Nicholas Kaldor on:

[Wikipedia]

[Google]

[Amazon]

Nicholas Kaldor, Baron Kaldor (12 May 1908 – 30 September 1986), born Káldor Miklós, was a Hungarian-born British economist. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the

After the publication of

After the publication of

Alternative Theories of Distribution

, 1956, RES * ''A Model of Economic Growth'', 1957, EJ * ''Monetary Policy, Economic Stability, and Growth'', 1958. * ''Economic Growth and the Problem of Inflation'', 1959, Economica. * ''A Rejoinder to Mr. Atsumi and Professor Tobin'', 1960, RES * ''Keynes's Theory of the Own-Rates of Interest'', 1960, in Kaldor, 1960. * ''Essays on Value and Distribution'', 1960. * ''Essays on Economic Stability and Growth'', 1960. * ''Capital Accumulation and Economic Growth'', 1961, in Lutz, editor, Theory of Capital * ''A New Model of Economic Growth'', with James A. Mirrlees, 1962, RES * ''The Case for a Commodity Reserve Currency'', with A.G. Hart and J. Tinbergen, 1964, UNCTAD * ''Essays on Economic Policy'', 1964, two volumes. * ''Causes of the Slow Rate of Economic Growth in the UK'', 1966. * ''The Case for Regional Policies'', 1970, Scottish JE. * ''The New Monetarism'', 1970, Lloyds Bank Review * ''Conflicts in National Economic Objectives'', 1971, EJ * ''The Irrelevance of Equilibrium Economics'', 1972, EJ * ''What is Wrong with Economic Theory'', 1975, QJE * ''Inflation and Recession in the World Economy'', 1976, EJ * ''Equilibrium Theory and Growth Theory'', 1977, in Boskin, editor, Economics and Human Welfare. * ''Capitalism and Industrial Development'', 1977, Cambridge JE * ''Further Essays on Economic Theory'', 1978. * ''The Role of Increasing Returns, Technical Progress and Cumulative Causation''..., 1981, Economie Appliquee * ''Fallacies on Monetarism'', 1981, Kredit und Kapital. * ''The Scourge of Monetarism'', 1982. *

The economic consequences of Mrs. Thatcher

', 1983. * ''The Role of Commodity Prices in Economic Recovery'', 1983, Lloyds Bank Review * ''Keynesian Economics After Fifty Years'', 1983, in Trevithick and Worswick, editors, Keynes and the Modern World * ''Economics Without Equilibrium'', 1985. * ''Causes of Growth and Stagnation in the World Economy'', 1996 (posthumous, based on 1984 Mattioli Lectures)

The Scourge of Monetarism

' (1982)

Kaldor Business Cycle Model

by Elmer G. Wiens {{DEFAULTSORT:Kaldor, Nicholas 1908 births 1986 deaths Writers from Budapest Hungarian Jews Post-Keynesian economists Labour Party (UK) life peers Life peers created by Elizabeth II Alumni of the London School of Economics Academics of the London School of Economics 20th-century British economists Naturalised citizens of the United Kingdom Hungarian emigrants to England Fellows of the Econometric Society Members of the Fabian Society

cobweb model

The cobweb model or cobweb theory is an economic model that explains why prices may be subjected to periodic fluctuations in certain types of markets. It describes cyclical supply and demand in a market where the amount produced must be chosen bef ...

, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal

Karl Gunnar Myrdal ( ; ; 6 December 1898 – 17 May 1987) was a Swedish economist and sociologist. In 1974, he received the Nobel Memorial Prize in Economic Sciences along with Friedrich Hayek for "their pioneering work in the theory of money an ...

to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated.

Biography

Káldor Miklós was born inBudapest

Budapest is the Capital city, capital and List of cities and towns of Hungary, most populous city of Hungary. It is the List of cities in the European Union by population within city limits, tenth-largest city in the European Union by popul ...

