Sparkasse (Germany) on:

[Wikipedia]

[Google]

[Amazon]

The ''Sparkassen-Finanzgruppe'' ("Savings Banks Financial Group") is a network of

The

The

File:Berlin, Mitte, Behrenstrasse, Berliner Bank 05.jpg, DSGV head office in Berlin

File:Gebäude des Sparkassenverbands Westfalen-Lippe (SVWL).jpg, Sparkassenverband Westfalen-Lippe head office in Münster

File:RSGV-Gebäude.JPG, Rheinischer Sparkassen- und Giroverband head office in Dusseldorf

File:Mainz - Vordere Synagogenstraße 2 - LBS Südwest - 2018-05-06 18-34-08.jpg, Sparkassenverband Rheinland-Pfalz head office in Mainz

File:Landesbank Stuttgart AmHbf2.jpg, LBBW building in Stuttgart, hosting the head office of Sparkassenverband Baden-Württemberg

accessed: 13.06.2011 Each savings bank is independent, locally managed and concentrates its business activities on customers in the territory in which it is situated under the Regional Principle. In general, ''Sparkassen'' are not profit oriented. The ''Träger'' of the savings banks are usually single municipalities or several municipalities within a district. As banks under public law, the vast majority of Sparkassen have a public mandate which requires that they serve their local stakeholders and local communities. Five institutions known as "free Sparkassen" (german: freie Sparkassen) are or recently were joint-stock companies. They are: , , Hamburger Sparkasse, Sparkasse zu Lübeck, and Sparkasse Mittelholstein. Their ''Träger'' are charitable foundations. They are members of the VFS, as is despite its current public-sector legal status. Fulfilling public interests is still one of the most significant characteristics of public banks in general and the savings banks in particular. Although public interest is very unspecific, objects of those companies are usually: * providing financial and monetary services in economically underdeveloped regions; * supporting saving processes and accumulation of capital; * strengthening competition in the banking industry. The total assets of the ''Sparkassen'' amount to about €1 trillion. The 431 savings banks operate a network of over 15,600 branches and offices and employ over 250,000 people.''Das Profil'', Publisher: Deutscher Sparkassen- und Giroverband, P.3

; accessed: 13.06.2011 Savings banks are

public bank

A public bank is a bank, a financial institution, in which a state, municipality, or public actors are the owners. It is an enterprise under government control.

s that together form the largest financial services group in Germany and in all of Europe. Its name refers to local government-controlled savings banks that are known in German as , plural . Its activity is overwhelmingly located in Germany.

History

The first savings banks in Germany were founded in the 18th century in its major trading cities. One of the first institutions with the business model of modern savings banks was the ''Ersparungscasse der Hamburgischen Allgemeinen Versorgungsanstalt'' in Hamburg in 1778. Founders were rich merchants, clerks and academics. They intended to develop solutions for people with low income to save small sums of money and to support business start-ups. In 1801 the first savings bank with a municipal guarantor was founded in Göttingen to fight poverty. In 1838,Prussia

Prussia, , Old Prussian: ''Prūsa'' or ''Prūsija'' was a German state on the southeast coast of the Baltic Sea. It formed the German Empire under Prussian rule when it united the German states in 1871. It was ''de facto'' dissolved by an ...

adopted the first savings banks legislation (), which subsequently served as a model for other German jurisdictions. Between 1850 and 1903 the idea of the municipal savings banks spread and the number of savings banks in Germany increased from 630 to 2834.

During World War I, the Imperial German government leveraged the network of Sparkassen to place war bonds, marking the beginning of their activity in the securities space. In 1934, all savings banks were designated as credit institutions under new banking legislation following the crisis of 1931. The savings banks group, designated from 1935 as , again participated in war financing before and during World War II. The savings banks in East Germany were nationalized and separated from the rest of the network in 1945, but reintegrated into it in 1990.

Key concepts

The Sparkassen-Finanzgruppe is highly idiosyncratic, and its description requires understanding of key notions that are unique to its German context.''Träger''

The German word ("holder", plural also ''Träger'') refers specifically, in the context of the Sparkassen-Finanzgruppe, to the specific owner-like relationship between a local government, e.g. a municipality (german: Gemeinde), union of municipalities ('' Gemeindeverband'') ordistrict

A district is a type of administrative division that, in some countries, is managed by the local government. Across the world, areas known as "districts" vary greatly in size, spanning regions or counties, several municipalities, subdivisions o ...

(german: Kreis, Landkreis, kreisfreie Stadt or Stadtkreis), and a public-sector institution (german: ), e.g. a . ''Träger'' implies a form of control that is not legally a form of ownership but is practically akin to it, given that the Sparkasse is itself an independent public entity but the ''Träger'' has ownership-like governance rights over it, with the consequence that most Sparkassen are chaired by local elected politicians. The ''Träger'' position (german: Trägerschaft) cannot be sold, however, and does not entail rights to the Sparkasse's financial surplus which is typically retained or used for local public welfare projects.

Until the early 21st century, the ''Träger'' also provided explicit financial guarantees to the institutions they controlled, but these guarantees were mostly phased out under an agreement concluded on between a group of German negotiators and the European Commission represented by Competition Commissioner Mario Monti, known in German as the .

Regional principle

The Regional Principle (german: ) stipulates that entities of the Sparkassen-Finanzgruppe such as Sparkassen or public insurers have a local monopoly within the group within the geographical area in which they are established, namely the territory of their ''Träger''. It is established in the Sparkassen legislation (german: , German acronym SpkG) which is specific to each of the states of Germany (german: Länder) except Hamburg, which has no SpkG. The states of Hesse of Schleswig-Holstein have less restrictive legislation on the Regional Principle than the other German ''Länder'', linked to the fact that, as in Hamburg, they have Sparkassen under the legal-form of joint-stock companies (''Aktiengesellschaft

(; abbreviated AG, ) is a German word for a corporation limited by share ownership (i.e. one which is owned by its shareholders) whose shares may be traded on a stock market. The term is used in Germany, Austria, Switzerland (where it is equi ...

