Progressive tax on:

[Wikipedia]

[Google]

[Amazon]

A progressive tax is a

A progressive tax is a

The first modern

The first modern

The rate of tax can be expressed in two different ways; the ''marginal rate'' expressed as the rate on each additional unit of income or expenditure (or last dollar spent) and the ''effective (average) rate'' expressed as the total tax paid divided by total income or expenditure. In most progressive tax systems, both rates will rise as the amount subject to taxation rises, though there may be ranges where the marginal rate will be constant. Usually, the average tax rate of a taxpayer will be lower than the marginal tax rate. In a system with refundable tax credits, or income-tested

The rate of tax can be expressed in two different ways; the ''marginal rate'' expressed as the rate on each additional unit of income or expenditure (or last dollar spent) and the ''effective (average) rate'' expressed as the total tax paid divided by total income or expenditure. In most progressive tax systems, both rates will rise as the amount subject to taxation rises, though there may be ranges where the marginal rate will be constant. Usually, the average tax rate of a taxpayer will be lower than the marginal tax rate. In a system with refundable tax credits, or income-tested

Inequality and Unsustainable Growth: Two Sides of the Same Coin

" IMF Staff Discussion Note SDN/11/08,

Tax Policy and Human Capital Formation

American Economic Review, 88, 293–297. Accessed: 31 July 2012. By reducing the after-tax income of highly educated workers, progressive taxes can reduce the incentives for citizens to attain education, thereby lowering the overall level of

A progressive tax is a

A progressive tax is a tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

in which the tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be in ...

increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be in ...

. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. Th ...

of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high t ...

, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income).

The term is frequently applied in reference to personal income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

es, in which people with lower income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. F ...

pay a lower percentage of that income in tax than do those with higher income. It can also apply to adjustments of the tax base by using tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

s, tax credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "disc ...

, or selective taxation that creates progressive distribution effects. For example, a wealth

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an ...

or property tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth t ...

, a sales tax on luxury good

In economics, a luxury good (or upmarket good) is a good for which demand increases more than what is proportional as income rises, so that expenditures on the good become a more significant proportion of overall spending. Luxury goods are in con ...

s, or the exemption of sales taxes on basic necessities, may be described as having progressive effects as it increases the tax burden of higher income families and reduces it on lower income families.

Progressive taxation is often suggested as a way to mitigate the societal ills associated with higher income inequality

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ...

, as the tax structure reduces inequality; economists disagree on the tax policy's economic and long-term effects. One study suggests progressive taxation is positively associated with subjective well-being, while overall tax rates and government spending are not.

Early examples

In the early days of theRoman Republic

The Roman Republic ( ) was the era of Ancient Rome, classical Roman civilisation beginning with Overthrow of the Roman monarchy, the overthrow of the Roman Kingdom (traditionally dated to 509 BC) and ending in 27 BC with the establis ...

, public taxes consisted of assessments on owned wealth and property. For Roman citizens, the tax rate under normal circumstances was 1% of property value, and could sometimes climb as high as 3% in situations such as war. These taxes were levied against land, homes and other real estate, slaves, animals, personal items and monetary wealth. By 167 BC, Rome no longer needed to levy a tax against its citizens in the Italian peninsula, due to the riches acquired from conquered provinces. After considerable Roman expansion in the 1st century, Augustus Caesar introduced a wealth tax of about 1% and a flat poll tax

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources. ''Poll'' is an archaic term for "head" or "top of the head". The sen ...

on each adult; this made the tax system less progressive, as it no longer only taxed wealth. In India under the Mughal Empire

The Mughal Empire was an Early modern period, early modern empire in South Asia. At its peak, the empire stretched from the outer fringes of the Indus River Basin in the west, northern Afghanistan in the northwest, and Kashmir in the north, to ...

, the Dahsala system was introduced in A.D. 1580 under the reign of Akbar

Akbar (Jalal-ud-din Muhammad Akbar, – ), popularly known as Akbar the Great, was the third Mughal emperor, who reigned from 1556 to 1605. Akbar succeeded his father, Humayun, under a regent, Bairam Khan, who helped the young emperor expa ...

. This system was introduced by Akbar's finance minister, Raja Todar Mal, who was appointed in A.D. 1573 in Gujarat. The Dahsala system is a land-revenue system (system of taxation) which helped to make the collecting system be organised on the basis of land fertility.

Modern era

The first modern

The first modern income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

was introduced in Great Britain

Great Britain is an island in the North Atlantic Ocean off the north-west coast of continental Europe, consisting of the countries England, Scotland, and Wales. With an area of , it is the largest of the British Isles, the List of European ...

by Prime Minister

A prime minister or chief of cabinet is the head of the cabinet and the leader of the ministers in the executive branch of government, often in a parliamentary or semi-presidential system. A prime minister is not the head of state, but r ...

William Pitt the Younger

William Pitt (28 May 1759 – 23 January 1806) was a British statesman who served as the last prime minister of Kingdom of Great Britain, Great Britain from 1783 until the Acts of Union 1800, and then first Prime Minister of the United Kingdom, p ...

in his budget of December 1798, to pay for weapons and equipment for the French Revolutionary War

The French Revolutionary Wars () were a series of sweeping military conflicts resulting from the French Revolution that lasted from 1792 until 1802. They pitted France against Great Britain, Austria, Prussia, Russia, and several other countries ...

. Pitt's new graduated (progressive) income tax began at a levy of 2 old pence in the pound ( or 0.83%) on annual incomes over £60 and increased up to a maximum of 2 shilling

The shilling is a historical coin, and the name of a unit of modern currency, currencies formerly used in the United Kingdom, Australia, New Zealand, other British Commonwealth countries and Ireland, where they were generally equivalent to 1 ...

s (10%) on incomes of over £200. Pitt hoped that the new income tax would raise £10 million, but actual receipts for 1799 totalled just over £6 million.

Pitt's progressive income tax was levied from 1799 to 1802 when it was abolished by Henry Addington during the Peace of Amiens. Addington had taken over as prime minister

A prime minister or chief of cabinet is the head of the cabinet and the leader of the ministers in the executive branch of government, often in a parliamentary or semi-presidential system. A prime minister is not the head of state, but r ...

in 1801, after Pitt's resignation over Catholic emancipation. The income tax was reintroduced by Addington in 1803 when hostilities recommenced, but it was again abolished in 1816, one year after the Battle of Waterloo

The Battle of Waterloo was fought on Sunday 18 June 1815, near Waterloo, Belgium, Waterloo (then in the United Kingdom of the Netherlands, now in Belgium), marking the end of the Napoleonic Wars. The French Imperial Army (1804–1815), Frenc ...

.

The present form of income tax in the United Kingdom was reintroduced by Sir Robert Peel in the Income Tax Act 1842. Peel, as a Conservative

Conservatism is a cultural, social, and political philosophy and ideology that seeks to promote and preserve traditional institutions, customs, and values. The central tenets of conservatism may vary in relation to the culture and civiliza ...

, had opposed income tax in the 1841 general election, but a growing budget deficit required a new source of funds. The new income tax, based on Addington's model, was imposed on incomes above £150. Although this measure was initially intended to be temporary, it soon became a fixture of the British taxation system. A committee was formed in 1851 under Joseph Hume

Joseph Hume Fellow of the Royal Society, FRS (22 January 1777 – 20 February 1855) was a Scottish surgeon and Radicals (UK), Radical Member of Parliament (United Kingdom), MP.Ronald K. Huch, Paul R. Ziegler 1985 Joseph Hume, the People's M.P ...

to investigate the matter but failed to reach a clear recommendation. Despite the vociferous objection, William Gladstone

William Ewart Gladstone ( ; 29 December 1809 – 19 May 1898) was a British politican, starting as Conservative MP for Newark and later becoming the leader of the Liberal Party.