, son of Gyula Káldor, lawyer and legal adviser to the German legation in Budapest, and Jamba, an accomplished linguist and "a well-educated, cultured woman". He was educated in Budapest, as well as in Berlin, and at the London School of Economics

The London School of Economics and Political Science (LSE), established in 1895, is a public research university in London, England, and a member institution of the University of London. The school specialises in the social sciences. Founded ...

, where he graduated with a first-class BSc (Econ.) degree in 1930. He subsequently became an assistant lecturer and, by 1938, lecturer and reader in economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

at the LSE. Between 1943 and 1945, Kaldor worked for the National Institute of Economic and Social Research

The National Institute of Economic and Social Research (NIESR), established in 1938, is Britain's oldest independent economic research institute. The institute is a London-based independent UK registered charity that carries out academic researc ...

and in 1947 he resigned from the LSE to become Director of Research and Planning at the Economic Commission for Europe

The United Nations Economic Commission for Europe (ECE or UNECE) is an intergovernmental organization or a specialized body of the United Nations. The UNECE is one of five regional commissions under the jurisdiction of the United Nations Econom ...

. He was elected to a Fellowship at King's College, Cambridge

King's College, formally The King's College of Our Lady and Saint Nicholas in Cambridge, is a List of colleges of the University of Cambridge, constituent college of the University of Cambridge. The college lies beside the River Cam and faces ...

and offered a lectureship in the Economics Faculty of the University in 1949. He became a Reader in Economics in 1952, and Professor in 1966.

From 1964, Kaldor was an advisor to the Labour government of the UK and also advised several other countries, producing some of the earliest memoranda regarding the creation of value added tax

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared wi ...

. Inter alia, Kaldor was considered, with his fellow- Hungarian Thomas Balogh, one of the intellectual authors of the 1964–1970 Harold Wilson

James Harold Wilson, Baron Wilson of Rievaulx (11 March 1916 – 23 May 1995) was a British statesman and Labour Party (UK), Labour Party politician who twice served as Prime Minister of the United Kingdom, from 1964 to 1970 and again from 197 ...

's government's short-lived Selective Employment Tax (SET) designed to tax employment in service sectors while subsidising employment in manufacturing. In 1966, he became professor of economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

at the University of Cambridge

The University of Cambridge is a Public university, public collegiate university, collegiate research university in Cambridge, England. Founded in 1209, the University of Cambridge is the List of oldest universities in continuous operation, wo ...

. On 9 July 1974, Kaldor was made a life peer

In the United Kingdom, life peers are appointed members of the peerage whose titles cannot be inherited, in contrast to hereditary peers. Life peers are appointed by the monarch on the advice of the prime minister. With the exception of the D ...

as Baron Kaldor, of Newnham in the City of Cambridge

Cambridge ( ) is a List of cities in the United Kingdom, city and non-metropolitan district in the county of Cambridgeshire, England. It is the county town of Cambridgeshire and is located on the River Cam, north of London. As of the 2021 Unit ...

.

In 1969–1970, Kaldor was involved in a fierce debate with the U.S. monetarist economist Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

. While Friedman defended the exogenous money supply theory, according to which money is created by powerful central banks

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monet ...

, Kaldor and Post-Keynesian economists claimed that money is created by second-tier banks through the distribution of credits to households and companies

A company, abbreviated as co., is a legal entity representing an association of legal people, whether natural, juridical or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specifi ...

. In the Post-Keynesian framework, central banks only refinance second-tier banks on demand, but they are unable to properly create money. Despite insightful contributions, Kaldor could not initially win the debate, as monetarist policies where implemented by most central banks. He would, however, later be vindicated by empirical findings and policy, with money creation now being generally agreed to be mostly endogenous. In 1981, he was one of the 364 economists who signed a letter to ''The Times

''The Times'' is a British Newspaper#Daily, daily Newspaper#National, national newspaper based in London. It began in 1785 under the title ''The Daily Universal Register'', adopting its modern name on 1 January 1788. ''The Times'' and its si ...