'') as opposed to public-sector entities.

Group entities

In late 2020, the Sparkassen-Finanzgruppe included 520 member entities, as described in its 2021 Annual Report: * 376 local savings banks (german: Sparkassen): 200,676 employees * 6 regional banking groups (german:Landesbank

In German-speaking jurisdictions, ''Landesbank'' (plural ), , generally refers to a bank operating within a territorial subdivision () that has autonomy but not full sovereignty. It is occasionally translated as "provincial bank".

Austria-Hungar ...

, including Landesbank Berlin

Landesbank Berlin Holding (formerly ''Bankgesellschaft Berlin''; ) is a large commercial bank based in Berlin, Germany. It is the holding company of the Berliner Sparkasse and Landesbank. In 2007, LBB was taken over by the Deutscher Sparkassen ...

which is directly owned by the DSGV): 33,502 employees

* 9 public insurance groups (german: ): 26,680 employees

* 8 regional building societies

A building society is a financial institution owned by its members as a mutual organization. Building societies offer banking and related financial services, especially savings and mortgage lending. Building societies exist in the United Kingdo ...

(german: , abbreviated as LBS; sometimes translated into English as "building and loan associations") and 7 LBS real estate companies: 7,392 employees

* DekaBank (asset management and wholesale financial services): 4,711 employees

* (IT services): 4,474 employees

* Deutsche Leasing

Deutsche Leasing AG (DL) is the largest manufacturer-independent leasing company in Germany. Since 1987, the company has had its headquarters in Bad Homburg vor der Höhe and is the centre of excellence for leasing for the Sparkassen-Finanzgruppe. ...

and other leasing companies: 3,441 employees

* (publishing and other group services): 2,100 employees

* Berlin Hyp

The Berlin Hyp AG, based in Berlin, is one of the large German real estate and mortgage banks. The bank was created in 1996 from the merger of ''Berliner Hypotheken- und Pfandbriefbank AG'' and ''Braunschweig-Hannoversche Hypothekenbank AG''.

T ...

(property lending): 593 employees

* (car loans and consumer credit): 530 employees

* 3 factoring companies: 403 employees

* Sparkassen Rating und Risikosysteme GmbH (risk management): 311 employees

* SIZ GmbH (IT security): 281 employees

* 51 capital investment companies: 179 employees

National and regional associations

The

The Deutscher Sparkassen- und Giroverband

The Deutscher Sparkassen- und Giroverband (DSGV, ) is the association of German savings banks (german: Sparkassen) and the apex entity of the Sparkassen-Finanzgruppe, the European Union's second-largest financial services group (after BNP Paribas ...

(DSGV, self-translated as "German Savings Banks Association") is a nonprofit association, based in Berlin and founded in 1924. It operates as an umbrella organization to facilitate decision-making processes, coordinate strategy, and represent its members' political and regulatory interests at the national and international levels.

The 12 regional associations (german: Sparkassenverbände) are statutory bodies, of which savings banks ''Träger'' are statutory members. They are responsible for coordination between savings banks in a region, and manage the regional sub-funds that participate in the Sparkassen-Finanzgruppe's institutional protection scheme (except in Berlin where a special arrangement is in place). They also act as auditors and operate regional savings bank academies for educational and training purposes.

They are, from north to south:

* with head office in Kiel, covering Schleswig-Holstein;

* in Hamburg, covering Bremen

Bremen ( Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state con ...

and Hamburg;

* in Berlin, covering Berlin;

* also in Berlin, covering Brandenburg

Brandenburg (; nds, Brannenborg; dsb, Bramborska ) is a state in the northeast of Germany bordering the states of Mecklenburg-Vorpommern, Lower Saxony, Saxony-Anhalt, and Saxony, as well as the country of Poland. With an area of 29,480 squar ...

, Mecklenburg-Vorpommern, Saxony, and Saxony-Anhalt;

* in Hanover, covering Lower Saxony;

* in Münster, covering the northeastern part of North Rhine-Westphalia;

* in Dusseldorf, covering the southwestern part of North Rhine-Westphalia;

* in Frankfurt and Erfurt

Erfurt () is the capital and largest city in the Central German state of Thuringia. It is located in the wide valley of the Gera river (progression: ), in the southern part of the Thuringian Basin, north of the Thuringian Forest. It sits in ...

, covering Hesse and Thuringia;

* in Mainz, covering Rhineland-Palatinate;

* in Saarbrücken, covering Saarland

The Saarland (, ; french: Sarre ) is a state of Germany in the south west of the country. With an area of and population of 990,509 in 2018, it is the smallest German state in area apart from the city-states of Berlin, Bremen, and Hamburg, and ...

;

* in Stuttgart, covering Baden-Württemberg

Baden-Württemberg (; ), commonly shortened to BW or BaWü, is a German state () in Southwest Germany, east of the Rhine, which forms the southern part of Germany's western border with France. With more than 11.07 million inhabitants across a ...

;

* in Munich, covering Bavaria

Bavaria ( ; ), officially the Free State of Bavaria (german: Freistaat Bayern, link=no ), is a state in the south-east of Germany. With an area of , Bavaria is the largest German state by land area, comprising roughly a fifth of the total lan ...

.

In addition, a dedicated association, the (VFS), exists for Sparkassen that are (or recently were) joint-stock companies. The latter are members of both the respective regional ''Sparkassenverband'' and the VFS.

