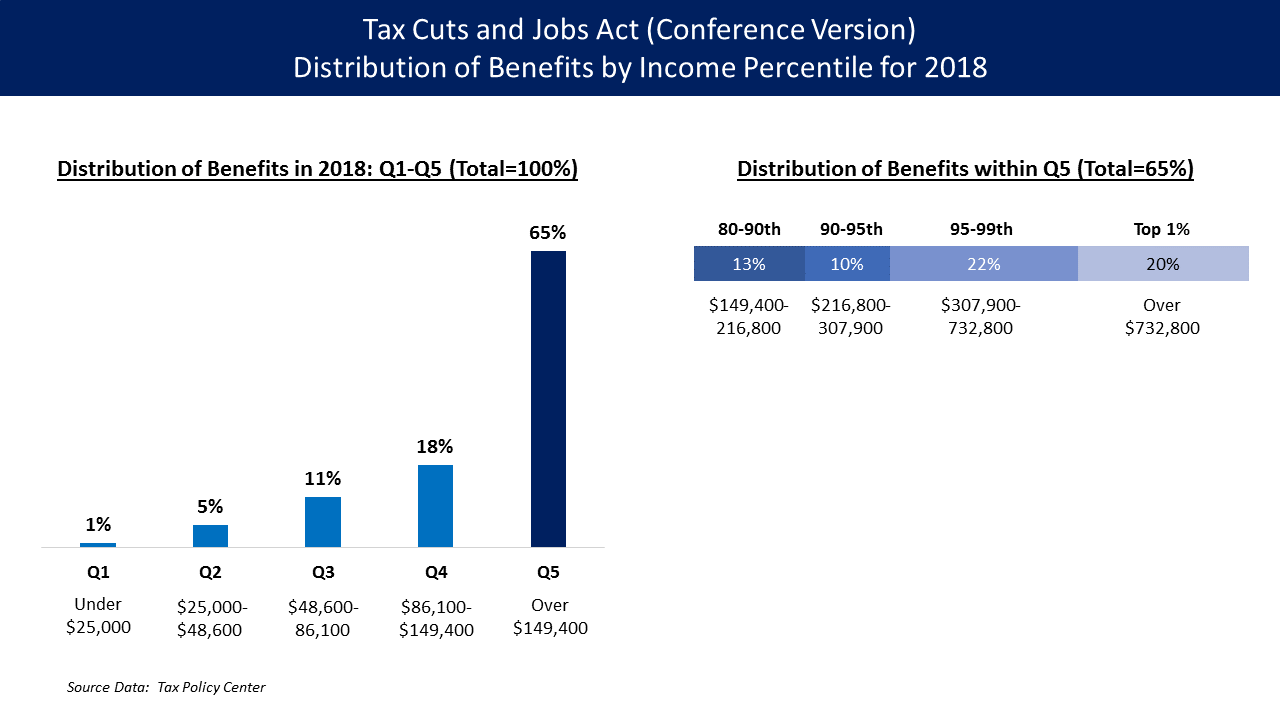

According to a 2017 report by Tax Policy Center, taxes would be reduced by about $1,600 on average in 2018 and 2025. The top 20% of Americans by income were projected to receive roughly 65% of the tax savings. In the two years since the Act was passed, it has failed to pay for itself through increased economic growth, according to

Maya MacGuineas

Maya MacGuineas (born February 21, 1968) is president of the Committee for a Responsible Federal Budget. She is a frequent commentator on issues such as the federal budget, national debt, taxes, the economy, retirement policy, government reform, ...

, president of the

Committee for a Responsible Federal Budget

The Committee for a Responsible Federal Budget (CRFB) is a non-profit public policy organization based in Washington, D.C. that addresses federal budget and fiscal issues. It was founded in 1981 by former United States Representatives Robert G ...

. According to

Bloomberg, the Act has simplified the tax code for some, but not others, lowered corporate debt, led investment to temporarily increase before then declining, and brought money back from overseas, but did not bring back business activity.

Plan elements

Individual income tax

Under the law, there are numerous changes to the individual income tax, including changing the income level of individual

tax brackets, lowering

tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be ...

s, and increasing the

standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deduc ...

s and family

tax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

s while

itemized deductions are reduced and the

personal exemption

Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in calculating taxable income and consequently federal income tax. In 2017, the personal exe ...

s are eliminated.

Most individual income taxes are reduced, until 2025. The number of income tax brackets remain at seven, but the income ranges in several brackets have been changed and most brackets have lower rates. These are marginal rates that apply to income in the indicated range as under current law (i.e., prior Public Law 115-97 or the Act), so a higher income taxpayer will have income taxed at several different rates.

A different inflation measure (

Chained CPI or C-CPI) will be applied to the brackets instead of the Consumer Price Index (CPI), so the brackets increase more slowly. This is effectively a tax increase over time, as people move more quickly into higher brackets as their income rises; this element is permanent.

The standard deduction nearly doubles, from $12,700 to $24,000 for married couples. For single filers, the standard deduction will increase from $6,350 to $12,000. About 70% of families choose the standard deduction rather than itemized deductions; this could rise to over 84% if doubled. The personal exemption is eliminated—this was a deduction of $4,050 per taxpayer and dependent, unless it is in an estate or trust.

The

child tax credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in ...

(CTC) is doubled from $1,000 to $2,000, $1,400 of which will be refundable. There is also a $500 credit for other dependents, versus zero under current law. The lower threshold for the high-income phaseout for the CTC changes from $110,000 AGI to $400,000 for married filers.

Mortgage interest deduction for newly purchased homes (and second homes) was lowered from total loan balances of $1million under current law to $750,000. Interest from home equity loans (aka second mortgages) is no longer deductible, unless the money is used for home improvements.

The deduction for state and local income tax, sales tax, and property taxes ("

SALT deduction") will be capped at $10,000. This has more impact on taxpayers with more expensive property, generally those who live in higher-income areas, or people in states with higher rates for state tax.

The act zeroed out the federal tax penalty for violating the individual mandate of the

Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Pres ...

, starting in 2019. (In order to pass the Senate under

reconciliation rules with only 50 votes, the requirement itself is still in effect). This is estimated to save the government over $300billion, because up to an estimated 13million fewer people will have insurance coverage, resulting in the government giving fewer tax subsidies. It is estimated to increase premiums on the health insurance exchanges by up to 10%.

It also expands the amount of out-of-pocket medical expenses that may be deducted by lowering threshold from 10% of adjusted gross income to 7.5%, but only for 2017 (retroactively) and 2018. Effective January 1, 2019, the threshold will increase to 10%.

No changes are made to major education deductions and credits, or to the teacher deduction for unreimbursed classroom expenses, which remains at $250. The bill initially expanded usage of

529 college savings accounts for both K–12 private school tuition and homeschools, but the provision regarding homeschools was overruled by the Senate parliamentarian and removed. The 529 savings accounts for K-12 private school tuition provision was left intact.

Taxpayers will only be able to deduct a casualty loss if it occurs in a federally declared disaster area.

Alimony paid to a former spouse will no longer be deductible by the payer, and alimony payments will no longer be included in the recipient's gross income. This effectively shifts the tax burden of alimony from the recipient to the payer, increases the amount of tax collected on the income transferred as alimony, and simplifies the audit trail for the IRS. This provision is effective for divorce and separation agreements signed after December 31, 2018.