'' condemning Geoffrey Howe's 1981 Budget. In 1982, he published a book entitled ''The Scourge of Monetarism'', deeply criticizing monetarist-inspired policies.

Kaldor was invited by then Prime Minister of India—Jawaharlal Nehru

Jawaharlal Nehru (14 November 1889 – 27 May 1964) was an Indian anti-colonial nationalist, secular humanist, social democrat, and statesman who was a central figure in India during the middle of the 20th century. Nehru was a pr ...

—to design an expenditure tax system for India in the 1950s. He also went to India's Centre for Development Studies (CDS) in 1985 to inaugurate and deliver the first Joan Robinson

Joan Violet Robinson ( Maurice; 31 October 1903 – 5 August 1983) was a British economist known for her wide-ranging contributions to economic theory. One of the most prominent economists of the century, Robinson incarnated the "Cambridge Sc ...

Memorial Lecture. Owing to these links, the Kaldor family donated his entire personal collection to the CDS Library. There are 362 books in the collection and they cover a wide range of titles on economic theory, classical political economy, business cycles and history of economic thought.

Business cycle theory

After the publication of

After the publication of John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

' General Theory, many attempts were made to build a business cycle model. The models that were built by American Neo-Keynesians such as Paul Samuelson

Paul Anthony Samuelson (May 15, 1915 – December 13, 2009) was an American economist who was the first American to win the Nobel Memorial Prize in Economic Sciences. When awarding the prize in 1970, the Swedish Royal Academies stated that he "h ...

proved unstable. They could not describe why an economy should cycle through recession and growth in a stable fashion. The British Neo-Keynesian John Hicks

Sir John Richard Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics ...

tried to improve the theory by imposing rigid ceilings and floors on the model. But most people thought that this was a poor way of explaining the cycle as it relied on artificial, exogenous constraints. Kaldor, however, had actually invented a fully coherent and highly realistic account of the business cycle in 1940. He used non-linear

In mathematics and science, a nonlinear system (or a non-linear system) is a system in which the change of the output is not proportional to the change of the input. Nonlinear problems are of interest to engineers, biologists, physicists, mathe ...

dynamics to construct this theory. Kaldor's theory was similar to Samuelson's and Hicks' as it used a multiplier-accelerator model to understand the cycle. It differed from these theories, however, as Kaldor introduced the capital stock as an important determinant of the trade cycle. This was in keeping with Keynes' sketch of the business cycle in his General Theory.

Following Keynes, Kaldor argued that investment depended positively on income and negatively on the accumulated capital stock. The idea that investment depends positively on the growth of income is simply the idea of the accelerator model that holds that in periods of high income growth and hence demand growth, investment should rise in the anticipation of high income and demand growth in the future. The intuition lying behind the negative relationship to the accumulation of the capital stock is due to the fact that if firms have a very large amount of productive capacity accumulated already they will not be as inclined to invest in more. Kaldor was in effect integrating Roy Harrod's ideas about unbalanced growth into his theory.

In the standard accelerator model that stood behind Samuelson's and Hicks' business cycle theories investment was determined as such:

This states that investment is determined by exogenous investment and lagged income multiplied by the accelerator coefficient. Kaldor's model modified this to include a negative coefficient for the capital stock:

