low-volatility anomaly on:

[Wikipedia]

[Google]

[Amazon]

In

online data library

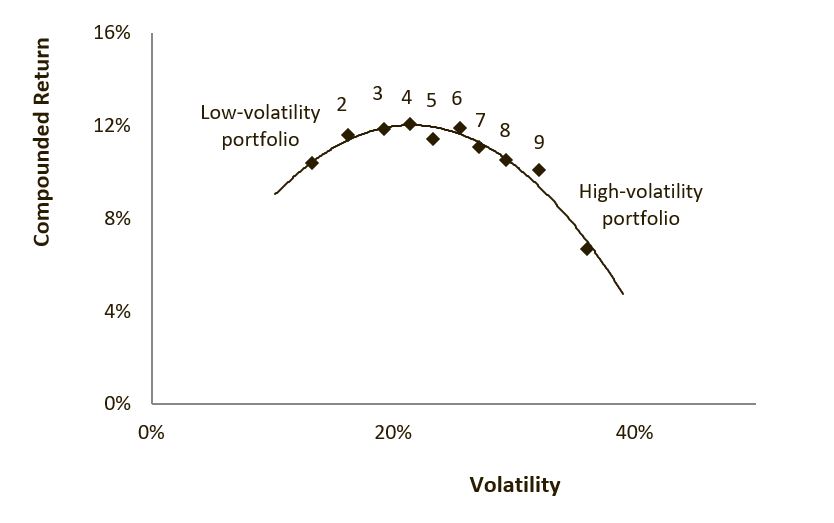

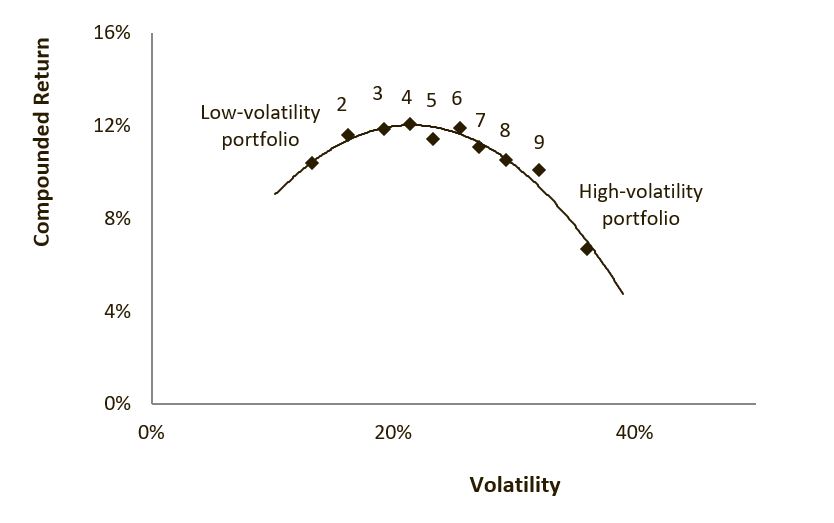

The picture contains portfolio data for US stocks sorted on past volatility and grouped into ten portfolios. The portfolio of stocks with the lowest volatility has a higher return compared to the portfolio of stocks with the highest volatility. A visual illustration of the anomaly, since the relation between risk and return should be positive. Data for the related low-beta anomaly is als

online available

The evidence of the anomaly has been mounting due to numerous studies by both academics and practitioners which confirm the presence of the anomaly throughout the forty years since its initial discovery in the early 1970s. Examples include Baker and Haugen ( 1991), Chan, Karceski and Lakonishok (1999), Jagannathan and Ma (2003), Clarke De Silva and Thorley, (2006) and Baker, Bradley and Wurgler (2011). Besides evidence for the US stock market, there is also evidence for international stock markets. For global equity markets,

investing

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing i ...

and finance, the low-volatility anomaly is the observation that low-volatility stocks have higher returns than high-volatility stocks in most markets studied. This is an example of a stock market anomaly since it contradicts the central prediction of many financial theories that taking higher risk must be compensated with higher returns.

Furthermore, the Capital Asset Pricing Model (CAPM) predicts a positive relation between the systematic risk-exposure of a stock (also known as the stock beta) and its expected future returns. However, some narratives of the low-volatility anomaly falsify this prediction of the CAPM by showing that stocks with higher beta have historically under-performed the stocks with lower beta.

Other narratives of this anomaly show that even stocks with higher idiosyncratic risk are compensated with lower returns in comparison to stocks with lower idiosyncratic risk.

The low-volatility anomaly has also been referred to as the low-beta, minimum-variance, minimum volatility anomaly.

History

The CAPM was developed in the late 1960s and predicts that expected returns should be a positive and linear function of beta, and nothing else. First, the return of a stock with average beta should be the average return of stocks. Second, the intercept should be equal to the risk-free rate. Then the slope can be computed from these two points. Almost immediately these predictions were empirically challenged. Studies find that the correct slope is either less than predicted, not significantly different from zero, or even negative. EconomistFischer Black

Fischer Sheffey Black (January 11, 1938 – August 30, 1995) was an American economist, best known as one of the authors of the Black–Scholes equation.