Employment-related moving expenses will no longer be deductible, except for moves related to active-duty military service.

The miscellaneous itemized deduction, including tax-deductions for tax-preparation fees, investment expenses, union dues, and unreimbursed employee expenses, are eliminated.

Fewer people will pay the

Alternative minimum tax because the act increases the exemption level from $84,500 to $109,400 for married taxpayers filing jointly and from $54,300 to $70,300 for single taxpayers.

The act repeals the ability to

recharacterize Roth Roth may refer to:

Places

Germany

* Roth (district), in Bavaria, Germany

** Roth, Bavaria, capital of that district

** Roth (electoral district), a federal electoral district

* Rhineland-Palatinate, Germany:

** Roth an der Our, in the district ...

conversions.

The act exempts the discharge of certain

student loans

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest ...

due to the death or total permanent disability of the borrower from

taxable income Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. ...

. This provision applies only to debt discharged during tax years 2018 through 2025.

The act now taxes survivors benefits that were allocated to the children of a deceased military service member as if they were for a trust or estate, which can subject them to an income tax rate of up to 37%.

Estate tax

For deaths occurring between 2018 and 2025, estates that exceed $11.2million are subject to a 40% estate tax at time of death, increased from $5.6million previously. For a married couple aggregating their exemptions, an estate exceeding $22.4million is subject to a 40% estate tax at time of death.

Corporate tax

The corporate tax rate was changed from a tiered tax rate ranging from 15% to as high as 39% depending on taxable income to a flat 21%, while some related business deductions and credits were reduced or eliminated. The Act also changed the U.S. from a global to a territorial tax system with respect to corporate income tax. Instead of a corporation paying the U.S. tax rate for income earned in any country (less a credit for taxes paid to that country), each

subsidiary

A subsidiary, subsidiary company or daughter company is a company owned or controlled by another company, which is called the parent company or holding company. Two or more subsidiaries that either belong to the same parent company or having a ...

pays the tax rate of the country in which it is legally established. In other words, under a territorial tax system, the corporation saves the difference between the generally higher U.S. tax rate and the lower rate of the country in which the subsidiary is legally established. ''

Bloomberg'' journalist Matt Levine explained the concept, "If we're incorporated in the U.S.

nder the old global tax regime we'll pay 35 percent taxes on our income in the U.S. and Canada and Mexico and Ireland and Bermuda and the Cayman Islands, but if we're incorporated in Canada

nder a territorial tax regime, proposed by the Act we'll pay 35 percent on our income in the U.S. but 15 percent in Canada and 30 percent in Mexico and 12.5 percent in Ireland and zero percent in Bermuda and zero percent in the Cayman Islands."

[Levine, Matt (August 25, 2014).]

Burger King May Move to Canada for the Donuts

. ''Bloomberg''. In theory, the law would reduce the incentive for

tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

, which is used today to obtain the benefits of a territorial tax system by moving U.S. corporate headquarters to other countries.

[Korving, Stephen (January 2, 2018).]

How tax cuts and job act will affect you and your business

. ''Inside Business''. The Hampton Roads Business Journal.

One-time repatriation tax of profits in overseas subsidiaries is taxed at 8%, 15.5% for cash. U.S. multinationals have accumulated nearly $3trillion offshore, much of it subsidiaries in tax-haven countries. The Act may encourage companies to

bring the money back to the U.S. at these much lower rates.

The

Corporate Alternative Minimum Tax was eliminated.

[

The law also eliminated the net operating loss carryback, a procedure by which a company with significant losses could receive a ]tax refund

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

By country

United States

According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check ...

by counting the losses as part of the previous year's tax return. They were considered important in providing liquidity during a recession. The provision was cut in order to finance the tax cuts in the act, and was one of the largest offsets in the law.

Additionally, the domestic production activities deduction was eliminated by the Tax Cuts and Jobs Act.

Churches and nonprofit organizations

Employee compensation

There is a 25% excise tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when ...

on compensation paid to certain employees of churches and other tax-exempt organizations.[Davis, Kelly (April 19, 2019).]

IRS Guidance Clarifies New Excise Tax on Nonprofit Executive Compensation

. ''CliftonLarsonAllen LLP

CliftonLarsonAllen LLP (known as CliftonLarsonAllen or CLA) is a professional services network and the eighth-largest ''. The excise tax applies to any organization that is tax-exempt under 501(c)

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code (26 U.S.C. § 501(c)) and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. ...

or 501(d), a Section 521(b)(1) farmer's cooperative, Section 527 political organizations, and organizations that have Section 115(1) income that is earned by performing essential government functions.[Notice 2019-09]

. ''Internal Revenue Service''. December 31, 2018.

The excise tax applies to compensation paid to certain employees in excess of $1,000,000 during the year. The employees covered under this rule are the organization's five highest-compensated employees and any employees who previous had this status after 2016.[ Compensation is exempt from the excise tax if the compensation is paid to medical doctors, dentists, veterinarians, nurse practitioners, and other licensed professionals providing medical or veterinary services. Compensation includes all current compensation, qualifying deferred compensation, non-qualifying deferred compensation without substantial risk of forfeiture, income under Section 457(f), and severance payments, but excluding Roth retirement contributions.][

An organization may also be subject to the 21% excise tax if an organization has a deferred compensation plan in which benefits are spread over several years and then vest all at once.][Moran, Christopher N.; Lewin, Cynthia M.; Constantine, George E. (April 24, 2019).]

New Excise Tax on Nonprofit Compensation Casts Wide Net

. ''Venable LLP

Venable LLP is an American law firm headquartered in Washington, D.C. It is the largest law firm in the state of Maryland. Founded in 1900 by Richard Venable in Baltimore, today Venable has 10 offices across the United States and 800 attorneys w ...

'' Severance payments exceeding triple an employee's average salary during the last five years may also be subject to the 21% excise tax.[

]

University investment tax

There is a 1.4% excise tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when ...

on investment income of certain private tax-exempt colleges and universities. The excise tax applies only if the institution has at least 500 tuition-paying students and more than half the students are located in the United States. The excise tax applies if the institution and its related organizations have an endowment

Endowment most often refers to:

*A term for human penis size

It may also refer to: Finance

* Financial endowment, pertaining to funds or property donated to institutions or individuals (e.g., college endowment)

*Endowment mortgage, a mortgage to ...

with an aggregate fair-market value at the end of the preceding tax year of at least $500,000 per full-time student, excluding assets used directly in carrying out institution's tax-exempt purpose.["Update on Tax Reform and the Impact on Tax-Exempt Organizations". ''Gelman, Rosenberg & Freedman CPAs''. July 10, 2018.]

This provision has been referred to as an endowment tax, and it has been estimated that it applies to around 32 universities.

Some provisions from the earlier House bill were dropped that would have taxed graduate student tuition waivers, tuition benefits for children and spouses of employees, and student loan interest. A Senate Parliamentarian ruling on December 19 changed the exemption threshold from 500 tuition-paying students to 500 total students. Endowment funds used to carry out a college's tax-exempt purpose are excluded from the asset threshold, but Internal Revenue Service has not issued regulations specifically defining this term.

