Property insurance on:

[Wikipedia]

[Google]

[Amazon]

Property insurance provides protection against most risks to

Property insurance can be traced to the

Property insurance can be traced to the

Fire insurance

(EH.Net Encyclopedia of Economic History) {{DEFAULTSORT:Property Insurance Types of insurance

property

Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves. Depending on the nature of the property, an owner of property may have the right to consume, alter, share, re ...

, such as fire, theft and some weather damage. This includes specialized forms of insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

such as fire insurance, flood insurance

Flood insurance is the specific insurance coverage issued against property loss from flooding. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and other areas th ...

, earthquake insurance, home insurance

Home insurance, also commonly called homeowner's insurance (often abbreviated in the US real estate industry as HOI), is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insur ...

, or boiler insurance. Property is insured in two main ways—open perils and named perils.

Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquake

An earthquakealso called a quake, tremor, or tembloris the shaking of the Earth's surface resulting from a sudden release of energy in the lithosphere that creates seismic waves. Earthquakes can range in intensity, from those so weak they ...

s, flood

A flood is an overflow of water (list of non-water floods, or rarely other fluids) that submerges land that is usually dry. In the sense of "flowing water", the word may also be applied to the inflow of the tide. Floods are of significant con ...

s, nuclear incidents, acts of terrorism

Terrorism, in its broadest sense, is the use of violence against non-combatants to achieve political or ideological aims. The term is used in this regard primarily to refer to intentional violence during peacetime or in the context of war aga ...

, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning

Lightning is a natural phenomenon consisting of electrostatic discharges occurring through the atmosphere between two electrically charged regions. One or both regions are within the atmosphere, with the second region sometimes occurring on ...

, explosion, cyber-attack, and theft.