Background

Fischer Sheffey Black was born on January 11, 1938. He graduated from Harvard ...

(1972) proposed a theory where there is a zero-beta return which is different from the risk-free return. This fits the data better since the zero-beta return is different from the risk-free return. It still presumes, on principle, that there is higher return for higher beta. Research challenging CAPM's underlying assumptions about risk has been mounting for decades. One challenge was in 1972, when Michael C. Jensen, Fischer Black

Fischer Sheffey Black (January 11, 1938 – August 30, 1995) was an American economist, best known as one of the authors of the Black–Scholes equation.

Background

Fischer Sheffey Black was born on January 11, 1938. He graduated from Harvard ...

and Myron Scholes published a study showing what CAPM would look like if one could not borrow at a risk-free rate. Their results indicated that the relationship between beta and realized return was flatter than predicted by CAPM. Shortly after, Robert Haugen and James Heins produced a working paper titled “On the Evidence Supporting the Existence of Risk Premiums in the Capital Market”. Studying the period from 1926 to 1971, they concluded that "over the long run stock portfolios with lesser variance in monthly returns have experienced greater average returns than their ‘riskier’ counterparts".

Evidence

The low-volatility anomaly has been documented in the United States over an extended 90-year period. Volatility-sorted portfolios containing deep historical evidence since 1929 are available in aonline data library

The picture contains portfolio data for US stocks sorted on past volatility and grouped into ten portfolios. The portfolio of stocks with the lowest volatility has a higher return compared to the portfolio of stocks with the highest volatility. A visual illustration of the anomaly, since the relation between risk and return should be positive. Data for the related low-beta anomaly is als

online available

The evidence of the anomaly has been mounting due to numerous studies by both academics and practitioners which confirm the presence of the anomaly throughout the forty years since its initial discovery in the early 1970s. Examples include Baker and Haugen ( 1991), Chan, Karceski and Lakonishok (1999), Jagannathan and Ma (2003), Clarke De Silva and Thorley, (2006) and Baker, Bradley and Wurgler (2011). Besides evidence for the US stock market, there is also evidence for international stock markets. For global equity markets,

Blitz

Blitz, German for "lightning", may refer to:

Military uses

*Blitzkrieg, blitz campaign, or blitz, a type of military campaign

*The Blitz, the German aerial campaign against Britain in the Second World War

*, an Imperial German Navy light cruiser b ...

and van Vliet (2007), Nielsen and Subramanian (2008), Carvalho, Xiao, Moulin (2011), Blitz

Blitz, German for "lightning", may refer to:

Military uses

*Blitzkrieg, blitz campaign, or blitz, a type of military campaign

*The Blitz, the German aerial campaign against Britain in the Second World War

*, an Imperial German Navy light cruiser b ...

, Pang, van Vliet (2012), Baker and Haugen (2012), all find similar results.

Explanations

Several explanations have been put forward to explain the low-volatility anomaly. They explain why low risk securities are more in demand creating the low-volatility anomaly. * Constraints: Investors faceleverage

Leverage or leveraged may refer to:

*Leverage (mechanics), mechanical advantage achieved by using a lever

* ''Leverage'' (album), a 2012 album by Lyriel

*Leverage (dance), a type of dance connection

*Leverage (finance), using given resources to ...

constraints and shorting

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional " long" position, where the investor will profit if the value of t ...

constraints. This explanation was put forward by Brennan (1971) and tested by Frazzini and Pederson (2014).

* Relative performance: Many investors want to consistently beat the market average, or benchmark

Benchmark may refer to:

Business and economics

* Benchmarking, evaluating performance within organizations

* Benchmark price

* Benchmark (crude oil), oil-specific practices

Science and technology

* Benchmark (surveying), a point of known elevati ...

as discussed by Blitz

Blitz, German for "lightning", may refer to:

Military uses

*Blitzkrieg, blitz campaign, or blitz, a type of military campaign

*The Blitz, the German aerial campaign against Britain in the Second World War

*, an Imperial German Navy light cruiser b ...

and van Vliet (2007) and Baker, Bradley, and Wurgler (2011).

* Agency issues: Many professional investors have misaligned interests when managing client money. Falkenstein (1996) and Karceski (2001) give evidence for mutual fund managers.

* Skewness preference: Many investors like lottery-like payoffs. Bali, Cakici and Whitelaw (2011) test the ‘stocks as lotteries

A lottery is a form of gambling that involves the drawing of numbers at random for a prize. Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. It is common to find some degree of ...

’ hypothesis of Barberis and Huang (2008).

* Behavioral biases. Investors are often overconfident and use the representative heuristic and overpay for attention grabbing stocks.