In addition, a tax deduction is now disallowed entirely for charitable contributions if the donor receives rights to receive seats to college athletic events.[ Formerly, 80% of the charitable contribution was considered to be a tax-deductible charitable contribution.][

]

Parking and public transportation provided to employees

Unrelated business income is now increased by the amount a church or other tax-exempt organization pays or incurs for qualifying parking or qualifying transportation benefits for its employees. This type of unrelated business income includes only tax-free transportation benefits provided to employees, not transportation benefits that are included in the employee's taxable wages.[Notice 2018–99]

. ''Internal Revenue Service''. December 10, 2018.

Unrelated business income does not result if the employer provides free parking for employees, the majority of the parking spaces are available to the general public during the organization's normal business hours, and none of the parking spots reserved for its employees.[ If some parking spots are reserved for employees, then unrelated business income results from a portion of the total parking expenses, based on the percentage of parking spots that are reserved for its employees.][

The Internal Revenue Service has clarified that the employer should use a reasonable method to determine the value of parking benefits provided to its employees.][ The value of the parking spaces should include repairs, maintenance, utility costs, insurance, property taxes, interest, snow and ice removal, leaf removal, trash removal, cleaning, landscape costs, parking attendant expenses, security, and rent or lease payments, but not depreciation expense.][

A church or other tax-exempt organization would need to file Form 990-T and pay unrelated business income tax if its total unrelated business income exceeds $1,000 during the fiscal year.][ Netting the unrelated business income from transportation with other unrelated business income in order to reduce or eliminate the amount of tax due is allowed.][

Some states and jurisdictions require all employers to provide these benefits to their employees, which may result in an organization being required to choose between paying unrelated business income tax to the federal government or being in noncompliance with state and local laws.][

]

Unrelated business income

Unrelated business income is now separately computed for each trade or business activity of the church or other tax-exempt organization. Losses on one trade or business can no longer be used to offset gains on another trade or business for unrelated business income purposes. Net operating losses generated before January 1, 2018, and carried forward to other tax years are not affected and can be used to offset gains from any trade or business activity. Some affected organizations are considering incorporating for-profit subsidiaries and then moving all unrelated business income to the for-profit subsidiaries, which might make all the unrelated business income count as the same category of trade or business activity, namely "income from for-profit subsidiaries".[ Unrelated business taxable income from transportation benefits is not considered a trade or business activity and will be applied after totaling all of the organization's unrelated business income overall.][

Net operating losses are now limited to 80% of taxable income for tax years beginning after December 31, 2017.][ ]Unrelated business income tax

Unrelated Business Income Tax (UBIT) in the U.S. Internal Revenue Code is the tax on unrelated business income, which comes from an activity engaged in by a tax-exempt 26 U.S.C. 501 organization that is not related to the tax-exempt purpose of t ...

is now assessed at the flat rate of 21%, rather than at a graduated tax rate, except for unrelated business income earned on or before December 31, 2017.[ Net operating losses for tax years ending after December 31, 2017 may now be carried forward to future tax years indefinitely.]["Not-For-Profit Tax Update". '']Cherry Bekaert LLP

Cherry Bekaert (formerly Cherry, Bekaert & Holland L.L.P.) is an accounting firm based in Raleigh, North Carolina. It has offices in California, Maryland, Virginia, Washington, D.C., Florida, Georgia, North Carolina, Rhode Island, Texas, Tenne ...

''. August 29, 2018.

Charitable contributions

More individuals will choose to take the standard deduction rather than itemize their tax deductions because of the increase in standard deduction and limitation on itemized deduction for state and local taxes. As a result, these individuals will not see a tax savings from donations to churches or other eligible nonprofit organizations, and churches and other organizations may receive fewer charitable contributions.[

The indexed estate tax exemption was doubled, which means that people may not need to include charitable contributions being written into their will in order to reduce the estate tax paid, which is expected to reduce the amount of charitable contributions given to churches and nonprofit organizations overall.][

]

Tax credit for paid family and medical leave

The Tax Cuts and Jobs Act of 2017 allows a tax credit for employers that provide paid family and medical leave to employees. A 501(c)(3) organization is not eligible for the tax credit.[Notice 2018–71]

. ''Internal Revenue Service''. September 24, 2018.

Miscellaneous tax provisions

The Act contains a variety of miscellaneous tax provisions, many advantaging particular special interests.[Sam Petulla & Jennifer Hansler]

CNN (November 16, 2017). Miscellaneous provisions include:

* Internal Revenue Code section 1031

Under Section 1031 of the United States Internal Revenue Code (), a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchange. In 1979 ...

, which allowed the deferment of capital gains taxes on so-called "like-kind exchanges" of a wide array of real, personal, and business property, was maintained for real property but repealed for other types of property.

* A tax break for citrus

''Citrus'' is a genus of flowering trees and shrubs in the rue family, Rutaceae. Plants in the genus produce citrus fruits, including important crops such as oranges, lemons, grapefruits, pomelos, and limes. The genus ''Citrus'' is native to ...

growers,Joint Committee on Taxation

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at .

Structure

The Joint Committee is composed of ten Members: five from the Senate Finance Committee and five from the House W ...

estimates that the extension will lead to the loss of about $1billion in federal revenue per year.Etihad

Etihad Airways ( ar, شَرِكَة ٱلْاِتِّحَاد لِلطَّيْرَان, sharikat al-ittiḥād li-ṭ-ṭayarān) is one of two flag carriers of the United Arab Emirates (the other being Emirates). Its head office is in Khalifa ...

, Emirates

Emirates may refer to:

* United Arab Emirates, a Middle Eastern country

* Emirate, any territory ruled by an emir

** Gulf emirates, emirates located on the Persian Gulf

** Emirates of the United Arab Emirates, the individual emirates

* The Emirat ...

and Qatar Airways); major U.S. airlines have complained that the Gulf states provide unfair subsidies to those carriers.excise tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when ...

es on alcohol for a two-year period.[Aaron Smith]

Cheers! Senators propose lowering alcohol tax

CNN (November 16, 2017). The Senate bill would reduce the tax on "the first 60,000 barrels of beer produced domestically by small brewers" from $7 to $3.50 and would reduce the tax on the first 6million barrels produced from $18 to $16 per barrel.sparkling wine

Sparkling wine is a wine with significant levels of carbon dioxide in it, making it fizzy. While the phrase commonly refers to champagne, European Union countries legally reserve that term for products exclusively produced in the Champagne regi ...

as well.Beer Institute

Beer Institute is a national trade association, headquartered in Washington, D.C.

)

, image_skyline =

, image_caption = Clockwise from top left: the Washington Monument and Lincoln Memorial on the National Mall, Uni ...

, Wine Institute, and Distilled Spirits Council.The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'', this "caused an uproar among independent agriculture businesses that say they can no longer compete with cooperatives."

Arctic National Wildlife Refuge drilling

The Act contains provisions that would open in the Arctic National Wildlife Refuge

The Arctic National Wildlife Refuge (ANWR or Arctic Refuge) is a national wildlife refuge in northeastern Alaska, United States on traditional Gwich'in lands. It consists of in the Alaska North Slope region. It is the largest national wildli ...

to oil and gas drilling.Lisa Murkowski

Lisa Ann Murkowski ( ; born May 22, 1957) is an American attorney and politician serving as the senior United States senator for Alaska, having held that seat since 2002. Murkowski is the second-most senior Republican woman in the Senate, after S ...