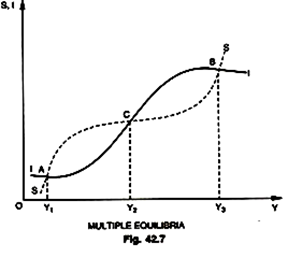

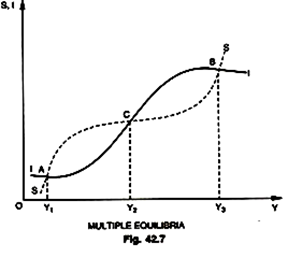

Kaldor then assumed that the investment and savings functions are non-linear. He argued that at the peaks and troughs of the cycle the marginal propensity to save shifts in opposite ways. The intuition behind this is that during recessions people will cut their savings to maintain their standard of living while at high levels of income people will save a larger proportion of their income. He also argued that at the peaks and troughs of the cycle the marginal propensity to invest shifts. The intuition behind this is that at the trough of the cycle there will be a large amount of excess capacity and so businessmen will not want to invest more, while at the peak of the cycle rising costs will discourage investment. This creates non-linear dynamics in the economy that then drive the business cycle.

When Kaldor combines these components we get a clear six-stage model of the business cycle. In the first stage the economy is in equilibrium position. Investment is taking place and the capital stock is growing. In the second stage the growth in the capital stock leads to a downward shift in the investment curve as businessmen decide their factories become overfull. In the third stage (which overlaps with the second stage) the high growth in income causes higher saving which pushes the savings curve upwards. At this point the two curves become tangential and the equilibrium becomes unstable which generates a recession. In the fourth stage the same dynamics kick in but this time moving in the opposite direction. By the sixth stage the equilibrium is again unstable and a boom is produced.

Kaldor also noted the importance of income distribution in his theory of the business cycle. He assumed that savings out of profits were higher than savings out of wages; that is, he argued that poorer people (workers) tend to save less than richer people (capitalists). Or:

Kaldor believed that the business cycle had an inherent mechanism built into it that redistributed income across the cycle and that these mitigated "explosive" results. As we have seen, in a cyclical upswing where planned investment begins to outstrip planned savings prices will tend to rise. Kaldor assumed that those who set prices have more power than those who set wages and so prices will tend to rise faster than wages. This means that profits must also rise faster than wages. Kaldor argued that due to the different savings propensities of capitalists and workers this will lead to higher savings. This will then dampen the cycle somewhat. In a recession or depression Kaldor argued that prices should fall faster than wages for the same reasons that Keynes laid out in his General Theory. This meant that income would be redistributed to workers as real wages rose. This would lead savings to fall in a recession or depression and so would dampen the cycle.

Kaldor's model assumes wage and price flexibility. If wage and price flexibility are not forthcoming the economy may have a tendency to either perpetual and rising inflation or persistent stagnation. Kaldor also makes strong assumptions about how wages and prices respond in both inflations and depressions. If these assumptions do not hold Kaldor's model would lead us to conclude that the cycle might give way to either perpetual and rising inflation or stagnation.

Kaldor's non-linear business cycle theory overcomes the difficulty that many economists had with Roy Harrod's growth theory. Many of the American Neo-Keynesian economists thought that Harrod's work implied that capitalism would tend toward extremes of zero and infinite growth and that there were no dynamics that might keep it in check. Robert Solow

Robert Merton Solow, GCIH (; August 23, 1924 – December 21, 2023) was an American economist who received the 1987 Nobel Memorial Prize in Economic Sciences, and whose work on the theory of economic growth culminated in the exogenous growth ...

, who eventually created the Solow Growth Model in response to these perceived problems, summarised this view as such:

In fact, Kaldor's 1940 paper had already shown this to be completely untrue. Solow was working with an erroneous and underdeveloped theory of the business cycle that he had taken over from Samuelson. By the time Solow was working on his growth theory, the Cambridge UK economists had already satisfactorily laid out a self-limiting theory of the business cycle that they thought was a reasonable description of the real world. This is one of the reasons that the Cambridge economists were so hostile in their reaction to Solow's growth model and went on to attack it in the Cambridge Capital Controversy of the 1960s. The ignorance on the part of the American economists' knowledge of Kaldor's model also explains why the Cambridge Post-Keynesian economists found the ISLM model favoured by the American Neo-Keynesians to be crude and lacking.

