List Of Countries By Tax Revenue As Percentage Of GDP on:

[Wikipedia]

[Google]

[Amazon]

This article lists countries alphabetically, with total

This article lists countries alphabetically, with total

This article lists countries alphabetically, with total

This article lists countries alphabetically, with total tax revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resour ...

as a percentage of gross domestic product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is of ...

(GDP) for the listed countries. The tax percentage for each country listed in the source has been added to the chart.

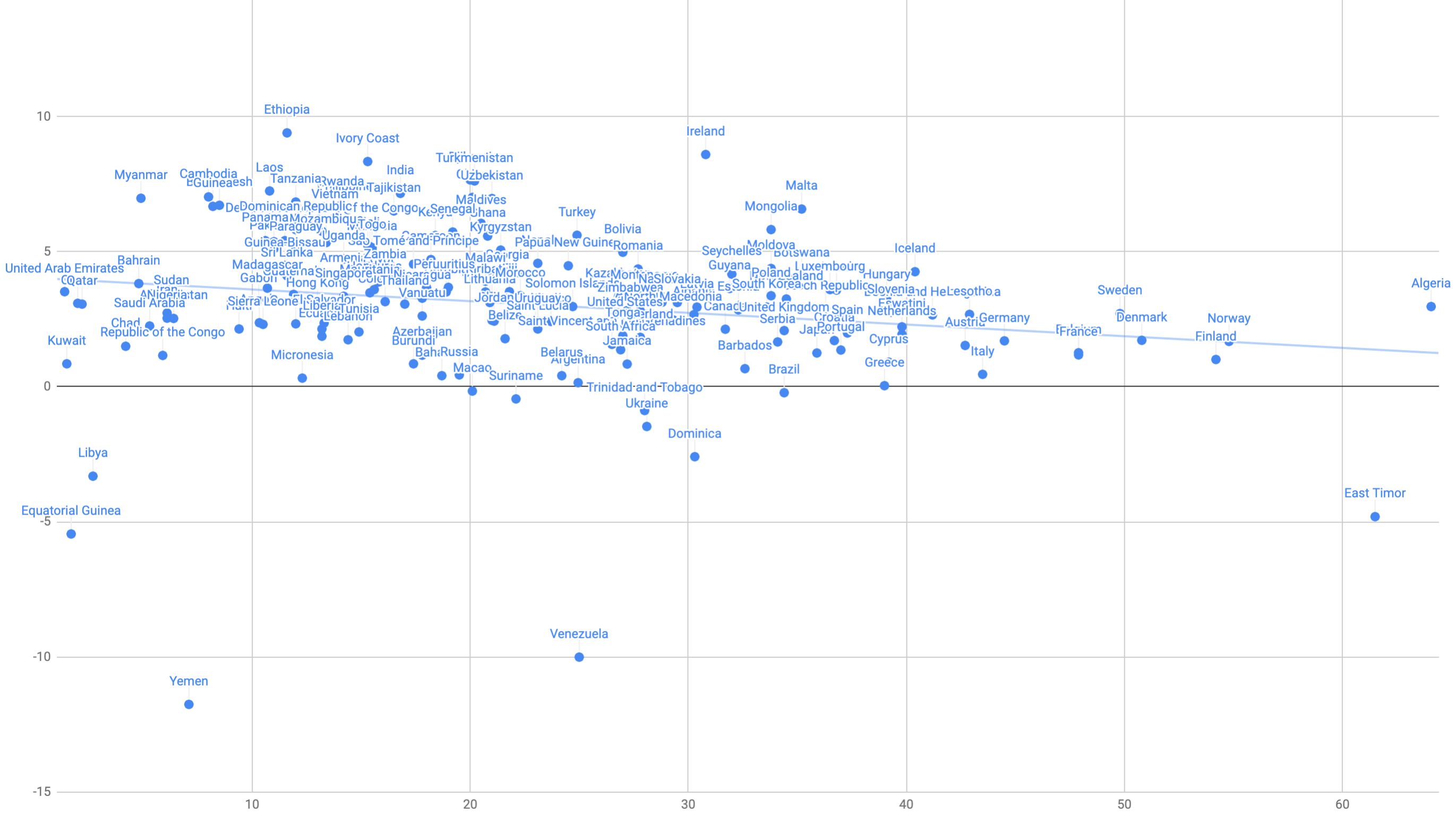

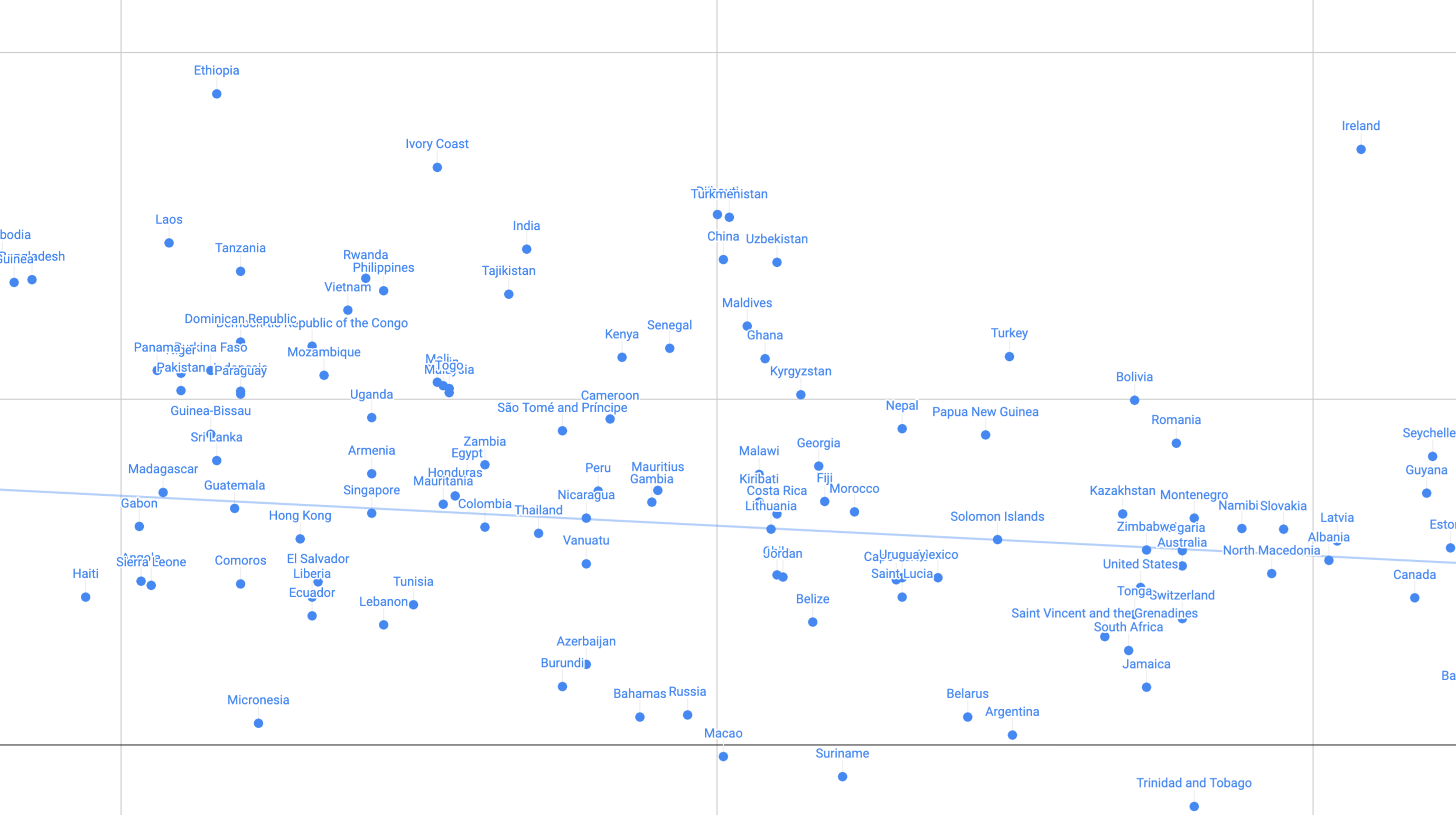

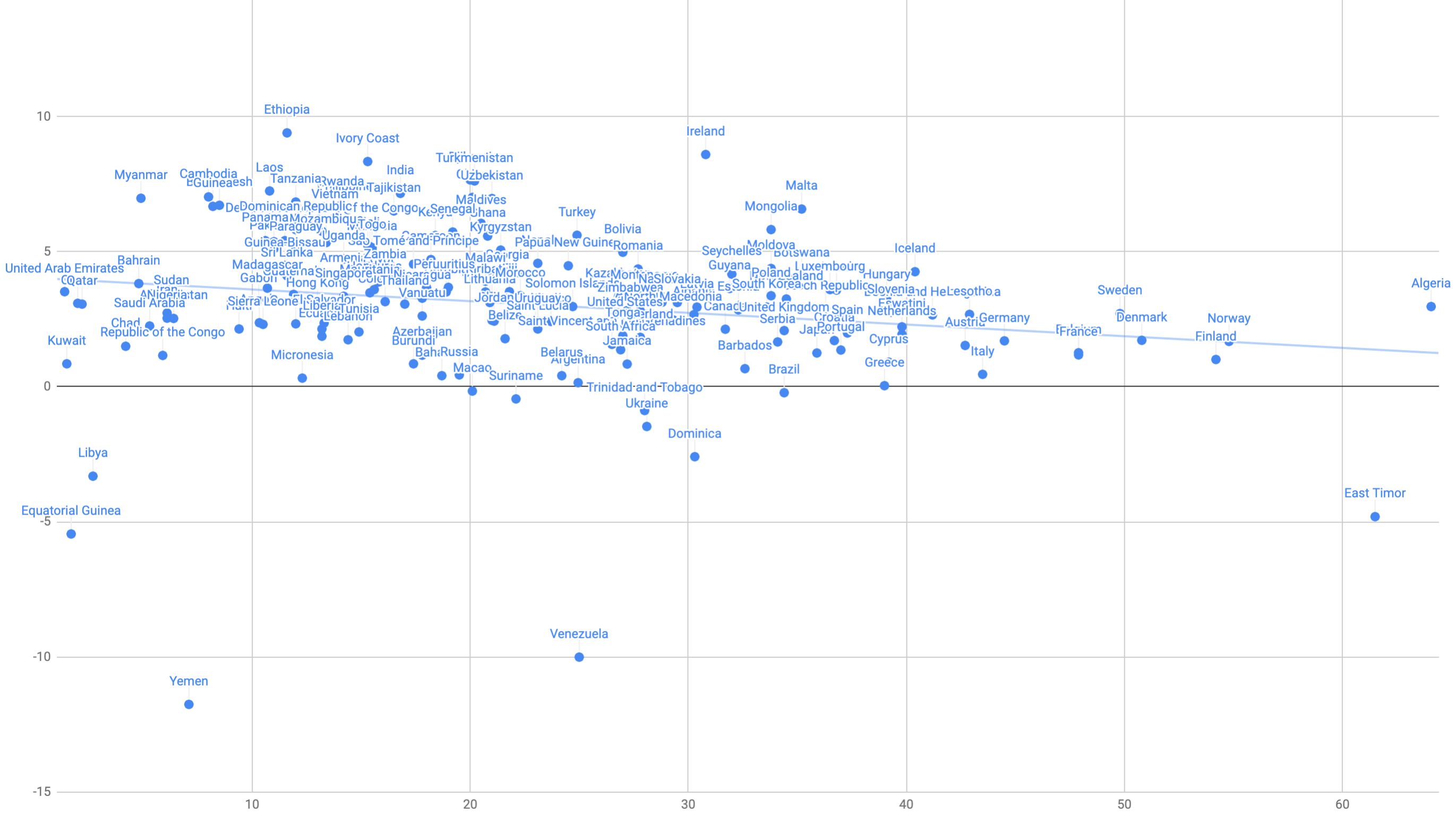

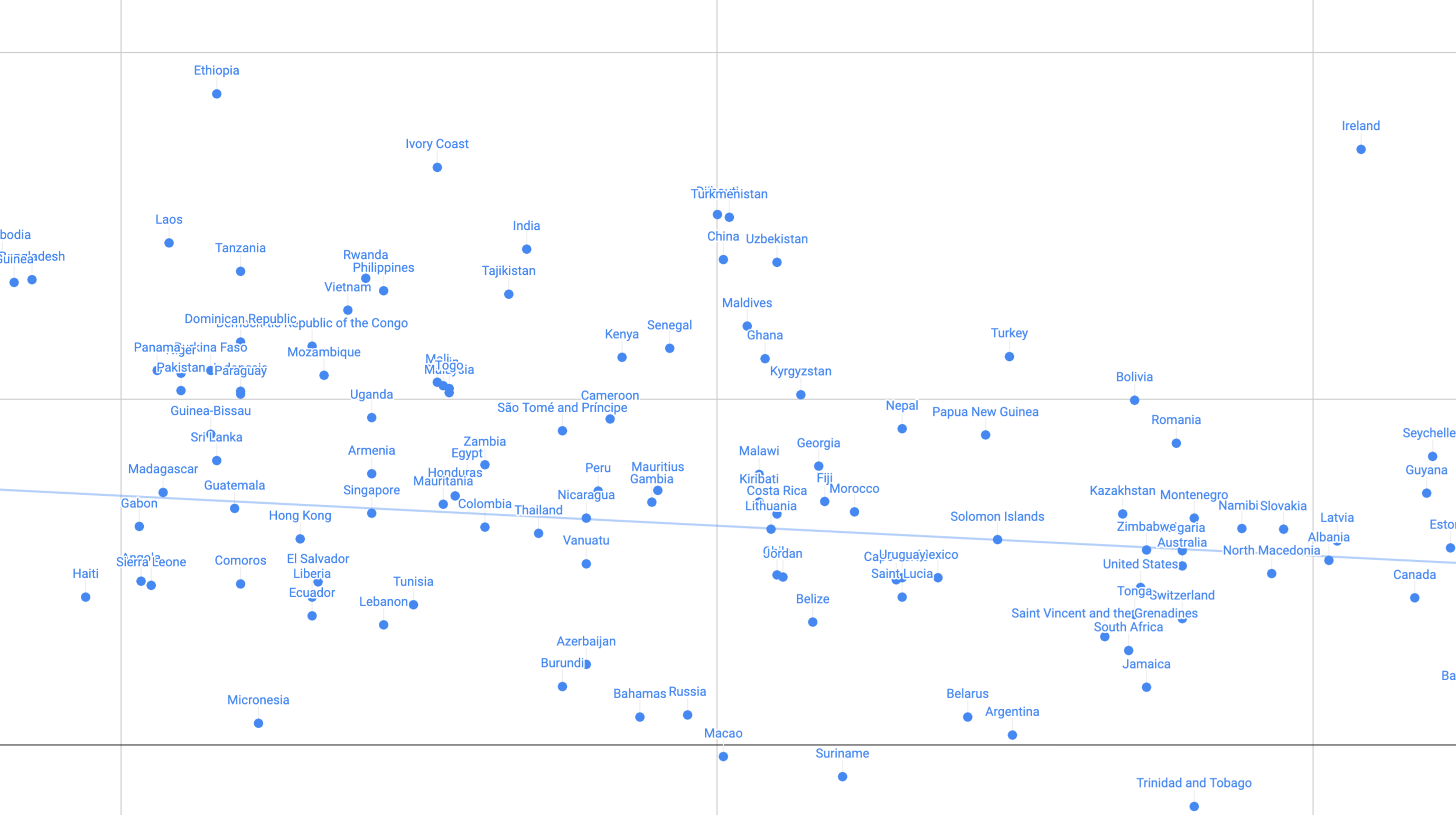

Tax as % of GDP (2020)

See also

*List of countries by government budget

The list is mainly based on CIA World Factbook for the year 2016 and 2019.

The Chinese, Brazilian, Indian, and United States government budgets are the figures reported by the International Monetary Fund.

The table includes information from gover ...

*List of countries by government spending as percentage of GDP

This article lists countries alphabetically, with total government expenditure as percentage of Gross domestic product (GDP) for the listed countries. Also stated is the government revenue and net lending/borrowing of the government as percentage ...

*List of countries by social welfare spending

This is a list of countries by spending on social welfare. Countries with the highest levels of spending are more likely to be considered welfare states.

As a percentage of GDP

These tables are lists of social welfare spending as a percentage of ...

*Taxation in the United States

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as ...

*List of countries by tax rates

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. The list focuses on ...

* Tax rates in Europe

References

{{DEFAULTSORT:Countries By Tax Revenue To Gdp Ratio Tax Revenue To Gdp Ratio Gross domestic product *Tax Revenue To Gdp Ratio