In a career lasting over 60 years, he was Prime Minister ...

, Chancellor of the Exchequer

The chancellor of the exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and the head of HM Treasury, His Majesty's Treasury. As one of the four Great Offices of State, t ...

from 1852, kept the progressive income tax, and extended it to cover the costs of the Crimean War

The Crimean War was fought between the Russian Empire and an alliance of the Ottoman Empire, the Second French Empire, the United Kingdom of Great Britain and Ireland, and the Kingdom of Sardinia (1720–1861), Kingdom of Sardinia-Piedmont fro ...

. By the 1860s, the progressive tax had become a grudgingly accepted element of the English fiscal system.

In the United States, the first progressive income tax was established by the Revenue Act of 1862. The act was signed into law by President Abraham Lincoln

Abraham Lincoln (February 12, 1809 – April 15, 1865) was the 16th president of the United States, serving from 1861 until Assassination of Abraham Lincoln, his assassination in 1865. He led the United States through the American Civil War ...

, and replaced the Revenue Act of 1861, which had imposed a flat income tax of 3% on annual incomes above $800. The Sixteenth Amendment to the United States Constitution

The Sixteenth Amendment (Amendment XVI) to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 ...

, adopted in 1913, permitted Congress to levy all income taxes without any apportionment requirement. By the mid-20th century, most countries had implemented some form of progressive income tax.

Both Karl Marx

Karl Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, political theorist, economist, journalist, and revolutionary socialist. He is best-known for the 1848 pamphlet '' The Communist Manifesto'' (written with Friedrich Engels) ...

and Friedrich Engels

Friedrich Engels ( ;"Engels"

''Random House Webster's Unabridged Dictionary''.Negative Income Tax In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money. NIT ...

(NIT) was stumbled upon and discussed by various thinkers and is most commonly attributed to ''Random House Webster's Unabridged Dictionary''.Negative Income Tax In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money. NIT ...