.[Scott Detrow]

Senate May Approve Drilling In Alaskan Wilderness With Tax Bill

NPR (November 18, 2017).Arctic Refuge drilling controversy

The question of whether to drill for oil in the Arctic National Wildlife Refuge (ANWR) has been an ongoing political controversy in the United States since 1977. As of 2017, Republicans have attempted to allow drilling in ANWR almost fifty time ...

; Republicans had attempted to allow drilling in ANWR almost 50 times.

Legislative history

The bill was introduced in the United States House of Representatives

The United States House of Representatives, often referred to as the House of Representatives, the U.S. House, or simply the House, is the lower chamber of the United States Congress, with the Senate being the upper chamber. Together they ...

on November 2, 2017 by Congressman Kevin Brady

Kevin Patrick Brady (born April 11, 1955) is an American politician and the U.S. representative for , serving since 1997. He is a member of the Republican Party. The district includes northern Houston, including The Woodlands. On April 14, 202 ...

, Republican representative from Texas

Texas (, ; Spanish: ''Texas'', ''Tejas'') is a state in the South Central region of the United States. At 268,596 square miles (695,662 km2), and with more than 29.1 million residents in 2020, it is the second-largest U.S. state by ...

. On November 9, 2017, the House Ways and Means Committee

The Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other progra ...

passed the bill on a party-line vote, advancing the bill to the House floor.[House Passes Historic Debt Increase](_blank)

(press release), House Passes Historic Debt Increase (November 16, 2017). On the same day, companion legislation passed the Senate Finance Committee

The United States Senate Committee on Finance (or, less formally, Senate Finance Committee) is a standing committee of the United States Senate. The Committee concerns itself with matters relating to taxation and other revenue measures general ...

, again on a party-line vote, 14–12.[Seung Min Kim, Colin Wilhelm and Bernie Becker]

Senate GOP gets breathing room as tax plan advances

''Politico'' (November 28, 2017). In the early morning hours of December 2, 2017, the Senate passed its version of the bill by a 51–49 vote. Bob Corker

Robert Phillips Corker Jr. (born August 24, 1952) is an American businessman and politician who served as a United States Senator from Tennessee from 2007 to 2019. A member of the Republican Party, he served as Chair of the Senate Foreign Rel ...

( R– TN) was the only Republican senator to vote against this version of the bill and it received no Democratic Party support.

Differences between the House and Senate bills were reconciled in a conference committee

A committee or commission is a body of one or more persons subordinate to a deliberative assembly. A committee is not itself considered to be a form of assembly. Usually, the assembly sends matters into a committee as a way to explore them more ...

that signed the final version on December 15, 2017. The final version contained relatively minor changes from the Senate version.

Differences between the House and Senate bills

There were important differences between the House and Senate versions of the bills, due in part to the Senate reconciliation rules, which required that the bill impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. (The Byrd Rule

Budget reconciliation is a special parliamentary procedure of the United States Congress set up to expedite the passage of certain budgetary legislation in the United States Senate. The procedure overrides the filibuster rules in the Senate, w ...

allows Senators to block legislation if it would increase the deficit significantly beyond a ten-year period.conference committee

A committee or commission is a body of one or more persons subordinate to a deliberative assembly. A committee is not itself considered to be a form of assembly. Usually, the assembly sends matters into a committee as a way to explore them more ...

, prior to providing a final bill to the President for signature. The Conference Committee version was published on December 15, 2017. It had relatively minor differences compared to the Senate bill. Individual and pass-through tax cuts expire after ten years, while the corporate tax changes are permanent.

Pre-conference vote

House of Representatives

Senate

Post-conference vote

House of Representatives

Senate

Impact

Financial impact

The tax cuts are expected to increase deficits thereby stimulating the economy, increasing GDP and employment, relative to a forecast without those tax cuts. CBO reported on December 21, 2017: "Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits (primarily stemming from reductions in spending) allocated to lower-income tax filing units and to increase deficits (primarily stemming from reductions in taxes) allocated to higher-income tax filing units".Joint Committee on Taxation

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at .

Structure

The Joint Committee is composed of ten Members: five from the Senate Finance Committee and five from the House W ...

also estimated that the GDP level would be 0.7% higher (in aggregate, not per annum) during the 2018–2027 period relative to the CBO baseline forecast, employment level would be 0.6% higher and personal consumption level would be 0.6% higher during the 2018–2027 period on average due to the Act.

Economy

The non-partisan

The non-partisan Joint Committee on Taxation

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at .

Structure

The Joint Committee is composed of ten Members: five from the Senate Finance Committee and five from the House W ...

of the U.S. Congress published its macroeconomic analysis of the final version of the Act, on December 22, 2017:

*Gross domestic product would be 0.7% higher on average each year during the 2018–2027 period relative to the CBO baseline forecast, a cumulative total of $1,895billion, due to an increase in labor supply and business investment.

*The Act would increase the total budget deficits (debt) by about $1trillion over ten years including macro-economic feedback effects. The effect of the tax cuts is only partially offset by incremental revenue due to the higher GDP levels. The initial deficit increase estimate without feedback effects of $1,456billion, less $384billion in feedback effects ($451billion less $66billion in higher debt service costs), results in a $1,071billion net debt increase over the 2018–2027 period. This increase is in addition to the $10trillion debt increase already in the CBO current law baseline projected over the 2018–2027 period, and the approximately $20trillion national debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

that already exists.

*Employment would be about 0.6% higher each year during the 2018–2027 period than otherwise. The lower marginal tax rate on labor would provide "strong incentives for an increase in labor supply."

*Personal consumption, the largest component of GDP, would increase by 0.7%.Committee for a Responsible Federal Budget

The Committee for a Responsible Federal Budget (CRFB) is a non-profit public policy organization based in Washington, D.C. that addresses federal budget and fiscal issues. It was founded in 1981 by former United States Representatives Robert G ...

(CRFB) summarized several studies that indicated a boost to annual GDP growth rates would be about 0.01% each year rather than the Administration's claims of 0.4% per year. In other words, a 2.0% annual GDP growth rate typical during the Obama era would rise to 2.01%–2.02% and not 2.4% as claimed, other things equal. The CRFB estimated that the JCT analysis implied a 0.02% annual growth rate increase, to arrive at a cumulative 0.7% GDP increase.

The Tax Policy Center (TPC) reported its macroeconomic analysis of the November 16 Senate version of the Act on December 1, 2017:

*Gross domestic product would be 0.4% higher on average each year during the 2018–2027 period relative to the CBO baseline forecast, a cumulative total of $961billion higher over ten years. TPC explained that since most tax reductions would benefit high-income households (who spend a smaller share of tax reductions than lower-income households) the effect on GDP would be modest. Further, TPC reported that: "Because the economy is currently near full employment, the impact of increased demand on output would be smaller and diminish more quickly than it would if the economy were in recession."

*The Act would increase the total budget deficits (debt) by $1,412billion, less $179billion in feedback effects, for a $1,233billion net debt increase (excluding higher interest costs).