''Sparkassen''

The ''Sparkassen'' work as commercial banks in a decentralized structure.DSGV-Website-Organisation-Sparkassenaccessed: 13.06.2011 Each savings bank is independent, locally managed and concentrates its business activities on customers in the territory in which it is situated under the Regional Principle. In general, ''Sparkassen'' are not profit oriented. The ''Träger'' of the savings banks are usually single municipalities or several municipalities within a district. As banks under public law, the vast majority of Sparkassen have a public mandate which requires that they serve their local stakeholders and local communities. Five institutions known as "free Sparkassen" (german: freie Sparkassen) are or recently were joint-stock companies. They are: , , Hamburger Sparkasse, Sparkasse zu Lübeck, and Sparkasse Mittelholstein. Their ''Träger'' are charitable foundations. They are members of the VFS, as is despite its current public-sector legal status. Fulfilling public interests is still one of the most significant characteristics of public banks in general and the savings banks in particular. Although public interest is very unspecific, objects of those companies are usually: * providing financial and monetary services in economically underdeveloped regions; * supporting saving processes and accumulation of capital; * strengthening competition in the banking industry. The total assets of the ''Sparkassen'' amount to about €1 trillion. The 431 savings banks operate a network of over 15,600 branches and offices and employ over 250,000 people.''Das Profil'', Publisher: Deutscher Sparkassen- und Giroverband, P.3

; accessed: 13.06.2011 Savings banks are

universal bank

A universal bank participates in many kinds of banking activities and is both a commercial bank and an investment bank as well as providing other financial services such as insurance. 50 million customers maintain business activities with savings banks. Although independent and regionally spread, the savings banks act as one unit under the brand ''Sparkasse'' with its iconic logo and recognizable red hue.

The size of savings banks differs widely depending on the economy in their region. While the biggest, Hamburger Sparkasse, had total assets of €37.7 billion and 5,500 employees in 2009, the smallest (''Stadtsparkasse Bad Sachsa'') had only €129.6 million in assets and 45 employees.

File:Nord-LB office building Aegidientorplatz Hannover Germany.jpg, NordLB head office in Hanover

File:Maintower Frankfurt.jpg, Helaba head office in frankfurt

File:20110726Ursulinenstr2 Saarbruecken2.jpg, SaarLB head office in Saarbrücken

File:Landesbank Stuttgart AmHbf2.jpg, LBBW head office in Stuttgart

File:Brienner Str. 16 Muenchen-1.jpg, BayernLB head office in Munich

File:Berlin, Mitte, Alexanderplatz, Alexanderhaus, Fassade Grunerstrasse 02.jpg, Landesbank Berlin head office in Berlin