Personal life

Kaldor was married to Clarissa Goldsmith. They had four daughters. He died in Papworth Everard, Cambridgeshire.Works

* ''The Case Against Technical Progress'', 1932, Economica * ''The Determinateness of Static Equilibrium'', 1934, RES * ''The Equilibrium of the Firm'', 1934, EJ * ''Market Imperfection and Excess Capacity'', 1935, Economica * ''Pigou on Money Wages in Relation to Unemployment'', 1937, EJ * 1939, Welfare propositions of economics and interpersonal comparisons of utility. Economic Journal 49:549–52. * ''Speculation and Economic Stability'', 1939, RES * ''Capital Intensity and the Trade Cycle'', 1939, Economica * ''A Model of the Trade Cycle'', 1940, EJ * ''Professor Hayek and the Concertina Effect'', 1942, Economica * ''The Relation of Economic Growth and Cyclical Fluctuations'', 1954 EJ * ''An Expenditure Tax'', 1955. *Alternative Theories of Distribution

, 1956, RES * ''A Model of Economic Growth'', 1957, EJ * ''Monetary Policy, Economic Stability, and Growth'', 1958. * ''Economic Growth and the Problem of Inflation'', 1959, Economica. * ''A Rejoinder to Mr. Atsumi and Professor Tobin'', 1960, RES * ''Keynes's Theory of the Own-Rates of Interest'', 1960, in Kaldor, 1960. * ''Essays on Value and Distribution'', 1960. * ''Essays on Economic Stability and Growth'', 1960. * ''Capital Accumulation and Economic Growth'', 1961, in Lutz, editor, Theory of Capital * ''A New Model of Economic Growth'', with James A. Mirrlees, 1962, RES * ''The Case for a Commodity Reserve Currency'', with A.G. Hart and J. Tinbergen, 1964, UNCTAD * ''Essays on Economic Policy'', 1964, two volumes. * ''Causes of the Slow Rate of Economic Growth in the UK'', 1966. * ''The Case for Regional Policies'', 1970, Scottish JE. * ''The New Monetarism'', 1970, Lloyds Bank Review * ''Conflicts in National Economic Objectives'', 1971, EJ * ''The Irrelevance of Equilibrium Economics'', 1972, EJ * ''What is Wrong with Economic Theory'', 1975, QJE * ''Inflation and Recession in the World Economy'', 1976, EJ * ''Equilibrium Theory and Growth Theory'', 1977, in Boskin, editor, Economics and Human Welfare. * ''Capitalism and Industrial Development'', 1977, Cambridge JE * ''Further Essays on Economic Theory'', 1978. * ''The Role of Increasing Returns, Technical Progress and Cumulative Causation''..., 1981, Economie Appliquee * ''Fallacies on Monetarism'', 1981, Kredit und Kapital. * ''The Scourge of Monetarism'', 1982. *

The economic consequences of Mrs. Thatcher

', 1983. * ''The Role of Commodity Prices in Economic Recovery'', 1983, Lloyds Bank Review * ''Keynesian Economics After Fifty Years'', 1983, in Trevithick and Worswick, editors, Keynes and the Modern World * ''Economics Without Equilibrium'', 1985. * ''Causes of Growth and Stagnation in the World Economy'', 1996 (posthumous, based on 1984 Mattioli Lectures)

See also

* Kaldor's facts * Kaldor's growth lawsReferences

Further reading

* * Memorandum on the value added tax, Labour NEC archives, 1963External links

* *The Scourge of Monetarism

' (1982)

Kaldor Business Cycle Model

by Elmer G. Wiens {{DEFAULTSORT:Kaldor, Nicholas 1908 births 1986 deaths Writers from Budapest Hungarian Jews Post-Keynesian economists Labour Party (UK) life peers Life peers created by Elizabeth II Alumni of the London School of Economics Academics of the London School of Economics 20th-century British economists Naturalised citizens of the United Kingdom Hungarian emigrants to England Fellows of the Econometric Society Members of the Fabian Society