*The lower marginal tax rates would increase labor supply, mainly by encouraging lower-earning spouses to work more. This effect would reverse after 2025 due to expiration of individual tax provisions.Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a ...

in May 2019 includes:

* "a relatively small (if any) first-year effect on the economy"

* "a feedback effect of 0.3% of GDP or less,"

* "pretax profits and economic depreciation (the price of capital) grew faster than wages"

* inflation-adjusted wage growth "is smaller than overall growth in labor compensation and indicates that ordinary workers had very little growth in wage rates"

* "the evidence does not suggest a surge in investment from abroad in 2018"

* "While evidence does indicate significant repurchases of shares, either from tax cuts or repatriated revenues, relatively little was directed to paying worker bonuses"

The tax cut was enacted three months into the 2018 fiscal year. Corporate tax receipts for the full fiscal year ended September 2018 were down 31% from the prior fiscal year, the largest decline since records began in 1934, except for during the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

when corporate profits, and hence corporate tax receipts, plummeted. Analysts attributed the fiscal 2018 decline to the tax cut.

The Council of Economic Advisers had estimated in October 2017 that the corporate tax cut of the TCJA would increase real median household income by $3000 to $7000 annually, but during the first year following enactment of the tax cut the figure increased by $553, which the Census Bureau characterized as statistically insignificant.

Budget deficits and debt

Fiscal year 2018 results

CBO reported that the budget deficit was $779billion in fiscal year 2018, up $113billion or 17% from 2017. The budget deficit increased from 3.5% GDP in 2017 to 3.9% GDP in 2018. Revenues fell by 0.8% GDP due in part to the Tax Act, while spending rose by 0.4% GDP. Total tax revenues in dollar terms were similar to 2017, but fell from 17.2% GDP to 16.4% GDP (0.8% GDP), below the 50-year average of 17.4%. Individual income tax receipts rose by $96billion as the economy grew, rising from 8.2% GDP in 2017 to 8.3% GDP in 2018. Corporate tax revenues fell by $92billion (31%) due primarily to the Tax Act, from 1.5% GDP in 2017 to 1.0% GDP in 2018, half the 50-year average of 2.0% GDP. Fiscal year 2018 ran from October 1, 2017 to September 30, 2018, so the deficit figures did not reflect a full year of tax cut impact, as they took effect in January 2018.[ and a shortfall of $196billion occurred.][

]

Ten-year forecasts

The non-partisan Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

(CBO) estimated in April 2018 that implementing the Act would add an estimated $2.289trillion

''Trillion'' is a number with two distinct definitions:

*1,000,000,000,000, i.e. one million million, or (ten to the twelfth power), as defined on the short scale. This is now the meaning in both American and British English.

* 1,000,000,000,00 ...

to the national debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

over ten years,Joint Committee on Taxation

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at .

Structure

The Joint Committee is composed of ten Members: five from the Senate Finance Committee and five from the House W ...

estimated the Act would add $1,456billion total to the annual deficits (debt) over ten years and described the deficit effects of particular elements of the Act on December 18, 2017:

Individual and Pass-Through (total: $1,127billion deficit increase)

*Add to the deficit: Reducing/consolidating individual tax rates $1,214billion; doubling the standard deduction $720billion; modifying the Alternative Minimum Tax $637billion; reduce taxes for pass through business income $415billion; modification of child care tax credit $573billion.

*Reduce the deficit: Repealing personal exemptions $1,212billion, repeal of itemized deductions $668billion; reduce ACA subsidy payments $314billion; alternative (slower) inflation measure for brackets $134billion.

*The pass through changes represent a net $265billion deficit increase, so the remaining individual elements are a net $862billion increase.

Business/Corporate and International (total: $330billion deficit increase)

*Add to the deficit: Reduce corporate tax rate to 21% $1,349billion; deductions for certain international dividends received $224billion; repeal corporate AMT $40billion.

*Reduce the deficit: Enact one-time tax on overseas earnings $338billion; and reduce limit on interest expense deductions $253billion.

Distribution

By income level

On December 21, 2017, the Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

(CBO) released its distribution estimate of the Act:

*During 2019, income groups earning under $20,000 (about 23% of taxpayers) would contribute to deficit reduction (i.e., incur a cost), mainly by receiving fewer subsidies due to the repeal of the individual mandate of the Affordable Care Act. Other groups would contribute to deficit increases (i.e., receive a benefit), mainly due to tax cuts.

*During 2021, 2023, and 2025, income groups earning under $40,000 (about 43% of taxpayers) would contribute to deficit reduction, while income groups above $40,000 would contribute to deficit increases.

*During 2027, income groups earning under $75,000 (about 76% of taxpayers) would contribute to deficit reduction, while income groups above $75,000 would contribute to deficit increases.

Individual vs. business

According to the CBO, under the Senate version of the bill, businesses receive a $890billion benefit or 63%, individuals $441billion or 31%, and estates $83billion or 6%.Center on Budget and Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the Center's stated mission is to "conduct resear ...

(CBPP), "Mainstream estimates conclude that more than one-third of the benefit of corporate rate cuts flows to the top 1% of Americans, and 70% flows to the top fifth. Corporate rate cuts could even hurt most Americans since they must eventually be paid for with other tax increases or spending cuts." Corporations have significant cash holdings ($1.9trillion in 2016) and can borrow to invest at near-record low interest rates, so a tax cut is not a prerequisite for investment or giving workers a raise. As of Q2 2017, corporate profits after taxes were near record levels in dollar terms at $1.77trillion annualized, and very high measured historically as a percentage of GDP, at 9.2%.

In 2017, the Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

Ins ...

(CBO) compared the U.S. corporate tax rates (statutory and effective rates) as of 2012 across the G20 countries:

*The U.S. federal corporate statutory tax rate of 35% (combined with state elements that add another 4% for a total of 39%), was the highest in the G20 countries. It was 10 percentage points higher than the average. While the U.S. made no changes in federal corporate tax rates between 2003 and 2012, nine of G20 countries reduced their rates.

*The U.S. average corporate tax rate of 29.0% (taxes actually paid as a share of income, after deductions and exemptions) was the third highest in the G20.

*The effective corporate tax rate of 18.6% (a measure of the percentage of income from a marginal investment) was the fourth highest in the G20.

''Bloomberg News'' reported in January 2020 that the top six American banks saved more than $32 billion in taxes during the two years after enactment of the tax cut, while they reduced lending, cut jobs and increased distributions to shareholders.

By state

An Institute on Taxation and Economic Policy analysis indicated the Act has more of a tax increase impact on "upper-middle-class families in major metropolitan areas, particularly in Democratic-leaning states where taxes, and usually property values, are higher. While only about one-in-five families between the 80th and 95th income percentiles in most red states would face higher taxes by 2027 under the House GOP bill, that number rises to about one-third in Colorado and Illinois, around two-fifths or more in Oregon, Virginia, Massachusetts, New York and Connecticut, and half or more in New Jersey, California and Maryland..."

Financing of the tax cut

The scoring by the organizations above assumes the tax cuts are deficit-financed, meaning that over ten years the deficit rises by $1.4trillion relative to the current law baseline; or $1.0trillion after economic feedback effects. However, if one assumes the tax cuts are paid for by per-household spending cuts, the distribution would be more unfavorable to lower-and middle-income persons.

According to the Tax Policy Center, the bill's effect on the financial well-being of taxpayers vary based on different financing assumptions.