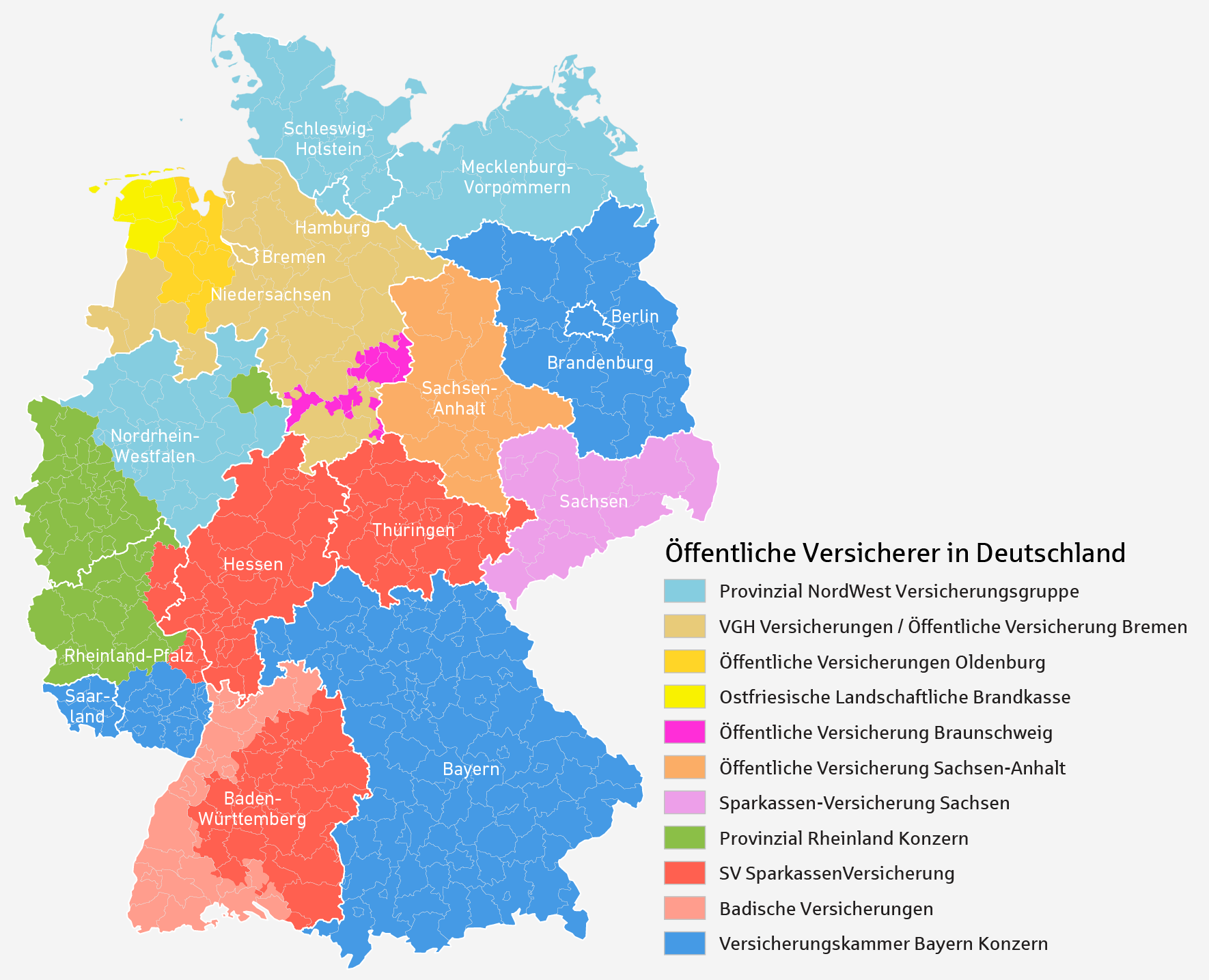

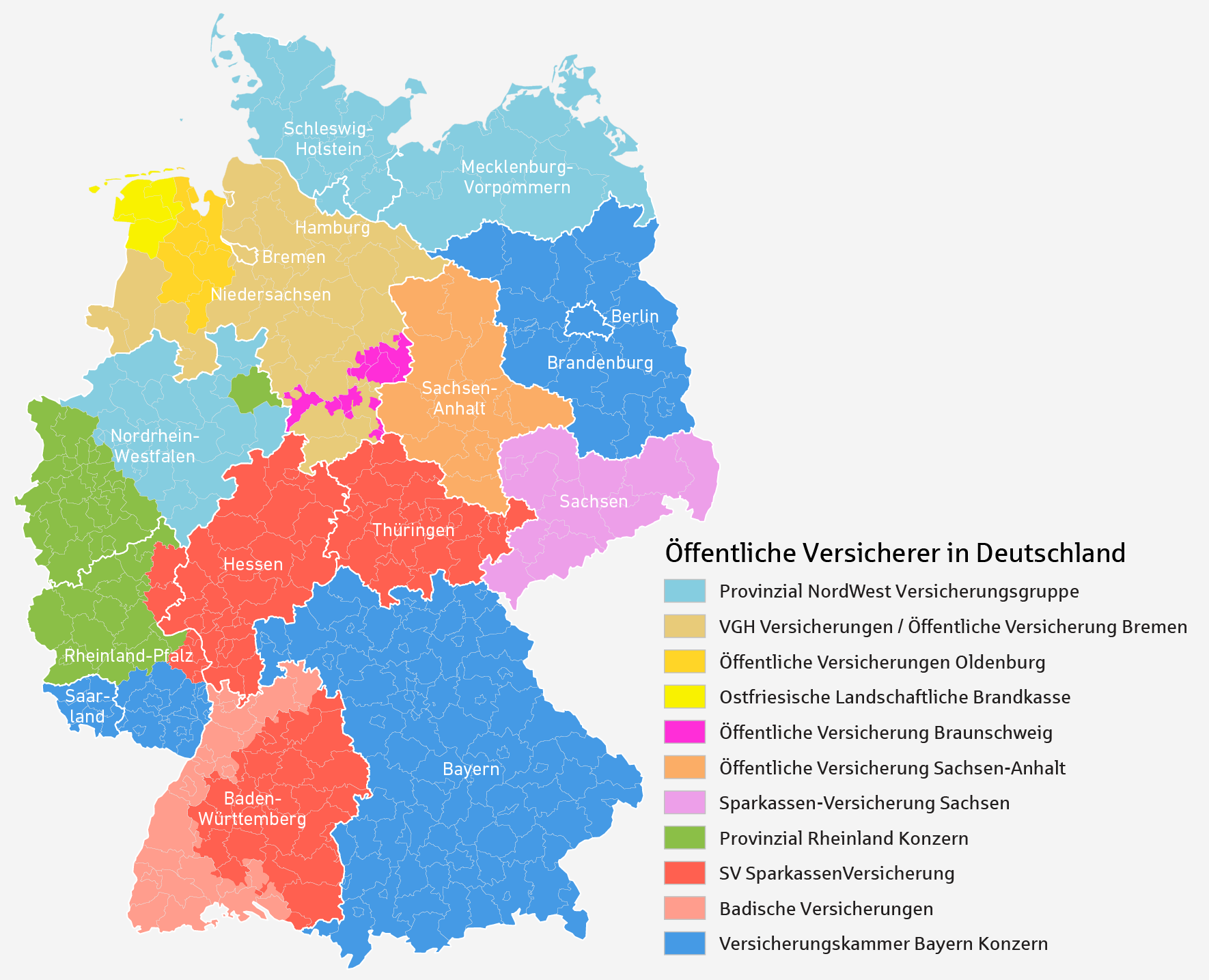

The nine public insurers that belong to the Sparkassen-Finanzgruppe are:

* (est. 1811 as in Munich):

The nine public insurers that belong to the Sparkassen-Finanzgruppe are:

* (est. 1811 as in Munich):

File:Versicherungskammer Bayern Sitz.jpg, Head office of Versicherungskammer Bayern in Munich

File:MuensterProvinzial.jpg, Head office of Provinzial in Münster

File:Gebaude stuttgart.jpg, Head office of SV Sparkassenversicherung in Stuttgart

File:VGH Insurance Office Building Hanover Germany 01.jpg, Head office of VGH Versicherungen in Hanover

File:Svsachsen firmensitz.jpg, Head office of Sparkassen-Versicherung Sachsen in Dresden

File:BS VerwGeb Oeffentliche.JPG, Head office of Öffentliche Versicherung in Braunschweig

File:Bgv-hauptgebaeude-karlsruhe.jpg, Head office of BGV / Badische Versicherungen in Karlsruhe

File:2022-02-12 Hauser Skulptur Bemerode 02.JPG, LBS Nord head office in Hanover

File:Münster, LBS, Die Taten des Herkules -- 2017 -- 9465.jpg, LBS West head office in Münster

File:LSBStuttgart 2012-09.jpg, LBS Südwest head office in Stuttgart

DekaBank with its subsidiaries is the central asset manager of the German Savings Bank Finance Group. Based in Frankfurt and Berlin it provides asset management and other services for the Sparkassen and Landesbanks. It resulted in 1999 from the merger of