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

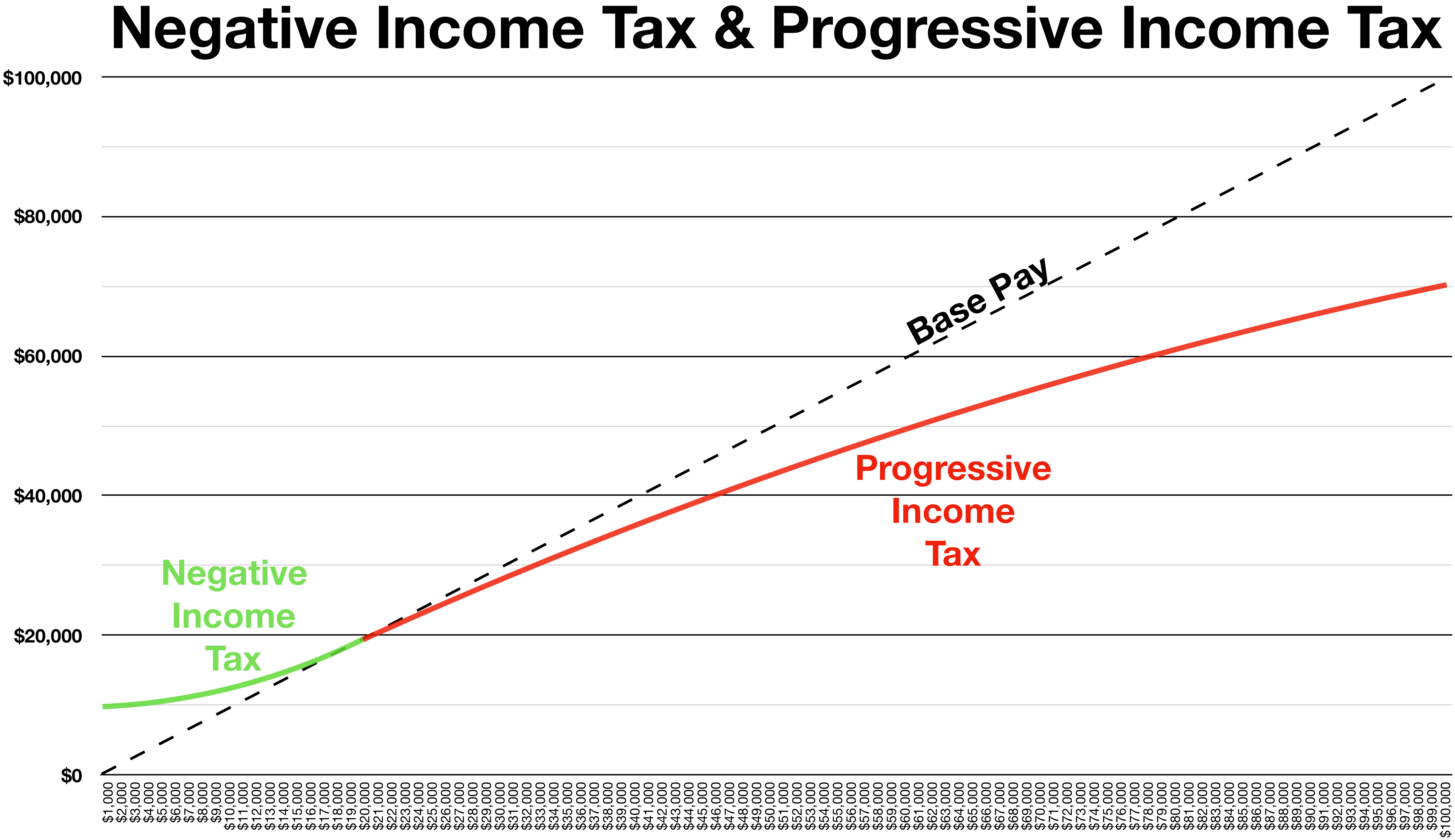

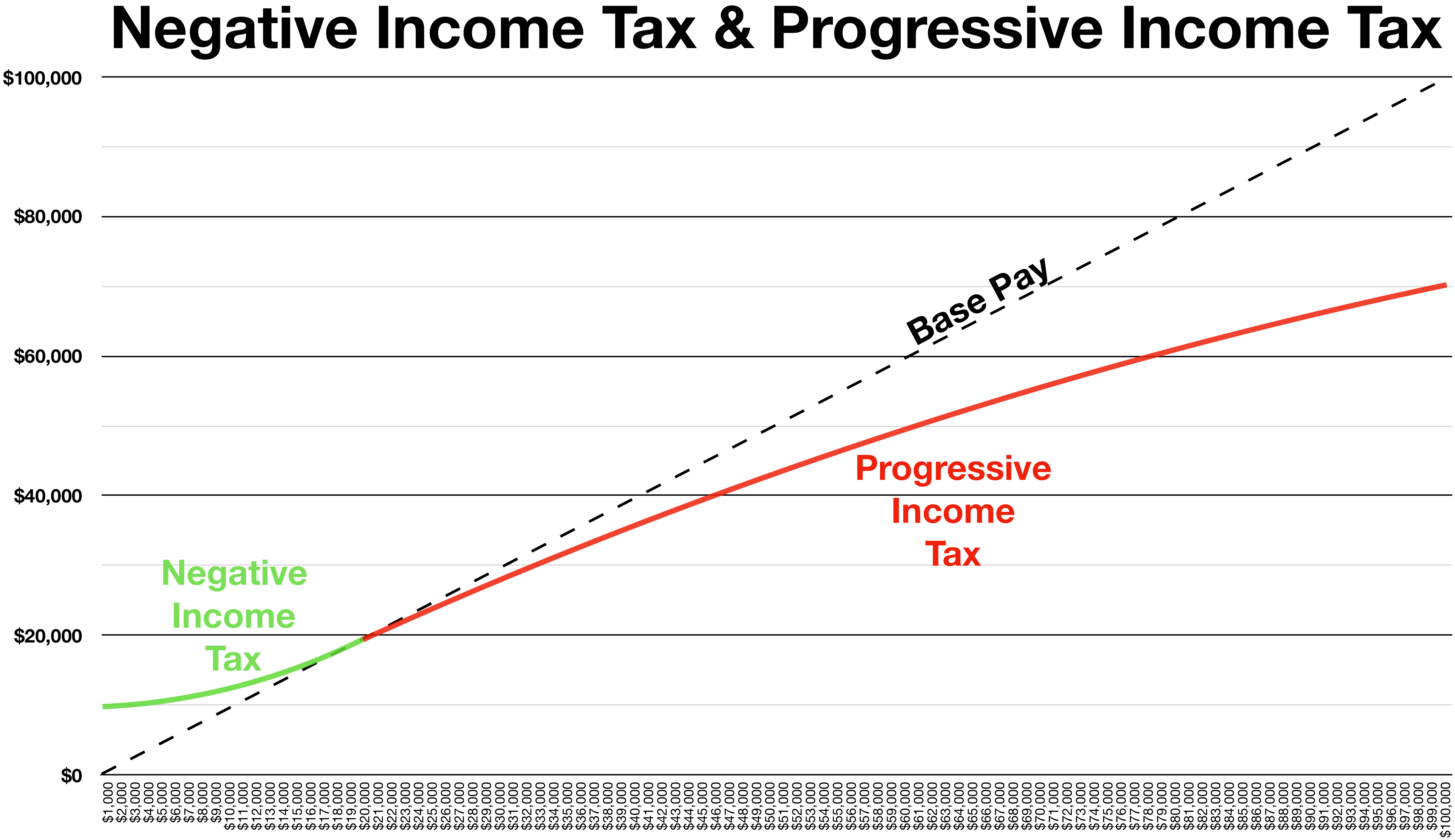

, who made it more prominent in his 1962 work ‘Capitalism and Freedom’. The theory places itself as an alternative to the contemporary progressive tax systems which are deemed too bureaucratic and inefficient, it’s emphasized for its lower administrative costs and unitary system of providing welfare and support without discrediting the beneficiaries. It also eliminates unnecessary processes and institutions by directly providing to the substandard.

NIT is a system where the flow of the tax payment is inverted for salaries falling a specified threshold; Individuals surpassing the given level have to contribute money to the state, while those below are recipients of said funds. Theoretical framework of this idea could be referred back to William Petty

Sir William Petty (26 May 1623 – 16 December 1687) was an English economist, physician, scientist and philosopher. He first became prominent serving Oliver Cromwell and the Commonwealth of England, Commonwealth in Cromwellian conquest of I ...

, Vilferdo Pareto, and Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

among others.

The adjustability of subsidies given to the poor households by the system eliminates the welfare trap

The welfare trap (aka the welfare cliff, unemployment trap, or poverty trap in British English) theory asserts that taxation and welfare (financial aid), welfare systems can jointly contribute to keep people on social insurance because the withd ...

issue faced by other proposals (i.e. means-test

A means test is a determination of whether an individual or family is eligible for government benefits, assistance or welfare, based upon whether the individual or family possesses the means to do with less or none of that help. Means testing is ...

). The ‘wage subsidy’ is best demonstrated by the gap between ones salary, base pay, and real income post-subsidy. Once the minimal criteria defined by the according government is met, the recipient becomes the payer.

Milton provides five other advantages to NIT. It allows households and families to sustain themselves directly from their income without having to rely on other programs or plans. Secondly, it provides cash to the recipient, which is perceived as the most superior means of support. Thirdly, Milton claims that negative income tax could replace all other supporting programs and work as the universal program on its own. Fourthly, lower administration costs associated with NIT compared to other systems. Lastly, it should not, in theory, interfere with market mechanisms unlike other government interventionist laws (i.e. minimum wage

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. List of countries by minimum wage, Most countries had introduced minimum wage legislation b ...

).

A survey conducted in 1995 established that the majority of American economists advocated for the addition of a negative income tax into the welfare system. The United States federal government took a key interest on the matter and between 1968 and 1982 sponsored four experiments across various states to see the effects of NIT on labor supply, income, and substitution effects. As part of the result, most participants reduced their labor supply, especially the youth by as much as four weeks. These responses may seem imminent from a generous system like NIT.

NIT saw extensive use under President Nixon's Family Assistance Plan

The Family Assistance Plan (FAP) was a welfare program introduced by President of the United States, President Richard Nixon in August 1969, which aimed to implement a negative income tax for households with working parents. The FAP was influence ...

in 1969. It was also implemented in 1975 for the working poor through the earned income tax credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

. The system is still in power today, but differs from the original theories of Milton and his supporters.

Measuring progressivity

Indices such as the Suits index,Gini coefficient

In economics, the Gini coefficient ( ), also known as the Gini index or Gini ratio, is a measure of statistical dispersion intended to represent the income distribution, income inequality, the wealth distribution, wealth inequality, or the ...

, Kakwani index, Theil index

The Theil index is a statistic primarily used to measure economic inequality and other economic phenomena, though it has also been used to measure racial segregation. The Theil index ''T''T is the same as redundancy in information theory which i ...

, Atkinson index The Atkinson index (also known as the Atkinson measure or Atkinson inequality measure) is a measure of income inequality developed by British economist Anthony Barnes Atkinson. The measure is useful in determining which end of the distribution cont ...

, and Hoover index have been created to measure the progressivity of taxation, using measures derived from income distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes e ...

and wealth distribution.Philip B. Coulter: ''Measuring Inequality'', 1989, (This book describes about 50 different inequality measures.)

Marginal and effective tax rates

The rate of tax can be expressed in two different ways; the ''marginal rate'' expressed as the rate on each additional unit of income or expenditure (or last dollar spent) and the ''effective (average) rate'' expressed as the total tax paid divided by total income or expenditure. In most progressive tax systems, both rates will rise as the amount subject to taxation rises, though there may be ranges where the marginal rate will be constant. Usually, the average tax rate of a taxpayer will be lower than the marginal tax rate. In a system with refundable tax credits, or income-tested

The rate of tax can be expressed in two different ways; the ''marginal rate'' expressed as the rate on each additional unit of income or expenditure (or last dollar spent) and the ''effective (average) rate'' expressed as the total tax paid divided by total income or expenditure. In most progressive tax systems, both rates will rise as the amount subject to taxation rises, though there may be ranges where the marginal rate will be constant. Usually, the average tax rate of a taxpayer will be lower than the marginal tax rate. In a system with refundable tax credits, or income-tested welfare benefit

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance p ...

s, it is possible for marginal rates to fall as income rises, at lower levels of income.

Inflation and tax brackets

Tax laws might not be accurately indexed toinflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

. For example, some tax laws may ignore inflation completely. In a progressive tax system, failure to index the brackets to inflation will eventually result in effective tax increases (if inflation is sustained), as inflation in wages will increase individual income and move individuals into higher tax brackets with higher percentage rates. This phenomenon is known as ''bracket creep

Bracket creep is usually defined as the process by which inflation pushes wages and salaries into higher tax brackets, leading to fiscal drag. However, even if there is only one tax bracket, or one remains within the same tax bracket, there wil ...

'' and can cause fiscal drag.