* Assuming that each household pays the same dollar amount in added burden, approximately 72% of taxpayers would be worse off than current law, meaning benefits from tax cuts would be more than offset by reduced spending on their behalf

* Assuming that each household pays the same percentage of its income to cover the added burdens, approximately 64% of taxpayers would be worse off than under current law

* Assuming that each household pays the same percentage as their current income tax liability, approximately 17% of taxpayers would be worse off than current law

Vox journalist Dylan Matthews argued that the first scenario would be most likely because most direct government spending is directed towards low-income households, and higher income households tend to receive tax breaks rather than direct expenditures. Report from Tax Policy Center stated that the first two scenarios "appear to most closely resemble current Administration and Congressional budget proposals."

Republican politicians such as Paul Ryan

Paul Davis Ryan (born January 29, 1970) is an American former politician who served as the 54th speaker of the United States House of Representatives from 2015 to 2019. A member of the Republican Party, he was the vice presidential nominee i ...

have advocated for spending cuts to help finance the tax cuts, while President Trump's 2018 budget includes $2.1trillion in spending cuts over ten years to Medicaid, Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Pres ...

subsidies, food stamps

In the United States, the Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp Program, is a federal program that provides food-purchasing assistance for low- and no-income people. It is a federal aid program, ad ...

, Social Security Disability Insurance

Social Security Disability Insurance (SSD or SSDI) is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide monthly benefits to people who ...

, Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social S ...

, and cash welfare (TANF

Temporary Assistance for Needy Families (TANF ) is a federal assistance program of the United States. It began on July 1, 1997, and succeeded the Aid to Families with Dependent Children (AFDC) program, providing cash assistance to indigent Ame ...

).

Healthcare impact

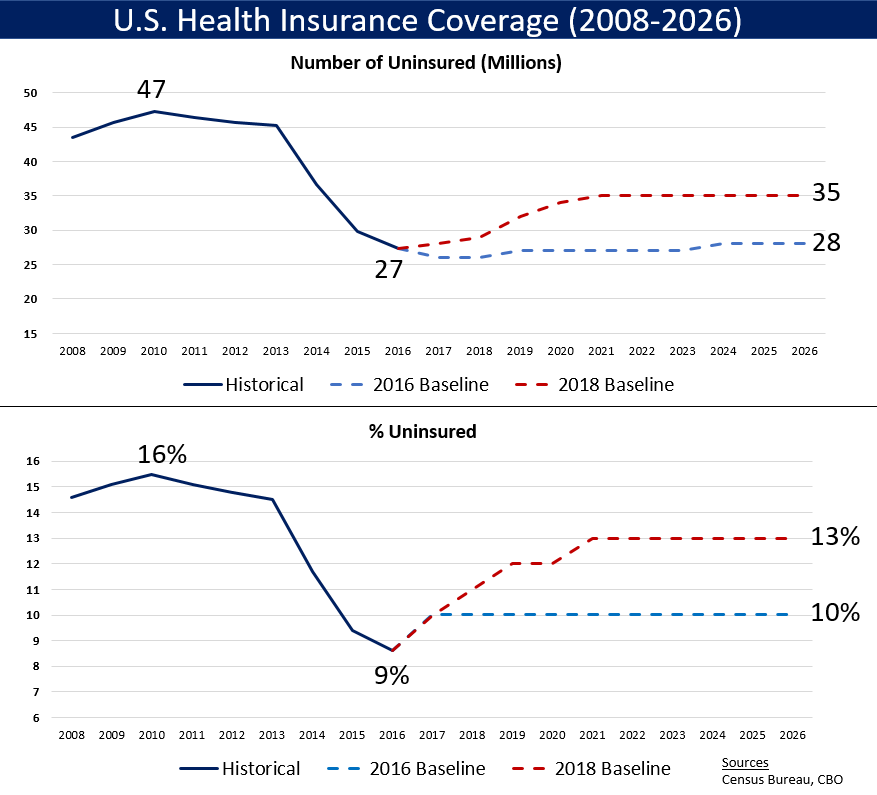

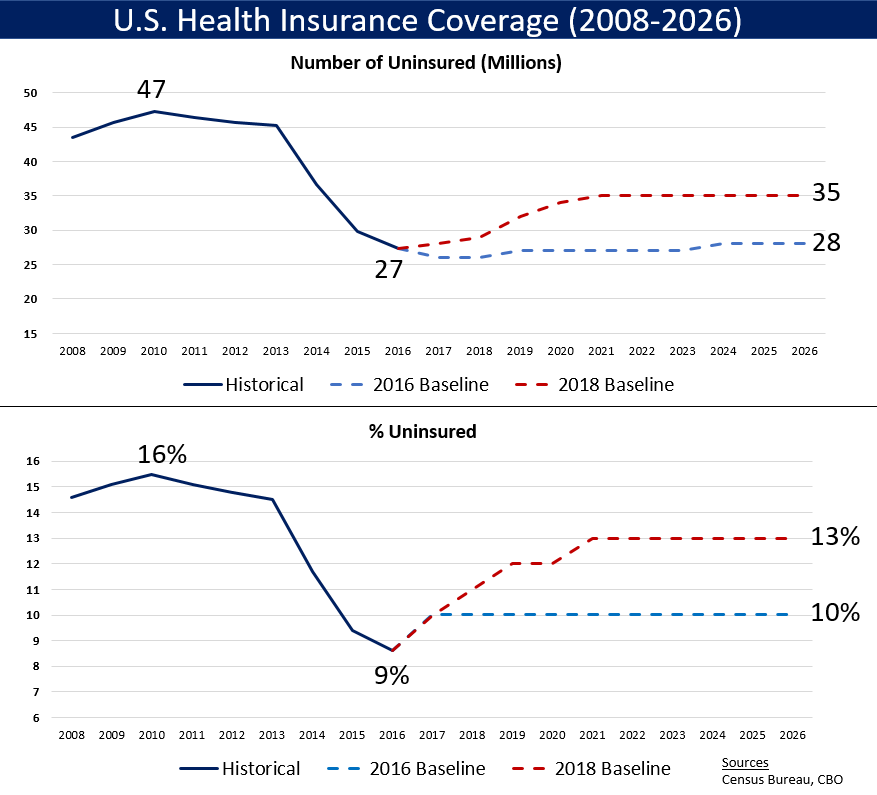

The Senate bill repeals the individual mandate that requires all Americans under 65 to have health insurance or pay a penalty, effective starting in 2019. The CBO initially estimated that 13million fewer persons would have health insurance by 2025, including 8million fewer on the

The Senate bill repeals the individual mandate that requires all Americans under 65 to have health insurance or pay a penalty, effective starting in 2019. The CBO initially estimated that 13million fewer persons would have health insurance by 2025, including 8million fewer on the Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Pres ...

exchanges and 5million fewer on Medicaid. Fewer persons with healthcare means lower costs for the government, so CBO estimated over $300billion in savings. This allowed Republicans to increase the size of the tax cuts in the bill. Health insurance premiums on the exchanges could rise as much as 10 percentage points more than they would otherwise.

Reception

Support

Leading Republicans supported the bill, including President Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of P ...

and Vice President Mike Pence

Michael Richard Pence (born June 7, 1959) is an American politician who served as the 48th vice president of the United States from 2017 to 2021 under President Donald Trump. A member of the Republican Party, he previously served as the 50th ...