History

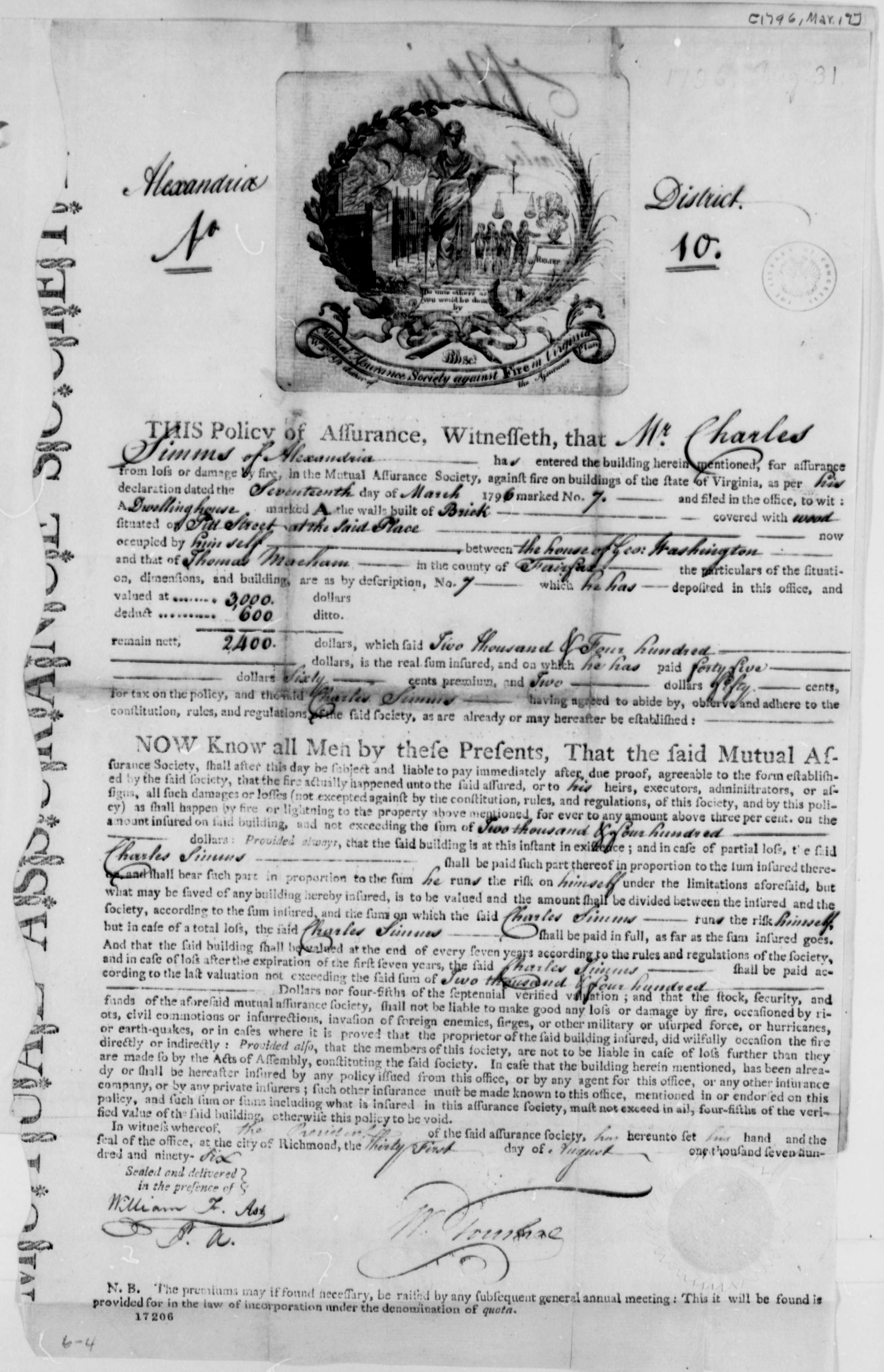

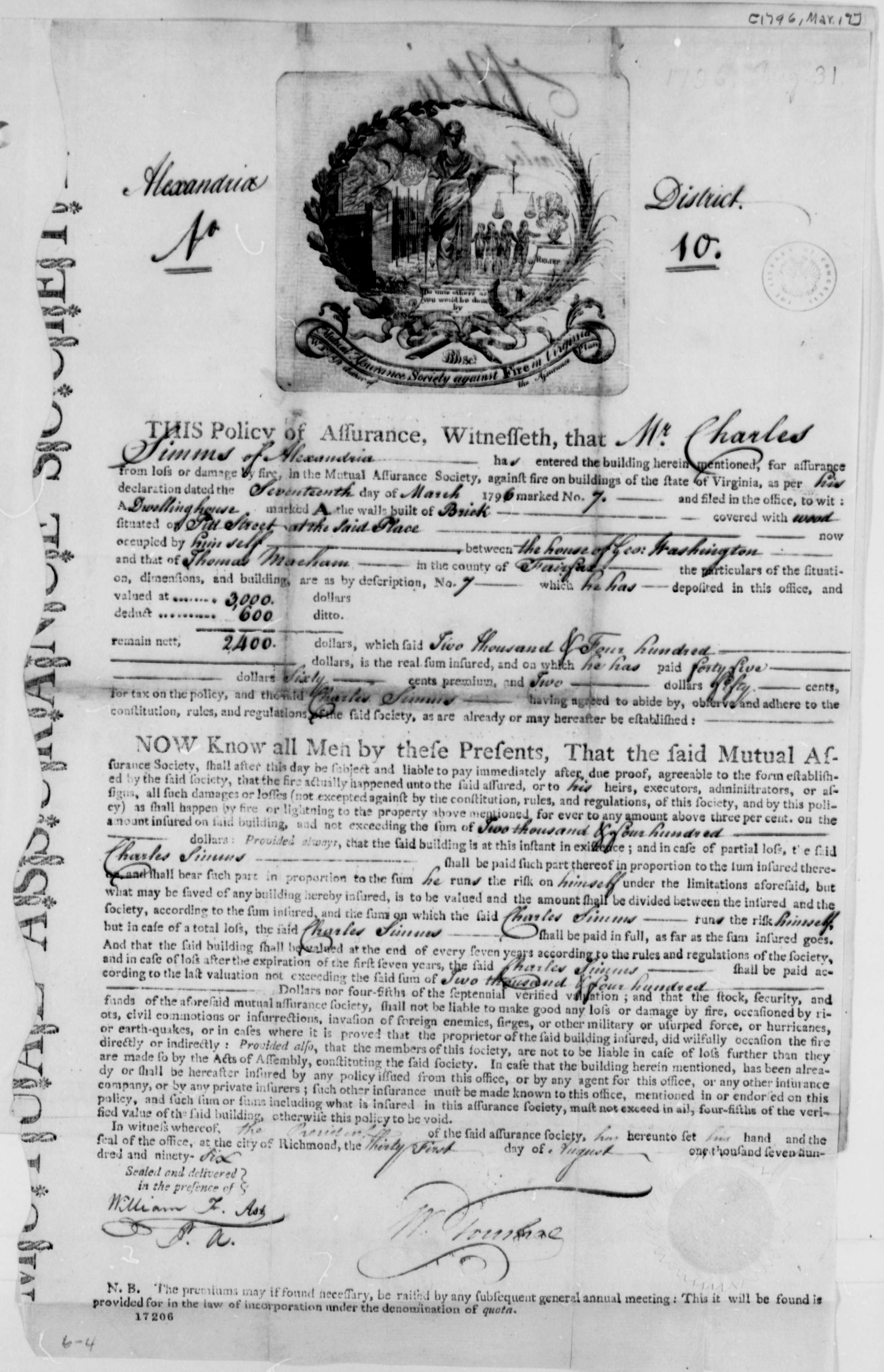

Property insurance can be traced to the

Property insurance can be traced to the Great Fire of London

The Great Fire of London was a major conflagration that swept through central London from Sunday 2 September to Wednesday 5 September 1666, gutting the medieval City of London inside the old London Wall, Roman city wall, while also extendi ...

, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren's inclusion of a site for 'the Insurance Office' in his new plan for London in 1667". A number of attempted fire insurance schemes came to nothing, but in 1681, economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this ...

Nicholas Barbon and eleven associates established the first fire insurance company, the "Insurance Office for Houses", at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by Barbon's Insurance Office.

In the wake of this first successful venture, many similar companies were founded in the following decades. Initially, each company employed its own fire department

A fire department (North American English) or fire brigade (English in the Commonwealth of Nations, Commonwealth English), also known as a fire company, fire authority, fire district, fire and rescue, or fire service in some areas, is an organi ...

to prevent and minimize the damage from conflagrations on properties insured by them. They also began to issue ' fire insurance marks' to their customers; these would be displayed prominently above the main door to the property in order to aid positive identification. One such notable company was the Hand in Hand Fire & Life Insurance Society, founded in 1696 at Tom's Coffee House in St Martin's Lane in London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

.

The first property insurance company still extant was founded in 1710 as the Sun Fire Office and is now, through many mergers and acquisitions, the RSA Insurance Group.

In Colonial America, Benjamin Franklin

Benjamin Franklin (April 17, 1790) was an American polymath: a writer, scientist, inventor, statesman, diplomat, printer, publisher and Political philosophy, political philosopher.#britannica, Encyclopædia Britannica, Wood, 2021 Among the m ...