Economic effects

There is debate between politicians and economists over the role of tax policy in mitigating or exacerbating wealth inequality and the effects on economic growth.Income equality

Progressive taxation has a direct effect on decreasingincome inequality

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ...

. This is especially true if taxation is used to fund progressive government spending such as transfer payments and social safety net

A social safety net (SSN) consists of non-contributory assistance existing to improve lives of vulnerable families and individuals experiencing poverty and destitution. Examples of SSNs are previously-contributory social pensions, in-kind and foo ...

s. However, the effect may be muted if the higher rates cause increased tax evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ...

. When income inequality is low, aggregate demand

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the ...

will be relatively high, because more people who want ordinary consumer good

A final good or consumer good is a final product ready for sale that is used by the consumer to satisfy current wants or needs, unlike an intermediate good, which is used to produce other goods. A microwave oven or a bicycle is a final good.

Whe ...

s and services will be able to afford them, while the labor force

In macroeconomics, the workforce or labour force is the sum of people either working (i.e., the employed) or looking for work (i.e., the unemployed):

\text = \text + \text

Those neither working in the marketplace nor looking for work are out ...

will not be as relatively monopolized by the wealthy.''The Economics of Welfare]'' Arthur Cecil Pigou

Arthur Cecil Pigou (; 18 November 1877 – 7 March 1959) was an English economist. As a teacher and builder of the School of Economics at the University of Cambridge, he trained and influenced many Cambridge economists who went on to take chair ...

Andrew Berg and Jonathan D. Ostry, 2011,Inequality and Unsustainable Growth: Two Sides of the Same Coin

" IMF Staff Discussion Note SDN/11/08,

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

High levels of income inequality can have negative effects on long-term economic growth, employment, and class conflict

In political science, the term class conflict, class struggle, or class war refers to the economic antagonism and political tension that exist among social classes because of clashing interests, competition for limited resources, and inequali ...

. Progressive taxation is often suggested as a way to mitigate the societal ills associated with higher income inequality. The difference between the Gini index for an income distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes e ...

before taxation and the Gini index after taxation is an indicator for the effects of such taxation.

The economists Thomas Piketty

Thomas Piketty (; born 7 May 1971) is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, associate chair at the Paris School of Economics (PSE) and Centennial Professor of Economics ...

and Emmanuel Saez

Emmanuel Saez (born November 26, 1972) is a French-American economist who is a professor of economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of the poor, mid ...

wrote that decreased progressiveness in US tax policy in the post World War II era has increased income inequality by enabling the wealthy greater access to capital.

According to economist Robert H. Frank, tax cuts for the wealthy are largely spent on positional goods such as larger houses and more expensive cars. Frank argues that these funds could instead pay for things like improving public education and conducting medical research, and suggests progressive taxation as an instrument for attacking positional externalities.

Economic growth

A report published by the OECD in 2008 presented empirical research showing a weak negative relationship between the progressivity of personal income taxes and economic growth. Describing the research, William McBride, a staff writer with the conservativeTax Foundation

The Tax Foundation is an international research think tank based in Washington, D.C. that collects data and publishes research studies on Taxation in the United States, U.S. tax policies at both the federal and state levels. Its stated mission ...

, stated that progressivity of income taxes can undermine investment, risk-taking, entrepreneurship, and productivity because high-income earners tend to do much of the saving, investing, risk-taking, and high-productivity labor. In contrast, according to the IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of la ...

, some advanced economies could increase progressivity in taxation for tackling inequality, without hampering growth, as long as progressivity is not excessive. The IMF also states that the average top income tax rate for OECD member countries fell from 62 percent in 1981 to 35 percent in 2015, and that in addition, tax systems are less progressive than indicated by the statutory rates, because wealthy individuals have more access to tax relief.

Educational attainment

EconomistGary Becker

Gary Stanley Becker (; December 2, 1930 – May 3, 2014) was an American economist who received the 1992 Nobel Memorial Prize in Economic Sciences. He was a professor of economics and sociology at the University of Chicago, and was a leader of ...

has described educational attainment as the root of economic mobility

Economic mobility is the ability of an individual, family or some other group to improve (or lower) their economic status—usually measured in income. Economic mobility is often measured by movement between income quintiles. Economic mobilit ...

. Progressive tax rates, while raising taxes on high income, have the goal and corresponding effect of reducing the burden on low income, improving income equality. Educational attainment is often conditional on cost and family income, which for the poor, reduces their opportunity for educational attainment. Increases in income for the poor and economic equality reduces the inequality of educational attainment. Tax policy can also include progressive features that provide tax incentive

A tax incentive is an aspect of a government's taxation policy designed to incentive, incentivize or encourage a particular economic activity by reducing tax payments.

Tax incentives can have both positive and negative impacts on an economy. Amo ...

s for education, such as tax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "dis ...

s and tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

s for scholarship

A scholarship is a form of Student financial aid, financial aid awarded to students for further education. Generally, scholarships are awarded based on a set of criteria such as academic merit, Multiculturalism, diversity and inclusion, athleti ...

s and grants

Grant or Grants may refer to:

People

* Grant (given name), including a list of people and fictional characters

* Grant (surname), including a list of people and fictional characters

** Ulysses S. Grant (1822–1885), the 18th president of the U ...

.

A potentially adverse effect of progressive tax schedules is that they may reduce the incentives for educational attainment.Heckman, J., L. Lochner and C. TabnerTax Policy and Human Capital Formation

American Economic Review, 88, 293–297. Accessed: 31 July 2012. By reducing the after-tax income of highly educated workers, progressive taxes can reduce the incentives for citizens to attain education, thereby lowering the overall level of

human capital

Human capital or human assets is a concept used by economists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a subs ...

in an economy. However, this effect can be mitigated by an education subsidy

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having acc ...

funded by the progressive tax. Theoretically, public support for government spending on higher education increases when taxation is progressive, especially when income distribution is unequal.

Opposition and criticism

Hayek's argumentation

Friedrich Hayek

Friedrich August von Hayek (8 May 1899 – 23 March 1992) was an Austrian-born British academic and philosopher. He is known for his contributions to political economy, political philosophy and intellectual history. Hayek shared the 1974 Nobe ...

viewed the implementation of progressive tax systems as incompatible with the principles of an open and liberal society. He argued that the imposition of higher taxes on higher incomes creates a bias against economic wealth and negatively impacts the incentives of the working age. His thought

In their most common sense, the terms thought and thinking refer to cognitive processes that can happen independently of sensory stimulation. Their most paradigmatic forms are judging, reasoning, concept formation, problem solving, and de ...

stems from philosophical and moral theories. Hayek believed that fiscal problems are partly to its foundations in moral philosophy practiced by society. Progressive tax prohibits the incentives of free market competition, whilst the wealth of the minority is subordinated to the democratic vote of a majority

A majority is more than half of a total; however, the term is commonly used with other meanings, as explained in the "#Related terms, Related terms" section below.

It is a subset of a Set (mathematics), set consisting of more than half of the se ...

. This results in illegitimate transfers of political power.

Hayek believed the sweeping rise of progressive tax has risen from deceptive justifications which in reality didn't bring fruit. He claims the historical and methodological conditions gave way to the imposition of the system. He believed the system was established from ludicrous premises and failed to attain its redistributive goals. He said the progressive tax failed to benefit the poor, instead the benefit fell to the middle class

The middle class refers to a class of people in the middle of a social hierarchy, often defined by occupation, income, education, or social status. The term has historically been associated with modernity, capitalism and political debate. C ...

who comprised the majority of voters, a majority which may push for tax changes.