, and Republicans in Congress, such as:

* Paul Ryan

Paul Davis Ryan (born January 29, 1970) is an American former politician who served as the 54th speaker of the United States House of Representatives from 2015 to 2019. A member of the Republican Party, he was the vice presidential nominee i ...

, Speaker of the United States House of Representatives

The speaker of the United States House of Representatives, commonly known as the speaker of the House, is the presiding officer of the United States House of Representatives. The office was established in 1789 by Article I, Section 2 of the ...

(R-WI)

* Mitch McConnell

Addison Mitchell McConnell III (born February 20, 1942) is an American politician and retired attorney serving as the senior United States senator from Kentucky and the Senate minority leader since 2021. Currently in his seventh term, McCon ...

, Majority Leader of the United States Senate (R–KY)

* Kevin Brady

Kevin Patrick Brady (born April 11, 1955) is an American politician and the U.S. representative for , serving since 1997. He is a member of the Republican Party. The district includes northern Houston, including The Woodlands. On April 14, 202 ...

, United States Congressman

The United States House of Representatives, often referred to as the House of Representatives, the U.S. House, or simply the House, is the lower chamber of the United States Congress, with the Senate being the upper chamber. Together they ...

(R–TX)

* Kevin McCarthy, House Majority Leader

Party leaders of the United States House of Representatives, also known as floor leaders, are congresspeople who coordinate legislative initiatives and serve as the chief spokespersons for their parties on the House floor. These leaders are e ...

(R–CA)

In the Senate, Republicans "eager for a major legislative achievement after the Affordable Care Act debacle ... have generally been enthusiastic about the tax overhaul."Montana

Montana () is a state in the Mountain West division of the Western United States. It is bordered by Idaho to the west, North Dakota and South Dakota to the east, Wyoming to the south, and the Canadian provinces of Alberta, British Columb ...

, ultimately voted for the Senate bill.

The Trump Administration's Council of Economic Advisors

The Council of Economic Advisers (CEA) is a United States agency within the Executive Office of the President established in 1946, which advises the President of the United States on economic policy. The CEA provides much of the empirical resea ...

supported the bill claimed it would have significant economic benefits.

*The CEA claimed the drop in corporate tax rates from 35 to 20% and immediate full expensing of non-structure investments (e.g., IT investments) would increase GDP growth rates by 3 to 5 percentage points over the then-baseline projections of around 2%. This projection excluded other tax cuts in the Act.Gary Cohn

Gary David Cohn (born August 27, 1960) is an American business leader who served as the 11th Director of the National Economic Council and chief economic advisor to President Donald Trump from 2017 to 2018. He managed the administration's econo ...

stated that "The wealthy are not getting a tax cut under our plan" and that the plan would cut taxes for low- and middle-income households. Further, Trump claimed that the tax plan "...was not good for im ersonally"

Republican supporters of the tax bill characterized it as a simplification of the tax code. While some elements of the legislation have simplified the tax code, other provisions in fact added additional complexity.

Opposition

Democrats opposed the legislation, viewing it as a giveaway to corporations and high earners at the expense of middle class communities. Every House Democrat voted against the bill when it came to the House floor; they were joined by 13 Republicans who voted against it.

Democrats opposed the legislation, viewing it as a giveaway to corporations and high earners at the expense of middle class communities. Every House Democrat voted against the bill when it came to the House floor; they were joined by 13 Republicans who voted against it.Chuck Schumer

Charles Ellis Schumer ( ; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021. A member of the Democratic Party, Schumer is in his fourth Senate term, having held his seat since 1999, an ...

of New York

New York most commonly refers to:

* New York City, the most populous city in the United States, located in the state of New York

* New York (state), a state in the northeastern United States

New York may also refer to:

Film and television

* '' ...

and House Minority Leader Nancy Pelosi

Nancy Patricia Pelosi (; ; born March 26, 1940) is an American politician who has served as Speaker of the United States House of Representatives since 2019 and previously from 2007 to 2011. She has represented in the United States House of ...

—strongly oppose the bill. Schumer said of the bill that "The more it's in sunlight, the more it stinks." Pelosi said the legislation was "designed to plunder the middle class to put into the pockets of the wealthiest 1 percent more money. ... It raises taxes on the middle class, millions of middle-class families across the country, borrows trillions from the future, from our children and grandchildren's futures to give tax cuts to the wealthiest and encourages corporations to ship jobs overseas."

The 13 House Republicans who voted against the bill were mostly from New York, New Jersey, and California, and were opposed to the $10,000 cap on the state and local income tax deduction, which benefits those states.

Billionaire and former Mayor of New York Michael Bloomberg

Michael Rubens Bloomberg (born February 14, 1942) is an American businessman, politician, philanthropist, and author. He is the majority owner, co-founder and CEO of Bloomberg L.P. He was Mayor of New York City from 2002 to 2013, and was a c ...

called this tax bill an "economically indefensible blunder" arguing that companies would not invest more because of the tax cuts: "Corporations are sitting on a record amount of cash reserves: nearly $2.3 trillion. That figure has been climbing steadily since the recession ended in 2009, and it's now double what it was in 2001. The reason CEOs aren't investing more of their liquid assets has little to do with the tax rate."

Bill Gates

William Henry Gates III (born October 28, 1955) is an American business magnate and philanthropist. He is a co-founder of Microsoft, along with his late childhood friend Paul Allen. During his career at Microsoft, Gates held the positions ...

and Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net ...

also thought that Trump's tax cut would not help businesses. In a CNBC

CNBC (formerly Consumer News and Business Channel) is an American basic cable business news channel. It provides business news programming on weekdays from 5:00 a.m. to 7:00 p.m., Eastern Time, while broadcasting talk s ...

interview, Buffett even said: "I don't need a tax cut in a society with so much inequality".

In a letter made public on the November 12, 2017, more than 400millionaires and billionaires (which include George Soros and Steven Rockefeller) asked Congress to reject the Republican tax plan. They note that it would disproportionately benefit the wealthy, while adding at least $1.5 trillion in tax cuts to the current national debt. This deficit "would leave us unable to meet our country's current needs and restrict us in advancing any future investments," the letter continues.

''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Eco ...

'' has also been critical of the tax cut and its lack of long-term vision: "The expiry of tax cuts for individuals is a ticking time-bomb in the tax code. It will explode just as America approaches a budget crisis, driven by rising spending on health care and pensions for the elderly. This gap will probably eventually be plugged by a combination of tax rises and spending cuts. But by cutting taxes now, Republicans have moved the starting point for any future negotiations.".

''The Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nik ...

'' argued that this bill was "built for plutocrats

A plutocracy () or plutarchy is a society that is ruled or controlled by people of great wealth or income. The first known use of the term in English dates from 1631. Unlike most political systems, plutocracy is not rooted in any established ...

" as it would mainly benefit very high income households ("45 per cent of the tax reductions in 2027 would go to households with incomes above $500,000 – fewer than 1 per cent of filers"). It concluded by stating: "The US the world once knew is drowning in a tide of unconscionable and apparently unlimited greed. We are all now doomed to live with the unhappy consequences.".