helped to popularize and make standard the practice of insurance, particularly Property insurance to spread the risk of loss from fire, in the form of perpetual insurance. In 1752, he founded the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire. Franklin's company refused to insure certain buildings, such as wooden houses, where the risk of fire was too great.

Types of coverage

There are three types of insurance coverage. Replacement cost coverage pays the cost of repairing or replacing the property with like kind & quality regardless of depreciation or appreciation. Premiums for this type of coverage are based on replacement cost values, and not based on actual cash value. Actual cash value coverage provides for replacement cost minusdepreciation

In accountancy, depreciation refers to two aspects of the same concept: first, an actual reduction in the fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation i ...

. Extended replacement cost will pay over the coverage limit if the costs for construction have increased. This generally will not exceed 25% of the limit. When obtaining an insurance policy, the limit is the maximum amount of benefit the insurance company will pay for a given situation or occurrence. Limits also include the ages below or above what an insurance company will not issue a new policy or continue a policy.

This amount will need to fluctuate if the cost to replace homes in a neighborhood is rising; the amount needs to be in step with the actual reconstruction value of the home. In case of a fire, household content replacement is tabulated as a percentage of the value of the home. In case of high-value items, the insurance company may ask to specifically cover these items separate from the other household contents. One last coverage option is to have alternative living arrangements included in a policy. If property damage caused by a covered loss prevents a person from living in their home, policies can pay the expenses of alternate living arrangements (e.g., hotels and restaurant costs) for a specified period of time to compensate for the "loss of use" of the home until the owners can return. The additional living expenses limit can vary, but is typically set at up to 20% of the dwelling coverage limit. Owners need to talk with their insurance company for advice about appropriate coverage and determine what type of limit may be appropriate.