Hayek advocated for a flat (or proportional) tax rate. Estonia

Estonia, officially the Republic of Estonia, is a country in Northern Europe. It is bordered to the north by the Gulf of Finland across from Finland, to the west by the Baltic Sea across from Sweden, to the south by Latvia, and to the east by Ru ...

was one of the first countries in Europe to adapt such a tax system.

Nozick's argumentation

Robert Nozick

Robert Nozick (; November 16, 1938 – January 23, 2002) was an American philosopher. He held the Joseph Pellegrino Harvard University Professor, University Professorship at Harvard University,

A 2011 study psychologists Shigehiro Oishi, Ulrich Schimmack, and

A 2011 study psychologists Shigehiro Oishi, Ulrich Schimmack, and

There are two common ways of computing a progressive tax, corresponding to point–slope form and slope–intercept form of the equation for the applicable bracket. These compute the tax either as the tax on the bottom amount of the bracket ''plus'' the tax on the marginal amount ''within'' the bracket; or the tax on the entire amount (''at'' the marginal rate), ''minus'' the amount that this overstates tax on the bottom end of the bracket.

For example, suppose there are tax brackets of 10%, 20%, and 30%, where the 10% rate applies to income from ; the 20% rate applies to income from ; and the 30% rate applies to all income above . In that case the tax on of income (computed by adding up tax in each bracket) is . The tax on $25,000 of income could then be computed two ways. Using point–slope form (tax on bottom amount plus tax on marginal amount) yields:

Geometrically, the line for tax on the top bracket passes through the point and has a slope of 0.3 (30%).

Alternatively, 30% tax on $20,000 yields , which overstates tax on the bottom end of the top bracket by , so using slope–intercept form yields:

Geometrically, the line for tax on the top bracket intercepts the ''y''-axis at −$3,000 – it passes through the point – and has a slope of 0.3 (30%).

In the United States, the first form was used through 2003, for example (for the 2003 15% Single bracket):

* If the amount on Form 1040, line 40 [Taxable Income], is: ''Over—'' 7,000

* ''But not over—'' 28,400

* Enter on Form 1040, line 41 [Tax] $700.00 + 15%

* ''of the amount over—'' 7,000

From 2004, this changed to the second form, for example (for the 2004 28% Single bracket):

* Taxable income. If line 42 is— At least but not over

* (a) Enter the amount from line 42

* (b) Multiplication amount × 28% (.28)

* (c) Multiply (a) by (b)

* (d) Subtraction amount

* Tax. Subtract (d) from (c). Enter the result here and on Form 1040, line 43

There are two common ways of computing a progressive tax, corresponding to point–slope form and slope–intercept form of the equation for the applicable bracket. These compute the tax either as the tax on the bottom amount of the bracket ''plus'' the tax on the marginal amount ''within'' the bracket; or the tax on the entire amount (''at'' the marginal rate), ''minus'' the amount that this overstates tax on the bottom end of the bracket.

For example, suppose there are tax brackets of 10%, 20%, and 30%, where the 10% rate applies to income from ; the 20% rate applies to income from ; and the 30% rate applies to all income above . In that case the tax on of income (computed by adding up tax in each bracket) is . The tax on $25,000 of income could then be computed two ways. Using point–slope form (tax on bottom amount plus tax on marginal amount) yields:

Geometrically, the line for tax on the top bracket passes through the point and has a slope of 0.3 (30%).

Alternatively, 30% tax on $20,000 yields , which overstates tax on the bottom end of the top bracket by , so using slope–intercept form yields:

Geometrically, the line for tax on the top bracket intercepts the ''y''-axis at −$3,000 – it passes through the point – and has a slope of 0.3 (30%).

In the United States, the first form was used through 2003, for example (for the 2003 15% Single bracket):

* If the amount on Form 1040, line 40 [Taxable Income], is: ''Over—'' 7,000

* ''But not over—'' 28,400

* Enter on Form 1040, line 41 [Tax] $700.00 + 15%

* ''of the amount over—'' 7,000

From 2004, this changed to the second form, for example (for the 2004 28% Single bracket):

* Taxable income. If line 42 is— At least but not over

* (a) Enter the amount from line 42

* (b) Multiplication amount × 28% (.28)

* (c) Multiply (a) by (b)

* (d) Subtraction amount

* Tax. Subtract (d) from (c). Enter the result here and on Form 1040, line 43

Most systems around the world contain progressive aspects. When taxable income falls within a particular tax bracket, the individual pays the listed percentage of tax ''on each dollar that falls within that monetary range''. For example, a person in the U.S. who earned US of taxable income (income after adjustments, deductions, and exemptions) would be liable for 10% of each dollar earned from the 1st dollar to the 7,550th dollar, and then for 15% of each dollar earned from the 7,551st dollar to the 10,000th dollar, for a total of .50.

In the United States, there are seven income tax brackets ranging from 10% to 39.6% above an untaxed level of income based on the Personal exemption (United States), personal exemption and usually various other tax exemptions, such as the Earned Income Tax Credit and home mortgage payments. The federal tax rates for individual taxpayers in the United States for the tax year 2021 are as follows: 10% from United States dollar, $0 to ; 12% from to ; 22% from to ; 24% from to ; 32% from to ; 35% from to ; and 37% from and over. The US federal tax system also includes deductions for state and local taxes for lower income households which mitigates what are sometimes regressive taxes, particularly Property tax in the United States, property taxes. Higher income households are subject to the alternative minimum tax that limits deductions and sets a flat tax rate of 26% to 28% with the higher rate commencing at in income. There are also deduction phaseouts starting at for single filers. The net effect is increased progressivity that completely limits deductions for state and local taxes and certain other credits for individuals earning more than . In order to counteract regressive state and local taxes, many US states implement progressive income taxes. 32 states and the District of Columbia have graduated-rate income taxes. The brackets differ across State income tax, states.

There has been a hefty decline in progressivity of the United States federal tax system since the 1960s. The two periods with the largest tax progressivity reductions occurred under Presidency of Ronald Reagan, the Reagan administration in the 1980s and Presidency of George W. Bush, the Bush administration in the 2000s. The Tax Cuts and Jobs Act of 2017 implemented by Donald Trump, President Trump greatly affected the United States tax system. The act took steps to dramatically lower taxes for high-income households, open deduction loopholes for businesses, and cut the Corporate tax in the United States, federal corporate tax rate down to 21 percent. It maintained the structure of seven tax brackets for personal income but lowered five of the seven by one percent or more. For example, after the Tax Cuts and Jobs Act of 2017 was implemented, in 2017, a married couple with a total income of $250,000 after deductions would have faced a tax rate of 33%. However, by 2023 and 2024, their highest tax rate would have decreased to 24%. This change would have resulted in a notable disparity in their take-home pay compared to previous years.

Albania transitioned from a flat tax to a progressive tax in 2014. Kraja, Lirëza and Morelli have concluded that while a progressive tax framework may be more effective in achieving policy objectives like reducing income inequality and boosting government tax revenue, policymakers must carefully weigh its impact on investment and entrepreneurship and implement strong tax administration and enforcement measures to combat tax evasion within a progressive tax framework.

Belgium has the following personal income tax rates (for the income year 2021): 25% from Euro, EUR€0 to €13,540; 40% from €13,540 to €23,900; 45% from €23,900 to €41,360; and 50% from €41,360 and any amount over.

Canada has the following federal tax rates on income (for the year 2021): 15% from Canadian dollar, C$0 to ; 20.5% from to ; 26% from to ; 29% from to ; and 33% on income over .

Denmark has the following state tax rates regarding personal income: 12.11% for the bottom tax base; 15% for the top tax base, or income exceeding Danish krone, DKK 544,800. Additional taxes, such as the municipal tax (which has a country average of 24.971%), the labour market tax, and the church tax, are also applied to individual's income.