The Editorial Board of ''The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' vigorously opposed the bill: "This bill is bad enough. No less revolting is the dishonest and sneaky way it was written.". In an article published in August 2018, it noted that none of the benefits that the GOP promised had been delivered. Corporate investments did not increase, real wages

Real wages are wages adjusted for inflation, or, equivalently, wages in terms of the amount of goods and services that can be bought. This term is used in contrast to nominal wages or unadjusted wages.

Because it has been adjusted to account ...

were down and corporate tax revenue plummeted. The article ended with the following statement: "Today, many Republicans seem to realize that the tax cut has become a political liability. Even they realize that it doesn't do any of what they promised.".

Editorial Boards of major US newspapers including ''USA Today

''USA Today'' (stylized in all uppercase) is an American daily middle-market newspaper and news broadcasting company. Founded by Al Neuharth on September 15, 1982, the newspaper operates from Gannett's corporate headquarters in Tysons, Virgini ...

'', ''The Washington Post

''The Washington Post'' (also known as the ''Post'' and, informally, ''WaPo'') is an American daily newspaper published in Washington, D.C. It is the most widely circulated newspaper within the Washington metropolitan area and has a large n ...

'', ''The Los Angeles Times

''The'' () is a grammatical article in English, denoting persons or things already mentioned, under discussion, implied or otherwise presumed familiar to listeners, readers, or speakers. It is the definite article in English. ''The'' is the ...

'', ''The San Francisco Chronicle

The ''San Francisco Chronicle'' is a newspaper serving primarily the San Francisco Bay Area of Northern California. It was founded in 1865 as ''The Daily Dramatic Chronicle'' by teenage brothers Charles de Young and Michael H. de Young. The p ...

'' and ''The Boston Globe

''The Boston Globe'' is an American daily newspaper founded and based in Boston, Massachusetts. The newspaper has won a total of 27 Pulitzer Prizes, and has a total circulation of close to 300,000 print and digital subscribers. ''The Boston Glob ...

'' also opposed the bill.

Minor impact on economic growth

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was t ...

disputed the Administration's primary argument that tax cuts for businesses will stimulate investment and higher wages:Economic Policy Institute

The Economic Policy Institute (EPI) is a 501(c)(3) non-profit American, left-leaning think tank based in Washington, D.C., that carries out economic research and analyzes the economic impact of policies and proposals. Affiliated with the labor mov ...

analyzed the data on business investment from the federal Bureau of Economic Analysis

The Bureau of Economic Analysis (BEA) of the United States Department of Commerce is a U.S. government agency that provides official macroeconomic and industry statistics, most notably reports about the gross domestic product (GDP) of the United ...

and concluded that, "if the TCJA’s corporate rate cuts were working, we would be seeing a permanent rise in investment. Instead, investment growth is cratering." Analysis conducted by ''The New York Times'' in November 2019 found that average business investment was lower after the tax cut than before, and that firms receiving larger tax relief increased investment less than firms receiving smaller tax relief. The analysis also found that since the tax cut firms increased dividends and stock buybacks by nearly three times as much as they increased capital investments.

Limited or no wage impact

Corporate executives indicated that raising wages and investment were not priorities should they have additional funds due to a tax cut. A survey conducted by Bank of America-Merrill Lynch of 300 executives of major U.S. corporations asked what they would do with a corporate tax cut. The top three responses were that they would pay down debt, conduct stock buybacks, and conduct mergers. An informal survey of CEOs by Trump advisor

Corporate executives indicated that raising wages and investment were not priorities should they have additional funds due to a tax cut. A survey conducted by Bank of America-Merrill Lynch of 300 executives of major U.S. corporations asked what they would do with a corporate tax cut. The top three responses were that they would pay down debt, conduct stock buybacks, and conduct mergers. An informal survey of CEOs by Trump advisor Gary Cohn

Gary David Cohn (born August 27, 1960) is an American business leader who served as the 11th Director of the National Economic Council and chief economic advisor to President Donald Trump from 2017 to 2018. He managed the administration's econo ...

resulted in a similar response, with few hands raised in response to his request for them to do so if their company would invest more.

Former Clinton cabinet Treasury Secretary Larry Summers referred to the analysis provided by the Trump administration of its tax proposal as "...some combination of dishonest, incompetent, and absurd." Summers wrote that the Trump administration's "central claim that cutting the corporate tax rate from 35 percent to 20 percent would raise wages by $4,000 per worker" lacked peer-reviewed support and was "absurd on its face."Chuck Schumer

Charles Ellis Schumer ( ; born November 23, 1950) is an American politician serving as Senate Majority Leader since January 20, 2021. A member of the Democratic Party, Schumer is in his fourth Senate term, having held his seat since 1999, an ...

stated that these were the exception to the rule and that AT&T was in litigation with the government over a pending merger. He stated: "There is a reason so few executives have said the tax bill will lead to more jobs, investments, and higher wages—because it will actually lead to share buybacks, corporate bonuses, and dividends."

In the immediate aftermath of the passage of the Act, a relatively small number of corporations—many of them involved in mergers disputed by the government or regulatory difficulties—announced pay raises or bonuses to employees, although it is not clear they would not have done so without the tax cut (many companies award raises and bonuses early each year in the normal course of business, after their prior year earnings are known and their new budgets are put in place). About 18 companies in the S&P did so; when companies paid awards to employees, these were usually a small percentage of corporate savings from the Act. A January 2018 study from the firm Willis Towers Watson found that 80% of companies were not "considering giving raises at all." Bloomberg reported in March 2018 that an estimated 60% of corporate tax savings were going to shareholders, while 15% was going to employees, based on analysis of 51 S&P 500 companies.real wages

Real wages are wages adjusted for inflation, or, equivalently, wages in terms of the amount of goods and services that can be bought. This term is used in contrast to nominal wages or unadjusted wages.

Because it has been adjusted to account ...

have actually fallen in the first quarter after the tax bill went into effect.

Increases income and wealth inequality

''The New York Times'' editorial board explained the tax bill as both consequence and cause of income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. Fo ...

and wealth inequality

The distribution of wealth is a comparison of the wealth of various members or groups in a society. It shows one aspect of economic inequality or economic heterogeneity.

The distribution of wealth differs from the income distribution in that ...

: "Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nation's wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests." The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

International tax standards

In November 2017, the OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate ...

reported that the U.S. tax burden was lower in 2016 than the OECD country average, measured as a percentage of GDP:

*Overall taxes, including many state and local taxes, were 26.0% GDP in 2016, versus the OECD average of 34.3%.

*Income taxes were 8.5% GDP in 2016, versus the OECD average of 8.9%.

*Corporate taxes were 2.3% GDP in 2011, versus the OECD average of 3.0% GDP. Despite this, the US corporate tax rate was 35% prior to the passage of the Tax Cuts and Jobs Act, ten percentage points higher than the OECD average of 25%; the TCJA reduced the American corporate tax rate to 21%, four percentage points lower than the OECD average at the time.

= International trade issues

=

A potential consequence of the proposed tax reform, specifically lowering business taxes, is that (in theory) the U.S. would be a more attractive place for foreign capital (investment money). This inflow of foreign capital would help fund the surge in investment by corporations, one of the stated goals of the legislation. However, a large inflow of foreign capital would drive up the price of the dollar, making U.S. exports more expensive, thus increasing the trade deficit