DekaBank with its subsidiaries is the central asset manager of the German Savings Bank Finance Group. Based in Frankfurt and Berlin it provides asset management and other services for the Sparkassen and Landesbanks. It resulted in 1999 from the merger of

As of end-2020, the Savings banks network maintained a total of 769 foundations in Germany, with total capital of €2.72 billion. At the national level, the (german: Deutsche Sparkassenstiftung für internationale Kooperation e.V.) in

As of end-2020, the Savings banks network maintained a total of 769 foundations in Germany, with total capital of €2.72 billion. At the national level, the (german: Deutsche Sparkassenstiftung für internationale Kooperation e.V.) in

''Landesbanken''

TheLandesbank

In German-speaking jurisdictions, ''Landesbank'' (plural ), , generally refers to a bank operating within a territorial subdivision () that has autonomy but not full sovereignty. It is occasionally translated as "provincial bank".

Austria-Hungar ...

en are mostly owned by the regional savings banks through its regional association and the respective federal states. In total, the assets of the Landesbanks have shrunk by 45 percent, or more than €702 billion, between end-2008 and end-2017.

The Landesbanks have traditionally acted as central financial services providers for regional savings bank association and as the "main bank" of the respective . They are also local banks, mortgage banks and general commercial banks. Their duties and powers are codified in the individual banking laws of the Länder (''Landesbankengesetze''). The specific tasks for the savings banks include central clearing for cashless payments and liquidity funding for the regional savings banks. They also provide many services for the savings banks in the region in securities and cross-country businesses. In contrast to savings banks, they do wholesale banking rather than retail banking.

After multiple mergers and restructurings, five Landesbanken operated in Germany as of late 2022:

* Landesbank Baden-Württemberg

Landesbank Baden-Württemberg (LBBW) is a universal bank and the Landesbank for some Federal States of Germany (Baden-Württemberg, Rheinland-Pfalz, Sachsen). As of 2018, it is Germany's biggest state-backed landesbank lender.

LBBW is a full-ser ...

(LBBW) in Stuttgart

** covers Baden-Württemberg

Baden-Württemberg (; ), commonly shortened to BW or BaWü, is a German state () in Southwest Germany, east of the Rhine, which forms the southern part of Germany's western border with France. With more than 11.07 million inhabitants across a ...

, Rhineland-Palatinate, and Saxony

** owned by the State of Baden-Württemberg (40.53 percent), the regional (40.53 percent), and the City of Stuttgart (18.93 percent)

* Bayerische Landesbank

Bayerische Landesbank (BayernLB; Bavarian State Bank) is a publicly regulated bank based in Munich, Germany and one of the six Landesbanken. It is 75% owned by the Free State of Bavaria (indirectly via BayernLB Holding AG) and 25% owned by the ' ...

(BayernLB) in Munich

** covers Bavaria

Bavaria ( ; ), officially the Free State of Bavaria (german: Freistaat Bayern, link=no ), is a state in the south-east of Germany. With an area of , Bavaria is the largest German state by land area, comprising roughly a fifth of the total lan ...

** owned by the Free State of Bavaria

Bavaria ( ; ), officially the Free State of Bavaria (german: Freistaat Bayern, link=no ), is a state in the south-east of Germany. With an area of , Bavaria is the largest German state by land area, comprising roughly a fifth of the total lan ...

(75 percent minus one share) and the Bavarian (25 percent plus one share)

* Landesbank Hessen-Thüringen (Helaba) in Frankfurt and Erfurt

Erfurt () is the capital and largest city in the Central German state of Thuringia. It is located in the wide valley of the Gera river (progression: ), in the southern part of the Thuringian Basin, north of the Thuringian Forest. It sits in ...

** covers Brandenburg

Brandenburg (; nds, Brannenborg; dsb, Bramborska ) is a state in the northeast of Germany bordering the states of Mecklenburg-Vorpommern, Lower Saxony, Saxony-Anhalt, and Saxony, as well as the country of Poland. With an area of 29,480 squar ...

, Hesse, North Rhine-Westphalia, and Thuringia

** owned by the of Hesse and Thuringia (68,85 percent), the State of Hesse (8,10 percent), the Rhenish , Westphalia-Lippe, FIDES Alpha, and FIDES Beta (4.75 percent each), and the Free State of Thuringia (4,05 percent)

* Norddeutsche Landesbank

The Norddeutsche Landesbank Girozentrale (abbreviated NORD/LB) is a German Landesbank and one of the largest commercial banks in Germany. It is a public corporation majority-owned by the federal states of Lower Saxony and Saxony-Anhalt with its he ...

(NORD/LB) in Hanover

** covers Bremen

Bremen ( Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state con ...

, Hamburg, Lower Saxony, Mecklenburg-Vorpommern, Saxony-Anhalt, and Schleswig-Holstein

** owned by the State of Lower Saxony (56.76 percent), FIDES Gamma and FIDES Delta (12.27 percent each), the of Lower Saxony (9.16 percent), the State of Saxony-Anhalt (6.42 percent), and holding entities of the in Saxony-Anhalt and Mecklenburg-Vorpommern (1.83 percent and 1.27 percent respectively)

* Landesbank Saar

Landesbank Saar (short SaarLB) is a public-law corporation established in Saarbrücken and the largest credit and mortgage bond institute in Saarland. In 2017, the balance sheet total was around €14 billion. Core markets are Saarland and Fra ...

(SaarLB) in Saarbrücken

** covers Saarland

The Saarland (, ; french: Sarre ) is a state of Germany in the south west of the country. With an area of and population of 990,509 in 2018, it is the smallest German state in area apart from the city-states of Berlin, Bremen, and Hamburg, and ...

** owned by the State of Saarland (74.90 percent) and the regional (25.10 percent)

FIDES Alpha and Gamma are trustee entities for the regional sub-funds of the within the Institutional Protection Scheme (IPS) under the DSGV, and FIDES Beta and Delta are trustees for the sub-fund of the in the IPS.