Germany has the following personal income tax rates for a single taxpayer (for the 2020 tax year): 0% up to Euro, EUREuro sign, €9,744; 14-42% from €9,744 to €57,918; 42% from €57,918 to €274,612; and 45% for €274,612 and any amount over.

Indonesia has implemented progressive vehicular taxes at the municipal level in Cimahi and Palembang, which had a significant impact of the progressive tax system on the local income of the municipality.

Norway has the following personal income tax rates (for the year 2020): 1.9% from Norwegian krone, NOK180,800 to NOK254,500; 4.2% from NOK254,500 to NOK639,750; 13.2% from NOK639,750 to NOK999,550; and 16.2% from NOK999,550 and above.

Sweden has the following state income tax brackets for natural persons: 0% on income up to Swedish krona, SEK 413,200; 20% from SEK 413,200 to SEK 591,600; and 25% from SEK 591,600 and any amount over.

The United Kingdom has the following income tax rates: 0% from Pound sterling, £0 to £12,570; 20% from £12,571 to £50,270; 40% from £50,271 to £150,000; and 45% from £150,000 and over. In Scotland, however, there are more tax brackets than in other UK countries. Scotland has the following additional income tax brackets: 19% from £12,571 to £14,667; 20% from £14,667 to £25,296; 21% from £25,297 to £43,662; 41% from £43,663 to £150,000; and 46% for any amount over £150,000.

New Zealand has the following income tax brackets: 10.5% up to ; 17.5% from to ; 30% from to ; 33% from to ; 39% for any amount over ; and 45% when the employee does not complete a declaration form. All values are in New Zealand dollars and exclude the earner levy.

Australia has the following progressive income tax rates (for the 2024-2025 financial year): 0% effective up to ; 16% from to ; 30% from to ; 37% from to ; and 45% for any amount over .

Italy also follows a progressive tax blueprint. As of October 2020, the progressive tax rates in Italy are outlined as follows. Income between 0 and €15,000 – 23%, €15,000 – €28,000 – 25%, €28,000 – €50,000 – 35%, €50,000 and over – 43%.

Most systems around the world contain progressive aspects. When taxable income falls within a particular tax bracket, the individual pays the listed percentage of tax ''on each dollar that falls within that monetary range''. For example, a person in the U.S. who earned US of taxable income (income after adjustments, deductions, and exemptions) would be liable for 10% of each dollar earned from the 1st dollar to the 7,550th dollar, and then for 15% of each dollar earned from the 7,551st dollar to the 10,000th dollar, for a total of .50.

In the United States, there are seven income tax brackets ranging from 10% to 39.6% above an untaxed level of income based on the Personal exemption (United States), personal exemption and usually various other tax exemptions, such as the Earned Income Tax Credit and home mortgage payments. The federal tax rates for individual taxpayers in the United States for the tax year 2021 are as follows: 10% from United States dollar, $0 to ; 12% from to ; 22% from to ; 24% from to ; 32% from to ; 35% from to ; and 37% from and over. The US federal tax system also includes deductions for state and local taxes for lower income households which mitigates what are sometimes regressive taxes, particularly Property tax in the United States, property taxes. Higher income households are subject to the alternative minimum tax that limits deductions and sets a flat tax rate of 26% to 28% with the higher rate commencing at in income. There are also deduction phaseouts starting at for single filers. The net effect is increased progressivity that completely limits deductions for state and local taxes and certain other credits for individuals earning more than . In order to counteract regressive state and local taxes, many US states implement progressive income taxes. 32 states and the District of Columbia have graduated-rate income taxes. The brackets differ across State income tax, states.

There has been a hefty decline in progressivity of the United States federal tax system since the 1960s. The two periods with the largest tax progressivity reductions occurred under Presidency of Ronald Reagan, the Reagan administration in the 1980s and Presidency of George W. Bush, the Bush administration in the 2000s. The Tax Cuts and Jobs Act of 2017 implemented by Donald Trump, President Trump greatly affected the United States tax system. The act took steps to dramatically lower taxes for high-income households, open deduction loopholes for businesses, and cut the Corporate tax in the United States, federal corporate tax rate down to 21 percent. It maintained the structure of seven tax brackets for personal income but lowered five of the seven by one percent or more. For example, after the Tax Cuts and Jobs Act of 2017 was implemented, in 2017, a married couple with a total income of $250,000 after deductions would have faced a tax rate of 33%. However, by 2023 and 2024, their highest tax rate would have decreased to 24%. This change would have resulted in a notable disparity in their take-home pay compared to previous years.

Albania transitioned from a flat tax to a progressive tax in 2014. Kraja, Lirëza and Morelli have concluded that while a progressive tax framework may be more effective in achieving policy objectives like reducing income inequality and boosting government tax revenue, policymakers must carefully weigh its impact on investment and entrepreneurship and implement strong tax administration and enforcement measures to combat tax evasion within a progressive tax framework.

Belgium has the following personal income tax rates (for the income year 2021): 25% from Euro, EUR€0 to €13,540; 40% from €13,540 to €23,900; 45% from €23,900 to €41,360; and 50% from €41,360 and any amount over.

Canada has the following federal tax rates on income (for the year 2021): 15% from Canadian dollar, C$0 to ; 20.5% from to ; 26% from to ; 29% from to ; and 33% on income over .

Denmark has the following state tax rates regarding personal income: 12.11% for the bottom tax base; 15% for the top tax base, or income exceeding Danish krone, DKK 544,800. Additional taxes, such as the municipal tax (which has a country average of 24.971%), the labour market tax, and the church tax, are also applied to individual's income.

Germany has the following personal income tax rates for a single taxpayer (for the 2020 tax year): 0% up to Euro, EUREuro sign, €9,744; 14-42% from €9,744 to €57,918; 42% from €57,918 to €274,612; and 45% for €274,612 and any amount over.

Indonesia has implemented progressive vehicular taxes at the municipal level in Cimahi and Palembang, which had a significant impact of the progressive tax system on the local income of the municipality.

Norway has the following personal income tax rates (for the year 2020): 1.9% from Norwegian krone, NOK180,800 to NOK254,500; 4.2% from NOK254,500 to NOK639,750; 13.2% from NOK639,750 to NOK999,550; and 16.2% from NOK999,550 and above.

Sweden has the following state income tax brackets for natural persons: 0% on income up to Swedish krona, SEK 413,200; 20% from SEK 413,200 to SEK 591,600; and 25% from SEK 591,600 and any amount over.

The United Kingdom has the following income tax rates: 0% from Pound sterling, £0 to £12,570; 20% from £12,571 to £50,270; 40% from £50,271 to £150,000; and 45% from £150,000 and over. In Scotland, however, there are more tax brackets than in other UK countries. Scotland has the following additional income tax brackets: 19% from £12,571 to £14,667; 20% from £14,667 to £25,296; 21% from £25,297 to £43,662; 41% from £43,663 to £150,000; and 46% for any amount over £150,000.

New Zealand has the following income tax brackets: 10.5% up to ; 17.5% from to ; 30% from to ; 33% from to ; 39% for any amount over ; and 45% when the employee does not complete a declaration form. All values are in New Zealand dollars and exclude the earner levy.

Australia has the following progressive income tax rates (for the 2024-2025 financial year): 0% effective up to ; 16% from to ; 30% from to ; 37% from to ; and 45% for any amount over .

Italy also follows a progressive tax blueprint. As of October 2020, the progressive tax rates in Italy are outlined as follows. Income between 0 and €15,000 – 23%, €15,000 – €28,000 – 25%, €28,000 – €50,000 – 35%, €50,000 and over – 43%.