For an overview of all explanations put forward in the academic literature also see the survey article on this topic by Blitz

Blitz, German for "lightning", may refer to:

Military uses

*Blitzkrieg, blitz campaign, or blitz, a type of military campaign

*The Blitz, the German aerial campaign against Britain in the Second World War

*, an Imperial German Navy light cruiser b ...

, Falkenstein, and Van Vliet (2014) and Blitz

Blitz, German for "lightning", may refer to:

Military uses

*Blitzkrieg, blitz campaign, or blitz, a type of military campaign

*The Blitz, the German aerial campaign against Britain in the Second World War

*, an Imperial German Navy light cruiser b ...

, Van Vliet, and Baltussen (2019).

Also see

* Market anomaly * Capital asset pricing model *Low-volatility investing Low-volatility investing is an investment style that buys stocks or securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to financial theory risk and return shou ...

*Style investing Style investing is an investment approach in which securities are grouped into categories and portfolio allocation based on selection among styles rather than among individual securities. Style investors can make portfolio allocation decisions by pl ...

*Value investing

Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. The various forms of value investing derive from the investment philosophy first taught by Benjamin Graham an ...

*Momentum investing Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period.

While momentum investing is well-established as ...

References

{{reflist, refs= Arnott, Robert, (1983) “What Hath MPT Wrought: Which Risks Reap Rewards?,” The Journal of Portfolio Management, Fall 1983, pp. 5–11; Fama, Eugene, Kenneth French (1992), “The Cross-Section of Expected Stock Returns”, Journal of Finance, Vol. 47, No. 2, June 1992, pp. 427- 465; see Roll, Richard, S.A. Ross, (1994), “On the Cross-Sectional Relation Between Expected Returns and Betas”, Journal of Finance, March 1994, pp. 101–121; see Ang, Andrew, Robert J. Hodrick, Yuhang Xing & Xiaoyan Zhang (2006), “The cross section of volatility and expected returns”, Journal of Finance, Vol. LXI, No. 1, February 2006, pp. 259–299; see also Best, Michael J., Robert R. Grauer (1992), “Positively Weighted Minimum-Variance Portfolios and the Structure of Asset Expected Returns”, The Journal of Financial and Quantitative Analysis, Vol. 27, No. 4 (Dec., 1992), pp. 513–537; see Frazzini, Andrea and Lasse H. Pedersen (2010) “Betting Against Beta” NBER working paper series. Jensen, Michael C., Black, Fischer and Scholes, Myron S.(1972), “The Capital Asset Pricing Model: Some Empirical Tests”, Studies in the theory of Capital Markets, Praeger Publishers Inc., 1972; see also Fama, Eugene F., James D. MacBeth, “Risk, Return, and Equilibrium: Empirical Tests”, The Journal of Political Economy, Vol. 81, No. 3. (May – Jun., 1973), pp. 607–636. Haugen, Robert A., and A. James Heins (1975), “Risk and the Rate of Return on Financial Assets: Some Old Wine in New Bottles.” Journal of Financial and Quantitative Analysis, Vol. 10, No. 5 (December): pp.775–784, see also Haugen, Robert A., and A. James Heins, (1972) “On the Evidence Supporting the Existence of Risk Premiums in the Capital Markets”, Wisconsin Working Paper, December 1972. R. Haugen, and Nardin Baker (1991), “The Efficient Market Inefficiency of Capitalization-Weighted Stock Portfolios”, Journal of Portfolio Management, vol. 17, No.1, pp. 35–40, see also Baker, N. and R. Haugen (2012) “Low Risk Stocks Outperform within All Observable Markets of the World”. Chan, L., J. Karceski, and J. Lakonishok (1999), “On Portfolio Optimization: Forecasting Covariances and Choosing the Risk Model”, Review of Financial Studies, 12, pp. 937–974. Jagannathan R. and T. Ma (2003). “Risk reduction in large portfolios: Why imposing the wrong constrains helps”, The Journal of Finance, 58(4), pp. 1651–1684. Clarke, Roger, Harindra de Silva & Steven Thorley (2006), “Minimum-variance portfolios in the US equity market”, Journal of Portfolio Management, Fall 2006, Vol. 33, No. 1, pp.10–24. Baker, Malcolm, Brendan Bradley, and Jeffrey Wurgler (2011), “Benchmarks as Limits to Arbitrage: Understanding the Low-Volatility Anomaly”, Financial Analyst Journal, Vol. 67, No. 1, pp. 40–54. Nielsen, F and R. Aylur Subramanian, (2008), “Far From the Madding Crowd – Volatility Efficient Indexes”, MSCI Research Insight. Carvalho, Raul Leote de, Lu Xiao, and Pierre Moulin,(2011) “Demystifying Equity Risk-Based Strategies: A Simple Alpha Plus Beta Description”, The Journal of Portfolio Management”, September 13, 2011. Behavioral finance Finance theories Mathematical finance Financial markets Portfolio theories Financial economics