Landesbank Berlin

Landesbank Berlin Holding (formerly ''Bankgesellschaft Berlin''; ) is a large commercial bank based in Berlin, Germany. It is the holding company of the Berliner Sparkasse and Landesbank. In 2007, LBB was taken over by the Deutscher Sparkassen ...

(LBB) does not belong in the same category as it was converted into a joint-stock company (german: Aktiengesellschaft) in 2007, when the DSGV rescued it and took full ownership through two of its legal entities, (owning 89.37 percent) and (owning 10,63 percent).

Public insurers

The nine public insurers that belong to the Sparkassen-Finanzgruppe are:

* (est. 1811 as in Munich):

The nine public insurers that belong to the Sparkassen-Finanzgruppe are:

* (est. 1811 as in Munich): Bavaria

Bavaria ( ; ), officially the Free State of Bavaria (german: Freistaat Bayern, link=no ), is a state in the south-east of Germany. With an area of , Bavaria is the largest German state by land area, comprising roughly a fifth of the total lan ...

, Berlin, Brandenburg

Brandenburg (; nds, Brannenborg; dsb, Bramborska ) is a state in the northeast of Germany bordering the states of Mecklenburg-Vorpommern, Lower Saxony, Saxony-Anhalt, and Saxony, as well as the country of Poland. With an area of 29,480 squar ...

, south of Rhineland-Palatinate, Saarland

The Saarland (, ; french: Sarre ) is a state of Germany in the south west of the country. With an area of and population of 990,509 in 2018, it is the smallest German state in area apart from the city-states of Berlin, Bremen, and Hamburg, and ...

* (est. 1676 as ): North Rhine-Westphalia, most of Rhineland-Palatinate, Schleswig-Holstein, Hamburg, Mecklemburg-Vorpommern

* (est. 1758 as in Karlsruhe: Baden-Württemberg

Baden-Württemberg (; ), commonly shortened to BW or BaWü, is a German state () in Southwest Germany, east of the Rhine, which forms the southern part of Germany's western border with France. With more than 11.07 million inhabitants across a ...

, Hesse, Thuringia, eastern fringe of Rhineland-Palatinate

* (est. 1750 as ): most of Lower Saxony, Bremen

Bremen ( Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state con ...

* (est. 1992 in Dresden: Saxony

* (est. 1754 as ): parts of southern Lower Saxony

* (est. 1923 in Karlsruhe): west of Baden-Württemberg

Baden-Württemberg (; ), commonly shortened to BW or BaWü, is a German state () in Southwest Germany, east of the Rhine, which forms the southern part of Germany's western border with France. With more than 11.07 million inhabitants across a ...

* (est. 1764 as ): parts of western Lower Saxony

* (est. 1754 as ): parts of western Lower Saxony

''Landesbausparkassen''

The core business of the eight ("Land-level building savings banks") is collective real estate saving products (''Bausparen'') and low-interest residential mortgage loans, with a share of the German mortgage market of about one-third and cumulative assets of €74.5 billion.. They are, from north to south: * Bausparkasse Schleswig-Holstein-Hamburg AG in Hamburg, covering Hamburg and Schleswig-Holstein * Ostdeutsche Landesbausparkasse AG (LBS Ost) inPotsdam

Potsdam () is the capital and, with around 183,000 inhabitants, largest city of the German state of Brandenburg. It is part of the Berlin/Brandenburg Metropolitan Region. Potsdam sits on the River Havel, a tributary of the Elbe, downstream of ...

, covering Brandenburg

Brandenburg (; nds, Brannenborg; dsb, Bramborska ) is a state in the northeast of Germany bordering the states of Mecklenburg-Vorpommern, Lower Saxony, Saxony-Anhalt, and Saxony, as well as the country of Poland. With an area of 29,480 squar ...

, Mecklenburg-Vorpommern, Saxony, Saxony-Anhalt, and the eastern part of Berlin

* Norddeutsche Landesbausparkasse Berlin – Hannover (LBS Nord) in Hanover, covering Berlin and Lower Saxony

* Westdeutsche Landesbausparkasse (LBS West) in Münster, covering Bremen

Bremen ( Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state con ...

and North Rhine-Westphalia

* Landesbausparkasse Hessen-Thüringen in Frankfurt, covering Hesse and Thuringia

* Landesbausparkasse Saar in Saarbrücken, covering Saarland

The Saarland (, ; french: Sarre ) is a state of Germany in the south west of the country. With an area of and population of 990,509 in 2018, it is the smallest German state in area apart from the city-states of Berlin, Bremen, and Hamburg, and ...

* Landesbausparkasse Südwest in Stuttgart, covering Baden-Württemberg

Baden-Württemberg (; ), commonly shortened to BW or BaWü, is a German state () in Southwest Germany, east of the Rhine, which forms the southern part of Germany's western border with France. With more than 11.07 million inhabitants across a ...

and Rhineland-Palatinate

* Bayerische Landesbausparkasse (LBS Bayern) in Munich, covering Bavaria

Bavaria ( ; ), officially the Free State of Bavaria (german: Freistaat Bayern, link=no ), is a state in the south-east of Germany. With an area of , Bavaria is the largest German state by land area, comprising roughly a fifth of the total lan ...

The first Landesbausparkassen were established in 1929. The corporate forms and ownership structures of the Landesbausparkassen are diverse, even though all involve one or several regional associations (). Some, like LBS Ost and Bausparkasse Schleswig-Holstein-Hamburg, are joint-stock companies, while others are public-sector entities. Bausparkasse Schleswig-Holstein-Hamburg is owned by the Sparkassenverband (57.5%) and Hamburger Sparkasse (42.5%). LBS Nord is owned by NordLB

The Norddeutsche Landesbank Girozentrale (abbreviated NORD/LB) is a German Landesbank and one of the largest commercial banks in Germany. It is a public corporation majority-owned by the federal states of Lower Saxony and Saxony-Anhalt with its he ...