US Property Insurance Claims

World Trade Center case

Following the September 11 attacks, a jury deliberated insurance payouts for the destruction of the World Trade Center. Leaseholder Larry A. Silverstein sought more than $7 billion in insurance money; he argued two attacks had occurred at the WTC. Its insurers—including Chubb Corp. and Swiss Reinsurance Co.—claimed the "coordinated" attack counted as a single event. In December 2004 the federal jury arrived at a compromise decision. In May 2007 New York Governor Eliot Spitzer announced more than $4.5 billion would be made available to rebuild the WTC complex as part of a major insurance claims settlement.Post-Hurricane Katrina property insurance claims

In the wake ofHurricane Katrina

Hurricane Katrina was a powerful, devastating and historic tropical cyclone that caused 1,392 fatalities and damages estimated at $125 billion in late August 2005, particularly in the city of New Orleans and its surrounding area. ...

, several thousand homeowners filed lawsuits against their insurance companies accusing them of bad faith and failing to properly and promptly adjust their claims.

Florida Consumer Choice Act

On 24 June 2009, Florida Governor Charlie Crist vetoed the Consumer Choice Act (H.B. 1171). The bill would have trumped state regulation, and allowed Florida's biggest insurance companies to establish their own rates. Remarking upon State Farm's pullout from Florida, Ted Corless, a property insurance attorney who has represented large insurance carriers like Nationwide, noted "that homeowners are really going to have to look out for themselves". Five days after Crist vetoed the Consumer Choice Act, Corless defended property insurance deregulation by pointing out that "if the blue-chip insurance companies wanted to price themselves out of the market", then they would go out of business. He accused Crist of making choices on behalf of consumers, not protecting their right to choose. In 2006 the average Florida annual insurance premium was $1,386 for a homeowner, one of the highest in the country. In May 2022, Florida lawmakers have signed off on quick fixes to the state's property insurance crisis but critics say the plan pays little attention to the growing threat of climate change. Governor Ron DeSantis signed bipartisan legislation implementing the most significant and comprehensive property insurance reforms Florida has seen in decades to provide short- and long-term relief to Floridians to combat skyrocketing insurance costs.Fire insurance in India

Fire insurance business inIndia

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

is governed by the All India Fire Tariff that lays down the terms of coverage, the premium rates and the conditions of the fire policy. The fire insurance policy has been renamed as "Standard Fire and Special Perils Policy".

Standard Fire and Special Perils Policy (SFSP)

The Standard Fire and Special Perils Policy (SFSP) is a kind of traditional insurance product that is specially designed to protect your property and its articles from the unforeseen unfortunate accidents caused due to fire and the allied perils. With multiple extensions, this policy not only keeps your property secure but also lessens the extent of the loss or damage that you may suffer causing a huge financial burden, and thus, it provides you relief from such anxiety. The risks covered are as follows: *Dwellings, offices, shops, hospitals: *Industrial, manufacturing risks *Utilities located outside industrial/manufacturing risks *Machinery and accessories *Storage risks outside the compound of industrial risks *Tank farms/gas holders located outside the compound of industrial risksPerils covered

The following causes of loss are covered: *Fire *Lightning *Explosion, implosion *Aircraft damage *Riot, strike *Terrorism *Storm, cyclone, typhoon, tempest, hurricane, tornado, flood & inundation. *Impact damage *Malicious damage *Subsidence, landslide *Bursting or overflowing of tanks *Missile testing operations *Bush fireAs per tariff wordings adopted by all insurersExclusions

The following are excluded from insurance coverage: *Loss or damage caused by war, civil war, and kindred perils *Loss or damage caused by nuclear activity *Loss or damage to the stocks in cold storage caused by change in temperature *Loss or damage due to over-running of electric and/or electronic machines Claims In the event of a fire loss covered under the fire insurance policy, the insured shall immediately give notice thereof to the insurance company. Within 15 days of the occurrence of such loss the insured should submit a claim in writing giving the details of damages and their estimated values. Details of other insurances on the same property should also be declared.See also

* Builder's risk insurance * *Home insurance

Home insurance, also commonly called homeowner's insurance (often abbreviated in the US real estate industry as HOI), is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insur ...

* Insurable interest

* Owner-controlled insurance program

* Renters insurance

*Vehicle insurance

Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for automobile, cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bo ...

Misc:

*Hamburger Feuerkasse, world's oldest fire insurer.

References

External links

*Fire insurance

(EH.Net Encyclopedia of Economic History) {{DEFAULTSORT:Property Insurance Types of insurance