''The Progressive Income Tax: Theoretical Foundations''

* {{DEFAULTSORT:Progressive Tax Taxation and redistribution Tax incidence Tax terms Economic progressivism

Loopholes

The current tax code has been criticized by many who believe that the nation's wealthiest are not paying their share. This is because the current tax system charges the individual based onwages

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remune ...

and not investment income, an area where the upper-class

Upper class in modern societies is the social class composed of people who hold the highest social status. Usually, these are the wealthiest members of class society, and wield the greatest political power. According to this view, the upper cla ...

make most of their money. Prominent investor Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is ...

has been a strong voice in support of taxing the rich proportional to investment income as well as wages. Buffett famously pointed out that if you analyzed every employee in his office including himself, he is quoted saying, "I'll probably be the lowest paying taxpayer in the office." This support ultimately led to the proposal of "The Buffett Rule" by President Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. Ob ...

which proposed a 30% minimum tax on people making more than $1 million a year. The aim of the Buffett Rule was to ensure that investment income would constitute as a taxable income instead of simply wages. Ultimately, the rule was rejected by congress in March 2012. President Joe Biden attempted to do what President Obama could not and introduced the "Paying a Fair Share Act" which followed the Buffett's Rule philosophy. As of August 2023, the bill has not picked up steam in congress. Those that take advantage of these tax codes in the United States include some of the most wealthy and prominent. It is said that " Bezos reportedly paid no federal income taxes at all in 2007 and 2011, while Musk paid none in 2018."

Psychological factors

Ed Diener

Edward Francis Diener (July 25, 1946 – April 27, 2021) was an American psychologist and author. Diener was a professor of psychology at the University of Utah and the University of Virginia, and Joseph R. Smiley Distinguished Professor Emeri ...

, using data from 54 countries, found that progressive taxation was positively associated with the subjective well-being, while overall tax rates and government spending were not. The authors added, "We found that the association between more-progressive taxation and higher levels of subjective well-being was mediated by citizens' satisfaction with public goods

In economics, a public good (also referred to as a social good or collective good)Oakland, W. H. (1987). Theory of public goods. In Handbook of public economics (Vol. 2, pp. 485–535). Elsevier. is a goods, commodity, product or service that ...

, such as education and public transportation." Tax law professor Thomas D. Griffith, summarizing research on human happiness, has argued that because inequality in a society significantly reduces happiness, a progressive tax structure which redistributes income would increase welfare and happiness in a society. Since progressive taxation economic inequality, reduces the income of high earners and is often used as a method to fund government social programs for low income earners, calls for increasing tax progressivity have sometimes been labeled as envy or class conflict, class warfare, while others may describe such actions as fair or a form of social justice.

Even with studies that conclude that a progressive tax can be positively associated with the increased well-being of certain individuals, experts point out that many wealthy democracies are often hesitant to enforce progressive taxes. A study conducted by Yale political scientist Kenneth Scheve and David Stasavage of New York University published in the Comparative Political Studies journal helps explains why that is. Their research findings concluded that voters hold the belief that all citizens should be treated equally with regards to taxation regardless of the income that they bring in. The authors point to this reasoning as one of the main reasons certain countries refuse to raise taxes on the wealthier despite rising inequality. Kenneth Scheve is quoted saying, “Progressive taxation is a powerful policy tool for responding to rising inequality, but we found that wealthy democracies don’t resort to it very often.” The study results result from studies conducted in the United Kingdom, United States, and Germany. Contrary to a progressive tax, some voters argue that a fair tax system should take into account whether individuals earned their wealth through hard work compared to others. This perspective emphasizes equal-treatment fairness norms, which suggest that all citizens should be treated equally in areas such as voting rights and legal protections. Accordingly, these voters believe that everyone should pay the same tax rate, mirroring the concept of equal treatment. While progressive tax policies may address income inequality in certain countries, there is a significant segment of the population that opposes them based on this notion of political equality. This opposition may hinder the formation of a consensus to address inequality by raising taxes on higher incomes and wealth.

Computation

Examples

Most systems around the world contain progressive aspects. When taxable income falls within a particular tax bracket, the individual pays the listed percentage of tax ''on each dollar that falls within that monetary range''. For example, a person in the U.S. who earned US of taxable income (income after adjustments, deductions, and exemptions) would be liable for 10% of each dollar earned from the 1st dollar to the 7,550th dollar, and then for 15% of each dollar earned from the 7,551st dollar to the 10,000th dollar, for a total of .50.

In the United States, there are seven income tax brackets ranging from 10% to 39.6% above an untaxed level of income based on the Personal exemption (United States), personal exemption and usually various other tax exemptions, such as the Earned Income Tax Credit and home mortgage payments. The federal tax rates for individual taxpayers in the United States for the tax year 2021 are as follows: 10% from United States dollar, $0 to ; 12% from to ; 22% from to ; 24% from to ; 32% from to ; 35% from to ; and 37% from and over. The US federal tax system also includes deductions for state and local taxes for lower income households which mitigates what are sometimes regressive taxes, particularly Property tax in the United States, property taxes. Higher income households are subject to the alternative minimum tax that limits deductions and sets a flat tax rate of 26% to 28% with the higher rate commencing at in income. There are also deduction phaseouts starting at for single filers. The net effect is increased progressivity that completely limits deductions for state and local taxes and certain other credits for individuals earning more than . In order to counteract regressive state and local taxes, many US states implement progressive income taxes. 32 states and the District of Columbia have graduated-rate income taxes. The brackets differ across State income tax, states.

There has been a hefty decline in progressivity of the United States federal tax system since the 1960s. The two periods with the largest tax progressivity reductions occurred under Presidency of Ronald Reagan, the Reagan administration in the 1980s and Presidency of George W. Bush, the Bush administration in the 2000s. The Tax Cuts and Jobs Act of 2017 implemented by Donald Trump, President Trump greatly affected the United States tax system. The act took steps to dramatically lower taxes for high-income households, open deduction loopholes for businesses, and cut the Corporate tax in the United States, federal corporate tax rate down to 21 percent. It maintained the structure of seven tax brackets for personal income but lowered five of the seven by one percent or more. For example, after the Tax Cuts and Jobs Act of 2017 was implemented, in 2017, a married couple with a total income of $250,000 after deductions would have faced a tax rate of 33%. However, by 2023 and 2024, their highest tax rate would have decreased to 24%. This change would have resulted in a notable disparity in their take-home pay compared to previous years.

Albania transitioned from a flat tax to a progressive tax in 2014. Kraja, Lirëza and Morelli have concluded that while a progressive tax framework may be more effective in achieving policy objectives like reducing income inequality and boosting government tax revenue, policymakers must carefully weigh its impact on investment and entrepreneurship and implement strong tax administration and enforcement measures to combat tax evasion within a progressive tax framework.

Belgium has the following personal income tax rates (for the income year 2021): 25% from Euro, EUR€0 to €13,540; 40% from €13,540 to €23,900; 45% from €23,900 to €41,360; and 50% from €41,360 and any amount over.

Canada has the following federal tax rates on income (for the year 2021): 15% from Canadian dollar, C$0 to ; 20.5% from to ; 26% from to ; 29% from to ; and 33% on income over .

Denmark has the following state tax rates regarding personal income: 12.11% for the bottom tax base; 15% for the top tax base, or income exceeding Danish krone, DKK 544,800. Additional taxes, such as the municipal tax (which has a country average of 24.971%), the labour market tax, and the church tax, are also applied to individual's income.

Germany has the following personal income tax rates for a single taxpayer (for the 2020 tax year): 0% up to Euro, EUREuro sign, €9,744; 14-42% from €9,744 to €57,918; 42% from €57,918 to €274,612; and 45% for €274,612 and any amount over.