(44%), Landesbank Berlin

Landesbank Berlin Holding (formerly ''Bankgesellschaft Berlin''; ) is a large commercial bank based in Berlin, Germany. It is the holding company of the Berliner Sparkasse and Landesbank. In 2007, LBB was taken over by the Deutscher Sparkassen ...

(12%) and the Lower Saxon Sparkassenverband (44%). Landesbausparkasse Hessen-Thüringen is majority-owned (68.85%) by the regional Sparkassenverband but also has stakes from the two Länder of Hesse and Thuringia as well as from the two Sparkassenverbände of North Rhine-Westphalia and two legal entities of the Finanzgruppe, FIDES Alpha and FIDES Beta. Landesbausparkasse Saar is owned by the Land (74.9%) and the Sparkassenverband (25.1%) of Saarland. For the others, the relevant regional association(s) are the sole ''Träger''.

DekaBank

DekaBank with its subsidiaries is the central asset manager of the German Savings Bank Finance Group. Based in Frankfurt and Berlin it provides asset management and other services for the Sparkassen and Landesbanks. It resulted in 1999 from the merger of

DekaBank with its subsidiaries is the central asset manager of the German Savings Bank Finance Group. Based in Frankfurt and Berlin it provides asset management and other services for the Sparkassen and Landesbanks. It resulted in 1999 from the merger of Deutsche Girozentrale

DekaBank Deutsche Girozentrale is the central provider of asset management and capital market solutions of the Sparkassen-Finanzgruppe. It is registered in both Frankfurt and Berlin, with main operational headquarters in Frankfurt. It traces its ...

(DGZ), established in 1918 as a national hub for the savings banks' regional giro associations, and Deka (Deutsche Kapitalanlagegesellschaft), an investment company established in 1956.

Until 8 June 2011, DekaBank was owned by the DSGV and Landesbanks which grouped the shares in the GLB GmbH & Co.OHG, which held the DekaBank shares. On 7 April 2011, the Savings Banks bought the 50% stake from the landesbanken for €2.3 billion to become sole owner of the DekaBank. The acquisition was closed on 8 June 2011 and DekaBank became fully, directly owned by the savings banks.

3,700 people throughout the group work in one of the three business divisions ''AMK'' (Asset Management Capital Markets), ''AMI'' (Asset Management Real Estate Business), ''C&M'' (Corporates and Markets), the sales division or one of the corporate centers.

Foundations

As of end-2020, the Savings banks network maintained a total of 769 foundations in Germany, with total capital of €2.72 billion. At the national level, the (german: Deutsche Sparkassenstiftung für internationale Kooperation e.V.) in

As of end-2020, the Savings banks network maintained a total of 769 foundations in Germany, with total capital of €2.72 billion. At the national level, the (german: Deutsche Sparkassenstiftung für internationale Kooperation e.V.) in Bonn

The federal city of Bonn ( lat, Bonna) is a city on the banks of the Rhine in the German state of North Rhine-Westphalia, with a population of over 300,000. About south-southeast of Cologne, Bonn is in the southernmost part of the Rhine-Ruhr ...

, also known as Deutsche Sparkassenstiftung, centralizes actions in favor of international development.

Group arrangements

The internal legal and financial arrangements of the Sparkassen-Finanzgruppe are complex, in line with its largely decentralized structure that mirrors its long history.Institutional protection scheme

The core feature of the Sparkassen-Finanzgruppe is a set of mutual support arrangements known as an Institutional Protection Scheme (IPS) in EU law, namely theCapital Requirements Regulation

The Capital Requirements Regulation''(EU) No. 575/2013is an EU law that aims to decrease the likelihood that banks go insolvent. With the Credit Institutions Directive 2013 the Capital Requirements Regulation 2013 (CRR 2013) reflects Basel III r ...

. The Sparkassen-Finanzgruppe IPS is complex and its contractual details are not made public. It started in 1969 with the establishment of protection schemes german: Sicherungseinrichtungen on a regional basis, expanded to the Landesbanks through a community of liability german: Haftungsverbund) in 1973, and reformed in 2005 following negotiations with the European Commission on state aid control.

As of 2021, the Sparkassen-Finanzgruppe IPS included 13 participating sub-funds:

* eleven regional Savings Banks sub-funds (german: Sparkassenstützungsfonds) managed by the respective regional , covering all of Germany except Berlin which relies on the reserve fund of the Landesbank Berlin;

* a national sub-fund of the Landesbank

In German-speaking jurisdictions, ''Landesbank'' (plural ), , generally refers to a bank operating within a territorial subdivision () that has autonomy but not full sovereignty. It is occasionally translated as "provincial bank".

Austria-Hungar ...

en and DekaBank (which includes Landesbank Berlin AG, and included Hamburg Commercial Bank

Hamburg Commercial Bank (formerly HSH Nordbank) is a commercial bank in northern Europe with headquarters in Hamburg as well as Kiel, Germany. It is active in corporate and private banking. Considered to be the world’s largest provider of marit ...

, a restructured former Landesbank, until end-2021);

* a national sub-fund of the eight .

Each of the regional sub-funds absorbs losses as needed to preventively support a member entity in need, unless it is itself depleted in which case it is in turn supported by the other regional sub-funds on a proportional basis ("supra-regional equalization") and, if further needed, also by the two national sub-funds ("system-wide equalization"). The exact formula for such equalization, however, has not been made clear in the public domain, and the protection is in no way automatic but instead relies on voting within the Sparkassenverbände and other managers of the relevant sub-funds. The corresponding uncertainty has generated concerns from the supervisors at the European Central Bank and BaFin and partial reform of the IPS adopted by the DSGV in August 2021. A new national protection fund is to be set up with 2.6 billion euro to be paid in by the Sparkassen and Landesbanken between 2025 and 2032, which is expected to allow for faster intervention in future cases of need, complementing the existing IPS setup of 13 regional and sectoral sub-funds.

The DSGV does not generally disclose cases or amounts of IPS interventions. One known case was the rescue of Norddeutsche Landesbank

The Norddeutsche Landesbank Girozentrale (abbreviated NORD/LB) is a German Landesbank and one of the largest commercial banks in Germany. It is a public corporation majority-owned by the federal states of Lower Saxony and Saxony-Anhalt with its he ...

in 2019, in which the IPS contributed 1.2 billion euro in fresh equity in addition to contributions by the relevant Länder. This case also highlighted the protracted nature of the Sparkassen-Finanzgruppe's IPS decision-making process, with a delay of nearly five months from the IPS's intervention decision to the agreement on basic principles (german: Grundlagenvereibarung) for NordLB's recapitalization.

Deposit guarantee scheme

In line with the EU Deposit Guarantee Scheme Directive of 2014, the IPS of the Sparkassen-Finanzgruppe is also designated as thedeposit guarantee scheme

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a ...

for all its member banks. in August 2021, the DSGV members unanimously adopted a resolution to reform the system and establish a Deposit Insurance Fund, gradually from 2024-2025.

Accounting and auditing

The Sparkassen-Finanzgruppe publishes unaudited, unconsolidated, aggregated financial statements of the German activities of its group entities, in line with the disclosure requirement for IPSs enshrined in Article 113(7)(e) of the EUCapital Requirements Regulation

The Capital Requirements Regulation''(EU) No. 575/2013is an EU law that aims to decrease the likelihood that banks go insolvent. With the Credit Institutions Directive 2013 the Capital Requirements Regulation 2013 (CRR 2013) reflects Basel III r ...

. Specifically, the scope of aggregation in 2021 (report on the financial year 2020) included all Savings Banks

A savings bank is a financial institution whose primary purpose is accepting savings deposits and paying interest on those deposits.

They originated in Europe during the 18th century with the aim of providing access to savings products to all ...

, Landesbanken, Landesbausparkassen, as well as Hamburg Commercial Bank

Hamburg Commercial Bank (formerly HSH Nordbank) is a commercial bank in northern Europe with headquarters in Hamburg as well as Kiel, Germany. It is active in corporate and private banking. Considered to be the world’s largest provider of marit ...

since it was still affiliated with the Institution Protection Scheme. Neither the foreign branches of Landesbanken nor any of their subsidiaries, whether domestic or foreign, are included, and neither are the foreign branches of Landesbausparkassen. On that basis, the group had total aggregated assets of €2.4 trillion as of end-2020, of which 1.4 trillion in the local savings banks.

The following entities are members of the IPS even though they are not included in the group's scope of accounting aggregation: Berlin Hyp

The Berlin Hyp AG, based in Berlin, is one of the large German real estate and mortgage banks. The bank was created in 1996 from the merger of ''Berliner Hypotheken- und Pfandbriefbank AG'' and ''Braunschweig-Hannoversche Hypothekenbank AG''.

T ...

, Deutsche Hypothekenbank, Frankfurter Bankgesellschaft (Deutschland) AG, Landesbank Berlin Holding

Landesbank Berlin Holding (formerly ''Bankgesellschaft Berlin''; ) is a large commercial bank based in Berlin, Germany. It is the holding company of the Berliner Sparkasse and Landesbank. In 2007, LBB was taken over by the Deutscher Sparkasse ...

, Portigon AG, , , and .

Most entities of the Sparkassen-Finanzgruppe have no external auditors but are audited instead by audit entities of the group itself. Some group-level entities such as DekaBank, however, publish externally audited financial statements.

Branding

The S-shaped logo of the Sparkassen-Finanzgruppe is one of Germany's most recognizable brand images. It was introduced in 1938 and given its present form, with the trademark red color, in 1972 by designerOtl Aicher

Otto "Otl" Aicher (; 13 May 1922 – 1 September 1991) was a German graphic designer and typographer. Aicher co-founded and taught at the influential Ulm School of Design. He is known for having led the design team of the 1972 Summer Olympics ...

.

Leadership

The leading public figure of the Sparkassen-Finanzgruppe at the national level is the President of the DSGV, also known as the . * 1924–1935: * 1935–1945: Johannes Heintze * 1945–1967: (1945–1953 as ) * 1967–1972: * 1972–1993: * 1993–1998: Horst Köhler * 1998–2006: * 2006–2012: * 2012–2017: Georg Fahrenschon * 2017–present:See also

* Erste Group in Austria * Südtiroler Sparkasse – Cassa di Risparmio di Bolzano in Italy * Banque et Caisse d'Épargne de l'État in Luxembourg * Swedbank in Sweden *SpareBank 1

SpareBank 1 is a Norwegian alliance and brand name for a group of savings banks. The alliance is organised through the holding company ''SpareBank 1 Gruppen AS'' owned by the participating banks. In total the alliance is Norway's second largest b ...

in Norway

* Sberbank

PJSC Sberbank (russian: Сбербанк, initially a contraction of russian: сберегательный банк, translit=sberegatelnyy bank, lit=savings bank, link=no) is a Russian majority state-owned banking and financial services compan ...

in Russia

* Groupe Caisse d'Épargne

Groupe Caisse d'épargne was a French cooperative banking group, with around, 4700 branches in the country. Its origins go back to the founding in 1818 of the , France's first savings bank. The group was active in retail and private banking, as ...

in France

* German Cooperative Financial Group, the other large German network of non-joint-stock banks

Notes

{{reflist Banks of Germany Public finance of Germany Government-owned companies of Germany Government-owned banks