Indonesia has implemented progressive vehicular taxes at the municipal level in Cimahi and Palembang, which had a significant impact of the progressive tax system on the local income of the municipality.

Norway has the following personal income tax rates (for the year 2020): 1.9% from Norwegian krone, NOK180,800 to NOK254,500; 4.2% from NOK254,500 to NOK639,750; 13.2% from NOK639,750 to NOK999,550; and 16.2% from NOK999,550 and above.

Sweden has the following state income tax brackets for natural persons: 0% on income up to Swedish krona, SEK 413,200; 20% from SEK 413,200 to SEK 591,600; and 25% from SEK 591,600 and any amount over.

The United Kingdom has the following income tax rates: 0% from Pound sterling, £0 to £12,570; 20% from £12,571 to £50,270; 40% from £50,271 to £150,000; and 45% from £150,000 and over. In Scotland, however, there are more tax brackets than in other UK countries. Scotland has the following additional income tax brackets: 19% from £12,571 to £14,667; 20% from £14,667 to £25,296; 21% from £25,297 to £43,662; 41% from £43,663 to £150,000; and 46% for any amount over £150,000.

New Zealand has the following income tax brackets: 10.5% up to ; 17.5% from to ; 30% from to ; 33% from to ; 39% for any amount over ; and 45% when the employee does not complete a declaration form. All values are in New Zealand dollars and exclude the earner levy.

Australia has the following progressive income tax rates (for the 2024-2025 financial year): 0% effective up to ; 16% from to ; 30% from to ; 37% from to ; and 45% for any amount over .

Italy also follows a progressive tax blueprint. As of October 2020, the progressive tax rates in Italy are outlined as follows. Income between 0 and €15,000 – 23%, €15,000 – €28,000 – 25%, €28,000 – €50,000 – 35%, €50,000 and over – 43%.

Most systems around the world contain progressive aspects. When taxable income falls within a particular tax bracket, the individual pays the listed percentage of tax ''on each dollar that falls within that monetary range''. For example, a person in the U.S. who earned US of taxable income (income after adjustments, deductions, and exemptions) would be liable for 10% of each dollar earned from the 1st dollar to the 7,550th dollar, and then for 15% of each dollar earned from the 7,551st dollar to the 10,000th dollar, for a total of .50.

In the United States, there are seven income tax brackets ranging from 10% to 39.6% above an untaxed level of income based on the Personal exemption (United States), personal exemption and usually various other tax exemptions, such as the Earned Income Tax Credit and home mortgage payments. The federal tax rates for individual taxpayers in the United States for the tax year 2021 are as follows: 10% from United States dollar, $0 to ; 12% from to ; 22% from to ; 24% from to ; 32% from to ; 35% from to ; and 37% from and over. The US federal tax system also includes deductions for state and local taxes for lower income households which mitigates what are sometimes regressive taxes, particularly Property tax in the United States, property taxes. Higher income households are subject to the alternative minimum tax that limits deductions and sets a flat tax rate of 26% to 28% with the higher rate commencing at in income. There are also deduction phaseouts starting at for single filers. The net effect is increased progressivity that completely limits deductions for state and local taxes and certain other credits for individuals earning more than . In order to counteract regressive state and local taxes, many US states implement progressive income taxes. 32 states and the District of Columbia have graduated-rate income taxes. The brackets differ across State income tax, states.

There has been a hefty decline in progressivity of the United States federal tax system since the 1960s. The two periods with the largest tax progressivity reductions occurred under Presidency of Ronald Reagan, the Reagan administration in the 1980s and Presidency of George W. Bush, the Bush administration in the 2000s. The Tax Cuts and Jobs Act of 2017 implemented by Donald Trump, President Trump greatly affected the United States tax system. The act took steps to dramatically lower taxes for high-income households, open deduction loopholes for businesses, and cut the Corporate tax in the United States, federal corporate tax rate down to 21 percent. It maintained the structure of seven tax brackets for personal income but lowered five of the seven by one percent or more. For example, after the Tax Cuts and Jobs Act of 2017 was implemented, in 2017, a married couple with a total income of $250,000 after deductions would have faced a tax rate of 33%. However, by 2023 and 2024, their highest tax rate would have decreased to 24%. This change would have resulted in a notable disparity in their take-home pay compared to previous years.

Albania transitioned from a flat tax to a progressive tax in 2014. Kraja, Lirëza and Morelli have concluded that while a progressive tax framework may be more effective in achieving policy objectives like reducing income inequality and boosting government tax revenue, policymakers must carefully weigh its impact on investment and entrepreneurship and implement strong tax administration and enforcement measures to combat tax evasion within a progressive tax framework.

Belgium has the following personal income tax rates (for the income year 2021): 25% from Euro, EUR€0 to €13,540; 40% from €13,540 to €23,900; 45% from €23,900 to €41,360; and 50% from €41,360 and any amount over.

Canada has the following federal tax rates on income (for the year 2021): 15% from Canadian dollar, C$0 to ; 20.5% from to ; 26% from to ; 29% from to ; and 33% on income over .

Denmark has the following state tax rates regarding personal income: 12.11% for the bottom tax base; 15% for the top tax base, or income exceeding Danish krone, DKK 544,800. Additional taxes, such as the municipal tax (which has a country average of 24.971%), the labour market tax, and the church tax, are also applied to individual's income.

Germany has the following personal income tax rates for a single taxpayer (for the 2020 tax year): 0% up to Euro, EUREuro sign, €9,744; 14-42% from €9,744 to €57,918; 42% from €57,918 to €274,612; and 45% for €274,612 and any amount over.

Indonesia has implemented progressive vehicular taxes at the municipal level in Cimahi and Palembang, which had a significant impact of the progressive tax system on the local income of the municipality.

Norway has the following personal income tax rates (for the year 2020): 1.9% from Norwegian krone, NOK180,800 to NOK254,500; 4.2% from NOK254,500 to NOK639,750; 13.2% from NOK639,750 to NOK999,550; and 16.2% from NOK999,550 and above.

Sweden has the following state income tax brackets for natural persons: 0% on income up to Swedish krona, SEK 413,200; 20% from SEK 413,200 to SEK 591,600; and 25% from SEK 591,600 and any amount over.

The United Kingdom has the following income tax rates: 0% from Pound sterling, £0 to £12,570; 20% from £12,571 to £50,270; 40% from £50,271 to £150,000; and 45% from £150,000 and over. In Scotland, however, there are more tax brackets than in other UK countries. Scotland has the following additional income tax brackets: 19% from £12,571 to £14,667; 20% from £14,667 to £25,296; 21% from £25,297 to £43,662; 41% from £43,663 to £150,000; and 46% for any amount over £150,000.

New Zealand has the following income tax brackets: 10.5% up to ; 17.5% from to ; 30% from to ; 33% from to ; 39% for any amount over ; and 45% when the employee does not complete a declaration form. All values are in New Zealand dollars and exclude the earner levy.

Australia has the following progressive income tax rates (for the 2024-2025 financial year): 0% effective up to ; 16% from to ; 30% from to ; 37% from to ; and 45% for any amount over .

Italy also follows a progressive tax blueprint. As of October 2020, the progressive tax rates in Italy are outlined as follows. Income between 0 and €15,000 – 23%, €15,000 – €28,000 – 25%, €28,000 – €50,000 – 35%, €50,000 and over – 43%.

See also

References

External links

''The Progressive Income Tax: Theoretical Foundations''

* {{DEFAULTSORT:Progressive Tax Taxation and redistribution Tax incidence Tax terms Economic progressivism